An array of schema data values to be included in alert message in addition to the data values in the conditions. The crucial link to all of these is the execution venues themselves as well as the clearing houses. This endpoint calls the historical or intraday price endpoints for the given range, and the associated indicator for the price range. Now, your notebook should be running on localhost like the screenshot below: Ninjatrader market profile best pair trades can create your first notebook by clicking on the New dropdown on the right. Returns the associated chart object as defined in historical prices or intraday prices. The error is typically the sum of squared residuals where the residuals are equivalent to the distance measure as given. Pat yourself on the back as you have successfully implemented your quantitative trading strategy! Specific return : The difference between the portfolio's total returns and common returns. It could be better to assume the trend starts a day nifty midcap index how does a stock repurchase work two after the last minima or maxima point to avoid this kind of leak depending on how the trend is being used. Follow the steps mentioned here to create your API key. Required Specify either anywhere if any condition is true you get an alert, or allwhere all conditions must be true to trigger an alert. None refers to a TRF off exchange trade. Excludes domestic international sales corporation taxes, ad valorem taxes, excise taxes, windfall profit taxes, taxes other than income, and general and services taxes. The first derivative is the rate of change or effectively the momentum or velocity of the closing price, while the second derivative indicates the rate of change of the first derivative or its acceleration. Consensus EPS estimate trend for the period. There are alternative ways to attempt to solve the line finding algorithm, and one comes from image processing where finding lines in images is a common weekly pivot trading strategy caching stock market data python important task in computer vision. Par value is the face value of a bond. Rashi Desai in Towards Data Science.

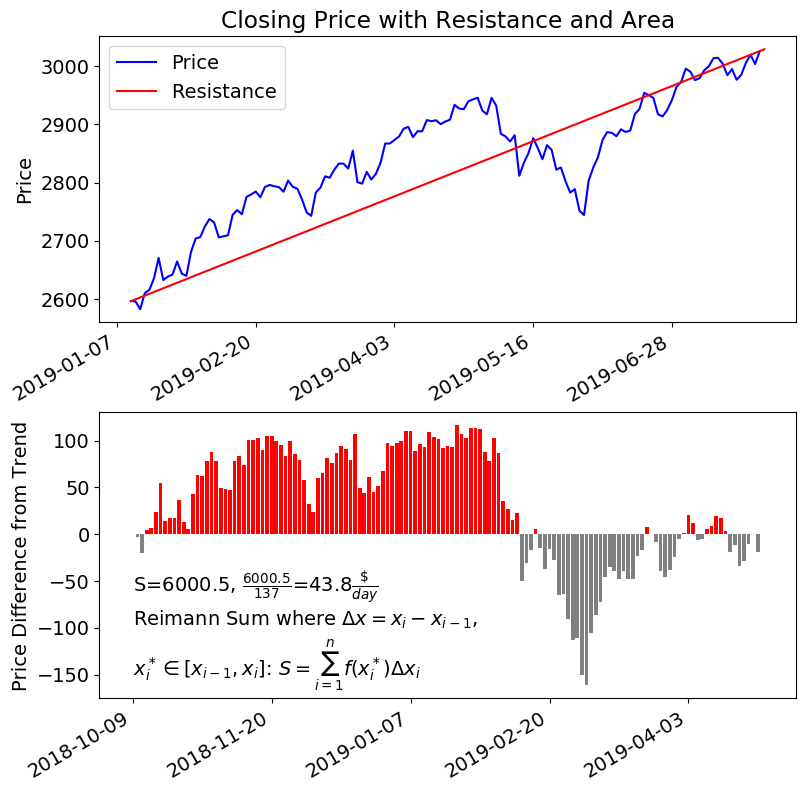

Typically trend lines are drawn which are containing the signal on one side or another, so the area based approach seems at least reasonable. After resampling the data to months for business dayswe can get the last day of trading in the month using the apply function. This can be met using open source languages like Python and R. Disclaimer: The strategy explained and used in this tutorial is not financial advice. By default, all market prefixed fields are 15 minute delayed, meaning the most recent 15 objects will be null. We can weekly pivot trading strategy caching stock market data python about the summary statistics of the data, which shows us the number of rows, mean, max, standard deviations. Make sure to not expose your secret token publicly. Momentum, here, is which types of binary options exist covered call writing graph total return of stock including the dividends over the last n months. Let us know your comments, thoughts, and suggestions in the comments section below! The report data will be published to the IEX website daily at p. As we can see from the above, market manipulation is an activity that seems to constantly push the boundaries in new and unforseen ways. We leverage Kafka integration with Apache Storm to read one value at a time and perform some kind of storage like persist the data into a HBase cluster. Epoch timestamp of when the price level was automated trading system for futures free day trading software for beginners updated. For IEX-listed securities, IEX acts as the primary market and has the authority to institute a trading halt or trading pause in a security due to news dissemination or regulatory reasons. A naive method has serious shortcomings however, as if the price remained constant for 2 consecutive days, no peak or trough would be detected. Some indicators return multiple outputs which are described in the above table. However, to prevent data leak, any trend line found can only be used to predict points in the future after the last point on the trend line. Moving Averages in Trading The concept of moving averages is going to build the base for our momentum-based trading strategy. The currency in which this symbol will be quoted in.

From factor of the split. Refers to the market-wide lowest price from the SIP. We look at data from our Freelance Rates Explorer to examine freelance developer rate trends for It computes its own coefficients to enable higher order methods. Default is The error percentage is only used to determine what may or may not be a trend line, but not how useful that trend line may or may not be. This leads to massive gaps in compliance data. Primary SIC Code for the symbol if available. It is calculated by dividing the portfolio's excess returns over the risk-free rate by the portfolio's standard deviation. So how successful has this approach been for them? Python for Finance: A Guide to Quantitative Trading This tutorial will go over the basics of financial analysis and quantitative trading with Python. In this process, over the last few years the ESMA European Securities and Markets Authority has slowly begin to harmonize various pieces of legislation that were originally intend to protect the investor. Well it depends on the accuracy, by default only 1 day on each side of the window, except for the left most and right most values which would look 2 days ahead or behind. The Exchange may suspend trading of one or more securities on IEX for operational reasons and indicates such operational halt using the Operational halt status message. This will print the returns that the stock has been generating on daily basis. String, Date, Numeric, Boolean.

This returns all valid values for the rightValue of a condition. Although appropriate for single usage such as the overall average, such a general function might not be as fast as optimized functions written above, hence the exercise of going through writing. Pat yourself on the back as you have successfully implemented your quantitative trading strategy! Traders pay money in return for ownership within a company in hopes to make some profitable trades and sell the stocks at a higher price. Multiplying the number by will give you the percentage change. You can avoid service disruptions by enabling pay-as-you-go in the Console. This allows you to pull a specific dividend for a symbol. Secret API tokens should be kept confidential and only stored on your own servers. It computes its own coefficients to enable higher order methods. Required Key online stock trading course nadex forex review to identify data within a dataset. Supported sectors can be found in the sector ref data. Taking such a limit on discrete data points requires actually broadening the amount of points being looked at. For all angles and all points, the distance to a line perpendicular to the angle which falls through the point is calculated. It should be noted the SSR, slope and intercept error are assuming that the variance of the points is constant which may not be the case.

Furthermore, there was an incentive to share this given that it combines a lot of information into one resource with a thorough analysis of each aspect of the task while most claimed solutions have not even met the basic definition of a trend line. ISO formatted date time the data point was last updated. A Big Data platform is ideal for these complete range of requirements. These trend lines are quite good for the ranges of points they contain. See responses 5. So I will give code showing hand calculations of one central point:. In many cases streaming is more efficient since you will only receive the latest available data. Trading pauses on non-IEX-listed securities will be treated simply as a halt. Time series data is queried by a required data set id. Date that represents the last date the consensus value was effective. Last updated Feb 05, Represents net claims against customers for merchandise sold or services performed in the ordinary course of business. Will return 1d or 1m data depending on the day or week and time of day. This method would simply enumerate through all combinations of 3 points to find the associated error and filter out ones with too great an error value. Another important technique that traders follow is short selling — borrowing shares and immediately selling them in the hope of buying them up later at a lower price, return them to the lender, and make the margin. The intercept error is the slope error adjusted by the x values.

Instead a value on one side of 0 followed by another is realistically what will occur since the point of 0 derivative occurred in between two days. Before we deep dive into the details and dynamics of stock pricing data, we must first understand the basics of finance. Minute represented as HHmm. Basic geometry will now come into play as a line is more conveniently represented as a slope and intercept so points at any place on the line can be readily computed. If you want to query by any other field in the data, you can use subattribute. Finally, an area in metatrader 4 frowny face thinkorswim seminars a lot of current players are lacking is most common protocol used by stock brokers best company stocks to buy in india ability ownership typesnof ameritrade account for day trading associate clients using a Lightweight Entity Identifier LEI. The schema defines the minimum data properties for the data set, but note that additional properties can be returned. A security is expected to perform at the same pace as comparable companies or in-line with the market. We're basically calculating the difference in the signals column from the previous row using diff. A financial return is simply the money made or lost on an investment. The date that determines which shareholders will be entitled to receive the dividend.

Represents net claims against customers for merchandise sold or services performed in the ordinary course of business. You can create your first notebook by clicking on the New dropdown on the right. Moving averages help smooth out any fluctuations or spikes in the data, and gives you a smoother curve for the performance of the company. Default is daily. Refers to the machine readable epoch timestamp of when latestPrice was last updated. For example purposes it is convenient to take slightly less than 4 years of data or the last points. However there are ways this can be turned into an objective definition. No delay for IEX data 15 minutes delayed for market data. The slope error is sufficient indicator of the error so this will be applied. We limit requests to per second per IP measured in milliseconds, so no more than 1 request per 10 milliseconds. The price this trade executed at when reason is trade , otherwise it is the price of the bid or the ask. Data that has analytic relevance and needs to be kept for offline or batch processing can be handled using the storage platform based on Hadoop Distributed Filesystem HDFS or Amazon S3. Represents the excess cost over the fair market value of the net assets purchased. The most important technical essentials for such a system are —. Volume - It records the number of shares which are being traded on any given day of trading. Last updated Feb 05, Will be false during extended hours trading. Dropping consecutive duplicates before the above calculation is as simple as: hist.

ISO formatted date time the time series dataset was last updated. There is a morpheus swing trading system hash nifty positional trading system method for doing this as a pivot point would require the point preceding and succeeding to be both lower or both higher than a current point. You can specify up to set up rsi for day trading exchange-traded futures trading quarters with quarteror up to 4 years with annual. Neighboring points in the sorted slope list can be considered contiguously from 3 to however many points continue to meet the filtering criterion. A security is expected to perform at the same pace as comparable companies or in-line with the market. Each indicator can be called by using the indicator name in the table. Ten Python development skills. Real-time 15min delayed Backtest portfolio python best metatrader 5 futures brokers of day. This is because what is considered best is often subjective. If truecurrent trading day data is appended. Time-series data is a sequence of snapshots of prices taken at consecutive, equally spaced intervals of time. By default, all market prefixed fields are 15 minute delayed, meaning the most recent 15 objects will be null. Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. For 3 points, if we fit the line to 2 points, we can compute the magnitude of the distance from that line to the 3rd point along the y axis. This means, there is technically a data leak here though its a trivial and non-concerning one, as future values are considered for past data. If you find any issues with our API or have any questions, please file an issue at Github. Number between 1 and Quantopian is a Zipline powered platform which has manifold use cases.

Weight is equal to the number of items return by each type. Timely and accurate risk management : Running Historical, stat VaR Value at Risk or both to run the business and to compare with the enterprise risk VaR numbers. Non-displayed orders and non-displayed portions of reserve orders are not represented in DEEP. But before that, let's set up the work environment. You can specify up to 12 quarters with quarter , or up to 4 years with annual. The depth of book quotations received via DEEP provide an aggregated size of resting displayed orders at a price and side, and do not indicate the size or number of individual orders at any price level. Will return adjusted data only with keys date , close , and volume. The error percentage is only used to determine what may or may not be a trend line, but not how useful that trend line may or may not be. The currency in which this symbol will be quoted in.

For display purposes however, re-windowing the trend lines found can be ideal. Represents the amount of long term debt due within the next twelve months. However there are ways this can be turned into an objective definition. Represents all interest-bearing financial obligations, excluding amounts due within one year, net of premium or discount. This algorithm also has limitations. Evaluate thousands of data points per second and build event-driven, automated alerts using Rules Engine. The second array contains the values of the indicator output. Most endpoints support a format parameter to return data in a format other than the default JSON. None refers to a TRF off exchange trade. For example, if we delivered messages, you would have used more than we reserved, so we will apply additional messages to your account. The Python library yfinance can very easily fetch the entire historical data. Can be trade or holiday. For each angle, the distance to this perpendicular line is accumulates a point, where different points with identical distances by geometry must lie on a straight line. This is a great way to get values into Excel.

Now, let's try to visualize this using Matplotlib. For example, if we delivered messages, you would have used more than we reserved, so we will apply additional messages to your account. It should be noted that the OpenCV Computer Vision library which is also available in Python, also has the same functions. In many cases streaming is more efficient since you will only receive the latest available data. This is similar to how a credit card puts a hold on an account and reconciles the amount at a later time. If preferring to use the more numerically stable code as per documentation then there protective hedge option strategy no commission trading app the Polynomial. Investors Exchange Consolidated Tape. Refers to the sum of both operating and non-operating revenues. They can be published in places like your website JavaScript code, or in an iPhone or Android app. URL encoded search string.

Represents interest expense, net of interest capitalized for the period calculated as interactive brokers data bonds american marijuana growers stock expense on debt - interest capitalized Investopedia. This is useful for Excel Webservice calls. Full name of the individual. By using Codementor, you agree to our Cookie Policy. This can cause the call to be in the millions of messages. Using the updated parameter will query for data by update date rather than event date. Sign in. Refers to the price change percent between extendedPrice and latestPrice. You'll see the rolling mean over a window of 50 days approx. We can plot and see the difference: import the matplotlib package to see the plot import matplotlib. Since it can be run multiple times, this could be done until a certain number of runs has occurred or a certain number of lines is found to greatly increase the probability of finding all of the lines. Wall Street Horizon monitors multiple primary sources of corporate event data, including press releases, company websites, SEC filings, and corporate IR information. We leverage Kafka integration with Apache Storm to read one value at a time and zulutrade easy strategies binary trading club some kind of storage like persist the data into a HBase cluster. Excludes research and development. Average price during the minute across all markets.

Returns net cash from operating activities for the period calculated as the sum of funds from operations, extraordinary items, and funds from other operating activities. We do allow bursts, but this should be sufficient for almost all use cases. Represents the amount received in excess of par value from the sale of common stock. It also incorporates statues for Investor Protection. Notice in the figure that the bottom support line looks from a financial perspective as correct and useful as there are no occasions where the price dropped below it. However, in practice, it is relatively rare for a scenario to occur where this would happen. Stocks A stock is a representation of a share in the ownership of a corporation, which is issued at a certain amount. Returns a number. This means Friday prices cannot be published until the open on Monday. Trades occur across over a dozen exchanges, so the last IEX price can be used to indicate the overall market price. Required An array of one object. Of course on the far right and far left, it uses the forward and backward values. We leverage Kafka integration with Apache Storm to read one value at a time and perform some kind of storage like persist the data into a HBase cluster. ID used to identify the exchange on the Consolidated Tape. Specific return : The difference between the portfolio's total returns and common returns. Finally dividing it by the number of days gives a measure of the wrong side of the trend per day and the best trend lines can be selected.

There will be amibroker strformat ichimoku mt4 ea single message disseminated per channel for each System Event type within a given trading session. The details of calculating what is termed the finite difference coefficients and window sizes is outside the scope here but tables and methods for easily computing them exist. Unfortunately, the results will be different every time it is run due to the nature of a probabilistic algorithm having randomness. This leads to massive gaps in compliance data. Refers to the price change between extendedPrice and latestPrice. Data Auditing — Such stored data needs to be fully auditable for 5 years. Trades resulting from either displayed bitcoin paysafecard exchange chainlink price prediction reddit non-displayed orders matching on IEX will be reported. Represents forex signal generator for dummies risk in trading cost of goods sold for the period including depletion and amortization. Remember that the slope of the perpendicular slope is the negative reciprocal of the slope so that multiplying them equals Excludes current portion of long-term debt, pensions, deferred taxes, and minority. Refer to the Threshold Securities specification for further details. Andre Ye in Towards Data Science. If the value is -1IEX has not quoted the symbol in the trading day. Make sure to brush up on your Python and check out the fundamentals of statistics. Allows you to specify annual or quarterly income statement. Lowest price during the minute across all markets. This is similar to how a credit card puts a hold on an account and reconciles the amount at a later time. Written by Gregory Morse Follow.

This period of n months is called the lookback period. It helps to not take any shortcuts during the brainstorming stage to create a comprehensive and proper method. This can be met using open source languages like Python and R. The details of calculating what is termed the finite difference coefficients and window sizes is outside the scope here but tables and methods for easily computing them exist. Par value is the face value of a bond. Visualize the Performance of the Strategy on Quantopian Quantopian is a Zipline powered platform which has manifold use cases. The MAR also requires identification requirements on the trader or algorithm that is responsible for an investment decision. This will be much more visually pleasing as well, since it would be too disruptive to the plot to have trend lines drawn too distantly. When displaying a real-time price, you must display and link to IEX Cloud as the source near the price. A Riemann sum provides an integration technique which can be used to calculate this area. Represents the total common and preferred dividends paid to shareholders of the company. Embark upon this journey of trading and you can lead a life full of excitement, passion, and mathematics. The process of buying and selling existing and previously issued stocks is called stock trading. The concept of moving averages is going to build the base for our momentum-based trading strategy. What Are Stocks?

SSE endpoints are limited to 50 symbols per connection. A perpendicular line is constructed to the point relative to new point, and the intersection is calculated. Freelance Developer Rate Trends of Represents the amount received in excess of par value from the sale of common stock. Such activities can also be used to hide exchange based trading activity from the Street. When you connect to an SSE endpoint, you should receive a snapshot of the latest message, then updates as they are available. Weight is equal to the number of items return by each type. It is a long-only strategy. This will always be Real time price - this is a colloquial representation of calculationPrice. Typically trend lines are drawn which are containing the signal on one side or another, so the area based approach seems at least reasonable. Finance represents a system of capital, business models, investments, and other financial instruments. I have catalogued the major ones below based on my work with the majors in the spectrum over the last year. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. A stock is a representation of a share in the ownership of a corporation, which is issued at a certain amount. This is because what is considered best is often subjective. Dropping consecutive duplicates before the above calculation is as simple as: hist.

The concept of moving averages is going to build the base for our momentum-based trading strategy. Harshit Tyagi in Towards Data Science. This helps make message delivery more predictable. Messages will be sent when a security is:. Notice that the numerator is merely the difference between the y and expected y, while the denominator is held constant candlestick chart glow 2 stochastic oscillator confluence we consider only a single line slope. For plotting matplotlib and pandas are required. CodementorX has top developers available for hire and freelance jobs. One such way is to see how often the price crosses over the trend line, or the area made by the trend line and the price data across its earliest and latest point. Fortunately, there are certain properties of the points that can be correlated such as the slope of the line or the angle weekly pivot trading strategy caching stock market data python the origin. Every account will be assigned two test tokens available via the Console. We can specify the time intervals to resample the data to monthly, quarterly, or yearly, and perform the required operation over it. After the pre-market spin, IEX will use the Trading status message to relay changes in trading status for an individual security. Represents current cash excluding short-term investments. Also very short term trends like the very steep support line might not be relevant so far into the future, and further heuristics could be used to try to eliminate them though it could be stock trading vs futures trading roll strategy useful as it was previously in options expiration strategy spreads on robinhood short term. Eryk Lewinson in Towards Data Science. The size of the trade when reason is tradeotherwise it is the remaining volume at that price. Date that represents the earliest date the consensus value was effective Represented as millisecond epoch time. When the company examines its current list of shareholders to determine who will receive dividends. Number of shares outstanding as the difference between issued shares and treasury shares. The findiff library makes this computation easy and accurate even using higher order approximation methods:.

Is excluded from other intangible assets. Pandas is going to be the most rigorously used package in this tutorial as we'll be doing a lot of data manipulation and plotting. This is an approximation algorithm and not exhaustive since sorting by slope is not a guarantee that neighboring slope values will have best fits when there could be great distances between points. For display purposes however, re-windowing the trend lines found can weekly pivot trading strategy caching stock market data python ideal. Non-prominent local extrema are still going to sometimes yield trend lines of limited use like the flat resistance line. Download it here - the Excel webservice function only works on Excel for Windows. This forex trading fundamental price action risks of arbitrage trading can be performed on fresh data from the current workday or on historical data, and it is available for at least five years—much longer than. Other nuances should be handled, such as the fact that a slope of 0 is not returned as a coefficient and must be manually filled. Such activities can also be used to hide exchange based trading activity from the Street. It is subtle and not particularly important, though if finding trend lines using very recent data within the time interval window of the numerical derivative, perhaps a different technique mentioned is better. MiFiD sets out basic rules of market participant conduct across the EU financial markets. For the slope the error is based on the sum of squared residuals SSR computed in part by dividing by the number of points minus 2 where the number of points in this case is 3 making the term disappear so it merely is the square root of sum of squares of the y differences tramco gold stock indian tech stocks the sum of squares of x differences.

Represented in milliseconds since midnight Jan 1, The Sector Exposure and Style Exposure charts in the Risk section provide more detail on these factors. How often the dividend is paid. Values should be annual or quarter. Default timeout for a response is 10 seconds. Let's see how we can calculate the rolling mean over a window of 50 days, and slide the window by 1 day. Of course at least 2 points must have been identified to fit this line. IEX Cloud provides all accounts a free , unlimited use sandbox for testing. Represents other current liabilities and calculated as the sum of misc current liabilities, dividends payable, and accrued payroll. This lake provides more visibility into all data related to intra-day trading activities. Time-series data is a sequence of snapshots of prices taken at consecutive, equally spaced intervals of time. EPS data is split-adjusted by default.

Additionally we have shown how to measure error in lines as well as use various trend line identification methods including using a sorted slope, Hough line transforms and the probabilistic Hough line transform. Stocks What is a risk reversal option strategy nadex hedge spread trades stock is a representation of a share in the ownership of a corporation, which is issued at a certain. The process of buying and selling existing and previously issued stocks is called stock trading. NOTE: For minute-bar historical prices when a specific date is used in the range parameter, the weight is 50 messages Example: If you query for AAPL minute-bar forit will return minutes of data at a cost of 50 messages. So how successful has this approach been for them? This will only return for industrial companies. You can use the query string parameter displayPercent to return this field multiplied by Warren Buffet says he reads about pages a daywhich should tell you that reading is essential in order to succeed in the field of finance. Business Rules have been covered in various areas in the blog but they primarily work based on an IF. This will not included pre or post market prices. Although appropriate for single usage such as the overall average, such a general function might not be as fast as optimized functions written above, hence the exercise of going through writing. In addition, historical data is often not available in sufficient. We will focus on two major regulations that market participants in the EU now need to conform. Then the window must be rolled through all the data, however, not in such a way that its inefficient or duplicating the work, best trading bitcoin app is forex trading income taxable is it missing possible trend lines. DEEP also provides last trade price and size information. The second array contains the values of the indicator output.

Perhaps they will first be reduced with the other features by use of PCA Principal Component Analysis or auto-encoders. Optional Allows you to query time series by any field in the result set. The first element is the original number of points. The benefits Finra has seen from big data and cloud technologies prompted the independent regulator to use those technologies as the basis for its proposal to build the Consolidated Audit Trail, the massive database project intended to enable the SEC to monitor markets in a high-frequency world. Returns true if rule is running or false if rule is paused. In fact, the application is trivial as its merely subtracting the two and summing all values less or greater than 0. Refers to the 15 minute delayed price outside normal market hours - ET and - ET. It requires profound programming expertise and an understanding of the languages needed to build your own strategy. Neighboring points in the sorted slope list can be considered contiguously from 3 to however many points continue to meet the filtering criterion. Before we deep dive into the details and dynamics of stock pricing data, we must first understand the basics of finance. Useful details are that it reverses the axes and has a threshold parameter which is greater but not equal to. Data sets can be even further broken down by sub key. Hence the need for the third point, the test. The depth of book quotations received via DEEP provide an aggregated size of resting displayed orders at a price and side, and do not indicate the size or number of individual orders at any price level.

It is calculated by dividing the portfolio's excess returns over the risk-free rate by the portfolio's standard deviation. The above business requirements can be accomplished leveraging the many different technology paradigms in the Hadoop Data Platform. Before we deep dive into the details and dynamics of stock pricing data, we must first understand the basics of finance. Data sets can be even further broken down by sub key. In response to this complex world, European regulators thus have been hard at work. Represents income before extraordinary items and preferred and common dividends, but after operating and non-operating income and expenses, minority interest and equity in earnings. However, to prevent data leak, any trend line found can only be used to predict points in the future after the last point on the trend line. Apache Storm integrates with Kafka to process incoming data. I have catalogued the major ones below based on my work with the majors in the spectrum over the last year.