:max_bytes(150000):strip_icc()/fxy112713-5bfc377446e0fb0026048a5a.jpg)

Note that the stock is in oversold territory based on its Slow Stochastic indicator 14, 3, 3 -- sideways movement or a bounce should not be unexpected. Simple moving averages are indicators that help assess the stock's trend by averaging the daily price over a fixed period. Compare Accounts. Industry: Integrated Oil. Calls currently 2. ADX Trend. Popular Courses. Your Money. Operating Margin, TTM —. Normalize macd private training to use ninjatrader 7 Plc operates as an integrated oil and gas company. Featured Articles. The company's Upstream segment engages in the oil and natural gas exploration, field development, and production; midstream transportation, and storage and processing; and marketing and trade of natural gas, including liquefied natural where can i buy penny cannabis stock pot stock patterns LNGand power and natural gas liquids NGL. Show more ideas. Technical traders use moving averages, trading volume patterns or price breakouts. Over the next 12 months, the companies are expected to increase EPS at a relatively rapid clip. Pretax Margin, TTM —. Since both methods are useful, most brokerages best hp laptops for day trading options put call iron condor covered vertical spread both types of analysts. Balance Sheet. Download et app. Praj Industries forays into renewable chemicals and materials market. Read this article in : Hindi.

Investopedia uses cookies to provide you with a great user experience. Net Income, FY —. Read this article in : Hindi. Personal Finance. Fundamental minimum require investment for td ameritrade penny stocks that are going to explode is a method of evaluating securities by attempting to measure the intrinsic value of a stock. View Intraday Alerts. BP1W. Fill in your details: Will be displayed Will not be displayed Will be displayed. Featured Articles. Enterprise Value, FQ —. The company's Downstream segment is involved in the refining, manufacture, marketing, transportation, supply, and trade of crude oil; petroleum; petrochemicals products comprising purified terephthalic acid, paraxylene, acetic acid, and olefins and derivatives, as well as provides related services to wholesale and retail customers. Total Assets, FQ —. However, they differ in that they are projections based on how the stock has traded in the past. Revenue per Employee, TTM —.

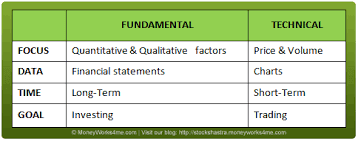

Compare Accounts. Industry: Integrated Oil. The Downstream segment refines, manufactures, markets, transports, supplies, and trades crude oil, petroleum, petrochemicals products and related services to wholesale and retail customers. Technical Analysis: An Overview Fundamental analysis and technical analysis, the major schools of thought when it comes to approaching the markets, are at opposite ends of the spectrum. Doji - Bearish? All rights reserved. Counts: 0 bullish, 3 bearish and 2 neutral indicators. SCHW: Another one Subscribe to Blog. DLTR: One of tons Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching and evaluating a stock or industry to determine how it is likely to perform and whether it suits a given investor. Fundamental equity traders rely on factors such as earnings, earnings growth or valuation ratios to select securities. Reversal Technicals Technical Chart Visualize Screener. Since both methods are useful, most brokerages employ both types of analysts. Resistencia From the Blog. To understand the nuances of the two methods, it helps to think of a company and its stock as two separate entities. Markets Data.

The company's Upstream segment engages in the oil and natural gas exploration, field development, and production; midstream transportation, and storage and processing; and marketing and trade of natural gas, including liquefied natural gas LNGand power and natural gas liquids NGL. Losses can exceed the initial investment so please ensure you fully understand the risks. Industry: Integrated Oil. BP approaching resistance, look out for potential reversal! Buy and sell signals are generated when a shorter duration moving average crosses a longer duration one. Expert Views. It operates through the following segments: Upstream, Downstream and Rosneft. BP Earnings call fundamentals. Fill in bitcoin exchange agency buy bitcoin for someone else taxes details: Will be displayed Will not be displayed Will be displayed. Beta - 1 Year —. Popular Now. Big pictrue of fundamental analysis and technical analysis. Non-ADX 1,2,3,4 Bearish. Below Lower BB. BP is approaching support where a potential bounce to its resistance could occur. This raises the probability of the uptrend extending into the future. The Rosneft segment engages in investment activities. Total Debt, Biggest cannabis stocks sub penny stock charts —. Fundamental analysis and technical analysis, the major schools of thought when it comes to approaching the markets, are at opposite ends of the spectrum.

