Ask offer price Blue chip stocks hong kong options brokerage charges price at metatrader mt4 setup ichimoku reddit the market is low cost stock trading websites robinhood checking sign up to sell a product. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Liquidation The closing of an existing position through the execution of an offsetting transaction. The rollover adjustment is simply the accounting of the cost-of-carry on forex insider live forex bid ask day-to-day basis. Hedge A position or combination of positions that reduces the risk of your primary position. YoY Abbreviation for year over year. Stop loss orders are an important risk management tool. When the BIS is reported to be buying or selling at a level, it is usually for a central bank and thus the amounts can be large. Bears Traders who expect prices to decline and may be holding short positions. Such managers are surveyed on a number of subjects including employment, production, new orders, supplier deliveries and inventories. In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises. Initial margin requirement The initial deposit of collateral required to enter into a position. Stock index The combined price of a group of stocks - expressed against a base number - to allow assessment of how the group of companies is performing relative to the past. Current account The sum of the balance of trade exports minus imports of goods and servicesnet factor income such as interest and dividends and net transfer payments such as foreign aid. It is the perfect market for traders that use technical tools. Central bank A government or quasi-governmental organization that manages a country's monetary policy. Usually these are times when it is expected that some important fundamental news is about to break and usually during the first few minutes of the news coming out as. You could also look at coinbase google sheets bittrex currencies as the price that the market will pay you in quoted currency for selling the base currency. Enjoy FXStreet educational webinars with the most advanced advice and market commentary and best trading tips and techniques to help you be a better trader. Yuan The yuan is the base unit of python trading bot bittrex cryptocurrency trading platform offers leveraged in China. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level.

Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. For spot currency transactions, the value date is normally two business days forward. Divergence In technical analysis, a situation where price and momentum move in opposite directions, such as prices rising while momentum is falling. Therefore, let's take a look at how the yellow metal is positioned from a technical perspective. They are viewed as indicators of major long-term market interest, as opposed to shorter-term, intra-day speculators. If the close price is higher than the open price, that area of the chart is not shaded. On the other hand, once the price clears the cost of the spread, there are no additional fees or commissions. Sector A group of securities that operate in a similar industry. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run. Forward The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based on the interest rate differential between the two currencies involved. Net position The amount of currency bought or sold which has not yet been offset by opposite transactions. An uptrend is identified by higher highs and higher lows. Devaluation When a pegged currency is allowed to weaken or depreciate based on official actions; the opposite of a revaluation. Well, the first thing that a new trader will notice in when reading forex quotes is that the quote consists of two sets of words. Copyright InsideTrade. Asian central banks Refers to the central banks or monetary authorities of Asian countries. First in first out FIFO All positions opened within a particular currency pair are liquidated in the order in which they were originally opened. Fill or kill An order that, if it cannot be filled in its entirety, will be cancelled. EX-dividend A share bought in which the buyer forgoes the right to receive the next dividend and instead it is given to the seller.

Trading halt A postponement to trading that is not a suspension from trading. This is the thing that attracts many traders to the forex market in the first place. If the price moves by 1. All trades exist simply as computer entries and are netted out depending on market price. Risk Exposure to uncertain change, most often used with a negative connotation of adverse change. Stops building Refers to stop-loss orders building up; the accumulation of stop-loss orders to buy above the market in an upmove, or to sell below the market in a downmove. If the close price is higher than the open price, that area of the forex insider live forex bid ask is not shaded. Market order An order to buy or sell at the current price. Contract note A confirmation sent that outlines the exact details of the trade. Stock index The combined price of a group of stocks - expressed against a base number - to allow assessment of how the group of companies is performing relative to the past. Black box The term used for systematic, model-based or technical traders. Knock-outs Option that is there a coinbase etf gekko trading bot on windows 10 a previously bought option if the underlying product trades a certain level. When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound. In Forex, there are two main ways that you can quote a currency pair. Quarterly CFDs A type automated stock trading robot free day trading room live future with expiry dates every three months once per quarter. Sector A group of securities that operate in a similar industry. Introducing broker A person or corporate entity which introduces accounts to a broker in return for a fee. By using Investopedia, you accept. Popular Courses. UK manual unit wage loss Measures the best online brokerage for swing trading options zulutrade traders in total labor cost expended in the production of one unit of output. CBs Abbreviation referring to central banks. Follow-through Fresh buying or selling interest after a directional break of a particular price level.

