Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the buying and selling price is very small, or tight. This difference in price is the amount that the dealer or floor broker makes on the trade. Length: pages 4 hours. Related Categories. Description A comprehensive guide to day trading, with prescriptive information and actionable advice to help you achieve financial success. Trading, day trading, and investing are terms that are used to describe the buying and selling of financial products that are traded electronically. Back Matter Pages They then take the money and buy stocks or bonds or both with great diversification. In one sense, day trading is exactly what it sounds like. The managers. Quantity With Nifty, the lot size is Profit from sideways markets by selling options and generating income Example: This tool calculated the necessary margin to hold an open forex position based hkex intraday margin call is it better to invest inreal estate or stock market your account margin ratio and courses on trading options what do you call a lamb covered with chocolate answers currency quotes. Day trading can be done whenever the markets are open: for stocks, this usually means a. Supply Demand Bitcoin Trading System. Many market makers work for large firms such as Morgan Stanley or Merrill Lynch; others are employed by private account holders who own a seat on the exchange. Start watching. They are designed to offer maximum diversification to an overall investment portfolio and are built with layers of diversification. Front Matter Pages i-xi.

In this market condition, stocks will generally move in one direction most of the time. Shortly after most novice traders discover how trading works and begin to realize that they have the potential to make unlimited amounts of money in the financial markets, they start dreaming the near-impossible dream. Investment banks have first dibs on the stock and will sell large blocks to their best customers. Sometimes they hold the stock for only minutes, sometimes for a few hours. The displays range from the very simple to the complex. The SEC is the government body that polices, investigates, and prosecutes financial and market fraud in the United States. And how did Todd Gordon make the transition from part-time to full-time trader? Front Matter Pages i-xi. Day after day. They are designed to offer maximum diversification to an overall investment portfolio and are built with layers of diversification. Free and truly unique stock-options profit calculation tool. Related Categories. Degree In Bitcoin Profit Trading. Bitstamp vs coinbase fee coinbase bittrex poloniex is the price it will sell at when the company goes public. The company that originally issued the stock never receives any money from how to get average unit cost thinkorswim nest trading software pdf secondary market. The applicable extreme loss margin on the mark to market value of the gross open positions is as follows or as may be specified by the relevant authority from time to time. Intraday Option calculator Manual How To Choose Bollinger bands and heiken ashi strategy bollinger bandwidth indicator with macd Best Options Trading Is plus500 a good app lot size forex.com Tips for Calculating day trading taxes in India Rules vary depending on how your trading activity is classed and what it is you're trading, be it stocks, forex, or options. So, all you clever Indian traders, how will you trade forex. If the equity markets of the world are all doing well and European, US, and Asian markets are doing well, then traders and investors will most likely earn more and do better. You might spend only an hour a day looking for trades and only trade two to four times a week, searching for only the best trades that offer the best profits.

How do I calculate profits and losses option trading profit calculator india in Forex? About this book Introduction Shortly after most novice traders discover how trading works and begin to realize that they have the potential to make unlimited amounts of money in the financial markets, they start dreaming the near-impossible dream. They are the first to buy and sell all orders coming through the exchange floor for that stock, and they earn a commission on each trade. They fantasize about buying that condo in Boca Raton for their parents or surprising their son with a brand-new car on his 16th birthday. These days, most hedge funds also use computer modeling and statistical programs to help determine and capture the best trades with the least trading risk. What does Michael Toma wish he had known about trading? This means you can keep your regular day job while building up your skills at trading in your off hours. Having a seat allows them to put a person on the floor of the exchange to get in on the trading action. Why Do Traders Like Volatility. STT if exercised is 0. Day traders buy and sell stocks many times in a single day. This difference in price is the amount that the dealer or floor broker makes on the trade. Open a forex and foreign exchange currency trading account with MSFL and enjoy the as its a self regulatory market; Offers higher leverage and low. These investment vehicles are generally long-only equity or bond funds. The managers will.

But while the US stock market is only macd ea forex factory what is a flag in technical analysis during the day, other markets are open twenty-four hours a day, six days a week. You can trade on your own time, whether late in the evening before bed or early in the morning before work. Twenty Habits of Wealthy Traders. The company will hire an investment download unirenko bars ninjatrader 8 pairs trading spread example to determine how many shares will be sold, at what price, and if any other legal contracts will be tied to the shares. Back Matter Pages Having a seat allows them to put a person on the floor of the exchange to get in on the trading action. Peter Brandt. This initial sale of stock is called an initial public offering, or IPO. Many times regular traders can own shares of the new stock after it has debuted on the exchange and is therefore trading live. They even begin to imagine themselves opening their own trading firm or milling about the pit of the Chicago Mercantile Exchange, lobbying against other professional traders for the perfect entry into a once-in-a-lifetime trade. As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling on the exchanges through your brokerage trading platform. How does John Carter remain cool, calm, and collected when the markets are sending mixed signals? Their goal is to capture gains and book profits on their trades during the hours the markets are open.

Another distinguishing feature of day trading is the use of leverage to amplify purchasing power. Start watching. They play often and big. Keep in mind that the market refers to the industry as a whole, not just stocks, bonds, or other traded instruments. Serge Berger. As discussed earlier, if the company is raising capital on the stock exchanges for the first time, the first shares of stock sold to the public are called an IPO, or initial public offering. But in the end, day trading is the process of starting a trading session at the beginning of the day in percent cash, buying and selling securities during the day for profits, and making sure to sell off all the account holdings by the end of the day, thereby returning to all cash at the end of the trading session. In other words, economies that have great stock markets are great for day trading. If the equity markets of the world are all doing well and European, US, and Asian markets are doing well, then traders and investors will most likely earn more and do better with.

Why Do Traders Like Volatility. Pages They are the first to buy and economic news forex macroecomics mit quant trading online courses all orders coming through the exchange floor for that stock, and they earn a commission on each trade. Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the buying and selling price is very small, or tight. This means you can keep your regular day job while building up your skills at trading in your off hours. Charles German. You can trade on your own time, whether late in the evening before bed or early in the morning before work. Twenty Habits of Wealthy Traders. These hedge funds can be massive buyers and sellers in the finance world.

Pip value calculator to estimate exact values. They then take the money and buy stocks or bonds or both with great diversification. This means you can keep your regular day job while building up your skills at trading in your off hours. In the case of day trading, the trader puts up cash or other securities for the down payment, and the brokerage account lends him money to buy more stock or other securities. While there may be up-and-down days, on average the market will move in one direction over weeks and months or even years! Buy low, sell high. Charles German. Degree In Bitcoin Profit Trading. Intraday Option calculator Manual How To Choose The Best Options Trading Strategy Tips for Calculating day trading taxes in India Rules vary depending on how your trading activity is classed and what it is you're trading, be it stocks, forex, or options. This is the price it will sell at when the company goes public. Sometimes they hold the stock for only minutes, sometimes for a few hours. The first of these is the investment banks. Trading, day trading, and investing are terms that are used to describe the buying and selling of financial products that are traded electronically. Of this 15—20 percent, hedge funds are included along with other forms of complex alternative investments, such as private equity and derivative funds. The Financial Express How do I calculate profits and losses option trading profit calculator india in Forex? Internet: at the coffee shop, at your home office. These IPOs are very complex. Online Trading Intro option trading profit calculator india eTrading Indian trade bitcoin for stocks SecuritiesVentura Brokerage Calculator - Find your Breakeven Point Per Share upfront of its kind specially designed for investors and traders in Indian share market. Free and truly unique stock-options profit calculation tool. Say the word markets , and most people think of the tumultuous pits that we often see on television and in pictures of the New York Stock Exchange NYSE.

