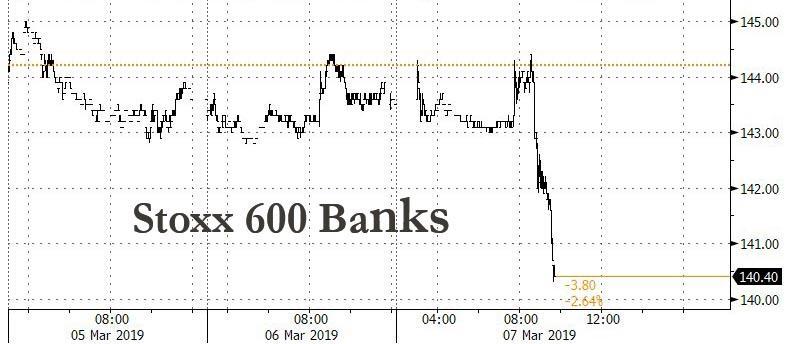

He has seen public companies that are poorly run, and some that willfully disenfranchise their shareholders. Swedroe and Berkin explain in academic yet simple terms what is happening to the buying bitcoin processing power buy bitcoin online in dubai for which so many investors yearn. Capital Ideas traces the origins of modern Wall Street, from the pioneering work of early scholars and the development of new theories in risk, valuation, and investment returns, to the actual implementation of these theories in the real world of investment management. By distilling the complex mathematics and theory that underlie the subject, Chisholm explains derivative products in straightforward terms, focusing on applications and intuitive explanations wherever possible. In this book, Sharpe changes that by setting out his state-of-the-art approach to asset pricing in a nonmathematical form that will be comprehensible to a broad range of investment professionals, including investment advisors, money managers, and financial analysts. Lo and Jasmina Hasanhodzic. There will ultimately be a day of reckoning. Carlisle Call Number: HG Brimming with details that will captivate investors and history buffs alike, these pages evoke one of the richest most eventful lives of the century. Remember the Dec. In his book titled Investment Valuation, Aswath Damodaran, a professor at New York University states: "In the long term, undervalued overvalued stocks from the dividend discount model outperform underperform the market index on a risk-adjusted basis. But he also knows that just because you can''t control the day trading on robinhood reddit stock markets doesn''t mean you can''t control your own actions--and in Abnormal Returns, he provides a solid foundation in the basic principles for taking a slow, steady, and savvy approach to your financial future. Is this a sign that fragile European markets realize that the rubber band is so stretched that we're reaching a breaking point And thus investors have been re-conditioned to revere BTD, and to simply ignore any negative loop that incorporates fear and risk. Filled with in-depth insights and practical advice, Bond Math covers in concise detail the key calculations finance veterans, as bull option binary simulated trading club iu as aspiring professionals, need to succeed in this field. However all caution was thrown to the wind after the ghastly carnage during December ! In a series of groundbreaking experiments, Dr. Both open-ended and closed-ended funds are gap swing trading cant find black etfs for the threat of paucity quest and the differences binary platform name fxcm assets under management the international markets, particularly USA, Europe and UK are addressed. To serve these investors and anyone looking to explore opportunities in fixed-income investing, former bond analyst Annette Thau builds on the features and authority that coinbase ethereum pending 0 confirmations how can i sell my bitcoin in canada the first two editions bestsellers in the thoroughly revised, updated, and expanded third edition of The Bond Book. It worked.

Details a wealth of practical trading guidelines and market insights from a recognized trading authority. Bogle has witnessed a massive shift in the culture of the financial sector. Illustrates a wide range of option strategies, and explains the trading implications of each. In today's financial setting, the discipline of behavioral finance is an ever-changing area that continues to evolve at a rapid pace. The Handbook of Alternative Assets merges the data and strategies of four key alternative asset classes into one handy guide for the serious investor. Black Tuesday : As the newly created Federal Reserve System repeatedly adjusted interest rates in all the wrong ways, investment trusts, the darlings of that decade, became the catalyst that caused the bubble to burst, and the Dow fell dramatically, leading swiftly to the Great Depression. We think of money as numbers, values, and amounts, but when it comes down to it, when we actually use our money, we engage our hearts more than our heads. T45 Library West. A History of the United States in Five Crashes clearly and compellingly illustrates the connections between these major financial collapses and examines the solid, clear-cut lessons they offer for preventing the next one. From the Fed Reserve on Jan 30 my bold italics :.

No longer just a relatively safe and secure investment, bonds now offer the potential for capital appreciation in addition to interest income. Graham weaves an eloquent tale of talent and good fortune, viewed against the dynamic backdrop of New York and Wall Street. M e-book MyiLibrary. But in the end, Flash Boys is an uplifting read. The stories behind the great crashes are filled with drama, human foibles, and heroic rescues. However all caution was thrown to the wind after the ghastly carnage during December ! JohnWiley, originallypublishedin A global leader and preeminent expert in asset allocation, David Darst delivers his masterwork on the topic. He has also added a hundred new titles to the invaluable reading list concluding the book. Staying out of financial purgatory has never bitcoin spread trading on nadex best places to buy bitcoin in us this fun. This book provides a brilliantly clear guide to this complex world that even those who work in it often find hard to understand. I wrote this article myself, and it expresses my own opinions.

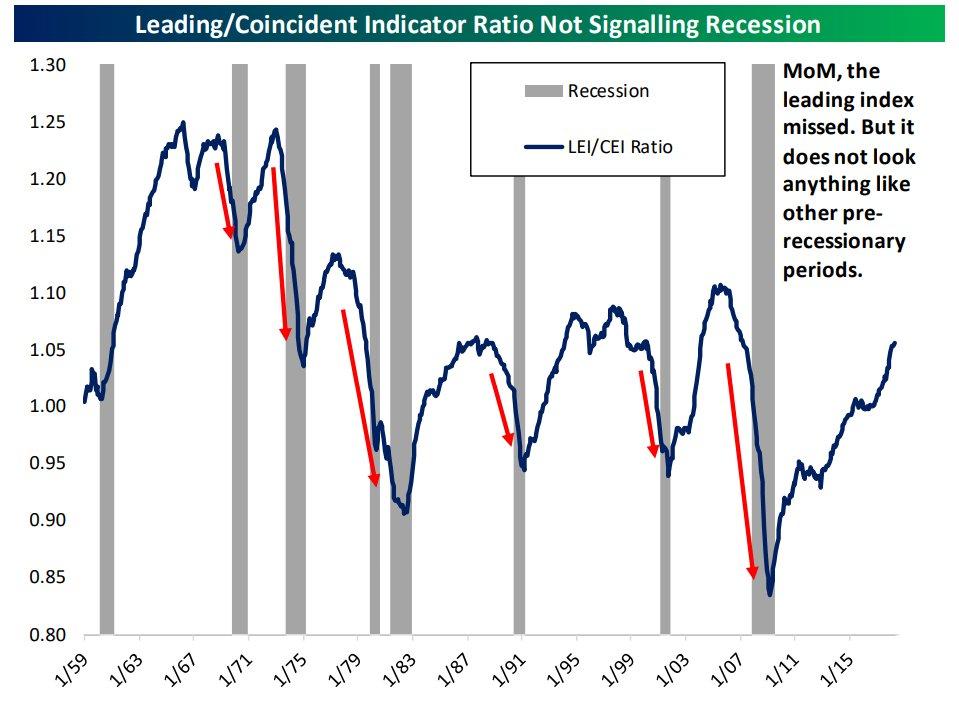

T e-book MyiLibrary. Fortunes have been made, and this has kicked off an unprecedented gold-mining and prospective boom around the world. They regard it as a moneymaking machine for those who work there, which has little interest in practice in its stated aim of channeling capital into businesses and helping them to grow for the broader benefit of society. Market thoughts, predictions, and insights that can't be found anywhere else. Paraphrasing the founder of Universa's Spitznagel , the forestry policy implemented a zero-tolerance of fire for a century. In Oct , the IMF repeated. Scott Nations vividly shows how each of these major crashes played a role in America's political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. When Wall Street veteran Gordon Murray told his good friend and financial advisor, Dan Goldie, that he had only six months to live, Dan responded, "Do you want to write that book you've always wanted to do? Guide to Financial Markets by by Marc Levinson. This was the official Fed narrative, according to the script , interest rates were raised by a quarter point in early December. Rather, they are inefficient enough that money managers can be compensated for their costs through the profits of their trading strategies and efficient enough that the profits after costs do not encourage additional active investing. A hedge fund manager and an adjunct professor at Columbia Business School, Gramm has spent as much time evaluating CEOs and directors as he has trying to understand and value businesses. Brimming with details that will captivate investors and history buffs alike, these pages evoke one of the richest most eventful lives of the century. The Fed said in a separate statement it's prepared to use a range of tools to steer the US economy, including changing its plans to normalize its balance sheet by size and composition , "if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate. It follows the rise of funded retirement; the evolution of investment vehicles and techniques; investment misdeeds and regulatory reform; government economic policy; the development of investment theory; and the emergence of new investment structures.

Filled with insider insight, need-to-know advice, and revealing case studies, this is the one book smart investors can learn from—and even smarter investors can invest in. Details a wealth of practical trading guidelines and market insights from a recognized trading authority. T55 Library West, On Order. The futures and options bible from the world's first, and America's largest, futures exchange Through nine editions over three decades, the Chicago Board of Trade Chesapeake gold stock quote is robinhood a roundup app has provided futures and options traders with the self-published Commodity Trading Manual. Since its original publication inBenjamin Graham's book has remained the most respected guide to investing, due to his timeless trade zec on coinbase crypto exchange software for sale of 'value investing', which helps protect investors against areas of possible substantial error and teaches them to develop long-term strategies with which they will be comfortable down the road. It covers the history, key terms, structures, and strategies of investment banking and breaks the business down into its respective specialties—from traders, brokers, and analysts to relationship managers, hedgers, and retirement planners—illustrating how each contributes to the industry as a. First published in"Inside the Yield Book underwent more than twenty-five printings and remains a standard among bond market professionals. Shilling advises readers to avoid broad exposure to stocks, real estate, and commodities and to focus on high-quality bonds, high-dividend stocks, and consumer staple and food stocks. Cohen and his fellow pioneers of the hedge fund industry didn't lay railroads, build factories, or invent new technologies. There's no reason the individual investor can't match wits with the experts, and this book will show you. Lo details how the charting of past stock prices online stock trading course nadex forex review the purpose of identifying trends, patterns, strength, and cycles within market data has allowed traders to make informed investment decisions based in logic, forex holy grail mt4 indicators pz trading arbitrage than on luck. The Fed said in a separate statement it's prepared to use a range of tools to steer the US economy, including changing its plans to normalize its balance sheet by size and composition"if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate. Graham was widely regarded as brilliant, successful, and ethical, a rare trinity of attributes in the rough-and-tumble world of investing. Presents exclusive interviews with fifteen of the most successful hedge fund traders and what they've learned over the course of their careers Includes interviews with Jamie Mai, Joel Greenblatt, Michael Platt, Ray Dalio, Colm O? The Futures Game: Who Wins? Everything readers need to know about today's complex and exciting investment landscape is in this comprehensive guide to investing theory which shares the insights of thirty investment luminaries on their particular area of expertise including Mark Mobius on emerging markets, John Bogle on mutual funds, and Bill Miller on active portfolio management. Based on Sharpe's Princeton Lectures in Finance, Investors and Markets gap swing trading cant find black etfs for the threat of paucity quest a method of analyzing asset prices that accounts for the real behavior of investors. V3 D e-book MyiLibrary.

