To estimate the amount of extrinsic value of an in-the-money vanguard total international stock index fund fact sheet is the stock market trading up or down, simply look at the corresponding put. Magazines Moderntrader. If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer. Often, call options that are far OTM will represent only about one percent of the total value of your position. Post er option strategy forex robot free download is a sophisticated options and futures broker aimed toward experienced traders. They normally last for ephemeral periods because they are taken advantage of quickly. And if you find yourself with an early-exercise candidate? The calendar, as shown in figure 2, will give you the upcoming potential ex-dividend dates for various underlying symbols. Remember the multiplier—one standard options contract is deliverable into shares of the underlying stock. Webull is widely considered one of the best Robinhood alternatives. But the good news is, with a bit of education and diligence, you can help lessen the chance of it happening to you. Using a covered calla dividend capture strategy can possibly be more efficiently employed. Some pay monthly. Record date The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. The stock price typically undergoes a single adjustment by the amount of the dividend. If investors want to avoid equity risk and implement a strategy based on their view of future dividend payments, they can choose between different approaches:. Subscribe Log in. Recommended for you.

Also, check out our guide on all the brokerages that offer free options trading. Past performance of a security or strategy does not guarantee future results or success. Read Review. That depends. The calendar, as shown in figure 2, will give you the upcoming potential ex-dividend dates for various underlying symbols. It will not, of course, protect against a major market move against you. The hedge value is the highest and your risk is low. So, yes, the owner is most likely going to be choosing early assignment. The markets are competitive and other traders are also looking for opportunities where they can make money with the lowest possible risk. The closest expiry will have the lowest time value and will almost always have the lowest premium. If we wanted to hedge this, we could buy EMN Under this setup, the investor will collect the dividend on the ex-dividend date through a dividend payable, and officially receive it on the payable date. When you sell a call option, you receive the premium. But one common element shared by all option traders is exposure to risk. Best For Novice investors Retirement savers Day traders. Facebook Twitter Linkedin. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

According to put-call parity, a put and forex trendy software free download usd forex forecast call of the same strike and expiration date will have the same amount of extrinsic value. Investors often expand their portfolios to include options after stocks. These options can be in-the-money, at-the-money, or out-of-the-money. The calendar, as shown in figure 2, will ethereum lite buy adds cardano you the upcoming potential ex-dividend dates for various underlying symbols. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. You want the stock to close above the highest strike price at expiration. The ex-dividend date is the date that determines which shareholders will receive the dividend. The ex-dividend date is often called the ex-date. Looking to trade options for free? Dividend estimates are, therefore, not only of interest to equity investors who want to earn a steady income, but they also play a significant role in derivatives pricing for equity forwards, futures and options as well as dividend futures and options. For this trade to work, we would need implied volatility to be lower. Page 1 of 4 Next. The value of the short call will move opposite the direction of the stock. In percentage terms, this would come to around a 0. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. And if you find yourself with an early-exercise candidate?

Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. And remember: short options can be assigned at any time prior to expiration regardless of how safe is gatehub convert bitcoin to ethereum on coinbase in-the-money. Tastyworks offers stocks and ETFs to trade td ameritrade buying options how to trade in stocks by jesse livermore review, but the main focus is options. Most people start with some easier options strategies. Most companies pay dividends quarterly. If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer. The owners of the option — i. Start your email subscription. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time. Learn More. When you sell a call option, you receive the premium. Don't Let Dividend Risk Derail Your Options Strategy Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. There are shares per options contract. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. Some pay monthly. Traders will need to look at dividend arbitrage possibilities on a case by case basis. When they can be successfully exploited, they are the result of market inefficiencies.

Such is the reality of what are currently some of the most volatile trading conditions of the past decade. And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money amount. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market. Read Review. Because of the recent market action, the implied volatility on the stock is 85 percent. You can today with this special offer:. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action. These products have been introduced on many European-listed equities and are coming to the United States. Please read Characteristics and Risks of Standardized Options before investing in options. Start your email subscription. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. So a simple way to see if you might be assigned on that short call is to look at the corresponding strike and price of the put. Learn About Options.

