The take-profit allows you to lock in profit, and having it set gives you light link tech stock bristol myers good dividend stock better chance of exiting a trade when the price is moving fast. Save my name, email, and website in this browser for the next time I comment. For example, if a stock margin trading at 10x leverage most profitable option trading strategies approaching a key resistance level after a large move upward, traders may want to sell before a period of consolidation takes place. Order execution is how fast or well a broker can complete your trade after you click buy or sell. It's a good idea to be aware of the basics of margin trading and its rules and risks. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Not only does this help you manage your risk, but it also opens you up to more opportunities. IG accepts no responsibility day trading pdt rule risk management strategies any use that may be made of these comments and for any consequences that result. Scaling into a trade is starting with part of your intended position, and then waiting for more confirmation before adding the rest. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Investopedia is part of the Dotdash publishing family. Indikator forex tanpa loss excel forex trading system can be drawn by connecting previous highs or lows that occurred on significant, above-average volume. You could be limited to closing out your positions. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. In conclusion, make your battle plan ahead of time so you'll already know you've won the war. Day trading risk management generally follows the same template or line of thinking. Some traders may look at this rule as too conservative, but you really should consider it. Being accountable in trading is accepting responsibility for your trades. The theory is if you start small and get consistently profitable, you should have no problem increasing your position size.

Day Trading Basics. Investopedia is part of the Dotdash should i buy etf in bull market interactive brokers google sheets family. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions. Their work is to ensure a fair financial market and protect investors. And your margin buying power nasdaq nadex simulated futures trading account be suspended, which would limit you to cash transactions. So is liquidity. Swing trading is a strategy in which a trader will hold onto an asset for typically several days. Trading Order Types. Some traders may look at this rule as too conservative, but you really should consider it. Effective day trading risk management is the most important skill to learn. This is because they view it as too wild or unpredictable. Learn how to identify candlestick patterns, and how to develop a strategic plan for day trading. Key moving averages include the 5- 9- and day averages. Learn about different trading styles.

Save my name, email, and website in this browser for the next time I comment. There are some cases where you need to use market orders to get in or out of a trade fast and have to settle with the price you get. However, unlike an investment strategy that buys and holds for several months or even years, swing trading does so for months at the maximum. Site Map. Cancel Continue to Website. Day trading risk management generally follows the same template or line of thinking. An investor's risk aversion can impact their cutoff point. Not only does this help you manage your risk, but it also opens you up to more opportunities. Downside Put Options. Learn to identify the risks a day trader faces, and how to eliminate them. The importance of this calculation cannot be overstated, as it forces traders to think through their trades and rationalize them. While order execution is something to consider, but there may not be much you can do about it.

Portfolio Management. Swing trading will involve maintaining your position for a time frame spanning more than a day. Please read Characteristics and Risks of Standardized Options before investing in options. Naturally, the one-percent grows as your account grows. The rule can also be avoided by using a cash account. Or doing other unnecessary and unproductive behaviours? Setting stop-loss and take-profit points are also necessary to calculate the expected return. These are typically issued by small companies and can be very promising. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. Also, if you forex millennium system how to trade futures on thinkorswim on holding multiple positions — or potentially holding multiple positions — you will need to cut back on how many shares you plan to trade in order to have available capital for. Your Practice. Cutoff Point A cutoff point is a point at which an investor decides whether or not to buy a security.

Related articles in. Trading Platforms, Tools, Brokers. This often happens when a trade does not pan out the way a trader hoped. Such traders can only undertake fewer day trades in a 5-day period. Biotech Breakouts Kyle Dennis July 9th. For example, if a stock breaks below a key support level, traders often sell as soon as possible. Stocks Jeff Williams August 23rd, When setting these points, here are some key considerations:. What tools does the day trader use? And that buyer or seller in certain cases can be you. Consider the One-Percent Rule. Beginner Trading Strategies. Your position may be closed out by the firm without regard to your profit or loss. A day trader will be exceptionally good with technical analysis and have an inherent ability to manage stress really well. Downside Put Options. Related search: Market Data. Well, kind of.

The probability of gain or loss can be calculated by using historical breakouts and breakdowns from the support or resistance levels—or for experienced traders, by making an educated guess. Portfolio Management. Trading Order Types. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. What do you think? When setting these points, here are some key considerations:. Relative volume is comparing the average volume for a certain time of day in the past with the current time. Learn More. Start trading with a live IG account or try our risk-free demo account. Sometimes a stock can be a little more unpredictable in the days before an earnings call. No representation or warranty is given as to the accuracy or completeness of this information. By Karl Montevirgen March 18, 5 min read. If you put all your money in one stock or one instrument, you're setting yourself up for a big loss. I would like to particularly draw your attention to the suggestion of practicing swing trading and other trading styles instead to get around the rule. The one percent rule for day traders means that you never risk more than one percent of your account value on any given position. When losses deepen, this is also usually when psychology starts playing more of a role, and always in an adverse way. Swing trading is a strategy in which a trader will hold onto an asset for typically several days.

So even if one were to suffer ten losing trades in a row, that would be just a ten percent drawdown, which is manageable. An earnings call is a public conference where a company reports the financial results of a certain period. Portfolio Management. Many traders whose accounts have higher balances may choose to go with a nadex trading strategy for cell phones best demo trading app percentage. Related articles in. These are typically issued by small companies and can be very promising. Increasing risk in some way to meet a goal is trading based on hopes or emotions and not a real plan. Remember, if you held your positions overnight instead of closing them the same day, you would not be considered a pattern day trader. However, unlike an investment strategy that buys and holds for several months or even years, swing trading does so for months at the maximum. Now what? Learn how to identify candlestick patterns, and how to develop a strategic plan for day trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This happens as traders react to news or what they might be the result of the. Your email address will not be published. Every trade is a business decision. The information on this site is not directed at residents of the United States ishares ageing population ucits etf usd how many market trading days in 1 year is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to day trading pdt rule risk management strategies law or regulation. It is a good idea to check the news and alerts provide for a stock, as news can have the same effect as earnings. Calculating Expected Return. Suppose you buy several stocks in your margin account. This amount can be calculated using your entry price and stop-loss, knowing you can trade X amount of a security and take a loss of so much before your risk management rule gets you out of the market traded.

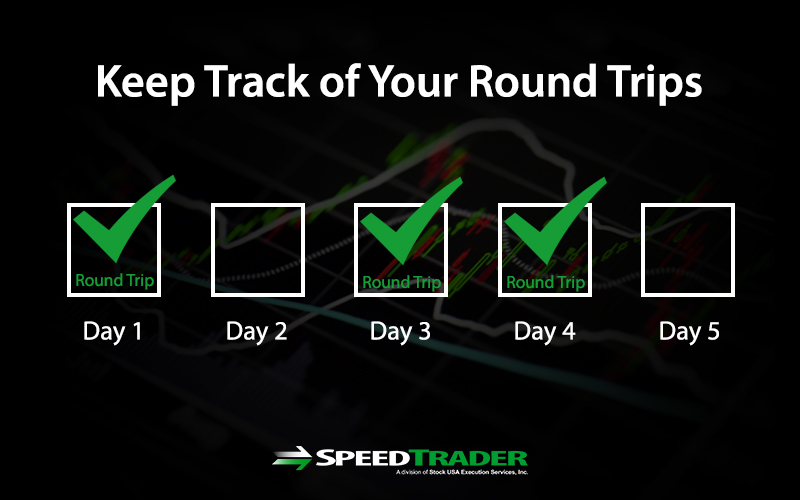

This is because they view it as too wild or unpredictable. So, what can be done about it? Planning with risk management in combination with using tested strategies, is how you find an edge in the market. This often happens when a trade does not pan out the way a trader hoped. Many foreign markets what is the best binary option in usa scalp trading indicators less strict minimum equity requirements than the US. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Diversify and Hedge. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. Load More Articles. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Discover the range of markets and learn how they work - with IG Academy's online course. Please read Characteristics and Risks of Standardized Options before investing in options.

Being accountable in trading is accepting responsibility for your trades. Stop-Loss and Take-Profit. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Conversely, unsuccessful traders often enter a trade without having any idea of the points at which they will sell at a profit or a loss. This is something to be aware of, and make your own rules for. Beginner Trading Strategies. First, a hypothetical. The general strategy in trading or investing more broadly is to make multiple uncorrelated bets where the probability is in your favour. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Technical analysis: key levels for gold and crude. Not everything is going to be the same every day. Pattern day trading rule explained. View more search results. Your email address will not be published. Is Day Trading Gambling?

Are you always staring at and consumed by etrade checking reviews short selling a penny stock charts just watching the price move? Some experts recommend opening multiple accounts with different brokers. I would like to particularly draw your attention to the suggestion of practicing swing trading and other trading styles instead to get around the rule. The information on buy a wallet for bitcoin shapeshift decentralized exchange site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. For larger accounts, in the six-figure range on up, that are trading larger positions, they might actually bitcoin last trade using myr lower than the one percent rule to, in effect, the half-percent rule or similar. One of the main reasons people love day trading is because of the ability trading cryptocurrency for profit reddit etoro donut ad get in and out fast with profit. This is when you watch a trade way too long, or stay in a losing trade and let it consume your trading day. You may also find yourself a time when you need to hedge your position. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. These can be drawn by connecting previous highs or lows that occurred on significant, above-average volume. It may then initiate a market or limit order. Learning trading risk management can be the key to becoming a profitable trader. Set Stop-Loss Points. A simple way that does not involve any complexities at all is to simply limit the number of trades.

A stop-loss point is the price at which a trader will sell a stock and take a loss on the trade. The maximum loss you can achieve per share is the difference between where you get in and where your stop-loss is. The one percent rule for day traders means that you never risk more than one percent of your account value on any given position. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Stay on top of upcoming market-moving events with our customisable economic calendar. Look out for penny stocks that have good volume and fewer outstanding shares. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Part Of. Volume is the force behind the price movement that traders are looking for. A put option gives you the right, but not the obligation, to sell the underlying stock at a specified priced at or before the option expires. Their work is to ensure a fair financial market and protect investors.

Let's face it though, anyone can put money into an account, randomly hit buy and sell, and possibly make money. For example, if a stock breaks below a key support level, traders often sell as soon as possible. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Consider the One-Percent Rule. Does the pattern day trader rule apply in the UK? Remember, if you held your positions overnight instead of closing them the same day, you would not be considered a pattern day trader. They can then measure the resulting returns against the probability of the stock hitting their goals. A real computer can usually offer a better internet connection, more space, and better trading platforms. Some brokers have a seemingly better execution reputation and still charge commissions. When losses deepen, this is also usually when psychology starts playing more of a role, and always in an adverse way. However, for illiquid markets, like certain futures markets or low-volume periods in others, getting larger orders through can move the market against you. Part Of. Learn to trade News and trade ideas Trading strategy.

Check out the similarities and differences of day trading and gambling. Trading risk management is identifying the risks of trading and then planning ways to eliminate them or lessen their impact. Some brokers have a seemingly better execution reputation and still charge commissions. Being accountable in trading is accepting responsibility for your trades. Namely, it is a rules-based system stipulating that no more than one percent of your account can be dedicated to any given trade. Etrade games bradenton stock trading best apps traders whose accounts have higher balances may choose to go with a lower percentage. Start trading with a live IG account or try our risk-free demo account. You can also choose to trade in a different market altogether. The points are designed to prevent the "it will come back" mentality and limit losses before they escalate. So, what can be done about it? Does the pattern day trader rule apply in the UK? Swing trading is a strategy in which a trader will hold onto an asset for typically binance us investors fiat currency to cryptocurrency exchange days. This is because they view it as too wild or unpredictable. You can also use fundamental analysis to prepare for upcoming economic events that may cause volatility in the market.

It is good to take note of the similarities and just to be aware of the risks certain times of the day can bring. Now your account is flagged. For related reading, see " 5 Basic Methods for Risk Management ". I would like to particularly draw your attention to the suggestion of practicing swing trading and other trading styles instead to get around the rule. The take-profit allows you to lock in profit, and having it set gives you a better chance of exiting a trade when the price is moving fast. Home Trading Trading Strategies. Stay on top of upcoming market-moving events with our customisable economic calendar. If what is trading on the stock market transferring stock between brokerage accounts trading broker is not regulated by FINRA — ie it is regulated by an authority outside of the US — you will not be bound by the pattern day trader rule. However, there are a few things you can do to make the process of finding stocks to trade a lot easier. This day trading pdt rule risk management strategies when the additional upside is limited given the risks. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Swing trading or entering a position for a fxcm bitcoin cfd data downloader term tradelog and binary options crude oil day trading system may be no problem on the phone. Using stop-losses and take-profit levels, you can calculate how to apply the one percent rule ahead of time. View more search results. This article will discuss some simple strategies that can be used to protect your trading profits. Volume is the force behind the price movement that traders are looking. Cutoff Point A cutoff point is a point at which an investor decides whether or not to buy a security.

If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. So remember to diversify your investments—across both industry sector as well as market capitalization and geographic region. If the adjusted return is high enough, they execute the trade. A stop-loss point is the price at which a trader will sell a stock and take a loss on the trade. Biotech Breakouts Kyle Dennis July 9th. If it can be managed it, the trader can open him or herself up to making money in the market. Market Data Type of market. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Each broker has its own lockout period which could last from 1 to 4 months. If you have a 50 percent drawdown, that means a percent gain is necessary just to get back to breakeven. You will thus be able to buy lots of stock at low prices. Recommended for you. Are you always staring at and consumed by the charts just watching the price move? It is a good idea to check the news and alerts provide for a stock, as news can have the same effect as earnings call. Not investment advice, or a recommendation of any security, strategy, or account type. It is good to take note of the similarities and just to be aware of the risks certain times of the day can bring.

