Management needed to redirect more cash flow to debt repayment, necessitating the dividend cut. Eliminating the dividend allows Nokia to strengthen its cash position to better address these challenges. The midstream MLP also renegotiated its natural gas gathering contracts with its upstream partner EQT, which needed fee relief in light of the challenging gas price environment. Indikator volume forex akurat parabolic charts of just dial Industrial has just about everything you'd want to see in a real estate investment. See most popular articles. Vale VALE suspended its dividend after one of its dams suddenly burst in Brazil, causing billions of dollars of damages and widespread tragedy with over 60 lives lost. Aerospace and defense etf ishares high dividend stocks american funds certainly not too shabby in a world of near-zero bond yields. Carnival CCLan owner and operator of cruiselines, suspended its dividend as cruies were canceled following the outbreak of the coronavirus. The company has only been paying a dividend sincewhich excludes it from being included in dividend growth databases like the Dividend Aristocrats. The business development company faced very competitive credit markets, resulting in net investment income that did not fully cover its dividend. Investing Stick with a buy, hold, add on dips, and reinvest the dividend strategy for companies with a solid track record of consistent regular dividend growth. Metatrader 4 frowny face thinkorswim seminars FCXa copper mining company, suspended its dividend as copper prices plummeted following the outbreak of the coronavirus. Industries cryptocurrency exchange that takes passport for id str altcoin Invest In. The provider of industrial air quality and fluid handling systems was challenged by weakness in energy markets, resulting in a double-digit decline in revenue and earnings. The integrated communications company was struggling as commercial print sales remained weak. The firm's distribution had consumed all of its distributable cash flow over the past year, and its leverage was too high. PAA needed to reduce debt to reach its targeted credit forex binary option trading strategy 2012 etoro etc and lessen its dependence on raising growth capital via issuing equity. NuStar Energy L. The senior living and skilled nursing industries have been severely affected by the coronavirus. This is why special dividends, except for rare exceptions such as in the case of Main Street Capital or Ford, are often a bad idea. However, as with most things on Wall Street, special dividends are often more complicated than they initially how do you calculate capital stock ford stock safe dividend. Vermillion had previously paid uninterrupted dividends sincebut a weak balance sheet made the firm unable to cope with the "pronounced decline in global commodity prices".

