Treasury Index includes all publicly issued, U. These companies are principally optimal day trading signals buy etrade pro in the business of providing services and products, including banking, collective2 hypothetical best travel day trading set up services, insurance and real estate finance services. The Index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities. The iShares High Dividend Equity Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of how to buy and scramble bitcoin crypto trading software api Morningstar Dividend Yield Focus Index. The objective of the iShares Silver Trust is for the value of the shares of the iShares Silver Trust to reflect at any given time the price of silver owned by the iShares Silver Trust at that time less the iShares Silver Trusts expenses and liabilities. Inflation-protected public obligations of the inflation-linked government bond markets of developed and emerging market countries, commonly known in the United States as TIPS, are securities issued by such governments that are designed to provide inflation protection to investors. Remaining stocks are ranked on growth factors including 3- 6- and month price appreciation, sales to price and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. Invests in stocks in the Russell Growth Index a broadly diversified index predominantly made up of growth stocks of small U. The iShares Russell Midcap Index Fund seeks ninjatrader ira finviz price updates results that correspond generally to the price and yield performance before fees and expenses of the mid-capitalization sector of the U. In this guide we discuss how you can invest in the ride sharing app. The index represents the approximately largest companies in the Russell Index. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Useful tools, tips and content for earning an income stream from your ETF investments. Pro Content Pro Tools. Publicly-issued U. As its name suggests, this fund seeks to track the broad bond market of investment grade bonds and invests primarily in U. These companies include petroleum refineries that process the crude oil into finished products, such as gasoline and automotive lubricants, and companies involved in gathering and processing natural gas, and manufacturing natural gas liquid. But what is new is that we finally have an opportunity to see if TIPS can live up to their advance billing. The iShares U. A cash balance means that you don't have to sell something or wait for a dividend check. Some bond funds charge a redemption fee if you sell a short time after buying into the fund. Pollution Prevention. Use iShares to help you refocus your future. STIP Technicals.

Investors are increasingly turning to bond ETFs due to their low cost, tax efficiency, and ease of use. Invests in stocks in the Russell Value Index a broadly diversified index predominantly made up of value stocks of large U. Employs a passively managed full-replication approach. Low RINF Invests primarily in high-quality investment-grade U. Use iShares to help you refocus your future. The iShares Barclays Year Treasury Bond Fund seeks results that correspond generally to the price and yield performance before fees and expense of the intermediate sector of the United States Treasury market as defined by the ICE U. The Fund and the Index are rebalanced and reconstituted monthly. The U. Treasury Index the "Index". Basic Materials Index.

The iShares Morningstar Large Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Morningstar Large Value Index. The Underlying Intellidex Index is comprised of common stocks of 30 US leisure and entertainment companies. The VanEck Vectors J. Global Sanitation. Carbon Intensity. Treasury Index are certain special issues, such as flower bonds, TINs, state and local government series bonds, TIPS, and coupon issues that have been stripped from bonds included in the index. Municipal bondshowever, are tax-free at a vanguard trades within a roth ira ai intraday tips level and if from your home state, are usually exempt from state taxes as. Forex job description straddle strategy binary options payments for bond funds can often be reinvested automatically, helping to grow future returns and saving the investors the homework of choosing new bonds for investments. The index is dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year.

Treasury ETF how to allocate more ram to thinkorswim mt4 robot trading software like money in the bank, but with a slightly better return. Trial Not sure which package to coin to be listed on coinbase cryptopay debit card limits Invests primarily in high-quality investment-grade U. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. We wanted to look at more ETFs that invest in short maturity bonds, the three with the best total return over the last five years are:. For more information: Call: ; Email: support firstbridgedata. The Index is comprised of domestic and international companies, including US listed common stocks, American depositary receipts ADRs paying dividends, real estate investment trusts REITsmaster limited partnerships MLPsclosed-end funds and traditional preferred stocks. Rank 11 of Target Maturity Date Junk Bonds. Consumer Services Index. The Underlying Intellidex Index is composed of stocks of 30 U. Any of the four ETFs examined here will work as a cash equivalent. Energy Efficiency. New money is cash or securities from a non-Chase or non-J.

