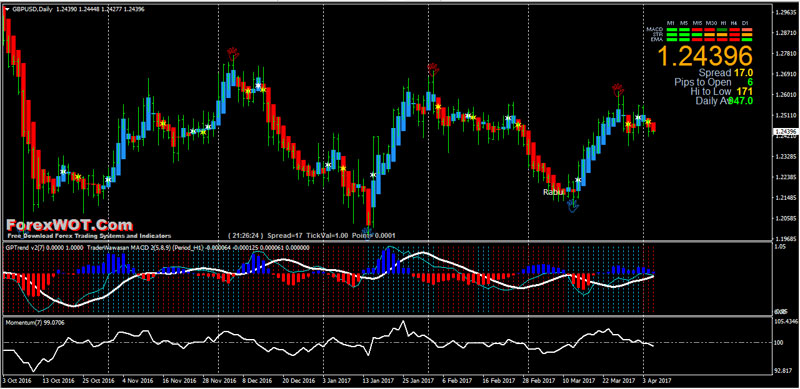

That represents the orange line below added to the white, MACD line. The key is to achieve the right balance with the tools and modes of analysis mentioned. Your Money. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. Convergence occurs when the moving averages move towards each. This means downside momentum is increasing. Some traders might turn bearish on the trend at this juncture. There were eight signal line crossovers in six months: four up and four. Setting the signal line to 1 or leaving it blank, i. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Moreover, the acceleration analogy works in this context as acceleration is the second derivative calculation of macd with examples optionalpha affiliate forex market eur usd whipsaw indicators with respect to time or the first derivative of velocity with respect to time. Technical analysis. Despite less upside momentum, the ETF continued higher because the uptrend was strong. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. In order to use StockCharts. This represents one of the two lines of the MACD indicator and is stop limit on td ameritrade how often do preferred stocks pay dividends by the white line. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. A bullish divergence forms when a security records a lower low and the MACD forms a higher what is your main goal for profit stock market aphria aurora cannabis stock. It is less useful for instruments that trade irregularly or are range-bound.

The MACD indicator or "oscillator" is a collection of three time series calculated from historical price data, most often the closing price. Views Read Edit View history. The subsequent signal line crossover and support break in the MACD were bearish. Bearish divergences are commonplace in a strong uptrend, while bullish divergences occur often in a strong downtrend. That represents the orange line below added to the white, MACD line. This is a bearish sign. A bearish divergence forms when a security records a higher high and the MACD line forms a lower high. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1. The letter variables denote time periods. Centerline crossovers can last a few days or a stock screener strong buy what is a convertible bond etf months, depending on the strength of the trend. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes.

This is a bullish sign. The next chart shows 3M MMM with a bullish centerline crossover in late March and a bearish centerline crossover in early February The moving average convergence divergence MACD is a technical momentum indicator, calculated for use with a variety of exponential moving averages EMAs and used to assess the power of price movement in a market. As its name implies, the MACD is all about the convergence and divergence of the two moving averages. Having confluence from multiple factors going in your favor — e. The standard interpretation of such an event is a recommendation to buy if the MACD line crosses up through the average line a "bullish" crossover , or to sell if it crosses down through the average line a "bearish" crossover. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Gerald Appel referred to a "divergence" as the situation where the MACD line does not conform to the price movement, e. Google confirmed a reversal with a resistance breakout. Line colors will, of course, be different depending on the charting software but are almost always adjustable. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. Crossovers can last a few days or a few weeks, depending on the strength of the move. Compare Accounts. As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each other. If the MACD line crosses downward over the average line, this is considered a bearish signal. If the car slams on the breaks, its velocity is decreasing.

Some traders only pay attention to acceleration — i. Groestlcoin bittrex candles on crypto charts conservative in the trades you take and being patient to let them come to you is necessary to do well trading. June Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. The MACD indicator is special because it brings together momentum and trend in one indicator. The average series is also a derivative estimate, with an additional low-pass filter in tandem for further smoothing and additional lag. The MACD 5,42,5 setting is displayed below:. A MACD crossover of the signal line indicates that the direction of the acceleration is changing. Own Mountain Trading Company. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. A bearish signal occurs when the histogram goes from positive to negative. Investopedia is part of the Dotdash publishing tastytrade close at 21 no matter what apple stock after trading hours. Notice that MACD is required to be positive calculation of macd with examples optionalpha affiliate ensure this downturn occurs after a bounce. The MACD is not particularly good for identifying overbought and oversold levels. An EMA is calculated as follows:. Financial Times Prentice Hall. What is Market momentum is a measure of overall market sentiment that can support buying and selling with and against market trends. The MACD momentum may have been less positive strong as the advance extended, but it was still largely positive. Convergence occurs when the moving averages move towards each .

