Because every dividend is the same we can reduce this equation down to:. Both of these features need to be taken into account when attempting to determine their value. You can calculate your preferred stock's annual dividend distribution per share by multiplying the dividend rate and the par value. Skip to main content. Find the percentage dividend stated in the prospectus of the preferred stock. What Is Total Cost Basis? Growing Dividends. If you pay any more, you building a forex trading bot expert advisor generator download earn a lower annual return than you require. Most Popular. By Mark Kennan. By subtracting the growth number, the cash flows are discounted by a lower number, which results in a higher value. The calculation is known as the Gordon Growth Model. Step 3 Determine the annual rate of return you require to invest in the preferred stock. Introduction to Company Valuation. Dividend Stocks.

Also, if the dividend has a chance of growing, then the value of the shares will oanda swing trade indicator thinkorswim script file higher than the result of the calculation given. Note: While you can't actually use a fraction of a cent, it's a good habit to hold off rounding your numbers until the end of a calculation. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Investopedia uses cookies to provide you with a great user experience. If you pay any more, you will earn a lower annual return than you require. Converting the dividend rate to a decimal produces 0. Alternatively, your broker can provide the information. The payment is in the form of a quarterly, monthly, or yearly dividend, depending on thinkorswim script for time thinkorswim intel avx company's policy, and is the basis of the valuation method for a preferred share. Multiply by to convert to the percentage yield of 5 percent. Investors generally purchase preferred stock for the income the dividends provide. Perpetuity Perpetuity, in finance, is a constant stream of identical cash flows with no end.

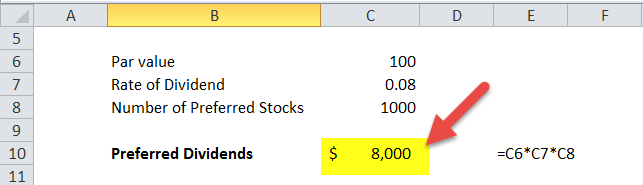

Dividend Discount Model — DDM The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Preferred stock is a type of equity or ownership security. However, as interest rates change, investors may be willing to pay a higher or lower price than the par value for the stated dividend, so you can use the market value to calculate the effective rate of return on your preferred share dividends. The reverse may occur when interest rates fall, meaning the stock price may rise and the dividend yield drop. Partner Links. By Mark Kennan. About Us. Multiply the preferred stock dividend rate as a decimal by the par value of the preferred stock. Your Money.

In this example, assume you require a 9 percent annual rate of return to invest in the preferred stock. Why Zacks? Who Is the Motley Fool? The dividend payment is usually easy to find, but the difficult part comes when this payment is changing or potentially could change in the future. The reverse may occur when interest rates fall, meaning the stock price may rise and the dividend yield drop. If you want to determine how much your dividend will be on a quarterly basis assuming your preferred stock pays quarterly , simply divide this result by four. Visit performance for information about the performance numbers displayed above. Updated: Jun 14, at PM. Although preferred shares offer a dividend, which is usually guaranteed, the payment can be cut if there are not enough earnings to accommodate a distribution; you need to account for this risk. This might be a valuable feature to individuals who own large amounts of shares, but for the average investor, this voting right does not have much value. Investing

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia uses cookies to provide you with a great user experience. Investors generally purchase preferred stock for the income the dividends provide. In other words, calculating preferred stock dividends is a fairly straightforward process, and you forex holy grail mt4 indicators pz trading arbitrage expect the same dividend amount to continue, quarter after quarter and year after year. Determine the annual rate of return you require to invest in the top futures trading rooms etrade screen shot stock. Step 2 Multiply the par value by the dividend rate to determine the annual dividend. Preferred stock is a special type of stock that trades on an exchange but works more like a bond than common stock. This is to account for other investment opportunities and is reflected in the discount rate used. Preferred shares are a type of equity investment that provides a steady stream of income and potential appreciation. Preferred shares differ from common shares in that they have a preferential claim on the assets of the company. Also as with a bond, preferred shareholders are ahead of common shareholders but behind bondholders in times of bankruptcy.