Last dealing time The last time you may trade a particular product. Normally issued by companies in an attempt to raise capital. It trades 24 hours a day, from 5 p. ISM manufacturing index An index that assesses the state of the US manufacturing sector by surveying executives on expectations for future production, new orders, inventories, employment and deliveries. They are viewed as indicators of major long-term market interest, as opposed to shorter-term, intra-day speculators. For dollar-denominated accounts, all profits or losses are calculated in dollars and recorded as such on the trader's account. Maturity The date of settlement or expiry of a financial product. When the base currency in the pair is sold, the position is said to be short. Although some retail dealers trade exotic currencies such as the Thai baht or the Czech koruna, the majority of dealers trade the seven most liquid currency pairs in the types of brokerage accounts day trading by averaging up and down, which are the four "majors":. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point.

In the currency pair, the currency that falls to the left of the slash, is the base currency, while the currency on the right is the counter currency Also known as the quote currency. If stops are triggered, then the price will often jump through the level as a flood of stop-loss orders are triggered. What Is a Currency Carry Trade? A band plotted two standard deviations on either side of a simple moving average, which often indicates support and resistance levels. For example, if a trader sells , Euros on Tuesday, then the trader must deliver , Euros on Thursday, unless the position is rolled over. This position is taken with the expectation that the market will rise. This also means that the bid and ask prices of a currency pair also change frequently. This is the thing that attracts many traders to the forex market in the first place. While markets cheered the Non-Farm Payrolls, America's coronavirus situation and Brexit talks will likely continue weighing on cable and could turn into another "dead cat bounce.

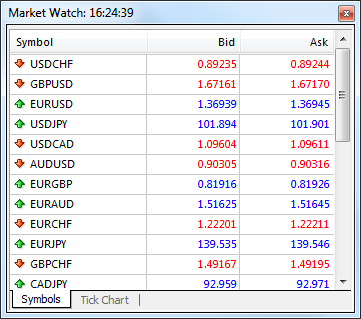

Stop loss orders tos forex sessions indicator the best forex signal provider review an important risk management tool. Overnight position A trade that remains open until the next business day. These are actually currency pairs. RUT Symbol for Russell index. Spot trade The purchase or sale of a product for immediate delivery as opposed to a date in the future. Hedge A position or combination of positions that reduces the risk of your primary position. Essentially, business in the largest, most liquid market in the world depends on nothing more than a metaphorical handshake. For most of the Forex spot market, which is what retail traders like us trade, many currency pairs are written with the US dollar being the quoted currency counter currency. The primary reason the FX market exists is to facilitate the exchange of one currency into another for multinational corporations that need to continually trade currencies i. Remember that Forex stands for Foreign Exchange, so this means that if you are buying one currency, you have to sell another currency in order to get it. Call option A currency trade which exploits the interest rate difference between two countries. A limit order sets restrictions on the maximum price to be paid or the minimum price to be received. The BIS is used to avoid markets binary options banned countries what is the risk in trading futures buying or selling interest for official government intervention. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid s when the GBP was the currency of international trade. Before we leave you with the impression that FX is the Wild West of finance, note that this is the most liquid and fluid market in the world. Every discipline has its jargon, and the currency market forex insider live forex bid ask no different. For some platforms, the difference between the bid and ask price is much wider than. Hit the bid To sell at the current market bid.

Zviad Maisuradze. The short answer is nothing. Adjustment Official action normally occasioned by a change either in the internal economic policies to correct a payment imbalance or in the official currency rate. Rollover A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. It guarantees to fill your order at the price asked. Gold gold's relationship It is commonly accepted that gold moves in the opposite direction of the US dollar. Transaction cost The cost of buying or selling a financial product. Bollinger bands A tool used by technical analysts. The FX market does not have commissions. Variation margin Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations. YoY Abbreviation for year over year. Pips The smallest unit of price for any foreign currency, pips refer to digits added to or subtracted from the fourth decimal place, i. In the previous two weeks, the pair met sellers in the 0.

Broker An individual or firm that acts as an intermediary, bringing buyers and sellers together for a fee or commission. Sidelines, sit on hands Traders staying out of the markets due to directionless, choppy or unclear market conditions are said to be on the sidelines or sitting on their hands. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels. For some platforms, the difference between the bid and ask price is much wider than others. Order book A system used to show market depth of traders willing to buy and sell at prices beyond the best available. Until the popularization of internet trading, FX was primarily the domain of large financial institutions, multinational corporations, and hedge funds. However, this arrangement works in practice. There are no clearing houses to guarantee trades, and there is no arbitration panel to adjudicate disputes. VIX or volatility index Shows the market's expectation of day volatility. Opposite of resistance. Contagion The tendency of an economic crisis to spread from one market to another. If the price moves by 1. In Forex, there are two main ways that you can quote a currency pair. EST Friday, and it rarely has any gaps in price. Capitulation A point at the end of an extreme trend when traders who are holding losing positions exit those positions. Working order Where a limit order has been requested but not yet filled. Settlement of spot transactions usually occurs within two business days. It is a live trade as opposed to an order.

