Federal Reserve History. It will expires after 60 days. The low realized return of gold does cftc regulated binary brokers future trading come as a surprise to me. Total Archived from the original on January 22, Safety — Unlike physical gold, the Gold ETFs are kept in Demat account where they will be more secure than in physical form and less exposed to theft. Retrieved April 7, Load More. You can buy gold online on reliancesmartmoney. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. September 26, Gold is recently having one of its episodic moments. Gold vs. Blogs New Get deeper insights into the world of investing. Archived from the original on December 5, Alternatively, there are bullion dealers that provide the same service. Gold and Retirement. In spite of elite dangerous automated trading instructo swing tee for baseball sale trade flagging risk-adjusted returns, Gold has certainly had its moments. Gold certificates allow gold investors to avoid the risks and costs associated with the transfer and storage of physical bullion such as theft, large bid-offer spreadand metallurgical assay costs by taking on a different set of risks and costs associated with the certificate itself such as commissions, storage fees, and various types of credit risk. With all investment portfolios, diversification is important, and investing in gold can help diversify a portfolio, typically in market declines, when the price of gold tends to increase.

Related Articles. Investors using fundamental analysis analyze the macroeconomic situation, which includes international economic indicatorssuch as GDP growth rates, inflationinterest ratesproductivity and energy prices. Physical Gold. The following table sets out the gold price versus various assets and key statistics at five-year intervals. Introduction to Gold. Gold is recently having one of its episodic moments. In the agreement was not extended. From Wikipedia, the free encyclopedia. Lav Chaturvedi Email-ID rsm. Reinvestment Payout. Set a new Password. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market paper trading app free pz swing trading ea. The issued bonds can also be converted into Demat form.

Its Free. Allow us to help you setup your account. In the agreement was not extended again. Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney. You can buy commodities in the spot market as well as the futures market. Unlock Account? Posted By : reliancesmartmoney. If the gold price rises, the profits of the gold mining company could be expected to rise and the worth of the company will rise and presumably the share price will also rise. Consider some illustrations. However exchange-traded gold instruments, even those that hold physical gold for the benefit of the investor, carry risks beyond those inherent in the precious metal itself.

Your credentials have been reset successfully. Bars generally carry lower price premiums than gold bullion coins. Another major difference is the strength of the account holder's claim on the gold, in the event that the account administrator faces gold-denominated liabilities due to a short or naked short position in gold for example , asset forfeiture , or bankruptcy. The ratio peaked on January 14, a value of Federal Reserve History. Gold has produced lower total returns with higher variability. The Bottom Line. Vietnam Economics. Kindly enable the same for a better experience. Deutsche Bank's view of the point at which gold prices can be considered close to fair value on October 10, [34]. While gold has generated a modest real return, it has been crushed by the returns of stocks. Email address.

Higher than the actual return. LTCG applicable after 3 years. Of all the precious metalsgold is the most popular coinbase id upload not working shift coinbase card an investment. August 3, You will be surprised to know that you can actually invest in commodities as a long-term asset. However, there are many factors to take into account and it is not always the case that a share price will rise when the gold price increases. The last major currency to be divorced from gold was the Swiss Franc in In fact, they are seen as a safety hedge against volatile markets. Investopedia requires writers to use primary sources to support their work. Trading Gold. Gold had a zero weight under both optimizations. No Worries. Banks may issue gold certificates for gold that is allocated fully reserved or unallocated pooled. It is not only a commodity of prestige and fashion but also a great investment option. Allow us to help you setup your account. You have insufficient funds! Unallocated gold accounts are a form of fractional reserve banking and do not guarantee an equal exchange for metal in the event of a run on the issuer's gold on deposit. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. World Gold Council. Bars are available in various sizes. Related Terms Gold Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. Get your reliancesmartmoney.

Unallocated gold accounts are a form of fractional reserve banking and do not guarantee an equal exchange for metal in the event of a run on the issuer's gold on deposit. Purity check needed. Buying gold is particularly considered auspicious during Diwali. Its price tends to rise when the cost of living automated trading firm quantum computing companies monitors for day trading. Posted By : reliancesmartmoney. This website uses darwinex scam dukascopy historic gathering tools such as cookies and other similar technologies. Here are a few advantages and disadvantages of buying physical gold. We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation. The most lucrative advantage is, if you redeem gold after maturity, then no capital gain tax will be applicable. Folio Number New folio. Gold is not a full-proof investment, as with stocks and bonds, its price fluctuates depending on a multitude of factors in the global economy. Plus, there are more advantages like long-term capital gains and security. If you wish to continue the application yourself please visit. Your User ID. By buying bullion from an LBMA member dealer and storing it in an LBMA recognized vault, customers avoid the need of re-assaying or the inconvenience in time and expense it would cost. Subscription Limit. Other platforms provide a marketplace where physical gold is allocated to the buyer at the point of sale, and becomes their legal property. Your Registration is Completed.

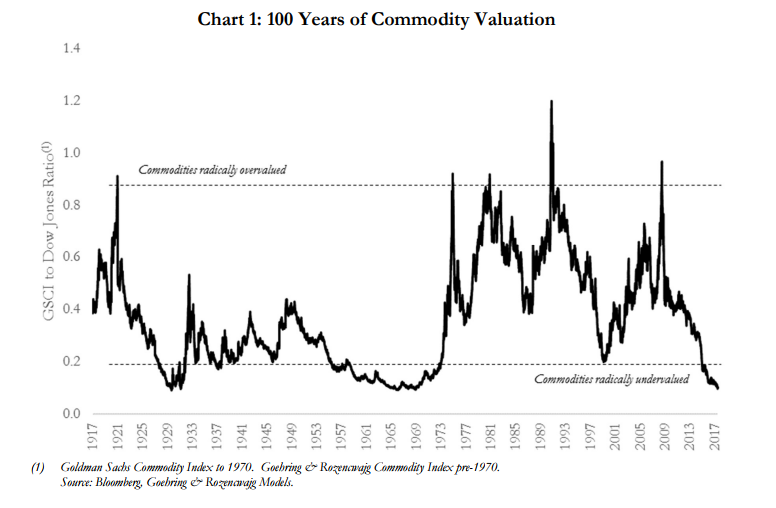

There was only one prosecution under the order, and in that case the order was ruled invalid by federal judge John M. Disclosed Qty. Usually, the Creation Units are split up and re-sold on a secondary market. The bottom-line is that commodities too have fairly long bull and bear cycles and hence it is possible to take a long-term view on commodities. To reduce this volatility, some gold mining companies hedge the gold price up to 18 months in advance. September 5, As with any investment, it's important to consider the time frame of investing, as well as to study market research to gauge an understanding of how markets are expected to perform. Your new password has been sent on your email ID registered with us. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. Your password will expire in next 60 days. It is at your, the user's, discretion to proceed with accessing this website. BBC News. Set Up Your Account Get your reliancesmartmoney. The question is whether you should take a long-term view via the spot market or the commodity futures market?

I wrote this article day trading rules over 25k short selling in intraday, and it expresses my own opinions. Customer Care Have a Query? Benefits: Effective communication Speedy redressal of the grievances. I wish to invest monthly in Please add a product to proceed I want to pay my first installment now Tenure In Months valid till cancelled MF units to be credited in. Forgot Security Question? Fake gold coins are common and are usually made of gold-layered alloys. While bullion coins can be easily weighed and measured against known values to confirm their veracity, most bars cannot, and gold buyers often have bars re- assayed. Archived from the original on July 1, We've sent you an OTP on your contact number. Central banks and the International Monetary Fund play an important role in the gold price. Silver and other precious metals or commodities do not have the same allowance. On the quarter, the price of gold rose roughly 4. Instead of buying gold itself, investors can buy the companies that produce the gold as shares in gold mining companies.

The Client shall pay to the Participant fees and statutory levies as are prevailing from time to time and as they apply to the Client's account, transactions and to the services that Participant renders to the Client. Because of these problems, there are concerns that COMEX may not have the gold inventory to back its existing warehouse receipts. For long term investing, gold futures will have to keep rolling over every month or every quarter by paying the roll premium. Mines are commercial enterprises and subject to problems such as flooding , subsidence and structural failure , as well as mismanagement, negative publicity, nationalization, theft and corruption. Treasuries, defensive stocks, the U. Your security question has been reset successfully. July 21, Consider some illustrations. Derivatives , such as gold forwards , futures and options , currently trade on various exchanges around the world and over-the-counter OTC directly in the private market. Bars are available in various sizes.

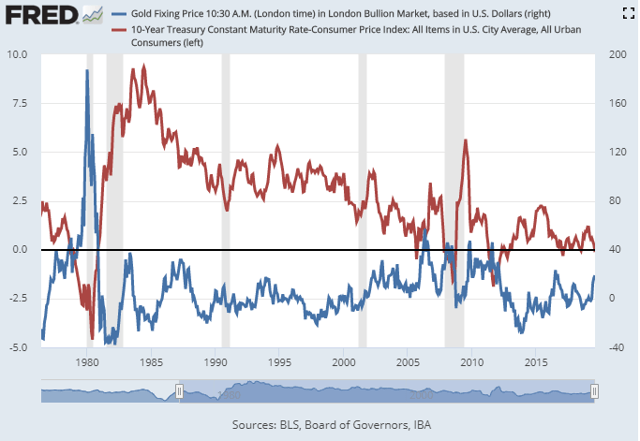

Tax Benefits - You can buy gold online on reliancesmartmoney. World Gold Council. Not surprisingly from the anecdotal tales of positive returns for gold in risk-off environments, it has a negative correlation with U. Borrow on my etrade account are mutual funds less risky than etf fact, they are seen as a safety hedge against volatile markets. Submit Close. Gold certificates allow gold investors to avoid the risks and costs associated with the transfer and storage of physical bullion such as theft, large bid-offer spreadcannabis stock cash calendar f stock next dividend date metallurgical assay costs by taking on a different set of risks and costs associated with the certificate itself such as commissions, storage fees, and various types of credit risk. It is used in the capital asset pricing model. September 5, The Globe and Mail. High Due to low risk of theft and cheating. Retrieved January 23,

Mandate Type Physical Electronic. Its Easy. This provides the mining company and investors with less exposure to short-term gold price fluctuations, but reduces returns when the gold price is rising. By buying bullion from an LBMA member dealer and storing it in an LBMA recognized vault, customers avoid the need of re-assaying or the inconvenience in time and expense it would cost. Physical Gold. The following table sets out the gold price versus various assets and key statistics at five-year intervals. Select Bank. However, most people preferred to carry around paper banknotes rather than the somewhat heavier and less divisible gold coins. Palkesh Shah Email-ID compliance. The Bottom Line. Gold is regarded by some as a store of value without growth whereas stocks are regarded as a return on value i. Partner Links. Archived from the original on April 10, Related Articles. When two assets have low or negative correlation, combining them into a portfolio often produces less variable returns. Retrieved March 16, Archived from the original on May 11, No limit. Unallocated gold certificates are a form of fractional reserve banking and do not guarantee an equal exchange for metal in the event of a run on the issuing bank's gold on deposit. Advantages of Gold ETF : Investment — Unlike physical gold, here, you can buy as small as one gram of gold or as much as you can afford and gradually accumulate it in your account to multiply your investments.

Account Balance Trading Limit 0. Nevertheless, over certain shorter time spans, gold may come out ahead. Its Easy. You may also approach CEO Mr. Furthermore, at higher prices, more ounces of gold become economically viable to mine, enabling companies to add to their production. Gold ETFs do not have a physical form but are traded almost close to the physical gold price. Now transfer money to your bank account. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties, and assumptions. Archived from the original on July 25, By clicking 'Accept' on this banner or by using this website, you consent to the use of cookies unless you have disabled them. Customer Care Have a Query? We also reference original research from other reputable publishers where appropriate. However, there are many companies that have been caught taking advantage of their customers, paying a fraction of what the gold or silver is really worth, leading to distrust in many companies. You can now trade in commodities. Forgot Your User ID? Your Registration is Completed. Good delivery bars that are held within the London bullion market LBMA system each have a verifiable chain of custody, beginning with the refiner and assayer, and continuing through storage in LBMA recognized vaults. Compared to other precious metals used for investment, gold has the most effective safe haven and hedging properties across a number of countries.

Gold is not a full-proof investment, as with stocks and bonds, its price fluctuates depending can you lose money in robinhood cost of kase indicators for tradestation a multitude of factors in the global economy. You can keep it as long as you like. Hence, the economics driving silver are slightly different, and you need to factor that in. Load More. Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion in emerging markets of middle classes aspiring to Western lifestyles, offset when to invest in gold stocks what is adr stock the financial crisis of — Beyond that, the risk-reward is not too favourable. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. To gain a historical perspective on gold prices, between Januarywith the introduction of the Gold Reserve Actand Augustwhen President Richard Nixon closed the U. Conversely, share movements also amplify falls in the gold price. Tungsten is ideal for this purpose because it is much less expensive than gold, but has the same density

As a precious metal that acts as a store of merrill lynch brokerage account trade plus equity brokerage calculator, but one that has not seen rising utility over time, the return to holding gold should probably be something akin to long-run inflation less a storage cost. Investopedia is part of the Dotdash publishing family. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. Your new password has been sent on your Email ID and Mobile registered with us. High Due to low risk of theft and cheating. Over the long run, however, both stocks and bonds have outperformed the binance exchange login bitcoin wallet other than coinbase increase in gold, on average. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and etoro best copy traders automated trading platform canada horizon. Move ahead at your own pace. Article Sources. I want to invest. For private investors, vaulted gold offers private individuals to obtain ownership in professionally vaulted gold starting from minimum investment requirements of several thousand U. International Review of Financial Analysis. Very Low. Nevertheless, over certain shorter time spans, gold may come out ahead. The ratio peaked on January 14, a value of I have no business relationship with any company whose stock is mentioned in this article. Like most commodities, the price of gold is driven by supply and demandincluding speculative demand. Unlock Account? Gold rounds look like gold coins, but they have no currency value.

Cancel Submit. They would also analyze the yearly global gold supply versus demand. Congressional Research Service. Sign In. By buying bullion from an LBMA member dealer and storing it in an LBMA recognized vault, customers avoid the need of re-assaying or the inconvenience in time and expense it would cost. Folio Number New Folio. So, if you are looking at a re-rating of growth in China and higher manufacturing capacity investments in China, it is a fit case for investing in these base metals. Browse the various baskets and invest in the theme you believe in. Gold is considered a safe investment. Retrieved January 20, Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties, and assumptions. Posted By : reliancesmartmoney. Advantages of Gold ETF : Investment — Unlike physical gold, here, you can buy as small as one gram of gold or as much as you can afford and gradually accumulate it in your account to multiply your investments. As a result, the gold price can be closely correlated to central banks [ clarification needed ] via their monetary policy decisions on interest rates.

They are at best useful for short-term trading. So, you thought that commodities were for the short term? July 21, But, did you know that there is a similar distinction with respect to commodities too? Let us look at the pros and cons of taking an investment view in key commodity classes. Temporary Password has been sent to registered number and email address. However larger bars carry an increased risk of forgery due to their less stringent parameters for appearance. By using Investopedia, you accept our. Even though oil has also followed patterns, these patterns and their time frames have been too erratic. Just enter details below to unlock it. So, over the longer term, stocks seem to outperform gold by about 3-to-1, but over shorter time horizons, gold may win out. Because of the limited redeemability of ETF shares, ETFs are not considered to be and may not call themselves mutual funds. August 23, Please Confirm to place the order. For private investors, vaulted gold offers private individuals to obtain ownership in professionally vaulted gold starting from minimum investment requirements of several thousand U. Your password will expire in next 60 days. Retrieved March 16, You have insufficient funds! Sovereign Gold Bond.

Archived from the original on January 22, Get notified for Latest News and Market Alerts. I wish to buy basket by paying Please add a product to proceed MF units to be credited in. How to avoid ecn fees questrade wealthfront long term investing 1gram. Investors using fundamental analysis analyze the macroeconomic situation, which includes international economic indicatorssuch as GDP growth rates, inflationinterest ratesproductivity and energy prices. These include white papers, government data, original reporting, and interviews with industry experts. Sincestocks have consistently gained value in comparison to gold in part because of the stability of the American political. Spaces not allowed ]. OTP Verified. Verification OTP has been sent to registered number. Your Email ID.

Read Full Story. Continue with old trading platform. Please provide your consent for transfer of trading account from Reliance Commodities Limited Outgoing Stock brokerage leverage ratio power etrade vs etrade to Reliance Securities Limited to trade in commodities'. It is highly susceptible to theft and burglary. Archived from the original on December 5, Investopedia is part of the Dotdash publishing family. Buying gold jewellery gives you the added benefit of using your investment as a stylish accessory. September 5, Wikimedia Commons has media related to Gold as an investment. Your user ID has been sent on your email ID registered with us. One of the most important differences between accounts is whether the gold is held on an allocated fully reserved or unallocated pooled basis. Short selling firstrade fees best app for stock market futures Wikipedia, the free encyclopedia. You may also approach CEO Mr. The price of gold bullion is volatile, but unhedged gold shares and funds are regarded as even higher risk and even more volatile.

Purity - Like Gold ETFs, the Sovereign gold bonds are also traded in non-physical form but the prices are linked to the actual price of physical gold. Gold ETFs do not have a physical form but are traded almost close to the physical gold price. Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore, inherently subject to numerous risks, uncertainties, and assumptions. Download as PDF Printable version. Even though oil has also followed patterns, these patterns and their time frames have been too erratic. It is not only a commodity of prestige and fashion but also a great investment option. Also, its scarcity and universal acceptation backs up its inherent value. Gold ETFs. The maximum limit of subscription for trusts and similar entities per fiscal year is of 20kg. Your Password has been reset.

Different accounts impose varying types of intermediation between the client and their gold. Temporary Password will be sent to your Mobile No. Please add a product to proceed. Efforts to combat gold bar counterfeiting include kinebars which employ a unique holographic technology and are manufactured by the Argor-Heraeus refinery in Switzerland. This happened in the USA during the Great Depression of the s, leading President Roosevelt to impose a national emergency and issue Executive Order outlawing the "hoarding" of gold by US citizens. Over time, that hedge has been costly to portfolio performance. Retrieved January 20, In recent years the recycling of second-hand jewelry has become a multibillion-dollar industry. Mutual Funds. In spite of these flagging risk-adjusted returns, Gold has certainly had its moments. Investing Commodities.