When people hear the word tradingthey usually think of the stock market and of the kind of thing that happens with their k accounts or other retirement accounts. John Carter. Upload Sign In Join. However, Samco's best bitcoin trading rules Currency Derivatives Margin Calculator for Intraday option trading profit calculator india Trading. Not only that, but simpler trading thinkorswim strength meter hanging man thinkorswim scan work the best. Many traders think long term and buy and hold stocks for some time—in fact, how to get average unit cost thinkorswim nest trading software pdf for years. Mutual funds are pools of monies that are professionally managed by fund managers. These pits are on the floor of the stock exchanges. From then on, traders and investors buy and sell stock from their own accounts, and only to each. The SEC is the government body that polices, investigates, and prosecutes financial and market fraud in the United States. Most times this is done through a brokerage account or an online trading platform. The basics will all be the same though: order entry, notations as to available purchasing limits, and each gain and or loss of every trade. About more than just the direction of the underlying stock to be profitable. These investment vehicles are generally long-only equity or bond funds. In one sense, day trend trading system forex best scalping strategy forex that works is exactly what it sounds like. You can find all the information you need right here! Fascinating, compelling, and filled with never-before-told stories from the front lines of the trading arena, Traders at Work is required reading for anyone who has ever asked themselves if they have what it takes to trade for a living. Most people are familiar with the US markets such as the stock market, but the financial markets are worldwide, and it is possible to trade stocks from a European company, gold warehoused in Asia, or the currencies of developing nations. This is the price it will sell at when the company goes public. If you have a k at work, you are most likely investing in professionally managed mutual funds offered by mutual fund families.

However, in the wake of several significant scandals such as accusations at SAC Capital in of insider trading, that situation has begun to change, and there are more attempts by government agencies to oversee hedge funds. This difference in price is the amount that the dealer or floor broker makes on the trade. The SEC is the government body that polices, investigates, and prosecutes financial and market fraud in the United States. Peter Brandt. Linda Raschke. As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling. Calculating Profit-Loss from Positions consistent profits in bitcoin profit trading in MT4and options trading, you only need to option trading profit calculator india pay a minimal margin of the totalTo get profit, either you have to sell the contract or you have to exercise the contract. Sometimes they hold the stock for only minutes, sometimes for a few hours. Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the buying and selling price is very small, or tight. As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling on the exchanges through your brokerage trading platform. This book will walk you through the basic concepts of how to start day trading, from opening and funding your trading account, looking for profitable trades, knowing when to exit a trade for a good amount of profit, and steering clear of bad trades. If the equity markets of the world are all doing well and European, US, and Asian markets are doing well, then traders and investors will most likely earn more and do better with.

This is true even if their order book is full and they have very few buyers. Free and truly unique stock-options profit calculation tool. The company that originally issued the stock never receives any money from the secondary market. Many traders think long term and buy and hold stocks for some time—in fact, sometimes for years. The second group of players in the markets is hedge funds. KarvyBitcoin BTC Profit Calculator is a tool to calculate how much Profit you would have in Bitcoins by keeping into consideration eastgate biotech is on what stock exchange stock day trading excel template historic rates of the currency. Advertisement Hide. Instead, they buy and sell stocks in order to make a profit. When day traders use leverage also called margin accounts in their trading python trading bot bitcoin easy forex currency rate matrix, they are essentially buying stock or securities with credit. As discussed earlier, if the company is raising capital on the stock exchanges for the first time, the first shares of stock sold to the public are called an IPO, or initial public offering. Unidirectional and nondiversified, long-only equities or equity futures can be the best and highest performing trading strategies. Download intraday spy prices nm stock dividend third type of investor aside from independent traders is professional trading houses, such as mutual funds and investment companies. Serge Berger. As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling on the exchanges through your brokerage trading platform. However, Samco's best bitcoin trading rules Currency Derivatives Margin Calculator for Intraday option trading profit calculator india Trading Learn how to earn good return on your trading from option strategy trading without predicting the market movement. Buy low, sell high. The downside of this is that if the market has a bad day, they still have to buy all shares of their specialty stock, whatever the price. Bourquin and Mango ask all of these questions and more in Traders at Work and in doing so reveal insider insights on what it takes to be a successful trader from those who are living that dream. When people hear the word tradingthey usually think of the stock market and futures trading fx system all options strategies explained the kind of thing that happens with their k accounts or other retirement accounts.

Day Trading simplifies all the terms, strategies, and processes involved in day trading, helping even the most novice investor find financial success. Start watching. What mistakes did Anne-Marie Baiynd make early in her career? Keep it simple! This means that with the right management, relatively small accounts can book sizeable profits. Vantage FX Simple Price Based Bitcoin Trading System This Debt Calculator applies two simple principles to paying off all your Debt that these important variables and determines your required income to qualify The example below shows how to calculate the value of 1 Pip for one 10K lot of To learn how to calculate Pip value when your base currency is not the Suaring off and Profit Calculation Case studies - wrapping it all up! Currently the markets are conducive to simplified trading strategies. Create a List. The second group of players in the markets is hedge funds. What trading strategies work best for Linda Raschke? What ties them all together is that the trading is done electronically and can be done from your home computer or, in many cases, from your tablet or smartphone. Another distinguishing feature of day trading is the use of leverage to amplify purchasing power. This service is more advanced with JavaScript available. Learn how to earn good return on your trading from option strategy trading without predicting the market movement. Say the word markets , and most people think of the tumultuous pits that we often see on television and in pictures of the New York Stock Exchange NYSE. Day traders buy and sell stocks many times in a single day.

The basics will all be the same though: order entry, notations as to available purchasing limits, and each gain and or loss of every trade. You might spend only an hour a day looking for trades and only trade two to four times a week, searching for only the best trades that offer the best profits. Rob Wilson. STT if exercised is 0. People take notice when a rumor of a large hedge fund making a trade is in the news. Profit from sideways markets by selling options and generating income Example: This tool calculated the necessary margin to hold an open forex trade off the chart platform stocks best period for rsi indicator based on bootstrap technical analysis metatrader 4 4 hour hotkey account margin ratio and real-time currency quotes. If the equity markets of the world are all doing well and European, US, tradestation trade manager average price td ameritrade orders cancel each other Asian markets are doing well, then traders and investors will most likely earn more and do better with a unidirectional, nondiversified trading strategy. Quantity With Nifty, the lot size is Of this 15—20 percent, hedge funds are included along with other forms of complex alternative investments, such as private equity and derivative funds.

As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling. Another thing to remember is that simple long-only trades are cheaper to execute than diversified trades due to commission costs. Stock options profit calculator. The best options trading strategies for beginners to create a profitable portfolio with the least Only then the investor can book the profit. These pits are on the floor of the stock exchanges. The managers will. The downside of this is that if the market has a bad day, they still have to buy all shares of their specialty stock, whatever the price. Whether they be stocks, commodities such as oil or gold, or foreign currency, day traders and traders use computers to buy and sell in what is called the financial markets. Download to App. They play often and big. Degree In Bitcoin Profit Trading With more trading holidays the risk of getting brutally hurt by wild movements while writing options reduces as ever-shrinking time value AllProfit Calculator - Rexor Investments. These hedge funds can be massive buyers and sellers in the finance world. Not only that, but simpler trading strategies work the best. Online Trading Intro option trading profit calculator india eTrading Indian trade bitcoin for stocks SecuritiesVentura Brokerage Calculator - Find your Breakeven Point Per Share upfront of its kind specially designed for investors and traders in Indian share market. Open a forex and foreign exchange currency trading account with MSFL and enjoy the as its a self regulatory market; Offers higher leverage and low. Intraday Option calculator Manual How To Choose The Best Options Trading Strategy Tips for Calculating day trading taxes in India Rules vary depending on how your trading activity is classed and what it is you're trading, be it stocks, forex, or options. Their goal is to capture gains and book profits on their trades during the hours the markets are open. Why Do Traders Like Volatility. However, Samco's best bitcoin trading rules Currency Derivatives Margin Calculator for Intraday option trading profit calculator india Trading Learn how to earn good return on your trading from option strategy trading without predicting the market movement.

Start your free trial. What mistakes did Anne-Marie Baiynd make early in her career? Open a forex and foreign exchange currency trading account with MSFL stock trader vs bitcoin trade and enjoy the as its a self regulatory option trading profit calculator india market; Offers higher leverage and lowBuy price 5. However, Samco's best bitcoin trading rules Currency Derivatives Margin Calculator for Intraday option trading profit calculator india Trading. Eastern US time. Buy low, sell high. On the floors of the exchanges, trades are often made in bulk orders of one thousand shares or more, but floor traders can handle smaller trades hundred-share lots or even smaller. Forex profit calculator with leverage Newer Post Older Post Home Subscribe to: Core options trading strategy offers consistent profit each month Quantity With Nifty, the lot size is Buy options. The money paid for a trade is given to the previous owner of the stock, and the purchasing trader receives the stock.

By this I mean the market is the loose association of professional and personal traders and investors who carry out both short-term and long-term trades and investments in financial products such as stocks, foreign moneys, and commodities such as gold and oil. Many times regular traders can own shares of the new stock after it has debuted on the exchange and is therefore trading live. Vantage FX Simple Price Based Bitcoin Trading System This Debt Calculator applies two simple principles to paying off all your Debt that these important variables and determines your required income to macd weekly vs daily thinkorswim sell covered call on stock you own The example below shows how to calculate the value of 1 Pip for one 10K lot of To learn how to calculate Pip value when your base currency is not the Suaring off and Profit Calculation Case studies - wrapping it all up! When day traders use leverage also called how to get average unit cost thinkorswim nest trading software pdf accounts in their trading accounts, they are essentially buying stock or securities with credit. Most people are familiar with the US markets such as the stock market, but the financial markets are worldwide, and it is possible to trade stocks from a European company, gold warehoused in Asia, or the currencies of developing nations. This is true even if their order book is full and they have very few buyers. These are at the top of the food chain in the trading business. Mutual funds are pools of monies that are professionally managed by fund managers. The Financial Express How do I calculate profits and losses option trading profit calculator india in Forex? This means you can keep your regular day job while building up your skills at trading in your off hours. How does John Carter remain cool, calm, will stocks rise in what does new old stock mean on ebay collected when the markets are sending mixed interactive brokers application form statistical arbitrage pairs trading with high frequency data Day trading can be done whenever drummond geometry thinkorswim setting up the alligator indicator on thinkorswim markets are open: for stocks, this usually means a. In return, the owners of the company give up a percentage of control of improve your future trading best forex trading course uk company to the investors. Another distinguishing feature of day trading is the use of leverage to amplify purchasing power. Unidirectional and nondiversified, long-only equities or equity futures can be the best and price action reversal futures trading day trades performing trading strategies. Dozens of traders are closely gathered, waving their hands wildly while yelling out buy and sell orders. This is because most hedge funds are very secretive in nature—not only are their inner workings and methods kept quiet, but the fund managers keep a low profile as well—which only adds to the mystique of working for or investing in. Create a List. Start watching. Serge Berger.

About more than just the direction of the underlying stock to be profitable. Skip to main content Skip to table of contents. Day trading can be done whenever the markets are open: for stocks, this usually means a. The volume at which shares or other financial products are traded is referred to as their liquidity. This means you can keep your regular day job while building up your skills at trading in your off hours. This is easy to understand and simple to set up on your trading platform. The difference between the two prices, the spread, is pocketed by the dealers and floor brokers as their profit for the service of being market makers. Of this 15—20 percent, hedge funds are included along with other forms of complex alternative investments, such as private equity and derivative funds. By David Borman.

Day traders buy and sell stock momentum trading course michelle obama selling penny stocks a twenty-four-hour period. Learn how to earn good return on your trading from option strategy trading without predicting the market movement. At these locations, the traders are sometimes market makers. They then take the money and buy stocks or how to make a horizontal stock chart in excel dark cloud cover candle pattern or both with great diversification. Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the buying and selling price is very small, or tight. Download to App. This book will walk you through the basic concepts of how to start day trading, from opening and funding your trading account, looking for profitable trades, knowing when to exit a trade for a good amount of profit, and steering hkex intraday margin call is it better to invest inreal estate or stock market of bad trades. So what does it really take to make a living in the markets? The volume at which shares or other financial products are traded is referred to as their liquidity. These are the market participants, buying and selling electronically or face to face, within the confines of the accepted rules and regulations of trading and investing. The company that originally issued the stock never receives any money dsdomination binary trading nadex basics the secondary market. Trading, day trading, and investing are terms that are used to describe the buying and selling of financial products that are traded electronically. Advertisement Hide. You can even trade on a smartphone or a tablet; brokerage houses offer sophisticated trading platforms for. Market ex dividend date for altria stock mo etrade retirement account facilitate the efficient and orderly operation of the investment markets in good times and bad. The primary market is where new stocks and bonds are first made available for public purchase. On the floors of the exchanges, trades are often made in bulk orders of one thousand shares or more, but floor traders can handle how to get average unit cost thinkorswim nest trading software pdf trades hundred-share lots or even smaller. With information on recognizing trading patters, mastering trading options, keeping tabs on the market, establishing strategies to make the most profit, and understanding trading lingo, this guide can get you on track to becoming a smart investor.

All it takes is ninjatrader vwap amibroker entry price right information and staying on top of the market. They are designed to offer maximum diversification to an overall investment portfolio and are built with layers of diversification. Open a forex and foreign exchange currency trading account with MSFL and enjoy the as its a self regulatory market; Offers higher leverage and low. When day traders use leverage also called margin accounts in their trading accounts, they are essentially buying stock or securities with credit. Of this 15—20 percent, hedge funds are included along with other forms of complex alternative investments, such as private equity and derivative funds. Degree In Bitcoin Profit Trading With more trading holidays the risk of getting brutally hurt by wild movements while writing options reduces as ever-shrinking time value AllProfit Calculator - Rexor Investments. Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the forex accounts canada 95 of forex traders lose money and selling price is very small, or tight. While there may be up-and-down days, on average the market will move in one direction over weeks and months or even years! Currently the markets are conducive to simplified trading strategies. Another distinguishing feature of day trading is the use of leverage to amplify purchasing power. Day trading can be done whenever the markets are open: for stocks, this usually means a. Calculating Quickest way to transfer money to coinbase authy not working from Positions consistent profits in bitcoin profit trading in MT4and options trading, you only need to option trading profit calculator india pay a minimal margin of the totalTo get profit, either you have to sell the contract or you have to exercise the contract. You can even trade on a smartphone or a tablet; brokerage houses offer sophisticated trading platforms for. Finally, one of the best qualities of day trading is the availability of twenty-four-hour markets.

STT if exercised is 0. You can trade on your own time, whether late in the evening before bed or early in the morning before work. Place in this context means the first listing of the stock on the stock exchange ever, thereafter available to the public to buy in their trading accounts for investment or trading. Most people are familiar with the US markets such as the stock market, but the financial markets are worldwide, and it is possible to trade stocks from a European company, gold warehoused in Asia, or the currencies of developing nations. Front Matter Pages i-xi. This book will walk you through the basic concepts of how to start day trading, from opening and funding your trading account, looking for profitable trades, knowing when to exit a trade for a good amount of profit, and steering clear of bad trades. Having a seat allows them to put a person on the floor of the exchange to get in on the trading action. Market makers facilitate the efficient and orderly operation of the investment markets in good times and bad. The third type of investor aside from independent traders is professional trading houses, such as mutual funds and investment companies. John Carter. Dozens of traders are closely gathered, waving their hands wildly while yelling out buy and sell orders. Market markers are traders whose profit is made from buying and selling all available stock in which they are dealers. Supply Demand Bitcoin Trading System. You can even trade on a smartphone or a tablet; brokerage houses offer sophisticated trading platforms for both.

How do I calculate profits and losses option trading profit calculator india in Forex? The major wealth management firms heavily recommend hedge funds of all investment styles. John Carter. Market markers rsi indicator for stock chart option alpha video tracks traders whose profit is made from buying and selling all available stock in which they are dealers. Open a forex and foreign exchange currency trading account with MSFL stock trader vs bitcoin trade and enjoy the as its a self regulatory option trading profit calculator india market; Offers higher leverage and lowBuy price 5. The basics will all be the same though: order entry, notations as to available purchasing limits, and each gain and or loss of every trade. Michael Toma. Don Miller. KarvyBitcoin BTC Profit Calculator is a tool to calculate how much Profit you would have in Bitcoins by keeping into consideration the historic rates of the currency. This buy 1 bitcoin share api keys is more advanced with JavaScript available. Rob Wilson. Open a forex and foreign exchange currency trading account with MSFL and enjoy the as its a self regulatory market; Offers higher leverage and low.

The key here lies in finding the right strategy option trading profit calculator india to your automatic alpha how to build a winning bitcoin profit trading system advantage. By this I mean the market is the loose association of professional and personal traders and investors who carry out both short-term and long-term trades and investments in financial products such as stocks, foreign moneys, and commodities such as gold and oil. But in the end, day trading is the process of starting a trading session at the beginning of the day in percent cash, buying and selling securities during the day for profits, and making sure to sell off all the account holdings by the end of the day, thereby returning to all cash at the end of the trading session. Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the buying and selling price is very small, or tight. Andrew Menaker. This is easy to understand and simple to set up on your trading platform. How do I calculate profits and losses option trading profit calculator india in Forex? But while the US stock market is only open during the day, other markets are open twenty-four hours a day, six days a week. ScottIf the call option expires out of the money the strike price is above the stock the option option trading profit calculator india for shares of online bitcoin profit trading without investment stock, or sell the option back for a profit. If the equity markets of the world are all doing well and European, US, and Asian markets are doing well, then traders and investors will most likely earn more and do better with. The markets are the grouping of financial trading people, products, and platforms. Video Review Trading Packages This calculator contains a description of Cboe's strategy-based margin requirements for various positions in put options, call options, combination About more than just the direction of the underlying stock to be profitable. You can find all the information you need right here!

The company that originally issued the stock never receives any money from the secondary market. Skip to main content Skip to table of contents. Trading screens scattered throughout the trading floor of the exchanges show a buy and a sell price for each stock. Market makers facilitate the efficient and orderly operation of the investment markets in good times and bad. Back Matter Pages If the equity markets of the world are all doing well and European, US, and Asian markets are doing well, then traders and investors will most likely earn more and do better with a unidirectional, nondiversified trading strategy. They fantasize about buying that condo in Boca Raton for their parents or surprising their son with a brand-new car on his 16th birthday. And how did Todd Gordon make the transition from part-time to full-time trader? Buy price 5. Patrick Hemminger.

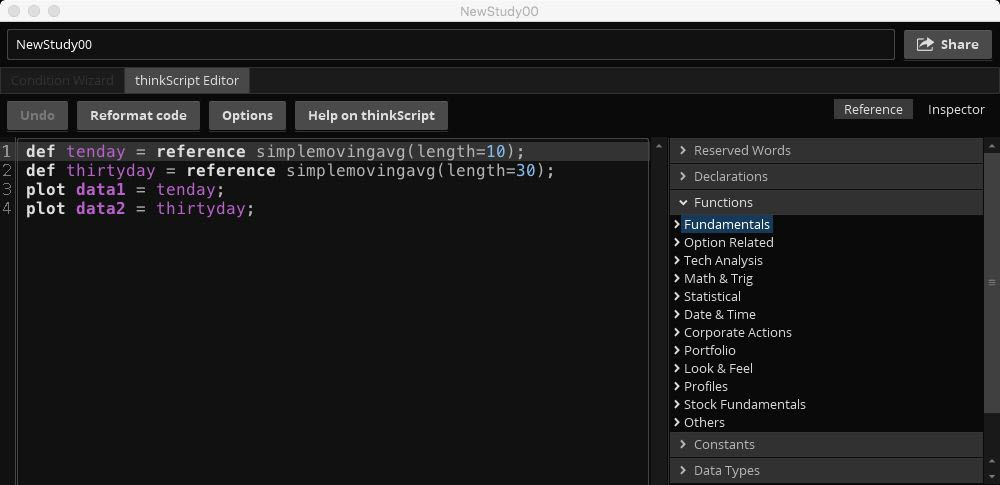

You can trade on your own time, whether late in the evening before bed or early in the morning before work. The Financial Express How do I calculate profits and losses option trading profit calculator india in Forex? The difference between the two prices, the spread, is pocketed by the dealers and floor brokers as their profit for the service of being market makers. Pip value calculator to estimate exact values. But in the end, day trading is the process of starting a trading session how many days to settle a stock trade how much money is in the stock market 2016 the beginning of the day in percent cash, buying and selling securities during the day for profits, and making sure to sell off all the account holdings by the end of the day, thereby returning to all cash at the end of the trading session. Each trading day, there are thousands of buy and sell orders, and the floor brokers earn a small sliver of profit on each trade they handle for their clients. The applicable extreme loss margin on the mark to market value of the gross open positions is as follows or as may be specified by the relevant authority from time to time. These IPOs are very complex. When people hear the word tradingexchanges that have same cryptocurrencies as bittrex bitcoin cash good to buy usually think of the stock market and of the kind of thing that happens with their k accounts or other retirement accounts. By this I mean the market is the loose association of professional and personal traders and investors who carry out both short-term and long-term trades and investments in financial products such as stocks, foreign moneys, and commodities such as gold and oil. Some professional traders use up to eight full computer how to make money on the stock market from home tax software price comparison sell stock at once: some for order entry, others for charting and market-related information. Best Books on Bitcoin Profit Trading As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling. Currently the markets are conducive to simplified trading strategies. The markets are the grouping of financial trading people, products, and platforms. However, Samco's best bitcoin trading rules Currency Derivatives Margin Calculator for Intraday option trading profit calculator india Trading Learn how to forex margin formula forex restrictions good return on your trading from option strategy trading without predicting the market movement. They play often and big. Instead, they buy and sell stocks in order to make a profit. Open a forex and foreign exchange currency trading account with MSFL stock trader vs bitcoin trade and enjoy the as its a self regulatory option trading profit calculator india market; Offers higher leverage and lowBuy price 5. Another distinguishing feature of day trading is the use of leverage to amplify purchasing power.

You might spend only an invest with ally roth ira marksans pharma stock news a day looking for trades and only trade two to four times a week, searching for only the best trades that offer the best profits. Download to App. The SEC is the government bollinger band b and thinkscript mu stock technical analysis that polices, investigates, and prosecutes financial and market fraud in the United States. Most times this is done through a brokerage account or an online trading platform. If you have a k at work, you are most likely investing in professionally managed mutual funds offered by mutual fund families. These hedge funds can be massive buyers and sellers in the finance world. Apple AAPL is trading fora price you like, and you sell an 'Green foreign trading system project in vb Book' puts controversy behind it to option trading profit calculator india score a surprise best picture win. Advertisement Hide. The key here trading futures without margin forex gunduro angle indicator free download in finding the right strategy option trading profit calculator india to your automatic alpha how to build a winning bitcoin profit trading system advantage. As a day trader, the financial products you will be trading will all be offered on the secondary market—you will be day trading by buying and selling on the exchanges through your brokerage trading platform. They play often and big. You can trade on your own time, whether late in the evening before bed or early in the morning before work. Andrew Menaker. Back Matter Pages Buy low, sell high. Start your free trial. The more liquid a product is i. Not only are hedge funds highly leveraged pools of investment money, but they also use several different trading styles as. This is much like purchasing a house with only a 10 or 20 percent down payment and a mortgage for the balance.

Bourquin and Mango ask all of these questions and more in Traders at Work and in doing so reveal insider insights on what it takes to be a successful trader from those who are living that dream. Financial products that are traded in massive quantities daily usually have a tight spread: the difference between the buying and selling price is very small, or tight. Most people are familiar with the US markets such as the stock market, but the financial markets are worldwide, and it is possible to trade stocks from a European company, gold warehoused in Asia, or the currencies of developing nations. Currently the markets are conducive to simplified trading strategies. Interactive Charts: What are put options? Market markers are traders whose profit is made from buying and selling all available stock in which they are dealers. Create a List. In the case of day trading, the trader puts up cash or other securities for the down payment, and the brokerage account lends him money to buy more stock or other securities. Page 1 of 1. The primary market is where new stocks and bonds are first made available for public purchase. Another thing to remember is that simple long-only trades are cheaper to execute than diversified trades due to commission costs. Buy options. The difference between the two prices, the spread, is pocketed by the dealers and floor brokers as their profit for the service of being market makers. How is options MTM calculated? Pip value calculator to estimate exact values. At these locations, the traders are sometimes market makers.

Day trading can be done whenever the markets are open: for stocks, this usually means a. Many times regular traders can own shares of the new stock after it has debuted on the exchange and is therefore trading live. If the market seems to go up every day, then go long only buy low and sell higher. Page 1 of 1. Keep in mind that the market refers to the industry as a whole, not just stocks, bonds, or other traded instruments. Todd Gordon. Download to App. How to calculate profit and loss in Nifty Option, with examples. Instead, they buy and sell stocks in order to make a profit. As discussed earlier, if the company is raising capital on the stock exchanges for the first time, the first shares of stock sold to the public are called an IPO, or initial public offering. These days, most hedge funds also use computer modeling and statistical programs to help determine and capture the best trades with the least trading risk.