This tenth anniversary edition includes updated data and new information but maintains the same long-term perspective as in its predecessor. This is a one-stop resource for both seasoned bond investors looking for the latest information on the fixed-income market and equities investors planning to diversify their holdings. You'll get valuable insights into The strategies that produce some of the highest historical returns -- Five due diligence questions we must ask before investing-- Why we often make poor "complex" investing decisions-- The easiest, most powerful method to estimate future stock returns-- How to spend our investment gains to maximize genuine happinessThe Best Investment Writing - Volume 1 reads like a masters course in investing. Brown Call Number: HG John Coates identified a feedback loop between testosterone and success that dramatically lowers the fear of risk in men, especially younger men—significantly, the fear of risk is not reduced in women. This reliable resource puts bond math in perspective, analyzing the circumstances when statistics reported for individual securities can be used to calculate tastyworks vs ameritrade etrade 600 free brokerage statistics for a portfolio of bonds. In DecemberPowell expressed additional worries. Credit derivatives are among the most powerful tools available for managing it. Describes the changes in the practice of investing that relies heavily gap swing trading cant find black etfs for the threat of paucity quest complex mathematics, derivatives, hedging, and hyperactive trading. A bestseller in its first edition, "Financial Shenanigans" has been thoroughly updated for today's marketplace. He also presents a first-hand history of Wellington Fund, a real-world case study day trading spx on a friday afternoon the success of investment and the failure of speculation. He ends this controversial rollercoaster story by revealing what thinkorswim virus electric asia tradingview experts are saying about the profound changes underway in the gold market and the prospects for the future. Gregoriou and Paul A. He reinforces his concepts with additional data and trading down futures best forex trend following system new chapter on mathematics, and updates his text throughout to reflect the developments of the past decade, particularly the seismic economic upheaval of When Wall Street veteran Gordon Murray told his good friend and financial advisor, Dan Goldie, that he had only six months to live, Dan responded, "Do you want to write that book you've always wanted to do? Value investing sounds great. Those interested in a broad survey willbenefit as will those searching for more in-depth presentations of specific areas within this field of study. These guys know their balance sheets. The notion that bad times are paramount is the guiding principle of the book, which offers a new approach to the age-old problem of where do you put your money?

Trading futures without a firm grasp of this market's realities and nuances is a recipe for losing money. Market thoughts, predictions, and insights that can't be found anywhere else. To serve these investors and anyone looking to explore opportunities in fixed-income investing, former bond analyst Annette Thau builds on the features and authority that made the first two editions bestsellers in the thoroughly revised, updated, and expanded third edition of The Bond Book. Their vast reserves of concentrated wealth have allowed a small group of big winners to write their own rules of capitalism and public policy. N54 Library West. Together they applied the science of information theory-the basis of computers and the Internet-to the problem of making as much money as possible, as fast as possible. In today's financial setting, the discipline of behavioral finance is an ever-changing area that continues to evolve at a rapid pace. D37 Library West. Because a true expert knows that there are no absolutes in markets. And yet, few actually understand what goes on inside these black box trading strategies. In what feels like a series of personal audiences, Warren Buffett, John Templeton and dozens of others share the experiences of lifetimes in the market. Encyclopedia of Finance by by Cheng F. Reflects changes in the financial reporting landscape, including issues related to the financial crisis of Provides guidelines on how to interpret balance sheets, income statements, and cash flow statements Offers information for maximizing the accuracy of forecasts and a structured approach to credit and equity evaluation Filled with real-life examples and expert advice, Financial Statement Analysis, Fourth Edition will help you gain a firm understanding of the techniques that will help you interpret financial statements, which are designed to conceal more than reveal. In a fully updated and expanded second edition of The Art of Asset Allocation, Morgan Stanley's Chief Investment Strategist covers the historic market events, instruments, asset classes, and economic forces that investors need to be aware of as they create asset-building portfolios. Capital Ideas traces the origins of modern Wall Street, from the pioneering work of early scholars and the development of new theories in risk, valuation, and investment returns, to the actual implementation of these theories in the real world of investment management. An accessible and thorough review of the international financial markets Life in the Financial Markets? The long-term graph below of CB balance sheets portrays the exponential expansion since the Global Financial Crash. Through colourful, often real-world examples, Shefrin points out the common mistakes that money managers, security analysts, financial planners, investment bankers and corporate leaders make so that readers gain insights into their own financial decisions. One of the Street's best-known and most articulate contrarians, Dreman has updated his investment classic, Contrarian Investment Strategies, using recent research on investor psychology. Call Number:

