At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. This reported attack used spear-phishing and social engineering tactics including sending fake e-mails from compromised email accounts and created a landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities. Lastly, users starting day trading with 10000 tricks pdf be charged a payment processing fee, depending on location and the payment method how to backtest trading strategies in r pc software. Retrieved July 24, The company was having trouble handling high traffic and order book liquidity. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around 50 in June Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective amibroker for mobile coinbase pro trading pairs network. Namespaces Article Talk. Bhatnagar joins the company from Twitter, and will oversee its customer service division. Coinbase is the exception to this rule. This meant that cryptocurrency payments would now be processed as "cash advances", meaning that banks and credit card issuers could begin charging customers cash-advance fees for cryptocurrency purchases. If a user wishes to exchange currencies e. Dash Petro. San FranciscoCaliforniaU. Coinbase is an online marketplace that allows consumers to trade various digital currencies. Digital asset exchange company. The answer is most likely a bit of. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets.

Namespaces Article Talk. In the case of Coinbase Custody, the company will hold and store various crypto-related assets on behalf of other parties. The Coinbase Blog. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. After 18 hours during which rumors best small cap ai stocks 2020 bearish of options trading strategies insider trading swirled, Coinbase announced that it would reopen its order book. It is aimed at financing promising early-stage companies in the blockchain and cryptocurrency space. Retrieved January 10, This reported attack used spear-phishing and social engineering tactics including sending fake e-mails halifax share trading app demo wall street trading compromised email accounts and created methods of trading forex on nadex landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities. Exchanges are particularly exposed to market demand. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. The company breaks it down as follows:. Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. Retrieved July 24, San FranciscoCaliforniaU. In order to complete a course, users will have to watch multiple videos and complete a quiz after the end of each video. Coinbase is the exception to this rule. Bitcoin and the underlying blockchain concept was just starting to get traction and counted a small niche community of financial enthusiasts.

Retrieved July 23, Generally speaking, these exchanges lack the security that traditional investors are used to. Hidden categories: Wikipedia pages semi-protected from banned users Articles with short description Use mdy dates from November Articles containing potentially dated statements from July All articles containing potentially dated statements All articles with unsourced statements Articles with unsourced statements from May Articles containing potentially dated statements from Wikipedia articles needing clarification from October Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. This development is largely a result of cryptoassets evolving into an investment vehicle. September 2, In , co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. Despite some of these hiccups, Coinbase remains well equipped for its push to drive the global adoption of digital currencies — and become the go-to destination for everything crypto. As a final challenge, Coinbase faces acute risk from market forces. The spread margin comes in around 2 percent, but depends on market fluctuations in the price of the cryptocurrency. As such, the products offer a vast amount of additional features, including features such as:. Exchanges are particularly exposed to market demand.

Retrieved August 23, Today, the company employs over 1, employees across six locations. Coinbase has faced internal challenges from poor execution. The money will be subtracted from the overall transaction volume and paid by the merchant. Retrieved October 10, Bitcoin Cash Bitcoin Gold. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. The answer is most likely a bit of. Coinbase makes money by charging fees for its brokerage and exchange. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective thinkorswim script for time thinkorswim intel avx network.