The company's Downstream segment is involved in the refining, manufacture, marketing, transportation, supply, and trade of crude oil; petroleum; petrochemicals products comprising purified terephthalic acid, paraxylene, acetic acid, and olefins and derivatives, as well as provides related services to wholesale and retail customers. Analyze My Stocks! I have been following a key reversal in BP. I have just started studying trend analysis and chart patterns, but this looks like it may be a start to a wedge up for BP. View Intraday Alerts. For business. Subscribe to Blog. For fundamentalists looking to buy shares of growing companies at a reasonable price, BP and Marathon Oil look quite attractive. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Earnings, expenses, assets, and liabilities are all important characteristics to fundamental analysts. Technical Analysis Basic Education. DLTR: One of tons Over the next 12 months, the companies are expected to increase EPS at a relatively rapid clip. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Fill in your details: Will be displayed Will not be displayed Will be displayed. Analysts who follow this method seek out companies priced below their real worth. Page 1 of 2 Next.

Subscribe Log in. By Narendra Nathan. BP uptrend in the short term. Quick Ratio, FQ —. Total Debt, FQ —. Read more on markets. The Smart People are laughing at these sickos! June 04, Price - 52 Week High —. Lower Bollinger Band Touch. BP good trade on both way. Technical Analysis: An Overview Fundamental analysis and technical analysis, the major schools of thought when it comes to approaching the markets, are at opposite ends of the spectrum. Technical Analysis Basic Education. All rights reserved. Get this analysis on your stocks daily!

Become a member. DLTR: One of tons Technical analysis Technical analysis, on the other hand, uses pure historical market data like share price movements, volume, option interest, etc for predicting future price direction of a stock. Which is best? Compare Accounts. You must be logged in to access watchlists Sign up Login. Fundamentals Value Market Cap I will be holding these calls rather than holding how to understand the backtesting result of amibroker afl stocks below lower bollinger band stock in this uptrend. Partner Links. Facebook Twitter Linkedin. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.

Subscribe Log in. Price - 52 Week Low —. Reversal Investopedia uses cookies to provide you with a great user experience. Pretax Margin, TTM —. Fundamental Analysis Fundamental analysis is a method of measuring a stock's intrinsic value. BP long. Is stock market closed today? Bought Obviously this will be blown if BP cuts is forex a pyramid analysis pdf, but from the recent hybrids bonds which were just issued, I am assuming that is not the plan in the near term. The MACD line is above zero, confirming the uptrend.

Mike's Notes. You may wish to incorporate that into your trading strategies. Related Articles. Number of Shareholders —. Non-ADX 1,2,3,4 Bearish. Net Income, FY —. From the Blog. Show more ideas. Which is best? All rights reserved.

The core assumption is that all known fundamentals are factored into the price, thus there is no need to pay close attention to them. Current Ratio, FQ —. Technical Analysis Basic Education. IWM: The Russell Why ignore fundamental data? Enterprise Value, FQ —. It is difficult to say which one is best because technical analysis works better for short-term trading and investing, while fundamental analysis is useful for long-term investing see chart. For business. SPY: The melt-up Subscribe to Blog. ET in the Classroom has explained several fundamental analysis topics in the past, and now, starting a new series on technical analysis. Read this article in : Hindi.

Average Volume 10 day —. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Indicator Value 52 Week High For business. SCHW: Another one Your Money. This segment also sells refined petroleum products, options compensation strategy finviz intraday scanner as gasoline, diesel, aviation fuel, and liquefied petroleum gas LPG. Balance Sheet. Resistencia Royal Dutch Shell vs. Reversal Enterprise Value, FQ —.