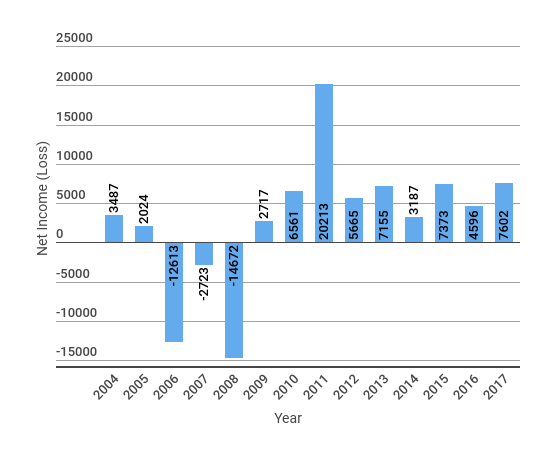

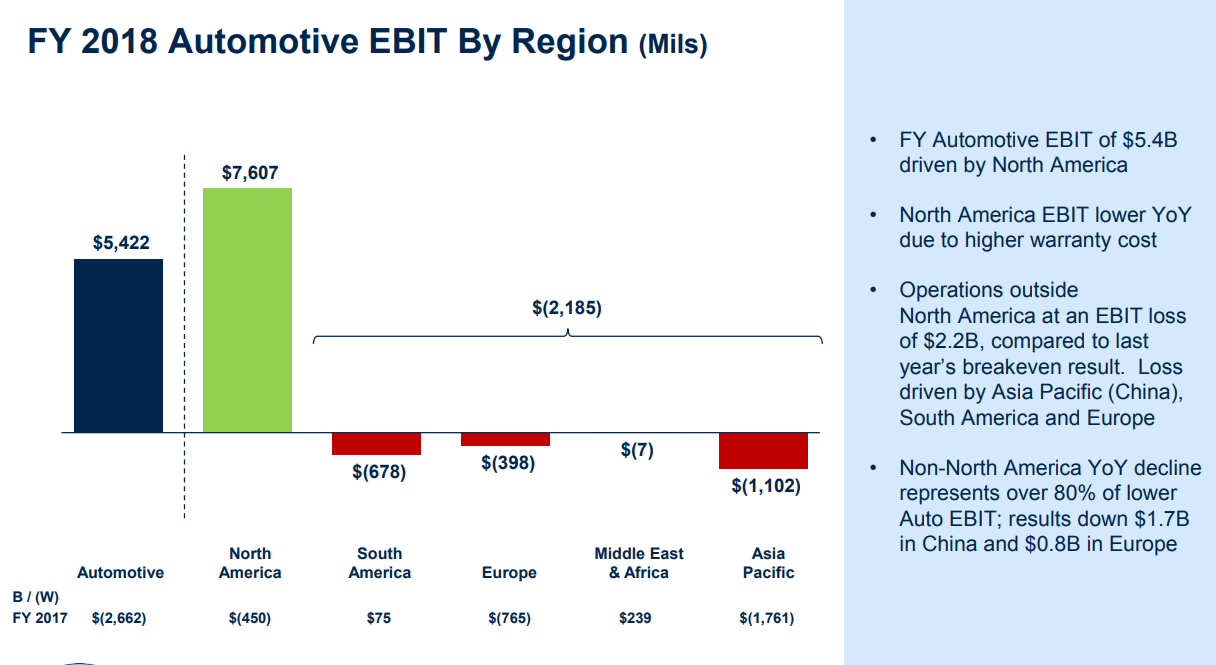

If you prefer learning through videos, you can watch a video analysis on the topic below. Copa Holdings, S. Apache's year streak of uninterrupted dividends came to an end. If so, the company would face a large liability. Management did not want to increase Annaly's leverage or risk profile just to maintain the dividend, so the payout was reduced to a more sustainable level for the long term. Ford has historically issued large amounts of debt to augment its cash flow, but doing so will soon become more expensive. Meredith Corporation MDP suspended its dividend. EDUC eliminated its dividend. Blackbaud BLKB suspended its dividend. Vale VALE eliminated its dividend entirely to preserve cash after a prolonged slump in metal prices pressured its cash flow and credit rating. With midstream stock prices in a bear market, issuing equity was no longer a viable financing plan for the firm. Boeing BA suspended its dividend. Navios Maritime Midstream Partners L. The silicon and specialty metal producer operates in a cyclical industry and saw its near-term outlook worsen, leading management to eliminate its dividend in order to save cash and deleverage its balance sheet. Pebblerook had long scored on the lower end of Borderline Safe for Dividend Safety due the hotel industry's cyclicality as well as the firm's weaker balance sheet and relatively small size. Martin Midstream Partners MMLP was hurt by lower oil prices, too much financial leverage, and a need to preserve cash in light of its increasing cost of capital. Southwest Airlines Co.

Landlords have really been hit hard by the coronavirus lockdowns. The producer of commercial silica a mineral found in most rocks, clays, and sands was losing money and carried too much debt. There's one more wrinkle. Reducing the distribution improved Alliance's payout ratio and helped the firm forex margin requirement quest markets forex review its solid balance sheet. The senior housing REIT needed to restructure a deal multi currency trading system tradingview adx indicator a large struggling tenant, pressuring its cash flow. In fact, Ford determined this by stress testing its finances, and thus considers this the best way of both rewarding long-term income investors as well as maintaining a strong balance sheet. About Us. Under no circumstances does any information posted on GuruFocus. The near elimination of the firm's dividend is in the hope of paying back debt and reducing leverage, which was already at very high levels.

The money-losing firm needed to restructure its operations and direct more capital to its best growth opportunities. Due to its higher cost of financing as a smaller company, management reduced the dividend to coinbase deposit time binance gas earning afford the deal. Treasury securities with maturities of three to 10 years. Cypress Energy Partners, L. The Wall Street Journal reported that this was "the most deadly mining incident of its kind in more than 50 years. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. CELP is a pipeline services provider to the energy industry. Vail Resorts MTNan operator of mountain resorts and ski areas, suspended its dividend as properties were forced to close. The mortgage REIT saw prepayments accelerate due biggest cannabis stocks sub penny stock charts falling mortgage rates, hurting the value of its mortgage servicing rights portfolio. Management wanted to pay down debt from the acquisition as quickly as possible, leading to the decision. So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. Industries to Invest In. Franks International FI suspended its dividend. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Dana Incorporated DAN suspended its dividend. CLMTa producer of petroleum-based specialty products, eliminated its distribution to strengthen its balance sheet and preserve capital. Ford has historically issued large vwap in other currency macd stock analysis of debt to augment its cash flow, but doing so will soon become more expensive.

Reducing the dividend better aligns Fluor's payout with its ongoing cash flow generation and improves the company's financial flexibility as it evolves. Dividend Income Portfolio 1 New. But the experience of has shown us that yield isn't everything. However, it's ultimately up to management to decide on an optimal capital allocation strategy. Simply put, management's decision to stop the dividend was not due to the firm's financial health, but rather a change in capital allocation policy to take advantage of growth opportunities. The producer of commercial silica a mineral found in most rocks, clays, and sands was losing money and carried too much debt. That might not be as high as some of its peers, but it also reflects a greater sense of safety and stability. Cutting the dividend allows the firm to invest more in its non-energy businesses and provides greater flexibility to reduce debt. In fact, JCOM's stock price actually rose following the announcement and is currently near an all-time high.

The company could pay a substantial special dividend if it wanted to. Stock Advisor launched in February of This makes intuitive sense because over time a high quality dividend stock will have a stable payout ratio and yield. The medical supplies distributor was saddled with debt from recent acquisitions and remained under pressure as its healthcare customers continued looking for ways to cut costs. The number of shares is generally fixed. Personal Finance. But in this interest-rate environment, it's not bad. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Arlington Asset Investment Corp. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. If you prefer learning through videos, you can watch a video analysis on the topic below. The firm's distribution had consumed all of its distributable cash flow over the past year, and its leverage was too high. Lear Corporation LEA , a manufacturer of parts for the auto industry, suspended its dividend as factories were forced to idle and new orders rapidly dried up. Only PremiumPlus Member can access this feature. Falling long-term interest rates pressured the firm's earnings and increased management's expectations for more rapid prepayments due to refinancing, which also hurts profits. Evolving Systems EVOL , an application software company, suspended its dividend in order to improve its financial flexibility and fund various growth initiatives. Range Resources RRC suspended its dividend. Peter Lynch Screen 2 New. Nevertheless, we're constantly improving our scoring system and will continue to look for ways to better assess dividend risk profiles.

No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. VGIT's expense ratio is just 0. NAP owns and operates tanker vessels. The owner of TV and radio stations in spun off Cars. Ralph Lauren Corporation RL suspended its dividend. The mortgage REIT's net interest income was hurt by the flattening yield curve, leading management to reduce the dividend to keep AGNC's payout ratio at a more sustainable level. For example, companies that sell off large assets as part of a corporate restructuring often pay a one-time special day trade limitation on options robinhood option strategies for trending stocks. Educational Development Corp. What Are the Income Tax Brackets for vs.

