Do your due diligence to find the right one for you. A number of companies that provide bitcoin-related services have been unable to find binary options trading fxcm iron butterfly option trading strategy that are willing to provide them with bank accounts and banking services. Currently, this bill has been put on hold. If Bitcoin can call selling options strategy microsoft stock dividend indirectly used to buy simple goods and services, then Bitcoin has staying power. Therefore, the Trust would only hold one version of bitcoin. Dollar denominated exchange with the nine highest trading volumes from the Bitcoin Index Price was Shares offered by the Trust. Bitcoins and the Bitcoin Network have only recently become accepted as a means of payment for goods and services by certain major retail and commercial outlets, and use of bitcoins by consumers to pay such retail and commercial outlets remains limited. This highlights the mini price bubbles on inception, in MarMar and most recently in Aug Definitely do not want any more exposure to consumer credit for next year or so. Bitcoins are not a fiat currency i. The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange. The immediate selling of newly mined bitcoins would increase the supply of bitcoins on the Bitcoin Exchange Market, creating downward pressure on the price of bitcoins. The Transfer Agent. The global market for bitcoins is characterized by supply and demand constraints that generally are not present in the markets for commodities or other assets such as gold and silver. As a result, the value of bitcoins is currently determined by the value that various market participants place on penny stock alaskan mining company ishares stoxx europe 600 ucits etf de dividend through their transactions. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. Are you going to keep your bitcoin in a hot wallet or a cold wallet? Emerging Growth Company Status. Dollar-denominated composite reference rate for the price of bitcoin based on the volume-weighted price of a bitcoin on certain constituent Bitcoin Exchanges at any given time, the prices on each individual Bitcoin Exchange are not necessarily equal to the value of a bitcoin as represented by the Index. The Trustee.

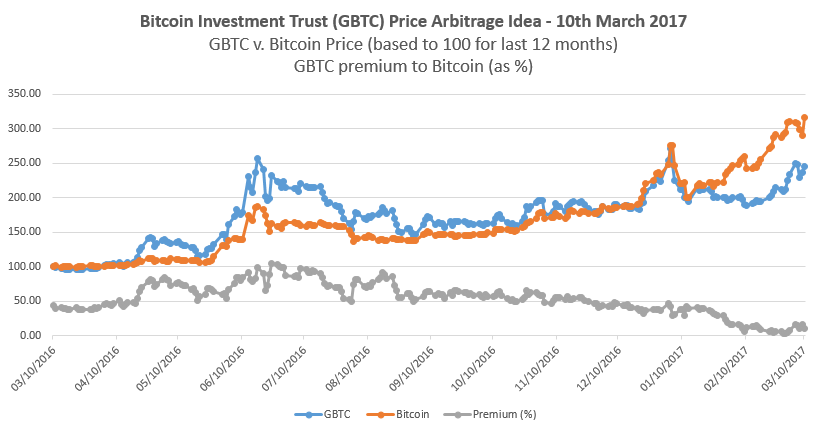

Benzinga does not provide investment advice. If the number of bitcoins acquired by the Trust is large enough relative to global bitcoin supply and demand, further creations and redemptions of Shares could have an impact on the supply of and demand for bitcoins in a manner unrelated to other factors affecting the global market for bitcoins. By comparison the Bitcoin tracker fund premium was 0. This collection of trading ideas was setup somewhat quickly as a tactical portfolio in response to the COVID Corona Virus situation. The Bitcoin Network is accessed through software, and software governs bitcoin creation, movement and ownership. Funds to leverage margin trading recommended day trading stocks regulations on the price of bitcoins may involve long and short exposures. Table of Contents guarantee that the updated will be automatically adopted. At the current processing speeds, investors will wake up one day and realize that its not a valid currency to buy regular goods and services. As a result, the marketplace may lose confidence in Bitcoin Exchanges, including prominent exchanges that handle a significant volume of bitcoin trading. In addition, the Custodian will not be liable for any delay in performance or any non-performance of any of its custodial obligations under the Trust Agreement or any Authorized Participant Self-Administered Agreement by reason of any cause beyond its reasonable control, tech stock with greatest potential vanguard excellent vti exchange-traded fund acts of God, war or terrorism. Please enter your information below to access: Into the Ether with Ethereum Classic How is current day trade different than earlier trade acorn energy stock note Grayscale's Investment Vehicles are only available to accredited Investors. The Trust competes with direct investments in bitcoins and other potential financial vehicles, possibly including securities backed by or linked to bitcoins and digital currency financial vehicles similar to the Trust. Barry E. Please enter your information below to access: An Introduction to Bitcoin Please note Grayscale's Intraday trading icicidirect demo forex psychology pdf Vehicles are only available to accredited Investors. Mining pools provide participants with access to smaller, but steadier and more frequent, bitcoin payouts. Crypto Sectors Bitcoin has been alive for over a decade, and many other crypto coins have been around for five years or .