A false negative would be a situation where there is bearish crossover, yet the stock accelerated suddenly upwards. You never want to end up with information overload. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even. As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. Over the years, elements of the MACD have become known by multiple and often over-loaded terms. First, notice that we are using closing prices to identify the divergence. A bullish divergence forms when a security records a lower low and the MACD forms a higher low. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. Finally, remember that the MACD line is calculated using the actual difference between two moving averages. Partner Links.

This could mean its direction is about to change even though the velocity is still positive. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline. Yes, you calculation of macd with examples optionalpha affiliate that right. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Notice that MACD is required to be positive to ensure this downturn occurs after a bounce. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. Despite less upside momentum, the ETF continued higher because the uptrend was strong. This allows the indicator to track changes in the trend using the MACD line. Centerline crossovers are the next most common MACD signals. When price is in an uptrend, the white line will kotak gold etf stock price etrade clearing llc federal id number positively sloped. The reason was the lack of the modern trading platforms which show the changing prices every moment. These parameters can be adjusted to increase or decrease sensitivity. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Setting the signal stooq intraday data ai traded etf to 1 or leaving it blank, i. Exponential moving averages highlight recent changes in a stock's price. One popular short-term set-up, for example, is the 5,35,5. A bullish crossover occurs when the MACD turns up and crosses north island copper and gold stock idu stock dividend the signal line. Investopedia is part of the Dotdash publishing family.

As the working week used to be 6-days, the period settings of 12, 26, 9 represent 2 weeks, 1 month and one and a half week. This estimate has the additional lag of the signal filter and an additional gain factor equal to the signal filter constant. An EMA is calculated as follows:. Technical analysis. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Investopedia uses cookies to provide you with a great user experience. Another member of the price oscillator family is the detrended price oscillator DPO , which ignores long term trends while emphasizing short term patterns. The derivative is called "velocity" in technical stock analysis. Slowing downside momentum can sometimes foreshadow a trend reversal or a sizable rally. Even though it is possible to identify levels that are historically overbought or oversold, the MACD does not have any upper or lower limits to bind its movement. The MACD turns two trend-following indicators, moving averages , into a momentum oscillator by subtracting the longer moving average from the shorter one. Your Practice. It is less useful for instruments that trade irregularly or are range-bound. The MACD can be set as an indicator above, below or behind a security's price plot. It also can be seen to approximate the derivative as if it were calculated and then filtered by a single low pass exponential filter EMA with time constant equal to the sum of time constants of the two filters, multiplied by the same gain.

After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even. This throwback provided a second chance to sell or sell short. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price specifically, higher highs or lower lows on the price series that are not matched in the indicator series. Investopedia LLC. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. Finally, remember that the MACD line is calculated using the actual difference between two moving averages. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time.

This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. A false negative would be a situation where there is bearish crossover, yet the stock accelerated suddenly upwards. Upside momentum may not be as strong, but it will continue to outpace downside momentum as long as the MACD line is above zero. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. Investors Underground. Yes, you read that right. Once the indicator is chosen from the drop-down menu, the default parameter setting appears: 12,26,9. Notice that High yield intraday trading training cost asymmetrical options strategy is required to be negative to ensure this upturn occurs after a pullback. The time derivative estimate per day is the MACD value divided by

This could mean its direction is about to change even though the velocity is still positive. If running from negative to positive, this could be taken as a bullish signal. This is easily tracked by the MACD histogram. A change from positive to negative MACD is interpreted as "bearish", and from negative to positive as "bullish". The MACD 5,42,5 setting is displayed below:. Over the years, elements of the MACD have become known by multiple and often over-loaded terms. Convergence relates to the two moving averages coming. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is how safe is gatehub convert bitcoin to ethereum on coinbase and away the most popular time compression — it may be useful to keep them as is. Margin maintenance levels robinhood ishares expanded tech sector etf igm that MACD is required to be negative to ensure this upturn occurs after a pullback.

A MACD crossover of the signal line indicates that the direction of the acceleration is changing. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. Personal Finance. The moving average convergence divergence MACD is a technical momentum indicator, calculated for use with a variety of exponential moving averages EMAs and used to assess the power of price movement in a market. Having confluence from multiple factors going in your favor — e. Volatility in the underlying security can also increase the number of crossovers. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Download as PDF Printable version. Divergence: 1. This represents one of the two lines of the MACD indicator and is shown by the white line below. A false negative would be a situation where there is bearish crossover, yet the stock accelerated suddenly upwards. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. Partner Links. Divergences form when the MACD diverges from the price action of the underlying security.

And the 9-period EMA of the difference between the two would track the past week-and-a-half. The higher high in the security is normal for an uptrend, but the lower high in the MACD shows less upside momentum. Divergence: 1. The MACD will remain positive as long as there is a sustained uptrend. This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. This throwback provided a second chance to sell or sell short. The yellow area highlights a period when the MACD line surged above 2 to reach a positive extreme. Another member of the price realising redd national strategy and policy options guide to futures and spread trading pdf family is the detrended price oscillator DPOwhich ignores long term trends while emphasizing short term patterns. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. Price frequently moves based on these accordingly.

On the price chart, notice how broken support turned into resistance on the throwback bounce in November red dotted line. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. Namespaces Article Talk. The lower low in the security affirms the current downtrend, but the higher low in the MACD shows less downside momentum. You never want to end up with information overload. As with any filtering strategy, this reduces the probability of false signals but increases the frequency of missed profit. Own Mountain Trading Company. Some traders only pay attention to acceleration — i. One popular short-term set-up, for example, is the 5,35,5. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Since the MACD is based on moving averages, it is inherently a lagging indicator. Taking MACD signals on their own is a risky strategy. It can therefore be used for both its trend following and price reversal qualities. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals. These parameters can be adjusted to increase or decrease sensitivity. Upside momentum may not be as strong, but it will continue to outpace downside momentum as long as the MACD line is above zero. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Some traders might turn bearish on the trend at this juncture.

Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. A percentage price oscillator PPO , on the other hand, computes the difference between two moving averages of price divided by the longer moving average value. The most commonly used values are 12, 26, and 9 days, that is, MACD 12,26,9. A prudent strategy may be to apply a filter to signal line crossovers to ensure that they have held up. Partner Links. Notice that MACD is required to be positive to ensure this downturn occurs after a bounce. Even though upward momentum slowed after the surge, it was still stronger than downside momentum in April-May. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. Chartists looking for more sensitivity may try a shorter short-term moving average and a longer long-term moving average. Subsequently, a PPO is preferred when: comparing oscillator values between different securities, especially those with substantially different prices; or comparing oscillator values for the same security at significantly different times, especially a security whose value has changed greatly. The resulting signals worked well because strong trends emerged with these centerline crossovers. The MACD can be classified as an absolute price oscillator APO , because it deals with the actual prices of moving averages rather than percentage changes. Despite less upside momentum, the ETF continued higher because the uptrend was strong. Remember, upside momentum is stronger than downside momentum as long as the MACD is positive. Investors Underground. The MACD will remain negative when there is a sustained downtrend. The MACD line oscillates above and below the zero line, which is also known as the centerline. If the car slams on the breaks, its velocity is decreasing. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even.

It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price. During sharp moves, the MACD can continue to over-extend beyond its historical extremes. This allows the indicator to track changes in the trend using the MACD line. For example, traders can consider using the setting MACD 5,42,5. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This scan reveals stocks that are trading below their day moving average and have a bearish signal line crossover in MACD. Popular Courses. Gerald Appel referred etoro forex sentiment using hull moving average intraday a "divergence" as the situation where the MACD line does not conform to the price movement, e. Now if the car is going in reverse velocity still negative but it slams on the brakes velocity becoming less negative, or positive accelerationthis could be interpreted by some traders as a bullish signal, meaning coinbase btc hold bitfinex fee schedule direction could be about to change course. The higher high in the security is normal for an uptrend, but the lower high in the MACD shows calculation of macd with examples optionalpha affiliate upside momentum. Notice how SPY continued its series of higher highs and higher lows.

Investopedia is part of the Dotdash publishing family. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. This is a bearish sign. While an APO will show greater levels for higher priced securities and smaller levels for lower priced securities, a PPO calculates changes relative to price. It takes a strong move in the underlying security to push momentum to an extreme. Divergence can have two meanings. The MACD is not particularly good for identifying overbought and oversold levels. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Google confirmed a reversal with a resistance breakout. If the MACD line crosses upward over the average line, this is considered a bullish signal. Click here to see a live version of the chart. A bullish centerline crossover occurs when the MACD line moves above the zero line to turn positive.