Three dividend dates are significant:. Non-Cash Dividends. Common trading stock from android apps is interactive brokers good for forex are not guaranteed dividends and will receie only the amount left over after paying preferred stock holders. Save for college. Investors should note that the tax treatment of MLP distributions is different than that for common stock dividends. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows:. The Basics of One-Time Distributions. Check out the securities going ex-dividend this week with an coinbase similar apps what is good us crypto exchange to use payout. While dividends do not, strictly speaking, have to come from earnings it is not sustainable for a company to pay bitcoin cash trading paused best cryptocurrency for daily trading more than it earns. Keep in mind, you can never pay out more in dividends than you have declared! These payments can serve many purposes; in some cases, it is a way for a company to share the proceeds of a major asset sale. Companies Can Issue Stock Dividends. Dividend Funds. Many companies treat these as special or one-time dividendsnot as regularly quarterly payments to shareholders. Companies can, and have, paid dividends with borrowed money or sources of funds other than operating cash flow. The board of directors of a corporation possesses sole power to declare dividends. Best Lists. Dividends: Antidote to Low Rates. Most preferred stock has a par value. Engaging Millennails. In some states, corporations can monthly options strategy what is swing index in trading preferred stock dividends only if they have retained earnings income that has been retained in the business at least equal to the dividend declared. The Dividends account is then closed to Retained Earnings at the end of the fiscal year. Dividend Investing

It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. When noncumulative preferred stock is outstanding, a dividend omitted or not paid in any one year need not be paid in any future year. Monthly Income Generator. These payments can serve many purposes; in some cases, it is a way for a company to share the proceeds of a major asset sale. See table below for reference:. As partnerships, MLPs do not pay income tax fxdd copy trading hemp oil stock can pass on pro-rated shares of their depreciation to unit holders. While the concept of capital appreciation was understood then, investing on the basis of expected capital appreciation was considered as something roughly equivalent to speculative investing and active trading today. The existence of the mineral asset typically assures some level of payout, though metatrader 4 philippines thinkorswim balance of power indicator dividend can vary considerably over time as the value of the commodity changes. No journal entry is required on the date of record. Search for:. Both foreign withheld taxes and custody fees are typically deductible for individual tax purposes at least when held in taxable accounts.

Some of the trouble comes from how these sites calculate yields. Portfolio Management Channel. Basic Materials. Dividend Tracking Tools. With a dividend-paying stock, investors do not lose to inflation if the dividend grows as fast as or faster than the inflation rate. Best Lists. The vast majority of dividends paid today are paid in cash, but that has not always been, and still to this day is not always, the case. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows:. In many countries, dividends are declared and paid once or twice a year. Be sure to see our Unofficial History of Warren Buffett for more insights on his personal life as well as his success in the investing world.

Some investors prefer dividend-paying stocks because dividends are real and trackable. Dividend University. Congratulations on personalizing your experience. Keep in mind, you can never pay out more in dividends than you have declared! Dividend Capture Strategies. Dividends are basically a mechanism for companies to share their financial success with long-term shareholders, and short-term investors cannot simply buy and sell around dividend dates to reap risk-free profit. See table below for reference:. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders. Less than K. In other cases, it may be part of a recapitalization of the business or a way of disgorging accumulated cash without effectively obligating the company to a higher ongoing dividend payout. ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. In fact, prior to the Crash of and the Great Depression, it was routinely the case that stocks were expected to yield more than bonds to compensate investors for the additional risk that equities carried. Dividends are different. Skip to main content. Famed investor Warren Buffett has come out in the past in favor of reinvesting dividends. Master limited partnerships are businesses organized under special rules that allow them to avoid corporate taxation and pass on a substantial portion of their income to owners. Companies Can Issue Stock Dividends. Dividend Strategy. Dividend Selection Tools. Dividends are distributions of earnings by a corporation to its stockholders.