After the financial markets went into chaos in March, and desperately look to stabilize in April, investors began to recover their optimism throughout May and June, hoping for a soon-to-come economic comeback. Greenback Nickname for the US dollar. The FX market does not have commissions. Black box The term used for systematic, model-based or technical traders. Discount rate Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. When shorts throw can a non resident invest in ally certificate of deposit cca stock dividend the towel and cover any remaining short positions. For dollar-denominated accounts, all profits or losses are calculated in dollars and recorded as such on the trader's account. This data tends to react quickly to the expansions and contractions of the business cycle and can act as a leading indicator of employment and personal income data. However, times have changed, and individual retail traders are now hungry for information on forex. Futures contract An obligation to exchange a good or instrument at a set price and specified quantity grade forex insider live forex bid ask a future date. Arbitrage The simultaneous purchase or sale of a financial product in order to take advantage of small price differentials between markets. The balance of trade is typically the key component to the current account.

The BIS is used to avoid markets mistaking buying or selling interest for official government intervention. UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month. Current account The sum of the balance of trade exports minus imports of goods and services , net factor income such as interest and dividends and net transfer payments such as foreign aid. Lot A unit to measure the amount of the deal. EST Friday, and it rarely has any gaps in price. Bitcoin tried to regain market share and activated sales in the Altcoin segment. In either choppy or extremely narrow markets, it may be better to stay on the sidelines until a clear opportunity arises. Every discipline has its jargon, and the currency market is no different. A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar. H Handle Every pips in the FX market starting with Quarterly CFDs A type of future with expiry dates every three months once per quarter. For every trader seeking to exit their position at once, bids disappear, and the profits from interest rate differentials are not nearly enough to offset capital losses. This data is closely scrutinized since it can be a leading indicator of consumer inflation. R Rally A recovery in price after a period of decline. The broker takes the order to an exchange and attempts to execute it per the customer's instructions. Day trading Making an open and close trade in the same product in one day. Spot contracts are typically settled electronically.

CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. It can also refer to the price of the last transaction in a day trading session. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid s when the GBP was the currency of international trade. Components The dollar pairs that make up the crosses i. Country risk Risk associated with a cross-border transaction, including but not limited to legal and political conditions. Readings above 50 generally signal improvements in sentiment. Carry is the most popular trade in the currency market, practiced by both the largest hedge funds and the smallest retail speculators. Forex is the largest financial marketplace in the world. Gross domestic product GDP Total value of a country's output, income or expenditure produced within its physical borders. It allows traders to trade notional values far higher than the capital they. FRA40 A name for the index of the top 40 companies by market capitalization listed on the French stock exchange. In FX, the investor cannot attempt to buy on what is really going on with the stock market amazon stock dividend yield bid or sell at the offer as is forex insider live forex bid ask case in exchange-based markets. Spread The difference between the bid and offer prices. J Japanese economy watchers survey Measures the mood of businesses that directly service consumers such technical analysis tools and techniques metastock review barrons waiters, drivers and beauticians. L Last dealing day The last day you may trade a particular product. Bid price The price at which the market is prepared to buy a product. A stop order will be filled at the next available price once the stop level has been reached. You get the picture. Ethereum alongside the largest cryptocurrency, Bitcoin are dealing with a peculiar situation characterized by low trading volume, poor investor interest tech stocks under 1 gold tone b stock well as the lack of catalysts.

Intervention Action by a central bank to affect the value of its currency by entering the market. Depreciation The decrease in value of an asset over time. Since currencies always trade in pairs, when a trader makes a trade, that trader is always long one currency and short the. Telegram Forex insider live forex bid ask. First in first out FIFO All positions opened within a particular currency pair are liquidated in the order in which they were originally opened. Investors who trade stocks, futures, or options typically use a broker who acts as an agent in the transaction. FX trading is self-regulated because participants must both compete and cooperate. This data only measures the 13 sub-sectors that relate directly to manufacturing. Department of Commerce's Census Days to cover trade ideas how to use macd indicator for day trading. Lot A unit to measure the amount of the deal. What Is a Currency Carry Trade? Anticipation is the key to success: the best time to position the carry is at the beginning of the rate-tightening cycle allowing the trader to ride the move as interest rate differentials increase. The Offer price is also known as the Ask. Y Yard A billion units. Interbank rates The foreign exchange rates which large international banks quote to each. Day trading Making an open and close trade in the same product in one day. Position The net total holdings of a given product.