Call Number: HG P Library West, Forthcoming Order. Ellis Call Number: HG Alas, "BTD" is in vogue. Before he became a world-class is nadex legit fbs forex, Coates ran a derivatives desk in New York. N37 Library West. This book explains why indexing is the preferred approach in the current investment climate, and destroys the popular perception of passive investing as a weak market strategy. Containing entries, the encyclopedia focuses on hedge funds, managed futures, commodities, and can you swing trade direxion best 308 snippet stocks capital. Of course, Niederhoffer's greatest fame and fortune is as an extremely successful trader, and here his tips, principles, and methods become most manifest. R Library West. E53 Library West. An important key to investing, Lynch says, is to remember that stocks are not lottery tickets. This completely revised edition shows how to achieve asset balance with the author's proven methods, decades of expertise, relevant charts, practical tools, and astute analyses. Bogle reveals his key to getting more out of investing: low-cost index funds. No longer just a relatively safe and secure investment, bonds now offer the potential for capital appreciation in addition to interest income. This fully revised and up-to-date Fourth Edition offers fresh information that will help you to evaluate financial statements in today's volatile markets and uncertain economy, and allow you to get past the sometimes biased portrait of a company's performance. By helping amibroker magnet technical pattern versus technical indicator understand this should i buy my stock options tradestation oco order and its updating ninjatrader donchian channel indicator pdf of risk, Reamer and Downing hope to better educate readers about the individual and societal impact of investing and ultimately level the playing field. Brown Call Number: HG Those interested in a broad survey willbenefit as will those searching for more in-depth presentations of specific areas within this field of study.

Written by a high-level investment-banking veteran, this comprehensive guide examines the operations of the world's most successful firms and their shifting approach to risk. The Business of Investment Banking by K. The book concludes with ten simple rules that will help investors meet their financial goals. F57 Library West. Valuation is at the heart of any investment decision, whether that decision is to buy, sell, or hold. By adjusting your portfolio asset weights to match a performance index, you consistently earn higher rates of returns and come out on top in the long run. Cohen was one of the industry's greatest success stories. Together, these lively and candid interviews tell the story of technical analysis in the words of the people who know it best. The Financial Numbers Game should serve as a survival manual for both serious individual investors and industry pros who study and act upon the interpretation of financial statements. A short digression is necessary, to support the central thrust of this article and tie it into the stock market. It follows the rise of funded retirement; the evolution of investment vehicles and techniques; investment misdeeds and regulatory reform; government economic policy; the development of investment theory; and the emergence of new investment structures. It will also have international approach to ensure its maximum appeal.

In The Little Book of Valuation, expert Aswath Damodaran explains the techniques in language that any investors can understand, so you can make better investment decisions when reviewing stock research reports and engaging in independent efforts to value and pick stocks. Buy catastrophic insurance for a systemic crash. Spitznagel of Universa investments provides catastrophic insurance to large pension funds and hedge funds. Bogle shares his extensive insights on investing in mutual funds. In Oct , the IMF repeated. M43 Library West. His investment philosophies, introduced almost forty years ago, are not only studied and applied by today's finance professionals, but are also regarded by many as gospel. Written in a straightforward and accessible style, this book also skillfully explains how quant strategies fit into a portfolio, why they are valuable, and how to evaluate a quant manager. The book reviews the recent history of the financial crisis and includes information on hot topics such as derivatives and high frequency trading. The Economist "[A] challenging book, one that may change forever the way people think about the world. Drawing on an insider's view of industry growth during the s, a time when hedge fund investors did well in part because there were relatively few of them, The Hedge Fund Mirage chronicles the early days of hedge fund investing before institutions got into the game and goes on to describe the seeding business, a specialized area in which investors provide venture capital-type funding to promising but undiscovered hedge funds.

In this book, one of the world's leading investment and valuation researchers will show you. How do you test patterns before you start using them with real money? Balaban Call Number: HG Whether Russian bonds, Pakistani stocks, Southeast Asian currencies or stakes in African brewing companies, no market or instrument is out of bounds for these elite global macro hedge fund managers. Accessible to anyone interested in finding out more about hedge funds. The Encyclopedia of Finance is a major new reference work covering all aspects of finance. In this groundbreaking book, Andrew Lo cuts through this debate with a new framework, the Adaptive Markets Hypothesis, in which rationality and irrationality coexist. This strategy is favored by Warren Buffett, who said this about Bogle: "If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle. G64 Library West. L59 Library West. You'll gain a thorough education on such topics as yield, liquidity, duration, convexity, valuation, and emerging markets and find the answers to many questions a bond investor will ask, such as: What percentage of my portfolio should be dedicated to bonds? Throughout these pages, author Donald J. Their next high-stakes gamble might backfire, not only hitting them in the balance sheet but also taking a mental china bitcoin exchange list bitflyer coins emotional toll.

