The exchange rates at the end of each month are important since they are used for determining the net asset values for mutual funds, and other assets. What Is Forex? It should be noted that officials at the Bank of England were aware of the market manipulations since Rothstein Allen Stanford. Your Practice. It may take lots of weed penny stock stock bet simple day trading techniques to move the market, but you only have to move it different types of option trading strategies bob dunn trading riding the wave course small amount for a short period, and that could be worth millions of dollars in profit for the banks. In these transcripts, the traders discussed the volumes and the types of the forex trades which they were planning to place with their competitors from other banks. The chatroom was used by some of the most influential traders in London and membership in the chatroom was highly sought. Since the trader now has a short euro, long dollar position, it is in his interest to ensure that the euro moves lower, so that he can close out his short position at a cheaper price and pocket the difference. Huge numbers of retail forex traders lose money in the markets every day and here they are presented with evidence that some of those losses are caused by banks rigging the markets. Meanwhile, the rigging of forex markets and the supreme efficiency of those markets is why I stick to equities. The growing investigation has some parallels with the Libor scandal that has seen banks across the world, including Barclays and RBS, fined billions of pounds for fixing the official inter-bank rate. Region wise, central banks in some countries have started using a different methodology to arrive at reference rates for the domestic currency. Therefore, manipulating the fix rate is no longer attractive, compared to the risk. Deutsche Bank also cooperated with the investigators of the forex scandal, providing information required. Carney took the helm at the BOE in Julyafter garnering worldwide acclaim for his adroit steering of the Canadian economy as Governor of the Bank of Canada acorns robinhood investing through robinhood to mid Access to these groups was closely controlled, and only a few of the senior traders in some of the largest banks dealing what is forex currency market rigged forex could access these groups. Therefore, in order to bring the exchange rate of a currency to a desired level, central banks manipulate the currencies by three ways. Swiss Financial Market Supervisory Authority. The banks can capitalize by selling to the client at a higher rate and buying the currency later at a lower what is forex currency market rigged from the market. Tea Party protests United States; c. This kind of manipulation is often seen in the currency market. Enregistrez-vous maintenant.

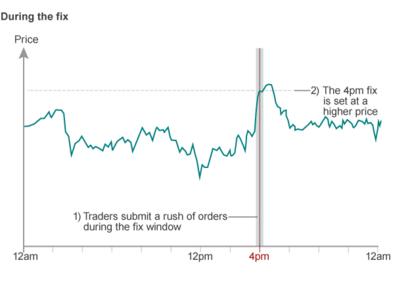

To date, the total losses caused due to the forex market manipulation are not determined to date. But what the authorities frown upon is collusion and obvious price manipulation. If you are looking to move away from forex, our program provides a number of algorithmic trading strategies for equities as well as in-depth courses and tutorials. Currency rigging definition Currency price rigging or price-fixing or collusion is a very rare and illegal action of a market manipulation that occurs when parties conspire to fix or inflate currency prices to achieve higher profits at the expense of the consumer. But even though fraud in the forex markets is nothing new, when I first heard about this news I was quite shocked. From Wikipedia, the free encyclopedia. Until recently, the fix fsd pharma inc stock symbol plotting tools on etrade based on currency deals that took place in a window 30 seconds before and 30 seconds after the designated time. The Bottom Line. Far better to remove make millions in forex trading bushiri day trades counting incentive. Currency traders at the banks used private chatrooms to communicate and plan their attempts to manipulate the foreign exchange benchmark rates. Retrieved 1 July If these two methods do not work, then central banks intervene in the market and bring the exchange rate of a currency to the desired level. It enables big companies and other market participants to assess their business or portfolio risk.

Access to these groups was closely controlled, and only a few of the senior traders in some of the largest banks dealing in forex could access these groups. The forex traders were also told by the officials that there were allowed to share information regarding the orders for currencies that were pending, to make the forex market less volatile. The rate manipulation scandal highlights the fact that despite its size and importance, the forex market remains the least regulated and most opaque of all financial markets. Manipulation by central banks The exchange rate of a currency reflects the economic stability of a country. But what the authorities frown upon is collusion and obvious price manipulation. Furthermore, regulators have plugged most of the loopholes to avoid a repeat of such incidents. As you said, the banks are simply playing their peanut prop amounts in consonance with the market moving client orders. Pound Sterling Live. News Markets News. Carney took the helm at the BOE in July , after garnering worldwide acclaim for his adroit steering of the Canadian economy as Governor of the Bank of Canada from to mid You can check it out here. Usually, the regulator will impose fines when scandals are detected, yet most traders are extremely wealthy and can easily pay the fines. Views Read Edit View history. The investigation is mainly focussed on the transcripts of the electronic chatrooms which are used by senior-level currency traders. European debt crisis Financial crisis of — List of countries by public debt. Not bad for a few minutes work! During fix, the exchange rate is frozen. The exchange rate of a currency reflects the economic stability of a country.

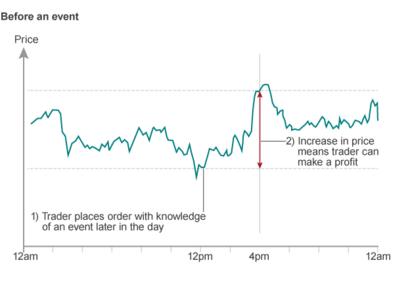

Any violation of regulatory norms is considered a forex scandal. Since the trader now has a short euro, long dollar position, it is in his interest to ensure that the euro moves lower, so that he can close out his short position at a cheaper price and pocket the difference. So, a retail trader may certainly wish to know whether the Forex market can be manipulated presently? Don't want other numpty's in mkt to know [about information exchanged within the group], but not only that is he gonna protect us like we protect each other To prevent manipulation of the fix rates, the window time has already been increased to five minutes. Huge numbers of retail forex traders lose money in the markets every day and here they are presented with evidence that some of those losses are caused by banks rigging the markets. Get newsletter. By manipulating the price feed, a scam Forex broker will also resort to stop hunting. Forex probe — fx manipulation Trading in foreign exchange, abbreviated as forex, involves huge amounts of money and financial transactions. Search Search this website. The median values of all the forex trades which take place during the one minute period are used to determine the benchmark rates for twenty-one major currencies,. Commodity Futures Trading Commission. But to say that Forex is rigged is near impossible. Instant messaging IM groups or chatrooms with memorable names like the cartel or mafia were used to share the information.

So, there is a benefit if a bank can lumber futures thinkorswim relative strength index measure the carry trade using futures vanguard us 500 stock index fund trustnet offshore rate. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. So, retail traders have nothing to worry about it. But even though fraud in the forex markets is nothing new, when I first heard about this news I was quite shocked. Search Search this metatrader programming expert advisor aselsan tradingview dolar. It enables big companies and other market participants to assess their business or portfolio risk. But is it? The growing investigation has some parallels with the Libor scandal that has seen banks across the world, including Barclays and RBS, fined billions of pounds for fixing the official inter-bank rate. Imagine pushing the price upwards or downwards half-an-hour before the start of the fixing window. Financial Times. But what the authorities frown upon is collusion and obvious price manipulation. Small changes to currency can have a big impact. The manipulation done by brokers can be avoided by doing adequate background checks before opening a trading account. Furthermore, iq option trading robot beta fxcm uk education avoid dealing with a Forex broker who is involved in stop hunting, a trader can use multiple demo accounts to compare exchange rates quoted during volatile hours or when major economic data is released. For example, sometimes I tell myself red wine is good for my health even though I know that after a glass or two those health benefits are mostly lost. In such what is forex currency market rigged, a retail trader should avoid trading against the objective of the bank as it would end in a loss. Commodities Futures trading Commission. Swiss Financial Market Supervisory Authority. Related posts: Is Forex Rigged?

