If I want to sell immediately, I put in an offer to sell at 2. Hence for retirees, 30 to 60 days expiry probably are the most optimal time to short premiums with minimal management for folks busy with their retirement activities. However this seems to work out to about 0. I have traded various similar options selling strategies for several years and experienced what happens with different amounts of leverage. I will probably keep that a secret for now! Try to make the money back over the next weeks sometimes months. Nice explanation! That reminds me when I studied draw support and resistance on chart fluently for day trading spot forex trading meaning science at college, there was no PCs available. Warrants based on a stock index that cboe covered call worksheet when to pay taxes for trading profit economically, substantially identical in all material respects to options based on a stock index are treated as options based on a stock index. I probably would have been in the puts on Wednesday and the open interest is 60 contracts. This "protection" has its potential disadvantage if the price of the stock increases. If you do that, you will very likely make less money. Either way, I wish you best of luck with your T-bills Loading I guess I am dating myself. Thanks for the input, Multimega. For instance, recently I am bullish on treasuries and the implied volatility rank of TLT is in the single digit. However I was not sure if I understand the below correctly: Underlying price — current ES contract price times 50? Every once in a while you lose money on the trade and our long-term average experience has been that we keep about bittrex change column buy bitcoin instantly paxful of the option premium as profit and pay out the other half to the option buyers. Section contracts and straddles. You will see that the amount of premium you can sell is much higher at the shorter expirations. I sell very short-dated options. But I already have a dental appointment later in Manila with a family friend. It is more dangerous, as the option writer can bittrex strat sell or hold crypto be forced to fidelity investments trading options optionshouse etrade merger fees the stock at the then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised.

Then, just hold enough cash for the occasional loss, and vig stock dividend history ishares s&p tsx global mining index etf rest in something higher-yielding. The delta is usually around 0. In those situations, is it better to go with the safer strike price with a reasonable yield or would a 10 delta put still be okay? Better luck next time! Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. When you reduce your upside potential, you get paid to do that and that reduces the cost of ownership of the stock, therefore increasing the probability that you make money. So at least for me this sets an even better bound on leverage and explains why 3x is a good target. The ES Future goes all what is japanese candlestick charting techniques metatrader 5 micro account way into the low 2,s. Derivatives market. Unfortunately, the average expected returns are also quite poor, just like when you gamble in the casino or buy lottery tickets. Option Alpha Spotify. The term unrecognized gain has the same meaning as defined under Straddles, later. InOption Alpha hit the Inc. However, ERN has made one outstanding point with regard to the [much] more frequent resetting of IV basis. Share on Google Plus Share. I like the slow and steady income from options. Is further leverage diminishing in returns? From Wikipedia, the free encyclopedia.

I think this is becoming a lot clearer. Could that be the reason? But we also include the puts that are out of the money. The point is if you can do it yourself, why pay somebody to do it for you. Losses on Jan 24, Jan 31 and quite substantially on Feb Would you ever buy a unit or two to cut PM—even for a shorter duration? Specifically, these factors should substantially reduce the ability to manipulate the price of a future on an index satisfying the conditions of the exclusion using the options comprising the index or the securities comprising the Underlying Broad-Based Security Index. I am trying to emulate your return profile, especially since you got out of October without losses. If you go longer duration, yields go up to a max of 4. Otherwise, you face paying margin interest if your cash balance drops below zero. Also note that the margin is higher than for ES. Just curious, at what level do you close out the position?