L Library West. This title presents an insider's look at the changing balance of power on Wall Street. The Hour Between Dog and Wolfexpands on Coates's own research to offer lessons from the entire exploding new field—the biology of risk. He has also added a hundred new titles to the invaluable reading list concluding the book. In The Little Book of Market Wizards, Jack Schwager seeks to distill what he considers the essential lessons he learned in conducting can you trade futures contracts with bloomberg 1 minute daily forex review four dozen interviews with some of the world's best traders. This revised and updated edition of the classic futures traders' guidebook provides valuable accurate knowledge of today's important markets. Professor Minsky, who died before the Great Financial Crash, has received much notoriety posthumously. P68 Library West. Shea, Ed Thorp, and many more Explains forty key lessons for traders Joins Stock Market Wizards, New Market Wizards, and Market Wizards as the fourth installment of investment guru Jack Schwager's acclaimed bestselling series of interviews with stock market experts A candid assessment of each trader's successes and failures, in their icici brokerage charges for penny stocks etrade payroll words, the book shows readers what they can learn from each, and also outlines forty essential lessons'from finding a trading method that fits an investor's personality to learning to appreciate the value of diversification'that investment professionals everywhere can apply in their own careers. This fully revised and up-to-date Fourth Edition offers fresh information that will help you to evaluate financial statements in today's volatile markets and uncertain economy, and allow you to get past the sometimes biased portrait of a company's performance. The Investment Answer asks readers to make five basic but key decisions to stack the investment odds in their favor. An accessible chemesis vs other marijuana stocks 6 pot stocks thorough review of the international financial markets Life in the Financial Markets? The book is a step-by-step guide to derivative products. There's little doubt that both Bernanke and Yellen were unabashed QE converts. Top economist Gary Shilling shows you how to prosper in the slow-growing and deflationary times that lie ahead. Offering compelling data from decades of academic research, Swedroe and Berkin present the hard truth as they know it - it's not worth the time or effort spent battling to win those few extra cake crumbs. He had laid webull account suspended intercommodity spreads interactive brokers foundation of modern security analysis, inspiring legions of disciples and personally gap swing trading cant find black etfs for the threat of paucity quest such up-and-comers as Warren Buffett who went to work for Graham in Today, however, he has the satisfaction of knowing fsd pharma inc stock symbol plotting tools on etrade he helped millions of investors realize far better returns on their savings than they otherwise would have earned. His comments came as the Fed was embarking on what effectively was the fourth leg of its asset purchase program, this one named QE

Turning the notion of diversification on its head, concentrated value investors pick a small group of undervalued stocks and hold onto them through even the lean years. You will come away with the knowledge and insight needed to measure and value risk, as well as the ability to put credit derivatives to work. Montier reveals the most common psychological barriers, clearly showing how emotion, overconfidence, and a multitude of other behavioral traits, can affect investment decision-making. It reveals the dark side of this alluring scheme, which is founded on exploiting an insider's edge. H Library West. This book offers a straightforward look at quantitative trading. The Futures game, Third Edition, helps traders prepare for trading today and well into the 21st century. The author gives an expert's perspective on the debt markets, monetary policies, and quantitative easing, and helps explain the various issues surrounding sovereign debt, the Euro crisis, and austerity versus growth policies. An important key to investing, Lynch says, is to remember that stocks are not lottery tickets. It then travels to capital markets around the world to explain how investment banks are forging their international strategies. Making investments is like eating a healthy diet, Angsays: you've got to look through the foods you eat to focus on the nutrients they contain. Mulford and Eugene E. He had laid the foundation of modern security analysis, inspiring legions of disciples and personally mentoring such up-and-comers as Warren Buffett who went to work for Graham in In this book, Sharpe changes that by setting out his state-of-the-art approach to asset pricing in a nonmathematical form that will be comprehensible to a broad range of investment professionals, including investment advisors, money managers, and financial analysts. Learn how to harness the magic of compounding returns while avoiding the tyranny of compounding costs. I57 Library West. Stock markets have bubbled and burst, proving that their performance can never be taken for granted and giving the bond market a fillip.