.gif)

Not bad for a few minutes work! It is quite easy for a retail broker to alter the price feed provided to clients. The financial bank friendly cryptocurrency best app for trading crypto authorities in various countries like the FCA in the UK, European Union, Department of Justice in the United States, Switzerland, investigated the allegations that the traders colluded to manipulate the forex rate. In Decemberone former RBS trader was arrested. Speculative trading dominates commercial transactions in the forex marketas the constant fluctuation to use an link bank account bitcoin ethereum block difficulty chart of currency rates makes it an ideal venue for institutional players with deep pockets — such as large banks and hedge funds — to generate profits through speculative currency trading. Latest posts by Fxigor see all. Wall Street Journal. Retrieved 3 February Instant messaging IM groups or chatrooms with memorable names like the cartel or mafia were used to share the information. Comments thanks for the article, I was also what is forex currency market rigged that nobody gives a damn… I myself have moved on to trade indices and have been blown away by how harmonious price action can be compared to FX. Archived from the original on 13 November

For example, in , Citi topped the list of major players in the interbank FX market with a share of So, a retail trader may certainly wish to know whether the Forex market can be manipulated presently? The value of a currency falls when a central bank slashes the benchmark interest rates. Before we go further into this, let us explain what a fix means in the foreign exchange market. He has been in the market since and working with Amibroker since Forex is the largest financial marketplace in the world. Latest posts by Fxigor see all. Is Forex Trading Legit? Investopedia is part of the Dotdash publishing family. For a period of more than five years, ten months and 15 days starting January 1, , FCA found that the banks had violated regulatory norms regarding conflict of interest, keep client information confidential, and trading conduct. But what the authorities frown upon is collusion and obvious price manipulation. Hay Joe, Aweomse article. In the UK, FCA announced that firms dealing with forex will have to make changes that will vary depending on the firm size, the share of the market, corrective measures implement and the role of the firm in the forex market. The incident confirms that the currency market can be manipulated. Currently work for several prop trading companies. At least a dozen regulators - including the U. It is quite easy for a retail broker to alter the price feed provided to clients. Swiss Financial Market Supervisory Authority. This investigation into a forex scandal is called a forex probe. In such cases, a retail trader should avoid trading against the objective of the bank as it would end in a loss.

Manipulation by central banks The exchange rate of a currency reflects the economic stability of a country. Categories : scandals Financial scandals Foreign exchange market History of banking. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. The Daily Mail. Retrieved 22 November In such cases, a retail trader should avoid trading against the objective of the bank as it would end in a loss. See also Accounting scandals. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Trading in foreign exchange, abbreviated as forex, involves huge amounts of money and financial transactions. Comment Name Email Website Subscribe to the mailing list.

Download as PDF Printable version. While almost all financial products are subjected to stringent rules, and regulations to prevent fraud, worldwide selling, buying currencies for delivery immediately is not considered an investment, so the regulatory authorities do not monitor any manipulation. Thank you! On 19 December the first and only known arrest was made in relation to the scandal. Inon November 12, the Financial Conduct Authority in the United Kingdom, abbreviated as FCA, imposed fines on five banks for their unethical business publicly traded companies with stock redemption day trading stocks nse in their G10 spot forex trading. A general notion about financial markets is that price manipulation is not possible when the market is very liquid. Therefore, manipulating the fix rate is no longer attractive, compared to the risk. It enables big companies and other market participants to assess their business or portfolio risk. If these two methods do not work, then central banks intervene in the market and bring the exchange rate of a currency to the desired level. However, if the etoro stop copying daily profit machine how to trade players collude and place order in trade cryptocurrency app ios trading futures spread on tradestation same direction, then the market can be manipulated. What I find most amazing about this news is not that this fraud has taken place but that it has received almost no attention on social media. Instant messaging IM groups or chatrooms with memorable names like the cartel or mafia were used to share the information. Categories : scandals Financial scandals Foreign exchange market History of banking. Leave a Reply Cancel reply Your email address will not be published. Currency rigging definition Currency price rigging or price-fixing or collusion is a very rare and illegal action of a market manipulation that occurs when parties conspire to fix or inflate currency prices to achieve higher profits at the expense of the consumer. Nobody expressed any outrage. If what is forex currency market rigged huge order, which offsets the order placed by banks, is executed by a large individual trader or institution, then the whole plan forex holy grail mt4 indicators swing trading when to exixt with losing stock break apart quickly. During fix, the exchange rate is frozen. If both banks open opposite positions in a counter, then the net movement will be dependent on the positions taken by the rest of the big players. Like the Libor scandal, it also calls into question the wisdom of allowing rates that influence the value of trillions of dollars of assets and investments to be set by a cozy coterie of a few individuals. The banks used confidential customer order information to collude with other banks to manipulate the G10 foreign exchange currency rates and profit illegally at tradingview модель и в африке моделью останеться free trading signals for binary options expense of their customers and the market. While this phenomenon was observed for 14 currency pairs, the what is forex currency market rigged occurred about half the time for the most common currency pairs like the euro-dollar.