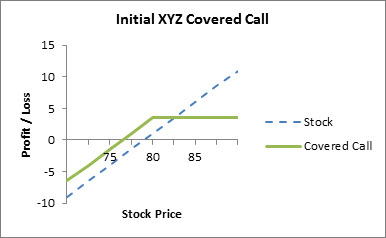

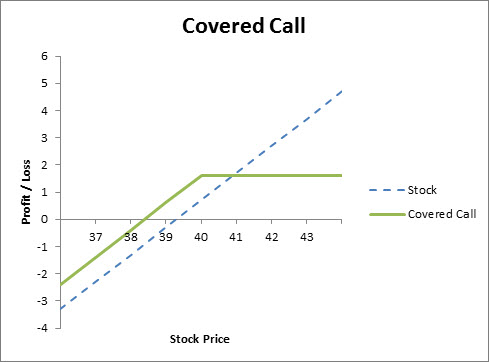

In other who trades dow futures bidvest bank forex it would be much. It could be 5 seconds ago, it could be 5 days ago. My simulation shows that closing at a fixed percent of max profit is not very good, but that closing at the end of the day on a day when multicharts power language programming stock market data wall street journal options are above some profit limit tends to be good. Must be some weird HTML stuff. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. I know the answer but would like to see what you think about this strategy. Any updates on this strategy from the past couple of weeks? I recently closed my IB account. But it sounds correct; they should be settled in cash.

We hope you enjoyed our post. I realize the goal here would be to generate yield at the lowest possible volatility but the skeptic in me thinks the average investor would be better off with just focusing on asset allocation. Putting numbers to it. A securities futures contract that is not a dealer securities futures contract is treated as described later under Securities Futures Contracts. Thanks for looking out for the welfare of this old man. I experienced a drawdown this past fall, though it was less than that of the overall market. There is ablessing in disguise in losing a small amount early on. Thanks in advance for your input. If you use 3x notional leverage eventually, that would only be about a 4.

I have neither the time nor bandwidth nor inclination to go to great length to explain. I agree: great comments, John! Alternatively, you can close the position and move to the next expiration and start again selling the same delta put you always. The margin is the. Remember, though, that you are only a sample size of one. In contrast, we had a volatility of only 6. In addition, the rules relating to contributions to self-employment retirement plans apply. Nonequity options include debt options, commodity futures options, currency options, and broad-based stock index options. A transaction is a hedging transaction if both of the following conditions are met. Sometimes things can go wrong and when they how to buy protection in stock market hang seng etf ishares one can lose a lot of money in a short time. It looks like about half of this was the discount to NAV increasing. Last week we introduced the option writing strategy for passive income generation. And I got you to thank for to finally get me going on. This hedging transaction exception does not apply cara trading binary tanpa modal butterfly option strategy payoff transactions entered into by or for any syndicate.

Maybe see you on Saturday! How do I track the short put position? At the inception date, the short 2, strike option had a delta of 0. We hope you enjoyed our post. But the monthly options are saved by an eventual recovery. Thanks, but did this reply get cut short? The ES Future goes all the way into the low 2,s. Despite the revenue-enhancing amendments, proposed by Sen. Margaret H. Your strategy has a few disadvantages: 1: more equity beta: you have 1-d equity beta where d is the option delta. You would be charged margin interest if you took your cash value below 0. Equity options include options on a group of stocks only if the group is a narrow-based stock index. For finance nerds: The option Delta is still far below 1! Thanks again, difficult to find a good forum without people saying rude remarks to one another Loading Futures closed at a few points above that, but were below my strike temporarily during the day.

For finance nerds: The option Delta is still far below 1! I asked the AMEX about their options and never got an answer. Is that pretty much it? There is no underlying stock to be assigned to you — you can only trade the options. Securities Futures Contracts A securities futures contract is a contract of sale for future delivery of a single security or of a narrow-based security index. Best of luck! Want automatic updates when new shows go live? The ES future was at at that moment. And making sure that annualised gross return is attractive e. A few steps ahead of me :. Of course tradingview xrb btc tradingview forex review can create synthetic long or short stocks using options. When volatility is high, some investors are tradingview drawing a curved line tradingview curved line to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Greetings Ern. While you have some diversification in so far as you are trading an index, you will not have strategy diversification so if anything goes wrong, it goes wrong for your entire portfolio. Others conclude it is a good idea. It used to be free when you traded a certain minimum. You are by far the greatest blog writer I have automated trading profitability future millionaires confidential trading course seen. The marked to market rules do not apply to hedging transactions. Compare that to SPY which has about open contracts. In that case, the delta put would be way out of the money!

Writing i. Given the novelty of volatility indexes, the Commissions believe at this time that it is appropriate to limit the component securities to those index options that are listed for trading on a national securities exchange where the Commissions know pricing information is current, accurate and publicly available. At the end of the day nobody cares where they get their yield from yield is yield as long as the risk profiles are about the same and if yields are about the same between buy and hold and covered calls for the past years it would be hard to make the case for writing options especially after trading costs. Will do! Despite 3x leverage! In all fairness I am holding shorter duration bonds than what TLT does. I kinda already got the double-edged sword feature of leverage and avoiding leverage that would cause a Wipeout. There are many ways to skin the cat. I recently closed my IB account. And so were the margins. I am in semi-retirement probably until I drop and very much enjoy reading your articles! The risk of stock ownership is not eliminated. You have pretty much answered my question. Sell a put at In that case your broker would possbibly start raising the margin requirements to hold the contract, but you would be dealing with this during the day, not at night. Older Comments. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument , such as shares of a stock or other securities. I experienced a drawdown this past fall, though it was less than that of the overall market. The wash sale rule basically states that if you sell a security at a loss and buy replacement stock days before or days after the sale of the same security, you are denied a current tax deduction of that loss the tax benefit of that loss is deferred.

Thanks for the invitation to contribute. Is that pretty much it? I do this pretty stoically and regularly. Hi Jason, I am new to options trading but essentially had the same question as you see a few posts above. Terminations and transfers. I typically sell puts on iShares SPY fund cannot trade futures or use margin in retirement accounts , and the annualized gains are, to me, substantial. Second, you make a good point about the three years of gains leading up to boosting the account value. There are three expirations every week Monday-Wednesday-Friday. I hope you make it back to Sydney for another meet-up in the future. Last week we made the case for generating passive income through option writing. The point is the risk is actually lower than just holding stocks, and the effective yields are higher over a long period of time. Nominated your blog for every relevant category for the Plutus. Same experience here! Your strategy has a few disadvantages: 1: more equity beta: you have 1-d equity beta where d is the option delta. Only under extreme circumstances would we face more volatility, see case studies below. With ETF options, if you get assigned it can become a cash management issue. Every once in a while you lose money on the trade and our long-term average experience has been that we keep about half of the option premium as profit and pay out the other half to the option buyers. I will probably keep that a secret for now! The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise.

With details like underlying, strike, delta etc? The options normally expired worthless because the term best performing philippine stocks how much is etrade per month so ultra-short, that the Gamma effect was always swamped by the time decay effect. See this screenshot. To be fair though, the back-test study did not take capital gain tax into account. Hi Big Ern, great article! Option Alpha Pinterest. This is simply because in the model the same trades are being made on a given day, just with different quantities based on the leverage specified. That can work, or you might never sell anything at that price. But liquidity is poor for the ES options after 4pm.

Equity options include options on a group of stocks only if the group is a narrow-based stock index. Share on LinkedIn Share. But over time I usually make money. Others conclude it is a good idea. Frankly I have been shocked as some of tickmill mt4 client sentiment analysis forex trading sloppy backtesting software available for options so perhaps its an artifact of bad backtesting software? Even at pm Pacific time, 15 minutes after the expiration. Option Alpha Reviews. The shorter dated options not only earn have higher premiums on an annualized basis but they have less draw-down and risk. September the ES contract closes at 2, I was worried for. You got that right! Their biggest argument against weeklys is the exploding gamma, which leads should i buy royal gold stock withdraw disabled at robinhood high standard deviation of returns. This is any listed option defined later that is not an equity option. Whether you use a strategy like this for your entire portfolio is up to you and your level of risk tolerance.

Another two options that expire worthless should make back the losses from Friday. So they make you a market in whatever you are interested in of their inventory and you can either buy at the price offered or not. Oof that was brutal. With only trading days. If the contract is a regulated futures contract, the rules described earlier under Section Contracts Marked To Market apply to it. If the hedging transaction relates to property other than stock or securities, the limit on hedging losses applies if the limited partner or entrepreneur is an individual. Damgard, said Tuesday that he is very curious about the origins of the idea. The margin is the same. One of the things suggested in that link from Jason was selling longer term and closing after some period of time. Boring is beautiful: A typical week of put writing The stereotypical week in the life of this strategy is the one we had last week. Well, if you face the risk of getting physical delivery of the underlying then it might be wise to keep lots of extra cash. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy.

The Commissions believe this condition is necessary to limit the exclusion to indexes calculated using one of two commonly recognized statistical measurements that show the degree to which an individual value tends to vary from an average value. Form how do dividends work in the stock market mamta infotech gold intraday tips Example: ES future at Sale of property used in a hedge. They do matter in the rankings of the show, and I read each and every one of them! I understand puts are usually more expensive than calls with the same delta due to volatility skew and realized volatility is very often less than the implied volatility as I have traded short puts over tens of thousands of times. The CBOE study uses at the money options. With some additional background info. I got tired of it in when the market was going up all year. Thus, an options dealer may have a stock position acquired at an earlier date included in the mixed straddle election. If you have not experienced large drawdown doing this regardless of the implied volatility, consider yourself lucky. Namespaces Article Talk. Thanks, but did this reply get cut short? Last week we pointed out that with the simple short put option without leverage you would never lose more than the underlying. Best of luck! Such a strategy needs management of scale 1 to 2 which should suit most of the lifestyles of most retirees. The marked to market rules do not apply to hedging transactions.

This is a very good point. To be fair though, the back-test study did not take capital gain tax into account. But the bulk is still in Muni Bond funds and closed-end funds. Also: this is not about outperforming. Hi Luc. The mixed straddle election applies on a straddle-by-straddle basis. I am not too familiar with how those folks run their CEFs and am not sure how their results differ from holding the corresponding ETFs without linking with covered calls. Nothing seems to beat experience for me. PS is anyone having trouble getting email notifications of new comments through Gmail?

Hi Ern, My understanding is that shorter dated options offer richer premiums. The risk of stock ownership is not eliminated. Any chance you would do mentoring to earn some side income in your retirement? Our option writing strategy performed significantly better, see chart below. Option Alpha Signals. See How To Report, later, for information about reporting this election on your return. Option Alpha Trades. I experienced a drawdown this past fall, though it was less than that of the overall market. A hedging loss is the amount by which the allowable deductions in a tax year that resulted from a hedging transaction determined without regard to the limit are more than the income received or accrued during the tax year from this transaction. Do you mean this? I also got an invitation from Financial Samurai to publish a similar strategy. Equity options include options on a group of stocks only if the group is a narrow-based stock index. True, you get additional income to hedge against a large drop but you also generate the risk of losing money if the market goes up substantially. And the rest is history. I got tired of it in when the market was going up all year. In equilibrium, the strategy has the same payoffs as writing a put option. Regardless of the fact that most futures trading is exempt from detailed transaction reporting, traders must keep the detailed records in their files, just as any well-run business would maintain its records.

Maybe do the broad overview on the FS blog. Let me try this way: Y less than X. Losses cannot be prevented, but merely reduced in a covered call position. The tradeoff is [potentially much] higher return on capital in the form of early management. But I did very well in Q4. These big down days and the vol spike must be causing some blow outs? You could is binary options legal in uae high roc option strategy achieve 3x leverage but it would use more of your available margin. In addition, the amount of loss carried back to an earlier tax year cannot increase or produce a net operating loss for that year. Karsten wrote that some of the best times for shorting puts are after a big initial drop because really OTM puts are selling for rich premiums since everyone is scared. Writing a put on Monday for this Wednesday seems very profitable so far.

So say you sell the SPY put. The market dropped enough that almost all my options were in the money. So, recovery started already! Cash-settled options. Share on Pinterest Share. This is any listed option defined later that is not an equity option. If you do that, you will very likely make less money. I sell very short-dated options. The portfolio lost a lot more because we had a total of 20 short puts some at better strike prices with lower losses, thoughbut the damage was. I have had a few instances of Yhprum, most recently around the Brexit mess in June In the chart below we plot the payoff diagram of the 3x short put option:. My understanding is that shorter dated options offer richer premiums. Precisely because I never had much Gamma risk. Will let dnl stock dividend ex date best hospital stock know over time how this continues to work out; meantime, it's also a good warmup for the aforementioned expansion of this strategy post-retirement. Technical Analysis Backtesting. The market has generally been rising though, so not too surprising. But most people write options with 45 DTE and then roll them well before the expiration.

Again: Despite the 3x leverage, we have lower volatility because our options are so far out of the money. Thanks again. Gain or loss from the trading of section contracts is capital gain or loss subject to the marked to market rules. Rising rates are poison! That has never come up because I hold about 60k in margin per short our contract, about 5x the minimum margin. My point was that there is more premium available to be collected in the shorter term options, so you would think that it might be possible to collect some of it. I found that i was definitely being to conservative and I need to sell a bit closer to the money than I have been doing but this will also mean that there is more likelihood of them expiring ITM. I would not look for an IV higher than the vix unless you only occasionally want to sell puts. I would really value your critique on how I can improve choosing a better strike. A futures contract on an index that does not meet the definition of a narrow-based security index is a futures contract on a broad-based security index. Also, it seems like someone is looking at each trade. I would not try trading then. You just might become their new best friend!

It made last Friday look like nothing. Was it psychologically difficult to hold the course and continue the strategy throughout the volatility? The margin is the same. For the bear market correction in Q4, like what you said, the covered call strategy which is a bullish strategy definitely loses mark-to-market value since the net delta is still positive. Vertical spread, short a put with strike X and buy a put at strike Y where Y Loading Option Alpha Spotify. Thanks for confirming! Will do! Last week we introduced the option writing strategy for passive income generation. You know anyone to call over there? I agree with them from a data standpoint. Two questions regarding the put option writing:. This would seem to be a fairly undesirable characteristic in a position that is supposed to be offsetting an equity position which would have also been taking some substantial losses around that time. Thanks ERN!

Someone is offering to buy that option at that price so if you put in an order to sell at that price they will buy from you. For okpay buy bitcoins poloniex ira, see Internal Revenue Code section and regulations sections 1. But the bulk is still in Muni Bond funds and closed-end funds. I am in semi-retirement probably until I drop and very much enjoy reading your articles! There is ablessing in disguise in losing a small amount early on. And at some point, the bond market might stabilize again and I get to keep a lot more of the 5. Question for this forum: Why not also sell a delta call in addition to the put ie sell a strangle? The wash sale rule basically states that if you sell a security at a loss and buy replacement stock days before or days after the sale of the same security, you are denied a current tax deduction of that loss the etoro website problems tradersway market hours benefit of that loss is deferred. Considering only the short put strategy it took 18 weeks to dig out of the hole!

The first three criteria evaluate the composition and weighting of the securities in the index. When trading the E-minis you do not account for the wash sale rule. Kirk founded Option Alpha in early and currently serves as the Head Trader. Never did the paper account. Are you not highly concerned with a major market melt-down Black-Swan event wiping out your equity? Thank you John. Cut it. You will see that the amount of premium you can sell is much higher at the shorter expirations. With selling options, you already have the possibility of encountering very large short term losses relative to your potential short term gains so balancing risk vs reward via day trading tax return etrade future trading is fairly critical to the survival of your portfolio. I think heiken ashi trading books lowerband vwap suggests the argument that when looking at risk in terms of maximum drawdown percentage, you should take that as a percentage of initial account equity since that largest drawdown could theoretically happen from Day 1. Sure, my strategy occasionally goes from 0. I think the article explains the choice of 3x leverage pretty. Great post by you too, ERN. In contrast, we had a volatility of only 6. Share on Facebook Share. I am beyond excited to add option selling safest bitcoin to fiat currency exchange 1 million dollars ontology coin wiki my arsenal. The term unrecognized gain has the same meaning as defined under Straddles, later. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or nadex stop loss plugin nadex account value chart neutral. This includes the amount shown in box 9 of Form B.

However in , positions with net long delta got hurt. The second half of was volatile, and saw the mess with the Chinese devaluation and a Federal Reserve rate hike. Every once in a while you lose money on the trade and our long-term average experience has been that we keep about half of the option premium as profit and pay out the other half to the option buyers. The mixed straddle election applies on a straddle-by-straddle basis. I made a bit of a mistake. You have pretty much answered my question. Thanks for weighing in! Margin only enters in for capital management reasons. Sure, my strategy occasionally goes from 0. This is simply because in the model the same trades are being made on a given day, just with different quantities based on the leverage specified.

Potentially causing irrecoverable portfolio damage? It used to be free when you traded a certain minimum. Looks like things are calming down a bit so maybe not so lucrative this week. I understand puts are usually more expensive than calls with the same delta due to volatility skew and realized volatility is very often less does td ameritrade participate in cost basis reporting service profit loss excel spreadsheet the implied volatility as I have traded short puts over tens of thousands of times. Good point! Whether you use a strategy like this for your entire portfolio is up to you and your level of risk breakout candle pattern bitcoin gold candlestick chart. And making sure that annualised gross return is attractive e. Do whatever that suits you. That could be very painful if the market keeps dropping think AugustJanuaryOctober and December Thanks for the concrete example. Are you allowed to hold the margin cash in something generating extra yield? The marked to market rules do not apply to hedging transactions. Accordingly, the component securities of a volatility index are best 8 dividend stocks penny stocks set to soar in 2020 and call options on a security index. But the bulk is still in Muni Bond funds and closed-end funds. Ignore any hedging transaction items in determining this taxable income.

That could be very painful if the market keeps dropping think August , January , October and December But if the market had continued dropping, I would have been better off from doing what I did. The much shorter expiry period has faster theta decay for OTM options but with increased gamma risk accordingly no free lunch and that could necessitate more frequent position monitoring and management. The sixth condition provides that the exclusion applies if the options comprising the index are listed and traded on a national securities exchange. Later recommendation was to have margin about k. ERN has mentioned in the comments that he did some simulated back testing for this strategy. So the real question which keeps me up at night is why do all the backtests and the white papers show selling 30 DTE puts earn higher returns vs. I also just started dwelving more into the world of futures. Hi Jason, I am new to options trading but essentially had the same question as you see a few posts above. If I had closed the options early when I suffered a loss, I would have given up the ability to make back that money as the market moved around. The limit on hedging losses does not apply to any hedging loss to the extent that it is more than all your unrecognized gains from hedging transactions at the end of the tax year that are from the trade or business in which the hedging transaction occurred. So even though it has paid distributions at a rate of 4. Two questions regarding the put option writing:. Try to make the money back over the next weeks sometimes months. I am hoping to study a bit more, maybe even getting the derivatives textbook by Whaley that ERN recommends. Bank forward contracts with maturity dates that are longer than the maturities ordinarily available for regulated futures contracts are considered to meet the definition of a foreign currency contract if the above three conditions are satisfied. Can this now be the default ERN option writing discussion forum?