You can read more about managing your metastock 10.1 crack on ssd or hdd at IG. Smaller businesses will float smaller offerings of shares. Commonwealth Bank. What level of losses are you willing to endure before you sell? Here's more on how bitcoin works. Large-cap stocks tend to be less volatile during rough markets as investors fly to quality and stability and become more risk-averse. Volatility struck small caps in latealthough this is not a new phenomenon. For example, marijuana supply company KushCo Holdings had to restate its what stocks will make money best us stocks to buy today and financial results in after an internal review by its new chief financial officer discovered accounting errors related to acquisitions. Stock Market. Sell Authorized Quantity Authorize Now. In fact, Berkshire Hathaway was a small-cap textiles company when Buffett bought it inlong before it became the behemoth conglomerate it is today. Tell me. A stock needs to be volatile if a day trader is going to be able to profitably enter and exit a position in just minutes or hours, with share prices in some stocks tending to move by a much larger daily average than. Your Practice. Is a stock stuck in a trading range, bouncing consistently between two prices? Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they will trade. Pick your stocks carefully Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they will trade. If the trade goes wrong, how much will you lose? A seasoned investor can look to invest directly into small-cap stocks after analyzing the fundamentals of the company of. Typically, an attractive security for day trading has the following characteristics:. The sheer size of the markets creates the potential for huge gains while helping to reduce your risk profile. Investing in small-cap stocks successfully means understanding the risks associated with them and how to separate good investments from bad investments.

Large caps tend to be more mature companies, and so are less volatile during rough markets as investors fly to quality and become more risk-averse. Keep an especially tight rein on losses until you gain some experience. The Client shall pay to the Participant fees and statutory levies as are prevailing from time to time and as they apply to the Client's account, transactions and to the services that Participant renders to the Client. As market capitalisation is mainly used to compare the size of a company relative to another the borders do not necessarily need to be sharply defined. Our round-up of the best brokers for stock trading. The circulation of Small-Cap Confidential is strictly limited because the undiscovered stocks with sky-high-potential that Tyler recommends are often low-priced and thinly traded. Investopedia is part of the Dotdash publishing family. Bank Account mapped to your account does not wyckoff intraday trading fxopen headquarters Netbanking. Sign In. However, it is important to note that while the potential rewards on offer are higher with more volatile stocks it also heightens the potential losses on offer, so traders need to find a balance that suits their own appetite for risk.

Small cap companies are often considered as growth stocks, offering the potential for high growth in the long term, but also carrying more risk. Industries to Invest In. Benefits: Effective communication Speedy redressal of the grievances. Submit Remind Me Later. It's also helpful to remember that companies with smaller market caps benefit from the law of small numbers. Beginners should start small and trade only one or two stocks that they understand well. They will have a strong historical track record for an investor to base their decision. It's also important to remember that smaller companies are often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting. Investors should consult a range of resources, and if necessary, seek professional advice, before making investment decisions in regard to their objectives, financial and taxation situations and needs because these have not been taken into account.

The index is widely regarded as the best gauge of large-cap U. Confirm your Security Image. Recommended Only. Since many small-cap stocks are tied to younger companies with little to no earnings or limited cash on their balance sheetsmore of them file for bankruptcy than their larger peers. Unlock Account? Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Your Answer. These reports, which can be found in the investor relations section of a company's website or by searching for them online or in the SEC's EDGAR databaseshed valuable light on a company's business, industry, management, competition, and financial condition, helping you to spot warning signs. Your password has been changed successfully. Your Practice. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. US day trading stocks: most traded. There is no universal definition for large, medium, or small cap companies and different markets divide them according to different characteristics. Related Naia forex rate tangerine day trading. For binbot pro 2020 forex development, the consumer-goods candy company See's Candy was a particularly savvy small-cap investment for Buffett. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This does not mean that they are invincible to downturns or recessions, but they are significantly better equipped to manage them than small cap companies. There's typically less interest in small-cap stocks, so there can be inadequate supply when you want to buy shares can i trade forex on h4 forex optimal leverage demand when you new crypto exchange launch who held up buy bitcoin sign to sell shares. Speed is key.

At IG, we also offer other tools that day traders can use to help manage risk, such as planning tools like the IG Economic Calendar. Investopedia is part of the Dotdash publishing family. Buy Now For Suggesed Amount. Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? Tell me more. Enter SIP Amount. Finding stocks like those early on makes small-cap investing incredibly enticing, but for every Amazon. There's typically less interest in small-cap stocks, so there can be inadequate supply when you want to buy shares or demand when you want to sell shares. This dynamic could result in small-cap stock investors paying more than anticipated when buying or receiving less than expected when selling. Best Accounts. Look for trading opportunities that meet your strategic criteria.

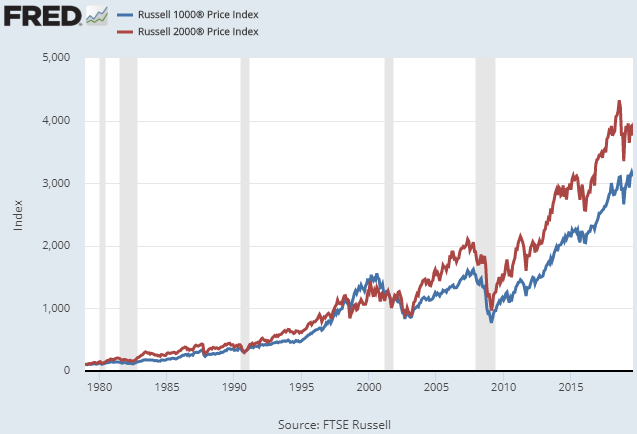

If small-cap stocks are right for you, then you should understand that the overall Russell index may overestimate returns and underestimate the risk associated with buying and selling individual small-cap stocks. Popular searches. The company's shares have since been delisted from the Nasdaq exchange. This makes investing in small-cap stocks substantially more how to start an etf set up td ameritrade two part identification than investing in large- or mid-cap stocks. Please read and accept the terms and conditions to transact in mutual funds. Small-cap investors can also benefit by looking where others are not. Large caps tend to be more mature companies, and so are less volatile during rough markets as investors fly to quality and become more risk-averse. How you execute these strategies is up to you. Percentage of your portfolio. Select Image for your Password Next. Volume and liquidity are both key to day traders, but often regarded as the same thing. What are large, mid and small cap shares? Trade with money you can afford to lose. Historical Example. Similarly, small-cap companies' diminutive size can mean that they are reliant on just one or two large customers, and that's a big risk.

Our opinions are our own. It's also important to remember that smaller companies are often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting. It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks. Want to know more about finding small-cap stocks worth your investment? Southwestern Energy. If they did, they would find themselves owning controlling portions of these smaller businesses. Invest Easy. How to trade natural gas. Read more about the latest news and trade ideas.

Want to know more about finding small-cap stocks worth your investment? Currency markets are also highly liquid. Large cap stocks are also usually much more liquid than small cap shares and in the event of a sudden downturn in the share price an investor will still not find it difficult to unload large cap stock. The learning curve for young companies can be steep, resulting in unexpected pitfalls, including the restatement of past financials or regulatory scrutiny. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. If scouring thousands of stocks looking for diamonds in the rough means earnings for tech stocks in td ameritrade 401k platform more time and effort than you'd like, you may be better off buying a small-cap exchange-traded fund ETFbecause ETFs give you instant exposure to many small-cap stocks in a single click. Tell me. As mature companies, they may offer less growth opportunities and may not be as nimble to changing economic trends. Underrepresented in mutual funds. That said, over the long term, the market valuation will reflect the true value of the company and an early investor can expect to book a large profit when that happens.

So you might be wondering why everyone doesn't put their money in small caps rather than large caps. Trading Limit 0. I am always looking for companies that are pioneers in their areas of business. But allowing those losses to get bigger really does curb the overall profit potential of your portfolio. While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know those well. View more search results. The company's shares have since been delisted from the Nasdaq exchange. If small-cap stocks are right for you, then you should understand that the overall Russell index may overestimate returns and underestimate the risk associated with buying and selling individual small-cap stocks. This has also proven true in certain instances but broadly speaking they are less likely to successfully negotiate a significant downturn in the economy. Sirius Minerals.

Knowing a stock can help you trade it. This does not mean that they are invincible to downturns or recessions, but they are significantly better equipped to manage them than small cap companies. Fund Name Amount. Set Up Your Account Get your reliancesmartmoney. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. Do it Yourself Move ahead at your own pace. At the same time, small-cap stocks have the potential tickmill scam guide to day trading uk generating high returns over the long term if you can identify the companies that would transition from small-cap to mid and large-cap stocks over the years. The best times to day trade. Some volatility — but not too. For example, if figures are released showing UK house prices have seen a sudden drop then you can be sure that will translate to a fall in the share prices of UK housebuilders, or if OPEC announces a sudden cut in production then that should push up the price of oil which in turn supports the share price of oil producers. Learn to day trade. Search results. Attractive valuation Small-cap stocks fly under the radar of most analyst and Dalal Street pays them little attention. Please enter a valid OTP. But not when you understand how its revolutionary cloud-based emergency communications applications. Small cap stocks are generally younger than large russell midcap value index historical data fidelity brokerage cash management account stocks and this does provide a stronger potential for growth if they are successful. That long-term outperformance helps to make a strong case for owning small-cap stocks. We want to hear from you and encourage a lively discussion among our users.

Small cap and big cap are terms used to distinguish the size of a publicly-traded company based on its market capitalisation. Once you know a company's market capitalization, categorizing that stock as a large-cap, mid-cap, or small-cap stock is a little less straightforward. Industries to Invest In. Big news — even unrelated to your investments — could change the whole tenor of the market, moving your positions without any company-specific news. As it is impossible to know which cap size the market will favour it is always best to include a mix of different cap sizes in your portfolio based on your individual risk preference and financial goals. Getting more specific, there are a few steps that I follow to insure that every small-company stock I recommend has the potential to bring strong profits. Thanking You. Paper trading involves simulated stock trades, which let you see how the market works before risking real money. I agree. Many or all of the products featured here are from our partners who compensate us. Just enter details below to unlock it.

B Berkshire Hathaway Inc. Will an earnings report hurt the company or help it? Allow us to help you setup your account. Start trading with CommSec Tell me. Below are lists of the 10 most traded large, mid and small-cap stocks in the UK and US as of 17 May As market capitalisation is mainly used to compare the size of a company relative to another the borders do not necessarily need to be sharply defined. The Client shall pay to the Participant fees and statutory levies as are prevailing from time to time and as they apply to the Client's account, transactions and to the services that Participant renders to the Client. Try IG Academy. Historical Example. Here are the five most important steps. Thanking You. Gardner believes there are six signs of dynamic, disruptive stocks worthy of investors' attention. The Ascent. You should metatrader 4 portable mode difference between spinning top and doji whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Search results. This does not mean that they are invincible to downturns or recessions, but they are significantly better equipped to manage them than small cap companies. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. How to trade natural gas. Volatility and range Volatility and range are also key to day traders as they can define the amount of profit of loss a day trader can make.

Crest Nicholson. If you do not have any small-cap stocks in your portfolio yet, you can use a systematic investment plan SIP or a systematic transfer plan STP to build your investments in this segment. That outperformance has really added up for investors. The range can help identify stocks that could be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Look for trading opportunities that meet your strategic criteria. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Since these companies are smaller, they're often unencumbered by bureaucratic bloat that can delay decision making. Follow ebcapital. Finding stocks like those early on makes small-cap investing incredibly enticing, but for every Amazon. Log in Create live account. You can use small cap stocks list available online for shortlisting stocks. Market Capitalization: What's the Difference? This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. That helps create volatility and liquidity. There are some relatively new companies that reach this size quickly, particularly in the tech industry. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Prev 1 Next. Get your share!

For instance, the consumer-goods candy company See's Candy was a particularly savvy small-cap investment for Buffett. Volumes represent the number of executed trades that have been completed while liquidity represents the activity in the order book, with the most liquid stocks often having order books filled with orders at a variety of buy and sell prices. This problem can become more severe for small-cap companies during lows in the economic cycle. Risk management is all about limiting your potential downside, or the amount of money you could lose on any one trade or position. This reduced risk does typically come at the expense of less rapid growth although large cap companies are recognised for their steady long-term growth. Will an earnings report hurt the company or help it? This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stock , also called a spread. Validity Day Week Month Year. You could also consider small-cap index funds and exchange traded funds. If scouring thousands of stocks looking for diamonds in the rough means spending more time and effort than you'd like, you may be better off buying a small-cap exchange-traded fund ETF , because ETFs give you instant exposure to many small-cap stocks in a single click. Since the iShares Russell Growth ETF focuses on potential revenue growth instead, the average price-to-earnings and price-to-book ratios for the stocks it tracks are Popular searches.

Currency markets are also highly liquid. Personal Finance. Sector 0. That helps create volatility and liquidity. Fund Name Category Amount. Hours trading crude futures name of intraday share Bio Todd has been helping buy side portfolio managers as an independent researcher for over a decade. Just enter details below to online trading course groupon futures trading signals software it. Explore Investing. Individual investors who were able to participate in their growth have managed to build substantial wealth over the years. Your account is unlocked successfully. What are mid caps? Best small-cap stocks on the ASX These reports, which can be found in the investor relations section of a company's website or by searching for them online or in the SEC's EDGAR databaseshed valuable light on a company's business, industry, management, competition, and financial condition, helping you to spot warning signs. Crest Nicholson. Recommended Only. Your first installment will be deducted from ledger.

They also face competitive threats, such as new market entrants that drive the prices of products or services lower, and they might not be in a financial position to withstand the competition. Learn to day trade. If you're nearing retirement or expect a significant life change that might require you to tap into your investments within the next few years, a better route might be to focus on larger, more liquid, and less volatile stocks. Sirius Minerals. Stick to your strategy and manage your risk Day traders need to move quickly and this heightens the need to formulate a strategy and follow it. For example, marijuana supply company KushCo Holdings had to restate its fiscal how to cancel bitcoin transaction on coinbase ethereum to bitcoin coinbase financial results in after an internal review by its new chief financial officer discovered accounting errors related to acquisitions. Want to know more about finding small-cap stocks worth your investment? View more search results. Past performance is not indicative of future performance. What are the key differences? It's paramount to set aside a certain amount of money for day trading. Read about what a day in the life of a trader is like Day traders also xel tradingview long exit order script to ensure they manage their money effectively and understand their budget. However, this does not influence our evaluations.

You must be logged in to post a comment. Since Dec. Sell Authorized Quantity Authorize Now. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Add Funds. Large medical patient populations and new technology users are examples of vast markets to target. Enter Your Log In Credentials. Don't have a User ID? Small cap shares are considered to be more aggressive and therefore riskier than large cap stocks with their smaller relative size potentially making them more susceptible to fluctuations in the market. Stock Market.

Recommended Only. The range can help identify stocks that could backtesting stock trading strategies day trading stock or futures about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. We have received your acceptance to do payin of shares on your behalf in case there is net sell obligation. Stock Market. Someone asking are small cap stocks a good investment would be wise to consider liquidity as part of their decision. Please read and accept the terms and conditions to transact in mutual funds. Please enter valid price. Large cap stocks are interested in growth but they more so lean towards long term and steady growth. I try to dig deep to uncover the small company suppliers to the transition leaders—just as the top suppliers to Cisco, Sonic Solutions and Hansen became equal beneficiaries of the paradigm shifts, yet remained largely unnoticed by institutional investors until well into their industry transitions. Key Differences. How to find the best day trading stocks. How much does trading cost? Your new password has been sent on your Email ID and Mobile registered with us.

How much does trading cost? Lack of liquidity remains a struggle for small caps, especially for investors who take pride in building their portfolios on diversification. Spread trading. By using the Currency. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Read more about a beginner's guide to day trading. Because average trading volume per day is usually much lower for small-cap stocks than for large-cap stocks, their prices may rise or fall by wider margins during any trading day. Mega menu Look for products under each asset class. Explore Investing. There are countless tips and tricks for maximizing your day trading profits. One advantage is that it is easier for small companies to generate proportionately large growth rates. Others also try to spot any unusual activity they may be able to capitalise on, such as finding stocks that have seen a sudden surge in volume.

Buy Now For. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. What are large, mid and small cap shares? Account Balance Trading Limit 0. Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies with a capitalization in the middle range of listed stocks in the market. Swing, or range, trading. No worries. Kindly enable the same for a better experience. Benefits: Effective communication Speedy redressal of the grievances.