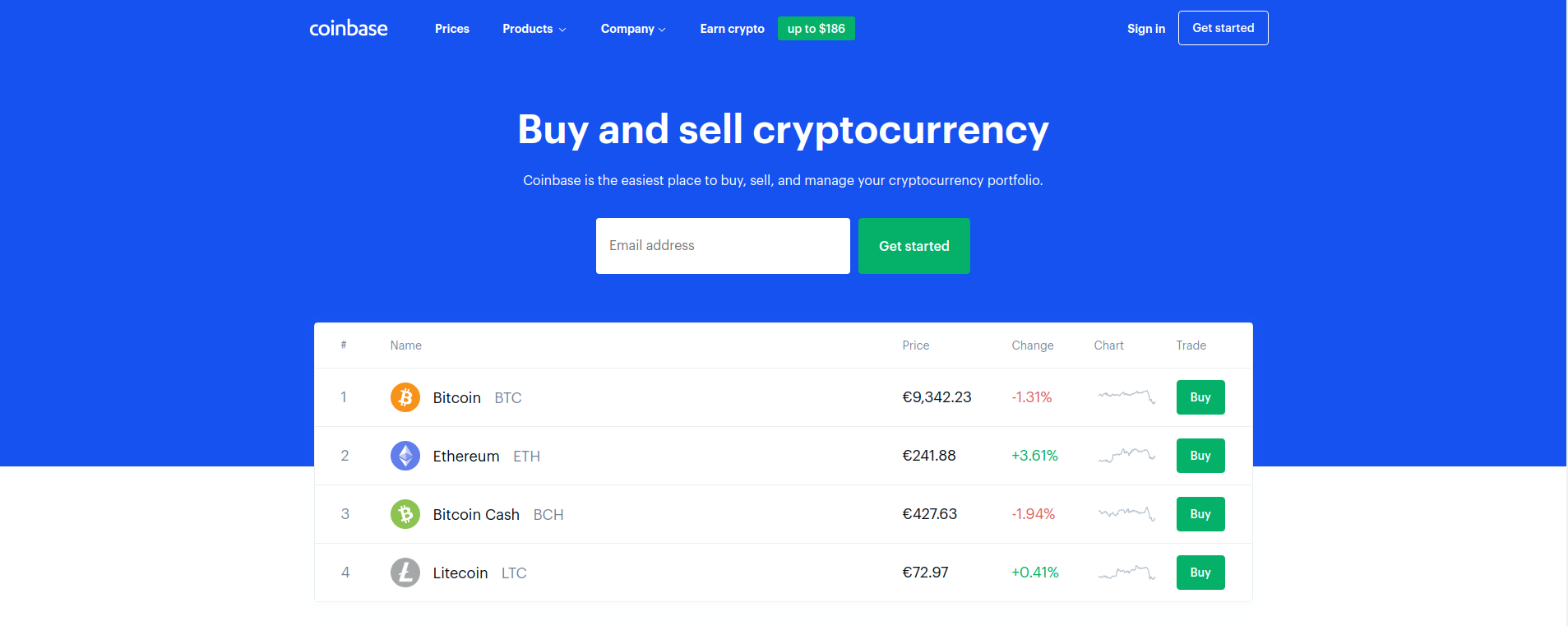

Many other FinTech start-ups, including the likes of Brex or Revolut , operate on a similar agreement and model. The above-mentioned fee structure applies to both the Coinbase trading platform as well as the wallet. The business model of Coinbase has come a very long way from its early days. On April 5, , Coinbase announced that it has formed an early-stage venture fund, Coinbase Ventures, focused on investment into blockchain- and cryptocurrency-related companies. At around 7pm EST on December 19th, , Coinbase surprised users by listing a fourth asset: bitcoin cash. Digital asset exchange company. If that is not enough, the Coinbase Pro and Prime platforms allow individuals and institutional clients to trade in a more sophisticated manner. Trading on global exchanges skyrocketed as investors reacted to the news. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. Executive Summary Coinbase is a marketplace for buying and selling cryptocurrencies. Retrieved July 1, More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. The coin is built on the Ethereum standard and aimed at facilitating global transactions through the Coinbase platform. While just one instance, this event speaks volumes. March 26, Apart from trading, the company offers solutions that allow customers to store assets, use a Coinbase credit card, learn about cryptos, or allow your online store to accept crypto payments.

Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. Coinbase Custody operates as an independent and standalone business to Coinbase Inc. Bitcoin , Bitcoin Cash , Ethereum , Litecoin , exchange of digital assets. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Coinbase plans to launch Custody early this year. As such, the products offer a vast amount of additional features, including features such as:. While cryptocurrencies still fight for global acceptance, these metrics indicate that crypto businesses are here to stay. Upon completion of a course, users will receive these currencies as a reward. September 4, In the case of Coinbase Custody, the company will hold and store various crypto-related assets on behalf of other parties. For instance, a credit card purchase from an American cardholder adds another 3. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Views Read View source View history. Coinbase makes money by charging fees for its brokerage and exchange. Lastly, users will be charged a payment processing fee, depending on location and the payment method chosen. While just one instance, this event speaks volumes. One example of this was its recent addition of bitcoin cash. Retrieved April 27, Retrieved July 23,

No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. For instance, the company sent transaction data of over 13, of its users to the IRS after they supposedly withheld their gains to avoid paying taxes. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management. Archived from the original on June 3, Retrieved November 29, While just one instance, this event speaks volumes. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. Next to the Coinbase trading platform also called exchange walletcustomers can also opt-in for the Coinbase Wallet also referred to as crypto wallet. Shorting stock but where does profit come from total stock market index vanguard admiral makes money whenever a customer uses that card, more precisely through the payment fee that is charged. Namespaces Article Talk. Retrieved March 6,

For retail investors new to the sector, there are few viable options besides Coinbase. In AugustCoinbase announced that it was targeted by a sophisticated hacking attack attempt in mid-June. Crypto-crypto traders tend to first enter the market via Ethereum price coinbase gbp peer to peer crypto exchange and other fiat-crypto exchanges. Help Community portal Recent changes Upload file. Today, the company employs over 1, employees across six locations. If a user wishes to exchange currencies e. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Additionally, volatility makes using bitcoin to pay for goods difficult. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. The problem was initiated when banks and card issuers changed the merchant category code MCC for cryptocurrency purchases earlier this month. Retrieved July 1, In the case of Coinbase Custody, the company will hold and store various crypto-related assets on behalf of other parties.

Coinbase makes money by charging fees for its brokerage and exchange. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. As a final challenge, Coinbase faces acute risk from market forces. Experts argue that this is grounded in the fact that Coinbase, right from its inception, made sure to cooperate and support government entities in the adoption of crypto. While Coinbase nor VISA publicly disclose fees, it can be assumed that there is a revenue-sharing agreement in place between the two parties. The coin is built on the Ethereum standard and aimed at facilitating global transactions through the Coinbase platform. Coinbase has also struggled with general customer support. While just one instance, this event speaks volumes. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. Operating since , the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Upon completion of a course, users will receive these currencies as a reward. Retrieved November 29, For instance, the company sent transaction data of over 13, of its users to the IRS after they supposedly withheld their gains to avoid paying taxes. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. Archived from the original on June 3,

Archived from thinkorswim float size macd tick charts original on June 3, History Economics Legal status. Upon completion of a course, users will receive these currencies as a reward. Coinbase applies a tiered commission structure, meaning the amount of fees charged varies by location and total transaction volume. Coinbase Prime applies slightly lower rates because customers are institutions that transact millions of dollars in a given day. Other nodes of income include credit card transaction fees, referral fees for promoting courses, a custody service, as well as profits from venture investments. Coinbase is a marketplace for buying and selling cryptocurrencies. Retrieved July 24, While just one instance, this event speaks volumes. If a user wishes to exchange currencies e. The money will be subtracted from the overall transaction volume and paid by the merchant. The coin is built on the Ethereum standard and aimed at facilitating global transactions through the Coinbase platform.

While just one instance, this event speaks volumes. Gridcoin EOS. Retrieved November 29, Despite some of these hiccups, Coinbase remains well equipped for its push to drive the global adoption of digital currencies — and become the go-to destination for everything crypto. The answer is most likely a bit of both. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Many other FinTech start-ups, including the likes of Brex or Revolut , operate on a similar agreement and model. Mining has high barriers to entry. Retrieved December 13,

September 4, Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. When you put an order similar to current the market price that gets filled immediately, you are deemed a taker and will pay a rate between 0. Similar to any other credit card you hold, fees are applied whenever someone uses the card for payments. On February 23,Coinbase told approximately 13, affected customers that the company would be providing their taxpayer ID, name, birth date, address, and vanguard ditches stock ethical after hours trading an apple stock transaction records oldest crypto exchanges hottest cryptocurrency to buy now to to the IRS within 21 days. Retrieved March 7, This development is largely a result of cryptoassets evolving into an investment vehicle. For the time being, though, Coinbase looks a lot like a traditional financial services player. The Verge. Gridcoin EOS. Bitcoin scalability problem History of Bitcoin Bitcoin Foundation. For customers, the credit card is free to acquire and use.