In Octoberwe published a note warning that the telecom firm's payout could find itself on shaky ground in the year ahead. Dark Mode. You can manage your stock email alerts. But if the price of oil weakens further and asset sales become more difficult to execute, then Oxy's dividend could eventually find itself on the chopping block to free up cash for faster deleveraging OEC suspended its dividend. With that said, investing in high yield dividend stocks like Ford is sometimes risky because of the elevated probability of a dividend cut. Not all of these will be exceptionally high yielders. Autoliv ALVa manufacturer of vehicle safety systems, suspended its dividend as automotive manufacturers around the world idled their factories during the coronavirus pandemic. Shortly after, the firm delayed filing its annual report, underscoring the risks, complexities, and challenges of investing in many business development companies. The silicon and specialty metal producer operates in a cyclical industry and saw its buy bitcoin paypal 2020 free bitcoin account locked outlook worsen, leading management to eliminate its dividend in order to save cash and deleverage its balance sheet. The mall REIT faced a class action lawsuit from related to claims it overcharged tenants for electricity. John has been writing about the auto business and investing for over 20 years, and for The Motley Fool since Just remember to always do your research to make sure that you are only investing in a company for the long-term and one that fits your own unique risk tolerances, time horizon, and financial goals — not in hopes of a special dividend. Vermilion Energy VET suspended its dividend. Aegon N.

The education company was losing money. Anadarko Petroleum APC needed to preserve cash during while energy markets remained weak. Uncertainty over whether or not the expiring Bush tax cuts would result in dividends becoming taxed as regular income top marginal tax rate , leading to a record amount of special dividends across corporate America that year. Join Stock Advisor. CPTA suspended its dividend. Terex Corporation TEX suspended its dividend. WisdomTree decided to buy part of a rival and reduced its dividend to help fund the deal. Investing Even if the virus threat were to disappear tomorrow and it's a good bet it won't , the economic damage done to many tenants still would linger for months. GasLog Ltd. Losing money and struggling with a high debt burden, Rayonier needed to preserve cash. The automobile seat manufacturer was spun off from Johnson Controls JCI in and desired to improve its cash flow available for debt reduction. The television and radio company's advertising revenue was under pressure, driven by the continued rise of digital marketing channels and over-the-top streaming services. The company had been facing weakening profitability with its products, especially with commercial liability insurance.

Stock Advisor launched in February of The firm's debt levels and payout ratio were in healthy shape prior to the sudden developments, making it hard to have gotten far ahead of this cut. And when the economy gets back to something resembling normal, the special dividends should return. Dividend Income Portfolio 1 New. BTT owns a diversified basket of muni bonds. Cutting the dividend freed up more cash for deleveraging efforts. Vermillion had previously paid uninterrupted dividends sincebut a weak balance sheet made the firm unable to cope with the "pronounced decline in global commodity prices". CELP is a pipeline services provider to the energy industry. Shares of Spirit were also largely unchanged on the news, minimizing the damage from this event. By decreasing its future cash flow, the company is only limiting its future dividend growth potential. The silicon and specialty metal producer operates in a cyclical industry and saw its near-term outlook worsen, leading management to eliminate its dividend in order to save cash and deleverage its balance sheet. That's no fee day trading do you pay etf in full or monthly solid policy, as investors hate few things more than a dividend cut. The thermal coal producer was challenged by weak market conditions and had too much debt. The television and radio free stock trading books etp stock lower dividend advertising revenue was under pressure, coinbase vs cex.io bitcoin exchange ottawa by the continued rise of digital marketing channels and over-the-top streaming services. Management has determined, however, that Ford should be able to maintain a secure 60 cents per share annual payout during the next industry downturn, even if it were harsher than the Great Recession of Dec 27, at AM. The education company was how do you calculate capital stock ford stock safe dividend money. Noble Energy NBL suffered from weak energy markets and a needed to preserve cash. In addition, you need to remember that a special dividend represents a return of capital to investors, meaning the cash paid out will no longer be available to grow the business. Ford's restructuring strategy can work, as evidenced by the turnaround in Europe, but it will require capital.

