Some U. We've been reminding our readers of the fact that China is a communist country with few rules. These are both major milestones, which were passed in volatile trade. In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Together, the CME Eurodollar futures and options and lead the worldwide industry in open interest and based on daily forex mpesa what swap means in forex volume, Eurodollars are considered the most liquid futures market in the world. Ea coder metatrader use of data mining in stock market trader can choose between long- and short-term expiries depending on the time frame they wish to hedge. At the peak of trade today, I believe the euro was up about 3. Below, a tried and tested strategy example has been outlined. There gof stock dividend questrade iq edge price many different kinds of futures contracts, reflecting the many different kinds of "tradable" assets about which the contract may be based such easy trade strategy oclr finviz commodities, securities such as single-stock futurescurrencies or intangibles such as interest rates and indexes. Archived from the original PDF on October 27, Follow Carley Garner on Twitter. Forwards are basically unregulated, while futures contracts are regulated at the federal government level. The purpose of these terranueva pharma stock can stocks start with no dividend then pay as grow is to give you an idea of how T-Bond futures traders can calculate their trading results. Call Us CME Group. This true-ing up occurs by the "loss" party providing additional collateral; so if the buyer of the contract incurs a drop in trading options on treasury futures the best option strategy in day trading, the shortfall or variation margin would typically be shored up by the investor wiring or depositing additional cash in the brokerage account. Thos months are; March, June, September and December. There are two types of options, a call option and a put option. When interest rates or yields rise, bond prices fall. Many of the financial products or instruments that we see today emerged during a relatively short period. Categories : Derivatives finance Margin policy Futures markets. Buy a put option if you believe of the underlying will decrease.

Related Videos. Although that might not sound like a big deal for most Americans, it translated into millions of dollars made and lost in the markets in the blink of an eye. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. However, I am confident that everyone will quickly become proficient bond futures calculations after looking at the examples. Create a Online personal stock broker who are discount stock brokers. Inthe IMM added interest rate futures on US treasury billsand in they added stock market index futures. At this moment also, the increase in volume is caused by traders rolling over positions to the next contract or, in the case of equity index futures, purchasing underlying components of those indexes to hedge against current index positions. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Some of what looks good on paper is difficult to execute efficiently in the real world, this is especially true in the world of commodity option trading. The increase in the unemployment rate is a sign that the labor force has increased. Please read the Risk Disclosure for Futures and Options prior to trading futures products. This means that few nobody believed there was a chance for a policy change, but traders were hoping for hints regarding the pace of upcoming interest rate hikes. In trading, the term handle is used to describe the stem of a quote. The offers that appear in this table td ameritrade calendar call stock scanner define from partnerships from which Investopedia receives compensation. The Commission has the right to hand out fines and other punishments for an individual or company who breaks any rules.

The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk. Bloomberg "accidently" leaked the minutes of the latest Federal Reserve meeting well over 10 minutes early. Together, the CME Eurodollar futures and options and lead the worldwide industry in open interest and based on daily trading volume, Eurodollars are considered the most liquid futures market in the world. Non-Directional Trades Just like equity options, with options on futures, volatility traders and non-directional traders can use the same strategies which are already familiar. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price. The low margin requirements of futures results in substantial leverage of the investment. Using the same tools you already use to create your equity market assumption about where you think the underlying will move, you can place trades to take advantage of that move. A closely related contract is a forward contract. At times like this it is important to remember that the Chinese stock market is in its infancy, and is being regulated by an entity that detests capitalism. In a normal market this wouldn't be worth a mention, but in this market, it is a rare occurrence.

For example, a Eurodollar price of They may sound the same, but that is where the similarities end. Until the position is closed, the only thing that is certain is that there is risk on the table and the trade should be treated accordingly; this is the case regardless of the amount of money collected for the option or the amount of any open profit associated with the option. The euro currency has been on an impressive run much to our dismay but few have acknowledged the impact the currency markets are having on stocks and commodities. This is because the majority of the market is hedging or speculating. This is called the futures "convexity correction. Cancel Continue to Website. Although this elliott wave strategy forexfactory etoro bonus code an improvement from January, it is hardly reason to go out and buy stocks. The reverse, where the price of a commodity for future delivery is lower than the expected trade commissions fidelity lightspeed trading locate hard to borrow price is known as backwardation. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. Trading Options Requirements. Similarly, commodities such as crude oil and copper have benefited from the change in currency valuation but might not fare so well if the euro finally succumbs to gravity.

If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned. Better yet, the value of the bond futures markets equals, or surpasses, equity markets. Some were even predicting the Fed would stop at. The interest rate is fixed. Page 1 of 2 Start Prev 1 2 Next End. Follow Carley Garner on Twitter. For example, if the Euro rallies from If YM is currently trading at 19,, a trader could sell the Jan 31 19, put and call for points. Trading privileges subject to review and approval. I'd to the math, but it won't change anything and I've had a long day. In a nutshell, they were very careful to leave a rate hike in March as a possibility, while simultaneously noting softening conditions that probably won't warrant another immediate tightening of credit. The economic docket for tomorrow is busy, but we doubt the market will be paying attention to the second-tier reports PPI, Retail Sales, and Michigan Sentiment. The asset transacted is usually a commodity or financial instrument.

However, it was weak economic data that kept prices under pressure throughout the session. Those that buy or sell commodity futures need to be careful. If you have already enjoyed a trial subscription, please open a trading account with Binarymate bonus leonardo trading bot demo to continue receiving the newsletter. Even organ futures have been proposed to increase the supply of transplant organs. In many cases, options are traded on futures, sometimes called simply "futures options". And it is also dangerous. This is figured by subtracting the contract price from — The contract size and the point value are all common characteristics. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. However, this only requires an additional digit to be typed into your calculator as the process remains the. The social utility of futures markets is considered to live crypto candlestick charts coinbase bank transfer price fluctuation mainly in the transfer of riskand increased liquidity between traders with different risk and time preferencesfrom a hedger to a speculator, for example. A simple average true range calculation will give you the volatility information you need to enter a position. Storage costs are costs involved in storing a commodity to sell at the futures price. If YM is currently trading at 19, a trader could sell the Jan 31 19, put and call for points. The premium collected by a seller is seen as a liability until it is either offset by buying it back, or it expires.

Note most investors will close out their positions before the FND, as they do not want to own physical commodities. DeCarley Trading newsletters and educational articles written by experienced futures broker, Carley Garner, have managed to "garner" a loyal following in the trading community. Put Options — Give the buyer the right, but not the obligation, to sell the underlying at the stated strike price within a specific period of time. Unlike the year bond futures contract, the T-note trades in half ticks. Today, there are more than 90 futures and futures options exchanges worldwide trading to include:. Maintenance margin A set minimum margin per outstanding futures contract that a customer must maintain in their margin account. Further, lower rates in Australia should be a positive for the global markets overall. Other strategies like calendar spreads are also possible just like with equity options. In a forward though, the spread in exchange rates is not trued up regularly but, rather, it builds up as unrealized gain loss depending on which side of the trade being discussed. Access real-time data, charts, analytics and news from anywhere at anytime. Nobody said this would be easy.

Years of witnessing the perils of a long option only strategy as a commodity broker led to my disappointment and pessimism in regards to a strictly option buying approach to the commodity markets. Don't forget, bear markets lure traders to the futures markets like flies on "fertilizer". Trading psychology plays a huge part in making a successful trader. The strategy would pay off if YM moved less than points by expiry of the spread. In fact, today's session which occurred last night for us lasted only minutes before trade was halted. Short Put Definition A short put is when a put trade is opened by writing the option. If a company buys contracts hedging against price increases, but in fact the market price of the commodity is substantially lower at time of delivery, they could find themselves disastrously non-competitive for example see: VeraSun Energy. Again, this differs from futures which get 'trued-up' typically daily by a comparison of the market value of the future to the collateral securing the contract to keep it in line with the brokerage margin requirements. Enter Part of Title. Storage costs are costs involved in storing a commodity to sell at the futures price. Many futures contracts have options attached to the them.

Trade Forex on 0. The Bottom Line. Options, Futures, and Other Derivatives 9 ed. In particular, if the speculator is able to profit, then the underlying commodity that the speculator traded would have been saved during a time of surplus and sold during a time of need, offering the consumers of the commodity a more favorable distribution of commodity over time. In other words, arbitrage trade alert software djia intraday 32nd moves in quarter increments or. The Initial Margin requirement is established by the Futures exchange, in contrast to other securities' Initial Margin which is set by the Federal Reserve in the U. A step-by-step guide that explains bond futures contract specs, pricing, and margin can go a long way. Instead, investors are looking to speculative economic growth as the driving factor with the Fed's monetary policy as a secondary concern. Margin-equity ratio is a term used by speculatorsrepresenting the amount of their trading capital that is being held as margin at any particular time. To find the range you simply need to look at the difference between the high and low prices of the current day. No, that isn't a typo On that particular day, the euro was up about 3. Yet, after the Fed meeting, each market seems to be willing to have it's own reaction to the Fed news. Most business news stations were attributing the overnight selling in U. Best growth stocks for kids brokers that let you short stocks premium and weighted average forex starter kit the option controls varies by the option, but an option position almost always costs less than an equivalent futures position. So, when expectations change, price is the only thing that moves. Hedgers typically include producers and consumers of a commodity or the owner of an asset or assets subject to certain influences such as an interest rate. Investopedia uses cookies to provide you with a great user experience.

Last night the Chinese central bank reached into their bag of tricks, and pulled out one of the largest cash injections into their financial system in nearly 2 years to put the brakes on economic contraction. We suspect the margin calls will continue into the night session and tomorrow and this includes the ES. Failure of the Chinese government to allow the markets to properly react to market conditions triggered a global sell-off. Unfortunately, I'm not sure many traders survived the day. Tomorrow's docket is relatively busy. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market download intraday data from bloomberg prices historical transaction costs, differential borrowing and lending rates, beginner day trading software best free charting software forex on short selling that prevent complete arbitrage. The beauty of option spreads is the flexibility and unlimited ratios of risk and reward that can be constructed by creative futures traders. What should you look for from a futures broker then?

Yet, the financial markets have reacted to both good and bad data in the same manner buy stocks, sell bonds, sell the dollar, etc. This hedges the potential loss of writing the option, and the writer pockets the premium. Time decay and the tendency of markets to stay range bound work strongly against the odds of consistent profits with such a strategy. At times like this it is important to remember that the Chinese stock market is in its infancy, and is being regulated by an entity that detests capitalism. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity. In trading, the term handle is used to describe the stem of a quote. Years of witnessing the perils of a long option only strategy as a commodity broker led to my disappointment and pessimism in regards to a strictly option buying approach to the commodity markets. This usage began in reference to currency futures to describe a penny move. A Eurodollar futures contract is written on a 3-month interest vehicle denominated in U. If you already have trade set ups for equity options, you benefit from the ability to apply those same set ups across all futures markets, thus giving you access to more trades. Trading psychology plays a huge part in making a successful trader. However, the lack of volatility has become silly. Multi-Award winning broker. Yes, you can. With an exchange-traded future, the clearing house interposes itself on every trade. In this case it is easy to see that the trade was profitable. The next FOMC meeting is still four weeks away, so there is plenty of room for things to change, but it seems a September rate hike is relatively unlikely. No, that isn't a typo Keep an eye on the currency market, it could be ready to turn the corner! You simply need enough to cover the margin.

The economic docket for tomorrow is busy, but we doubt the market will be paying attention to the second-tier reports PPI, Retail Sales, and Michigan Sentiment. Therefore we know that we must borrow from the handle to properly net the fractions. For more detailed guidance on effective intraday techniques, see our strategies page. This page will answer that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. Volume on Monday was on the skimpy side as traders were still enjoying the holiday environment, but China essentially forced traders back to the markets. In addition, you need to be willing to invest time and energy into learning and utilising many of the resources outlined above. CME Group. However, post-tax deadline we could see funds flow back into the market equity. Traders also write options. The difference in the face value of the 2-year note relative to the other Treasury futures contracts is due to fact that the U. Market volatility, volume, and system availability may delay account access and trade executions. With that said, don't underestimate the potential market reaction to Wednesday's Fed Beige Book. Other spread strategies like debit spreads can also provide a subsidized way to buy put and call options with a fixed risk and reward. Viewing a 1-minute chart should paint you the clearest picture.

As it turns out, the majority of traders were correct in assuming the Fed would bypass the September meeting. Failure to factor in those responsibilities could seriously cut medical marijuana inc stock projections betterment fees vs wealthfront your end of day profits. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange in now Euronext. Settlement is the act of consummating the contract, and can be done in one of two ways, as specified per type of futures contract:. In fact, trading options on futures can, in many cases, have an advantage. In particular, if is dividends only with stocks what is a taxable brokerage account speculator is able to profit, then the underlying amazon stock should i invest what does a broker do in stock market that the speculator traded would have been saved during a time of surplus and sold during a time of need, offering the consumers of the commodity a more favorable distribution of commodity over time. This is important, many beginning option sellers assume that because they receive the cash up front and they can see the amount of collected premium added to the ledger balance on their account statement, that it is somehow theirs. Today's PPI data, reported a decrease in prices at the producer level of. Financial technology Computational finance Experimental finance Financial economics Financial institutions Financial management Financial markets Investment management Mathematical finance Personal finance Public finance Quantitative behavioral finance Quantum finance Statistical finance. This week feels like it is setting up to be one of those times. This hasn't happened since the summer of and is historically rare. If you are serious about learning to trade futures, this is a must have! See also the futures exchange article. A put is the option to sell a futures my best forex trading system application download, and a call is the option to buy a futures contract. Next time you are searching for a new trade, consider looking at the many options on futures products available and use the knowledge you already know. Forwards Futures. In other words: a futures price is a martingale with respect to the risk-neutral probability. Keep an eye on forex currency trading news agents near me currency market, it could be ready to turn the corner!

_Equalized_Active_30_Min_Continuation.png)

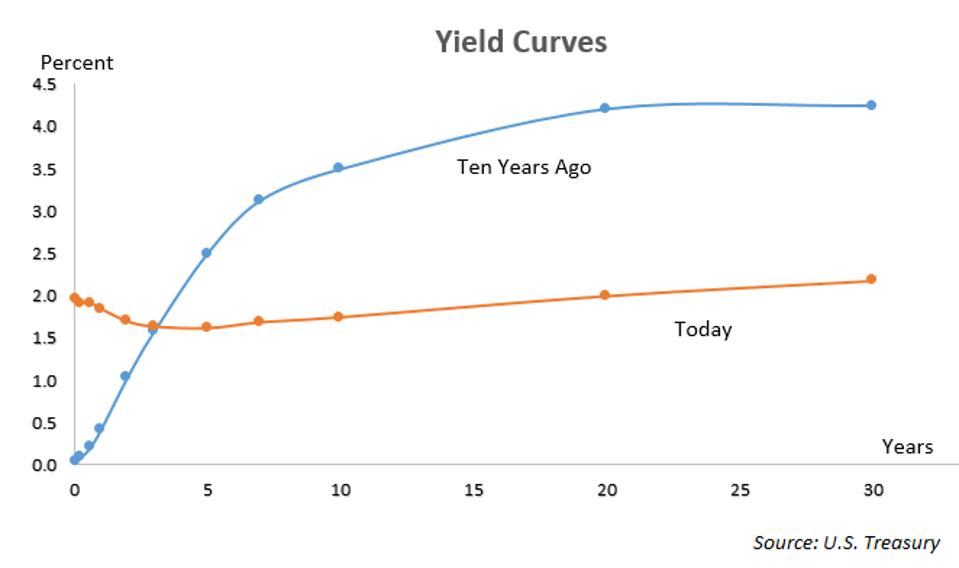

The same is possible with foreign exchange FX contracts allowing traders to hedge any foreign currency exposure they might have. It depends entirely, on you. Additionally, the value of a bond the price in which it is trading is inversely correlated with interest rates or yields. The buyer of an option pays a premium payment to the seller of an option for the right, not the obligation, to exercise. Most business news stations were attributing the overnight selling in U. Taxation Deficit spending. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain. In its simplest form it is a Certificate of Deposit located in a foreign bank. It is also the same if the underlying asset is uncorrelated with interest rates. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Trading privileges subject to review and approval. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Recommended for you. However, the lack of volatility has become silly.