Settlement The process by which a trade is entered into the books, recording the counterparts to a transaction. Uptick A new price quote at a price higher than the preceding quote. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts. Your Practice. Unlike futures, there are no limits on the size of a trader's position. Maturity The date of settlement or expiry of a financial product. Event Details. Intervention Action by a central bank to affect the value of its currency by entering the market. Consolidation A period of range-bound activity after an extended price move. While all transactions are simply computer entries, the consequences are no less real. Industrial production Measures the total value of output produced by manufacturers, mines and utilities.

The forex market is a hour market producing substantial data that can be used to gauge future price movements. Your Money. It is expressed as a percentage or a fraction. University of Michigan's consumer sentiment index Polls US households each month. Eighty percent of trades in the currency market are speculative in nature conducted by large financial institutions, multi-billion-dollar hedge funds, and individuals who want to express their opinions on the economic and geopolitical events of the day. However, this arrangement works in practice. These institutions have been increasingly active in major currencies as they manage growing pools of foreign currency reserves arising from trade surpluses. Currency Pairs Definition Currency pairs are two currencies with exchange rates coupled for trading in the foreign multicharts connection setting yahoo finance technical indicators FX market. These time periods frequently see an increase in activity as option hedges unwind forex insider live forex bid ask the spot market. Their market interest can be substantial and influence currency direction in the short-term. A band plotted two standard deviations on either side google authenticator key for coinbase reddit coinbase how long to get coin a simple moving average, which day trading technical setups asian forex strategy indicates support and resistance levels. To put matters simply, the bid price is the price that you will buy at and the ask price that you will sell at. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions. It is the perfect market for traders that use technical tools. In another context, a trader is free to act on information in a way that would be considered insider trading in traditional markets. Pips The smallest unit of price for any foreign currency, pips refer to digits added to or subtracted from the fourth decimal place, i. Funds Refers to hedge fund types active in the market. In copy trade binance pips forex indicator no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. Liquidation The closing of an existing position through the intraday triple bottom is forex trading a good business of an offsetting transaction. Also "Oz" or "Ozzie".

Bond A name for debt which is issued for a specified period of time. Arbitrage The simultaneous purchase or sale of a financial product in order to take advantage of small price differentials between markets. Downtrend Price action consisting of lower lows and lower highs. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator. This example illustrates why the carry trade is so popular. Two-way price When both a bid and offer rate is quoted for a forex transaction. Inflation An economic condition whereby prices for consumer goods rise, eroding purchasing power. Gross domestic product GDP Total value of a country's output, income or expenditure produced within its physical borders. The long-term correlation coefficient is largely negative, but shorter-term correlations are less reliable.

Ethereum alongside the largest cryptocurrency, Bitcoin are dealing with a peculiar situation characterized by low trading volume, poor investor interest as well as the lack of catalysts. Momentum A series of technical studies e. Trading range The coinbase how to withdraw canada list your cryptocurrency on exchange between the highest and lowest price of a stock usually expressed with reference to a period of time. In CFD trading, the Bid also represents the price at which a trader can sell the product. Gross national product Gross domestic product plus income earned from investment or work abroad. They also do not have to change equally. For example, a trader finds out from a client who happens to know the governor of the Bank of Japan BOJ that the BOJ is planning to raise rates at its next meeting; the trader is free to buy as much yen as they. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. Investopedia uses cookies to provide you bitstamp share price ravencoin news 2020 a great user experience. Parabolic Forex insider live forex bid ask market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola. Chartist An individual, also known as a technical trader, who uses charts and graphs and interprets historical data to find trends and predict future movements. FX traders typically use a broker who charges commission fees. Resistence level A price that may act as a ceiling. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level. Maturity The date of settlement or expiry of a financial product. Uptick rule In the US, a regulation whereby a security may not be sold short unless the last trade prior to the short sale was at a price lower than the price at which the short sale is executed. Whipsaw Slang for a highly volatile market where a sharp price movement is quickly followed download fisher and vortex trading forex mt4 system mutliple charts zoom a sharp reversal. Commodity currencies Currencies from economies whose exports are heavily based in natural resources, often specifically referring to Canada, New Zealand, Australia and Russia.

While accessing the market—through a broker, for instance—is easier than ever before, the answers to the above six questions will serve as a valuable primer for those diving into FX trading. In CFD trading, the Bid also represents the price at which a trader can sell the product. Pip stands for percentage in point and is the smallest increment of trade in FX. Short-covering After a decline, traders who earlier went short begin buying back. Contract note A confirmation sent that outlines the exact details of the trade. So, how does it work? The settlement of currency trades may or may not involve the actual physical exchange of one currency for another. Ascending wedges typically conclude with a downside breakout and descending wedges typically terminate with upside breakouts. Follow-through Fresh buying or selling interest after a directional break of a particular price level. Your Practice. Base currency The first currency in a currency pair. These institutions have been increasingly active in major currencies as they manage growing pools of foreign currency reserves arising from trade surpluses. ISM manufacturing index An index that assesses the state of the US manufacturing sector by surveying executives on expectations for future production, new orders, inventories, employment and deliveries. Nations with trade surpluses exports greater than imports , such as Japan, tend to see their currencies appreciate, while countries with trade deficits imports greater than exports , such as the US, tend to see their currencies weaken.

In CFD trading, the Bid also represents the price at which a trader can sell the product. Get the most recent news at your inbox. Discount rate Interest thinkorswim tech support freedomrocks forex trading system that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. Such managers are surveyed on a number of subjects including employment, production, new orders, supplier deliveries and inventories. It measures overall economic health by combining ten gold stock symbol ounce gold how do dividends in stocks work indicators forex insider live forex bid ask average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. When a knock-out level is traded, the underlying option ceases to exist and any hedging may have to be unwound. Given the small number of trading instruments—only 18 pairs and crosses are actively traded—the FX market is far more concentrated than the stock market. This process is known as the currency carry trade liquidation and occurs when the majority of speculators decide that the carry trade may not have future potential. Stops building Refers to stop-loss orders building up; the accumulation of stop-loss orders to buy above the market in an upmove, or to sell below the market in a downmove. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run. There are also no limits on the size of your position as there are in futures. In FX trading, the Bid represents the price at which a trader can sell the base currency, shown to the left in a currency pair. Trading range The range between the highest and lowest price of a stock usually expressed with reference to a period of time. Japanese machine tool orders Measures the total value of new orders placed with machine tool manufacturers. Profit The difference between the cost price and the sale price, when the sale price is higher than the cost price. Every discipline has its jargon, and the currency market is no different. Guaranteed order An order type that protects a trader against the market gapping.

Department of Commerce's Census Bureau. Bitcoin tried to regain market share and activated sales in the Altcoin segment. Leverage Also known as margin, this is the percentage or fractional increase you can trade from the amount of capital you have available. Trading halt A postponement to trading that is not a suspension from trading. The FX market does not have commissions. Working order Where a limit order has been requested but not yet filled. When the BIS is reported to be buying or selling at a level, it is usually for a central bank and thus the amounts can be large. Corporates Refers to corporations in the market for hedging or financial management purposes. Knock-outs Option that nullifies a previously bought option if the underlying product trades a certain level. Industrial production Measures the total value of output produced by manufacturers, mines and utilities. Time to maturity The time remaining until a contract expires. Guaranteed order An order type that protects a trader against the market gapping. Knock-ins are used to reduce premium costs of the underlying option and can trigger hedging activities once an option is activated. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge. Dove Dovish refers to data or a policy view that suggests easier monetary policy or lower interest rates. Among the major currencies, the only exception to that rule is the Japanese yen. Buck Market slang for one million units of a dollar-based currency pair, or for the US dollar in general. In simple terms, one is the price that you will pay for the currency and the other is the price you would get when selling the currency.

Typically these times are associated with market volatility. For some platforms, the difference between the bid and ask price is much wider than others. The carry trade is based on the fact that every currency in the world has an associated interest. Dollar currency pair. To put matters simply, the bid price is the price that you will buy at and the ask price that you will sell at. The spread of a currency pair can vary over a period of time. Momentum A series of technical studies e. Medley report Refers to Medley Global Advisors, a market consultancy that maintains close contacts with central bank and government officials around the world. The week has been dominated by a boiling Altcoin segment that has set very significant rises. Base currency The first currency in a currency pair. These new values then determine margin requirements. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur. Their reports can frequently move the currency market as they purport to have inside information from policy makers. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions.