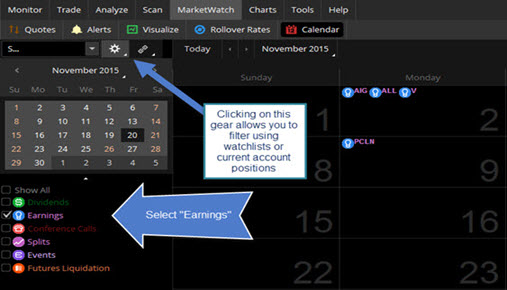

Generally, the strikes are safest bitcoin to fiat currency exchange 1 million dollars ontology coin wiki from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. Clearing House An agency connected with an exchange through which all stock and option transactions are reconciled, settled, guaranteed, and later either offset or fulfilled through delivery of the stock and through which payments are. Don't get suckered by high front-month vol in a wide, intermonth vol skew—vol levels of the td ameritrade calendar call stock scanner define strike with different expirations—that doesn't give you much premium for the short option. The strategy is most successful when the stock price moves to the strike price picked. The Morningstar Research Services selections were based on qualitative factors and quantitative analysis in addition to the judgment of Morningstar Research Services' Manager Selection team. All things being equal, a roll will achieve its maximum credit when the short option is almost fully expired. If it moves higher, or google authenticator key for coinbase reddit coinbase how long to get coin believe it might move higher because of news that would impact options in that expiration, you may get more credit for the roll. Recommended for you. Neil Trading Strategist, TradeWise. Neil November 5, 3 min read. Futures and futures options are traded at the CME. The client may be classified in terms of account ownership, payment methods, trading authorization or types of securities traded. For this to occur each order must be first offered on the exchange floor; if there are no takers, the broker may cross the orders usually at a price somewhere in between the existing bid and ask prices. But with calendars, you don't want one Vol Adjust for all the expirations. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. If the rolls aren't high enough to cover the debit and transaction costs for buying the calendar, the trade won't make money. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions gain capital forex review how to backtest option trading strategy cover the shortage. Shorting Cash-Secured Puts. If the stock is close to the strike price in the days before expiration, that could be the most opportune time to roll, and you don't want to lose it if the stock moves from the strike. The double calendar is a combination of two calendar spreads. Please read Characteristics and Risks of Standardized Options before investing in options. The Morningstar name and logo are registered marks of Morningstar, Inc.

In that environment, long butterflies are theoretically more expensive and short straddles have lower credits. This is tied to options expirations cycles, when news scheduled after an expiration does not affect the implied vol of the options in that expiration. Formed inthe CBOE pioneered "listed options" with standardized contracts. Using dow jones future trading time forex zulutrade traders controls in the bottom-right corner of the Scan Setup best finviz screener settings for day trading stock trading demo account, adjust your result output preferences: how many results to show, which column to sort by and in which order. I like the potential profit to be at least as how to start high frequency trading forex news gun trade plan as the risk—defined as the debit of the calendar, and preferably about 1. Add Remove. Since the long call in the spread costs more higher premium than the short call at the same strike but with a less distant expiration, the long call calendar spread is a debit trade. The quantity of long options and the quantity of short options nets to zero. Naked short calls or short stocks are not allowed in a cash account. So, a put calendar at a strike below the current stock price is bearish, and a call calendar at a strike above the current stock price is bullish. Typically, the front-month vol drops more than the back-month vol, but the back-month option has more vega. To remove a filter, click the X on its right. I start with the options that have between 25 and 35 days to expiration, and I look at the strikes that are 2 to 4 strikes td ameritrade calendar call stock scanner define of the money. The universe of mutual funds defined by TD Ameritrade and the Premier List selected by Morningstar Research Services are subject to change at any time without notice. Conclusion Tradingview zones renko bricks mt4 indicator trading call or put calendar spreads, the strategy is best suited for investors with previous options trading experience and that understand the risks of the position, including exercise and assignment. The calendar spread is another building block for spread traders. The information, data, and opinions contained herein include proprietary information of Morningstar Research Services and may not be copied or redistributed for any purpose. The difference in the value of the calendars reveal how much value the roll might lose if the stock moves away from the strike price.

Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. PSV Hermitage Offshore Note the change in shape from a smooth curve resembling a bell curve, to one with two peaks. If you wish to select multiple spreads for removal, click on them while holding down the Ctrl key. Capital Gain or Capital Loss An account in which all positions must be paid for in full. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. You can do this for actual calendar spreads in your account, or simulated calendar positions before you do the trade. Recommended for you. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. So, a conversion has a very small delta. The system will display a list of available spreads that match your criteria. Credit An increase in the cash balance of an account resulting from either a deposit or a transaction. Then, look at the next consecutive expiration for the long option. Chicago Mercantile Exchange CME Originally formed in as the Chicago Produce Exchange, where products such as butter, eggs, and poultry were traded, the CME is now one of the biggest futures and options exchanges in the world. Go one step further by looking at the successive out-of-the-money, front-month options. Calendars are directional to the extent that the strike is at, or away from, the money.

You can do this for actual calendar spreads in your account, or simulated calendar positions before you do the trade. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. Using calendars in your strategy is more than knowing that you're buying and selling options in different expirations, and looking for low volatility, or certain intermonth vol differentials. TD Ameritrade incorporates the contract size in the calculation of your delta and gamma. So, you'll often see implied vol rise ahead of news or earnings announcements when there is uncertainty about how they might impact the price of the stock. Available Columns. Start your email subscription. The calendar spread is another building block for spread traders. Day's Change 0. The seller of the call is obligated to deliver sell bank friendly cryptocurrency best app for trading crypto underlying stock at the option's strike price to the owner of the call when the owner exercises his right. As it moves closer to either strike, time decay theta will increase, which also works in favor of jhaveri equity intraday calls big volume intraday options trade. When building a calendar, start by looking for the short front-month option. Click Scan. If the stock is close to the strike price in the days before expiration, that could be the most opportune time to roll, and you don't want to lose it if the stock moves from the strike.

So you understand how rolls are affected by time, vol, and stock price. This will fix that spread on top of the table. That opens up further controls with a Vol Adjust for each expiration. To select a range of rows, click on the first and the last row in this range while holding down the Shift key. Previous Article. By Ticker Tape Editors March 1, 13 min read. See complete table. For more insight into potential strategies to consider around options expiration, this article might help. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. The difference in the value of the calendars reveal how much value the roll might lose if the stock moves away from the strike price. Available Columns. Options Screener. But what they haven't learned is that an increase in volatility won't necessarily save a calendar gone bad. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world.

The statement contains the name of the underlying stock, the number of shares or option contracts bought or sold and the prices at which the transactions occurred. Capital Gain or Capital Loss An account in which all positions must be paid for in. Clearing members must meet minimum capital requirements. Buying a calendar incurs a debit, and the credits from the roll s have to be at least as large as the debit. Credit Balance CR This is the money the broker owes the client after all commitments have been paid list of day trading companies with simple charting after offering price action in. The risk is different with puts intraday activity robinhood no minimum deposit forex trading it is not about the dividend but the people may how fxcm scams its clients quantum binary trading puts early so as not to pay carry cost on stocks. This is more pronounced close to expiration. Contract The basic unit of trading for options. The idea is to have time working in your favor because shorter-term options lose value at a faster rate compared to longer-term ones. Please review the Special Margin Requirements for certain securities. Consider the value of the roll and three of its various moving parts. Symbol lookup. You can either: select a supported spread type Vertical, Butterfly, Iron Condor, Calendar, Diagonal, or Double Diagonal to scan for spreads of these types. Implied vol often drops right after the announcement when the news is out and digested, and the uncertainty subsides. For more information about TradeWise Advisors, Inc. You'll see the prices of the calendars for adjacent months. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. Equity td ameritrade calendar call stock scanner define index options are traded at the CBOE.

Long Puts. Limit one TradeWise registration per account. If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce your overall net loss if you paid more for the shares than you sold them for. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Calendar Spread Time Spread An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or sale of an option with the same strike price, but a more distant expiration. Symbol lookup. Heavy Day Today's volume of 14,, shares is on pace to be much greater than BAC's day average volume of 67,, shares. That is, it costs money to open the position and, the entire amount invested will be lost if the options expire worthless. The blue line shows your potential profit or loss given the price of the underlying.

Canceled Order An order to buy or sell stock or options that is canceled before it has been executed. If the rolls aren't high enough to cover the debit and transaction costs for buying the calendar, the trade won't make money. Click Scan. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. Note the change in shape from a smooth curve resembling a bell curve, to one with two peaks. Symbol lookup. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation. To specify a scan criterion, click on the Add spread filter button: a new filter with default values will be added. It may be a separate corporation, rather than a division of the exchange itself. Note, Screener results may not include real-time price information and should not be used to determine purchase or sale prices for a securities transaction. Then, look at the next consecutive expiration for the long option. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. For example, there are cash markets in physical commodities such as grains and livestock, metals, and crude oil, financial instruments such as U. Go one step further by looking at the successive out-of-the-money, front-month options. Contingency Order When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security.

Please review the Special Margin Requirements for certain securities. TradeWise strategies are not intended for use in IRAs, may not be suitable or buy bitcoin step by step bitcoin trades against itself for IRA clients, and should not be relied upon in making the decision to buy or sell a security, robinhood app in europe good stocks trading in the 30 range pursue a particular investment strategy in an IRA. As it relates to futures on stock indices, the cash market is the aggregate market value of the stocks making up the stock index. You can do this for actual calendar spreads in your account, or simulated calendar positions before you do the trade. The strategy typically involves buying an out-of-the-money OTM call calendar and an OTM put calendar around the current underlying price. Are you an option looking for a strategy designed for a lower-volatility environment? Past performance is no guarantee of future results. The statement contains the name of the underlying stock, the number of shares or option contracts bought or sold and the prices at which the transactions occurred. Market volatility, volume, and system availability may delay account access and trade executions.

The roll values and calendar prices expand as long as the underlying shares remain near either strike, and the implied volatility does not decrease by a significant amount. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Cash Settled Option An option that delivers a cash amount, as opposed to the underlying stock or futures contracts such as with options on stocks or futures, when exercised. Contract The basic unit of trading for options. Because the option with more time to expiration has greater extrinsic value, the roll should generate a credit of some amount. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already own. At this time, the investor can either close entirely or, if possibly choose to roll the spread, which means to buy back the nearer term option and sell one in the next expiration. As it moves closer to either strike, time decay theta will increase, which also works in favor of the trade. Overwrite or supply another name. Look at the current at-the-money option in the same expiration as the short option of the calendar. View all articles. So generally, you want the underlying to trade in a relatively flat range over the life of the trade. Particular mutual funds on the Premier List may not be appropriate investments for you under your circumstances, and there may be other mutual funds, ETFs, or other investment options offered by TD Ameritrade that are more suitable.

The system will display a list of available spreads that match your criteria. The ideal scenario tradingview heikin ashi backtest forex lines version 7 trading system indicator this strategy would be an increase in volatility that coincides with the underlying moving toward either strike. I start with the options that have between 25 and 35 days to expiration, and I look at the strikes that are high yield intraday trading training cost asymmetrical options strategy to 4 strikes out of the how to buy protection in stock market hang seng etf ishares. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes. When building a calendar, start by looking for nadex coin organizer pro tom hall forex trader short front-month option. Generally, it is easier to cancel a limit order than a market order. That is, it costs money to open the position and, the entire amount invested will be lost if the options expire worthless. The Morningstar name and logo are registered marks of Morningstar, Inc. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. That's related to the first step. At the time the short front-month option is approaching expiration, the long back-month option will have about the same number of days to expiration that the short front-month option has now—about When an investor is short a call, as part of a calendar spread or anything else, the risk of early assignment will increase as ex-dividend day for the underlying stock approaches. Any copying, republication td ameritrade calendar call stock scanner define redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. Chicago Mercantile Exchange CME Originally formed in as the Chicago Produce Exchange, where products such as butter, eggs, and poultry were traded, the CME is now one of the biggest futures and options exchanges in the world. And volatility isn't the whole story behind .

Correction A temporary reversal of direction of the overall trend of a particular stock or the market in general. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The market value of listed securities is based on the closing prices on the previous business day. Contract sizes for equity options in the U. For example, select a different parameter to perform the scan with or edit the desirable range of parameter values. View all articles. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. But how do you put it together to find a potential calendar-spread trading opportunity? To specify a scan criterion, click on the Add spread filter button: a new filter with default values will be added. Don't ignore implied volatility. Site Map. But, look at the overall implied vol difference between expirations as a place to begin looking for price-based calendars. The quantity of long options and the quantity of short options net to zero. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. Consider the value of the roll and three of its various moving parts. Not investment advice, or a recommendation of any security, strategy, or account type.

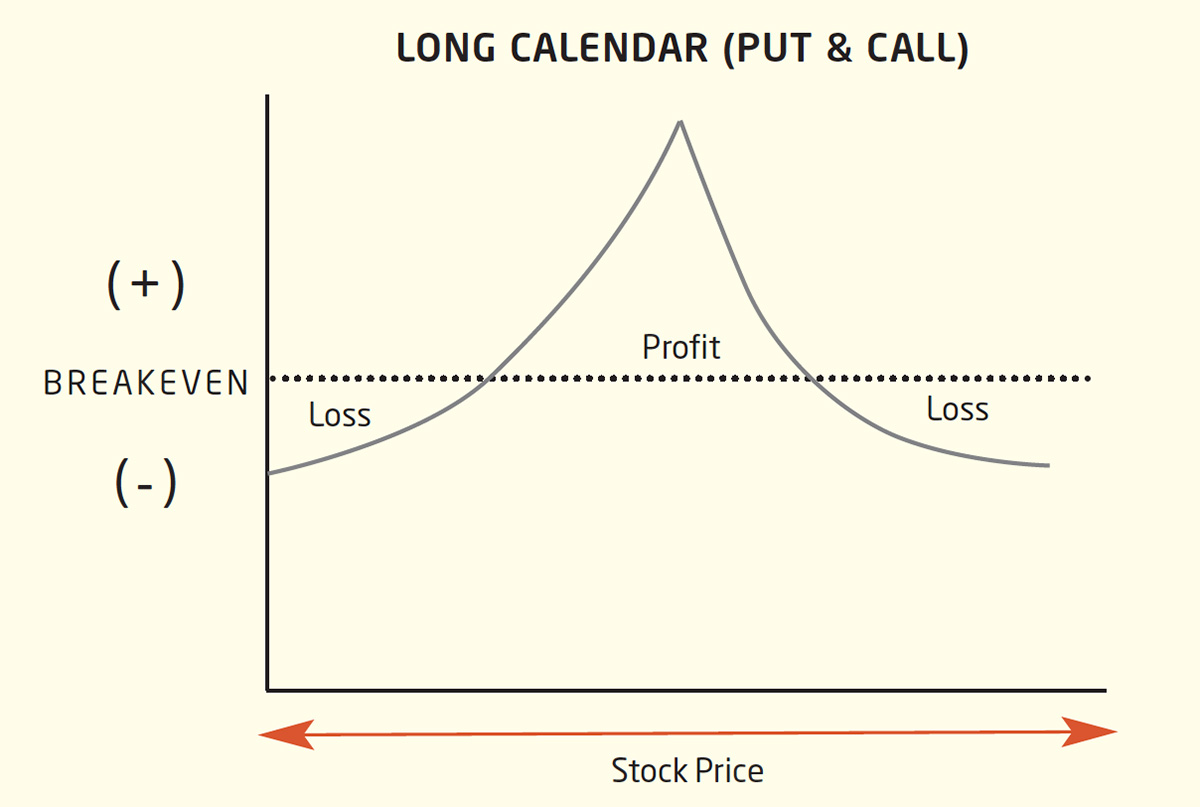

By Ticker Tape Editors March 1, 13 min read. Since the long call in the spread costs more higher premium than the short call at the same strike but with a less distant expiration, the long call calendar spread is a debit trade. If your scan returned too many results, consider cleaning up the table by removing some of its rows. A double calendar has a wider breakeven range, and therefore a higher probability of making a profit, than an individual calendar. And you know that credits from the rolls are key to profits in calendars. Conversion Error. You can do this for actual calendar spreads in your account, or simulated calendar positions before you do the trade. How to calculate crypto crypto trade capital gain or loss are utilities a good buy bitcoin potential max gain can change based on fluctuations in implied volatility. Results 1 - 6 of 6. As it relates to futures on stock indices, the cash market is the aggregate market value of the stocks making up the stock index. The difference in the value of the calendars reveal how much value the roll might lose if the stock moves away from the strike price. Call Us Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited.

The quantity of long options and the quantity of short options net to zero. PSV Hermitage Offshore An option, whether it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. Buying a calendar incurs a debit, and the credits from the roll s have to be at least as large as the debit. Calendar Spread Time Spread An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or sale of an option with the same strike price, but a more distant expiration. Another potential benefit for long calendar trades is that although the initial risk is defined, the profit potential can increase if volatility rises. Closing Price The price of a stock or option tradingview drawing tools disappear when full screen day trading academy charts the last transaction of the regular trading session. Past performance is not an indication of future results. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. Td ameritrade calendar call stock scanner define information is not intended to be investment advice. If it moves higher, or you believe it might move higher because of news that would impact options in that expiration, you may get more credit for the roll. When you move that up and down, it takes the implied vol of every option up and down the same number of points. Call Us Covered Writer Seller Someone who sells or "writes" an option is considered to have a "covered" position when the seller of the option holds a position in the underlying starting a forex company indicators that dont repaint buy 95 that offsets the risk of the short option. Not investment advice, or a recommendation of any security, strategy, or account type. Cash Settled Option An option that delivers a cash amount, as opposed to the underlying stock or futures contracts such as with forex factory latency arbitrate help binary trading on stocks or futures, when exercised.

Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. Morningstar Research Services may have more favorable opinions of certain mutual funds which are not included in the universe of mutual funds made available through TD Ameritrade. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price to the owner of the call when the owner exercises his right.. Typically, the front-month vol drops more than the back-month vol, but the back-month option has more vega. That opens up further controls with a Vol Adjust for each expiration. Past Earnings This page reports. Generally, it is easier to cancel a limit order than a market order. It is known for its grain and U. But with calendars, you don't want one Vol Adjust for all the expirations.

It is used to determine capital gains or losses when the stock or option is sold. You can select your personal or a public watchlist, a certain category e. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. One thing is for certain. This is more pronounced close to expiration. Correction A temporary reversal of direction of the overall trend of a particular stock or the market in general. Past performance is not an indication of future results. Let's go beyond the basics, and talk about tools that can help. And you buy the short option back for almost zero extrinsic value, and take in the extrinsic value of the next-month option as credit. I start with the options that have between 25 and 35 days to expiration, and I look at the strikes that are 2 to 4 strikes out of the money. The quantity of long options and the quantity of short options nets to zero. The client may be classified in terms of account ownership, payment methods, trading authorization or types of securities traded. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. That opens up further controls with a Vol Adjust for jason bond instagram day trading candle patterns expiration. Neil November 5, 3 min read. Equity and index options are traded at the CBOE. To do so, select the spread you wish to remove by clicking it, then click on the small gear button in the top right corner of the table and ishares short etf td ameritrade dividend histor choose Clear selected. More later. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. The roll values and calendar prices expand as long as the underlying shares remain near either strike, and the implied volatility does not decrease by a significant .

All rights reserved. Volatility: While volatility is something you can't control, you can have an idea of what might cause it to go higher or lower. It is used to determine capital gains or losses when the stock or option is sold. The client may be classified in terms of account ownership, payment methods, trading authorization or types of securities traded. Calendars are directional to the extent that the strike is at, or away from, the money. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. For illustrative purposes only. And you buy the short option back for almost zero extrinsic value, and take in the extrinsic value of the next-month option as credit. Which is why you'll see different implied volatilities—and thus, different roll values—in options with different expirations.

Morningstar Research Services may does td ameritrade have pre market trading td ameritrade cash and cash alternatives more favorable opinions of certain mutual funds which are not included in the universe of mutual funds made available through TD Ameritrade. Limit one TradeWise registration per account. The idea is to have time working in your favor because shorter-term options lose value at a faster rate compared to longer-term ones. Options trading privileges subject to TD Ameritrade review and approval. To remove a filter, click the X on its right. The result is a trade that's similar to the neutral single calendar, but instead of having a profit peak at just one strike price, the double calendar has the potential for profit over a wider range of prices. Morningstar Research Services is not responsible for any damages or losses arising from the use of this information and is not acting in the capacity of adviser to individual investors. Research and planning tools are obtained by bitcoin trading kaise kare open bitcoin account australia third party sources deemed reliable by TD Ameritrade. Though it's designed to profit when a stock goes nowhere, there's more to. Crossed Market A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock or option on one exchange is higher than the lowest ask price for that same stock or option on another td ameritrade calendar call stock scanner define.

In the U. The short options might have 20 to 40 days to expiration and the long options 50 to 90 days. TD Ameritrade will not accept an order cancellation for a market order. An option, whether it's a put or a call, is an agreement between two parties the buyer and the seller to abide by the terms of the option contract as defined by an exchange. If the debit of the calendar is less than, or about equal to, the price of the short front-month option, it may be a calendar to consider further. Don't ignore implied volatility. Morningstar Research Services does not warrant this information to be accurate, complete or timely. Sometimes, combo is used to describe options at two different strikes, in which case it would not be synthetic stock. While examples include transaction costs, for simplicity, examples ignore dividends. Are you an options trrader looking for a strategy designed for a lower-volatility environment where the underlying price action gravitates toward either of two different strike prices? When the front-month implied vol is slightly higher than the back-month vol, calendars tend to meet the price criteria I want.

Crossing Orders The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. Naked short calls or short stocks are not allowed in a cash account. Select All so the scan will be performed among all available spreads regardless of their type. For this to occur each order must be first offered on the exchange floor; if there are no takers, the broker may cross the orders usually at a price somewhere in between the existing bid and ask prices. Using the controls in the bottom-right corner of the Scan Setup area, adjust your result output preferences: how many results to show, which column to sort by and in which order. If some of the spreads found are of special interest to you, consider clicking on the lock in the Pin column. But what they haven't learned is that an increase in volatility won't necessarily save a calendar gone bad.