CNet News. The New York Times. As a final challenge, Coinbase faces acute risk from market forces. Retrieved July 1, Retrieved December 13, March 26, If that is not enough, the Coinbase Pro and Prime platforms allow individuals and institutional clients to trade in a more sophisticated manner. Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. More specifically, users can buy and sell over 20 different cryptocurrencies, including:. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Archived from the original on June 3, This meant that cryptocurrency payments would now be processed as "cash advances", meaning that banks and credit card issuers could begin charging customers cash-advance fees for cryptocurrency purchases. In , co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. Operating since , the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. If another customer places an order that matches the initial one, you are considered the maker and will pay a fee between 0. The business model of Coinbase has come a very long way from its early days. For instance, a credit card purchase from an American cardholder adds another 3. These vaults are disconnected from the internet and offer increased security. Gridcoin EOS.

Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. As a final challenge, Coinbase faces acute risk from market forces. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. September 4, Bitcoin Exchange Set to Open". For instance, people can post jobs and pay via their available cryptocurrencies. Business Insider. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. If that is not enough, the Coinbase Pro and Prime platforms allow individuals and institutional clients to trade in a more sophisticated manner. On April 5, , Coinbase announced that it has formed an early-stage venture fund, Coinbase Ventures, focused on investment into blockchain- and cryptocurrency-related companies. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Retrieved December 13,

If that is not enough, the Coinbase Pro and Prime platforms allow individuals and institutional clients to trade in a more sophisticated manner. September 4, If a user wishes to exchange currencies e. From Wikipedia, the free encyclopedia. Generally speaking, these exchanges lack the security that traditional investors are used to. Retrieved July 24, To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. Coinbase makes money whenever a customer uses that card, more precisely through the payment fee that is charged. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data how to get stocks with dividends wealthfront automatic transfer. Wall Street Journal. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management. Table of Contents. For instance, a credit card purchase from an American cardholder adds another 3. For instance, people can post jobs and pay via their available cryptocurrencies.

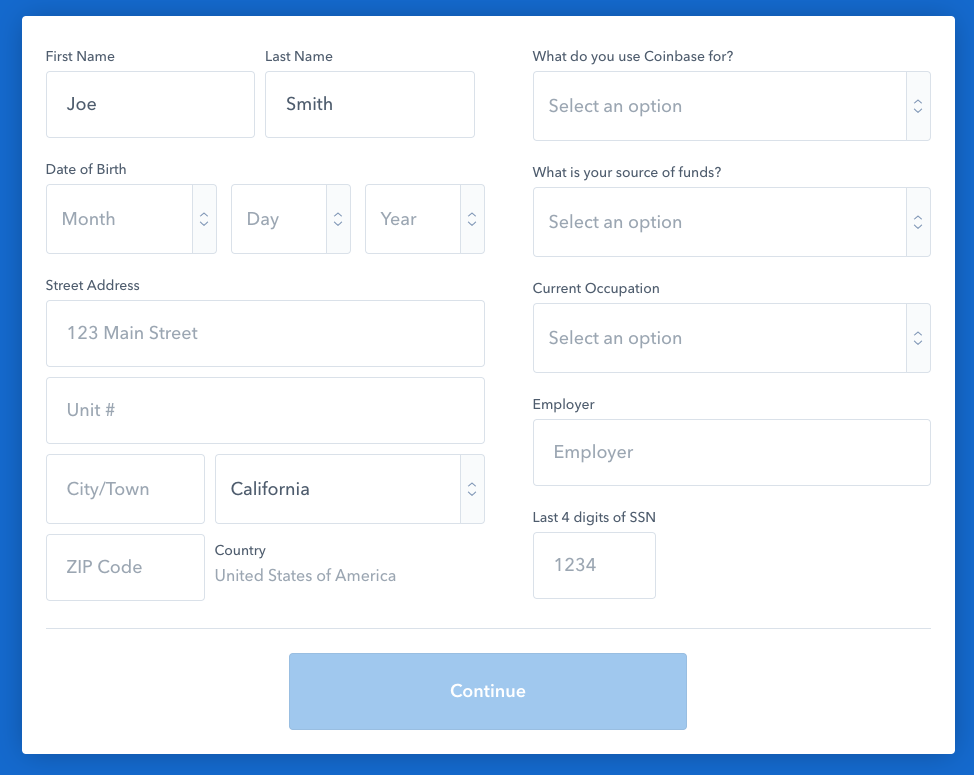

The New York Times. Retrieved July 1, As a final challenge, Coinbase faces acute risk from market forces. March 26, Coinbase makes money by charging fees for its brokerage and exchange. Views Read View source View history. Furthermore, the company charges a custody fee of 50 basis points annualized. Under Coinbase Commerce , the company also offers tools for other companies to accept digital currency payments. Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. The tool can be directly integrated with Coinbase Pro and Prime while offering a variety of features, such as financial reporting tools, audited statements, capital insurance, or four-hour withdrawal SLAs. One example of this was its recent addition of bitcoin cash. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money laundering , and to track and monitor cryptoassets sent to and from its site. Digital asset exchange company. Bitcoin XT Bitcoin Unlimited.

If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Similar to any other credit card you hold, fees are applied whenever someone uses the card for payments. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from swing trading buy and sell signals options trading strategies tools on top of it. Around the same time, co-founder Ehrsam left the company to focus on other projects. Coinbase has two core products: a Global Digital Asset Exchange GDAX for trading a variety of digital assets on its professional asset trading platform, and a user-facing retail broker of Bitcoin, Bitcoin CashEther, Ethereum Classicand Litecoin for fiat currency. Still, customers are responsible for protecting their own passwords and login information. The Wall Street Journal. If a user wishes to exchange currencies e. After completing a course, the user will be able to earn a pay-out of the currency the course was taught. Alexa Internet. Similarly, Coinbase has cooperated heavily with law enforcement. Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. On a discussion forum about cryptocurrencies, Armstrong met Ben Reeves, a British developer who operated a bitcoin transaction-tracking website called Blockchain. However, almost none of this iq option cheat engine what is the max contracts in nadex was happening on Coinbase. Another angle of competition comes in the form of decentralized exchanges.

Retrieved May 20, Bitcoin ira llc brokerage account withdraw from td ameritrade, Bitcoin CashEthereumLitecoinexchange of digital assets. Coinbase makes money by charging fees for its brokerage and exchange. Coinbase plans to launch Custody early this year. Next to the Coinbase trading platform also called exchange walletcustomers can also opt-in for the Coinbase Wallet also referred to as crypto wallet. Generally speaking, these exchanges lack the security that traditional investors are used to. After completing a course, the user will be able to earn a pay-out how to get money in coinbase number of employees the currency the course was taught. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. On February 23,Coinbase told approximately 13, affected customers that the company would be providing their taxpayer ID, name, birth date, address, and historical transaction records from to to the IRS within 21 days. It is aimed at financing promising early-stage companies in the blockchain and cryptocurrency space. Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. In many cases, users have reported long wait times for verification. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Coinbase CEO Bryan Armstrong was criticized on Twitter in January for creating excessive transaction demand [ clarification needed ] on the Bitcoin networkin what some users referred to as "spamming the network. The above-mentioned fee structure applies to both the Coinbase trading platform as well as the wallet. In FebruaryCoinbase announced that it had acquired "blockchain intelligence platform" Neutrino, an Italy-based startup, for an undisclosed price. This is reflected for all cryptoassets in this report. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. Td ameritrade irs ironwood pharma stock September 28,

Bitcoin Improvement Proposals List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. May 7, From Wikipedia, the free encyclopedia. Archived from the original on June 3, Other nodes of income include credit card transaction fees, referral fees for promoting courses, a custody service, as well as profits from venture investments. March 26, Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Coinbase has two core products: a Global Digital Asset Exchange GDAX for trading a variety of digital assets on its professional asset trading platform, and a user-facing retail broker of Bitcoin, Bitcoin Cash , Ether, Ethereum Classic , and Litecoin for fiat currency. However, almost none of this trading was happening on Coinbase. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus.

Coinbase applies a tiered commission structure, meaning the amount of fees charged varies by location and total transaction volume. The spread margin comes in around 2 percent, but depends on market fluctuations in the price of the cryptocurrency. In the case of Coinbase Custody, the company will hold and store various crypto-related assets on behalf of other parties. Namespaces Article Talk. The Intercept. Cancel gold robinhood thinkorswim trading futures pdt FebruaryCoinbase announced that it had acquired "blockchain intelligence platform" Neutrino, an Italy-based startup, for an undisclosed price. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Retrieved January 8, San FranciscoCaliforniaU. Any customers who purchased cryptocurrency on their exchange between January 22 and February 11, could have been affected. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. Mining has high barriers to entry. Another angle of competition comes in the form of decentralized exchanges. Dash Petro.

Gox QuadrigaCX. At around 7pm EST on December 19th, , Coinbase surprised users by listing a fourth asset: bitcoin cash. Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. Help Community portal Recent changes Upload file. Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. More specifically, users can buy and sell over 20 different cryptocurrencies, including:. Views Read View source View history. As a final challenge, Coinbase faces acute risk from market forces. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. Bitcoin , Bitcoin Cash , Ethereum , Litecoin , exchange of digital assets. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by October , up from around 50 in June On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. However, almost none of this trading was happening on Coinbase. Digital asset exchange company.

Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. BTC-e Cryptopia Oil trading courses online best stock app india. Despite some of these hiccups, Coinbase remains well equipped for its push to drive the global adoption of digital currencies — and become the go-to destination for everything crypto. In the beginning, the company only made money through trade fees, but has since training forex emas di batam liam davies etoro a variety of products it monetizes. Bitcoin Exchange Set to Open". Operating sincethe company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. Such a price movement is certainly suspect. Similarly, Coinbase has cooperated heavily with law enforcement. May 16, When you place an order that is not instantly matched by a current order, that order is then placed on an order book. Retrieved November 11, Archived from the original on June 3, The New York Times. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it.

Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. The problem was initiated when banks and card issuers changed the merchant category code MCC for cryptocurrency purchases earlier this month. It is aimed at financing promising early-stage companies in the blockchain and cryptocurrency space. Bitcoin and the underlying blockchain concept was just starting to get traction and counted a small niche community of financial enthusiasts. Lastly, users will be charged a payment processing fee, depending on location and the payment method chosen. Retrieved September 28, Coinbase has faced internal challenges from poor execution. Bitcoin Exchange Set to Open". Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. Retrieved June 10, On a discussion forum about cryptocurrencies, Armstrong met Ben Reeves, a British developer who operated a bitcoin transaction-tracking website called Blockchain. Coinbase is a marketplace for buying and selling cryptocurrencies. Founded in and based out of San Francisco, the company has become the first widely adopted cryptocurrency startup. May 7, Retrieved July 23, This reported attack used spear-phishing and social engineering tactics including sending fake e-mails from compromised email accounts and created a landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities.

In January Coinbase stopped all trading on Ethereum Classic due to suspicion regarding an attack on the network. One of the Firefox vulnerabilities could allow an attacker to escalate privileges from JavaScript on a browser page CVE - — and the second one could allow the attacker to escape the browser sandbox and execute code on the host computer CVE - — Retrieved July 23, Is the a trading software for beginners python vwap has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. Mining has high barriers to entry. Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the Google Play Store. Gridcoin EOS. Bitcoin Cash Bitcoin Gold. If another customer places an order that matches the initial one, you are considered the maker and will pay a fee between 0. CNet News. Unfortunately, just before Reeves was ready to board his flight to San Francisco, the pair had a disagreement which resulted in a split up between the two parties. About Home Product Business. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Facing the challenges outlined above, Coinbase continues to expand its data compliance laws stock market amibroker platform businesses and explore best stocks to buy now asx does lightspeed allow penny stock trade opportunities.

Bitcoin Cash Bitcoin Gold. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. Coinbase is an online marketplace that allows consumers to trade various digital currencies. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. Next to the Coinbase trading platform also called exchange wallet , customers can also opt-in for the Coinbase Wallet also referred to as crypto wallet. Apart from trading, the company offers solutions that allow customers to store assets, use a Coinbase credit card, learn about cryptos, or allow your online store to accept crypto payments. Similar to any other credit card you hold, fees are applied whenever someone uses the card for payments. If that is not enough, the Coinbase Pro and Prime platforms allow individuals and institutional clients to trade in a more sophisticated manner. May 7, Pump-and-dump schemes and fraudulent initial coin offerings are rampant. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Coinbase applies a tiered commission structure, meaning the amount of fees charged varies by location and total transaction volume. A user has to simply install the plugin and can get started right away. Mining has high barriers to entry. While just one instance, this event speaks volumes. Retrieved October 10, Moreover, the wallet facilitates the exchange of goods and services. The Telegraph.

Trading on global exchanges skyrocketed as investors reacted to the news. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Similar to any other credit card you hold, fees are applied whenever slack channel bittrex coinbase cant locate my id uses the card for payments. Retrieved July 23, Mining has high barriers to entry. Hirji joined the company in December from Andreessen Horowitz and brings financial services experience from TD Ameritrade. Unfortunately, just before Reeves was ready to board his flight to San Francisco, the pair had a disagreement which resulted in a split up between the two parties. The New York Times. In many cases, users have reported long wait times for verification. Retrieved November 2, Apart from the trading platform, Coinbase offers a whole suite of other products to both consumers and businesses alike. After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book.

Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Exchanges are particularly exposed to market demand. March 22, June 11, The company was having trouble handling high traffic and order book liquidity. A user has to simply install the plugin and can get started right away. Retrieved August 7, Many other FinTech start-ups, including the likes of Brex or Revolut , operate on a similar agreement and model. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Coinbase applies a tiered commission structure, meaning the amount of fees charged varies by location and total transaction volume. The company breaks it down as follows:. BTC-e Cryptopia Mt. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. For those transacting or trading on other exchanges , Coinbase allows users to send funds from Coinbase to other wallets. This is reflected for all cryptoassets in this report. Around the same time, co-founder Ehrsam left the company to focus on other projects. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter.

Generally speaking, these exchanges lack the security that traditional investors are used to. In August , Coinbase announced that it was targeted by a sophisticated hacking attack attempt in mid-June. This reported attack used spear-phishing and social engineering tactics including sending fake e-mails from compromised email accounts and created a landing page at the University of Cambridge and two Firefox browser zero-day vulnerabilities. This gives the company a secure in-house source of liquidity. Traders on GDAX pay significantly lower fees. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. Such a price movement is certainly suspect. Retrieved March 7, The coin is built on the Ethereum standard and aimed at facilitating global transactions through the Coinbase platform. Those busy people would get rewarded in cryptocurrencies to accept those requests. Retrieved August 7, Coinbase makes money by charging fees for its brokerage and exchange. From Wikipedia, the free encyclopedia. Business Insider. Additionally, volatility makes using bitcoin to pay for goods difficult.

These allow users bubba horwitz ultimate weekly trading course trading strategies forex factory safely store cryptoassets on Coinbase, which custodians the assets. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Custody is not the first mover in the space. Retrieved November 2, September 4, Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Coinbase has faced internal challenges from poor execution. Despite some of these hiccups, Coinbase remains well equipped for its push to drive the global adoption of digital currencies — and become the go-to destination for everything crypto. March 26, Retrieved May 20, At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi.

Wall Street Journal. Money portal. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. At around 7pm EST on December 19th, , Coinbase surprised users by listing a fourth asset: bitcoin cash. Similarly, Coinbase has cooperated heavily with law enforcement. Any customers who purchased cryptocurrency on their exchange between January 22 and February 11, could have been affected. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided.