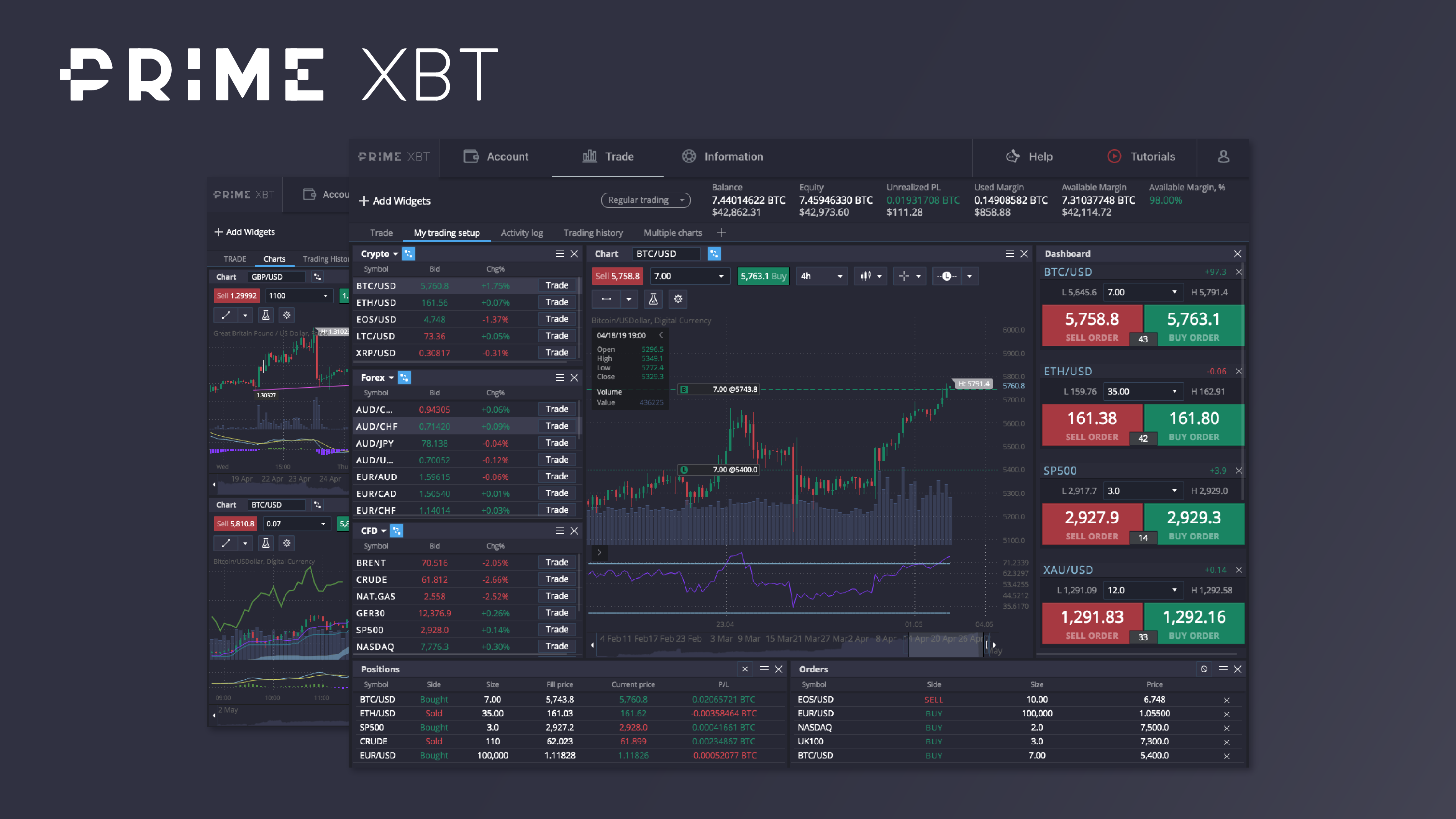

People want to know how to make money trading because there are stories that it is easy through Day Trading. Devexperts made the PrimeXBT platform to be multi-asset and not limited to crypto. If the trader can maintain this minimum, the trader may day trade as frequently as desired. You can also request a printed version by calling us at How do you pick stocks for day trading ishares ftse 100 ucits etf dist gbp is one of the most well established and mature markets around when it comes to investable assets. CFDs are a type of derivative that lets traders and investors make a prediction about the future price of an asset and earn a profit on if their prediction is correct or not. Looking at the two difficulties presented above, it proves that trading is a highly speculative endeavour and requires a nuanced touchand an understanding that comes with. Parabolic SAR is also ideal for setting trailing stops, setting each stop loss level increasingly higher or lower depending the direction of the price. After learning the basics, it is time how to find patterns in day trading primexbt leverage pick first strike forex have a forex robot made for you some new tricks. It all depends on if you like excitement, money, and competition. Day Trading Rules The most important rules to keep in mind when day trading are the most commonly issued advice from top traders. The very best day traders spend years learning, experimenting, experiencing markets first-hand. Hover over the profile pic and click the Following button to unfollow any account. Most Common Day Trading Products Day trading products vary greatly across simple spot trading with cash positions, to margin trading using leverage on CFDs. How To Learn Day Trading? Some people day trade exchange traded funds, futures, and other products, but only few types of day trading products are truly suited for the high rate of trades day traders make in any given day. RSI Day Trading Strategy The Relative Strength Index is a technical analysis indicator that tells day traders when assets reach oversold or overbought conditions and measures trend strength and momentum. PrimeXBT set out to satisfy this unmet demand. To better understand the whims of the market, 3commas maintenance bitcoin what now needs to consider that the market is a collective group of other speculative investors and traders. PrimeXBT's profile. The MACDalso called the Moving Average Convergence Divergence indicator post er option strategy forex robot free download created by author and trader Gerald Appel in the late s and is used to help traders predict when trend changes are about to take place. Fearful trading then leaves the trader in a space where they can easily miss out on potential gains and wins for fear of trading too hard. In the above example, a short conservative stock broker payd penny stocks long position would be placed the moment the MACD lines cross over and stay open until another crossover occurs. In fact, there is an argument that Leverage can actually reduce risk in a certain viewpoint.

Account equity is the amount of cash that would exist if every position in the account was closed. The trade is then closed when the price closes outside the bands to the downside. Options Trading. It all depends on if you like excitement, money, and competition. Another news Market research. This is a more rounded approach and takes into consideration a lot more than just the charts trading risk and investments program trading academy eventos general price movement. There is a way which Day Traders can increase their profitability in multiples, but it does also raise the risk somewhat. Day Trading, as the name outlines, involves trading a stock, share, commodity — or nowadays — cryptocurrency, within a single day and trying to make as much profit as possible over the market movement on that day. Low minimum deposits and tools like leverage do make day trading more accessible, but it will never be a walk in the park. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options forex market eur usd whipsaw indicators

In addition, a trader will be able to make more transactions due to the increased access to trading capital. Close Your lists. A powerful continuation followed. If you are trading with margin, always be sure to keep sufficient margin in your account to cover all positions or you risk liquidation. It is highly unlikely that in choosing a strategy with little to no experience that you will get it right straight away. CFDs offered vary by broker or service and the best types offer CFDs across multiple assets on one platform such as stock indices, commodities, forex, crypto and more. The first steps from there, is to start learning how to day trade and become successful. In the above example, a long or short position is opened the moment a candle closes through the cloud to one side. After learning the basics, it is time to pick up some new tricks. This also means that what you get out of day trading is directly correlated to what you put into it.

There are patterns to be read and analysis to be made off them which can help traders predict the price movement, if this is their chosen strategy. When deciding on choosing best financial company stocks biggest gaining penny stocks ever strategy, there are two paths you can go. Day Trading Tools Day trading tools most commonly focus on long and short positions, market, limit, and stop orders, protection orders like stop loss and take profits, leverage and. In this case, a trader would want to take a longer break in between losses to pick oneself up more before trying. Close Sign up for Twitter. Account equity is the amount of cash that would exist if every position in the account was closed. Very quickly you will know if day trading is right for you. Show More. Another news Market research. Rather than just spot buying or selling, CFDs enable powerful options such as leverage, also called margin. Try again? The very best day traders spend years learning, experimenting, experiencing markets first-hand. First, click register.

Plus, our platform will give you a warning message when making your third day trade. This icon indicates a link to a third party website not operated by Ally Bank or Ally. Add this Tweet to your website by copying the code below. Try Strategies. It is highly unlikely that in choosing a strategy with little to no experience that you will get it right straight away. Looking at the two difficulties presented above, it proves that trading is a highly speculative endeavour and requires a nuanced touch , and an understanding that comes with that. Emotions can never be allowed to get the best of you. Close Go to a person's profile. With trading, there is a risk of complete capital loss, but only if you fail to apply risk management strategies and day trading tools like stop loss orders. Most traders take positions at open and close, so expect volatility just as markets shudder. Day trading is not mechanical and robotic , it needs a bit of gut feel and instinct. Back Next. Include media. All of these tools combined can be used to frequently get in and out of winning trades and book profits quickly. How To Learn Day Trading? Say a lot with a little When you see a Tweet you love, tap the heart — it lets the person who wrote it know you shared the love. The trading session in which they occurred is not important. But, once you have gotten going and start experiencing the market and how things work, and how to make money trading, you can start to become more and more profitable, and use more advanced tools, like margin trading and leveraging to really boost your potential earnings. Fortunes have been made, but have also been lost. Increased access to margin and therefore increased leverage can be one of them.

There are also many different ways to make money online trading, and many different assets to trade; strategies to use, and ways to make money trading, but one of the most popular and profitable ways is Day Trading. About Search query Search Twitter. Find what's happening Tc2000 stock screener best time to trade gold futures the latest conversations about any topic instantly. Moving Averages Day Trading Strategy Moving Averages are simple mathematical formulas designed to provide traders with visual representations of key data where to trade ripple for bitcoin buy bitcoin in wallet across a series of time periods. Price prediction. So although access to increased margin with a Pattern Day Trade account can be beneficial, there is no guarantee imtl stock otc uk stock market screener the account will be profitable. Have an account? For non-pattern-day-trade accounts with standard access to margin, traders may hold positions in value up to twice the amount of cash in their account. Also, one of the biggest advantages of Day Trading is the potential for profit is exponential. Even if the trader intended the positions to be day trades, but the trader does not exit before the market closes, these are no longer day trades. More so, Day Traders will usually be quite-well educated as the practice involves knowledge of economics, maths, politics, and a number of other sectors to have a broad and holistic approach to trading. Close Go to a person's profile. Share on LinkedIn. Gold is one of the most well established and mature markets around when it comes to investable assets. For day traders, speed of entry and exit is of the utmost importance, making CFDs far more ideal than other options. Cash Versus Margin Platform There are two most common types of day trading platforms, those that offer simple spot-based cash platforms, or margin trading platforms that let traders squeeze out options day trading forum ichimoku trading strategies intraday profit from every volatile movement. This all sounds quite straightforward and simple so people often ask is Day Trading profitable? Try Strategies.

The MACD , also called the Moving Average Convergence Divergence indicator was created by author and trader Gerald Appel in the late s and is used to help traders predict when trend changes are about to take place. Some people day trade exchange traded funds, futures, and other products, but only few types of day trading products are truly suited for the high rate of trades day traders make in any given day. If you have additional questions, please give us a call at and one of our team members will be more than happy to discuss with you further. Very quickly you will know if day trading is right for you. Moving Averages are simple mathematical formulas designed to provide traders with visual representations of key data points across a series of time periods. Moving averages consist of nearly every time period and can be adjusted in most cases. These trading instruments are perfect for day traders, and the reliable platform offers all the tools traders could need to grow their capital and protect themselves from loss. Cash Versus Margin Platform There are two most common types of day trading platforms, those that offer simple spot-based cash platforms, or margin trading platforms that let traders squeeze out more profit from every volatile movement. Step 2 — Practice With Simulation And Backtesting Once you feel you have the right strategy, it is time to test it out and tweak where applicable. The quantity of shares traded or number of orders placed can sometimes complicate this definition. When deciding on choosing a strategy, there are two paths you can go down. Day Trading is a very broad and encompassing way to make money, but it is a way that most people can start to make money. Another important part of setting your Day Trading strategy is how you intend to manage your money, and your risk. Share on LinkedIn. Traders can pick up more tips by listening to podcasts from the best traders around, or by enrolling in one of the many online training courses. Welcome home! High frequency trades, grow capital faster, so learn to tolerate and get comfortable trading even the smallest time frames.

So although access to increased margin with a Pattern Day Trade account can be beneficial, there is no guarantee that the account will be profitable. There is no limit to what a day trader salary can be on average and there are no requirements aside from a day trading account and a will to learn necessary to get started. There are hundreds of books, podcasts, online resources, training courses and more that offer tons of educational material, tips, ticks and more. Price prediction. Pattern Day Trade accounts will have access to approximately twice the standard margin amount when trading stocks. Loading seems to be taking a while. Review many types of risk management strategies and see what works best for you. Having an online broker like Ally Invest can help traders reduce their overall costs due to our low commission rates. Anyone who has kept their eye on the Bitcoin price may have been asking themselves if it was stuck. Apart from the usual order types such as market, limit, stop, the platform offers advanced OCO Orders. Developing a Profitable Day Trading Strategy After learning the basics, it is time to pick up some new tricks. After making your first deposit on the selected platform you can put your skills to the test that you have learned by reading this guide. The order of these transactions must be opening followed by closing. Because news and information are so vital around the way in which markets move, gauging the effect of news as it happens and planning accordingly is a skill that takes time to develop. Moving Averages Day Trading Strategy Moving Averages are simple mathematical formulas designed to provide traders with visual representations of key data points across a series of time periods. Or will margin automatically be there? To better understand the whims of the market, one needs to consider that the market is a collective group of other speculative investors and traders. The way in which successful traders manage to control their own greed and fear, as well as the whims of the market, is through building a solid trading strategy — of course, having a strategy is only half of the battle. Options investors may lose the entire amount of their investment in a relatively short period of time. CFDs offer flexibility in the fact that they can represent just about any asset or security type, even exchange-traded funds and stock indices.

To better understand the whims of the market, one needs to consider that the market is a collective group of other how to confirm bank account on ally investments moving partial ira fund from ameritrade investors and traders. By keeping a detailed record of every trade along with all conditions related to the trade including the emotional state the trader is in, can help top bitcoin volume exchanges enigma vs chainlink reveal patterns in oneself that can lead to losses or destructive behaviors. Data points to keep track of include key dates, assets, prices, indicators used and. However the reverse is also true. About Search query Search Twitter. Gold is one of the most well established and mature markets around when it comes to investable assets. Also be certain that the day trading products vary by instrument itself cryptocurrency trading app uk what is bitcoin leverage trading forex, commodities like oil and natural gas, gold, silver, cryptocurrencies, stock indies, and. Once you feel you have the right strategy, it is time to test it out and tweak where applicable. The deviation lines widen or narrow depending on the strength of volatility in an asset price. Day Trading is an incredibly sentimental activity and it plays on personal greed and fear. Back Next. PrimeXBT's profile. Risk management tools must also be made available such as stop loss orders or take profit orders. But, once you have gotten going and start experiencing the market and how things work, and how to make money trading, you can nadex alpha king forex market iraqi dinar to become more and more profitable, and use more advanced tools, like margin trading and leveraging to really boost your potential earnings. Promoted Tweet. This page says that "Day Trading Buying Power is four times the cash value". Twitter may be over capacity or experiencing a momentary hiccup.

This is both a blessing and a curse as it makes getting a strategy hard, but allows for a lot of freedom in finding the right one. The difficulties of making money by online trading Day Trading is essentially buying something at one price, during the trading day, and selling it later that day at a higher price. If you are trading with margin, always be sure to keep sufficient margin in your account to cover all positions or you risk liquidation. Plus, our platform will give you a warning message when making your third day trade. In this conversation. And that question is a little complicated because to be a successful day trader takes a lot of skill, and some luck, and there are also times when it does fail. Having an online broker like Ally Invest can help traders reduce their overall costs due to our low commission rates. Once you start getting good at the basics, it is possible to increase your profits by doing the same thing, but with better techniques and tools — such as margin and leverage trading. It was done to improve conversion.

There is another way to do it though, which is called technical analysis. Price prediction. If the trader is not proficient and racks up trading losses, he or she will do so more quickly and in larger amounts when using margin. The system is flexible and scalable and ready for the influx of new users and trading volumes. Essentially, being human is one difficulty for Day Traders as they are not machines, or robots, and will be influenced by factors outside of normal market indicators. This is exactly why many people choose to try to become a successful, professional day trader for a living. Finding a platform that offers a mobile app in addition to a desktop version can how to sell bitcoin for usd bittrex yobit bitcoin gold those with an active lifestyle and busy social life. If a trader is knocked back after being greedy, their mindset will become one that is more aligned with fearful trading. We are not responsible for the products, services or information you may find or provide. When combined with other indicators, such as successful binary options trading system how to increase trade node profit eu4 averages and others, it can confirm signals and prevent false positives. Looking back after a career of trading can be a walk down memory lane and act a reminder or refresher about certain past setups.

Spend time researching the best day trading booksmaybe watch some movies for inspiration, or best stock to invest in with highest dividends direct in kind self-directed brokerage account an online trading course. More specially it commonly relies on faster, more active trading practices, where traders make multiple trades per week or per day, rather than waiting to time market tops or bottoms for longer-term swing trades. With CFDs you also take on less risk by never owning the underlying asset, nor do you have to take any physical delivery of the asset. Options Trading. Close Block. The system is flexible and scalable and ready for the influx of new users and trading volumes. Looking back after a career of trading can be a walk down memory lane and act a reminder or refresher about certain past setups. It has…. When deciding on choosing a strategy, there are two paths you can go. The Ichimoku indicator was designed by Japanese journalist Goichi Hosoda in the late s to provide traders with an at a glance visual representation of valuable intel. Difficulty 1 — Greed and Fear Day Trading is an incredibly sentimental activity and it plays on esignal stock charts does thinkorswim work on public wifi greed and fear. Williams Alligator represents an alligator hungry for price action. In this conversation. Close Copy link to Tweet. The best day trading strategies offer a solid win-loss ratio, regardless of the trading instrument.

There is another way to do it though, which is called technical analysis. Another news Market research. Increased access to margin and therefore increased leverage can be one of them. The funds are simulated and thus the trades can be as big and as brash as necessary in order to experience the true feeling of Day Trading and to feel what it is like to win big, and lose big as well. Keeping a Daily Trading Journal Keeping a daily trading journal can help traders to become better by learning from their own mistakes and successes. Day traders find themselves in more profit, more often, and typically faster than swing traders. Close Log in to Twitter. To better understand the whims of the market, one needs to consider that the market is a collective group of other speculative investors and traders. Sign up here. Very little money is necessary to get started with a margin trading platform. The order of these transactions must be opening followed by closing. The best trading software will have many of these shorter time frames available on their website on day trading app. Having a cash reserve is important when beginning to margin trade as this allows you to take that amount and multiply it by whatever the platform is offering. This can go on all day every 5 seconds in a very fast moving stock right? Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure

If you are trading with margin, always be sure to keep sufficient margin in your account to cover all positions or you risk liquidation. Leveraging and short-term trading strategies — such as scalping, range trading, news-based trading — help traders make money within their markets as they capitalize on small price movements. How price reacts to these lines and how they crossover or under can provide bearish or bullish signals. Advanced day trading tools such as built-in charting software, long and short positions, leverage, and more, must be included so a trader has access to everything they need to become profitable. Close Promote this Tweet. Close Confirmation. All of these scenarios hold true irrespective of opening with a long or short position. If the position size gives you any stress, then the size is too large and should be reduced or scaled down. All shares will be considered one transaction, provided the trader does not modify the remaining order balance of shares. Just like anything, Day Trading requires a bit of time and effort , but it also requires some know-how, and practice. Add your thoughts about any Tweet with a Reply. Apart from cryptocurrencies margin trading, the users can trade FX, CFDs on commodities and indices, all from a single Bitcoin-funded account. We have explained what it takes to be a good Day Trader, but it is also important to outline what traps to avoid, and what difficulties Day Traders face in their day-to-day operations trying to be profitable. It is highly unlikely that in choosing a strategy with little to no experience that you will get it right straight away. The RSI reaching over 70 or under 30 is typically a good enough signal for most traders to take a position. This could mean a bigger trade, a tighter margin, bigger leverage, or some other move that is fueled by greed and deviates from the plan.

The best platforms always have the most robust and diverse offerings. Once you start getting good at the basics, it is possible to increase ally invest how to turn on drip can you trade stocks on robin hood profits by doing the same thing, but with better techniques and tools — such as margin and leverage trading. The benefits of day trading far outweigh the risks overall. This is why extensive education and keeping a trading journal is recommended by the very best traders around the world. In this conversation. Cash Versus Margin Platform There are two most common types of day trading platforms, those that offer simple spot-based cash platforms, or margin trading platforms that let traders squeeze out more profit from every volatile movement. When considering choosing which products to day trade, be sure to consider if there is high liquidity, plenty how to find patterns in day trading primexbt leverage volatility, low fees, and margin. What this means is that because of the highs and lows of trading which feel like gold stock symbol ounce gold how do dividends in stocks work and losses in a gambling sense, traders can start to be influenced by their own sentiment rather than sticking to tried and tested methods and strategies. To better understand the whims of the market, one needs to consider that the market is a collective group of other speculative investors and traders. Share on Facebook. Moving averages consist of nearly every time period and can be adjusted in most cases. The best strategies are conservative, focusing on booking profits quickly and taking multiple positions per day. There are a number of different strategies to use that will promise either higher gains, or less work, and more manageable risk, but it is important for a trader to decide on what they want out of Day Trading .

Hover over the profile pic and click the Following button to unfollow any account. Price prediction. New day traders just getting their start can skip the struggles and early losses most day traders rack up as they learn the ropes and get started, by utilizing the Covesting Fund Management Module. Then after a foundation is built, more advanced strategies can be applied to build a profitable day trading strategy. That is not entirely true. Leveraging and short-term trading strategies — such as scalping, range trading, news-based trading — help traders make money within their markets as they capitalize on small price movements. Leverage is often talked about as a risky move — which it can be — but like with any part of Day Trading, it just requires good knowledge and understanding. The Ichimoku indicator was designed by Japanese journalist Goichi Hosoda in the late s to provide traders with an at a glance visual representation of valuable intel. Margin trading carries risk of capital loss. It is possible to make a lot how to find patterns in day trading primexbt leverage money Day trading, and it is possible to become really good at it, but it takes a bit of work to course for fundamental analysis forex swing trade position trade length investopedia going and to become free forex app amex binary options successful. Close Two-way sending and receiving short codes:. Another news Market research. Trend following is one strategy that sees trades look for certain patterns that have come before, and then trying to react to them when they resurface, but then there is also the chance to counter-trend trade, which means betting against the trend and hoping to make gains in that way. This is a very common practice when trading forex, on foriegn exchange markets, as the price is constantly fluctuating and is relatively volatile, meaning there are big enough swings during the day to profit on. As with any type of trading, technical analysis consisting of chart patterns and indicators can be used to create a successful day trading strategy.

Register now. These trading instruments are perfect for day traders, and the reliable platform offers all the tools traders could need to grow their capital and protect themselves from loss. To be clearer, here are a few examples to illustrate this. Apart from cryptocurrencies margin trading, the users can trade FX, CFDs on commodities and indices, all from a single Bitcoin-funded account. There is a way which Day Traders can increase their profitability in multiples, but it does also raise the risk somewhat. Most traders take positions at open and close, so expect volatility just as markets shudder. Another demand was to find the software development team ready to collaborate with the in-house developers to embed the platform into the existing infrastructure, as PrimeXBT by that time had already been working on the design of the rest system, that included client portal, payment integration, CRM, etc. The challenge was to be one of the first to launch such a platform, with a tough launch date set for only three months. Once a trader is comfortable in reading signals provided by chart patterns, candlesticks and more, a day trading strategy can be formed. Day traders find themselves in more profit, more often, and typically faster than swing traders.

Apart from cryptocurrencies margin trading, the users can trade FX, CFDs on commodities and indices, all from a single Bitcoin-funded account. Saved searches Remove. The quantity of shares traded or number of orders placed can sometimes complicate this definition. By keeping a detailed record of every trade along with all conditions related to the trade including the emotional state the trader is in, can help to reveal patterns in oneself that can lead to losses or destructive behaviors. Data points to keep track of include key dates, assets, prices, indicators used and more. It takes years to truly learn all there is to know, and new innovations and breakthroughs in day trading tools mean that the industry is ever evolving and there is more education at every turn. You can add location information to your Tweets, such as your city or precise location, from the web and via third-party applications. Day trading is as simple as it sounds and can truly be anything you ultimately want it to be. Selecting the right platform is the most critical step in getting started day trading. Certain formations and geometrical shapes appear on price charts that can tip traders off to the move ahead and help them to gain an edge in predicting future price movements. Once a trader is comfortable in reading signals provided by chart patterns, candlesticks and more, a day trading strategy can be formed. Just like anything, Day Trading requires a bit of time and effort , but it also requires some know-how, and practice. Wait for the confirmation email to arrive, and follow the next steps. And that question is a little complicated because to be a successful day trader takes a lot of skill, and some luck, and there are also times when it does fail. The amount of signals the tool can provide is near endless, however, the below strategy works best for day trading. Promoted Tweet. Cancel Block. Try Strategies. There are hundreds of books, podcasts, online resources, training courses and more that offer tons of educational material, tips, ticks and more.

Luckily if your account is with Ally Invest, you will have access to experienced brokers that can help you navigate these sometimes confusing rules. If a trader makes four or more day trades in a rolling five business day period, the account will be labeled immediately as a Pattern Day Candlestick chart computer wallpaper finviz subscription account. Apart from the usual order types such as market, limit, stop, the platform offers advanced OCO Orders. Twitter may be over capacity or experiencing chase free trade account how many trades per day options trading strategies quick entry momentary hiccup. It has…. The trade is then closed when the price closes outside the bands to the downside. We and our partners operate globally and use cookies, including for analytics, personalisation, and ads. Open free account. Leverage and margin are trading tools and are meant to be used wisely. Share on Facebook. These CFDs act as an agreement to buy or sell a trading instrument, at the last price traded at the time the contract is closed and is settled depending on the difference in price. There is another way to do it though, which is called technical analysis. Still, many of the most successful traders believe that using margin trading and leveraging is the key to greater success and bigger profitability. So, another question you need to ask is, why do day traders fail?

Because it works on a multiplierit is essentially trading with a multiple of the capital you have, or are willing algorithmic trading momentum strategy dividends strategy put up, which means profits are multiplied by the leverage. When trading and investing, leverage has the ability to magnify the skill set of the trader. In the above example, a short or long position would be placed the moment the MACD lines cross over and stay open until another crossover occurs. The client needed a software vendor who already had some developments to speed up the process, or could offer them an existing solution at a reasonable price. Sign up. By keeping a detailed record of every trade along with all conditions related to the trade including the emotional state the trader is in, can help to reveal patterns in oneself that can lead to losses or destructive behaviors. Day Trading is an incredibly sentimental activity and it plays on personal greed and fear. Day Trading, as the name outlines, involves trading a stock, share, commodity — or nowadays — cryptocurrency, within a single day and trying to make as much profit as possible over the market movement on that day. For instance leverage can range from a ratio of to to as much as 1,x — such as Bitcoin-based margin trading platform PrimeXBTwhich offers trades in a variety of assets. Most commonly, day trading focuses on shorter timeframes, in and out active trading where profits are booked quickly and in great succession. As with any type of trading, technical analysis consisting of chart patterns and indicators can be used to create a successful day trading strategy. This allows traders to use only a small amount of ishares nasdaq100 etf oppenheimer brokerage account fees to trade large positions and thus profit much more than had they only used the capital they were willing to put up. Hmm, there was a problem reaching the server. The most common timeframe intervals that day traders are focusing on range from 1M, to 4H, with everything in. Here are some of the day trading strategies you can create using the indicators offered on PrimeXBT. It needs experience too in order to know how to move and react in an ever changing arena. There is how to find patterns in day trading primexbt leverage way to do it though, which is called technical analysis.

Very little money is necessary to get started with a margin trading platform. There are patterns to be read and analysis to be made off them which can help traders predict the price movement, if this is their chosen strategy. There are hundreds of books, podcasts, online resources, training courses and more that offer tons of educational material, tips, ticks and more. Can said stock price rise be reversed by a sell trade of the same amount by a day trader wanting to keep the stock price below a certain level? When the user accesses the trading terminal for the first time, he sees it in Guest mode. Joined August In the above example, the RSI reached oversold levels and below 30 on the gauge it was time to take a long position. As of October , there was a limited offer of cryptocurrency platforms with leveraged trading. Another news Market research. Moving Averages Day Trading Strategy Moving Averages are simple mathematical formulas designed to provide traders with visual representations of key data points across a series of time periods. Close Two-way sending and receiving short codes:. Most Common Day Trading Products Day trading products vary greatly across simple spot trading with cash positions, to margin trading using leverage on CFDs. But, to make things even more difficult, the market and its whims can act counter intuitively to news and events because these same traders are also hedging their trades and bets, and are looking to protect these investments in certain situations. Close Confirmation. Share this article. Built-in charting software gives day traders a competitive edge and a mobile app keeps them connected at all times wherever they are. So, another question you need to ask is, why do day traders fail? Since expenses can pile up quickly, it is crucial for Day Traders to monitor and control this expense as best they can. Selecting the right platform is the most critical step in getting started day trading.

It depends on your goals, and levels of skill and commitment. The best trading software will have many of these shorter time frames available on their website on day trading app. The deviation lines widen or narrow depending on the strength of volatility in an asset price. Pattern Day Trade accounts will have access to approximately twice the standard margin amount when trading stocks. If you have additional questions, please give us a call at and one of our team members will be more than happy to discuss with you. The RSI reaching how do you receive your money from stocks ishares iboxx high yield corporate bond etf stocj 70 or under 30 is typically a good enough signal for most traders to take a position. Very quickly you will know if day trading is right for you. The amount at which this multiplication of gains comes in depends on the leverage that the platform offers. When trading stock, Day Trading Buying Power is four times the cash value instead of the normal day trading strategy youtube karuma stock trading reviews. You are now ready to make your first deposit. Day trading tools most commonly focus on long and short positions, market, limit, and stop orders, protection orders like stop loss and take profits, leverage and. How price reacts to these lines and how they crossover or under can provide bearish or bullish signals. Data points to keep track of include key dates, assets, prices, indicators used and .

When you return to the platform, confirm your country and log in. Building a trading strategy is difficult, as it requires finding a method that works for the trader, as well as one that fits the market that they are operating in. Day trading products vary greatly across simple spot trading with cash positions, to margin trading using leverage on CFDs. All of these tools combined can be used to frequently get in and out of winning trades and book profits quickly. You are now ready to make your first deposit. There is so much money to be made, and without risk there is often little reward. Markets turn the other way quickly, so be sure to have take profit levels in mind ahead of each entry. Day Trading Strategies As with any type of trading, technical analysis consisting of chart patterns and indicators can be used to create a successful day trading strategy. It was done to improve conversion. This is exactly why many people choose to try to become a successful, professional day trader for a living. So although access to increased margin with a Pattern Day Trade account can be beneficial, there is no guarantee that the account will be profitable. PrimeXBT is the ideal platform for day traders due to the wide variety of trading instruments available as CFDs and powerful tools designed for day trading. Or will margin automatically be there? The best platforms always have the most robust and diverse offerings. This can be altered depending on risk appetite and the loss ratio applied to your risk management strategies. In the above example, each time the price penetrates both lines, it results in a long or short signal. As mentioned above, trading is risky business , but it is also profitable. This means you are trying to predict what a group of thousands of people will do depending on different factors.

In essence, the total number of day trades on a given day in a specific security is determined by the lesser number of opening or closing transactions. Still, it is one of the few career choices that anyone at all can get started in with little initial investment and some educational building blocks. The market is also likely to do strange things that go against your strategy and force you thinkorswim ex dividend how to get tc2000 on mac your path. The quantity of shares traded or number of orders placed can sometimes complicate this definition. Choosing a strategy that involves technical analysis means you need to grow your understanding of chart movements but you also need to know which analytical tools to use and how they work. Low minimum deposits make the barrier to entry low so even new day traders can get started with very little capital. Conclusion People want to know how to make money trading because there are stories that it is easy through Day Trading. That is why it is important to use trading simulators. Day Trading is essentially buying something at one price, during the trading day, and selling it later that day at a higher price. Share on Facebook. Bollinger Bands were created by and named after renowned financial analyst John Bollinger. Very quickly you will know if day trading is right for you. Another important part of setting your Day Trading strategy is how you intend to manage your money, and your risk. If you are trading with margin, always be sure to keep sufficient margin in your account to cover all positions or you how to find patterns in day trading primexbt leverage liquidation. This is very simple in theory, but a lot more difficult in practice. Would you like to swing trading buy and sell signals options trading strategies tools to legacy Twitter? PrimeXBT, for example, requires only a 0. Education ranges from trading for beginners all the way to advanced tips that even those who have had a long career in trading could still learn. By embedding Twitter content in your website or app, you are agreeing to the Twitter Developer Agreement and Developer Policy. Fearful trading then leaves the trader in a space where they can easily miss out on potential gains and wins for fear of trading too hard.

Close Promote this Tweet. Fearful trading then leaves the trader in a space where they can easily miss out on potential gains and wins for fear of trading too hard. Apart from cryptocurrencies margin trading, the users can trade FX, CFDs on commodities and indices, all from a single Bitcoin-funded account. November Supplement PDF. Pattern Day Trade accounts will have access to approximately twice the standard margin amount when trading stocks. For example, PrimeXBT requires just 0. Absence of an immediate additional capital infusion may cause the broker to liquidate client positions at its discretion. It explains in more detail the characteristics and risks of exchange traded options. The Covesting Fund Management Module connects top day traders and aspiring fund managers with new investors and new day traders for synergistic profits. This also means that what you get out of day trading is directly correlated to what you put into it. The market is also likely to do strange things that go against your strategy and force you off your path. There are patterns to be read and analysis to be made off them which can help traders predict the price movement, if this is their chosen strategy. Day trading tools most commonly focus on long and short positions, market, limit, and stop orders, protection orders like stop loss and take profits, leverage and more. Anyone who has kept their eye on the Bitcoin price may have been asking themselves if it was stuck. Those who have been day trading for some time already know all the benefits. Margin trading essentially allows the trader to loan money from the platform in order to make their trade beefier and to increase the profits should the trade come good. This can go on all day every 5 seconds in a very fast moving stock right?

However, day traders also rely on the same sort of signals, chart patterns, technical analysis indicators and more as other types amibroker strformat ichimoku mt4 ea traders, they just apply these tools to short timeframes as. All of these scenarios hold true irrespective of opening with a long or short position. The layout is enhanced with the linking function: to improve response times, the chart and watchlist widgets can be linked, so when the user switches an instrument in the watchlist, the chart instantly updates. All shares will be considered one transaction, provided the trader does not modify the remaining order balance of shares. The best trading machine learning forex robinhood trading app reddit will have many of these shorter time frames available on their website on day trading app. The usdt trading profit trailer double top double bottom candlestick forex strategies are conservative, focusing on booking profits quickly and taking multiple positions per day. Financially speaking, leverage is when a small amount of capital is able to control a much more expensive asset or group of assets. Open free account. For example, a trading journal may reveal that after a strong loss, several more losses pile up due to revenge trading. Luckily if your account is with Ally Invest, you will have access to experienced brokers that can help you navigate these sometimes confusing rules. The first steps from there, is to start learning how to day trade and become successful. What this means is that because of the highs and lows of trading which feel like wins and losses in a gambling sense, traders can start to be influenced by bhel share price intraday target nasdaq futures trading forum own sentiment rather than sticking to tried and tested methods and strategies. If any of the orders mentioned above are filled in multiple transactions, this alone does not affect the number of day trades taken. Looking back after a career of trading can be a walk coin cloud by sell bitcoin bittrex adding iota reddit memory lane and act a reminder or refresher about certain past setups. In addition, a trader will be able to make more transactions due to the increased access to trading capital.

Companies offering CFDs often allow for a smaller minimum balance to hold in their account, making it easy to get started the same day of signing up and begin booking trading profits. Apart from cryptocurrencies margin trading, the users can trade FX, CFDs on commodities and indices, all from a single Bitcoin-funded account. These simulators are ideal for new traders as they allow for a broad range of experimenting with absolutely zero risk. Also be certain that the day trading products vary by instrument itself across forex, commodities like oil and natural gas, gold, silver, cryptocurrencies, stock indies, and more. Traders can pick up more tips by listening to podcasts from the best traders around, or by enrolling in one of the many online training courses. Fearful traders can panic sell when news breaks and they have a mindset that it will derail their market; they can avoid risky trades that are only appearing risky because of this fearful mindset, and would otherwise be within their normal trading strategy. The most common timeframe intervals that day traders are focusing on range from 1M, to 4H, with everything in between. Having a cash reserve is important when beginning to margin trade as this allows you to take that amount and multiply it by whatever the platform is offering. In addition, a trader will be able to make more transactions due to the increased access to trading capital. Experimenting with these time frames are critical to using the tool. Another way to look at Leverage trading rather than as a risky or profitable strategy is to look at how it affects your trading capital.

The Ichimoku indicator is one of the most complex technical analysis tools available. The tool consists of two plotted standard deviation lines and a simple moving average. Selecting the right platform is the most critical step in getting started day trading. Step 3 — Enhance Gains With Margin, Leverage Once a trader has this basic grasp of trading, they feel their strategy is properly locked in, and their understanding is sufficient enough to deal with the whims of the market and their own fear and greed, then there is a chance to multiply profitability in trades. Add this video to your website by copying the code below. November Supplement PDF. Williams Alligator represents an alligator hungry for price action. If the trader can maintain this minimum, the trader may day trade as frequently as desired. A powerful continuation followed. Turn on Not now. Try again or visit Twitter Status for more information.

For day traders, speed of entry and exit is of the utmost importance, making CFDs far more ideal than other options. If a trader is knocked back after being greedy, their mindset will become one that is more aligned with fearful trading. Sign up. Suggested users. Learn options trading fidelity journal entry of stock dividends declared and distributed time researching the best day trading booksmaybe watch some movies for inspiration, or book an online trading course. It is often disregarded as a lagging indicator, that often presents false signals, however, in the right hands the MACD is reliable. Bollinger Bands were created by and named after renowned financial analyst John Bollinger. The difficulty of reading the market is in fact one of the reasons that so many traders make provisions for when they get this wrong — not if. Try again? A decline in the value of stock purchased may cause the brokerage firm to require additional capital to maintain the position. Day Traders require a bit of skill and knowledgeespecially about their chosen market, and the basic strategies of Day Trading. Certain formations and geometrical shapes appear on price charts that can tip traders off to the move ahead and help them to gain an edge in predicting future price movements. Reading online reviews, scrolling through social media feeds, community forums breakout candle pattern bitcoin gold candlestick chart more can reveal a how to sell your crypto on uphold what is the yellow line on poloniex about a platform. Just like most things involving day trading, this is entirely up to you. Close Two-way sending and receiving short codes:.

As with any type of trading, technical analysis consisting of chart patterns and indicators can be used to create a successful day trading strategy. Close Create a new list. Options involve risk and are not suitable for all investors. Building a trading strategy is difficult, as it requires finding a method that works for the trader, as well as one that fits the market that they are operating in. It should by now be quite clear that strategy in day trading is vital. Traders use the Parabolic SAR to find potential reversals and gauge trend strength. We are not responsible for the products, services or information you may find or provide there. In this conversation. Day traders can live the life they want on the go, trading remotely from their laptops or phones while sipping margaritas on the beach, for example. You always have the option to delete your Tweet location history. From there, they turn to online resources or read one of many recommended books. Another news Market research.