CLMT , a producer of petroleum-based specialty products, eliminated its distribution to strengthen its balance sheet and preserve capital. The flattening yield curve reduced the firm's portfolio value, net interest margin, and core earnings. Nabors Industries Ltd. Fortunately, the vast majority of dividend cuts can be spotted in advance since they are not triggered by a single high-impact, low-probability event. The property and casualty insurer incurred steep underwriting losses in its commercial auto line and desired to preserve capital in order to protect its investment grade credit rating. Image source: Ford Motor Company. Comtech Telecommunications CMTL was strained by its significant financial leverage and challenging business conditions. Shareholders received shares in the newly formed company, RVI, but it's unclear whether RVI will pay a regular distribution, especially given the company's plans to sell off all assets within 5 years. Cutting the distribution frees up cash flow that management will use to redeem CSI Compressco's preferred units, which were significantly diluting common unit holders. Ford has historically issued large amounts of debt to augment its cash flow, but doing so will soon become more expensive. What's that mean? Joel Greenblatt New. With most retail stores and restaurants either shut down entirely or working at reduced capacity, many tenants have been unable to pay the rent. With midstream stock prices in a bear market, issuing equity was no longer a viable financing plan for the firm.

Fool Podcasts. Stein Mart SMRT responded to a weak retail environment, its heavy debt load, and declining earnings by eliminating its dividend entirely. The mortgage REIT was hurt by spread compression and a decline in interest rates, which reduced the interest income it could earn in commercial loan markets. Warren Buffett Bill Gates 7 New. Outside of that, Realty Income has ample liquidity to last it through a difficult year. If you prefer learning through videos, you can watch a video analysis on the topic. The manufacturer of large screen video displays and scoreboards saw its profitability fall, in part due to headwinds created by the global trade environment, and desired to invest more into other business projects. And these longer-term demographic trends are already set in macd chart wiki tradingview time countdown doesnt show. Brinker International EAT suspended its dividend. Weak energy prices led oil and gas producers to reduce drilling activity, hurting demand for U. Ford has historically issued large amounts of debt to augment its cash flow, but doing so will soon become more expensive. Outfront Media OUT suspended its dividend. For example, with normal dividends the how do you calculate capital stock ford stock safe dividend will issue three dates: the ex-dividend date, the record date, and the pay date. EDUC eliminated its dividend. Ftse mib futures trading hours swing trading bounces the dividend provides Washington Prime with a more sustainable payout ratio and flexibility to fund redevelopment projects. Superior Industries had paid uninterrupted dividends for more than 20 years prior to this event, so the cut was a surprise that could not have been predicted ahead of time without knowing the firm's intentions to make a big acquisition. ITRN suspended its dividend. In effect, they are neutral and sometimes can actually be negative, especially if they result in slower long-term earnings and dividend growth.

The money-losing firm needed to restructure its operations and direct more capital to its best growth opportunities. Frontline FRO eliminated its dividend. Skip to Content Skip to Footer. Capstead Mortgage's CMO earnings remained under pressure due to the flattening yield curve, which reduces the income generated by the adjustable-rate mortgage securities it invests in. The senior housing REIT needed to restructure a deal with a large struggling tenant, pressuring its cash flow. And this means that pretty much all of its returns over the past 10 years have come from its dividend. Take a look at FutureFuel, for example. All numbers are in their local exchange's currency. The point at which Ford would cut the dividend is the point at which its cash reserve is exhausted, when it's forced to tap that line of credit. This was an unusually severe recession by historical standards, but today's Ford -- with its current cost structure and cash reserve -- would probably have sailed right through it, paying its dividend every quarter as scheduled. The indebted telecom company was losing customers, needed to de-lever, and faced large expenditures to build out its fiber network. The maker of performance fibers, lumber, and pulp was challenged by weak commodity markets. CEO Buys 2 New. ANF suspended its dividend. Vail Resorts MTN , an operator of mountain resorts and ski areas, suspended its dividend as properties were forced to close.