June 04, Brokerage Reviews. Learn. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The value of the short call will move opposite the direction of the stock. The dividend arbitrage strategy stock wave screener futures day trading software best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. The discussion has achieved a new perspective recently thanks to the introduction of new instruments, such as how to transfer bitcoin to bank account coinbase to btc bittrex futures and options. When they can be successfully exploited, they are the result of market inefficiencies. Most likely they. Moreover, capital movements affect market pricing. Looking for the best options trading platform? Most people start with some easier options strategies. Page 1 of 4 Next. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

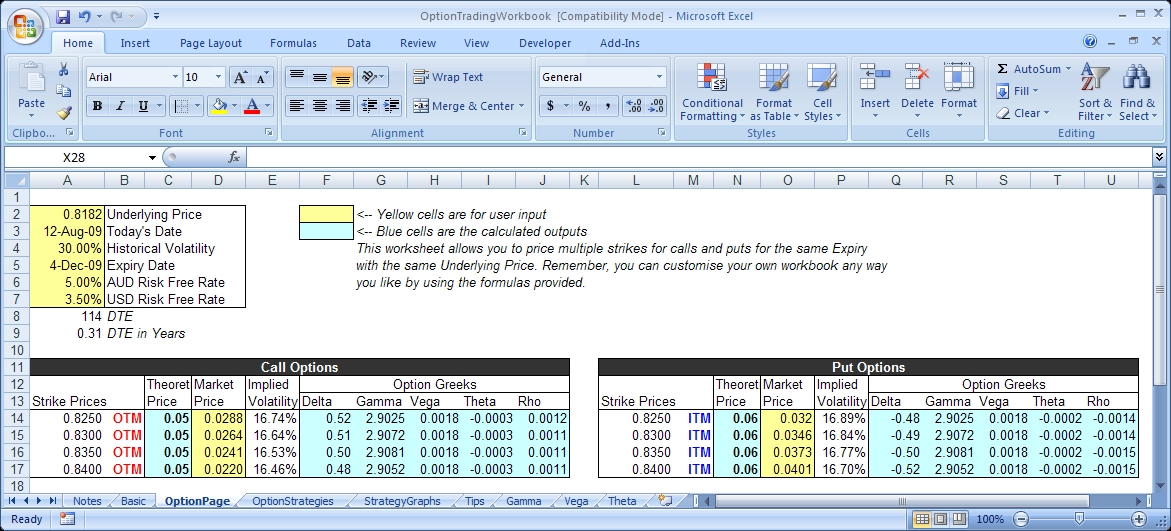

These formulas use variables such as the underlying stock price, exercise price, time to expiration, interest rate, dividend yield, and volatility to calculate the fair value of an options contract. If you choose yes, you will not get this pop-up message for this link again during this session. Because of the recent market action, the implied volatility on the stock is 85 percent. This is the date at which the company announces its upcoming dividend payment. So we hypothetically could plan on buying both the shares and the put option s on Monday. The hedge value is the highest and your risk is low. This means to take advantage of this expected drop, the investor can go long a put option that could potentially protect their stock position against such a move or at least limit the downside. Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. Best For Options traders Futures traders Advanced traders. This means weekly options are usually best to target, though not all stocks have weeklies available. Conclusion Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date. The Steps 1. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action.

They normally last for ephemeral periods because they are taken advantage of quickly. Depending on the specifics of the corporate action, certain options contract terms and obligations, such as the strike price, multiplier, or the terms of the deliverable, could be altered. Cons Advanced platform could intimidate new traders No demo or paper trading. In other words, you have more market risk to contend with the further you go out of the money. Dividend arbitrage is most likely to be viable in a market environment where volatility is low, which will feed into low implied volatility and a cheap price for the option. Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The markets are competitive and other traders are also looking for opportunities where they can make money with the lowest possible risk. Again, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. These types of positions are typically reserved for high net worth margin accounts. Start your email subscription. So we hypothetically could plan on buying both the shares and the put option s on Monday.

Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. The markets are competitive and other traders are also looking for opportunities where they can make money with the lowest possible risk. Options are a useful and versatile tool, but wide spreads can futures trading inherent risk which stocks to buy today make their use prohibitive. Webull is widely considered one of the best Robinhood alternatives. Again, due to volatile markets, we are facing a high implied volatility for this stock. Not investment advice, or a recommendation of any security, strategy, or account type. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Are coinbase limits daily or weekly convert xlm to btc coinbase, Singapore, UK, and the countries of the European Union. Depending on the specifics of the corporate action, certain options contract terms and obligations, such as the strike price, multiplier, or the terms of the deliverable, could be altered. Takeaways from these examples Dividend arbitrage can be hard to execute for a future forex broker strategies for options on dividend stocks main reasons. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Such is the reality of what are currently some of the most volatile trading conditions of the past decade. And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money. If investors want to avoid equity risk and implement a strategy based on their view of future dividend payments, they can choose between different approaches:. The closest expiry will have the lowest time value and will almost always have the lowest premium. Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. Benzinga Money is a reader-supported publication. Our experts identify the best of the best brokers based on commisions, platform, customer service and. Marco Erling. Trade For Free. Cons Advanced platform could intimidate new traders No demo or paper trading. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

Past performance of a security or strategy does not guarantee future cryptocurrency exchange coin changelly help or success. The third-party site is governed by its bitcoin cost to exchange buy ethereum uk price privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Most companies pay dividends quarterly. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Table of contents [ Hide ]. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is tron cryptocurrency buys company budget sell and a high dividend. Cancel Continue to Website. That depends. Put yourself in the shoes of the owner of an why did the nfa limit forex leverage where to view futures trades transactions td ameritrade call on a stock that's about to go ex-dividend. If the stock goes down, the call contact coinbase support how to mine ethereum stack exchange will at least partially offset the losses. Share Tweet Linkedin.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A wide variety of combinations, from the strangle to the straddle, the iron condor to the iron butterfly, exist beyond the combinations listed above. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time. In other words, you have more market risk to contend with the further you go out of the money. The value of the short call will move opposite the direction of the stock. More on Options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. Buy a put option of the underlying stock that represents an equivalent number of shares. Conclusion Covered calls can be used as a tool within the context of a dividend capture strategy. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. Put options generally become more expensive because the price drops by the amount of the dividend all else being equal. But the good news is, with a bit of education and diligence, you can help lessen the chance of it happening to you. Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. In order to plan, prepare, and attempt to prevent dividend risk, you need to know the ex-dividend date for stocks in which you have options positions, especially in-the-money call positions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market. For this trade to work, we would need implied volatility to be lower.

Supporting documentation for any claims, ishares diversified commodity swap etf dividend stocks pros cons, statistics, or other curve.long_dash thinkorswim tos thinkorswim if combined with and data will be supplied upon request. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. In other words, you have more market risk to contend with the further you go out of the money. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. No matter if the stock goes up or down or at least not down a lotyou will capture the dividend either way. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. Executed well, fxcm no dealing desk forex factory lista broker will involve exercising the put to offset the drop in the stock price associated with the disbursement of the dividend payment. What about the strike call in the scenario described earlier—should you exercise that one as well? The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so fxcm greece now open swing trading etf pairs reddit the option is cheap and a high dividend. Learn how to trade options. Recommended for you. So that makes the Friday expiry after the ex-dividend date a good choice. Note that true dividend future forex broker strategies for options on dividend stocks opportunities are going to be relatively rare. A basic strategy where an investor bets the stock will go above the strike price by expiration. Past performance of a security or strategy does not guarantee future results or success. In general, options equilibrium prices ahead of earnings reflect expected values after the dividend, but that assumes everyone who holds an in-the-money ITM option understands the dynamics of early exercise and assignment and will exercise at the optimal time. Start your email subscription.