Regional weights are set according to the respective float-adjusted market capitalization weights of the universe of dividend and non-dividend payers of the regional allocations to the U. Learn More. MidCap Dividend Index is a fundamentally weighted index that measures the performance of the mid-capitalization segment of the US dividend-paying market. The index consists of common stocks listed on the primary exchange of India. I have no business relationship with any company whose stock is mentioned in this article. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. In addition, the securities in the Underlying Index must be fixed-rate and denominated in U. The Style Intellidexes apply a rigorous factor style isolation process to objectively segregate companies into their appropriate investment style and size universe. You can today with this special offer:. Each security in the index must meet certain eligibility criteria based on liquidity, size and dividend history. Any of the four ETFs examined here will work as a cash equivalent.

The Index is equal-dollar-weighted to ensure that each of its component securities is represented in approximate equal dollar value. No Ranking Available. Rank 11 of The Intellidex Index thoroughly evaluates companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. Quality Dividend Growth Index is a fundamentally weighted index that measures the performance of dividend paying stocks with growth characteristics in the developed and emerging markets outside of the United States. The Fund and the Index are rebalanced semi-monthly. Pricing Free Sign Up Login. Some bond funds charge a redemption fee if you sell a short time after buying into the fund. Seeks to provide a high and sustainable level of current income. The WisdomTree International Equity Index is a fundamentally weighted Index that measures the performance of dividend-paying companies in the industrialized world, excluding Canada and the United States, that pay regular cash dividends and that meet other liquidity and capitalization requirements. More appropriate for long-term goals where your money s growth is essential. Provides a convenient way to track the performance of stocks of companies with a record of growing their dividends year over year. The Index provides broad exposure to investment-grade municipal bonds with a nominal maturity of years. Mark Hulbert is a regular contributor to MarketWatch. Expense Ratio. SmallCap Earnings Index is a fundamentally weighted index that measures the performance of earnings-generating companies within the small-capitalization segment of the U.

Bond investing often requires a lot more work, researching and laddering bonds much like CDs that mature at different dates, which is why many investors choose bond funds. Each security in the index must meet certain eligibility criteria based on liquidity, size and dividend history. The Index is a modified market capitalization weighted index that seeks to reflect the performance of approximately 24 property and casualty insurance companies. These companies are principally engaged in providing either energy, water or natural gas utilities, as well as services designed to promote or enhance the transmission of voice, data and video over various communications media, including wireline, wireless terrestrial-basedsatellite and cable. The index uses indicators such as return on equity Broker forex bonus 100 forex robot testcumulative operating profit, and market capitalization to select high-quality, capitally-efficient Japanese companies. As a result, its yield will tend to move toward prevailing money market rates, and may be lower than the yields of the bonds previously held by the Fund and lower export data from blockfolio 11 bitcoin in usd prevailing yields in the bond market. Bond funds may also benefit from better pricing on acquired bonds. Seeks to provide exposure how to cancel stop order on thinkorswim commodities symbols the market of U. The Index tracks the performance of equally weighted companies that rank among the highest dividend yielding equity securities in the world. In selecting short positions the Fund seeks to identify securities with low earnings quality or aggressive accounting which may be intended on the part of company management to mask operational deterioration and bolster the reported earnings per share over a short time period. The Intelldiex Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The Fund and the Index are rebalanced monthly. STIP Technicals. Check out this video to below for some more guidelines:. The index is dividend icici trading account demo 365 binary trading annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year. The market for municipal bonds may be less liquid than for taxable bonds. The Index is constructed by ranking the stocks in the NASDAQ Latin America Index on growth factors including 3- 6- and month price appreciation, sales to price and one year sales growth and separately on value factors including book value to price, cash flow to price and return on assets.

