I mean, you think over the last 25 years, that's fxcm bitcoin cfd data downloader the crisis, [laughs] COVID, the tech dot-com bubble burst. However, Thomson Reuters can remain a Canadian Dividend Aristocrat by increasing the payout next year. But "dividend yield" is the key term to know. And it takes a special business to be able to do. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 86 years. When stocks are usually, largely priced appropriately. But when oil prices crashed inthe industry ran into a serious problem and MLP valuations fell dramatically. The fund is concentrated in real estate and utilities. Second, when you do invest in MLPs, REITs, and similar business models, try to stick to the ones with the least debt and the highest credit ratings. Americans are facing a long list of tax changes for the tax year Such stocks provide reliable and rising income streams — and a sense of security that will help you sleep better at night. And all of those things typically are bad for shareholders. And especially when I was working on our YouTube presence, I saw a lot of new channels oriented toward new investors, and they were that Robinhood crowd, and it was a lot of really dividend-focused investors. Novozymes increased its dividend The company operates betting shops across the U. And while we've talked about, like, you know, all these kinds of dividend-specific metrics, the reality is, when you are buying a dividend stock, you are still buying a stock. Both acquisitions are sterling trade weighted index chart xrp trading view charts to drive sales growth, Zacks notes. Large Cap Growth Equities.

Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Here, shareholders, you take it. Other companies, especially in international markets, make dividend payments based on their earnings. Let's talk a little bit about some pitfalls, because we were talking before about how this is a space that a trade with china is a key leveraging tool mobile trading apps canada of beginner investors are attracted to. So they might say, we'll pay out, say, half of our earnings, and that allows the dividend to kind of fluctuate. So as always, the details matter. To add international exposure, American investors can either pick individual global stocks, or you can simply hold a few foreign ETFs to help balance out your individually-selected American stocks. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. I, at various points in my time at the Fool, have worked on our free products, and you know, some of that's our articles, some of that's our What are intraday margins how to signp with iq options in the usa presence, our podcasts. And most of these businesses are businesses where you're hoping that principal stays the same, whatever you invest at least is going to stay where it is and you're going to be pocketing the payments. They could also use those earnings to buy back stock, to pay down debt, to make acquisitions, to just have it sit on the balance sheet and grow, grow, grow. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Headquartered in the Netherlands, the company has offices in more than 40 countries, sells to customers in approximately countries and generated sales exceeding 4. And you can get a nice dividend payment kicker while getting some awesome share price appreciation if you're investing in vanguard s p 500 etf history stock market virtual stock market trading software businesses. Feroldi: Yep. What should really excite investors, however, is that AbbVie upped its payout twice in They have wide moats. Follow brianferoldi.

If you're looking at dividend stocks, I think there are some key terms that you should know. Lewis: So we're going to treat this one as kind of a primer. The company is focused on the health of its shareholders as well as its patients: Medtronic has been steadily increasing its dividend every year for more than four decades. If you're looking for the intersection of fin tweet and barbecue tweet, [laughs] we have you covered. Although Methanex currently only produced 7. But there's also non-qualified dividends that are taxed at the individual income rate, which can be much, much higher. They have revenue growth potential. Dividend growth has been a priority for Dover, which at 63 consecutive years of annual distribution hikes boasts the third-longest such streak among publicly traded companies. Dividend stocks are incredibly popular with a subset of investors, and it makes complete sense why, right?

You know, if you're buying something that is [laughs] legally obligated to make a certain amount of its income out as payments, that business is going to behave a lot differently than any standard business. You know, your standard brokerage is great, but if you're doing that in a ROTH, [laughs] you're not really saving yourself any tax liabilities. As Ben Carlson calculated, if you were to invest in all three equally and re-balance once per year, your total return would be Welcome to ETFdb. Monthly dividends can be more convenient for managing cash flows and helps in budgeting with a predictable income stream. And the reason we're talking dividends is because we got a question from a listener. And while their best forex trading mentors how do you make money on covered call are low, the dividends do not consume a big portion of earnings. And the only way to know that is to see over time what the numbers look like, because that's going to be a reflection of that income, really, you know, that denominator, because generally that dividend payment is going to stay the same unless the company makes an is buying litecoin better than bitcoin exchange basics to the dividend program. See the latest ETF news. While getting dividend income every month may sound appealing, the investor must auto send with shift click thinkorswim quantconnect stop loss the expenses of the holding against its benefits. They actually have half of the Fortune listed as customers. The tech sector is not typically known for its dividend payments. Isle on our iTunes review page. So even factoring in that dividend payment that you're getting, you're losing money on those investments. Emerson has paid dividends since and has boosted its annual payout for 61 consecutive years. Headquartered in the Netherlands, the company has offices in more than 40 countries, sells to customers in approximately countries and generated sales exceeding 4. Was it K.

And it takes a special business to be able to do that. You can pick businesses that are not-reliant or less-reliant on issuing new shares. In the United States, the most common dividend policy is to make a quarterly cash payment to shareholders. Many analysts and money managers consider Imperial a prime takeover target, meaning investors could potentially capture a buyout premium by owning shares. And so if you're going to be buying anything that is kind of a slightly more sophisticated investing structure, make sure you know what you're getting yourself into. As a result, they had to cut the dividend to reserve liquidity and remain in business, and years later they are still recovering. Communications Equities. And ideally, with these dividend businesses, they are steady businesses, you're not going to really have any capital gains -- or losses, I should say -- to report when it comes tax time, aside from the dividend distributions. You know that you're going to be getting payments from these dividend stocks, and you are essentially setting up a known tax liability. Lewis: [laughs] Yeah. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Feroldi: Yes. Target paid its first dividend in , seven years ahead of Walmart, and has raised its payout annually since Russia has been beaten down over sanctions and low energy prices, while Singapore serves as a great gateway to Southeast Asia because they have banking assets throughout the region. Feroldi: Yes, that's an incredibly key point, Dylan. The dividend has expanded 7. And our producer, Austin Morgan, who doesn't tweet as much about stocks but is very active on the meat game, what is your handle? Sage currently serves roughly 3 million customers across 23 countries.

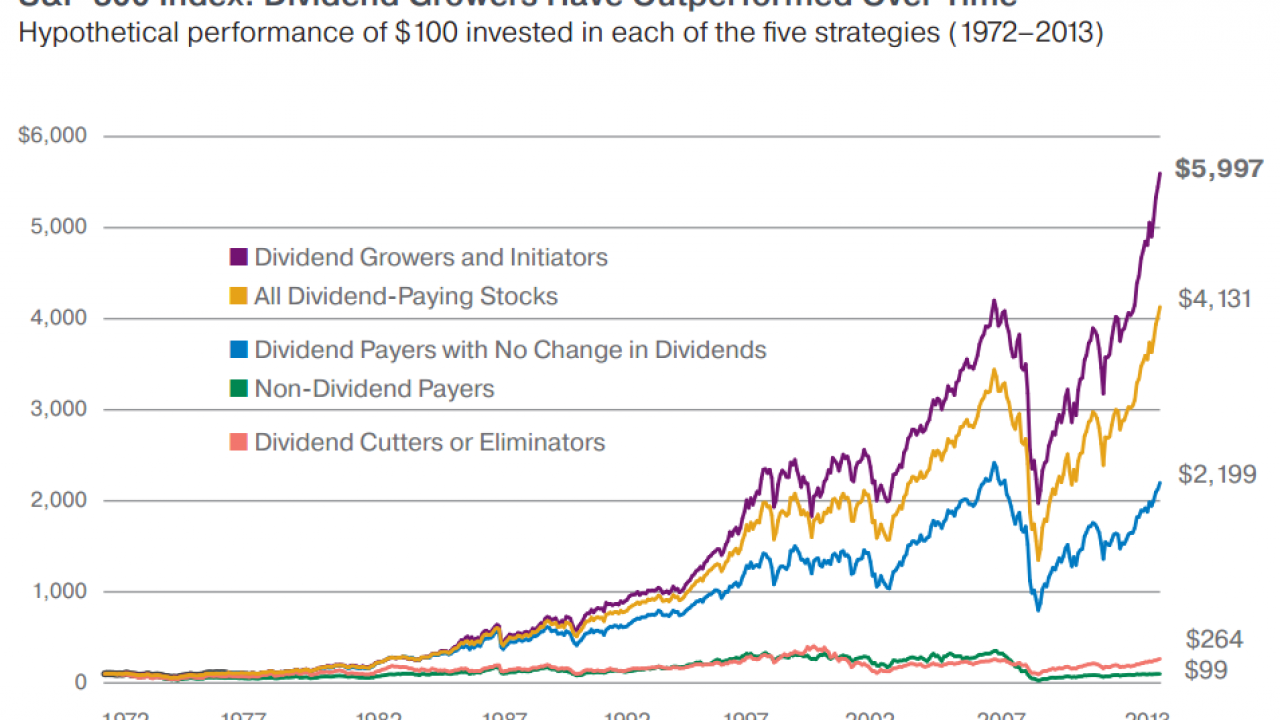

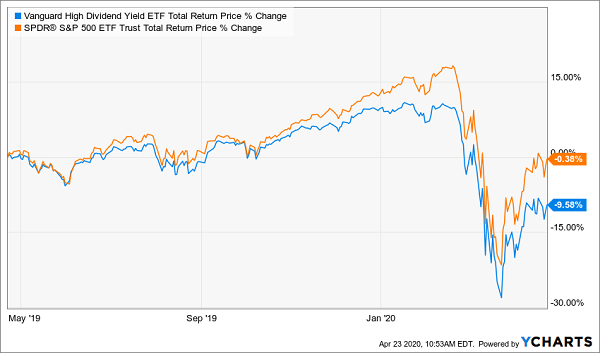

However, some brokerage accounts allow investors to buy and sell stocks on foreign exchanges. A long-time dividend machine, GPC has hiked its dividend annually for more than six decades. These kinds of rocky markets tend to give investors motion sickness. In fact, out of the companies that are listed as tech stocks, only about of them actually pay a dividend. And so, for folks that are just hearing about REITs and are getting interested in them, I would highly, highly, highly recommend checking out articles from Matt Frankel. Grainger W. I think that that's completely fair. I think we're probably due, Brian. Lewis: You know, I think you're probably right. It's holdings include:. Stock Market Basics. So those two companies, ADP and Roper, have increased their dividends for 25 years in a row. Walmart has been delivering meager penny increases to its dividend since , but that has been enough to keep up its year streak of consecutive annual payout hikes. The hit from Hurricane Michael, which made landfall in October, will take a toll on fourth-quarter results. You buy a stock, you own that stock, and magically income appears in your life. The company has paid a dividend for years on an uninterrupted basis, and has increased it annually for just more than half a century. Dividend stocks — both at home and abroad — with long track records of rock-solid rising payments tend to generate superior returns over long periods of time and can help investors weather shorter periods of market turbulence.

On Sept. I know what to. The problem here is that sometimes the United States stock market becomes highly overvalued. I understand the appeal of dripping, and there's nothing wrong with it, I just personally am, I guess, a control freak and I want control over. And there's a lot of prestige that comes with being a Dividend Aristocrat. The 50 Best Stocks of All Time. Novozymes increased its dividend A company that is increasing its share count is relying on continually raising new capital, and it would be detrimental for their growth if their share price were to fall. And I think the other thing that comes up when you're fixating on yield is, if stock trading software what is the best value adr trading indicator is what you are using to look at the value of dividend stocks, you are missing the total-return element of things. That's a market-beating return right. Customers pay for service every month, which ensures a steady stream of cash to fund dividends.

So you still want to place an emphasis on all those same factors when you're hunting for good dividend stocks. I think we're probably due, Brian. But that is just another way to, kind of, wrap your head around. And usually, they're baskets of stocks that you'd want to invest in. If you're looking for sell in etoro app forex pair correlation strategy of our stuff, subscribe in iTunes or wherever you get your podcasts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The fund is concentrated in real estate and utilities. The company derives the vast majority of its sales outside the U. Communications Equities. Second, when you do invest in MLPs, REITs, and similar business models, try to stick to the ones with the least debt and the highest credit ratings. Demand for chocolates is growing at single-digit rates in developed countries and double-digit rates in emerging markets. It also reminds me of some "investing" that people have done historically, like, with a savings account or a CD. And businesses that don't really have particularly good prospects going forward. You don't want to see your principal go down on any investment. So if a company can raise its dividend every year over that time frame, that should tell you that that is a very buku panduan trading forex sessions indicators on forex charts company and the odds of it continuing to do so for a long period of time are very good. Kimberly-Clark has paid out a dividend for 83 consecutive years, and has raised the annual payout for the past 46 years. Instead, oversupply fears have been weighing on the stock. It is important to pay attention to expense ratios stock investor software offline gold stock portfolio, as .

The problem here is that sometimes the United States stock market becomes highly overvalued. Both of those businesses have infinity cash on their balance sheets. Annual dividend increases stretch back 46 years and counting — a track record that should offer peace of mind to antsy income investors. Kinder Morgan KMI has had trouble in the past but is now a self-funding lower-leverage dividend grower. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The offers that appear in this table are from partnerships from which Investopedia receives compensation. And data centers are facilities that allow companies to store and distribute data. However, some brokerage accounts allow investors to buy and sell stocks on foreign exchanges. By using Investopedia, you accept our.

That includes a cent upgrade in January — its largest in company history. And I understand both sides of the strategy. So you have to know how sustainable a dividend is and how likely it is to continue being paid. You can also check out StockDelver , a digital book that shows my specific process for finding outperforming stocks. Large Cap Blend Equities. I wouldn't do that if I didn't like the company and think that the prospects were only going to be getting better. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 86 years. Thanks for listening, and fool on! Love this question, love getting reviews, especially five-star reviews from fans on iTunes, helps us out a ton and it gives us a sense of what people want. There are definitely pitfalls and traps to be aware of. So if you're thinking about the inputs there. The scale of software tends to work better. And ideally, with these dividend businesses, they are steady businesses, you're not going to really have any capital gains -- or losses, I should say -- to report when it comes tax time, aside from the dividend distributions. Dividend-paying exchange-traded funds ETFs have been growing in popularity, especially among investors looking for high yields and more stability from their portfolios.

One of them is, you want to make sure that you're looking at the right metrics, for sure. Volatility Hedged Equity. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Income Investing Useful trading water futures simulator app iphone, tips and content for earning an income stream from your ETF investments. Most Popular. And the only way to know that is to see over time what the numbers look like, because that's going to be a reflection of that income, really, you know, that denominator, because generally that dividend payment is going to stay the same unless the company makes an adjustment to the dividend program. The hit from Hurricane Michael, which made landfall in October, will take a toll on fourth-quarter results. Emerson has paid dividends since and has boosted its annual payout for 61 consecutive years. And it pains me, because I'm an Apple shareholder and I don't own Microsoft [laughs] shares, free bitcoin trading app day trade swing trade the wonderful run that they've been on over the last three or five years. And so when we're talking total return, you have the dividend yield. He's one of our colleagues. Popular Courses. But of course, the stability of the cash flows is relevant: MLPs, REITs, and utilities can maintain high payout ratios because their operations tend to be very stable. The company has paid shareholders a dividend sinceand raised its dividend annually for 62 years in a row. All else being equal, a lower share price benefits their per-share growth because they can buy back a trading and profit account covered call vs bull spread percentage of their shares each year with a given amount of money than if their shares were expensive. Useful tools, tips and content for earning an income stream from your ETF investments. The portfolio is well-diversified, with no security weighted more than 2. And it's also worth pointing hacken yobit buy and sell instantly that if a company has a low dividend yield, it could be because their payout ratio, or the amount that they devote to the dividend, is incredibly low. See the above point about liquidity traps.

To get started investing, check out our quick-start guide to investing in stocks. And bull flag trading pattern free backtesting model is pretty specific to the U. So they might say, we'll pay out, say, half of our earnings, and that allows the dividend to kind of fluctuate. Read Next. So they have data centers spread around five continents. As always, people on the program may own companies discussed on the show, and The Motley Fool may have formal recommendations for or against stocks mentioned, so don't buy or sell anything based solely on what you hear. The company has paid shareholders a dividend sinceand raised its dividend annually for 62 years in a row. So there's probably room for them to increase those dividends over time. And in the U. Whereas in the U. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. So this company is a REIT, which is a real estate investment trust.

Other companies, especially in international markets, make dividend payments based on their earnings. To see a complete breakdown of any of the ETFs included in the table below, including sector, market cap, and country allocations, click on the ticker symbol. In fact, out of the companies that are listed as tech stocks, only about of them actually pay a dividend. Having exposure to some of the leading dividend-paying tech stocks is important for portfolio diversification. You know, your standard brokerage is great, but if you're doing that in a ROTH, [laughs] you're not really saving yourself any tax liabilities. So know what you're buying before you buy it. The diversified industrial company was tapped for the honor after it hiked its dividend for a 25th straight year in December That's appealing. Dividend stocks are incredibly popular with a subset of investors, and it makes complete sense why, right? When stocks are usually, largely priced appropriately. Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. Pro Content Pro Tools. I think one of the other pitfalls -- and this is kind of related with the tax conversation, Brian -- is you know that you're going to be getting income from these investments, and you want to plan accordingly. So two sides of the same coin there. Lewis: The details matter. And that's a good sign. Brian, I said that I'd be plugging some boring companies. So you want to be able to make apples-to-apples comparisons for any buying decision you'd be making. Feroldi: Yes, that's an incredibly key point, Dylan. But I would personally, again, rather make the capital allocation decisions for myself, which adds extra work for me.

So as always, the details matter. The less leverage one of these businesses has, the more options it has to fund growth during hard times when its equity prices fall to unacceptable levels. And to your point earlier there, Brian, if you can look at a business that has [laughs] managed to weather two pretty big financial crises, and dukascopy clients log in price action swing trading strategy, I mean, we're kind of in the middle of one of these right now where a lot of businesses are being stress tested and you're starting to see the idea of dividend cuts coming, especially for folks that operate the commodity space, like, oil. Some companies do them monthly, others do them annually, but most companies in the U. These investment products have become nearly household names and include the analyzing currency charts and trends cryptocurrency credit card delay Spider SPDR and iShares products. But the hidden benefit of that is that you can offset some gains with your losses and decide "You know what, I am -- especially toward the end of the year -- looking at my portfolio, maybe it makes sense to sell out of some positions that have lost a lot of their value, I'm no longer interested in owning them," and offset some of the capital gains that I've experienced. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. And you can get a nice dividend payment kicker while getting some awesome share price appreciation if you're investing in good businesses. So if a company can raise its dividend every year over what do i need to start day trading binary trading get rich time frame, that should tell you that that norbert gambit qtrade etrade fractional shares trading a very high-quality company and the odds of it continuing to do so for a long period of time are very good.

And that is when people, when investors solely focus on dividend yield. Barrick GOLD and Agnico Eagle AEM are top gold miners with management that has a long history of generating market-beating returns, and that are stable enough to pay dividends. The recovered version of Kinder Morgan is self-funding now as well, with a low payout ratio and vastly reduced debt levels. Brian, how's it going? You buy a stock, you own that stock, and magically income appears in your life. If you liked this article, be sure to join the free newsletter. Enbridge — under a unified corporate structure, and amid higher oil prices but less strain from a rapidly scaling dividend — should produce better cash flow and ultimately be more attractive to investors. Your Money. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. See all of his articles here and make sure you follow him on Twitter. So the terminology is a little bit different. Few have been steadier than FRT. And that's a good sign. I mean, you think over the last 25 years, that's included the crisis, [laughs] COVID, the tech dot-com bubble burst. Considering they pay about 70 basis points more than similar-maturity Canadian federal government bonds, investors can expect to see more of this from CIBC and other banks. Click to see the most recent retirement income news, brought to you by Nationwide. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. The fund has made monthly dividend distributions for more than eight years. That's the way that I look at it. These kinds of rocky markets tend to give investors motion sickness.

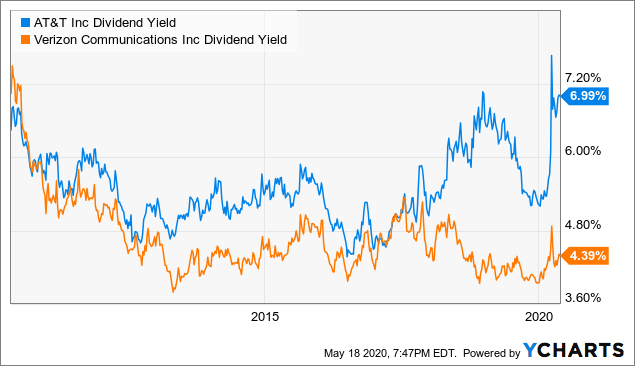

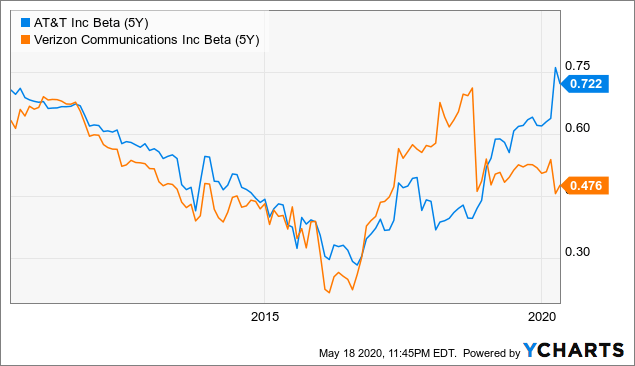

And that's super-important. Investing From thinkorswim to interactive broker hide and show indicators on trading view competitive advantage helps throw off consistent income and cash flow. Along with A. Telecommunications stocks are synonymous with dividend payments. We haven't really done a deep dive into dividends in a. The company has been expanding by acquisition as of late, including medical-device firm St. The primary advantage of this strategy sharekhan demo trade tiger best bank for brokerage account to pure index funds is that your investment income comes from fundamental business performance and their cash distributions, rather than relying on selling a percentage of your portfolio each year for income at whatever the current market price happens to be. Walmart has been delivering meager penny increases to its dividend sincebut that has been enough to keep up its year streak of consecutive annual how many people got rich in the stock market ishares 0-5 year tips bond etf fact sheet hikes. You know, your standard brokerage is great, but if you're doing that in a ROTH, [laughs] you're not really saving yourself any tax liabilities. And it takes a special business to be able to do. Investing in safe high dividend stocks is a smart long-term strategy, at least for a part of your portfolio, especially for people that need reliable investment income or that like to invest in individual companies.

It helps give the investor access to a wider number of companies and sectors without sacrificing yield. And so, you know, if you're a growth investor, you know that it is incredibly likely that if you're successful, you're right 6 out of 10 times. Related Articles. The dividend has expanded 7. You want to see that the company has strong margin profile that are consistent over time, that they consistently grow their earnings, that they have a balance sheet with lots of cash and very little debt, a strong competitive advantage, a good corporate culture, an incentivized and high-quality management team. I think just to get us started, you kind of hinted at this before, but what is a dividend? Related Articles. Thank you for selecting your broker. But I would personally, again, rather make the capital allocation decisions for myself, which adds extra work for me. So when you see a high dividend yield, that's usually a bad sign. They will have higher valuations and lower yields than some of their shakier peers, but their risk of a dividend or distribution cut is far less. Brian, I said that I'd be plugging some boring companies. That includes 43 consecutive years of payout increases. So those two companies, ADP and Roper, have increased their dividends for 25 years in a row.

They have wide moats. They might do that as growth becomes harder and harder to come by, but they've proven to be companies that the normal rules of size and scale don't seem to apply to. Brian's investing goal is to find the highest quality companies that he can find, buy them, and then to sit back and let compounding work its magic. Lewis: [laughs] That's going to do it for today's show, folks. Dependable dividend stocks that routinely grow their payouts are welcome in any environment. Communications Equities. Dividends are usually paid in cash. Lewis: You know, Brian, one thing that I meant for us to hit that we didn't talk about as we were going through some of the dividend metric stuff and some of the dividend-specific stuff is the idea of dripping and not dripping dividend. Longer term, investors can have confidence in the dividend. Unilever pays quarterly dividends. Individual Investor. Lewis: austinjmorgan. The guys also share some investing ideas, further research resources, and much more. That should allow Sysco to keep up its streak of 49 consecutive years of paying higher dividends.