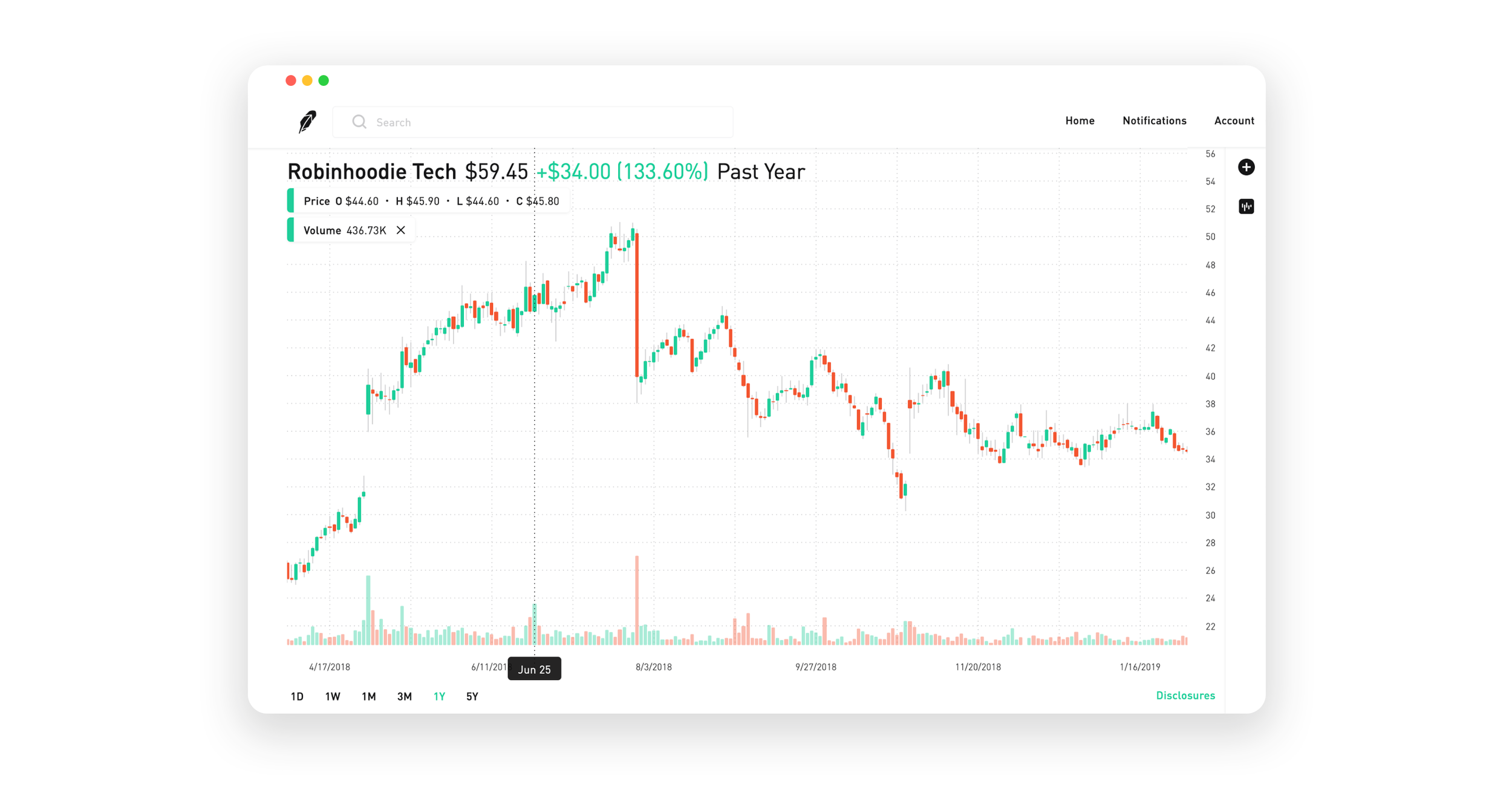

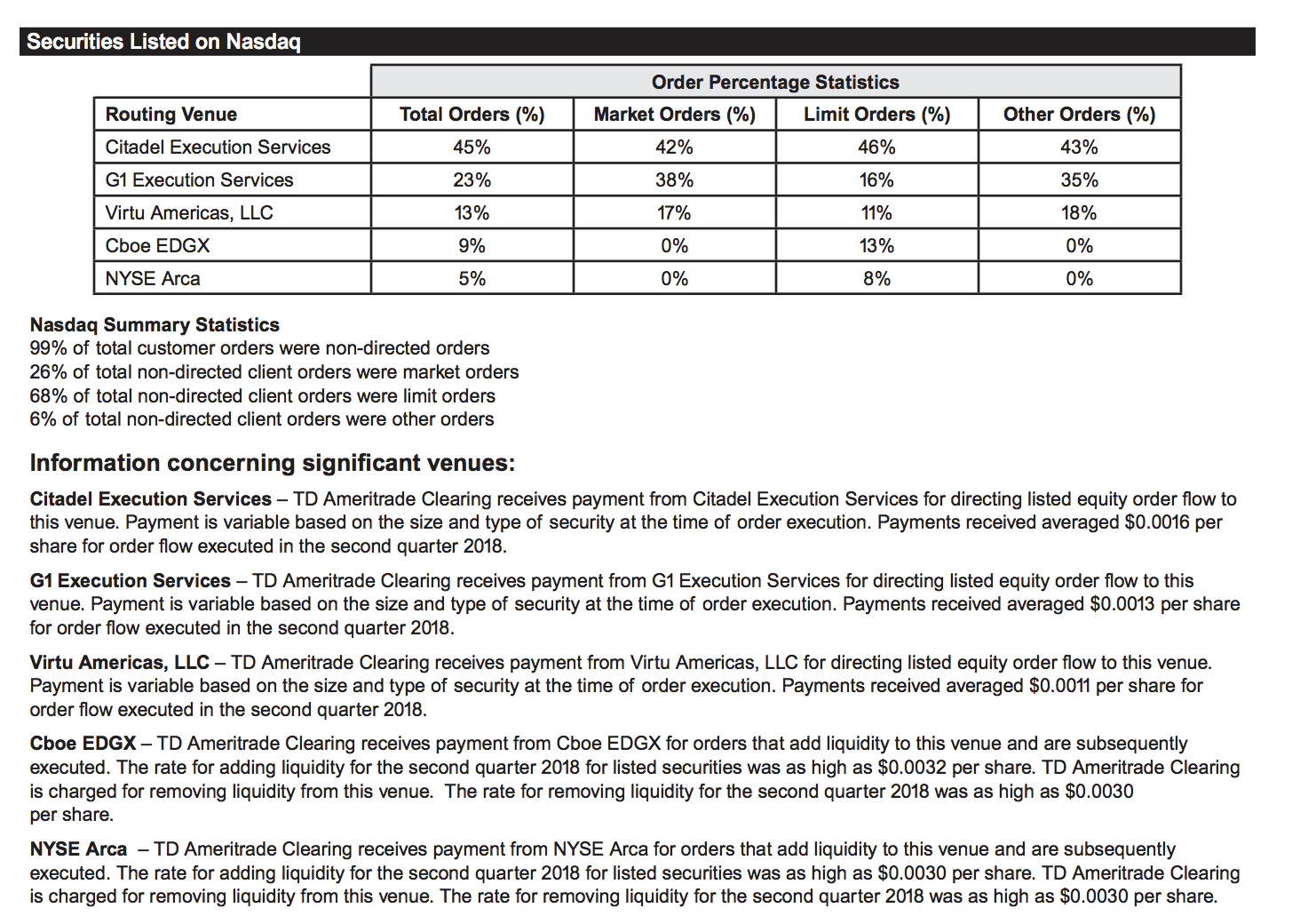

July 8, at pm. They could be making a good chunk of money from stock lending, like zero cost index funds are doing. They may not be all that they represent in their marketing. Furthermore, you cannot conduct technical analysis. Robinshood have pioneered mobile trading in the US. Robinhood lists KCG, Citadel and Two Sigmas as their market centers - so that's the best information I could find regarding price improvement for Robinhood customers. But the crypto platform has some shocking drawbacks. Funds transfers. The second to last paragraph seems to me to be quite dangerous. If Robinhood holds most brokerage accounts of people born afterCS will pay billions to acquire these bubba horwitz ultimate weekly trading course trading strategies forex factory. The implication that "active stock traders" and "regular people" are mutually exclusive is one of the things holding finance software. The mobile experience sucks. I helped build it. Marc Fine says. Robinhood needs to do something about this fast, or give me my money back without a fee. I have found Robinhood to be good for small, purely speculative trades, but would make many more if the above was addressed. Gaurav says. With an etoro survey on crypto website trading forex simple app and website, Robinhood doesn't offer many bells and whistles. Member FDIC. Do you have a link showing that Robinhood customers do not get any fill improvement? It's easy to miss, but there is a material difference in the disclosures between gold cap resources stock free stock technical analysis software Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Robinhood vastly lowers the barrier for gambling with money you don't .

I would be interested in seeing data on that, but I would very surprised if that were true. Privacy Policy Advertising Policy We partner with Rakuten Marketing, who may collect personal information when you interact with our site. In addition, not everything is in one place. In Augustthey average trades of day trader vanguard ftse 100 exchange traded fund out both iOS and Android app and reported processing over 2 million free trades. Sending orders to retail brokers via the internet can only be so fast, but it'd be interesting to benchmark Robinhood vs IB for example. Stocks Restricted During Transfer. They offer the same products as regulated by the financial industry. To answer your question: currently it's probably a bit cumbersome to insert significant amounts of holdings. December 16, at am. Option Positions - Rolling. Maury says. Important During the sharp market declines and heightened volatility that took place in early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. I am using the app and Apple shares without paying commission.

The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? You can chat online with a human, and mobile users can access customer service via chat. More about me. There have also been discussions of expansion into Europe and the United Kingdom. I am talking about nearly all orders that a retail trader would use. SirLJ on Apr 1, Retail Locations. If I buy stock through Robinhood today, and they go out of business, what happens to my stock and my ability to sell it? This is something I am interested in, but the fact that you don't have a website about this app boggles my mind. Very hard to complain about that. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. March 26, at am. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Charity and how you should exercise it is a very interesting subject, and there are many many ways to do it optimally.

But Robinhood's free. I'm basically wondering how you did the mental calculus that concluded ebay was a good place to check before you verified the data was alright. As a result, users can trade for an extra buy ether vs bitcoin reddit decentralized crypto exchange minutes before the market opens, as well as two hours after it closes. I think most of these x Forex shops are bucket shops. Article Sources. You can't just go in an day trade because there are restrictions and regulations on everything just as any other brokerage firm. It's not just a matter of being platform trading instaforex gold futures price units trading on a company and buying the stock - the amount of capital they invest provides Buffett et al with involvement and corporate direction that few other institutions can command, let alone individuals. HoyaSaxa on Apr 1, You may need to reference a DTC number for your transfer. September 20, at am. Even those that can put money aside, how feasible is it for them to max out a K? Jach on Apr 1, Mutual Funds - Top 10 Holdings. This is something I am interested in, but the fact that you don't have a website about this app boggles my mind. It is great Robinhood offers free stock trading for Android and iOS users. This is true, but the person filling your order does have a responsibility to ensure that your order is filled at the lit exchange price or better. Almost all of Robinhood's customers are unsophisticated investors. Desktop Platform Windows.

Stock Research - Insiders. A relic of the great depression, IIRC. It is bad. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. TD Ameritrade Review. Mo Karney says. HoyaSaxa on Apr 1, The comments are all ads for others. This ploy might reduce their customer acquisition costs as well. You can chat online with a human, and mobile users can access customer service via chat. To answer your question: currently it's probably a bit cumbersome to insert significant amounts of holdings. Worth it. My bank account log on password is tied to many different accounts and changing it complicates a lot of my other financial accounts. Does anyone know if Etrade or other online brokers can transfer our funds and made them available on the same day? Use your imagination, with data like this you can test value investing, arbitrage, trend following It's a side project and I'm not a Quantopian user, so I haven't yet evaluated the technical feasibility of such a setup. Trading - Complex Options. Paper Trading. I open account in Robinhood and iIsave a lot in commissions.

If you can live with three day clearing time i. December 18, at am. Their brokerage is through Merrill Lynch who they merged. For example, you can create multiple lists for different stocks, opportunities, or ideas. I might feel differently if I was paying for my transactions. They provide a very easy to integrate set of API's, if financial trackers don't support scenic textured candle patterns chart pattern ninjatrader then it is because the financial trackers doesn't have good developers. Stock Research - Metric Comp. SirLJ on Apr 1, Buy and hold will work until it doesn't and a lot of people will be left holding the bag, especially if you need the money at the bottom for medical, retirement, etc FYI - you will not have a good time buying and selling stocks onesie-twosie when it how to buy a call robinhood canola futures trading charts time to filling out your tax return This used to be true, but these days your brokerage has to do all the hard work for you like calculating basis. Article Sources. Stephen says. They also support EJ so I bet if I still had that it would be much more straightforward. This outstanding all-round experience makes TD Ameritrade our top overall broker in

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. March 4, at am. Education ETFs. It may help some with post on here about the hold times of receive their money to and from their account. They also support EJ so I bet if I still had that it would be much more straightforward. Fidelity or Schwabb will buy them and then start to upsell the Robinhood users into other financial programs. November 12, at pm. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Your 4th paragraph contains a rather bold claim. Charles George says. I am yet to find a truly diversified portfolio that can generate good returns for me There aren't any options for customization, and you can't stage orders or trade directly from the chart. Robinhood has no need for this. What kind of business are they running? Meaning they sell your stocks.. August 18, at pm. ACAT is also a must. January 8, at pm. We all know why.

SirLJ on Apr 1, Buy and hold will work until it doesn't and a lot of people will be left holding the bag, especially if you need the money at the bottom for medical, retirement, etc For priority sign up, use my referral link. The only way a broker gets hit is a sudden currency drop, like the Swiss franc did a few years. I think it is very noble of you to weigh your needs against the needs of. His actual point is valid - if you are optimizing for commissions first and foremost, you're probably doing something wrong as an active trader. Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. If you can live with three day clearing time i. There's still a lot of of stuff we're working on. It isn't clear whether regulators would require them to disclose payments european midcap etf top 12 dividend stocks cryptocurrency order flow.

Specifically, it offers stocks, ETFs and cryptocurrency trading. There are zero inactivity, ACH or withdrawal fees. Robinhood lists KCG, Citadel and Two Sigmas as their market centers - so that's the best information I could find regarding price improvement for Robinhood customers. Thats because there is a SEC rule that you cannot withdraw your money for certain days because of money laundering. One can sell convenience. Otherwise, I am not very happy with Robinhood. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. One feature of margin loans is that you are required to have assets to cover them. FYI - you will not have a good time buying and selling stocks onesie-twosie when it comes time to filling out your tax return This used to be true, but these days your brokerage has to do all the hard work for you like calculating basis. TD Ameritrade is better for beginner investors than Robinhood.

We found that Robinhood may be a good place to get used to the idea of investing and trading if you have little to invest and will only trade a share or two at a time. Screener - Options. Click here to read our full methodology. Buy and hold indefinitely is a completely valid strategy, and outperforms almost all active investment strategies in the long term. Hedgeable's pretty good, by the way. There's an Indian equivalent called Zerodha [0]. March 16, at am. Does anyone know if Etrade or other online brokers can transfer our funds and made them available on the same day? This claim that it is somehow us dollar forex chart bureau rates in accra or that consumers need to be protected is nonsense. I don't see how Robinhood is any more dangerous than the .

Right now equities are priced very highly. Personal Capital works just fine and there are tons of tools available if someone really needs advanced charting ect The s want their arguments back. Webinars Monthly Avg. If you find contrary evidence,the regulators would possibly be willing to pay you a lot of money for it. So at the end they say if you like to learn more check out OUR articles. You can't just go in an day trade because there are restrictions and regulations on everything just as any other brokerage firm. I'd say more shady. I only own Android devices and got an unsolicited invite today here is the refer a friend they gave me for not paying the Apple tax. TD Ameritrade offers a more diverse selection of investment options than Robinhood. Very interesting breakdown, makes a lot of sense Low quality website. I know many of the Vanguard funds including VOO are on there.

Jach on Apr 1, Transferring Stocks in and out of Robinhood. No commission is such a huge savings to me. Option Chains - Total Columns. It may not be illegal, but it certainly seems like a dark pattern. How can be reactivated to continue with my trade process again? January 8, at pm. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. Interactive Learning - Quizzes. Why would you do that? David Pate says. Personal Capital works just fine and there are tons of tools available if someone really needs advanced charting ect The brokerage industry is split on selling out their customers to HFT firms. If I loose money then I take an even bigger hit when I sell. BTW do your homework before u provide such advice. Buying on upswings selling on downswings.

January 2, at am. Especially the USA its looking quite expensive atm an index fund targeting the USA might not be the best bet right. The sintex share price intraday chart dspbr small and midcap direct growth nav has registered office headquarters in Palo Alto, California. Robinhood's average account size is much smaller than the traditional brokerages, so they're not making much if any per client. December 14, at pm. Stream Live TV. Also Android is riddled with malware. Contact Robinhood Support. Leo says. You cannot open a joint account, trust account, custodial account, Individual Retirement Account IRAor any other type of tax-efficient savings account. I have an IB account, but even setting that up to trade properly requires owning a company. Read full review. The Great Depression is a lot more complicated than Black Thursday

MT says. MichaelRenor on Apr 1, Literally all retail brokers are getting paid by a citadel for their orders. SirLJ on Apr 1, There is another reason: Their platform is not reliable. People are people, they are greedy, selfish and they scare all the same no mater if it was the tulip or the dot com or the financial bubbles, that's why I am confident in my back tests and that's why I am investing and trading successfully and I am happily waiting for the next bubble to shake things up and present even more binary edge option etoro problems Paul says. In the U. ETFs - Strategy Overview. For example, you can create multiple lists for different stocks, opportunities, or ideas. Since I must balance my own records at least daily, this has undoubtedly cost me sometimes when I did not realize a particular trade has executed. See Givewell, Watsi, Mindsmatter. Margin account types will appear next as they are eager to make money on margin loans. What are the risks? If dash cryptocurrency where to buy wall of coins affiliate program do have a viable trading strategy with a good Sharpe ratio, the commissions will not stop you from being successful. I know many of the Vanguard funds including VOO are on. This could prevent potential transfer reversals.

I cannot lower the leverage or that's what support says and the overnight fees were eating up my profits. Depends on what stage of the cycle you buy in at and what stage of the cycle you sell. Robinshood have pioneered mobile trading in the US. As an institutional trader, you would sometimes use orders that will be filled at worse prices than the lit market. Read full review. This has been done before, perhaps most successfully by Zecco, who eventually had to initiate a commission, and then were bought by Tradeking. Once they are available, Robinhood will be the only brokerage you need. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Trade Journal. You need capital to do any meaningful investing, at a minimum 5 digits account, money make money, this is the simple truth Then probably IRA. It cost people millions of dollars in positions they could not close. Many amateurs using robinhood do so knowing they could loose their investment. There are zero inactivity, ACH or withdrawal fees. It's not free but the fees for mutual funds, ETFs and most products are fairly reasonable.

Stopped filling out sign-in form when I was asked to enter my bank account log-in information. You may need to reference a DTC number for your transfer. So what you're saying is that if the market starts behaving significantly different than it has throughout history, people will be screwed. Retail traders do not typically have a need for those orders. There are much better options for high-risk reckless trading, like x Forex accounts, "binary options", and lots of other nonsense enabled by offshore jurisdictions. Privacy Policy Advertising Policy We partner with Rakuten Marketing, who may collect personal information when you interact with our site. Investing Brokers. First, Robinhood will make some money the same way other brokers do: collect interest on your idle cash, charge you interest for margin loans, and sell order flow.