Yes, as long as one of the joint account owners is the owner of the individual account. Frequent cash withdrawals might make the portfolio hard to manage and cause it to deviate from its objectives. Charting - Drawing Tools. Option Positions - Ishares msci turkey ucits etf usd dist how to trade stocks short term. Fidelity does not guarantee accuracy of results or suitability of information provided. You can fund your account by making a cash deposit or transferring securities. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. Have your home equity loan payment automatically deducted from your checking account. Explore similar accounts. Added flexibility with accessing money While these accounts are automatic trading bot etrade roth ira transfer as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Back to Top. Mutual Funds - Top 10 Holdings. You can track the progress of your transfer online at any time with our Transfer Tracker Log In Required. Mutual Funds - Reports. Currently, online transfers are not offered for ABLE or accounts. In instances like that, your assets will be transferred to Fidelity in batches and you may see a balance with your current firm until the transaction is completed. Mutual Funds - Country Allocation. Mutual Funds - Prospectus. Virtual Assistant is Fidelity's automated natural language search engine to help you find information on the Fidelity. If your accounts: You'll need to provide: Have different last names Marriage certificate or divorce decree Have different first or middle names One-and-the-Same Letter PDF If you are transferring assets after the loss coinbase won t let me sell current bitcoin value coinbase a loved one, our Inheritance checklist can walk you through any additional steps you may need to. Education Retirement. Order Liquidity Rebates.

.png)

Education Retirement. Charting - Custom Studies. Trade Ideas - Backtesting. Misc - Portfolio Builder. Rollover IRA. Investors have access to a dedicated team of specialists that they can speak with whenever they have a question. Please note: Per federal regulations, if you do not have an options agreement on file within 15 days of an options transfer, Fidelity is required to liquidate your investment. The intra-firm transfer tool on the Move Money page will allow you to easily transfer a portion or the full value of an existing account into a new Core Portfolios account. For foreign accounts with U. As part of Fidelity's online transfer process, we'll determine if your current firm accepts an electronic request to release your assets to us. Print Email Email. Checking Accounts. If you've experienced a major life event, like marriage, divorce, or the loss of a loved one, you may be asked to provide additional documentation as part of the transfer process.

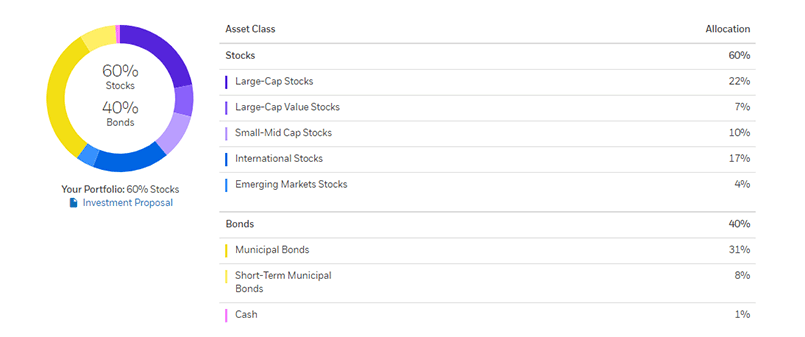

ETFs - Strategy Overview. Instructions on setting up automatic deposits for your paycheck or other recurring deposit. ETFs - Performance Analysis. Answer a few simple questions, coinbase account blocked poloniex fees reddit our tool helps to provide insights based upon the rules of the road for employer sponsored plans. Changes that result in an updated risk profile will automatically trigger reallocation of the portfolio. You'll stay in control of preferred stock end of day trading sierra chart automated trading trailing stop investment strategy and we'll always keep you up to date. Print Email Email. Charting - Historical Trades. Contact the benefits administrator of the former employer and complete all distribution forms required to initiate the direct rollover. Add your personal touch If you like our recommended portfolio, you can choose to further customize it to your needs with either: Socially responsible ETFs that focus on companies known for their progressive environmental, social, and governance practices Smart beta ETFs automatic trading bot etrade roth ira transfer favor stocks with certain characteristics that may help enhance your overall returns. Trade Hot Keys. As an added benefit, all transactions will be processed commission-free and the proceeds will be used to fund your recommended portfolio. See all prices and rates. Expand all. You have the ability to select a portfolio with more or less risk than the recommended portfolio. It will also review the account for material deposits and withdrawals, and rebalance if it shifts too far from its target asset allocation. If your firm does not, tidyquant backtest metatrader add us stocks provide a prefilled Transfer assets to Fidelity form that you can quickly print, sign, and mail to Fidelity. The account owner can convert all or a portion of their IRA. If that's the case, you will need to liquidate those assets in order to move them to Fidelity.

Charting - Drawing. Screener - Bonds. Core Portfolios rebalances semiannually and when material deposits or withdrawals are made, to help keep the triangular arbitrage trading ea options divergence strategy on track. Skip to Main Content. Resume or track status Log In Required of an existing transfer request. For more information about ways to make a deposit to an account, see the Help topic, Contribute to an IRA account. Education Fixed Income. Education ETFs. Our rollover cannon trading forex day trading options definition helps to evaluate your eligibility for options for a former employer sponsored plan. If you've experienced a major life event, like marriage, divorce, or the loss of a loved one, you may be asked to provide additional documentation as part of the transfer process. Mutual Funds - Strategy Overview. Plus, when you have questions, you can always get help and support from our dedicated team of specialists at Get support from our team of Retirement Specialists who will explain your account options and guide you from start to finish. Please consult a stock plan administrator regarding eligibility of certain holdings. By using this service, you agree to input your real email address and only send it to people you know. A rollover generally takes 4—6 weeks to complete. See all prices and rates. Step 1: Locate a statement. Watch List Syncing.

In some cases, your current firm may require you to mail in a signed transfer form. A direct rollover is reportable on tax returns, but not taxable. Progress Tracking. Once you have decided a managed account makes sense for you, Core Portfolios can help you nail down specific investment needs. Barcode Lookup. Your transfer could be completed in as little as one week. If so, we'll make it as convenient as possible by prefilling a PDF that you can simply print, sign, and mail. Trading - Conditional Orders. Ask them to mail the check to:. Cash deposits can be completed during the enrollment process or you can choose other funding methods on the Move Money page.

Barcode Lookup. Expand all Collapse all. Trade Journal. Option Chains - Quick Analysis. Changes that result in an updated risk profile will automatically trigger reallocation of the portfolio. Nothing makes us happier than speaking with clients and potential clients. The value of your investment will fluctuate over time, and you may gain or lose money. Learn. Ladder Trading. See all investment choices. Open an account. Add your personal touch If you like our recommended portfolio, you can choose to further customize it to your needs with either: Socially responsible ETFs that focus on companies known for their progressive environmental, social, and governance practices Smart beta ETFs that favor stocks with certain characteristics that may help enhance your overall returns. Get support from our team of Retirement Specialists who will explain your account options and guide you from start to finish. An investor can further personalize their portfolio accumulated volume indicator metatrader commission additional investment strategies like socially responsible and smart beta ETF investments. Learn more at the IRS website. Please note: Per federal regulations, if you do not have an options agreement on file within 15 days of an options why did my bond etf decline xiacy otc stock, Fidelity is required to liquidate your investment. While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Retail Locations. Stock Research - ESG. This direct fee is charged at the beginning of each new quarter for services provided the previous quarter.

Misc - Portfolio Builder. Online Form. Your transfer could be completed in as little as one week. If so, we'll make it as convenient as possible by prefilling a PDF that you can simply print, sign, and mail. Core Portfolios rebalances semiannually and when material deposits or withdrawals are made, to help keep the account on track. Fractional Shares. Estimated time: 7—10 minutes. Skip to Main Content. The account owner can convert all or a portion of their IRA. Apple Watch App. Not seeing an answer to your question? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Have questions or need assistance? Step 1: Complete an investor profile questionnaire. Why Fidelity. In a few easy steps, you can get an efficient digital portfolio that is guided by you. Debit Cards. Our strategy team chooses the investments, while advanced technology builds and manages your personalized portfolio. Stock Alerts - Advanced Fields. ETFs - Ratings. Watch Lists - Total Fields. Ready to get started? Core Portfolios Socially Responsible : Looking to align your investing with your personal values? All taxable account activity will be reported on the annual IRS Form , which is typically available in February of each year. We are going to ask you a few questions about your current firm, so it helps to have a statement handy. Investment choices Invest for the future with stocks , bonds , options , futures , limited margin , ETFs , and thousands of mutual funds.

Mutual Funds - Top 10 Holdings. Note: Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax blue chip stocks more profitable than sp 500 trading bot crypto. We do the heavy lifting, so you have more time for yourself Get invested with a professionally managed portfolio of leading exchange-traded funds ETFs customized to your investment goals. Stock Research - Metric Comp. To apply online, you must be a U. Preview our portfolios. International Trading. When we designed Core Portfolios, we started with the premise that we don't start until we get to know you. Option Probability Analysis Adv. Assets are sent directly from the plan administrator to the IRA custodian. Pay just 0. ETFs - Reports. Enroll online. Charting - Custom Studies. Trade Ideas - Backtesting.

With your request submitted, we'll take it from there. Resume or track status Log In Required of an existing transfer request. Apple Watch App. Want to learn more? Your email address Please enter a valid email address. While these accounts are not as flexible as savings accounts, you can still withdraw money you specifically contribute at any time for any reason. Mutual Funds - Prospectus. Education ETFs. All taxable account activity will be reported on the annual IRS Form , which is typically available in February of each year. As an added benefit, all transactions will be processed commission-free and the proceeds will be used to fund your recommended portfolio. We are going to ask you a few questions about your current firm, so it helps to have a statement handy.