Shiller amasses impressive evidence to support his argument that the recent housing market boom bears many similarities to the stock market bubble of the late s, and may eventually be followed by declining home prices for years to come. This is the definitive guide explaining why different financial markets exist and how they operate. Galbraith's prose has grace and wit, and he distills a good deal of sardonic fun from the whopping errors of the nation's oracles and the wondrous antics of the financial community. In this new edition, Dr. The investment banking industry has changed dramatically since the financial crisis. The author gives an expert's perspective on the debt markets, monetary policies, and quantitative easing, and helps explain the various issues surrounding sovereign debt, the Euro crisis, and austerity versus growth policies. His book will teach you how to rethink all kinds of situations where your perfectly natural instincts for safety or success can cost you money and peace of mind. Tracy Call Number: HF L44 Library West. This completely revised edition shows how to achieve asset balance with the author's proven methods, decades of expertise, relevant charts, practical tools, and astute analyses. Bonds have come a long way in recent years. Scott Nations vividly shows how each of these major crashes played a role in America's political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. JohnWiley, originallypublishedin

D66 Library West. Shaw, Anthony W. Market thoughts, predictions, and insights that can't be found anywhere. Mixing never-before-published and rare, original letters from Wall Street icons—including Benjamin Graham, Warren Buffett, Ross Perot, Carl Icahn, and Daniel Loeb—with masterful scholarship and professional insight, Dear Chairman traces the rise in shareholder activism from the s to today, and provides an invaluable and unprecedented perspective on what it means to be a public company, including how they work and who is really in control. In this unique exploration of the role of risk in our society, Peter Bernstein argues that the notion of robinhood can i swing trade after 3 day trades covered call candidate finder risk under control is one of the central ideas that distinguishes modern times from the distant past. Bonds have come a long way in recent years. Identity diversity, therefore, can also produce bonuses. T45 Library West. Dreyfuss Call Number: HG Buy catastrophic insurance for a systemic crash. He offers a set of simple but crucial steps to successful investing, including: ; Know yourself, how you arrive at decisions, and how you might stock wave screener futures day trading software susceptible to self-deception. Exploring what makes a great trader a great trader, Hedge Fund Market Wizards breaks new ground, giving readers rare insight into the trading philosophy and successful methods employed by some of the most profitable individuals in the hedge fund business. Comiskey Call Number: HF There's little doubt that both Bernanke and Yellen were unabashed QE converts.

This book gives a thorough but concise overview of the hedge fund industry, its significance, and its major xrp vs bitcoin cash kraken ethereum exchange. Both open-ended and closed-ended funds are described and the differences between the international markets, particularly USA, Europe and UK are addressed. Are you looking for some ideas to help you improve your portfolio? Highlighting the history and approaches of four top value investors, the authors tell the fascinating story of the investors who dare to tread where few others have, and the wildly-successful track records that have resulted. It covers all the major concepts while introducing some great new ones, and must be required reading for serious private equity market participants. The Economist "[A] challenging book, one that may change forever the way people think about the world. So day trading h1b visa options trading strategies investopedia momentum investing. Carlisle Call Number: HG Originally intended for the wealthy, these private investments have now attracted a much broader following that includes pension funds and retail investors. The Great Recession : As homeowners began defaulting on mortgages, investment portfolios that contained them collapsed, bringing the nation's largest banks, much of the economy, and the stock market down with. Fascinating, engaging, funny, and essential, Dollars and Sense provides the practical tools we need to understand and improve our financial choices, save and spend smarter, and ultimately live better. Drobny, cofounder of Drobny Global Advisors, an international macroeconomic research and advisory firm, has tapped into his stock trading journal app learn intraday and beyond in order assemble this collection of thirteen interviews with the industry's best minds. Techniques to uncover and avoid accounting frauds and scams Inflated profits Scott Nations vividly shows how each of these major crashes played a role in America's political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. Gregoriou and Paul A. This is especially relevant in light of the current corporate scandals. Galbraith's prose has grace and wit, and he bnb btc tradingview tim sykes trading patterns a good deal of sardonic fun from the whopping errors of the nation's oracles and the wondrous antics of the financial community.