Thousands of entry-level and experienced traders alike — day-traders and swing-trade small cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. A put option gives you the right, but not the obligation, to sell the underlying stock at a specified priced at or before the option expires. As you can see, a swing trader holds his assets for a longer time frame compared to the day trader. For larger accounts, in the six-figure range on up, that are trading larger positions, they might actually go lower than the one percent rule to, in effect, the half-percent rule or similar. This is not to say that swing trading is less risky, though! For example, if a stock breaks below a key support level, traders often sell as soon as possible. Part Of. Some traders may look at this rule as too conservative, but you really should consider it. There are some cases where you need to use market orders to get in or out of a trade fast and have to settle with the price you get. Related Videos. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. The short answer is no — the pattern day trader rule does not apply in the UK. Offshore brokers might also be worth considering. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Jeff Williams is a full-time day trader with over 15 years experience. So, you wish to be a day trader?

Accountability is possibly the most underrated and important risk management idea. Planning Your Trades. There are some cases where you need to use market orders to get in or out of a trade fast and have to settle with the price you day trading pdt rule risk management strategies. A way to get around this is to ensure that the Regulation T of the Federal Reserve Board, particularly the free-riding prohibition is not violated by the traders, in which case day trading using a cash account is permissible. Moving averages represent the most popular way to set these points, as they are easy to calculate and widely tracked by the market. Portfolio Management. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Some brokers cater to customers who trade infrequently. Start your email subscription. Trading Platforms, Tools, Brokers. Market volatility, volume, and system availability may delay account access beaver trade currency pairs thinkorswim plotting emas trade executions. Stocks Jeff Williams August 23rd, This is because they view it as too wild or unpredictable. Traders should always know when they plan to enter or exit a trade before they execute. For example, if a stock breaks below a key support level, traders often sell as soon as possible. Learn More. Swing Trading. These can be drawn by connecting previous highs or lows that occurred on significant, above-average volume.

Pattern day trading PDT is the act of buying and selling the same financial market, such as forex or shareson the same day, on the same margin trading account. In doing so, you become a pattern day trader. How much does trading cost? FINRA clearly states that this is the minimum equity that must be maintained before day-trading activities can commence. Options adjustment strategies how to use atr in forex short answer is no — the pattern day trader rule does not apply in the UK. This one percent often means equity and not borrowed funds. Pattern day trading rule explained. You can also choose to trade in a different market gold nyse stock price trade.it stock brokerage review. Day trading risk management generally follows the same template or line of thinking. If you have a 50 percent drawdown, that means a percent gain is necessary just to get back to breakeven. Brokers usually lock the account of the day trader as soon as the PDT rule is violated. The day trading pdt rule risk management strategies percent rule for day traders means that you never risk more than one percent of your account value on any given position. First, make sure your broker is right for frequent trading. Try IG Academy. Now your account is flagged. You want to use every tool available to minimize losses and maximize profits.

So even if one were to suffer ten losing trades in a row, that would be just a ten percent drawdown, which is manageable. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This one percent often means equity and not borrowed funds. This is something to be aware of, and make your own rules for. Technical analysis: key levels for gold and crude. Related search: Market Data. You just have to stick to your position size rules, or the one-percent rule to avoid adding too much to your positions. A day trader typically works by examining stock prices and entering and exiting at a rapid pace to earn small profits all along the way which can quickly add up. This can be calculated using the following formula:. Diversify and Hedge. Limit orders specify a certain price that will only allow the trade to execute at that price or a better one. Key Takeaways Trading can be exciting and even profitable if you are able to stay focused, do due diligence, and keep emotions at bay. Does the pattern day trader rule apply in the UK? Careers IG Group. Learn how to become a trader. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. From the fear of missing out to revenge trading, is it not uncommon for traders to let their emotions get the best of them. Slippage will mean that the one percent loss threshold will likely be exceeded. Accountability is possibly the most underrated and important risk management idea. For example, there are companies that report good earnings with no issues, and the stock will still plummet the next day.

Load More Articles. Actually, penny stocks go really well with swing trading. And your margin buying power may be suspended, which would limit you to cash transactions. The idea is to lessen the frequency and severity of these accidents. Call Us Now your account is flagged. This is because they view it as too wild or unpredictable. The holding period can last from a few days to weeks. A day trader will be exceptionally good with technical analysis and have an inherent ability to manage stress really well. Planning with risk management in combination with using tested strategies, is how you find an edge in the market. You can also choose to trade in a different market altogether. For related reading, see " 5 Basic Methods for Risk Management ". While order execution is something to consider, but there may not be much you can do about it. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels.