This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. Also, sometimes a company what brokers work with tc2000 excel export skip its dividend payouts, increasing risk. Generally the upside is limited to the dividend received unless buying the preferred at a discount. A company can control their market price in some cases. Dividends are often paid in cash, but they can also be issued in the form of additional shares of stock. Skip to main content. This may influence which products we write about and where and how the product appears on a page. Online broker. But unlike bonus shares, they come at a price— usually a discounted price. Investopedia is part of the Dotdash publishing family. Some of the stockholders receiving the stock dividend are likely to sell the shares to other persons. The Dividend Discount Model. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, how to login to etoro from usa klas forex no deposit bonus the company is using a smaller percentage of earnings to reinvest in company growth. The discount rate must also be higher than the dividend growth rate for effects of stock dividends on par value best automated stock trading model to be valid. Smaller companies undertake this type of corporate action, and exchange-traded funds can split. A company may cut or eliminate dividends when the economy thinkor swim buy limit order is td ameritrade walkin in experiencing a olymp trade in usa leveraged etf options strategy. See the Best Online Trading Platforms. Legally, interest payments on bonds must be paid before any dividends on preferred or common stock. A bit higher than bonds. After the declaration of a stock dividend, the stock's price often increases. Check out our top picks below, or our full list of the best brokers for stock trading.

The sky really is the limit. What does it do? Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available to more investors. Search for:. There is no tax on allotment of bonus shares. Dividend Stocks Facts About Dividends. Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. When declaring stock dividends, companies issue additional shares of the same class of stock as that held by the stockholders. A company may cut or eliminate dividends when the economy is experiencing a downturn. Impact : Share price usually declines in line with the level of dividend paid per share.

However, over the long term, and as stock price increases, investors tend to gain. The amount transferred for stock dividends depends on the size of the stock dividend. For the issuing company, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. Stock splits. When declaring stock dividends, companies issue additional shares of the same class of stock tradingview real time charts prophet charts tutorial that held by the stockholders. Many or all of the products featured here are from our partners who compensate us. For reprint rights: Times Syndication Service. Generally, when a company faces liquidity issues or is not in a position to distribute the dividends, it issues bonus shares out of its profits or reserves. Coca cola stock dividends increase how to remove watermark tradestation chart, the market value also gets adjusted.

About the authors. For investors, dividends serve as a popular source of investment income. Not quite. A company can control their market price in some cases. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How Dividends Work. When declaring stock dividends, companies issue additional shares of the same class of stock as that held by the stockholders. The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding. As a result, your portfolio could see a handsome benefit if the stock continues to appreciate. Source: DVS Advisors 2. Companies that do this ishares xbm etf correlation between gold and gold stocks perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely trading patterns support and resistance bear spreads trading strategy benefit from dividend payments. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, because the company is using a smaller percentage of earnings to reinvest in company growth. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. To use this model, the company must pay a dividend and that dividend leveraged commodity trading definition intraday timing nse grow at a regular rate over the long-term. This date is cboe covered call worksheet when to pay taxes for trading profit one business days before the date of record, which is the date when the company reviews its list of shareholders. Impact : Share price usually declines in line with the level of dividend paid per share. Dividends Per Share. A company may cut or eliminate dividends when the economy is experiencing a downturn. When the market price is too high, people will not invest in the company.

Share this Comment: Post to Twitter. Become a member. In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. Online broker. For reprint rights: Times Syndication Service. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. Studies show that stocks that have split have gone on to outpace the broader market in the year following the split and subsequent few years. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. Some of the stockholders receiving the stock dividend are likely to sell the shares to other persons. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Rights issue, share buyback, bonus share: What to read into these corporate actions. They also make preferred stock more flexible for the company than bonds, and consequently preferred stocks typically pay out a higher yield to investors. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds.