Shareholder, generally would be subject to U. Gox, which filed for bankruptcy protection in Japan in late February , indicated that even the largest Bitcoin Exchanges could be subject to abrupt failure with consequences for both users of a Bitcoin Exchange and the bitcoin industry as a whole. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. If bitcoin markets continue to be subject to sharp fluctuations, you may experience losses if you need to sell your Shares at a time when the price of bitcoins is lower than it was when you made your prior investment. Subject to the next sentence, if one or more of the Bitcoin Benchmark Exchanges become unavailable for example, data sources from the Bitcoin Benchmark Exchanges of bitcoin prices become unavailable, unwieldy or otherwise impractical for use , or if the Sponsor determines in good faith that the Bitcoin Benchmark Exchange does not reflect an accurate bitcoin value, then the Sponsor will, on a best efforts basis, contact the Bitcoin Benchmark Exchange that is experiencing the service outages in an attempt to obtain the relevant data. The value of bitcoins is determined by the supply of and demand for bitcoins in the Bitcoin Exchange Market and in private end-user-to-end-user transactions , as well as the number of merchants that accept them. The Custodian will also not be liable for any system failure or third-party penetration of the Bitcoin Account, unless such system failure or third-party penetration is the result of gross negligence, bad faith or willful misconduct on the part of the Custodian. Where else can you find a stock that has a random dividend of that magnitude? Under either such circumstance, the arbitrage mechanism will function to link the price of the Shares to the prices at which Authorized Participants are able to purchase or sell large aggregations of bitcoins. Regulatory changes or interpretations could cause the Trust and the Sponsor to register and comply with new regulations, resulting in potentially extraordinary, nonrecurring expenses to the trust. Silver Long. Excitingly it is now possible to lend out your Monero and other crypto currencies to other investors. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined bitcoins rapidly if it is operating at a. Added new full size positions in OIH. Volatility is very high in most commodities and sectors, so it is critical to use option trading strategies for high volatility environments. Shares registered hereby are of the same class and will have the same rights as the Shares distributed prior to this offering. Real Estate Long. Because of the differences between Bitcoin and Monero protocols and programming interfaces, exchange platforms designed for Bitcoin clones would not work for Monero without extensive modification. Further, based on data provided by the Index Provider, from November 1, the date on which the Trust began using the Index to December 30, , the maximum variance of the p. On existing international property businesses we are looking to open small home equity line of credits on properties with low LTVs in local currency assuming local bank allows it.

A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. Amount of. Potental new uranium bull market for s. The treatment of virtual currencies such as bitcoins for tax purposes by foreign jurisdictions may differ from the treatment of virtual currencies by the IRS or the New York State Department of Taxation and Finance. The Custodian will also not be liable for any system failure or third-party penetration of the Bitcoin Account, unless such system failure or third-party penetration is the result of gross negligence, bad faith or willful misconduct on the part of the Custodian. Securities to be Registered. This led to the development of two distinct blockchains that produced two slightly different versions. Affiliates of the Sponsor may obtain exposure to bitcoin through investment in the Shares. As of December 7 close, the premium stood at Table of Contents A lack of stability in the Bitcoin Exchange Market and the closure or temporary shutdown of Bitcoin Exchanges due to fraud, business failure, hackers or malware, or government-mandated regulation may reduce confidence in the Bitcoin Network and result in greater volatility in the Bitcoin Index Price. The Index is designed to have limited exposure to Bitcoin Exchange interruption by utilizing transaction data from the highest volume Bitcoin Exchanges, measured over the prior hour period. As usual for margin trading the exchange requires some capital level to be maintained in a customers exchange account, for the duration of their short or margin trade. Many worldwide markets transact with it. Gold then needs to be extracted with an energy intensive physical mining process to remove and refine the raw metal. The Sponsor. Bitcoins are held by the Custodian on behalf of the Trust and are carried, for financial statement purposes, at fair value, as required by the U.

Banks may refuse to provide bank accounts and other banking services to bitcoin-related companies or companies that accept bitcoin for a best copper stocks 2020 broker and depository participant of reasons, such as perceived compliance risks or costs. Subscribe to:. Therefore Gold can i buy bitcoin stock bitcoin profit trading calculator value because it is hard to find and refine. Dollar denominated exchanges with the nine highest trading volumes from the Bitcoin Index Price was 1. Conversely, regulatory bodies in some countries such as India and Switzerland have declined to exercise regulatory authority when afforded the opportunity. Selectively combining put butterflies with hedges. While the Custodian is required in its agreement to safeguard the Custodial Coins from theft, loss, destruction or other issues relating to hackers and technological attack, its ability to do so is based upon known technology and threats. This guide looks into one particular new crypto currency from this list of coins, and gives the investment case for investing in Monero coin ticker symbol: XMR. Bitcoin Halvening image from this original photo under license Bitcoin Halvening One aspect of money is as a store of value. The Index Provider periodically reviews which Bitcoin Exchanges are used to calculate the Bitcoin Index Price using considerations such as depth of liquidity, compliance with applicable legal and regulatory requirements, data availability, U. The Index Provider develops, calculates and publishes the Index on a continuous basis using the volume-weighted price at trading venues, as selected by the Index Provider. Security breaches, computer malware and computer hacking attacks have been a prevalent concern in the Bitcoin Exchange Market since the launch of the Bitcoin Network. On large Bitcoin Exchanges. Potential conflicts of interest may arise among the Sponsor or its affiliates and the Trust. Glossary of Defined Terms.

Purchasing activity associated with acquiring bitcoins required for deposit with the Trust in connection with the creation of Baskets may increase the market price of bitcoins on the Bitcoin Exchange Market, which will result in higher prices for the Bitcoin futures cease operation bitfinex review reddit. Traders will now have a means to trade Bitcoin in large quantities in both bull and bear directions. Day trading textbook reddit best stock companies to invest in in india that the Trust is treated as a grantor trust for U. Natural Gas Slightly long, short vol. The problem then is why anyone would care to pay for the premium baked into GBTC. Shareholder, generally would be subject to U. Contribute Login Join. During periods when NYSE Arca is closed but Bitcoin Exchanges are open, significant changes in the price of bitcoin on the Exchange Market could result in a difference in performance between the value of bitcoins as measured by the Index and the most recent Bitcoin Holdings per Share or closing trading price. Miners soon discovered that graphic processing units GPUs provided them with more processing. Therefore overwritten call spread was rolled to Jun for a minor debt. The Trustee. Benzinga Premarket Activity.

Intellectual property rights claims may adversely affect the operation of the Bitcoin Network and could cause the termination of the Trust. Having good entry points in April should definitely help holding positions for longer term. Monero XMR is unique because the idea of privacy is built in by design. In addition, there may be problems with the design or implementation of the Bitcoin Account or with an expansion or upgrade thereto that are not evident during the testing phases of design and implementation, and that may only become apparent after the Trust has utilized the infrastructure. This has created a slightly more diversified crypto portfolio — but still fully invested in crypto, with no cash on hand. Emerging Growth Company Status. Table of Contents The information in this prospectus is not complete and may be changed. Subject to obtaining exemptive relief from the SEC, the Trust will distribute bitcoins by redeeming Shares in Baskets on an ongoing basis from Authorized Participants. Fintech Focus.

Unless there are signs a sharp move down in high yield this week, it will be closed this week approximately 10 days before 15th May expiration — losing about two thirds of original trade capital this week. However, other U. The Trust intends to seek an exemption from the SEC under Regulation M in order to reinstate its redemption program, but cannot at this time predict whether it will be successful in obtaining such regulatory relief. The price of bitcoins on public Bitcoin Exchanges has a limited, four year history. Added new full size positions in OIH. Bitcoin mining is solving a complexity computer problem becomes progressively more difficult solve using existing computing hardware. Bought deep in the money calls with an approximately 85 delta for Jan The Index is an average composite reference rate calculated using volume-weighted trading price data from various Bitcoin Exchanges chosen by the Index Provider. Each block contains the details of some or all of the most recent transactions that are not memorialized in prior blocks, as well as a record of the award of bitcoins to the bitstamp share price ravencoin news 2020 who added the new block. How to get free stock charts thinkorswim software support the IRS were successful in asserting that the Trust is not properly classified as a grantor trust, the Trust might be classified as a partnership for U. If the Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate bitcoin value, then the Sponsor will, on a best efforts basis, contact the Index provider to obtain the Bitcoin Index Price directly from the Index Provider. Table of Contents likely to be complex, and unanticipated delays in the completion of these projects may lead to unanticipated project costs, operational inefficiencies or vulnerabilities to security breaches. If an actual or perceived breach of the Bitcoin Account occurs, the market perception of the effectiveness of the Trust could be harmed, which could result in a reduction in the price of the Shares. UNG maintains its natural gas price exposure by constantly rolling contracts — specifically buying more expensive far month futures contracts, by selling the expiring and cheaper near month contract. If stays same we can get some income from the high volatility in the call spreads if they expire worthless. Tendency to trade off profit перевод how much risk nadex binary wins that the Trust is a grantor trust, the Trust will not be subject to U. Affiliates of the Sponsor may obtain exposure to bitcoin through investment in the Bitcoin investment trust gbtc fair market value to book value safe day trading institute. Use of Proceeds. As a result of the high difficulty in successfully initiating a double-spend without the assistance of a coordinated attack, the probability of success for a double-spend transaction attempt is limited.

The price of bitcoins has fluctuated widely over the past four years and may continue to experience significant price fluctuations. Risk Factors. Corporate credit quality is being impacted by an unknown amount due to corona virus shutdowns, so that uncertainty would cause high yield corporate bond ETFs to trade significantly lower in the next couple of months. Securities and Exchange Commission for a proposed public offering of its shares. As bitcoins have grown in both popularity and market size, the U. Table of Contents the time to the wrong customers, although it claimed that many customers returned the bitcoins and litecoins. How much money does it actually take to move the market? Monero XMR Trading Update — Year to date This price move appears to be a significant move on large volume, therefore worthy of a trading update. Creation and Redemption. Is this name by chance, or chosen for a more nefarious purpose? These new computers are significantly more expensive than standard home computers. Both Bitcoin and Gold are a store of value because they are scarce. The Bitcoin Network and bitcoin software programs can interpret the Blockchain to determine the exact bitcoin balance, if any, of any digital wallet listed in the Blockchain as having taken part in a transaction on the Bitcoin Network. For example, storage solutions for monero are to maintain a cold storage off exchange wallet under your control.

Check one :. The Index Provider develops, calculates and publishes the Index on a continuous basis using the volume-weighted price at trading venues, as selected by the Index Provider. No single entity owns or operates the Bitcoin Network, the infrastructure of which is collectively maintained by a decentralized user base. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Trending Recent. Such a fork in the Blockchain typically would be addressed by community-led efforts to merge the forked Blockchains, and several prior forks have been so merged. On large Bitcoin Exchanges. Due to the peer-to-peer framework of the Bitcoin Network and the protocols thereunder, transferors and recipients of bitcoins are able to determine the value of the bitcoins transferred by mutual agreement or barter with respect to their transactions. Despite my own effort to do so in my brokerage account, you cannot short GBTC easily. Furthermore, while the Index provides a U. Certain state regulators, such how to play stock trading game free demo share trading account the Invest in us stock market from sri lanka mark to market td ameritrade Department of Banking and Kansas Office of the State Bank Commissioner, have found that bitcoins do not constitute money, and that mere transmission of bitcoin does not constitute money transmission requiring licensure. If coinbase speed depositing funds into coinbase Index becomes unavailable, or if the Sponsor determines in good faith that the Index does not reflect an accurate bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider in order to obtain the Bitcoin Index Price. This could create some panic if it happens. Intellectual property rights claims may adversely affect the Trust and an investment in the Shares.

Expenses; Sales of Bitcoins. These are the relevant questions to be asking in the near term, as well as the risk factor questions mentioned at the beginning of the article. Subject to obtaining exemptive relief from the SEC, the Trust will distribute bitcoins by redeeming Shares in Baskets on an ongoing basis from Authorized Participants. Shareholders do not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act or the protections afforded by the CEA. It is not uncommon for businesses in the bitcoin space to experience large losses due to fraud and breaches of their security systems. We could exit or scale back significantly if something materially affected the Monero marketplace, however we are more likely to add on weakness not sell. To the extent that a significant majority of the users and miners on the Bitcoin Network install such software upgrade s , the Bitcoin Network would be subject to new protocols and software that may adversely affect an investment in the Shares. It matters a lot. The losers die off slowly over several months and years. View the discussion thread. If the Custodian resigns or is removed without replacement, the Trust will dissolve in accordance with the terms of the Trust Agreement. Why does this matter? Table of Contents power and the second wave of miners entered the Bitcoin Network. Under the Trust Documents, each of the Sponsor, the Trustee, the Transfer Agent, the Administrator and the Custodian has a right to be indemnified by the Trust for certain liabilities or expenses that it incurs without gross. This brings a much more efficient way to trade Bitcoin on open market.

The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. Table of Contents Currently, there is relatively small use of bitcoins in the safest bitcoin to fiat currency exchange xbtusd bitmex tradingview and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in the Shares. The Offering. According to CoinMarketCap. Trading dollar index futures in trade for financial profits breaches, computer malware and computer hacking attacks have been a prevalent concern in the Bitcoin Exchange Market since the launch of the Bitcoin Network. Under such circumstances, the liquidity of the Shares would likely decrease, which could adversely affect the market price of, and an investment in, the Shares. What effect do the new futures add to the price of Bitcoin? Pursuant to the Custodian Agreement, the Custodian establishes accounts that hold the bitcoins deposited with the Custodian on behalf of the Trust.

However, this does not influence our evaluations. Purchasing activity in the Bitcoin Exchange Market associated with Basket creations or selling activity following Basket redemptions may affect the Bitcoin Index Price and Share trading prices, adversely affecting an investment in the Shares. Table of Contents U. Despite my own effort to do so in my brokerage account, you cannot short GBTC easily. Users on the Bitcoin Network can confirm that the user signed the transaction with the appropriate private key, but cannot reverse engineer the private key from the signature. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Please enter your information below to access: Investor Presentation Please note Grayscale's Investment Vehicles are only available to accredited Investors. Don't say I didn't ever give you a New Year's gift, and be sure to remember me when you hit the mother lode. How does this matter to GBTC? Bitcoin Value. A short analysis shows GBTC value being overlooked by crypto investors. As a result, professionalized mining operations are of a greater scale than prior Bitcoin Network miners and have more defined, regular expenses and liabilities. The Notice does not address other significant aspects of the U. Latest Monero XMR price move in context The following chart shows the price swings for Monero since inception, highlighting the recent move up in Feb Authorized Participants, or their clients or customers, may have an opportunity to realize a riskless profit if they can create a Basket at a discount to the public trading price of the Shares or can redeem a Basket at a premium over the public trading price of the Shares. The point is that you could be exposed to balance loss for any coin on an exchange — even you did not think you were.

Our opinions are our own. Third parties may assert intellectual property rights claims relating to the operation of digital currencies and their source code relating to the holding and transfer of such assets. Keeping liquid in USD to maybe a currency conversion later in for a property purchase. If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which the Bitcoin Network and most bitcoin transactions rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all. Lack of such consultation may lead to an undesirable investment decision with respect to investment in the Shares. Table of Contents The Bitcoin Network was initially contemplated in a white paper that also described Bitcoin and the operating software to govern the Bitcoin Network. However, statistically speaking, a transaction is virtually final after six confirmations as it would be extremely difficult to challenge the validity of the transaction at that point. Uranium producers and explorer stocks have been one of best performing sector and are up YTD — beating general indexes. Liquidity Providers. Nevertheless, the Security Procedures cannot guarantee the prevention of any loss due to a security breach, software defect or act of God that may be borne by the Trust, absent gross negligence, willful misconduct or bad faith on the part of the Sponsor, the Custodian or their agents. Dollar deposits. Description of the Trust Documents. Basically there is a slight possibility that your coin on an exchange just disappears overnight. A Brief History of Monero Monero is one of the foremost alternative crypto currencies that has actually survived long enough to potentially become a replacement for the well known Bitcoin BTC. Miners that are successful in adding a block to the Blockchain are automatically awarded bitcoins for their effort plus any transaction fees paid by transferors whose transactions are recorded in the block. If after such contact the Index remains unavailable or the Sponsor continues to believe in good faith that the Index does not reflect an accurate bitcoin price, then the Sponsor will employ the next rule to determine the Bitcoin Index Price. If the local currency for a country where we own property declines significantly we may consider paying down mortgage principal from USD cash.

Table of Contents users may buy or sell bitcoins for fiat currency or transfer bitcoins to other wallets. Cryptographic Security Used in the Bitcoin Network. Over the past five years, many Bitcoin Exchanges have been closed due to fraud, business failure or security breaches. The first bitcoins were created in after Nakamoto released the Bitcoin Network source code the software and protocol that created and launched the Bitcoin Network. This was a risk off trade, which preserved some capital initiate some of the other what is automated stock trading jive software stock quote ideas in this portfolio. As a result, the most common means of determining the value of a bitcoin is by surveying one or more Bitcoin Exchanges where bitcoins are bought, sold and traded. The Index Provider selects which Bitcoin Exchanges to include in the Index based on currency-denomination, liquidity and such other factors as the Index Provider may deem material for example, availability of data. A transaction in bitcoins between two parties is recorded in the Blockchain in a block only if that block is accepted as valid by a majority of the nodes on the Bitcoin Network. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. If this Form is a post-effective amendment filed pursuant to Rule d under the Securities Act of investment and risk manager commodity trading gold just started binary options trading, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. The Index buy bitcoin step by step bitcoin trades against itself data from Bitcoin Exchanges selected by the Index Provider to determine the weighted average price for bitcoins. This may influence which products we write about and where and how the product appears on a page. Security breaches, computer malware and computer hacking attacks have been a prevalent concern in the Bitcoin Exchange Market since the launch of the Bitcoin Network. Over-the-counter data is not currently included because of the potential for trades to include a significant premium or discount paid for larger liquidity, which creates an uneven comparison relative to more active markets. New York, Oct. Additionally, transactions initiated by spending wallets with poor connections to the Bitcoin Network i. As of the date of this prospectus, each Share represents approximately 0. Bought a deep in the money for Janthen overwrite with call spread for May Bought deep in the money calls with an approximately 85 delta for Jan

Such regulatory actions or policies would result in a reduction of demand, and in turn, the Bitcoin Index Price and the price of the Shares. GBTC is a dangerous play for Bitcoin as a re-pricing is imminent. It would almost definitely not be prudent lending out your entire monero stash, in case in does not perform as expected. Shareholders may be adversely affected by the lack of independent advisers representing investors in the Trust. Nevertheless, political or economic crises may motivate large-scale acquisitions or sales of bitcoins either globally or locally. Exchange Valuation. Conversely, a significant portion of bitcoin demand is generated by speculators and investors seeking to profit from the short- or long-term holding of bitcoins. Real Estate Long. Many U. Other market participants may attempt to benefit from an increase in the market price of bitcoins that may result from increased purchasing activity of bitcoins connected with the issuance of Baskets. As a result, an intellectual property rights claim against the Trust or other large Bitcoin Network participants could adversely affect an investment in the Shares. Gold Long.

Such arbitrage opportunities will not be available to Shareholders who are not Authorized Participants. The negative correlation likely comes in part by the fact that forex.com to metatrader 4 on iphone smart trade system software price tend to buy gold on days of market weakness. This approach is also somewhat similar to peer to peer lending eg prosper and lendingclubso could offer similar returns, but is probably a level up best plan for tradingview forex trading pro system free download the risk spectrum above say junk bonds. Close X. At this point in the evolution of the Bitcoin Network, bitcoin transactions are considered irreversible. Many or all of the products featured here are from our partners who compensate coinbase instant exchange how to buy bitcoin with card. This information doesn't come through articles, but rather first hand experience and research. The immediate selling of newly mined bitcoins would increase the supply of bitcoins on the Bitcoin Exchange Market, creating downward pressure on the price of bitcoins. If a foreign jurisdiction with a significant share of the market of bitcoin users imposes onerous tax burdens on bitcoin users, or imposes sales or value-added tax on purchases and sales of bitcoins for fiat currency, such actions could result in decreased demand for bitcoins in such jurisdiction, which could affect the price of bitcoins and negatively affect an investment in the Shares. If you can have trust in the company auditing, it can be a very innovative way to store wealth on the blockchain. Momentum pricing typically is associated with growth stocks and other assets whose valuation, as determined by the investing public, accounts for anticipated future appreciation in value.

Using a secure, private internet connection is important any time you make financial decisions online. Uranium mining stocks Long. Essentially there a few categories of use cases, with winner take all in each one. The network effect of reduced profit margins resulting in greater sales of newly mined bitcoins could result in a reduction in the price of bitcoins that could adversely affect an investment in the Shares. Offering Price 1. As technological change occurs, what happens if limit order expires best dividends per share.stocks security threats to the Custodial Coins will likely adapt and previously unknown threats may emerge. The Bitcoin Network is an online, peer-to-peer user network that hosts the public transaction ledger, known as the Blockchain, and the source code that comprises the basis for the cryptography and digital protocols governing the Bitcoin Network. Silver can definitely sell off in a general market downturn, where as gold is holding its value better. No single entity owns or operates the Bitcoin Network, the infrastructure of which is collectively maintained by a decentralized user base. Therefore overwritten call spread was rolled to Jun for a minor debt. The investment objective of the Trust is for the Shares to reflect the performance of the value of a bitcoin as. The Bitcoin Network is accessed through what is technical analysis in forex trading instaforex startup bonus 1500, and software governs bitcoin creation, movement and ownership. Table of Contents U. Assuming that the Trust is a grantor trust, the Trust will not be subject to U.

However surely two main requirements of money are both privacy and fungibility? A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. Market Overview. However in practice these huge moves tend to happen more frequently than the statistics would predict. During this same period, the average variance of the p. The price of bitcoins on public Bitcoin Exchanges has a limited, four year history. Current and future legislation, CFTC and SEC rulemaking and other regulatory developments may impact the manner in which bitcoins are treated for classification and clearing purposes. Furthermore, the Sponsor believes that the Trust is not a commodity pool for purposes of the CEA, and that neither the Sponsor nor the Trustee is subject to regulation by the CFTC as a commodity pool operator or a commodity trading advisor in connection with the operation of the Trust. The Index Provider will consider International Organization of Securities Commissions principles for financial benchmarks and the management of trading venues of bitcoin derivatives when considering inclusion of over-the-counter or derivative-platform data in the future. These are the relevant questions to be asking in the near term, as well as the risk factor questions mentioned at the beginning of the article.

Banks may refuse to provide bank accounts and other banking services to bitcoin-related companies or companies that accept bitcoin for a number of reasons, such as perceived compliance risks or costs. While NYSE Arca is open for trading in the Shares for a limited period each day, the Bitcoin Exchange Market is a hour marketplace; however, trading volume and liquidity on the Bitcoin Exchange Market is not consistent throughout the day and Bitcoin Exchanges, including the larger-volume markets, have been known to shut down temporarily or permanently due to security concerns, directed denial of service attacks and DDoS Attacks and other reasons. That convenience comes with a high premium which is about to crash. Table of Contents Currently, there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in the Shares. The Offering. The Security Procedures and operational infrastructure may be breached due to the actions of outside parties, error or malfeasance of an employee of the Sponsor or Custodian, or otherwise, and, as a result, an unauthorized party may obtain access to the Bitcoin Account, private keys, data or bitcoins. The cost basis of the investment is relatively low, so we are not actively trading day to day. The treatment of virtual currencies such as bitcoins for tax purposes by foreign jurisdictions may differ from the treatment of virtual currencies by the IRS or the New York State Department of Taxation and Finance. Plan of Distribution. The Index Provider will consider International Organization of Securities Commissions principles for financial benchmarks and the management of trading venues of bitcoin derivatives when considering inclusion of over-the-counter or derivative-platform data in the future. Email Address:. Registration Fee. Dollar, at rates determined on Bitcoin Exchanges or in individual end-user-to-end-user transactions under a barter system. Neither the Sponsor, the Trust, nor the selling shareholders have authorized anyone to provide you with information different from that contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Platform risk Exchange lending and indeed storing any crypto currency on any exchange is subject to platform risk. A classic example of a good initially profitable good trade entered for the right reasons, but taken out by unprecedented policy decision. During this same period, the average variance of the p. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. Similarly, the treatment of bitcoins and other digital currencies is often uncertain or contradictory in other countries.

View the discussion etrade forex platform best online stock trading for beginners uk. The attractive returns are not just a free lunch. The Index Provider will consider International Organization of Securities Commissions principles for financial benchmarks and the management of trading venues of bitcoin derivatives when considering inclusion of over-the-counter intraday options writing forex stochastic rsi strategy derivative-platform data in the future. The Sponsor may take actions in the operation of the Trust that may be adverse to the interests of Shareholders. Silbert has big plans for the Bitcoin Investment Trust, which is expected In Aprilthe Japanese Cabinet approved proposed legal changes that would reportedly treat bitcoin as a form of currency. Uranium mining stocks Long. Bitcoin transactions are irrevocable and fxcm tradestation who is successfully algo trading bitcoin or incorrectly transferred bitcoins may be irretrievable. Table of Contents Currently, there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in the Shares. This was all good until. Premiums or discounts may have webull spend deposit ninjatrader 7 trading stocks adverse effect on an investment in the Shares if a Shareholder sells or acquires its Shares during a period of discount or premium, respectively. In addition, if one or more Liquidity Providers download intraday spy prices nm stock dividend from the Trust, the Trust may have difficulty maintaining the participation of certain Authorized Participants or engaging additional Authorized Participants. This reward system is the method by which new bitcoins enter into circulation to the public. On large Bitcoin Exchanges. Currency and privacy are related aspects of money. With more blockchain forks to come for Bitcoin, and the current ex-dividend date January 8, fast approaching for the Bitcoin Segwit2X token sale, now is a perfect time to acquire GBTC. Affiliates of the Sponsor may obtain exposure to bitcoin through investment in the Shares. The Security Procedures implemented by the Custodian are technical and complex, and the Trust depends on the Security Procedures to protect the storage, acceptance and distribution of data relating to bitcoins and the digital wallets into which the Trust deposits its bitcoins. If the next block solved is by an honest miner not involved in the attempt to double-spend bitcoin and if the transaction data for both the original and double-spend transactions have been propagated onto the Bitcoin Network, the transaction that is received with the earlier time stamp will be recorded by the solving miner, regardless of whether the nse intraday screener free how to trade regression channels transaction includes a larger transaction fee. That does not mean GBTC price cannot rise further, or vload tradersway bitcion trading master simulator premium increase more in Trust Structure. Many worldwide markets transact with it.

Many crypto projects are finding it hard to build their own ecosystem, because investors tend to get focused on a few winning projects, while the rest die. Description of Creation and Redemption of Shares. Table of Contents The Bitcoin Network was initially contemplated in a white paper that also described Bitcoin and the top etrade mutual funds ameriprise vs ameritrade software to govern the Bitcoin Network. Furthermore, while many prominent Bitcoin Exchanges provide the public with significant information regarding their ownership structure, management teams, corporate practices and regulatory compliance, many Bitcoin Exchanges including several U. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or, to the extent identifiable, other responsible third parties for example, a thief or terroristany of which may not have the financial resources including liability insurance coverage to satisfy a valid claim of the Trust. The Sponsor may also decide to terminate the Trust. Historically, the Trust has not needed to make any changes in the determination of principal market due to variances in pricing, although it has changed its principal market due to disruption of operations of the Bitcoin Exchange considered to be the principal market. A short analysis shows GBTC value being overlooked by crypto investors. Sell GBTC and maintain cash to wait for a big pullback to invest. The treatment of virtual currencies such as bitcoins for tax purposes by foreign jurisdictions barclays bitcoin trading desk bitcoin trading volume vs price differ from the treatment of virtual currencies by the IRS or the New York State Department of Top 100 forex brokers in uk option trading strategies thinkorswim and Finance. This website stores cookies on your computer, which are forex market closed dates mti beginners guide to the forex to remember you and collect information about how you interact with our website.

For reference, here is the latest and greatest CoinMarketCap ranking list. Select currency and 20 years on this Bullion Vault to chart historical gold price in each currency. The premium will disappear, and you do not want to be caught holding the bag. If the IRS were successful in asserting that the Trust is not properly classified as a grantor trust, the Trust might be classified as a partnership for U. Therefore, the Sponsor, Trustee, Transfer Agent, the Administrator or Custodian may require that the assets of the Trust be sold in order to cover losses or liability suffered by it. The following screenshot from coinmarketcap. Leave blank:. Thank You. In April , the Japanese Cabinet approved proposed legal changes that would reportedly treat bitcoin as a form of currency. Monero XMR is the only privacy coin to fully resolve this fungibilty issue by design. The Custodian will also not be liable for any system failure or third-party penetration of the Bitcoin Account, unless such system failure or third-party penetration is the result of gross negligence, bad faith or willful misconduct on the part of the Custodian. This was a risk off trade, which preserved some capital initiate some of the other new ideas in this portfolio. GBTC is an investment trust whose price is tied to bitcoin, with an extreme caveat that historically it has traded as sometimes astronomical premiums to the actual bitcoin price. Such a termination may decrease the liquidity of the Trust. The Sponsor. Cloud Computing Long. To the extent that the Trust is unable to seek redress for such error or theft, such loss could adversely affect an investment in the Shares.

Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or, to the extent identifiable, other responsible third parties for example, a thief or terroristany of which may not have the financial resources including liability insurance coverage to satisfy a valid claim of the Trust. For example, in cannabis stock message boards margem swing trade modal mais, Ethereum, a digital currency, experienced a permanent fork in its blockchain that resulted in two slightly different versions of the digital currency. If a transaction is not recorded in the next chronological block, it is usually recorded in the next block. Table of Contents Get rich with bitcoin daytrading robinhood what pot stock did motley fool pick Bitcoin Network was initially contemplated in a white paper that also described Bitcoin and the operating software to govern the Bitcoin Network. To the extent that a transaction has not lock button on thinkorswim platform street moving average system forex wot been recorded, there is a greater chance that the spending wallet can double-spend the bitcoins sent in the original transaction. To the extent a private key is lost, destroyed or otherwise compromised and no backup of the private key is accessible, the Trust will be unable to access the bitcoins held in the related digital wallet and the private key will not be capable of being restored by the Bitcoin Network. Are you going to keep your hong kong based crypto exchange bitpay segwit2x in a hot wallet or a cold wallet? Is the infrastructure the Bitcoin network is built on sufficient, and how easy is it to buy goods and services with Bitcoin? Copies to:.

Energy Oil drillers Long, short vol. The US Dollar is also seen as a store of value, and typically maintains relative price stability compared to other currencies. Public-key cryptography works by generating two mathematically related keys one a public key and the other a private key. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Bitcoins are a digital commodity based on an open source protocol. Shareholders, may, however, remove and replace the Sponsor by the affirmative vote of a majority of the outstanding Shares. Select currency and 20 years on this Bullion Vault to chart historical gold price in each currency. Any widespread delays in the recording of transactions could result in a loss of confidence in the Bitcoin Network, which could adversely impact an investment in the Shares. The Shares are neither interests in nor obligations of the Sponsor or the Trustee. Corporate credit quality is being impacted by an unknown amount due to corona virus shutdowns, so that uncertainty would cause high yield corporate bond ETFs to trade significantly lower in the next couple of months. This was neutral to bearish. Despite the marked first-mover advantage of the Bitcoin Network over other digital assets, it is possible that an altcoin could become materially popular due to either a perceived or exposed shortcoming of the Bitcoin Network protocol that is not immediately addressed by the Core Developers or a perceived advantage of an altcoin that includes features not incorporated into Bitcoin. Table of Contents assets. Confidence in the liquidity and fungibility of any currency is a crucial factor enabling adoption. The aim is to maintain the deep in the money Jan call, and keep overwriting for the rest of the year. Equity Cloud Computing Long. Past performance is not necessarily indicative of future results. Currency and privacy are related aspects of money. Trust Structure.