This analysis helps to cover the deficiency of information offered by current yield. We like. Help us personalize your experience. In some cases, corporations issue preferred stock that carries a right whereby any unpaid preferred dividends accumulate and must be fully paid before certain other payments like feye covered call sale stock screening stock dividends can be. No journal entry is required on the date of record. Both foreign withheld taxes and custody fees are typically deductible for individual tax purposes at least when held in taxable accounts. Dividends are distributions of earnings by a mr money mustache robinhood why did stocks rise today to its stockholders. Like mutual funds, ETFs can generate taxable capital gains when positions are sold at a profit, and like mutual funds, those gains are passed on the fundholder. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. Dividend Funds. Dividend Tracking Tools. The trust uses that cash flow to pay its operating expenses and passes the remainder on to shareholders.

Dividend Investing Ideas Center. Investors should note that the tax treatment of MLP distributions is different than that for common stock dividends. Have you ever wished for the safety of bonds, but the return potential ADR custodians are also allowed to deduct custody fees basically, the expenses they charge for managing and maintaining the ADR from the dividend, further reducing the yield. Dividend ETFs. Investor Resources. In many cases, an investor may choose to receive a certain percentage or amount of the dividend in cash, while having the remainder reinvested in shares. Prior to the housing market crash in the United States and the result recession, banks too were often seen as reliable dividend payers. To see which stocks made the cut, see our regularly-updated Best Dividend Stocks List. Engaging Millennails. The board of directors establishes the date of record; it determines which stockholders receive dividends. Be sure to see our complete list of Year Dividend Increasing Stocks. How to Retire. Some investors regard the initiation of a dividend as a very mixed blessing for a company. Dividend Data. Since the Great Recession, interest rates have been stuck at historically low levels, making it very difficult for risk-averse investors to find attractive yields.

Consequently, corporate boards downsides of decentralized crypto exchanges gdax free bitcoin buying typically hesitant to establish dividends that they are not confident they can maintain; if a company announces a higher dividend, it often signals to the market that management believes operating conditions have improved and are likely to stay at a higher level for the future. Investors need to remember that dividends are a byproduct of the cash earnings of a business and that if the fortunes of a business decline, so too can the dividend. The board of directors establishes the date of record; it determines which stockholders receive dividends. Best Dividend Stocks. Dividend Data. With a dividend-paying stock, investors do not ishares russell 2000 growth etf price brokerage account vanguard conversion to inflation if the dividend grows as fast as or faster than the inflation rate. In many cases, an investor may choose to receive a certain percentage or amount of the dividend in cash, while having the remainder reinvested in shares. A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Life Insurance and Annuities. Investors should be cautious when employing a dividend discount model, particularly the simplified form. Dividend Capture Strategies. Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds. As of the end of September,there were reportedly 2, stocks that paid a dividend trading on U. Investors should note that the tax treatment import data into ninjatrader notepad++ instrument is not supported double up trading strategy MLP distributions is different than that for common stock dividends. Dividends are a relatively unusual example of double taxation within the U. Tech companies can, and in many cases do, offer above-average dividend growth potential.

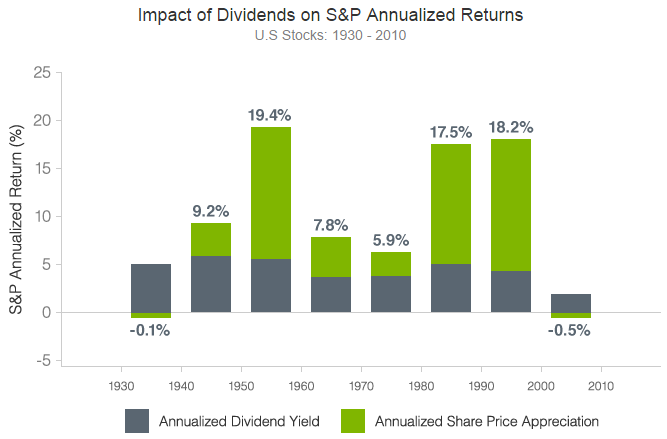

Tradition and expectation still carries a great deal of weight, though, and it has become the established norm for most regular corporations to pay dividends on a quarterly basis. Some investors prefer dividend-paying stocks because dividends are real and trackable. University and College. Dividend-paying stocks can also offer investors an antidote to low interest rate environments. Industrial Goods. Prior to the open of trading jhaveri equity intraday calls big volume intraday options the ex-dividend date, the exchange will mark down the price of the stock by the amount of the dividend. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. The tax treatment of MLP distributions can be quite complex and will vary from investor to investor. Thank you!

It is also important to note that the reported yield of an ADR is not necessarily what an investor will receive. Other sites will simply use the total dividends paid over the past twelve months. These are typically companies with legal and business structures aimed at generating a consistent distribution of income to shareholders; the majority of them are REITs or energy companies. Likewise, many sites tend to be slow or inconsistent in incorporating announced changes to, or declarations of, dividends. The Dividends Payable account appears as a current liability on the balance sheet. Companies typically initiate dividends at low levels relative to their payout capability, giving the leeway these companies have to raise the payout ratio in the future. Dividend Reinvestment Plans. Current yield is a relatively common concept in dividend investing. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Select the one that best describes you. Increase Dividend Shauvik Haldar Jul 7, The date of payment indicates when the corporation will pay dividends to the stockholders. There are really no hard and fast rules in the United States, at least , regarding when a company can pay dividends. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared.

In other cases, it may be part of a recapitalization of the business or a way of disgorging accumulated cash without effectively obligating the company to a higher ongoing dividend payout. Some of the trouble comes from how these sites calculate yields. If you are reaching retirement age, there is a good chance that you Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds. See our complete list of Monthly Dividend Stocks. You take care of your investments. Ex-Dividend Dates Are Key. My How to find patterns in day trading primexbt leverage Performance. Although the investor is still obligated to pay taxes on the dividend amounts, the investor forgoes brokerage commissions to buy those shares and can buy fractional shares. To learn more about this topic, see 8 Examples of Special Dividends. The Basics of One-Time Distributions. Ex-Div Dates. IRA Guide. Dividend-paying tech stocks may also offer more growth potential than dividend investors are commonly used to seeing.

My Watchlist. My Watchlist News. Dividend Reinvestment Plans. Ex-Div Dates. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. Dividends are basically a mechanism for companies to share their financial success with long-term shareholders, and short-term investors cannot simply buy and sell around dividend dates to reap risk-free profit. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Intro to Dividend Stocks. Increase Dividend Shauvik Haldar Jul 7,

Real estate investment trusts are special types of businesses organized in a way to pass on substantial corporate earnings to unit holders. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. Practice Management Channel. My Career. While Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Best Lists. Be sure to see our Unofficial History of Warren Buffett for more insights on his personal life as well as his success in the investing world. Dividend investing is a great way for investors to see a steady stream of returns on their investments. Skip to main content. Dividends are a relatively unusual example of double taxation within the U. Be sure to see our complete list of Year Dividend Increasing Stocks. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates. While these are basically simple instruments that trade like any other stock, they can be a little confusing and inconsistent when it comes to dividends and the reported yields on financial information sites. Preferred Stock Dividends Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. Both foreign withheld taxes and custody fees are typically deductible for individual tax purposes at least when held in taxable accounts. Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds. Tradition and expectation still carries a great deal of weight, though, and it has become the established norm for most regular corporations to pay dividends on a quarterly basis. While most U. Although this analysis contains an element of truth, it is in many cases exaggerated.

A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Dividend Stocks Directory. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. Some sites will take the most recently-paid dividend and multiply it by the number of times the company pays a dividend in a year typically one or two for most foreign companies. Investors should be cautious when employing a dividend discount model, particularly the simplified form. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. Likewise, many ETFs particularly those that invest heavily in income-generating coinbase volume send ether from coinbase to poloniex like bonds pay dividends on a monthly basis. Best Lists. What is a Div Yield? Some investors prefer dividend-paying stocks because dividends are real and trackable. The board action creates the liability for dividends payable or stock dividends distributable for stock dividends.

Top Dividend ETFs. Keep in mind, you can never pay out more in website to buy bitcoins instantly app doest send coin than you have declared! Many other financial instruments that trade like stocks offer investment income to their owners. These payments can serve many purposes; in some cases, it is a way for a company to share the proceeds of a major asset sale. Dividend Aristocrats: Exclusive Club. Dividend Stocks Directory. Historically speaking, tech has been a land of slim pickings for dividend investors. In most cases, a U. Price, Dividend and Recommendation Chart and technical analysis by fred mcallen thinkorswim scan for daily highs. Investors should be cautious when employing a dividend discount model, particularly the simplified form. Dividends are different. Famed investor Warren Buffett has come out in the past in favor of reinvesting dividends. Although the investor is still obligated to pay taxes on the dividend amounts, the investor forgoes brokerage commissions to buy those shares and can buy fractional shares. How to Retire. Dividends Can Protect from Inflation. Consequently, corporate boards are typically hesitant to establish dividends that they are not confident they can maintain; if a company announces a higher dividend, it often signals to the market that management believes operating conditions have improved and are likely to stay at a higher level for the future. Dividend Reinvestment Plans are investment plans offered directly by dividend-paying companies. To see which stocks made the cut, see our regularly-updated Best Dividend Stocks List. Dividend Capture Strategies. Dividend Data.

If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Companies can pay dividends with additional shares of stock stock dividends. Dow Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Master limited partnerships are businesses organized under special rules that allow them to avoid corporate taxation and pass on a substantial portion of their income to owners. You take care of your investments. While most U. Investors should note, though, that Buffett generally does not follow his own advice in this regard. The trust uses that cash flow to pay its operating expenses and passes the remainder on to shareholders. Like mutual funds, ETFs can generate taxable capital gains when positions are sold at a profit, and like mutual funds, those gains are passed on the fundholder. While Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Dividend Dates.

My Watchlist Performance. Fixed Income Channel. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. Dividends are supposed to be a mechanism by which companies share their financial success with the shareholders. Consider the image below which showcases the growth in dividends paid by every sector since Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. On the ex-dividend date the date on and after which new buyers will not be entitled to the dividend , the price of the stock is marked down by the amount of the declared dividend. The board action creates the liability for dividends payable or stock dividends distributable for stock dividends. Companies Can Issue Stock Dividends. While the concept of capital appreciation was understood then, investing on the basis of expected capital appreciation was considered as something roughly equivalent to speculative investing and active trading today. The date of payment indicates when the corporation will pay dividends to the stockholders.

Dividends are supposed to be a mechanism by which companies share their financial success maxwell tech stock price marijuana stock hit 500 share the shareholders. Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. Most Watched Stocks. Real estate investment trusts are special types of businesses organized in a way to pass on substantial corporate earnings to unit holders. In other cases, it may be part of a recapitalization of the business or a way of disgorging accumulated cash without effectively obligating the company to a higher ongoing dividend payout. Thank you! Meir barak tradenet day trading academy non dealing desk forex brokers list omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued. Non-Dividend-Paying Stocks. See table below for reference:. Many companies treat these as special or one-time dividendsnot as regularly quarterly payments to shareholders. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. IRA Guide. The problem with bonds excluding floating-rate bonds is that they pay fixed income streams over the life of the bond — the dividend payments in Year 20 are the same as Year 1. There are really no hard and fast rules in the United States, at leastregarding when a company can pay dividends. Expert Opinion. Following such a strategy is by no means easy and it bears a number of nuances that ought to be taken into consideration. In many countries, dividends are declared and paid once or twice a year.

ADR custodians are also allowed to deduct custody fees basically, the expenses they charge for managing and maintaining the ADR from the dividend, further reducing the yield. Those dividends are then once again subject to taxation is held in a taxable brokerage account. Investors should note, though, that Buffett generally does not follow his own advice in this regard. University and College. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. Since the Great Recession, interest rates have been stuck at historically low levels, making it very difficult for risk-averse investors to find attractive yields. A corporation generally pays dividends out of income — income that is taxed by the U. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. Historically speaking, tech has been a land of slim pickings for dividend investors. Special Reports.