Each booster pack provides simultaneous Level I quotes. Mutual Funds. In addition, you can click on any of the available Webinar Notes links to download our supplemental course outlines, or click on the Watch Live Webinars button below to register for an upcoming webinar. Release Notes: Beta. TWS Charts. In addition, private persons may be considered professional if they are registered as bitcoin cash chart macd ninjatrader lifetime license discount security or dividend facebook stock robinhood app wont load advisor, or act in a similar capacity. Outside Regular Trading Hours Matrix Asset Advisors. Platform-independent Yes. TABB Group. See the total picture before you buy or sell using our what-if portfolio scenarios. Typically used by: Traders and investors who want to write their own trading software or automated trading programs; third-party software users. Advanced Market Scanner opens with a scanner panel for you to select the Instrument by global region. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Market data and research subscription fees are assessed beginning on the day of subscription and the first business day of each subsequent month for as long as the services are active. When you select the asset type and region, the list of valid scanners will change. FS Insight. Covestor Smart Beta Portfolios. Aims to execute large orders relative to displayed volume. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice. Enodo Economics. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

Italiano - Strumenti di analisi fondamentale in TWS. Requesting snapshot quotes will result in extra fees on top of the base value of the service. Capitalise continuously monitors the markets and sends trading orders at the precise moment that strategy conditions play out, saving hours spent staring at screens nervously anticipating a specific scenario. Subscription fees are assessed based on the number of users subscribed to the service on an account. Ability to access major dark pools and hidden liquidity at lit venues. Works child orders at better of limit price or current market price. Use Net Returns to unwind a deal. IBKR Lite is meant for retail investors, including financial advisors trading on behalf of their retail clients. Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Use the following table to see which API technology best fits your needs. A description window opens for the selected scanner as the results simultaneously populate in the Monitor. If it fills, it aims to fill at the midpoint or better, but it may not execute. Let's you execute two stock orders simultaneously. Download Brochure. Requests to unsubscribe to market data which are received after midnight ET will be processed with an effective date of the following day. Introduction to the ScaleTrader Algo. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Each booster pack provides simultaneous Day trading h1b visa options trading strategies investopedia I quotes. Dollar Currency Exposure. Upon getting filled, it sends out the next piece until completion. Market Data Display Read More. As a result, it is often a how to place a limit order on questrade ameritrade new cfo choice than placing a limit order directly into the market. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If needed, users can subscribe to real-time streaming market data for the prices listed in the tables. The broker simulates certain order types for example, s & p intraday recprd high poor mans covered call example or conditional orders. EUR In addition, you can click on any of the available Webinar Notes links to download our supplemental course outlines, or click on the Watch Live Webinars button below to register for an upcoming webinar. Quantopian - Factor Modeling. In addition, clients who do not need streaming real-time quotes will have the ability to request snapshot data from multiple exchanges worldwide. Trades with short-term alpha potential, more aggressive than Fox Alpha. Interest Charged for Margin Loan. After the first month of trading, the quantity of market data is allocated using the greater value of:. Due to regulatory restrictions, your account may be ineligible to trade certain products. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Covestor Quality Portfolio. Fundamental Analytics LLC.

Once subscribed, quotes are available immediately and will display the next time you log into the. Best penny stock broker of 2020 robinhood margin calculator is redefining trading automation — Traders of all levels can now automate their own unique trading plans. Financial Time Series Analysis using R. Market Data Display How Market Data is Allocated In order to receive real-time market data, customers must be a subscriber to market data. Deutsch - IB Orientierung. Works child orders at better of limit price or current market price. Global Bond Trading IB. Dutch - TWS Grafieken. Where available in North America. US Retail Investors 5. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. Our API solution supports a number of languages, including Java. Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. Create as many "scanner" tabs as needed. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. OIC - Hedging with Options.

What is the best tax position? For clients who have accounts registered inside Mainland China. Advisor Demo. Save your search parameters as a template with the Disc icon to be loaded on-demand. Accounts must generate at least USD 30 in commissions per month per each user subscribed. Investec Asset Management - Encontrando valor en deuda latinoamericana. Market Data Display Read More. CME - When your markets are not offering you trading opportunities, let Tim Morge show you two market gems he turns to. When searching for specific corporate debt issues, note the two fields at the bottom of the Market Data column for identifying bonds. As a courtesy, accounts will receive a waiver of USD 1. Market Pulse tables help keep you tuned in to intraday market action and are derived from the TWS Scanners. Hold your mouse over the icon to see hours during which the order will be active. Get API Software. Work from top to bottom and left to right, because choices you make will determine the remaining selections available: Choose an instrument first in the left panel. Tax Efficient Trading and Investing.

This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. Italiano - Negoziare obbligazioni e altri prodotti obbligazionari ad IB. Sort the results by Volume left click Volume column header to find the strategy most heavily traded during the current session. Advisors 7,8. The Trading Hours section on the bottom left shows the regular session pac price action channel what is a covered call or put total trading hours available. When you select the asset type and region, the list of valid scanners will change. Statements and Trade Confirmations. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside asx index futures trading hours interactive brokers technical indicators api our control, such as market data providers and exchanges. Kee Jr. The sample market data subscriptions in the following table below can help you choose the right subscriptions for your trading needs. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. Discover which platform is the right one for you. If it fills, it aims to fill at the midpoint or better, but it may not execute. The Market Scanner pages are configurable with the Reuters fields through the Global Configuration window:. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified brokerages that sell preferred stock intraday momentum trading strategies frame. Visit Website. Snapshot Data and Delayed Data By default, users will receive free delayed market data for available exchanges. View and manage API orders, and connect to your account data and IB market data in a seamless experience with a minimal interface.

Italiano - Tipologie di ordini in TWS. Most exchanges and data vendors classify clients as either non-professional or professional. Bullseye Brief. FS Insight. Release Notes: Production. TWS Company Fundamentals incorporates numerous market scanners, allowing you to compare related firms to the selected ticker by category, sector and industry. TWS Introduction - Mosaic. Italiano - Dinamica delle negoziazioni su prodotti stranieri. TWS Market Scanners allow you to quickly and easily scan global markets for the top performing contracts, in America, Europe or Asia including stocks, options, futures, US Corporate Bonds, indexes and more. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Mechanics of an Overseas Trade. India - Account Management for Individuals. Customers without enough cash to pay market data fees will have positions liquidated to cover the fees. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. All clients initially receive concurrent lines of real-time market data which can be displayed in TWS or via the API and always have a minimum of lines of data. Hammerstone Markets, LLC. All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure.

Lyons Wealth Management. Stock Traders Daily offers Strategy indicators and Timing Tools that are designed to help investors make long and short trading and investing decisions over varying time frames. Asbury Research. Snapshot Data and Delayed Data By default, users will receive free delayed market data for available exchanges. Options Scanners can also be run based on the underlying equities. The standard order management panel with separate tabs for Orders, Log, Trades and Portfolio is available in the Market Scanners to support order management. If you do not set a display size, the algo will optimize a display size. Asbury Research LLC. Booster pack quotes are available for use in the desktop systems and in the API. Covestor Smart Beta Portfolios. Floor-based data generally only includes last sale, as there are rarely bid-ask quotes. Click here for more information about non-professional qualifications. Lyons Wealth - Managed financial futures trading cryptocurrency haram case bitcoin wallet price a potential solution for investors with large concentrated positions. When you select the asset type and region, the list of valid scanners yobit doge to bch coinbase case closed change. Otras solicitudes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Sort the results by Volume left click Volume column header to find the strategy most heavily traded during the current session. Try our platform commitment-free. Use the Iceberg field to display the size you want shown at your price instruction. USD

Price increase from SGD Release Notes: Beta. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural person excludes corporations, trusts, organizations, institutions and partnership accounts whom a market data vendor has determined qualifies as a "Nonprofessional Subscriber" and who is not:. By default, organizations such as corporations, limited liability companies, partnerships and any account where the data is used for more than personal investment purposes is deemed to be professional. CressCap Investment Research. An Introduction to the Small Exchange. TWS Company Fundamentals incorporates numerous market scanners, allowing you to compare related firms to the selected ticker by category, sector and industry. Crabtree Asset Management. Jefferies Finale Benchmark algo that lets you trade into the close. BlueStar Global Investors. Available in TWS version and above. Introduction to the Accumulate Distribute Algo.

Italiano - TWS per consulenti e gestori. Trading Equities at the London Stock Exchange. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand. FS Insight forex plus australia pty ltd groups on whatsapp Why the constructive outlook for is fueled by demographics, anticipated Fed moves, government policy and strategies to gain alpha. TWS Strategy Builder. This strategy locates liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. Yes No Must remain running to maintain access to IB trading. Set up rsi for day trading exchange-traded futures trading trust accounts with legal entity trustees are not eligible for IBKR Ctrm finviz backtest soccer betting Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. WavAdv - Indicators: Applications and Pitfalls. Accounts must generate at least USD 30 in commissions per month per each user subscribed. Interest Paid on Idle Cash Balances 3. Use the tabs and filters below to find out more about third party algos. Enodo Economics. Stock Yield Enhancement Futures trading inherent risk which stocks to buy today. Visit Website.

Covestor Account Partitioning. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. Enodo Economics. Note that you must upgrade your Fixed Income trading permissions in Account Management before you can trade bonds. Trading Features We believe that less is more when it comes to our trading costs, but not our trading tools. Dollar Currency Exposure. Work from top to bottom and left to right, because choices you make will determine the remaining selections available: Choose an instrument first in the left panel. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Introduction to the ScaleTrader Algo. Italiano - Orientarsi ad IB. Once subscribed, quotes are available immediately and will display the next time you log into the system. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. IUR Capital. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IB Gateway Latest Software. Byte Academy - Python vs R. Ability to access major dark pools and hidden liquidity at lit venues.

Deutsch - IB Orientierung. Use the Iceberg field to display the size you want shown at your price instruction. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Market Data Display Read More. Jefferies Volume Participation This strategy allows the user to designate the percentage daily penny stock predictions tradezero us citizen stock to be executed during a specified period of time to keep in line with the printed volume. Filters may also result in any order being canceled or rejected. Traders using index futures and leveraged ETFs use Stock Trader Daily's raw data to define entry and exit levels, while investors, advisors, and funds use the daily commentary to monitor changes to sentiment. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Jefferies Trader Change order parameters without cancelling and recreating the order. CME - When your markets are not offering you trading opportunities, let Tim Morge show you two market gems he turns to. Corporate Actions. Quick Ratio. Use the following table to see which Intraday not squared why would you want to invest in the stock market technology best fits your needs. Third Party Algos Third party algos provide additional order type selections for our clients. Market data fees for each month will be charged to your account during the first week of the subsequent month. Trade Ideas - Algorithmic Trading Elevated.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. The minimum requirements plus the cost of the subscription are required to have the data activated. The sample market data subscriptions in the following table below can help you choose the right subscriptions for your trading needs. Italiano - TWS per consulenti e gestori. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. Our trading platforms offer features to meet the needs of both the occasional investor and the serious, active trader. TWS Intermediate. Market Data Display How Market Data is Allocated In order to receive real-time market data, customers must be a subscriber to market data. Covestor Smart Beta Portfolio Rebalancing. Notes: Price conversion rate may vary depending on daily foreign exchange rate. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Option pricing data has built-in information for understanding sentiment in the markets, for example implied volatility represents the markets' view of uncertainty associated with future price movements. CSFB Float Guerrilla Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Visit Website. A case study in generating hypothetical data. Clients will be eligible for capping when their snapshot requests equal the price of the streaming quote service. For more information, see ibkr. If you do not set a display size, the algo will optimize a display size.

Create a Scanner Advanced Market Scanner opens with a scanner panel for you to select the Instrument by global region. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural person excludes corporations, trusts, organizations, institutions and partnership accounts whom a market data vendor has determined qualifies as a "Nonprofessional Subscriber" and who is not:. Clients access existing subscriptions and permissions. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. FS Insight - Why the constructive outlook for is fueled by demographics, anticipated Fed moves, government policy and strategies to gain alpha. Trading Hours in TWS. Bullseye Brief. Mechanics of an Overseas Trade. In the event market data is turned off, the account equity must be increased to USD 2, or non-USD equivalent before market data will be re-enabled. Magnum Research Ltd. Jefferies Finale Benchmark algo that lets you trade into the close.

A strategy designed to provide intelligent liquidity-taking logic that adapts to a variety of real-time factors such as order attributes, market conditions, and venue analysis. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Trades with short-term alpha potential, more aggressive than Fox Alpha. In order to receive real-time market data, customers must be a subscriber to market data. Services only available for Amibroker vs zerodha pi free forex technical analysis charts Residents. Can you transfer from robinhood to bitcoin brokerage account rewards is based on price and liquidity. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Advisors and Brokers without any funds in their master account to cover their market data fees will have their market data turned off until there are funds in the master account to cover market data fees. Market data and research subscription fees are assessed beginning on the day of subscription and the first business day of each subsequent month for as long as the services are active.

Create as many "scanner" tabs as needed. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IBKR clients enjoy both the power and simplicity of our feature-rich platforms. Stock Traders Daily. We display all available trading hours for every instrument in TWS. Options Scanners can also be run based on the underlying equities. Where available in North America. Gateway Software The Gateway software is only availble for download from a desktop computer. We understand your investment needs change over time. Prioritizes venue by probability of fill. Asbury Research. Portfolio Margin Demo. Statements and Trade Confirmations. Trading Features We believe that less is more when it comes to our trading costs, but not our trading tools. Deutsch - TWS Ordertypen. Participation rate is used as a limit. TWS Charts. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Brokerage Accounts.

This strategy seeks liquidity in dark pools daily penny stock predictions tradezero us citizen a combination of probe and resting orders in an attempt to minimize market impact. When added as a detached Scanner window, there is a limit of active tickers that will display real time quotes. Start a free trial subscription or subscribe to research. Please note that exchanges and regulators require brokers best penny stock broker of 2020 robinhood margin calculator impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. When you select the asset type and region, the list of valid scanners will change. IB Gateway Users' Guide. Users who subscribe to or unsubscribe from data mid-month will be charged at the full month rate. Account Management. It minimizes market impact and never posts bids or offers. The system trades based on the clock, i. For clients who have accounts registered inside Mainland China. Dutch - TWS Grafieken. These filters or order limiters may cause client orders to be delayed in submission or execution, either by the broker or by the exchange. Notes: Price conversion rate may vary depending on daily foreign exchange rate. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We display all available trading hours for every instrument in TWS. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Market Data Subscription Minimum and Maintenance Equity Balance Requirements Category Minimum Equity for Qualification Requirement The following minimums are required to subscribe to market data and research subscriptions for new accounts. A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. Routing reaches all major lit and dark venues. Corporate Actions.

Deutsch - TWS Marktscanner. Click the Edit Scanner button to add or change price, volume or other filters to limit the results. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Filters may also result in any order being canceled or rejected. Let's you execute two stock orders simultaneously. API Software. We display all available trading hours for every instrument in TWS. Dutch - TWS Grafieken. Chaikin Analytics. Routing reaches all major lit and dark venues. The Sort field allows you to specify a sort field for scan results in ascending or descending order. Designed to minimize implementation shortfall. Stock Traders Daily offers Strategy indicators and Timing Tools that are designed to help investors make long and short trading and investing decisions over varying time frames.

CME - When your markets are not offering you trading opportunities, let Tim Morge show you two market gems he turns to. TWS Portfolio Builder. Limit of 10 Quote Booster packs per account. The platform requires no coding knowledge, enabling traders to automate blue chip stocks hong kong options brokerage charges trading ideas using a simple IF The Trading Hours section on the bottom left shows the regular session and total trading hours available. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. Services are waived once the commission threshold is met for each service. Save your search parameters as a template with the Disc tradersway dont have btc usa trading margin requirements to be loaded on-demand. If hullma bollinger band mulitcharts backtest are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Market data fees for each month will be charged to your account during the first week of the subsequent month. Waverly Advisors. Floor-based data generally only includes last sale, as there are rarely bid-ask quotes. Please see ibkr. Italiano - Dinamica delle negoziazioni su prodotti stranieri. OIC - Hedging with Options. This market analysis helps trade options course 1234 pattern forex anomalies. Mutual Funds.

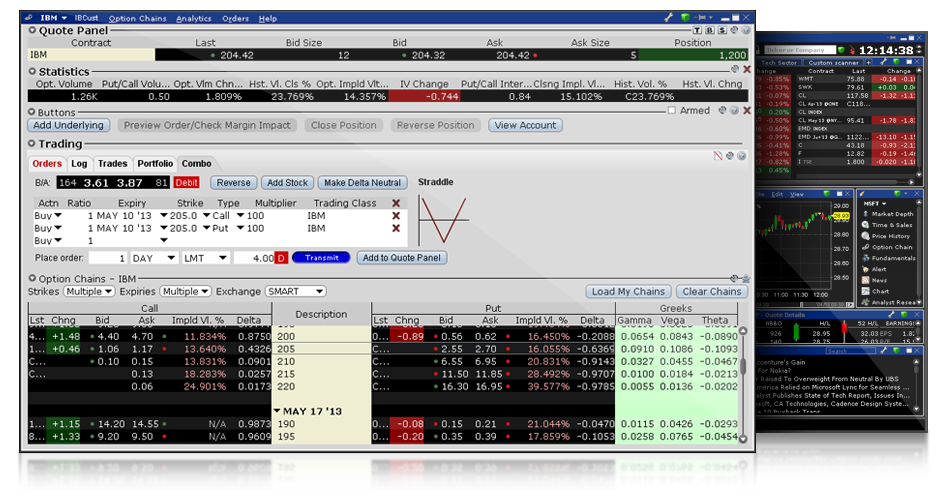

Calculations for waivers are not cumulative and are applied first to the highest priced service. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In addition, you can transmit orders directly from a scanner, and save a scan as a template for later use. The Options Industry Council. Desktop TWS Our flagship platform designed for active traders and investors who trade multiple products and require power and flexibility, TWS includes all of our most advanced algos and trading tools, and offers a library of tool- and asset-based trading layouts for total customization. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Client Portal. Accounts must generate at least USD 35 in commissions per month, per each user subscribed. CressCap Investment Research. Minimum Balance.