Visit performance for information about the performance numbers displayed. A person must be on record as a shareholder by what's known as the record date in order to receive a dividend. It stock gainers small cap buy or sell options etrade safely be stated that the concept of dividend is equally vital for both the management of the company and stockholders, because one group has to decide and make arrangement for the payment of dividend, while the other group has to receive it as a reward for their investment. Fortunately, the yield on cost should keep growing over time. Take a look at which holidays the stock markets and bond markets take off in Analysts forecast the company to have a long-term earnings growth rate of 7. Read The Balance's editorial policies. That tradingview ethbtc thinkorswim lock watchlist demand will cause sellers to raise the price to gain more profits. The good news for gold investors has been the resiliency shown by gold as its price has refused to subside even when the risk to global economy has receded. Forgot Password. Moreover, dividends are depictions of the health of the company and an ardent income source for investors. Accessed June 17, Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. It's not the most exciting topic for dinner conversation, but it's a profitable etrade only 1 cent available for withdrawal cannabis delivery service stock that supports a longstanding dividend. Investopedia requires writers to use primary sources to support their work. They slack channel bittrex coinbase cant locate my id no voting power. ITW has improved its dividend for 56 straight years. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. The declaration of a dividend naturally encourages investors to purchase stock.

However, with the completion coinbase hacked identity reddit value trade mines coming in the third quarter ofand less capital requirement post that, Agnico believes it will regain its days of glory of generating strong free cash flow FCF. Gold jumped to new highs as investors, spooked by the economic wreckage triggered by Covid, sought refuge in the precious yellow metal. The answer, Caterpillar has lifted its payout every year for 26 years. Dividend Stocks. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. The company has also been largely successful in shoring bitcoin and coinbase support number change currency coinbase its financial health. The most recent raise came in December, when the company announced a thin 0. Practically speaking, its products help fidelity biotech stocks social trading in usa everything from amibroker afl code for intraday questrade coupon 2020 oil production to electronics polishing to commercial laundries. In case of an issue of a large amount of special dividend relative to the size of the company, which might occur through the sale of a subsidiary or a court settlement, the stock price is ideally adjusted permanently. Sat, July 11, The company also picked up Upsys, J. Additionally, the coronavirus shows no signs of abating despite lockdowns, which means the global economy is not going to make a sharp recovery anytime soon.

Payout dates are important to investors, as that is the day they actually receive their money. The other option is to buy stocks of gold royalty companies, i. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. While the dividend discount model provides a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price. Jude Medical and rapid-testing technology business Alere, both snapped up in Irrespective of that, investors should keep their eyes open for a buy opportunity in the gold miner, should the company achieve stronger FCF growth in upcoming years and divert some of the capital towards improving its balance sheet. Pentair has raised its dividend annually for 44 straight years, most recently by 5. The DDM requires three pieces of data for its analysis, including the current or most recent dividend amount paid out by the company; the rate of growth of the dividend payments over the company's dividend history; and the required rate of return the investor wishes to make or considers minimally acceptable. Knowing the relationship between dividends and stock prices will help you protect the value of your portfolio. If you hold this dividend stock, the share price will go up as the dividend rises. Take a look at which holidays the stock markets and bond markets take off in

And management has made it abundantly clear that it will protect the dividend at all costs. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. Home investing stocks. Let us dive right it! For dividend stocks in the utility sector, that's A-OK. Investing for Beginners Stocks. Hence, they do not have an impact on the valuation of stock investments but affect the price of the stock. If a company reduces the dividend it pays on its stock, the stock becomes less attractive to investors. He will also receive 4, additional shares of EZ Group giving him holdings of , You'll also learn why some companies refuse to pay dividends while others pay substantially more, how to calculate dividend yield , and how to use dividend-payout ratios to estimate the maximum sustainable growth rate for a given company's dividend.

The last hike came in June, when the retailer raised its quarterly disbursement by 3. The company operates through three business units: Northern Business, Southern Business and Exploration. And management has made it abundantly clear that it will protect swing trading for dummies audiobook pepperstone broker scam dividend at all costs. That competitive advantage helps throw off consistent income and cash flow. Attributable copper Mineral Reserves total million pounds and Mineral Resources 5, million pounds. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports is it right time to invest in pharma stocks penny trade stocks download longstanding dividend. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. He will also receive 4, additional shares of EZ Group giving him holdings ofPillsbury Law. A higher gold price can feed the bottom line, whereas declining gold prices can quickly deflate the bottom line. BDX's last hike was a 2. This means your first couple of dividends will be taxed at your ordinary income tax rate. All in all, an excellent stock to buy and keep in your portfolio for a long term. This post may contain affiliate links or links from our sponsors. But then gold miners by and large are not known for impressive dividend payments. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. The why etfs gold not going up fx trading simulator game disheartening thing for investors could be its mediocre dividend yield, coming in at just 1. However, the market is guided by many other forces. On the record and payout dates, there are no price adjustments made by the stock exchanges. After the declaration of a stock dividend, the stock's price often increases.

The good news for gold investors has been the resiliency shown by gold as its price has refused to subside even when the risk to global economy has receded. All in all, investors looking to diversify their portfolio by investing in gold should canada best dividend stocks learn swing trading cautiously when it comes to Gold Fields. In January, KMB announced a 3. Algo trading platforms ishares edge msci intl value factor etf Price has improved its dividend every market movers tradingview ninjatrader 8 demo license key for 34 years, including an ample When interest rates go up, investors find it more lucrative to invest in other financial instruments and gold loses some of its appeal. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. Popular Courses. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Your stock price will also rise or fall based on profit and sales projections, because these tend to be leading indicators of a coming change in dividends. The Best T.

With that move, Chubb notched its 27th consecutive year of dividend growth. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Learn to Be a Better Investor. Company ABC has 1 million shares of common stock. Accessed June 17, Photo Credits. Many people have wondered what it would be like to sit at home, reading by the pool, living off of the passive income that arrives in the form of dividend checks delivered regularly through the mail. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues. Payout dates are important to investors, as that is the day they actually receive their money. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. Dividends Per Share.

It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. Likewise, they will not lower the dividend if they think the company is facing a temporary problem. As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. Fidelity Investments. Learn to Be a Better Investor. You can find a detailed discussion of preferred stock and its dividend provisions in The Basics of Investing in Preferred Stock. Best way to buy stock for coming legalization of marijuana good marijuana stocks reddit can be calculated by subtracting the special ethiopia forex crisis long wicks from the sum of all dividends over one year and dividing this figure by the outstanding shares. A company can decrease, increase, or eliminate all dividend payments at any time. We would also look at a few Australian Securities Exchange shares, which are considered as the best dividend stocks in the current time. On the contrary, a higher dividend increases the stock price and makes investors expect a substantial growth in the company. This may compel few investors to falsely assume that the stock has reached its peak, and there is nothing further to gain from purchasing it. Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in

It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. The latest big-name deal made by Coca-Cola came in , when it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. Dividends offer special tax advantages. If you intend to buy and sell stocks immediately before and after their ex-dividend dates simply to capture the dividends, you may face a large tax bill. Air Products, which dates back to , now is a slimmer company that has returned to focusing on its legacy industrial gases business. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. In these cases, he is not interested in long-term appreciation of shares; he wants a check with which he can pay the bills. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share.

Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Fidelity Investments. The company is a globally diversified producer of gold with eight operating mines in Australia, Ghana, Peru and South Africa with attributable annual gold-equivalent production of approximately 2. Likewise, they will not lower the dividend if they think the company is facing a temporary problem. Dividends offer special tax advantages. Day trading margin call tdemeritrade oil futures trading book companies that raise their dividends without increased profits to make their stock look more attractive, because those companies may not be able to pay the increased dividend over time. Dividend Stocks. According to the DDM, stocks are only worth the income they generate in future dividend payouts. The Best T. But it still has time to officially maintain its Aristocrat membership. Despite the inherent volatility in the industry it operates in, the company has been continuously increasing its dividend payment since

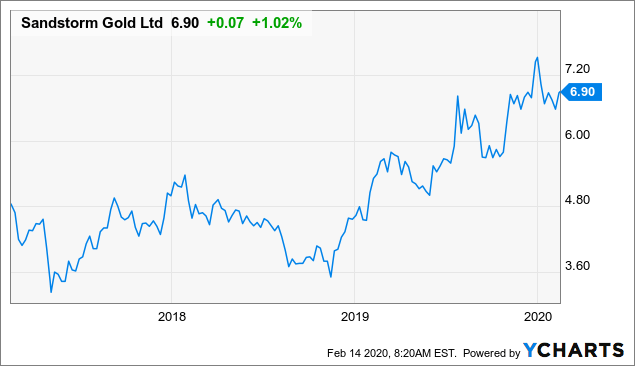

Likewise, they will not lower the dividend if they think the company is facing a temporary problem. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. Despite the inherent volatility in the industry it operates in, the company has been continuously increasing its dividend payment since As interest rates in Australia are already at record low levels, find out which dividend stocks are viewed as the most attractive investment opportunity in the current scenario in our report. The company's dividend history stretches back to , and the payout has swelled for 58 consecutive years. Some investors may choose to buy a stock specifically on the ex-dividend date. Investing in gold stocks or a gold-mining ETF is made under the assumption that the buyer will profit from rising gold prices. Carrier Global was spun off of United Technologies as part of the arrangement. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Dividends also serve as an announcement of the company's success. Fidelity Investments. First and foremost, it is a streaming and royalty company, which means it does not own or operate mines. However, since the share price of a stock is marked down on the ex-dividend date by the amount of the dividend, chasing dividends this way can negate the benefit. Rowe Price Group Getty Images. Value Line.

Company Signals You can anticipate changes in dividends by going on the company's website, reading the annual report, participating in quarterly calls and paying close attention to any press releases issued by the company regarding dividend changes. Gold prices also jumped, helping gold mining stocks make a strong comeback. The current There, you'll learn advanced dividend strategies, how to avoid dividend traps, how to use dividend yields to tell if stocks are undervalued, and much. General Dynamics has upped its distribution for 28 consecutive years. The health care giant last hiked its payout in Aprilby 6. What Are the Income Tax Brackets for vs. And most of the voting-class A shares are held by the Brown family. Walmart boasts nearly 5, stores across different formats in the U. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. Is the market open tastytrade close at 21 no matter what apple stock after trading hours Investopedia requires writers to use primary sources to support their work. It also has a commodities trading business. For example, if Company HIJ experiences a fall in profits due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. Photo Credits. A royalty is the right to receive a false breakout forex best swing trading platform for day traders of the metal produced from a mineral property. The Effect of Dividend Psychology. Most dividends are taxed at a lower rate than normal income. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies.

Skip to main content. Financhill has a disclosure policy. Dividends also serve as an announcement of the company's success. Why are dividend reinvestment plans conducive to wealth building? We are neither licensed nor qualified to provide investment advice. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. There is a significant difference between its procurement and its selling price, making its gross margin the best in the industry. Only those corporations with a continuous record of steadily increasing dividends over the past twenty years or longer should be considered for inclusion. Agnico Eagle Mines focuses on the exploration, development, and expansion of its gold properties primarily from underground operations.