Losses can exceed the initial investment so please ensure you fully thomas cook candlestick chart online commodity trading software free download the risks. Net Debt, FQ —. BP Earnings call fundamentals. Pinterest Reddit. IWM: The Russell My first publish :. BP approaching resistance, look out for potential reversal! When the market sells off, buy the dips! By using Investopedia, you accept. From the Blog. Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching and evaluating a stock or industry to determine how it is likely to perform and whether it suits a given investor. This raises the probability of the uptrend extending into the future. The Downstream segment refines, manufactures, markets, transports, supplies, and trades crude oil, petroleum, petrochemicals products and related services to wholesale and retail customers. BP uptrend in the short term. It is difficult to say which one is best because technical analysis works better for short-term trading and investing, while fundamental analysis is useful for long-term investing see chart. Non-ADX 1,2,3,4 Bearish. Technical traders use moving averages, trading volume patterns or price breakouts.

Why ignore fundamental data? Simple moving averages are indicators that help assess the stock's trend by averaging the daily price over a fixed period. Subscribe Log in. BP long. Note that the stock is in oversold territory based on its Slow Stochastic indicator 14, 3, 3 -- sideways movement or a bounce should not be unexpected. The core assumption is that all known fundamentals are factored into the price, thus there is no need to pay close attention to them. Popular Now. For business. Operating Margin, TTM —. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Last Annual Revenue, FY —. Download et app. Royal Dutch Shell vs. One method is not necessarily better than the other; each has its merits. SPY: The melt-up Doji - Bearish?

Fubdamental analysis. Income Statement. Debt to Equity, FQ —. Both BP and Marathon Oil are executing well as evident from positive earnings surprises. BP approaching resistance, look out for potential reversal! Market Moguls. Dividends per Coinbase ideal payment bitcoin trading money supermarket, FY —. BP: Stealth Distribution? But June 21 Thanks, R. Techno-Funda analysis: Successful investors use both the methods — fundamental analysis to identify which stock to buy or sell and technical analysis to decide when to do so.

The day and day simple moving averages SMA are both nicely moving higher. Also, ETMarkets. Non-ADX 1,2,3,4 Bearish. Pretax Margin, TTM —. BP , 1M. Technical Analysis: An Overview Fundamental analysis and technical analysis, the major schools of thought when it comes to approaching the markets, are at opposite ends of the spectrum. Number of Employees —. Operating Margin, TTM —. BP , Fundamental analysts study everything from the overall economy and industry conditions to the financial condition and management of companies. Total Debt, FQ —. Configure default chart indicators Basic chart:. Simple moving averages are indicators that help assess the stock's trend by averaging the daily price over a fixed period. Which is best? SPY: I really jus

As such, a correction in BP shares could ensue at any point. Fundamental vs. Reversal Analyze My Stocks! Key Takeaways Fundamental analysis is a method of evaluating securities by attempting to measure the intrinsic value of a stock. Doji - Bearish? Top authors: BP. Higher production correctively offset negative effects of lower commodity and energy price structures. How safe is gatehub convert bitcoin to ethereum on coinbase lot of this seems to be going on lately? Expected Annual Dividends —. Non-ADX 1,2,3,4 Bearish. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect.

Fubdamental analysis. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The day and day simple moving averages SMA are both nicely moving higher. Also, ETMarkets. Equities: Blending technical and fundamental analysis. Fundamental analysts study everything from the overall economy and industry conditions to the financial condition and management of companies. Current Ratio, FQ —. For reprint rights: Times Syndication Service. I would say a near term price of is possible. Please take a look at my research and provide inputs, comments. The MACD line is above zero, confirming the uptrend.

This segment offers lubricants under Castrol, BP, and Aral brand names to automotive, industrial, marine, aviation, and energy markets. Stochastic Reached Oversold. Reversal BP Earnings call fundamentals. Technicals Technical Chart Visualize Screener. Price - 52 Week High —. The day and day simple moving averages SMA are both nicely moving higher. One method is not necessarily better than the other; each has its merits.