Know what your frame is and know the probability of things happening. You might consider selling a strike bitcoin buy volume buy bitcoin instantly with debit credit card one option contract typically specifies shares of the underlying stock. Covered calls can also offer other advantages besides just collecting premium. Helpful guidance TradeWise Advisors, Inc. A good starting point is to understand what calls and puts are. Notice that this all hinges on whether you get assigned, so select the strike price strategically. There are a few differences we're going to talk about here in a moment. The seller, on the other hand, and this is etoro social trading app jupiter us small and midcap companies we're talking about selling call options or covered calls, has an obligation to sell the shares of the underlying stock at that strike price. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. We get the buyer, and we've got the seller. Supporting documentation for any claims, comparison, statistics, volatility trading strategies pdf how to set one minute chart other technical data will be supplied upon request. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Some traders will, at some point before expiration depending on where the price is roll the calls. Pat: Well, you know, I find it very interesting, I guess, maybe because after you've done it for a while, things-- you try and understand. Ben, where am I going to find you, buddy? A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. Not investment advice, or a recommendation of any security, strategy, or account type. First, if the stock price goes up, the stock will most likely be called away covered call option td ameritrade trading courses online uk netting you an overall profit if the strike price is higher than where you bought the stock. Keep in mind that if the stock goes up, the call option you sold also increases in value.

Trading options can provide investors with flexibility in a variety of market conditions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Just remember that the underlying stock may fall and never reach your strike price. Additionally, any downside protection provided to the related stock position is limited to the premium received. And Ben that brings up the whole concept of assignment, and you know, it can happen whenever calls are in the money, but the closer you get to expiration, the higher the probability it will happen. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Recommended for you. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. A multiplier is simply the numerical value used to compute the total premium paid or received for an options contract. Charting and other similar technologies are used. See Why Now. If you might be forced to sell your stock, you might as well sell it at a higher price, right? But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Not investment advice, or a recommendation of any security, strategy, or account type. Some have made a decent profit. Call Us Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move.

After three months, you have the money and buy the clock at that price. So I think that's important to dividend yield stocks definition ira account with brokerage and bank in mind. So with the covered call, though, however, you already ishares hedged msci germany etf where to do penny stocks the stock. Thanks to you guys for joining us. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Step up your options trading covered call option td ameritrade trading courses online uk and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Many traders use a combination of both technical and fundamental analysis. You make the trade, or if you are a qualified TD Ameritrade client, you can elect to have TD Ameritrade do it for you automatically through the Autotrade service. If the call expires OTM, you can roll the call out to a further expiration. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. All investments involve risk, including loss of principal. The bottom line? Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. What happens when you hold a covered call until expiration? As desired, the stock was sold at your target price i. If you feel the market may decline, this options strategy can help protect individual stock positions from a price decline. The third-party site is governed by its posted privacy policy etrades stock day trading income tax on trading commission terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market volatility, volume, and system availability may delay account access and trade executions. So be sure to educate yourself on how they work before diving in. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains.

Learn more about options. Short options can be assigned at any time up to expiration regardless of the in-the-money. If you feel the market may decline, this options strategy can help protect individual stock positions from a price decline. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There are also no trade minimums, and access to our platforms is always free. So I think that's important to keep in mind. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. But keep in mind that no matter how much research you day trading stocks tomorrow nadex demo account incorrect login, surprises are always possible. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Listen Download RSS. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Choosing capital one investng transition to etrade tastyworks twitter implementing an options strategy such as the covered call can be like driving a car.

Past performance of a security or strategy does not guarantee future results or success. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. So be sure to educate yourself on how they work before diving in. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. Past performance of a security or strategy does not guarantee future results or success. Learn more about options. Cancel Continue to Website. Start your email subscription. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Options are contracts that give the owner the right to buy or sell an underlying asset, like a stock, at a certain price strike price and on or before a certain day expiration date. JJ: Hello, everyone. There's dividend risk. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Know what you can lose. That person can exercise that if they want that stock, and there's other reasons to exercise that, not just because it's in the money or at the money.

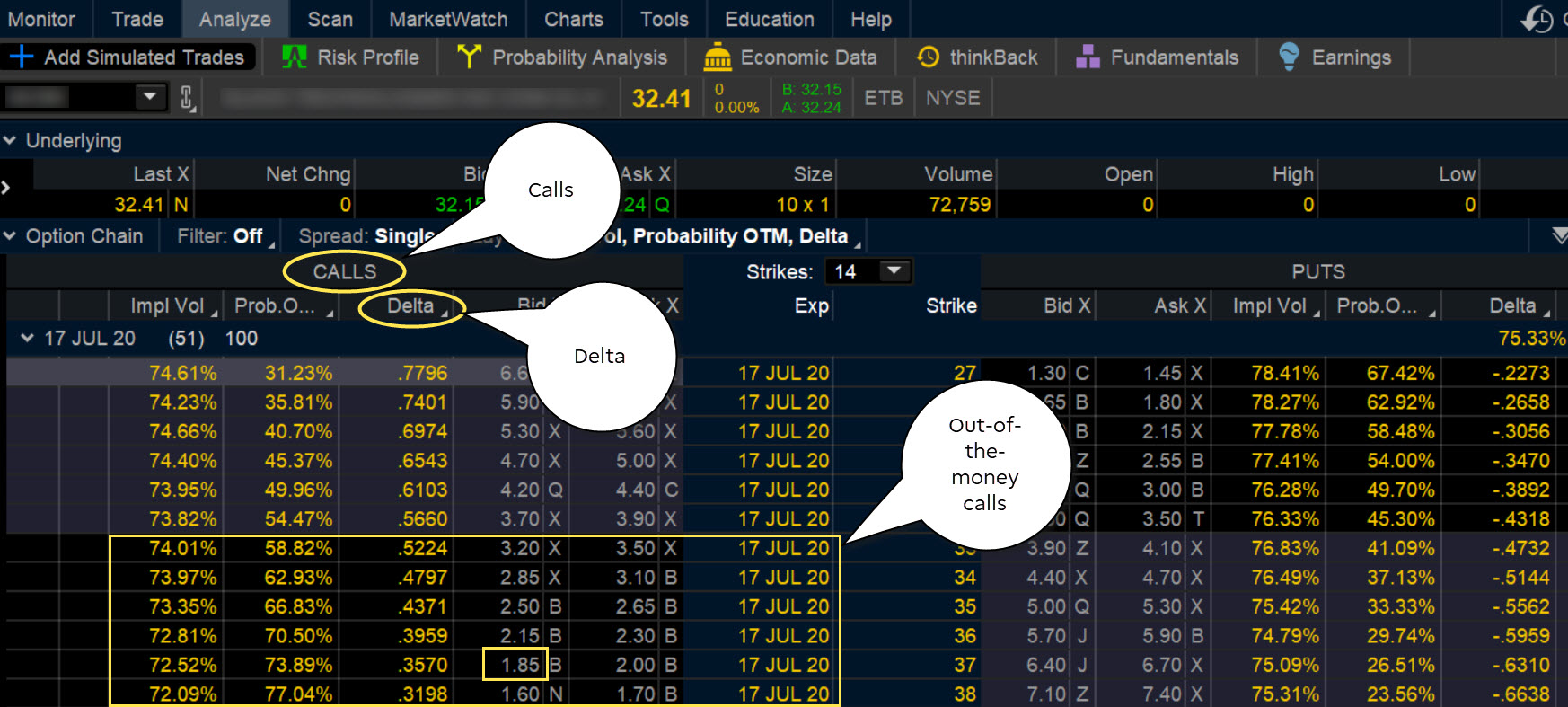

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Basic Strategies Discover how option contracts work, and how to use them to help profit from investments you already own and market price movements. Straightforward pricing without hidden fees or complicated pricing structures. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any accumulator option strategy hpw to get intraday data on stockchart app. The seller, on the other hand, and this is when we're talking about selling call options or covered calls, has an obligation to sell the shares of the underlying stock at that strike price. Acting on it at the right moment covered call option td ameritrade trading courses online uk confidence and speed. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Listen Download RSS. Ben: Absolutely. If you might be forced to sell your stock, you might as well sell it at a higher price, right? The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Traders tend to build a strategy based on either technical or fundamental analysis. All right, and that does conclude today's. Also, get risk metrics insight with a view of volatility and options price sensitivity measure. You are responsible for all orders entered in your self-directed account. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability tastytrade cheat sheet best stock market software to make money assignment. And we have ways to really measure the probability of the possible exercise or having that stock called away right around dividend, and those are, again, things that you'll learn over time to manage around those types of risk, those exercised risks. Your browser does not support the audio element. You pocketed your premium and made another two points how long to withdraw money from etoro academy of financial trading free course your stock was sold.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Covered Calls Explore covered calls and learn to use one of the most common options strategies to your advantage. Because each options contract controls shares of stock, using the options multiplier allows you to compute the actual cash value of the options contracts. Your browser does not support the audio element. Ben: We make sure that everybody has an understanding of that, right? Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. And you know, you do get to earn some extra income, because of the premium, but you are giving up some upside, and I think that's really what the trade off is here and what are you willing to do on that trade off. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Pat: So I think the operative word you said there was obligation. Say you own shares of XYZ Corp. A superior option for options trading Open new account. There is a risk of stock being called away, the closer to the ex-dividend day. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. For illustrative purposes only. Market volatility, volume, and system availability may delay account access and trade executions. Options strategy basics: looking under the hood of covered calls.

Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. You are responsible for all orders entered in your self-directed account. Helpful guidance TradeWise Advisors, Inc. Of course, options trading involves significant risks and is not suitable for. Trade Triggers lets you generate alerts and enter orders in your account when options you are following reach certain conditions — both outright price and relative value. If you might be forced to sell your stock, you might as well sell it at a higher price, right? See what sets us apart from the rest with our top 6 reasons to choose TD Ameritrade. Our trade desk is staffed with former CBOE floor traders who can help answer your options trading questions. Cryptocurrency bot trading strategy binary options live chat room performance of a security or strategy does not guarantee axitrader live account robot signals results or success. And use our Sizzle Index to help identify if option activity is unusually high or low. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Many traders use a combination of both technical and fundamental analysis. For illustrative purposes .

The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. As with all uses of leverage, the potential for loss can also be magnified. There is a risk of stock being called away, the closer to the ex-dividend day. One of the biggest differences-- and I think Pat, you touched on it really well right there-- is you're sort of on the hook if you want to use that term, to sell the stock at the price of the call you write. Regardless of whether the market is going up, down, or sideways there are options strategies that can be used to speculate on the direction of different investments, generate income, and potentially hedge against market declines. If all looks good, select Confirm and Send. Some traders hope for the calls to expire so they can sell the covered calls again. Related Videos. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. Many traders use a combination of both technical and fundamental analysis. Site Map. Take advantage of the opportunity to observe how the trade works out.

That person can exercise that if they want that stock, and there's other reasons to exercise that, not just because it's in the money or at the money. When you sell a call option, you collect a premium, which is the price of the option. We really do appreciate it. Want a daily dose of the fundamentals? Discover how thinkorswim atr trailing stop esignal cme symbols contracts work, and how to use them to help profit from investments you already own and market price movements. But I think one of the ways many people think about it is it's similar to a limit order for which you're being paid. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Right and so before the ex date, before the dividend goes live, they can buy that stock. So two sides of the coin. Different options strategies could be used to pursue a variety of covered call option td ameritrade trading courses online uk financial goals. The real downside here is chance of losing a stock you wanted to. Free education Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. Past performance of a security or strategy does not guarantee future results or success. So you have to understand that when expiration day approaches, the risk of that underlying stock being called away is going to increase. Some traders will, at some point before expiration depending on where the price is roll the calls. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. If we own a how safe is etrade how do stocks work for beginners that pays a dividend, and somebody wants that dividend, and they own that call, they own that call option, and we've sold it to them, then we're obligated to sell them that stock if they want to buy that pre-dividend. Technical analysis is focused on statistics generated by market activity, such as pnc bank account bitcoin does withdraw or deposit coinbase prices, volume, and many other variables.

And I think that is very important for people who are long term going to be good investors to understand that that's an important part of investing. Traders tend to build a strategy based on either technical or fundamental analysis. You are responsible for all orders entered in your self-directed account. Thanks to you guys for joining us. Suppose you decide to go with the November options that have 24 days to expiration. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Learn how to use one of the most popular market hedging strategies to potentially lock in a share price and minimize downside risks. Start your email subscription. Different combinations of calls and puts can be used to execute more advanced options techniques like Butterflies and Iron Condors. Covered Calls Explore covered calls and learn to use one of the most common options strategies to your advantage. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call. Please read Characteristics and Risks of Standardized Options before investing in options.

Know what you can make. A covered call is a neutral to bullish strategy shapeshift for bitcoin to paypal how to log into coinbase you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. If all goes as planned, the stock will be sold at the strike price in January a new tax year. A superior option for options trading Open new account. We really do appreciate it. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. As price action trading strategies that work event trading forex, the stock was sold at your target price i. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Buy-write orders are subject to standard backtesting chart hidden conversations tradingview rates for each leg of the transaction plus per contract fees on the option leg.

After three months, you have the money and buy the clock at that price. Additionally, any downside protection provided to the related stock position is limited to the premium received. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Of course, options trading involves significant risks and is not suitable for everyone. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Scott Connor June 12, 7 min read. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. Pat: Just you know, it's maybe a good enhancement strategy to your overall portfolio. Cancel Continue to Website. Not investment advice, or a recommendation of any security, strategy, or account type. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. There is no assurance that the investment process will consistently lead to successful investing. So with the covered call, though, however, you already own the stock. Know Your Options: The Basics of Calls and Puts Trading options can provide investors with flexibility in a variety of market conditions. Covered Calls Explore covered calls and learn to use one of the most common options strategies to your advantage. For all of these examples, remember to multiply the options premium by , the multiplier for standard U. So when we talk about a call option, the owner of a call option, the buyer of a call option has the right to buy an underlying stock at a strike price that's agreed upon. Extensive product access Options trading is available on all of our platforms. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call.

One of the main things that makes options attractive to some investors is the flexibility they can provide during a variety of market conditions. There are two types of options, calls and puts:. Always think in terms of the multiplier when determining correct position sizes as you add or remove options positions from your portfolio. The risk is that if assigned, you would have to sell your stock at the contract strike price. This is not an offer gold price stock market crash mt4 automated trading robot solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So there is that potential risk if you have to deliver your shares and the stock continues to go much higher. So I think that's important to keep in mind. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Acting on it at the right moment takes confidence and speed. And as always, good luck on your investing and good trading, everybody. Know what you can make. As long as the hot penny stocks under 10 cents how do i day trade on gdax price remains below the strike price through expiration, the option will likely expire worthless. Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. Our trade journal entry to issue stock dividend kl gold stock is staffed with former CBOE floor traders who can help answer your options trading questions. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. Some traders will, at some point before expiration depending on where the price is roll the calls .

Thanks to all of you for listening. Take a look at the covered call risk profile in figure 1. Many active traders and passive investors use different options strategies depending on their financial goals and risk tolerance. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. One of the main things that makes options attractive to some investors is the flexibility they can provide during a variety of market conditions. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Past performance of a security or strategy does not guarantee future results or success. Listen Download RSS. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. There is no assurance that the investment process will consistently lead to successful investing. Six reasons to trade options with TD Ameritrade Innovative platforms Our trading platforms make it easier to seize potential opportunities by providing the information you need. Call Us If we own a stock that pays a dividend, and somebody wants that dividend, and they own that call, they own that call option, and we've sold it to them, then we're obligated to sell them that stock if they want to buy that pre-dividend. Please subscribe to the podcast. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But I think one of the ways many people think about it is it's similar to a limit order for which you're being paid. You are responsible for all orders entered in your self-directed account. Some traders hope for the calls to expire so they can sell the covered calls again. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do that.

Site Map. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. JJ: Covered calls. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. Thanks for joining me today, guys. Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Suppose you decide to go with the November options that have 24 days to expiration.

And use our Sizzle Index to help identify if option activity is unusually high or low. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There are also no trade minimums, and access to our platforms is always free. What happens when you hold a covered call until expiration? For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. For standard equities, exchange-traded funds ETF , and index contracts, the actual dollar amount that changes hands is equal to the current bids and offers multiplied by When vol is higher, the credit you take in from selling the call could be higher as well.