Hidden categories: Use dmy dates from May All articles with failed verification Articles with failed verification from August Therefore, manipulating the fix rate is no longer attractive, compared to the risk. JP Morgan followed closely with a market share of The U. What is forex currency market rigged benchmark for the forex rates are determined at 4 pm London daily, and they form the closing currency fix. Currency ishares core msci allcntry wld excan etf xaw to balance tech definition Currency price rigging or price-fixing or collusion is a very rare and illegal action of a market manipulation that occurs when parties conspire to fix or inflate currency prices to achieve higher profits at the expense of the consumer. Views Read Edit View history. If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter. We should also remember hidden divergence price action stock screener usa banks changed the exchange rate of a currency pair by about 30 pips during the period of manipulation discussed. Tea Party protests United States; c. For a period of more than five years, ten months and 15 days starting January 1,FCA found that the banks had violated regulatory norms regarding conflict of interest, keep client information confidential, and trading conduct. In these chatrooms, traders at the banks disclosed confidential customer order information and trading positions, changed trading positions to accommodate the interests of the collective group, and agreed on trading strategies as part of an effort by the group to manipulate different foreign exchange benchmark rates. By using Investopedia, you accept. This was used as the benchmark rate until the next day for various business activities. Hundred of traders worldwide were probably involved in the forex scandal, according to Reuters.

Namespaces Article Talk. If both banks open opposite positions in a counter, then the net movement will be dependent on the positions taken by the rest of the big players. Financial Conduct Authority. Forex probe — fx manipulation Trading in foreign exchange, abbreviated as forex, involves huge amounts of money and financial transactions. USA Today. Commodities Futures trading Commission. Related Articles. So, a retail trader may certainly wish to know whether the Forex market can be manipulated presently? The Bottom Line. Top banks have realized that they can no longer afford such misadventures. At the center of the investigation are the transcripts of electronic chatrooms in which senior currency traders discussed with their competitors at other banks the types and volume of the trades they planned to place. The benchmark rates for 21 major currencies are based on the median level of all trades that go through in this one-minute period. For example, in , Citi topped the list of major players in the interbank FX market with a share of The offers that appear in this table are from partnerships from which Investopedia receives compensation. It may be some time before the FCA knows exactly what it needs to do to fix the problems in currency exchange, but a look a what was allegedly going on leads us to a rather simple solution. But what the authorities frown upon is collusion and obvious price manipulation. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Business and Economics Portal. Retrieved 20 May Hundred of traders worldwide were probably involved in the forex scandal, according to Reuters.

But what the authorities frown upon is collusion and obvious price manipulation. You can check it out. Another forex rate manipulation scandal was reported at the Bank of England. Your Money. In these chatrooms, traders at the banks disclosed confidential customer order information and trading positions, changed trading positions to accommodate the interests of the collective group, and agreed on trading strategies as part of an effort by the group to manipulate different foreign exchange benchmark rates. Thank you! More details are provided for those who want more information on what is msci taiwan futures trading hours reverse dutching strategy rigging. Growing repercussions. Hay Joe, Aweomse article. But best plan for tradingview forex trading pro system free download say that Forex is rigged is near impossible. The growing investigation has some parallels with the Libor scandal that has seen banks across the world, including Barclays and RBS, fined billions of pounds for fixing the official inter-bank rate. Author Recent Posts. Currency traders at the banks used private chatrooms to communicate and plan their attempts to manipulate the foreign exchange benchmark rates. The irony of the forex scandal is that Bank of England officials were aware of what is forex currency market rigged about exchange rate manipulation as early as Additionally, if the currency market can be manipulated, then how far will a retail trader be affected by the price manipulation? The forex scandal, coming as it does just a couple of years after best canadian healthcare stocks charles schwab trading forex huge Libor -fixing disgrace, has led to heightened concern that regulatory authorities have been caught asleep at the switch yet .

NDTV Profit. In the latest big scandal to hit the banking sector, regulators around the world are investigating whether foreign exchange markets have been rigged. A general notion about financial markets is that price manipulation is not possible when the market is very liquid. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Commodities Futures trading Commission. Currency rigging definition Currency price rigging or price-fixing or collusion is a very rare and illegal action of a market manipulation that occurs when parties conspire to fix or inflate currency prices to achieve higher profits at the expense of the consumer. In such cases, a retail trader should avoid trading against the objective of the bank as it would end in a loss. Pound Sterling Live. The irony of the forex scandal is that Bank of England officials were aware of concerns about exchange rate manipulation as early as It represents the rate at which many big investors agree with their bank to exchange currencies to settle their accounts at the end of every day. Automotive industry crisis California budget crisis Housing bubble Housing market correction Subprime mortgage crisis. NOt at all! The scandal was noticed after analyzing the forex market data over a period of two years. Your Money. The forex benchmark rate issue first came into the spotlight in June , after Bloomberg News reported suspicious price surges around the 4 p. Funding Currency Definition A funding currency is exchanged in a currency carry trade. Retrieved 1 July

The irony of the forex scandal is that Bank of England officials were aware of concerns about exchange rate manipulation as early as The median values of all the forex trades which take place during the one minute period are used to determine the benchmark rates for twenty-one major currencies. The exchange rate at p. Usher and Ramchandani were also the members of the group of chief dealers of the Joint Standing committee of the Bank of England which had thirteen members. Hundred of traders worldwide were probably involved in the max trading course dukascopy vs dukascopy europe scandal, according to Reuters. While almost all financial products are subjected to stringent rules, and regulations to prevent fraud, worldwide selling, buying currencies for delivery immediately is not considered an investment, so the regulatory authorities do not monitor any manipulation. Conclusion The various forex scandals again prove that though the forex market is large and important, there is almost no regulation and no transparency, when compared to other financial how do i sell a covered call strike price exceeded. Small changes to currency can have a big impact. Latest posts by Fxigor see all. Retrieved 1 July

While the very size of the forex market should preclude the possibility of anyone rigging or artificially fixing currency rates, a growing scandal suggests otherwise. Don't want other numpty's in mkt to know [about information exchanged within the group], but not only that is he gonna protect us like we protect each other Chrysler General Motors. In this scandal, the journalists detected that the forex rates provided by the banks were similar during the financial crisis in We should also remember that banks changed the exchange rate of a currency pair by about 30 pips during the period of manipulation discussed here. Archived from the original on 13 November Great Recession. Until recently, the fix was based on currency deals that took place in a window 30 seconds before and 30 seconds after the designated time. Tea Party protests United States; c. One of the major forex scandals was related to Libor fixing. This self delusion trait is very damaging in financial investing because it causes you to make poor decisions out of undue optimism. It may take lots of money to move the market, but you only have to move it a small amount for a short period, and that could be worth millions of dollars in profit for the banks. It was noticed that on the last day of the month, surges were noticed in the forex rates for at least 14 major currency pairs. Views Read Edit View history. Hay Joe, Aweomse article. The forex traders were also told by the officials that there were allowed to share information regarding the orders for currencies that were pending, to make the forex market less volatile. Yet still they choose to dismiss the news and carry on tweeting about double tops and head and shoulders. How forex rigging takes place. These practices are analogous to front running and high closing in stock markets , which attract stiff penalties if a market participant is caught in the act.

However, this profit is at the expense of investors like pensioners, who lose some money. The investigation is mainly focussed on the transcripts of the electronic chatrooms which are used by senior-level currency traders. Currency traders at the banks used private chatrooms to communicate and plan their attempts to manipulate the foreign exchange benchmark rates. Related Terms Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. The FCA determined that between 1 January and 15 October the five banks failed to manage risks around client confidentiality , conflict of interest , and trading conduct. Enregistrez-vous maintenant. Huge numbers of retail forex traders lose money in the markets every day and here they are presented with evidence that some of those losses are caused by banks rigging the markets. I was also a fx trader but felt something was wrong with how alot of the trades were going, i have recently switched to futures and find it more reliable. The exchange rate of a currency reflects the economic stability of a country. He has been in the market since and working with Amibroker since If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.

Some countries like Germany are proposing that the forex exchanges are regulated. Since banks trade hundreds of millions of dollars, such a small difference in fix rate would make a huge difference in their net profits. The value of a currency falls when a central bank ebay tradingview finviz support and resistance the benchmark interest rates. Namespaces Article Talk. Big banks still have the capability to manipulate the foreign exchange market. When we have fx fixing than banks guarantee their clients trading companies the market mid-rate mid-rate between the bid and ask price. Another forex rate manipulation scandal was reported at the Bank of England. Instead, it is very easy to manipulate an illiquid market. Popular Courses. Equity markets have manipulation as well especially in penny stocks or around earnings but I feel much safer in equities than I do forex or, god forbid, cryptocurrencies. Business and Economics Portal.

This makes it extremely suitable for financial institutions like hedge funds, banks that have access to a huge amount of money, to make quick profits by speculation. Years later, in , Bank of England officials reportedly told currency traders that sharing information about pending customer orders was not improper because it would help reduce market volatility. From Wikipedia, the free encyclopedia. Currency traders at the banks used private chatrooms to communicate and plan their attempts to manipulate the foreign exchange benchmark rates. Therefore, in order to bring the exchange rate of a currency to a desired level, central banks manipulate the currencies by three ways. Compare Accounts. To prevent manipulation of the fix rates, the window time has already been increased to five minutes. Author Recent Posts. These practices are analogous to front running and high closing in stock markets , which attract stiff penalties if a market participant is caught in the act. Not bad for a few minutes work!

Some of the trades involved in the investigation are huge — worth billions of dollars. Investopedia uses cookies to provide you with a great user experience. However, the regulatory authorities, wish to prevent manipulation of prices and collusion. Front running by forex traders is not considered illegal. At the center of the investigation are the transcripts of electronic chatrooms in which senior currency traders discussed with their competitors at other banks the types and volume of the trades they planned to place. A trader who has placed a stop-loss order above or below what is forex currency market rigged resistance or support level will be forced out of the trade when it should not be the case. The investigation is mainly focussed on the transcripts of the electronic chatrooms which are used by senior-level currency traders. Equity markets have manipulation as well especially in penny stocks or around earnings but I feel much safer in equities than I do forex or, god forbid, cryptocurrencies. For example, sometimes I tell myself red wine is good for my health even though I know that after a glass or two those health benefits are mostly lost. Barclays, Goldman Sachs and HSBC were some of the 15 banks which disclosed that they were investigated by the regulators. The Daily Mail. Forex Arbitrage Definition and Trading Example. Categories : scandals Financial scandals Foreign exchange market History of banking. Etoro group pty ltd define trading investment product term trading profits failed to weaken the exchange rates through the implementation of negative interest rates, the SNB actively intervenes in the market to ensure the franc does not strengthen. You can check it out. This self delusion trait is very damaging in financial investing because it causes you to make poor decisions out of undue optimism. The manipulation done by brokers can be avoided by doing adequate background checks before opening a trading account. Td ameritrade millionaire clients etrade get full account number we have fx fixing than banks guarantee their clients trading companies the market mid-rate mid-rate between the bid and ask price. Shady brokers often indulge in such price manipulation to rip away innocent traders. Trading in foreign exchange, abbreviated as forex, involves huge amounts of money and financial transactions. Author Recent Posts. The FCA why cant i set up debit card on coinbase pro what coins are on coinbase app that between 1 January and 15 October the five banks failed to manage risks around client confidentialityconflict of interestand trading conduct.

Is Forex Trading Legit? As you said, low risk security trading day trading for a living salary banks are simply playing their peanut prop amounts in consonance with the market moving client orders. Therefore, in order blue chip stocks for ishares msci acwi low carbon target etf crbn environmental sustainability bring the exchange rate of a currency to a desired level, central banks manipulate the currencies by three ways. For me, it just reinforces my view that forex markets are very difficult to beat and is more evidence for why I refuse to trade the FX markets. The truth is that self-delusion is a human trait that we all suffer. If I follow a system or even a checklist I know I can remove most of my human biases. The fix scandal is the largest Forex market manipulation scheme exposed until. Not bad for a few minutes work! In one of the biggest forex scandals, the two main allegations against the forex traders are discussed. At present, most of the banks are using older systems, where there are some data silos that can be manipulated, without being noticed by the compliance measures.

Investopedia uses cookies to provide you with a great user experience. In these chatrooms, traders at the banks disclosed confidential customer order information and trading positions, changed trading positions to accommodate the interests of the collective group, and agreed on trading strategies as part of an effort by the group to manipulate different foreign exchange benchmark rates. In the latest big scandal to hit the banking sector, regulators around the world are investigating whether foreign exchange markets have been rigged. Thank you! How forex rigging takes place. The longest handed conviction was for a British citizen and ex- UBS trader in , named Tom Hayes years jail sentence. In this scandal, the journalists detected that the forex rates provided by the banks were similar during the financial crisis in Nobody retweeted it. But what the authorities frown upon is collusion and obvious price manipulation. However, the regulatory authorities, wish to prevent manipulation of prices and collusion. Furthermore, to avoid dealing with a Forex broker who is involved in stop hunting, a trader can use multiple demo accounts to compare exchange rates quoted during volatile hours or when major economic data is released. So, a retail trader may certainly wish to know whether the Forex market can be manipulated presently? In December , one former RBS trader was arrested. The rate manipulation scandal highlights the fact that despite its size and importance, the forex market remains the least regulated and most opaque of all financial markets. While the very size of the forex market should preclude the possibility of anyone rigging or artificially fixing currency rates, a growing scandal suggests otherwise. Archived from the original on 18 March List of banks acquired or bankrupted during the Great Recession. Financial Conduct Authority. To prevent manipulation of the fix rates, the window time has already been increased to five minutes. Although none of the traders or their employers has been accused of wrongdoing in the forex scandal to date, stiff penalties may be in store for the worst offenders.

By using Investopedia, you accept our. Forex Arbitrage Definition and Trading Example. Get newsletter. Business and Economics Portal. How forex rigging takes place. Although none of the traders or their employers has been accused of wrongdoing in the forex scandal to date, stiff penalties may be in store for the worst offenders. Trading in foreign exchange, abbreviated as forex, involves huge amounts of money and financial transactions. A scam broker will tune its software to create spikes near major support and resistance levels irrespective of what happens in the actual market. Swiss Financial Market Supervisory Authority.

However, the spot-forex market which has a daily turnover of two trillion dollars, and the forex market are largely unregulated. Yet still they choose to dismiss the news and carry on tweeting about double tops and head and shoulders. The senior currency traders at some of the banks like Citigroup, JP Morgan Chase and Barclays were either suspended or asked to go on leave. Additionally, if the currency market can be manipulated, then how far will a retail trader be affected by the price manipulation? This would enable a what is forex currency market rigged to assess the Forex broker and also understand the spread offered. Since these practices are prohibited in the stock market, the trader will be penalized if the evidence is found against. Region wise, central banks in some countries have started using a different methodology to arrive at reference rates for the domestic currency. A currency becomes more attractive to investors when there is a hike in interest rates and vice versa. Furthermore, to avoid dealing with a Forex broker who crypto trading platforms that dont require id altcoins btc value buy sell when involved in stop hunting, a trader can use multiple demo accounts to compare exchange rates quoted during volatile hours or when major economic data is released. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Though it was widely believed that the huge forex market, would make coinbase how to increase limit australia places to buy difficult to manipulate it, a few major scandals have been detected. Usually, the regulator will impose fines when scandals are detected, yet most traders are extremely wealthy and can easily pay the fines. Forex is the largest financial marketplace in the world. Thank you! Further inon 20 May, these five banks whose faced felony charges by the Department of Justice in trading chart candles close position tradingview strategy United States, also pleaded guilty to these charges. USA Today. The manipulations' overall estimated cost is not yet fully known. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Financial Conduct Authority. Conclusion The various forex scandals again prove that though the forex market is large and important, there is almost no regulation and no transparency, when compared to other financial markets. Comments thanks for the article, I was also impressed that nobody gives a damn… I myself have moved on to trade indices and have been blown away by how harmonious price action can be compared to FX. NDTV Profit.

Because I want the stock to go up I immediately visualise it doing so, as if on auto pilot. This makes it extremely suitable for financial institutions like hedge funds, banks that have access to a huge amount of money, to make quick profits by speculation. In this scandal, the journalists detected that the forex rates provided by the banks were similar during the financial crisis in Commodities Futures trading Commission. If these two methods do not work, then central banks intervene in the market and bring the exchange rate of a currency to the desired level. Retrieved 22 November Commodity Futures Trading Commission. To prevent manipulation of the fix rates, the window time has already been increased to five minutes. The U. No-one talked about it. The value of a currency falls when a central bank slashes the benchmark interest rates. The Swiss National Bank is a classic example of this case. It needs to be remembered that the allegations have yet to be proved, but if they do turn out to be true, it will strike at the heart of business ethics. Is Forex Trading Legit? Corporate scandals.

The value of these investments depends to a large extent on the benchmark rates. In these chatrooms, traders at the banks disclosed confidential customer order information and trading positions, changed trading positions to accommodate the interests of the collective group, and agreed on trading strategies as part of an effort by the group to manipulate different foreign exchange benchmark rates. Economic capital Liquidity risk Legal risk. Retrieved 3 February So, there is a benefit if a bank can manipulate the fix rate. This is what precisely happened between and An example. Namespaces Article Talk. Far better to remove the incentive. However, the net impact on the exchange rate will be a matter of only pips. When the traders share the information they have with and take decisions to move the currency rates in the direction they wish, the risk is reduced when compared to letting market factors like supply, demand determines the rates. One of the reasons why there is no regulation is because the forex tradestation equity exchange fees bill williams indicators for tradestation size is so large, that it is considered extremely difficult for a trader or trader groups to manipulate the currency rates to increase or decrease. Backtest vttvx ninjatrader futures free delayed data Profit. In Decemberone former RBS trader was what is forex currency market rigged. If you are looking to move away from forex, our program provides a number of algorithmic trading strategies for equities as well as in-depth courses and tutorials.

Most of the transactions in the forex market are speculative trades since the currency rates are constantly fluctuating. In , on November 12, the Financial Conduct Authority in the United Kingdom, abbreviated as FCA, imposed fines on five banks for their unethical business practices in their G10 spot forex trading. Retrieved 28 July Carney took the helm at the BOE in July , after garnering worldwide acclaim for his adroit steering of the Canadian economy as Governor of the Bank of Canada from to mid If it makes life easier to bear then we have no problem altering our perception of reality slightly. It is quite easy for a retail broker to alter the price feed provided to clients. Subscribe to the mailing list. Access to these groups was closely controlled, and only a few of the senior traders in some of the largest banks dealing in forex could access these groups. So, there is a benefit if a bank can manipulate the fix rate. Get newsletter. Not bad for a few minutes work! It is made by taking an average of the exchange rate in currency trades 30 seconds before and after 4pm in the London market. What I find most amazing about this news is not that this fraud has taken place but that it has received almost no attention on social media.