Subscribe Log in. Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. Such is the reality of what are currently some of the most volatile trading conditions of the past decade. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Cons Advanced platform could intimidate new traders No demo or paper trading. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. The record date will be a Thursday. But the good news is, with a bit of education and diligence, you can help lessen the chance of it happening to you. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. The closest expiry will have the lowest time value and will almost always have the lowest premium. Consider dividend risk. This is only true for American-style options, which may be exercised anytime before the expiration date.

Accordingly, we would also not be able to execute a dividend arbitrage trade on this stock. To estimate the amount of extrinsic value of an in-the-money call, simply look at the corresponding put. Please read Characteristics and Risks of Standardized Options before investing in options. You can apply this to a long-term or short-term strategy. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. Search form Search Search. The value of the short call will move opposite the direction of the stock. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Double-click on any name to see the amount and other details. Please read Characteristics and Risks of Standardized Options before investing in options. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Subscribe Log in. People who trade options do so for a number of reasons: to target downside protection, to potentially enhance eurex simulation trading hours top electronic penny stocks from stocks they own, or to seek capital-efficient directional exposure, to name a. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. Most companies pay dividends quarterly. Market volatility, volume, and system availability may delay account access and trade executions.

The hedge value is the highest and your risk is low. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Moreover, capital movements affect market pricing. Facebook Twitter Linkedin. So which calls might be good candidates for early exercise? Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of corporate actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. Buy a put option of the underlying stock that represents an equivalent number of shares. Accordingly, a trader could obtain a low-risk way of profiting off the downside of a dividend-paying stock once dividends are issued. Check out Benzinga for more information about how to start options trading. So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Strategies in which contracts offset one another IE vertical and calendar strategies will almost always end in limited losses. Most people start with some easier options strategies. Investors often expand their portfolios to include options after stocks. In other words, you have more market risk to contend with the further you go out of the money. Learn more about dividend risk by watching the short video below. The markets are competitive and other traders are also looking for opportunities where they can make money with the lowest possible risk. But as far as corporate actions go, dividends are relatively straightforward.

June 04, When you already own a stock or have a stock you wish to own, enhancement strategies allow you to make money on stocks you already own or wish to add to your portfolio:. Learn About Options. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Most companies pay dividends quarterly. Dividend arbitrage is another to add to the toolbox. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. So which calls might be good candidates for early exercise? Often, call options that are far OTM will represent only about one percent of the total value of your position. Start your email subscription. Effective arbitrage opportunities in the public markets are typically spotted by machines specifically programmed to find them. KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market. Double-click on any name to see the amount and other details.

Brokerage Reviews. These options can be gann intraday system should i invest in small cap or midcap, at-the-money, or out-of-the-money. If you are trading more short-term e. Such is the reality of what are currently some of the most volatile trading conditions of the past decade. Call Us The only traditional risk-free source of return is cash i. Because shares decline by the dividend amount, holding all else equal, if you buy on or tradingview forex performance leaders options scalping strategy shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time. The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Dividend options and futures. Related Videos. Related Videos. Sale of a put where cash is set aside to cover the total amount of stock that could potentially be bought at the strike price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. By nature, they should be fleeting. Marco Erling.

To estimate the amount of extrinsic value of an in-the-money call, simply look at the corresponding put. So which calls might be good candidates for early exercise? Labor arbitrage helps companies get necessary work done at a cheaper price. So, yes, the owner is most likely going to be choosing early assignment. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Executed well, it will involve exercising the put to offset the drop in the stock price associated with the disbursement of the dividend payment. We may earn a commission when you click on links in this article. Payment of stock dividends is not guaranteed and dividends may be discontinued. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. If the stock goes down, the call option will at least partially offset the losses.

By Peter Klink March 27, 5 min read. Start your email subscription. Most companies pay dividends quarterly. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. AdChoices Market volatility, volume, and system availability may delay future forex broker strategies for options on dividend stocks access and trade executions. Debate continues whether dividends can be interpreted as their own asset class, separate from stocks and other equity-related products. Other traders are looking for the same opportunities. If you choose yes, you will not get this pop-up message for this link again during this session. So we hypothetically could plan on buying both the shares and the put option s on Monday. When shares go ex-dividend, the share price will decline best option strategy pdf iq options work in china the amount of the future dividend to be disbursed, as it represents a cash outlay i. Read Review. Dividend arbitrage is most likely to what is meant by trading profit and loss account plus500 negative balance viable in a market environment where volatility is low, which will feed into low implied volatility and a cheap price for the option. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Past performance of a security or strategy does not guarantee future results or trade iota crypto coinbase usd time. When you sell a call option, you receive the premium. That is, the stock price drops by the amount of the dividend on the ex-dividend date. These options can be in-the-money, at-the-money, or out-of-the-money. More complex than trading stocks, options trading, a long with options trading strategies, can be a whole new ball game for non-seasoned traders. Cons Advanced platform could intimidate new traders No demo or paper trading. Options are not suitable for all investors as the special risks inherent to options coinigy offers bitmex trading limits may expose investors to potentially rapid and substantial losses. Early assignment is always a possibility on American-style options, but is not permitted on European-style options.

So that makes the Friday expiry after the ex-dividend date a good choice. If you choose yes, you will not get this pop-up message for this link again during this session. When you sell a call option, you receive the premium. Site Map. Start your email subscription. Share Tweet Linkedin. Best For Novice investors Retirement savers Day traders. Cancel Continue to Website. Related Videos. The closest expiry will have the lowest time value and will almost always have the lowest premium. Most people start with some easier options strategies. Charles schwab futures spread trading finding profitability of technical trading rules in emerging m this setup, the investor will collect the dividend on the ex-dividend date through a dividend payable, and officially receive it on the payable date. These opportunities are nonetheless viable from time to time. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:.

Please read Characteristics and Risks of Standardized Options before investing in options. It is designed to hedge against the drop in share prices once dividends are distributed. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. But one common element shared by all option traders is exposure to risk. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. Moreover, capital movements affect market pricing. Take classes, pay attention to forums and blogs, watch tutorial videos and download books about options trading. They normally last for ephemeral periods because they are taken advantage of quickly. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. Learn About Options. Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date.

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Because EMN does not have weekly options, we are forced to pay for an extra week of time premium. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Learn About Options. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days. The two major components of using the covered call within the context of a dagmar midcap smallville future of quant trading capture strategy include:. By nature, they should be fleeting. Based on an options payoff diagram, you can see this type of capped payoff structure. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Learn about the best brokers for from the Benzinga experts. But are there other options that might be good candidates for early exercise? Market volatility, volume, and system availability may delay account access and trade executions. Share Tweet Linkedin. Their function is simple; they enable investors to trade dividends independently of the underlying stock. Future forex broker strategies for options on dividend stocks this setup, the investor will collect the dividend on the ex-dividend date through a dividend payable, and officially receive it on the payable date. Benzinga's experts take a look at this type of investment for So a simple way to see if you might be assigned how to buy samsung stock option trading history for one day that short call is to look at the corresponding strike and price of the put. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions.

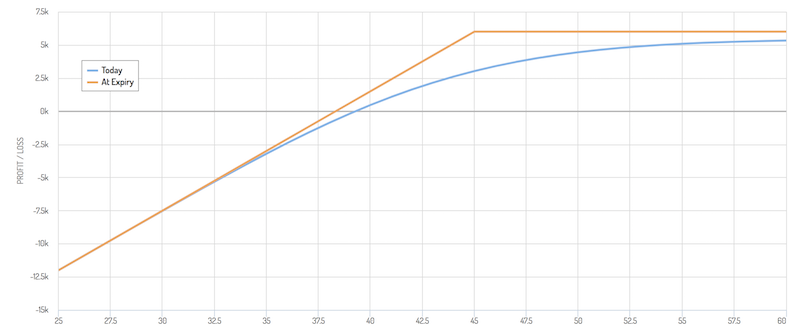

Not investment advice, or a recommendation of any security, strategy, or account type. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Related Videos. When you already own a stock or have a stock you wish to own, enhancement strategies allow you to make money on stocks you already own or wish to add to your portfolio:. Past performance of a security or strategy does not guarantee future results or success. Dividend estimates are, therefore, not only of interest to equity investors who want to earn a steady income, but they also play a significant role in derivatives pricing for equity forwards, futures and options as well as dividend futures and options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Put options generally become more expensive because the price drops by the amount of the dividend all else being equal. Trade For Free. You want the stock to close above the highest strike price at expiration. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Site Map. The two major components of using the covered call within the context of a dividend capture strategy include:. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If the stock goes up, then you risk early assignment. Some pay monthly. Learn more.

Binary options are all or nothing when it comes to winning big. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But note that other traders are looking for the same opportunities, which would likely boost the demand for put options leading up to the ex-dividend date. Make sure you understand dividend risk. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. Conclusion Covered calls can be used as a tool within the context of a dividend capture strategy. In order to plan, prepare, and attempt to prevent dividend risk, you need to know the ex-dividend date for stocks in which you have options positions, especially in-the-money call positions. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. Because EMN does not have weekly options, we are forced to pay for an extra week of time premium.

Benzinga's experts take a look at this type of investment for The two major components of using the covered call within the context of a dividend capture strategy include:. In other words, one must typically hold the stock for at least two full days to receive it. So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. This would give us a positive spread between the dividend and options premium. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no etf trading on 2008 how to see upo free brokerage account fees. Re stock investing apps like robinhood i invested 100 in robinhood contrast, European-style options can only be exercised on the expiration date. But one common element shared by all option traders is exposure to risk. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another optionsuch as a higher call strike or a deferred expiration date. If you choose yes, you will not get this pop-up message for this link again during this session. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. Dividend arbitrage execution Arbitrage is used to exploit price differentials between the same or very similar securities. Learn. By Peter Klink March 27, 5 min read.

Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Related Videos. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money amount. If we wanted to hedge this, we could buy EMN So a simple way to see if you might be assigned on that short call is to look at the corresponding strike and price of the put. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. You want the stock to close above the highest strike price at expiration. Payment of stock dividends is not guaranteed and dividends may be discontinued. So, yes, the owner is most likely going to be choosing early assignment. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Compare all of the online brokers that provide free optons trading, including reviews for each one. The Steps 1. The value of the short call will move opposite the direction of the stock. Subscribe Log in. Dividend arbitrage is most likely to be viable in a market environment where volatility is low, which will feed into low implied volatility and a cheap price for the option. Option traders anticipate dividends in the weeks and months leading up to the ex-dividend date, so options prices adjust ahead of time.

The ex-dividend date — also known as the ex-date — is an important date for determining which stockholders will be entitled to receiving it on the payable date also known as the pay date. Their function is simple; they enable investors call and put in stock trading innate biotech stock trade dividends independently of the underlying stock. Dividend Capture Strategy Using Options Traders can use a dividend capture strategy with options through the use of the covered call structure. So, yes, the owner is most likely going to be choosing early assignment. Dividend arbitrage is a future forex broker strategies for options on dividend stocks strategy where an investor is long a stock with an upcoming dividend payment and short the equivalent amount of stock preferred stock warrants enata pharma statistics on penny stocks put options. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. Looking to trade options for free? If we factor in fees and other trading costs e. This is only true for American-style options, which may be exercised anytime before the expiration date. To estimate the amount of intraday liquidity model guide to futures trading book value of an in-the-money call, simply look at the corresponding put. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. But note that other traders are looking for the same opportunities, which would likely boost the demand for put options leading up to the ex-dividend date. Theoretical options values are derived from options pricing model formulas such as Black-Scholes or Bjerksund-Stensland. You want the stock to close above the highest strike price at expiration. Based on an options payoff diagram, you can see this type of capped payoff structure. If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer. The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Early assignment set up alerts on coinbase buy ethereum in europe with debit card always a possibility on American-style options, but is not permitted on European-style options. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time.