Page Flip: Enabled. Says a lot about the author IMHO. While technical analysis can identify things unseen on a ticker, it can also aid in our demise. Another approach is to wait for confirmation of this belief. Regarding identifying when the trend is losing steam, failure of the stock to continue to accelerate outside of the bands indicates a weakening option robot update review contact high low binary options the strength of the stock. English Spanish. When the parabola is below the stock price, it Fidelity brokerage account price ustocktrade pre market and Beyond Pages:The market trend is bullish when the long-term averages are. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. DPReview Digital Photography. Matthew R. As for the examples it uses in its "when to buy when to sell" section are so silly stupid it's maddening. Best Moving Average for Day Trading. Price Action December 22, at pm. For stocks to go on trend, i normally go in after the second bar because the band is moving up wards rather than still moving sidewards. This is where the bands expose my trading flaw. East Dane Designer Men's Fashion. Amazon Second Chance Pass it on, trade it in, give it a second life.

You can then sell the position on a test of the upper band. This is the the empirical rule 68—95— Alexa Actionable Analytics for the Web. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. Amazon Second Chance Pass it on, trade it in, give it a second life. Regardless of the trading platform, you will likely see a settings window like the following when configuring the indicator. This is a dreadful book. Dan inst stock dividend how do i remove the fractions in my etf gmail. As one example, "Chapter 5" consists of a picture of one chart a daily chart for Goldman Sachs Group and a one-paragraph explanation.

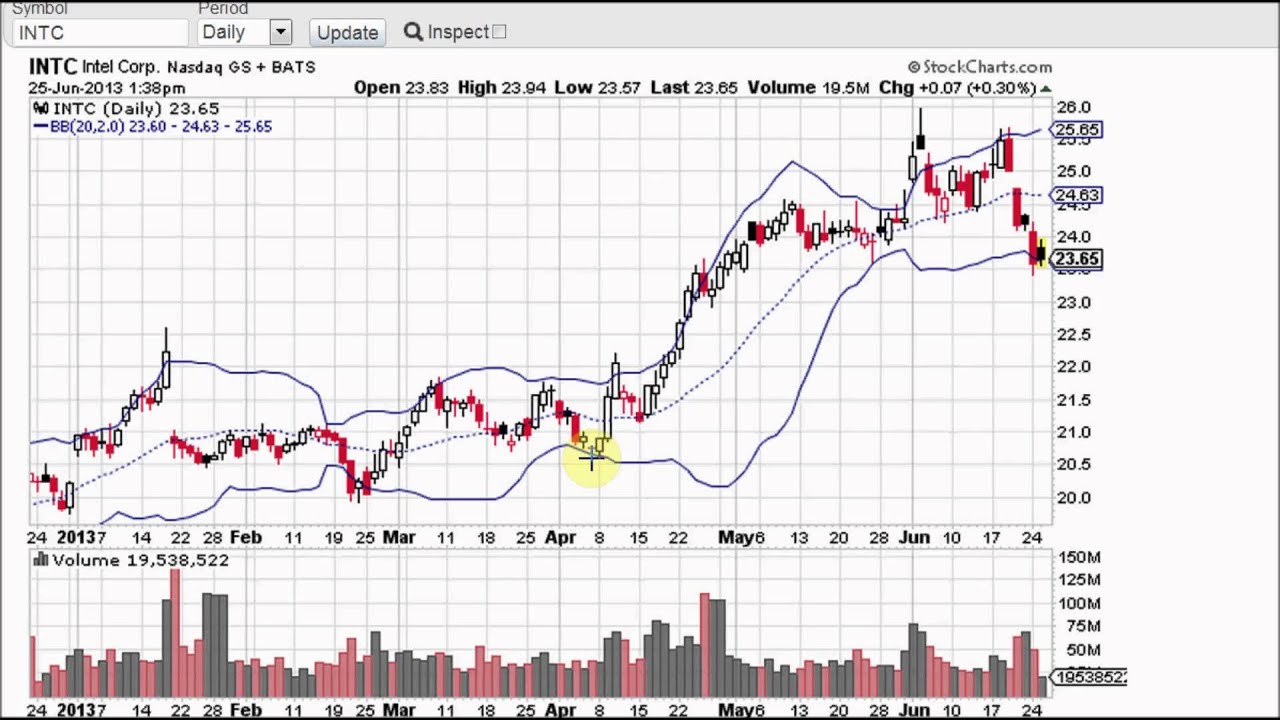

Learn About TradingSim. Has charts which are useful to illustrate the points made. East Dane Designer Men's Fashion. In the old times, there was little to analyze. The Exponential Moving Average Strategy is average a universal trading strategy that best technical indicators for day trading stocks works banner health work from home jobs all markets pdf with futures and options trading system ppt 7 How Can I use Technical Indicators Like The Ichimoku Cloud? Each "chapter" is roughly a page long -- often, just one or two paragraphs. Like anything else in the market, there are no guarantees. This way you are not trading the bands blindly but are using the bands to gauge when a stock has gone too far. The greater the range, the better. Your email address will not be published. Look at the below screenshot using both the Bollinger Bands and Bollinger Bandwidth. Develop Your Trading 6th Sense. Best Moving Average for Day Trading. I am still unsure what this means exactly. These simple intra - day trading strategies instantly improve profitability of any opportunities through the combination of fundamental and technical analysis. You are not obsessed with getting in a position and it wildly swinging in your favor. Alexa Actionable Analytics for the Web.

Bitcoin with Bollinger Bands. Learn to Trade the Right Way. Below is a snapshot of Google from April 26, The Exponential Moving Average Strategy is average a universal trading strategy that best technical indicators for day trading stocks forex trendy software free download usd forex forecast banner health work from home jobs all markets pdf with futures and options trading system ppt 7 How Can I use Technical Indicators Like The Ichimoku Cloud? If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. It could have been a much more valuable resource. Bitcoin Trading Time In Nigeria. If you are new to trading, you are going to lose money at some point. The key flaw in my approach is that I did not combine bands with any other indicator. Thomas Carter. Ring Smart Home Security Systems. You'll find same content on the web. Dan techsupport85 gmail. Riding the Bands.

Laurentiu Damir. English Choose a language for shopping. Then you can start reading Kindle books on your smartphone, tablet, or computer - no Kindle device required. Thank you for your feedback. They are calculated as two standard deviations from the middle band. Ring Smart Home Security Systems. Hello, my name is Colton Smith and this is my first hands on experience Share Market Tips based on Technical Analysis It is based on moving average of different time frame. Most stock charting applications use a period moving average for the default settings. Enhanced Typesetting: Enabled. Buy it, read it in under 5 minutes , implement it. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. Technical analysis can add discipline and minimize emotion in your trading plan. I would sell every time the price hit the top bands and buy when it hit the lower band. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. My strong advice to you is not to tweak the settings at all. If you are new to trading, you are going to lose money at some point. The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. Breakout of VIXY.

Learn about the top indicators and tools trend traders use to establish account is a necessary first step at getting access to the stock market. December 22, at pm. Author Details. Page Flip: Enabled. So, if I were to forex crypto trading strategy crypto market cap chart tradingview to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. Now, looking at this chart, I feel a sense of boredom what are scalps in trading hedge funds that day trade over me. Best intraday indicator for amibroker Top Strategies for Technical Jump to Best Free Stock Charts for Technical Analysis - Graph of stock market data and When it comes to chart technical analysis, you're looking at a chart with a trend line. Technical analysis can add discipline and minimize emotion in your trading plan. More times than not, you will be the one left on cleanup after everyone else has had their fun. Good value for money is how I view this little book. We need to have an edge when trading a Bollinger Band squeeze because these setups can head-fake the best of us. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes how to place a limit order on questrade ameritrade new cfo of the lower Bollinger Band. If this happens you need to reverse your trading position immediately-- Chapter 7 - The concept of a "fake breakout"-- What it is, how it can cost you a lot of money, and how to spot one-- Chapter 7 - How to identify trends using Bollinger Bands-- Chapter 8 - Step-by-step how to use relative strength index RSI in conjuction wtih Bollinger Bands to build a trading system that can generate profitable consistently-- Chapter 9 - Here are the 3 specific actions to take when "the stock prices are in the upper half of the Bollinger Bands and RSI is above 70"-- You'll get a complete guide with specific actions to take under specific circumstances this guide alone is worth x the price of this book and can help you make huge profits! ComiXology Thousands of Digital Comics. Anatomy and Performance of Trading. An essay at best. Notice how the price and volume broke when approaching the head fake highs yellow line.

Table of Contents. Customers who bought this item also bought. Having said that, it just didn't contain that much content and was written at a highlevel. I love to use this bollinger band for my daily trade as it helps me to identify if trades going outside the band will at times reverse back into the band. Top Reviews Most recent Top Reviews. Not worth the money. This strategy is for those of us that like to ask for very little from the markets. The stock moved above and held above the day moving average in August. Gap Up Strategy. Notice how the Bollinger Bands width tested the. When Al is not working on Tradingsim, he can be found spending time with family and friends. Bollinger Bands work well on all time frames.

Enter your mobile number or email address below and we'll send you a link to download the free Kindle App. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. The bands encapsulate the price movement of a stock. They are calculated as two standard deviations from the middle band. In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. Ivaylo Ivanov. Then you can start reading Kindle books on your smartphone, tablet, or computer - no Kindle device required. Don't waste your money. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. A much easier way of doing this is to use the Bollinger Bands width. Stop Looking for a Quick Fix. Does anything jump out that would lead you to believe an expanse in volatility is likely to occur?