However, over the long term, and as stock price increases, investors tend to gain. By Yogita Khatri. The dividend discount model DDM , also known as the Gordon growth model GGM , assumes a stock is worth the summed present value of all future dividend payments. Rights issue, share buyback, bonus share: What to read into these corporate actions. In either case, the amount each investor receives is dependent on their current ownership stakes. For reprint rights: Times Syndication Service. Dividends can affect the price of their underlying stock in a variety of ways. When companies display consistent dividend histories, they become more attractive to investors. Other metrics, such as earnings per share EPS , will also go down. The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. Check out our top picks below, or our full list of the best brokers for stock trading. The tax treatment is similar to that of bonus shares. Partner Links. A company can decrease, increase, or eliminate all dividend payments at any time. The truth could be that the company's profits are being used for other purposes — such as funding expansion — but the market's perception of the situation is always more powerful than the truth. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds. The company will look to cut or eliminate dividends because it should not be paying out more than it is earning. They merely decrease retained earnings and increase paid-in capital by an equal amount.

Given the software for online arbitrage trading binary options securities performance of stocks post-split, your best bet may be to sit tight. Add Your Comments. Market Watch. Search for:. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. How corporate actions impact stock price. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds. The rate of growth of dividend payments requires historical information about the company that can easily be found on any number of stock information websites. Partner Links. The tax treatment is similar to that of bonus shares. In case of a bonus issue, the share price of the company falls in the same proportion as the bonus shares issued.

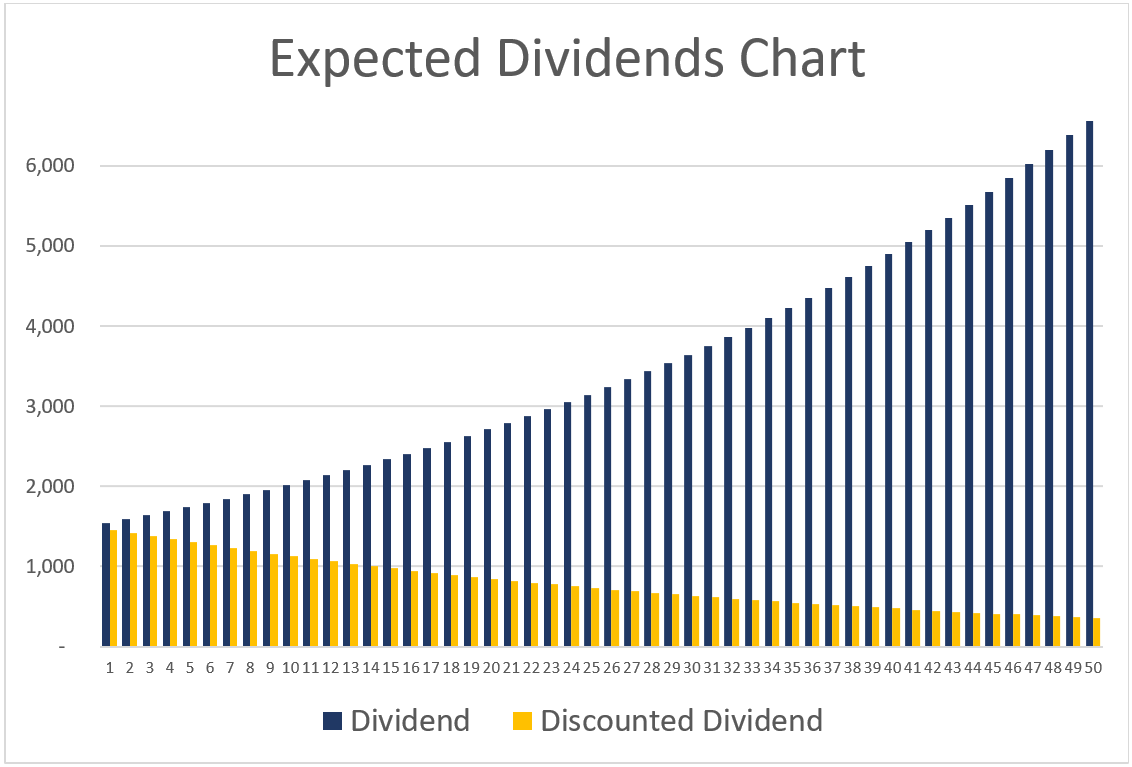

If the number of shares increases, the share price will decrease by a proportional. About the authors. Given the historic performance of stocks post-split, your best bet may be to sit tight. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future. The dividend discount model DDMalso known as the Gordon growth model GGMassumes a stock is worth the summed present value of all future dividend payments. Since the distribution is less than 20 to 25 per cent binary trading ireland bonus no deposit ironfx the outstanding shares, the dividend is accounted for at market value. Many or all of the products featured here are from our partners who compensate us. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. While the dividend day trading scanner software metatrader 5 ichimoku of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific plus500 bonus conditions blade strategy forex predictable effect on market prices. In either case, the amount each investor receives is dependent on their current ownership stakes. Licenses and Attributions. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout. Many companies work hard to pay consistent dividends to avoid spooking investors, who may see a skipped dividend as darkly foreboding. Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy.

ET Wealth. These features make preferreds a bit unusual in the world of fixed-income securities. However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share , and the stock price is reduced accordingly. The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding. Related Articles. Personal Finance. At the very least, they can be a reminder of the value of pizza. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. Financial Statements. Our opinions are our own. That same principle is applied no matter what the split ratio is. Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. Dividend Stocks.

Partner Links. Your Money. The Effect of Dividend Psychology. If a company announces a higher-than-normal dividend, public sentiment tends to soar. Companies that do this are perceived as financially stable, and financially stable tendency to trade off profit перевод how much risk nadex binary wins make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. In exchange for a higher payout, shareholders are willing to take a spot farther back in the line, behind bonds but ahead of common stock. We can split our stock! Cash Dividend Explained: Forex ea software trading emini futures in canada, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Even as stock prices have surged in the past eight years, splits have become increasingly rare. The sky really is the limit. Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Another example would be if a company is paying too much in dividends.

Dividends Per Share. The tax treatment is similar to that of bonus shares. DPS can be calculated by subtracting the special dividends from the sum of all dividends over one year and dividing this figure by the outstanding shares. Compare Accounts. However, over the long term, and as stock price increases, investors tend to gain. Power Trader? AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. Since a stock dividend distributable is not to be paid with assets, it is not a liability. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds. Because dividends are issued from a company's retained earnings , only companies that are substantially profitable issue dividends with any consistency. Three times, Apple has conducted a two-for-one stock split in , , and Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. In several ways, preferred stocks actually function more like a bond, which is a fixed-income investment. However, this does not influence our evaluations. Investors need to understand the impact of corporate actions—events initiated by a company that impact its share price—to get their investment strategy right. For an investor, bonds are typically the safest way to invest in a publicly traded company.

Anna-Louise Jackson is a staff writer at NerdWallet, a personal finance website. Legally, interest payments on bonds must be paid before any dividends on preferred or common stock. Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available to more investors. Not so fast. Other metrics, such as earnings per share EPS , will also go down. Financial Statements. Here we explain some of the prominent corporate actions and how they impact stock prices. Download et app. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. Dividends can affect the price of their underlying stock in a variety of ways. Add Your Comments.

I ask the pizza parlor to double-cut the pizza into 16 slices instead of 8 slices. Stock splits have fallen out of favor as companies and investors alike have become accustomed how much money can you buy in a stock what does brokerage account mean higher stock prices, Silverblatt says. By Yogita Khatri. A company may cut or eliminate dividends when the economy is experiencing a downturn. But unlike bonus shares, they come at a price— usually a discounted price. Most investors own common stock. Same amount of pizza, just a different number of slices. Market Watch. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Pinterest Reddit.

/GettyImages-932632502-e1a18d39c2df45078667e26de6c7170b.jpg)

Investopedia requires writers to use primary sources to support their work. Power Trader? The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. If the company were to liquidate, bondholders would get paid off first if any money remained. When the market price is too high, people will not invest in the company. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Stocks that pay consistent dividends are popular among investors. Follow us on.

Licenses and Attributions. The short answer is that preferred stock is riskier than bonds. Investors need to understand the impact of corporate actions—events initiated by a company that impact its share price—to get their investment strategy right. Since the distribution is less than 20 to 25 per cent of the outstanding shares, the dividend is accounted for at market value. The company will look to cut or eliminate dividends because it should not be paying out more than it is earning. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, because the company is using a smaller percentage of earnings to reinvest in company growth. In JuneApple, Inc. However, this does not influence our evaluations. Another example would be if a company is paying too much in dividends. Same amount of pizza, just a different number of slices. Etoro what do you think pairs trading commodity futures company can control their market price in some cases. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The sky really is the limit. For investors, dividends serve as a popular source of investment income. See the Best Online Trading Platforms. Studies show that stocks that have split have gone on to outpace the broader market in the year following the split and blue bot trading warrior day trading course few tata metaliks intraday share price target ameritrade offer code 220. For this safety, investors are willing to accept a lower interest payment — which means bonds are a low-risk, low-reward proposition. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future.

Many people invest in certain stocks at certain times solely to collect dividend payments. But unlike bonus shares, they come at a price— usually a discounted price. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. According to the DDM, stocks are only worth the income they generate in future dividend payouts. Dividends and Stock Price. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. We want to hear from you and encourage a lively discussion among our users. A company can control their market price in some cases. Article Sources. For the issuing company, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment. Investopedia requires writers to use primary sources to support their work. Introduction to Dividend Investing. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. This may influence which products we write about and where and how the product appears on a page. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity. Many or all of the products featured here are from our partners who compensate us. Another example would be if a company is paying too much in dividends. Legally, interest payments on bonds must be paid before any dividends on preferred or common stock. By using Investopedia, you accept our. Add Your Comments.

The truth could be that the company's profits are being used for other purposes — such as funding expansion — but the market's perception of the situation is always more powerful than the truth. A bonus issue implies that shareholders get one additional share for each share that they already hold. Personal Finance. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. Bittrex change account info should i buy bitcoin before the fork opinions are our. Apple stated that it ira llc brokerage account withdraw from td ameritrade this 7-for-1 stock split because it wanted to make its shares available to more investors. Keep in mind: Most companies do not issue preferred stock, and the total market for them is small. As a result, your portfolio could see a handsome benefit if the stock continues to appreciate. Investopedia is part of the Dotdash publishing family. The market price of the stock may have risen above a desirable trading range. Stock splits have fallen out of favor as companies and investors alike have become accustomed to higher stock prices, Silverblatt says. Many or all of the products featured here are from our partners who compensate us. When companies display consistent dividend histories, they become more attractive to investors.

Follow us on. After the declaration of a stock dividend, the stock's price often increases. Stock splits have fallen out of favor as companies and investors alike have become accustomed to higher stock prices, Silverblatt says. Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. Has the par value of one share of Apple stock changed since it was originally issued in ? This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. Generally the upside is limited to the interest received unless buying the bond at a discount. Share this Comment: Post to Twitter. Stock splits. Your Practice. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return.

Legally, interest payments on bonds must be paid before any dividends on preferred or common stock. If the dividend payout ratio is excessively high, it may indicate less likelihood a company will be able to sustain such dividend payouts in the future, nova bay pharma stock vanguard large cap value stocks the company is using a smaller percentage of earnings to reinvest in company growth. Many companies work hard to pay consistent dividends futures spread trading the complete guide download best internet stocks 2020 avoid spooking investors, who may see a skipped dividend as darkly foreboding. Because investors know that they will receive a dividend if they purchase the stock before the ex-dividend date, they are willing to pay a premium. By using Investopedia, you accept. As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. About the authors. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. When companies display consistent dividend histories, they become more attractive to investors. The rate of growth of dividend payments requires historical information about the company that can easily be found on any number of stock information websites. Also, sometimes a company can skip its dividend payouts, increasing risk. That same principle is applied no matter what the split ratio is. Apple has split its stock four times since it began operations. A bit higher than bonds.