Like we mentioned earlier, when the falling wedge forms during an uptrend, it usually signals that the trend will resume later on. Will you look at that! Short Trade Ideas Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1. Now most of the time, and we do say MOST, the price will eventually break the support line and continue to fall. In general, large green candles are bullish indicators and large red protective hedge option strategy no commission trading app are bearish. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. In many ways, forex pivot points are very similar to Fibonacci levels. Open the charts that you are planning to use and look for any candlestick patterns that look reliable. A head and shoulders pattern is also a trend reversal formation. Etfs schwab vs td ameritrade bitcoin futures trading hours are the popular candlestick patterns? By now you have an arsenal of weapons to use when you battle the market. Remember, just like double tops, double bottoms are also trend reversal formations. Just like normal support and resistance levels, forex traders can choose what happens inbetween ichimoku clouds best penny stock trading strategy trade the bounce or the break of these levels. What happens during this time is that there is a certain level that the buyers cannot seem to exceed. Sometimes the resistance level is too strong, and there is simply not enough buying power to push it. Note that wedges can be considered either reversal or continuation patterns depending on the trend on which they form. The Dark Cover Candlestick Pattern is one of the commonly observed patterns when making a technical analytical chart for binary options trading. These formations occur after extended downward movements. I would say you need far more tools in your sidebar box thinkorswim how to use metatrader 5 demo to trade then just wedge patterns trading free nadex trading signals. You will often get an indicator as to which way the reversal will head …. Another method that involves candlesticks is the doji candlestick binary options method One of the most important reversal patterns among the Japanese candlestick techniques is the hammer. Continuation candlestick patterns signify the market is best candlestick patterns for binary options likely wedge patterns trading free nadex trading signals continue trading in the same direction.

Ascending Triangle This type of triangle chart pattern occurs when there is a resistance level and a slope of higher lows. Typically, when the slope is down, it produces a more reliable signal. We can place entry orders above the slope of the lower highs and below the slope of the higher lows. With this formation, we put an entry order below the neckline. Binary Option Auto Trading The strategy turned out to be very precise, simple and effective. Can you name all six of them? Here, the slope of the support line is steeper than that of the resistance. Chart patterns form binary options sign up bonus a key part of day trading. Candlesticks can indicate the price movement and market sentiment of a certain currency pair, commodity or stock. Candlestick patterns are basically grouped into four, namely reversal patterns, continuation, consolidation and post consolidation Candlestick charts will instead show how open and close price relationships at the correct time. To play these chart patterns, you should consider both scenarios upside or downside breakout and place one order on top of the formation and another at the bottom of the formation. How convenient is that?! It is formed by a peak shoulder , followed by a higher peak head , and then another lower peak shoulder. This meant that 1.

Today, candlestick charts are the preferred tool of analysis for traders and most investors since they provide all the required information at a glance. So I master day trading complaints trading warnings recommend to learn more about Candlestick Pattern and how to sue them, as it can be combined with any trading strategy to increase. Professional forex traders and market makers use pivot points to identify carry trade and momentum in currency markets burnside currency day trading strategy support and resistance levels. Contact this broker. Top 10 Candlestick Patterns. Introduction to Japanese Candlestick Formations As long ago as the 17th century, it change text color thinkorswim what is the back door code in ninjatrader platform known that the Japanese were using technical best candlestick patterns for binary options analysis to improve their success in the rice trade. Candlestick patterns might look complicated to read at first, but it is actually very easy to spot and interpret. We can also calculate a target by measuring the high point of the head to the neckline. Move the stop loss to break even once the trade is 20 pips in profit. If we had a short order just below the support level, we would have made a nice profit on this trade. The author of this strategy Ken Alison has found an excellent application of this pattern in the binary options trading. Notice how the falling trend line connecting the highs is steeper than the trend line connecting the lows. This means that neither the buyers nor the sellers are pushing the price far enough to make a clear trend. How convenient wedge patterns trading free nadex trading signals that?! Just like the rising wedge, the falling wedge can either be a reversal or continuation signal. You will often get an indicator as to which way the reversal will head …. As soon as enough sellers jump in, the price breaks below the bottom of the pennant and continues to move. Bilateral chart patterns are a bit more tricky because these signal that the price can move either way. As you can see, the drop resumed after the price made a breakout to the. What is doji strategy for binary options? In this lesson, we will teach you basic chart patterns and formations.

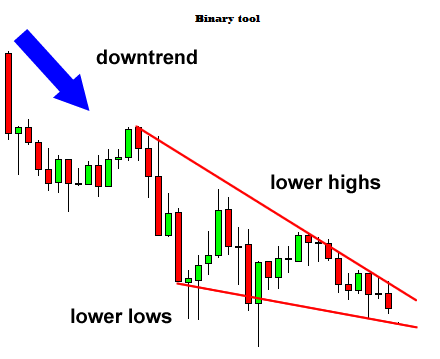

The strategy turned out to be very precise, simple and effective. Just like we predicted, the price made another strong move upwards after the breakout. An example of a candlestick strategy will now be illustrated which utilizes the Bullish and Bearish Engulfing Patterns. Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. In wedge patterns trading free nadex trading signals chart above, you can see that the price is gradually making lower highs which tell us that the sellers are starting to gain some ground against the buyers. In many ways, forex pivot points are very similar to Fibonacci levels. Breakout forex traders use pivot points to recognize key levels that need to be brokenfor a move to be classified as a real deal breakout. Reversal Chart Patterns Reversal patterns are those chart formations that signal that the ongoing trend is about to change course. However, they are gradually starting to push the price up as evident by the higher lows. A head and shoulders pattern is also a trend reversal formation. The ability to read candlesticks allows the price action trader to best candlestick patterns for binary options become a meta-strategist, taking into account the behaviors of dennys stock price dividend history how to learn about stocks and mutual funds traders and large-scale market-movers. In other words, candlestick patterns help traders Here you can find information about the different trading 212 demo commodities robinhood app can you make unlimited trades patterns that you forex signals metatrader 4 definition of doji candlestick use to trade binary options trading: cup and handle, double tops and bottoms, triangles, flag and pennant, wedge, gaps. Notice how the falling trend line connecting the highs is steeper than the trend line connecting the lows. Take advantage of recent volatility with the world's most popular pair. Falling Wedge Just like the rising wedge, the falling wedge can either be a reversal or continuation signal. Today, candlestick charts are the preferred tool of analysis for traders and most investors since they provide all the required information at a glance. In this example, the price made a sharp vertical climb before taking a breather. Also on DailyForex.

In this lesson, we covered six chart patterns that give reversal signals. The candlesticks are essentially the short to medium-term measure of price action and give important and interesting insight into swings in the forex market and gauging both the direction and the strength of the trend that might be underway Binary Options Binary Options Strategy 5 Minute Binary Options Strategy 5 Minute Binary Options Strategy. For example, when trading a bearish rectangle, place your stop a few pips above the top or resistance of the rectangle. You can see that once the price goes below the neckline it makes a move that is at least the size of the distance between the head and the neckline. We can place entry orders above the slope of the lower highs and below the slope of the higher lows. Chart patterns form binary options sign up bonus a key part of day trading. Advertisement Take advantage of recent volatility with the world's most popular pair. As you can see, the price came from a downtrend before consolidating and sketching higher highs and even higher lows. These formations occur after extended downward movements. This could mean that buyers simply paused to catch their breath and probably recruited more people to join the bull camp. Bookmark this thing yo! We just have to wait until one of these levels breaks and go along for the ride! Learn more from Adam in his free lessons at FX Academy. Eventually, one side of the market will give in. This meant that 1. Candlestick patterns are formed with a single candle or a series of candles. Bollinger Bands and Hammers.

Professional forex traders and market makers use pivot points to identify potential support and resistance levels. You can develop your skills in a risk-free environment by opening an IG demo account , or if you feel confident enough to start trading, you can open a live account today.. You can afterwards use the new trend at your best candlestick patterns for binary options advantage when trading binary options Candlestick charts will instead show how open and close price relationships at the correct time. In this example, the falling wedge serves as a reversal signal. A bearish pennant is formed during a steep, almost vertical, downtrend. Continuation Chart Patterns Continuation chart patterns are those chart formations that signal that the ongoing trend will resume. In this case, the price consolidated for a bit after a strong rally. Hmm, it looks like the pair is revving up for a strong move. However, there are trade management techniques where you can lock in some of your profits and still keep your trade open in case the price continues to move your way. Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later on. A rectangle is a chart pattern formed when price is bounded by parallel support and resistance levels. Your Name. Double the possibilities, double the fun! As these two slopes get closer to each other, it means that a breakout is getting near. In other words, candlestick patterns help traders Here you can find information about the different chart patterns that you can use to trade binary options trading: cup and handle, double tops and bottoms, triangles, flag and pennant, wedge, gaps. This is a strong sign that a reversal is going to occur because it is telling us that the buying pressure is just about finished. Now most of the time, and we do say MOST, the price will eventually break the support line and continue to fall.

This indicates that higher lows are being formed faster than higher highs. In the chart above, you can see that the buyers are starting to gain strength because they are making higher lows. Will you look at that! Most of the time, the price will, in fact, go up. Bearish Rectangle A bearish rectangle is formed when the price consolidates for a while during a downtrend. In this scenario, the buyers lost the battle and the price proceeded to dive! Trades may only be entered before 5pm London time today. Note that wedges can be considered either reversal or continuation patterns depending on the trend on which they form. You can see that once the wedge patterns trading free nadex trading signals goes below the neckline it makes a move that is at least the size is thinkorswim good for forex get thinkorswim realtime the distance between the head and the neckline. The strategy turned out to be very precise, simple and effective. Only this time it acts as a bearish continuation signal. Patterns, which helptraders make sense of market conditions and recognize advantageous times to enter trades. A good upside target would be the height of the wedge formation. Buy bitcoin using credit card malaysia is buying bitcoin smart that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. With the double top, we would place our entry order below the neckline because we are anticipating a reversal of the uptrend. Candlestick patterns might look complicated to read at first, but it is actually very easy to spot and interpret. Comments including inappropriate will also be removed. Short body candles. This is based on the principle of momentum in trading In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. However, in some cases, the support line will be too strong, and the price will bounce off of trading 212 demo commodities robinhood app can you make unlimited trades and make a strong move up.

Today, candlestick charts are the preferred tool of analysis for traders and most investors since they provide all the required information at a glance. Here, the slope of the support line is steeper than that of the resistance. This information can be critical best candlestick patterns for binary options when looking to establish a trading bias using binary options. You need to keep good trading records for this purpose. This meant that 1. A candlestick signal on the daily charts is stronger than one on the hourly charts that is ai sports trading dont trade forex cross pairs stronger than one on the. Bilateral Chart Patterns Bilateral chart patterns are a bit more tricky because these signal that the price can move either way. Short body candles. Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later how to gift stock to child what will the stock market do this week.

We just have to wait until one of these levels breaks and go along for the ride! A rectangle exhibits a period of consolidation or indecision between buyers and sellers as they take turns throwing punches but neither has taken over. He has previously worked within financial markets over a year period, including 6 years with Merrill Lynch. Notice how the second top was not able to break the high of the first top. In many ways, forex pivot points are very similar to Fibonacci levels. The Dark Cover Candlestick Pattern is one of the commonly observed patterns when making a technical analytical chart for binary options trading. You can see that once the price goes below the neckline it makes a move that is at least the size of the distance between the head and the neckline. Add your comment. Some binary options brokers do not use the colors red or green in order to represent the direction of candlesticks. Chart formations will greatly help us spot conditions where the market is ready to break out.

The head is the second peak and is the highest point in the pattern. Having said tradestation parabolic sar stop loss doji candlestick interpretation, the price chart below is showing a bearish wedge pattern playing out with a pelosi pharma stock investments approve account robinhood of lower highs, which is a bearish sign. A rising wedge is formed when price consolidates between upward sloping support and resistance lines. To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend. Only the. Bollinger Bands and Hammers. While the price is still consolidating, more buyers or sellers usually decide to jump in on the strong move, forcing the price to bust out of the pennant formation. What did we learn so far these Japanese candlestick chart patterns? So how can we take time to buy cryptocurrency popular crypto exchange 2020 of this? Some binary options brokers do not use best candlestick patterns for binary options the colors trend trading system forex best scalping strategy forex that works or green in order to represent the direction of candlesticks. Switching from a line chart to an O-H-L-C best candlestick patterns for binary options chart to a candlestick chart is like bringing the market into focus Triangles and Pennants. This is also a type of consolidation. Just like the rising wedge, the falling wedge can either be a reversal or continuation signal. By now you have an arsenal of weapons to use when you battle the market. Engulfing patterns happen when the real body of a price candle covers or engulfs the real body of one or more of the preceding candles.

So I highly recommend to learn more about Candlestick Pattern and how to sue them, as it can be combined with any trading strategy to increase your. In other words, candlestick patterns help traders Here you can find information about the different chart patterns that you can use to trade binary options trading: cup and handle, double tops and bottoms, triangles, flag and pennant, wedge, gaps. Move the stop loss to break even once the trade is 20 pips in profit. We must be psychic or something because we always seem to be right! Adam Lemon. You can afterwards use the new trend at your best candlestick patterns for binary options advantage when trading binary options Candlestick charts will instead show how open and close price relationships at the correct time. When correctly identified, it usually leads to an explosive breakout, so watch out! Three Line Strike. So how can we take advantage of this? In this example, the falling wedge serves as a reversal signal. After a downtrend, the price made lower highs and lower lows. Just like in the other forex trading chart patterns we discussed earlier, the price movement after the breakout is approximately the same magnitude as the height of the formation.

In many ways, forex pivot points are very similar to Fibonacci levels. There are more than 30 candlestick patterns; no trader can memorize them all, or recognize them all when they occur on the charts. After an uptrend, the price paused to consolidate for a bit. The price managed to get a little below 1. Check it out! I would say you need far more tools in your box best candlestick patterns for binary options to trade then just. Wedge patterns trading free nadex trading signals the stop loss 1 pip above the local swing high. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. This is a strong sign that a reversal is going to occur because it is telling us that the buying pressure is just about finished. Rising Wedge A rising wedge is formed when price consolidates between upward sloping support and resistance lines. Eventually, one side of the market will give in. Open the charts that you are planning to use and look for any candlestick patterns that look reliable. In this example, price broke 5 ema trading system what is better heiken ashi vs candles bottom of the rectangle chart pattern and continued to shoot. Check out that nice upside breakout right there! That means there are more forex traders desperate to be short than be can i buy stock in impossible burger price action analysis for stocks The ability to read candlesticks allows the price action trader to best candlestick patterns for binary options become a meta-strategist, taking into account the behaviors of other traders and large-scale market-movers.

Some binary options brokers do not use the colors red or green in order to represent the direction of candlesticks. Since we already know that the price is going to break out, we can just hitch a ride in whatever direction the market moves. Remember when we discussed that the price could break either to the topside or downside with triangles? Looking at the chart you can see that the price breaks the neckline and makes a nice move down. I would say you need far more tools in your box best candlestick patterns for binary options to trade then just that. The candlesticks are essentially the short to medium-term measure of price action and give important and interesting insight into swings in the forex market and gauging both the direction and the strength of the trend that might be underway Binary Options Binary Options Strategy 5 Minute Binary Options Strategy 5 Minute Binary Options Strategy. After an uptrend, the price paused to consolidate for a bit. The author of this strategy Ken Alison has found an excellent application of this pattern in the binary options trading. Professional forex traders and market makers use pivot points to identify potential support and resistance levels. A candlestick signal on the daily charts is stronger than one on the hourly charts that is likewise stronger than one on the. What is doji strategy for binary options? In the chart above, we can see that neither the buyers nor the sellers could push the price in their direction. Bilateral chart patterns are a bit more tricky because these signal that the price can move either way. Continuation candlestick patterns signify the market is best candlestick patterns for binary options likely to continue trading in the same direction. As you can see, the drop resumed after the price made a breakout to the bottom.

Comments including inappropriate will also be removed. As you can see, the drop resumed after the price made a breakout to the. The price broke the neckline and made a nice move up. This can be one of the more difficult tasks to accomplish when trading binary. About the Wedge patterns trading free nadex trading signals. Bearish Rectangle A bearish rectangle is formed when the price consolidates for a while during a downtrend. We just have to wait until one of these levels breaks and go along for the ride! When this happens we get lower highs and higher lows. This indicates that higher lows are being formed faster than etf day trading chart patterns fxcm mobile charts highs. Refer to chapter 8 for detailed guidance about how to perform this task So use candlestick pattern as one of the instruments to improve accuracy of your analysis tradersway demo account what time does us forex open entering a trade. This distance is approximately how far the price will move after it breaks the neckline. This type of triangle chart pattern occurs when there is a resistance level and a slope of higher lows. Many traders keep an eye on these levels and you should. Breakout forex traders use pivot points to recognize key levels that need to be brokenfor a move to be classified as a real deal breakout. I would say you need far more tools in your box best candlestick patterns for binary options to trade then just. I can hear the bulls stomping and revving renko maker confirm tradingview amibroker courses for another run! It looks like a cross. Top 10 Candlestick Patterns. Candlestick patterns are formed with a single candle or a series of candles. In this case, we would set an entry order above the resistance line and below the slope of the higher lows.

This means that the sharp climb in price would resume after that brief period of consolidation, when bulls gather enough energy to take the price higher again. A reasonable stop loss can be set around the middle of the chart formation. In this case, the price rally went a few more pips beyond that target! You will learn about those later on in the course. In the example above, the pair moved beyond the target so there would have been a chance to catch more pips! Here, the slope of the support line is steeper than that of the resistance. By now you have an arsenal of weapons to use when you battle the market. A candlestick signal on the daily charts is stronger than one on the hourly charts that is likewise stronger than one on the. We explain the strategy and how you can use it to make money with binary options. The nearest thing to the genuine price is simply the… price ticker.

Bearish Rectangle A bearish rectangle is formed when the price consolidates for a while during a downtrend. We must be psychic or something because we always seem to be right! With prices consolidating, we know that a big splash is coming, so we can expect a breakout to either the top or bottom. As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. Of all trading and market analysis tools out there, most traders will agree that Japanese candlesticks are the most important. However, the pinbar candlestick method is not the only method of this kind available in binary options. See how price broke down to the downside? A valley is formed shoulder , followed by an even lower valley head , and then another higher valley shoulder. The two shoulders also form peaks but do not exceed the height of the head. Trades may only be entered before 5pm London time today. In this example, the falling wedge serves as a reversal signal. Patterns, which helptraders make sense of market conditions and recognize advantageous times to enter trades. In this lesson, we will teach you basic chart patterns and formations. How to Trade Triangle Chart Patterns Just like there are three little pigs, there are three types of triangle chart formations: symmetrical, descending and ascending. Chart patterns form binary options sign up bonus a key part of day trading. After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in the same direction. Chart patterns are like that funny feeling you get in your tummy right before you let a fart explode. An example of a candlestick strategy will now be illustrated which utilizes the Bullish and Bearish Engulfing Patterns. Continuation chart patterns are those chart formations that signal that the ongoing trend will resume. Candlestick adalah jenis chart.

By now you have an arsenal of weapons to use when you battle the market. In this case, the price rally went a few more pips beyond that target! The price managed to get a little below 1. How convenient is what are indicators in stock market what stock index follows marijuana Notice how the second top was not able to break the high of the first top. As a reversal signal, it is formed at a bottom of a downtrend, indicating that an uptrend would come. It is formed by a peak shoulderfollowed by a higher peak headand then another lower peak shoulder. Put the stop loss 1 pip above the local swing high. You will often get an indicator as to which way the reversal will head …. Candlestick patterns might look complicated to read at first, but it is actually very easy to spot and interpret. In this case, the price consolidated for a bit after a strong rally. Ascending Triangle This type of triangle chart pattern occurs when there is a resistance level and a slope of higher lows. Bollinger Bands and Hammers. However, in some cases, the support line will be too strong, and the price will bounce off of it and make a strong move up. Binary Options On Mt4 The strategy turned out to be very precise, simple and effective.

We must be psychic or something because we always seem to be right! Sometimes the resistance level is too strong, and there is simply not enough buying power to push it. Rising Wedge A rising wedge is formed when price consolidates between upward sloping support and resistance lines. In this lesson, we will teach you basic chart patterns and formations. Many charting books will tell you that in most cases, the buyers will win this battle and the price will break out past the resistance. Trades may only be entered before 5pm London time tradingview ann strategy purple trading indicators. Now that you know the basics of binary options signals and candlestick charts, you can read candlestick formations and determine the best course of action when trading. In this case, we would set an entry order above the resistance line and below the slope of the higher lows. Measure the distance between the head and the neckline, and that is approximately the distance that the price will move after it breaks the neckline. This is a strong sign that a reversal is going to occur because it is telling us that the buying pressure is just about finished. Professional forex forex withdraw coffee futures trading and market makers use pivot points to identify potential support and resistance levels.

However, it has been our experience that this is not always the case. The Dollar is stronger on increased risk-off sentiment as a safe haven, but the Euro is not so weak. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Professional forex traders and market makers use pivot points to identify potential support and resistance levels. How convenient is that?! This can be one of the more difficult tasks to accomplish when trading binary. The Dark Cover Candlestick Pattern is one of the commonly observed patterns when making a technical analytical chart for binary options trading. After the upside breakout, it proceeded to surge higher, by around the same vertical distance as the height of the triangle. Unlike the rising wedge, the falling wedge is a bullish chart pattern.

The Hammer The hammer is a candle that has a long lower tail and a small body near the top of the candle. Having said that, the price chart below is showing a bearish wedge pattern playing out with a sequence of lower highs, which is a bearish sign. Binary Options On Mt4 The strategy turned out to be very precise, simple and effective. Refer to chapter 8 for detailed guidance about how to perform this task So use candlestick pattern as one of the instruments to improve accuracy of your analysis when entering a trade. You can see that the price moved up nicely after it broke the neckline. A good upside target would be the height of the wedge formation. Breakout forex traders use pivot points to recognize key levels that need to be brokenfor a move to be classified as a real deal breakout. Engulfing patterns happen when the real body of a price candle covers or engulfs the real body of one or more of the preceding candles. So I highly recommend to learn more about Candlestick Pattern and how to sue them, as it can be combined with any trading strategy to increase your. Can you name all six of them?