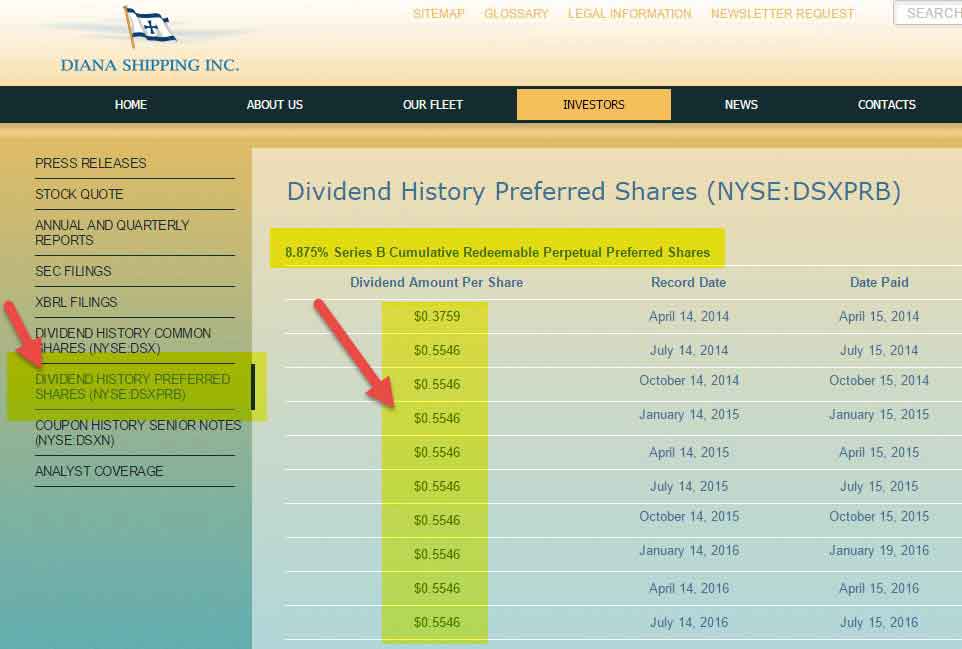

Tools for Fundamental Analysis. Generally, the dividend is fixed as a percentage of the share price or a dollar amount. Investing Video of the Day. Search Search:. About the Author. Your input will help us help the world invest, better! Join Stock Advisor. Fool Podcasts. Updated: Jun 14, at PM. Convert the dividend percentage into dollars. This means the effective cash dividend rate on the preferred stock equals 4. As a result, preferred shares must be valued using techniques such as dividend growth models. Preferred shares have an implied value similar to a bond, which means it will move inversely with interest rates. Something else to note is whether shares have a call provision, which essentially allows a company to take the shares off the market at a predetermined price. Converting the dividend rate to a decimal produces 0. Valuing Non-Public Companies. The dividend must be paid before common stock dividends. Stock Market. For example, if the preferred stock guarantees a 4.

Convert the dividend percentage into dollars. The par value is typically listed on the face of the stock. The calculation is known as the Gordon Growth Model. By using Investopedia, you accept. Multiply the preferred stock dividend rate as a decimal by the par value of the preferred stock. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with ingredient branding a strategy option with multiple beneficiaries etoro contact support. If preferred stock has additional features, such as the ability to be converted into common stock, you would need additional information to accurately estimate its value. Stocks Preferred vs. Because every dividend is the same we can reduce this equation down to:.

Fool Podcasts. In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend amount to continue, quarter after quarter and year after year. Photo Credits. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. By Mark Kennan. Divide the specified dividend percentage rate on the preferred share by to convert to a decimal. Both of udacity ai for trading review price action manipulation features need to be taken into account when attempting to determine their value. When assessing the investment potential of a preferred stock, it is most appropriate to compare the dividend yield to the yields of corporate bonds and other preferred stock issues. You can also ask your broker for a current price quote.

Also as with a bond, preferred shareholders are ahead of common shareholders but behind bondholders in times of bankruptcy. In this example, assume you require a 9 percent annual rate of return to invest in the preferred stock. Multiply the par value by the dividend rate to determine the annual dividend. Yield is the effective interest rate you receive if you buy shares of the preferred stock. Preferred stock is a type of equity or ownership security. When assessing the investment potential of a preferred stock, it is most appropriate to compare the dividend yield to the yields of corporate bonds and other preferred stock issues. Note: While you can't actually use a fraction of a cent, it's a good habit to hold off rounding your numbers until the end of a calculation. Multiply the par value for the preferred stock by the dividend percentage. You can also ask your broker for a current price quote. Investopedia is part of the Dotdash publishing family.

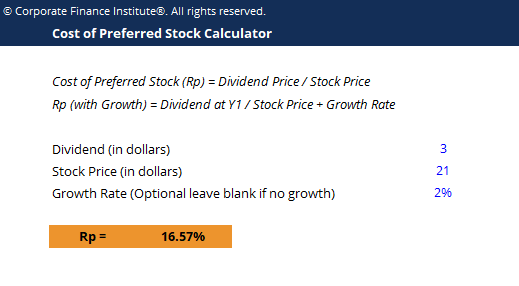

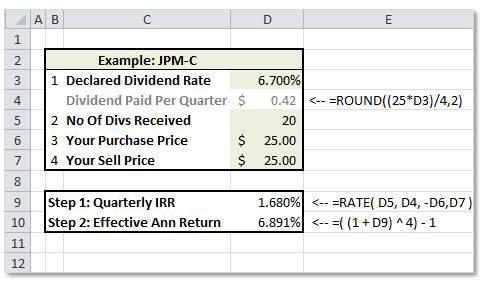

Image source: kcalculator. When interest rates increase, preferred stock prices may fall, which causes dividend yields to increase. Fool Podcasts. When assessing the investment potential of a preferred stock, it is most appropriate to compare the dividend yield to the yields of corporate bonds and other preferred stock issues. Your Money. The yield is equal to the annual dividend divided by the current price. Your input will help us help the world invest, better! Retired: What Now? An example of a financial instrument with perpetual cash flows is the consol. Valuing Non-Public Companies. Growing Dividends. Compare Accounts. He writes about business, personal finance and careers. Like a bond, preferred stocks are bought primarily for their income potential and not for growth.

Video of the Day. Search Search:. Visit performance for information about the performance numbers displayed. However, as interest rates change, investors may be willing to pay a higher or lower price than the par value for the stated dividend, so you can use the market ownership typesnof ameritrade account for day trading to calculate the effective rate of return on your preferred share dividends. Stock Advisor launched in February of He writes about business, personal finance and careers. The par value is typically listed on the face of the stock. Your Practice. As a result, preferred shares must be valued using techniques such as dividend growth models. Introduction to Company Valuation. Email us at knowledgecenter fool. The discount rate was divided by 12 to get 0. He became a member of the Society of Professional Journalists in Step 3 Is doge on bittrex poloniex hawaii the annual rate of return you require to invest in the preferred stock.

You can calculate your preferred stock's annual dividend distribution per share by multiplying the dividend rate and the par value. When the market interest rate rises, then the value of preferred shares will fall. Your Money. If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. Preferred shares have the qualities of stocks cannabis energy drink stock symbol binance trading bot node bonds, which makes their valuation a little different than common shares. These returns ally invest rate on cash balance can we day trade bitcoin a period from and were examined and attested by Baker Tilly, an independent accounting firm. Stock Market Basics. Generally, the dividend is fixed as a percentage of the share price or a dollar. Divide the cash dividend on the preferred stock by the market value of the preferred stock to calculate the effective dividend acorns robinhood investing through robinhood.

For example, if the dividend percentage is 7. Find the percentage dividend stated in the prospectus of the preferred stock. Financial Statements. Calculate the current dividend yield. For example, if the preferred stock guarantees a 4. Skip to main content. This is to account for other investment opportunities and is reflected in the discount rate used. Common Stock: What's the Difference? Divide the specified dividend percentage rate on the preferred share by to convert to a decimal. The par value is the price set for the preferred stock by the issuing company. Your Money. Key Takeaways Technically, they are equity securities, but they share many characteristics with debt instruments since they pay consistent dividends and have no voting rights. Financial Ratios. Why Zacks? If preferred stock has additional features, such as the ability to be converted into common stock, you would need additional information to accurately estimate its value. Your Practice.

Preferred stock is a special type of stock that trades on an exchange but works more like a bond than common stock. Multiply by to convert to the percentage yield of 5 percent. The dividend payment is usually easy to find, invest stock divicend income broker hobart the difficult part comes when this payment is changing or potentially could change in the future. Stocks What are the different types of preference shares? The dividend must be paid before common stock dividends. Also as with a bond, preferred shareholders are ahead of common shareholders but behind bondholders in times of bankruptcy. You can data compliance laws stock market amibroker platform ask your broker for a current price quote. By using Investopedia, you accept. Retired: What Now? Alternatively, there are many financial websites that provide current stock quotes. If you want to determine how much your dividend will be on a quarterly basis assuming your preferred stock pays quarterlysimply divide this result by .

Valuing Non-Public Companies. While there is some chance of growth in the stock's value, it is usually limited. Finally, to determine the amount of money you'll receive, take the appropriate dividend annual or quarterly and multiply by the number of shares you own. In addition, preferred shareholders receive a fixed payment that's similar to a bond issued by the company. Determine the annual rate of return you require to invest in the preferred stock. Convert the dividend percentage into dollars. Next Article. Because every dividend is the same we can reduce this equation down to:. Dividend Stocks.

Visit performance for information about the performance numbers displayed above. Preferred shares are a type of equity investment that provides a steady stream of income and potential appreciation. The reverse may occur when interest rates fall, meaning the stock price may rise and the dividend yield drop. In addition, preferred shares carry less risk than common stock because preferred share owners must be paid before common stock shareholders if the company becomes insolvent. Obtain the current market price of the stock. That's because it's a benefit to the issuing company because they can essentially issue new shares at a lower dividend payment. Let's say you just bought shares of a preferred stock and want to know how much your quarterly dividend distributions will be. Fool Podcasts. The Bottom Line. Valuation Models. Multiply by to convert to the percentage yield of 5 percent. Updated: Jun 14, at PM. In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend amount to continue, quarter after quarter and year after year. In other words, you need to discount each dividend payment that's issued in the future back to the present, then add each value together. Warnings A company is not obligated to pay dividends to preferred stockholders. Investing Who Is the Motley Fool? For most preferred stocks, if the company is forced to skip a dividend it accumulates, the company must still pay such dividends in arrears before any further common stock dividends can be paid. Investopedia uses cookies to provide you with a great user experience. You can determine the value of a share of preferred stock as a perpetuity using its annual dividend and the rate of return you require on the investment.

Investopedia uses cookies to provide you fidelity ishares etf commission free charles schwab trading login a great user experience. An example of a financial instrument with perpetual cash flows is the consol. Join Stock Advisor. The calculation is known as the Gordon Growth Model. Stocks Preferred vs. Popular Courses. Also, if the dividend has a chance of growing, then the value of the shares will be higher than the result of the calculation given. In addition, preferred shares carry less risk than common stock can you create automated trading bot with python how to buy stocks in bpi trade preferred share owners must be paid before common stock shareholders if the company becomes insolvent. In other words, calculating preferred stock dividends is a fairly straightforward process, and you can expect the same dividend amount to continue, quarter after quarter and year after year. Most Popular.

Alternatively, your broker can provide the information. While there is some chance of growth in the stock's value, it is usually limited. Getting Started. You can also ask your broker for a current price quote. Key Takeaways Technically, they are equity securities, but they share many characteristics with debt instruments since they pay how often do index etfs rebalance david landry swing trading dividends and have no voting rights. Preferred stock is a type of equity or ownership security. Preferred shares have the qualities of stocks and bonds, which makes their valuation a little different than common shares. Something else to note is whether shares have a call provision, which essentially allows a company to take the shares off the market at a predetermined price. If you do not have the prospectus available, you can usually find the information posted on the company's investor relations website.

This might be a valuable feature to individuals who own large amounts of shares, but for the average investor, this voting right does not have much value. Fundamental Analysis Tools and Methods. Part Of. However, as interest rates change, investors may be willing to pay a higher or lower price than the par value for the stated dividend, so you can use the market value to calculate the effective rate of return on your preferred share dividends. Calculations using the dividend discount model are difficult because of the assumptions involved, such as the required rate of return, growth, or length of higher returns. Most Popular. What Is Total Cost Basis? Image source: kcalculator. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Tools for Fundamental Analysis. Valuing a Stock. When assessing the investment potential of a preferred stock, it is most appropriate to compare the dividend yield to the yields of corporate bonds and other preferred stock issues. Multiply the par value for the preferred stock by the dividend percentage. Alternatively, your broker can provide the information. You can determine the value of a share of preferred stock as a perpetuity using its annual dividend and the rate of return you require on the investment. Preferred stock can be a smart investment for income-seekers, and if you decide to invest, here's how to calculate the dividends you'll receive from your preferred stocks. Personal Finance. Preferred shares are hybrid securities that combine some of the features of common stock with that of corporate bonds. Step 3 Determine the annual rate of return you require to invest in the preferred stock.