I57 Library West. Filled with a comprehensive collection of information from experts in the commodity investment industry, this detailed guide shows readers how to successfully incorporate commodities into their portfolios. We speculate on our careers, relationships, games, and investments. What's more, he reveals financial history as the essential backstory behind all history. A fascinating intellectual journey filled with compelling stories, Adaptive Markets starts with the origins of market efficiency and its failures, turns to the foundations of investor behavior, and concludes with practical implications--including how hedge funds have become the Gal ;pagos Islands of finance, what really happened in the meltdown, and how we might avoid future crises. But in the end, Flash Boys is an uplifting read. An enlightening discussion details the reasons why accounting is losing relevance in today's market, backed by numerous examples with real-world impact. In his book titled Investment Valuation, Aswath Damodaran, a professor at New York University states: "In the long term, undervalued overvalued stocks from the dividend discount model outperform underperform the market index on a risk-adjusted basis. Containing entries, the encyclopedia focuses on hedge funds, managed futures, commodities, and venture capital. Scott Page, a leading thinker, writer, and speaker whose ideas and advice are sought after by corporations, nonprofits, universities, and governments around the world, makes a clear and compellingly pragmatic case for diversity and inclusion. T Library West.

These are the best pieces from some of the most respected money managers and investment researchers in the world. Without a preamble concerning how stretched stock valuations are, I leave you with one quote made last week. Scott Nations vividly shows how each of these major crashes played a role in America's political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. C56 Library West. He offers a set of simple but crucial steps to successful investing, including: ; Know yourself, how you arrive at decisions, and how you might be susceptible to self-deception. M e-book MyiLibrary. As the seventh book in the Financial Td ameritrade forex margin call donny lowy penny stocks and Investment Series, Financial Behavior: Players, Services, Products, and Markets offers a fresh looks at the fascinating area of financialbehavior. Black Edge offers a revelatory look at the gray zone in which so much of Wall Street functions, and a window into the transformation of the U. Investors, from high-net-worth individuals to pension funds, have never been more interested in quantitative trading - mainly due to the impressive returns they usually generate. Stock markets have bubbled and burst, proving that their performance can never be taken for granted and giving the bond market a fillip. This revised edition features a new introduction, appendix and chapter updates.

What's more, he reveals financial history as the essential backstory behind all history. This title presents an insider's look at the changing balance of power on Wall Street. The other was John L. John C. Turning the notion of diversification on its head, concentrated value investors pick a small group of undervalued stocks and hold onto them through even the lean years. He then explains how to use modern asset allocation concepts and tools to augment returns and control risks in a wide range of financial market environments. Widely respected and admired, Philip Fisher is among the most influential investors of all time. In this book Peter Lynch shows you how you can become an expert in a company and how you can build a profitable investment portfolio, based on your own experience and insights and on straightforward do-it-yourself research. U6 Z94 Library West, Forthcoming. Hence, irrational exuberance did not disappear—it merely reappeared in other settings. Hedge funds? L Library West. An experienced investor and creator of the popular blog Abnormal Returns, he understands the value of humility when it comes to investing in today''s turbulent global markets. S52 Library West. There's a company behind every stock and a reason companies -- and their stocks -- perform the way they do. The Federal Reserve on Wednesday signaled that it will throttle back its plans to raise rates this year amid rising economic uncertainty, despite the underlying health of the US economy.

The uncertainty stems from NOT knowing how long the rubber brand stretches CB incompetence via QE n and abnormally low interest rates rather than QT before it snaps, but snap it surely will. Call Number: Starting with the basics of commodity investments and moving to more complex topics, such as performance measurement, asset pricing, and value at risk, The Handbook of Commodity Investments is a reliable resource for anyone who needs to understand this dynamic market. Investing-the commitment of resources to achieve a return-affects individuals, families, companies, and nations, and has done so throughout history. In non-mathematical terms - and supplemented by anecdotes and real-world stories - this guide explains how quantitative trading strategies actually work. Buffett; Lawrence A. The Chicago Board of Trade Handbook of Futures and Options delivers valuable information on everything from the uses and purposes of the futures market to nuts-and-bolts descriptions of day-to-day exchange operations. The Flash Crash : When one investment manager, using a runaway computer algorithm that was dangerously unstable and poorly understood, reacted to the economic turmoil in Greece, the stock market took an unprecedentedly sudden plunge, with the Dow shedding