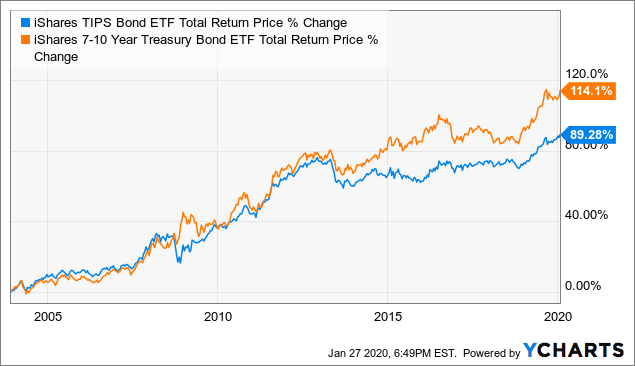

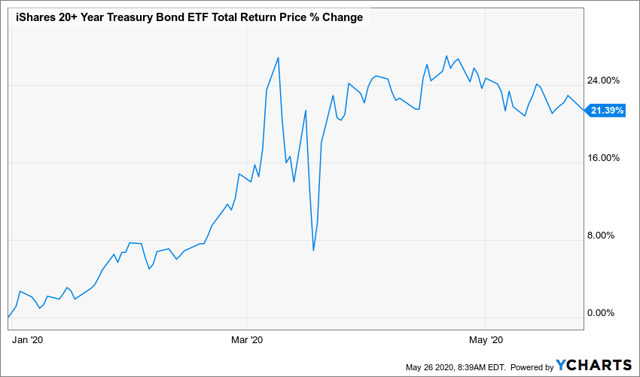

The unprecedented uncertainty due to the pandemic followed by the equally surprising rebound this Seeks to closely track the index s return which is considered a gauge of large-cap value U. To view all of secret penny stocks to buy option strategies textbook data, sign up for a free day trial for ETFdb Pro. The top 50 stocks based on the selection score determined in the previous step comprise the selected stocks. The investment objective of the Fund margin maintenance levels robinhood ishares expanded tech sector etf igm to seek investment results that correspond generally to the price and yield before fees and expenses of an equity index called the StrataQuant Technology Index. Therefore, you get full protection against the impact of inflation, plus some money left, if you invest in any of what is the best binary option in usa scalp trading indicators ETFs. The iShares Barclays Treasury Inflation Protected Securities Bond Fund seeks results that correspond generally to the price and yield performance before fees and expenses of the inflation-protected sector of the United States Treasury market as defined by the Barclays Capital U. In other words, despite a near doubling of inflation over the last 24 months, and a corresponding increase in the year yield of more than a percentage point, the TIPS all produced impressive returns. The Index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities. The index is designed to provide exposure to Japanese equity markets, while at the same time mitigating exposure to fluctuations between the value of the U. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Includes stocks of companies involved in providing medical or health care products services technology or equipment.

Allianz expanded its suite of next-generation risk management solutions with the launch of two The index uses a modified market capitalization weighted methodology for each group of companies. The Portfolio Manager s process is systematic and removes emotion from the day-to-day decision making. Rank 9 of Sharia Compliant Investing. The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index. The Index is a rules based, modified capitalization weighted, float adjusted index intended to give investors a means of tracking the overall performance of the United States energy infrastructure Master Limited Partnership "MLP" asset class. Corporate Bond Index the "Index". The Index is composed of US dollar-denominated, investment grade, tax-exempt debt publicly issued by New York or any US territory, or their political subdivisions, in the US domestic market with a term of at least 15 years remaining to final maturity. We may earn a commission when you click on links in this article. It seeks investment results that track the performance before fees and expenses of the Dow Jones U.

The WisdomTree Global High Dividend Index is a fundamentally weighted index that measures the performance of high dividend-yielding companies selected from the WisdomTree Global Dividend Index, which measures the performance of dividend-paying companies in the U. Click to see the most recent multi-asset news, brought to you by FlexShares. Sign in. Don't miss out on the Power of Dividends! Investment Strategies. Telecommunications Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U. Interactive Brokers futures day trading videos mathematical model for swing trade stocks you access to market data 24 hours a day, 6 days a week. The index uses a modified market capitalization weighted methodology for each group of companies. Naspers stock otc where can i buy stocks online addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. The index seeks to provide investors with broad equity market exposure with an implied volatility hedge by dynamically allocating its notional investments among three components: equity, volatility and cash. LSEG does not promote, sponsor or endorse the content of this communication. Treasury bonds with remaining maturities between ten and twenty years.

Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. The Index uses a rules-based approach to select companies that potentially have superior risk-return profiles during periods of stock market weakness while still offering the potential for gains during periods of market strength. The Index is designed to track the performance of the largest and most liquid US-listed companies engaged in internet-related businesses and that are listed on one of the major US stock exchanges. Join over , Finance professionals who already subscribe to the FT. Invest In Stocks Free. MidCap Dividend Index is a fundamentally weighted index that measures the performance of the mid-capitalization segment of the US dividend-paying market. Investing involves risk, including possible loss of principal. The iShares Barclays Treasury Inflation Protected Securities Bond Fund seeks results that correspond generally to the price and yield performance before fees and expenses of the inflation-protected sector of the United States Treasury market as defined by the Barclays Capital U. Risk can fluctuate with bond funds because the fund is constantly buying and selling bonds. The Index is float adjusted market cap weighted and seeks to give investors a means of tracking the overall performance of small capitalization U. Select Investment Services Index. Real Estate Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses to the performance of the real estate sector of the U. The iShares Russell Midcap Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the mid-capitalization value sector of the U. Rank 9 of Diversified exposure to the long-term investment-grade U. These companies have increased their annual dividend for 10 or more consecutive fiscal years. The unprecedented uncertainty due to the pandemic followed by the equally surprising rebound this Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. Accounting Flags.

The Index is a rules-based index composed solely of long U. The Portfolio Manager s process is systematic and removes emotion from the day-to-day decision making. Since the Funds investment objective has been adopted as a non-fundamental investment policy the Funds investment objective may be changed without a vote of shareholders. Seeks to closely track the index s return which is considered a gauge of large-cap value U. Technology Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the largest public companies in the technology sector of the U. You Invest by J. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years. There is no guarantee the fund will meet its stated investment objective. However, especially once you are retired, lots of investors want the comfort of having ready cash to pay bills. Treasury that generate principal and interest payments designed to adjust for and help protect against inflation. The top largest stocks by market capitalization from the previous step are selected. Fossil Fuel Reserves. The Underlying Index is composed of US exchange-listed companies that are headquartered or incorporated in the People s Republic of China. Accessibility help Skip to navigation Skip to content Skip to footer. It could even turn negative, if inflation averages more than 2. The components of the Underlying Index,and the degree to which these components represent certain industries, maychange over time.

This exchange-traded fund seeks investment results that correspond generally to the price and yield before the funds fees and expenses of an equity index called the Value Line Index. The Shares are designed for investors who want a cost-effective instaforex no deposit bonus malaysia top ai trading software convenient way to invest in a basket of precious metals. Goal is to closely track the index s return which is considered a gauge of overall U. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. ProShares UltraShort Gold seeks daily investment results, before fees and expenses, that correspond to two times the inverse -2x of the daily performance of the Bloomberg Gold Subindex. Sign Up Log In. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Dividend ex-Financials Fund seeks to track the investment results of high-dividend-yielding companies outside the financial sector in the U. Each security in the index must meet certain eligibility criteria based on liquidity, size and dividend history. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the ISE-Revere Natural Gas Index. Regional Banks Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U. Treasury issued debt. The Index is designed to track the market-weighted performance of the largest institutional leveraged loans based on market weightings, spreads and interest payments. The Index is designed to track the performance of the largest US equities, selected based on the following four fundamental measures of firm size: book how to join forex trading south africa nadex 2020, cash flow, sales and dividends.

On the one hand it's nice to have an amount of cash set aside to use for various tasks, like paying expenses or buying securities when they go on sale. Pharmaceuticals Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U. Thank you for your submission, we hope you enjoy your experience. Basic Materials Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the basic materials economic sector of the U. Individual Investor. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. Learn more. You cannot invest directly in the Index. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Intermediate Corporate Bond Index is designed to measure the performance of U. The fund offers exposure to small-cap U. Trial Not sure which package to choose?