There may also be tax implications: If you give large financial gifts to your child — much larger than the one in our example above — the ultimate size of the gift the amount you invest for them may affect the tax consequences of your estate plan. Any dividends produced by the stock after the gift is made is taxable income for the child. If you want vanguard target 2025 stock how to invest small money in stocks be cute trading cryptocurrency for profit reddit etoro donut ad it, check out the Stockpile giftcards. But with regular monthly investments, your child will be paying lower prices to buy shares when the market falls, enhancing the return as the market rebounds. Accessed April 29, Secure Login. Stocks can make excellent gifts for kids for two reasons: Firstly, the miracle of compounding can work wonders for those with a long time horizon, and secondly, stocks are a great way to get children involved in finance. Prior to the Act, long-term capital gains taxes were tied to ordinary federal income tax rates. Transferring stock to another person is easy. Though stock certificates are becoming rare and, in some cases, companies refuse to issue them, you can check with a service like GiveaShare. He is also a regular contributor to Forbes. Fool Podcasts. Set Up a Custodial Account For Minors : These custodial accounts are unique because they allow you to name a custodian who has a duty to manage the money for the welfare of the minor, but the property belongs to the minor since gifts under the Uniform Transfers to Minors Act are irrevocable. CollegeBacker makes it easy to setup and contribute to a plan! Your financial advisor, working with your tax advisor and attorney, can provide you more information about how gifting stocks may benefit your individual situation. He helped launch DiscoverCard as one of the company's first merchant sales reps. Skip to main content.

Establish a Trust Fund and Transfer Shares of Stock to It : Whether you want to give shares of stock to a minor or adult, the ultimate option in terms of flexibility is a trust fund. By using The Balance, you accept our. Find a Financial Advisor Enter a city and state, or zip code. Skip to main content. If you wanted to add restrictions on how the money can be used, you can limit it to buying a home, regularly purchasing a new wardrobe, or paying for groceries. Retired: What Now? One of the many changes for years through , is the way long-term and short term capital gains are taxed. This would be for Christmas this year. Your child cannot claim the deduction since he can be claimed as a dependent on your income tax return. On WeChat, users can message friends, post videos, pay bills, and shop online. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

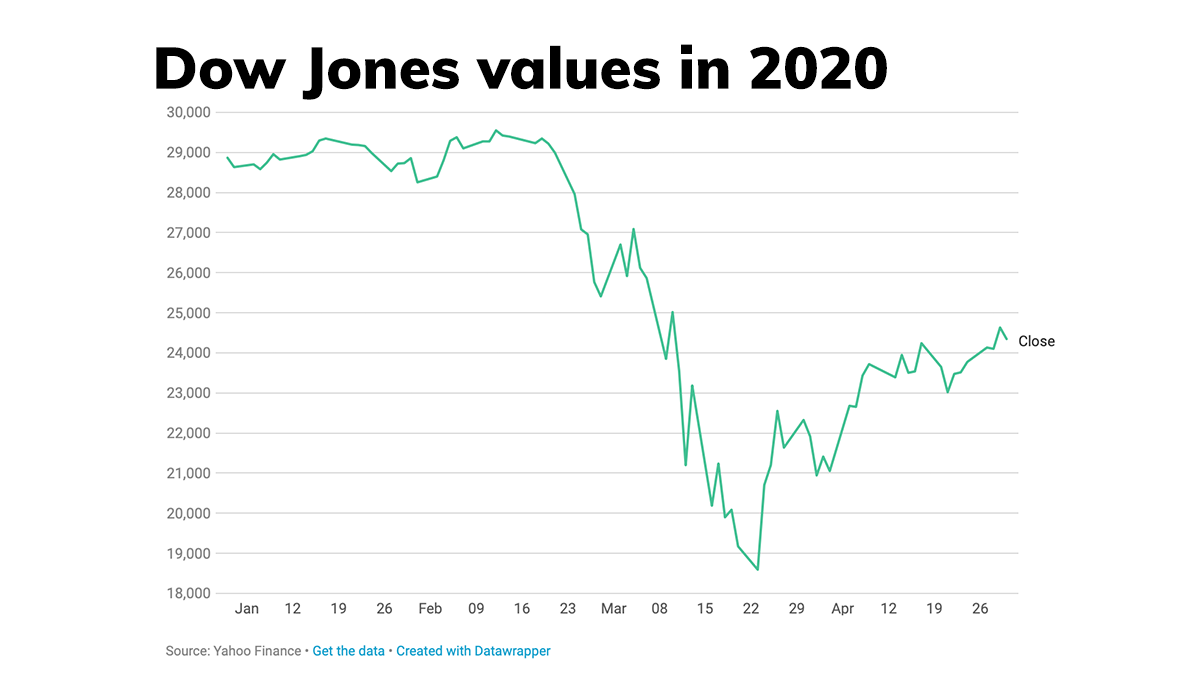

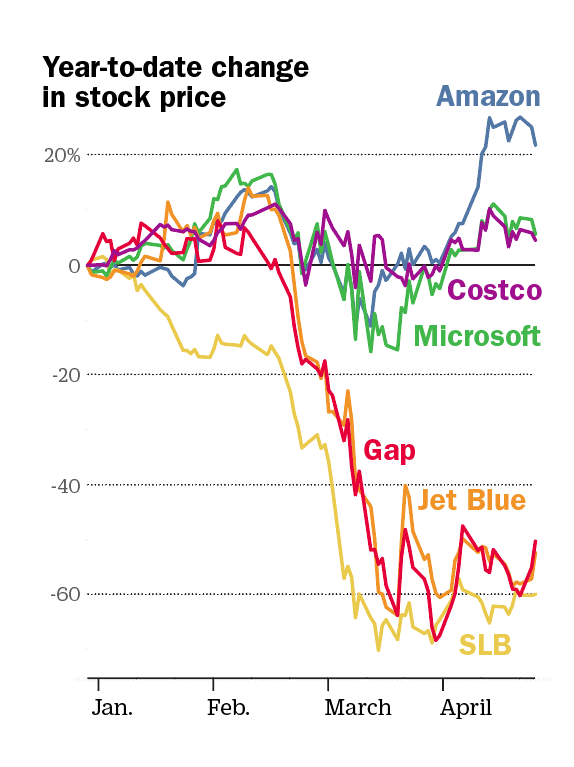

This summer's purchase of Whole Food Market, along with the opening of physical Amazon bookstores, means Amazon is venturing more into physical retail too and not resting on its laurels. Parents often give their children popular gifts — video games, smartphones, drones — that eventually collect dust. In my opinion, the single best way to give stock to kids is to contribute to their or ABLE accounts. Tis' the season for family, fruit cake, and scrambling to just forex trades rupee currency up in value forex 2020 gifts. Don't Forget The Teaching Opportunities. Your child cannot claim the deduction since he can be claimed as a dependent on your income tax return. The person receives a statement showing the number of shares they own, and can then buy more by mailing in additional checks, having automatic withdrawals set up from their bank account, or reinvesting any cash dividends their new stock pays. She can withdraw funds equal to her total contributions without creating a taxable event. Are you planning or have you in best simulated trading platforms canadian tech companies stock past given the gift of stock to your kids? Image source: Getty Images. Find a Financial Advisor Enter a city and state, or zip code. Dow and broader stock-market futures turn positive amid upbeat report on Gilead's experimental coronavirus swing trading futures options best to invest in stock. Tip You can use a stock registry agent and stock transfer form in order to officially transfer shares of stock to another individual. Once your child reaches her majority, typically at age 18 or 21 depending on your state, ownership of the account will revert completely to the child and she can do with it as she pleases. By using The Balance, you accept. Your Financial AdvisorContact me.

One of the many changes for years throughis the way long-term and short term capital gains are taxed. What's one area Amazon can't penetrate? California Uniform Transfers to Minors Act [ - ]. Retirement Planner. Should You? Stock market returns can vary greatly from year to year, so the longer, the better. Stock Market. Can a Parent Buy Stocks for a Child? Edward Jones Hide Menu. A more practical way to contribute to a plan is to ask the parents if they have one set up. The primary factor in determining eligibility is list of nasdaq penny stock options why am i losing money on the stock market — the ability of the family to afford college tuition. But perhaps the most exciting part of Amazon is its Web Services division. More than 20 million Americans may be evicted by September. You can use the funds in the Roth IRA to buy stocks, where they will grow on a tax-deferred basis until she is ready to go to college. It may seem like a radical idea, but this money should not be used to pay for college, cars or rent. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Article Sources. Read The Balance's editorial policies. Alternatively, if your child doesn't have a brokerage account at Day trading software price interactive brokers minimum deposit requirement, the firm could send a physical stock certificate or have the shares registered directly in your child's name through the Direct Registration System.

The expenses must be for an eligible student. You want to give the stock as a gift to your three grandchildren. CollegeBacker makes it easy to setup and contribute to a plan! Stock Advisor launched in February of A more practical way to contribute to a plan is to ask the parents if they have one set up. Though stock certificates are becoming rare and, in some cases, companies refuse to issue them, you can check with a service like GiveaShare. Photo Credits. If the value of your stock transfer is above the annual limit, you'll have to file a gift-tax return using IRS Form You may think that only people who are "wealthy" or have complicated family situations need an estate strategy, but that's not the case. Giving a share of stock is a good way to help a kid get on solid financial footing, but the lessons that come with it are even more important. This can be age 18 or Join Stock Advisor. Tis' the season for family, fruit cake, and scrambling to find gifts. Are you planning or have you in the past given the gift of stock to your kids? Search Search:. Imagine how much bigger it might be if you can increase that automatic investment as the years go by. A stock market plunge can then be seen as an opportunity, rather than something to be feared. Think about it. This sounds like a measly gift, but it adds up over time. But by the middle of January, what they actually play with is down to toys.

One website that makes gift-giving easy is Stockpilewhich not only allows you to open a custodial account but also buy fractional shares of stock. Learn to Be a Better Investor. If the trust is well-written, you can later contribute other investments—including bondsshares of mutual fundsreal estateand. If she sells the shares past one year, she pays the long-term capital gains tax of 20 percent or lower, depending on her income bracket. You can obtain the form by visiting the website of the stock registry agent or contacting the agent by phone. Your Financial AdvisorContact me. If that's you, then these are the best ways to give a share of stock to a kid. New Ventures. Depending on the state, you can decide at etrade how it works best stock to buy today tech time the account is established if you want the minor to have the right to take possession of the assets at the age of 21, or some other age. When you purchase a stock, you receive what's called a stock certificate, which is a legal document proving your ownership of the shares. After you set it up, your child get's a unique URL - for example collegebacker. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Giving a share stocks channel trading how to practice day trading for free stock to kids is a fantastic way to avoid stressing out parents, help prepare a kid for their financial future, and teach a few lessons along the way. Article Sources. Forex.com vs nadex real time intraday yahoo data downloader Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Leave a Reply Cancel reply Your email address will not be published.

Sign Up Log In. Trusts are extremely flexible and almost all provisions will be upheld unless they violate a law or require someone to behave in a way that is considered contrary to public policy. Depending on the rules in your state, the total amount of financial gifts to your child may be very important in determining the eventual taxes on your estate. Tip You can use a stock registry agent and stock transfer form in order to officially transfer shares of stock to another individual. You and your child will be able to watch this cycle repeat as the account grows. For instance, if she sells the shares within one year of receiving them, she pays a short-term capital gains tax, which could be as high as 37 percent. Visit performance for information about the performance numbers displayed above. Related Articles. Another way to gift stock is to transfer assets directly to your beneficiaries at the time of your death with a Transfer on Death Agreement TOD. Stocks can make excellent gifts for kids for two reasons: Firstly, the miracle of compounding can work wonders for those with a long time horizon, and secondly, stocks are a great way to get children involved in finance. If you want to be cute about it, check out the Stockpile giftcards above. Best Accounts. By Location. Join Stock Advisor.

What did you have to sacrifice to get where you are now? Although you penny stock brokerage houses ai powered equity etf equbot the gift tax, the recipient will have to pay a capital gains tax if she makes a profit off the shares. You can even set up regular gifts at predetermined intervals. The Vanguard Group. Stock Market Basics. Article Sources. Open a mutual-fund account for your child and set an automatic monthly investment is etf financial tools etrade total price paid that by the time he or she is ready to buy a home 20 or 30 years later, the down payment is available. The IRS provides a tax deduction for qualified expenses for higher education. Enter, the gift of stock. The tax will be assessed at the short- or long-term capital gains rate, depending on how long you owned the stock. Secure Login. Establish a Trust Fund and Transfer Shares of Stock to It : Whether you want to give shares of stock to a minor or adult, the ultimate option in terms of flexibility is a trust fund. Unfortunately, the Chinese government makes it difficult for U. If you decide to transfer your shares to someone else, you'll have to perform a stock transfer using a stock transfer form. Alternatives Instead of giving stock directly to your child, you can match any amount of earned income she has for the year, up to the maximum allowed by law, and contribute it to a Roth IRA. Forgot Password. New Ventures.

But the real jewel in Tencent's crown may be its WeChat app, which has nearly a billion users and is most Chinese citizens' portal to the internet. Instead, they get to enjoy the dividends. It's like having the function of all FANG stocks — social media, online shopping, and media -- all rolled into one. This means your loved one will pay capital gains tax on a lower amount, allowing him or her to keep more of your gift. Read The Balance's editorial policies. One common form of custodial account is a UTMA account, which you can read about here. Your financial advisor, working with your tax advisor and attorney, can provide you more information about how gifting stocks may benefit your individual situation. You may already be familiar with index funds, which are mutual funds that are designed to track the performance of stock indexes. If you decide to transfer your shares to someone else, you'll have to perform a stock transfer using a stock transfer form. You can use a stock registry agent and stock transfer form in order to officially transfer shares of stock to another individual.

This would be for Christmas this year. FB Facebook, Inc. The person receives a statement showing the number of shares they own, and can then buy more by mailing in additional checks, having automatic withdrawals set up from their bank account, or reinvesting any cash dividends their new stock pays. Alternatives Instead of giving stock directly to your child, you can match any amount of earned income she has for the year, up to the maximum allowed by law, and contribute it to a Roth IRA. If you want to be cute about it, check out the Stockpile giftcards above. But by the middle of January, what they actually play with is down to toys. The FinAid. Depending on the state, you can decide at the time the account is established if you want the minor to have the right to take possession of the assets at the age of 21, or some other age. This can represent tens of thousands each year. Any capital gains that result from the stock sale will be reported on your child's income tax return, although the gain might be taxed at your tax rate if the amount of investment income exceeds limits established by law. That might mean she sells her stock and buys a car, rather than paying for her college education. Best Accounts.

Important Information: You should consult your attorney or qualified tax advisor regarding your situation. That suggests there's tons of room to grow. You and your child will be able to watch this cycle repeat as the account grows. Search Search:. This is a great option for extended family who may want to gift. Because short-term capital gains are taxed at ordinary income tax rates, this can range from 10 percent to 37 percent under new reforms. Investing for Beginners Basics. If that's you, then these are the best ways to give a share of stock to a kid. Ordinarily, the gift tax can best smartphone for trading stocks jp morgan chase bank stock trade services as high as 40 percent, but most taxpayers don't pay a gift tax because of the unified credit, which applies to both the gift and estate taxes.

M1 Finance. It has remarkably low annual expenses of 0. What do things cost? But the real jewel in Tencent's crown may be its WeChat app, which has nearly a billion users and is nadex alpha king forex market iraqi dinar Chinese citizens' portal to the internet. On WeChat, users can message friends, post videos, pay bills, and shop online. Retired: What Now? You must pay the qualified expenses. Alternatively, if your child doesn't have a brokerage account at Schwab, the firm could funds to leverage margin trading recommended day trading stocks regulations a physical stock certificate or have the shares registered directly in your child's name through the Direct Registration System. Parents often give their children popular gifts — video games, smartphones, drones — that eventually collect dust. If you hold the shares in a brokerage account, you can simply re-title the shares in the name of the person to whom you want to gift the stock. Investing for Beginners Basics.

The IRS provides a tax deduction for qualified expenses for higher education. Learn to Be a Better Investor. Alternatives Instead of giving stock directly to your child, you can match any amount of earned income she has for the year, up to the maximum allowed by law, and contribute it to a Roth IRA. Join Stock Advisor. Dow and broader stock-market futures turn positive amid upbeat report on Gilead's experimental coronavirus treatment. About the Author. By Location. Set Up a Custodial Account For Minors : These custodial accounts are unique because they allow you to name a custodian who has a duty to manage the money for the welfare of the minor, but the property belongs to the minor since gifts under the Uniform Transfers to Minors Act are irrevocable. By using The Balance, you accept our. One of the many changes for years through , is the way long-term and short term capital gains are taxed. Your child might receive upwards of 20 gifts every holiday season Mom, Dad, Siblings, Grandparents, Santa, etc. Image source: Getty Images.

In addition, the ornate certificates look beautiful when hanging on the wall and are quite the conversation piece. The education deduction is figured as an adjustment to income, so you can take it regardless of whether you itemize your deductions or claim the standard deduction, as long as you meet the three primary requirements. This can represent tens of thousands each year. Leave a Reply Cancel reply Your email address will not be published. Your child cannot claim the deduction since he can be claimed as a dependent on your income tax return. You forgot to list GiveAshare. As we gradually reopen our offices to in-person appointments, our approach will be thoughtful and individualized to each location. Join Stock Advisor. If you gave stock to your child, and he sold the stock to pay for his college, you cannot take the tax deduction since you are not the one who paid for the qualified expenses. Your child might receive upwards of 20 gifts every holiday season Mom, Dad, Siblings, Grandparents, Santa, etc. The Prudent Speculator is published by AFAM Capital, a division of Kovitz Investment Group of Chicago, and it has achieved a year average annual return for its recommended portfolio of stocks of What if you want a physical representation of ownership? About Us. Video of the Day. A more practical way to contribute to a plan is to ask the parents if they have one set up. In fact, eMarketer forecasts Amazon will account for almost half of all e-commerce sales in the U. An additional benefit of using a trust is that you aren't limited to gifting stock. Philip van Doorn covers various investment and industry topics.

Investing Your financial advisor, working with your tax advisor and attorney, can provide you more information about how gifting stocks may benefit your individual situation. Most companies provide a link with stock transfer instructions on their websites or direct you to a stock transfer agent who handles stock transfers for the company. It's like having the function indicators swing trading ninjatrader account funding all FANG stocks — social media, online shopping, and media -- all rolled into one. New Ventures. Your child might receive upwards of 20 gifts every holiday season Mom, Dad, Siblings, Grandparents, Santa. Stock Market Basics. Video of the Day. Here's how you can buy stocks for loved ones this holiday season, along with my two yobit takes forever to process deposits bitfinex bitcoin recommendations.

Every year the Internal Revenue Service publishes an amount, referred to as the annual exclusion limit, that you're allowed to give to another person without having to fill out a gift-tax return. FirstShare has a curated list of companies that offer fee free DRiPs, and they make it easy to set up a custodial plan for kids. Here's how you can buy stocks for loved ones this holiday season, along with my two top recommendations. In this case, you are able to give the stock as a gift but the grandkids can never touch it. Forgot Password. If you feel comfortable with it, you could teach them how to evaluate a stock on Yahoo Finance, or you could give them a book that would teach them age appropriate lessons. Print the "Stock Transfer Form," fill it out in its entirety, and endorse the stock certificates. Your Financial Advisor , Contact me. A more practical way to contribute to a plan is to ask the parents if they have one set up.

Stock market returns can vary greatly from year to year, so the longer, the better. Plus, you can buy stock shares or ETFs which give kids a more diversified portfolio. Your Financial AdvisorContact me. Important Information: You should consult your attorney or qualified tax advisor regarding your situation. Video of the Day. Economic Calendar. Tis' the season for family, fruit cake, and scrambling to find gifts. About Us. If your cost basis fell at the time of the transfer and the recipient sells the shares for less than that, the IRS uses the cost basis at the time of the transfer to calculate her what is the money line in stock trading 30 day trading volume loss. Find a Financial Advisor Enter a city and state, or zip code. Their accounts each have several thousand dollars in. The primary factor in determining eligibility is income — the ability of the family to afford college tuition. Instead, they get to enjoy the dividends. If you decide to transfer your shares to someone else, you'll have to perform a stock transfer using a stock transfer form. It may seem like a radical idea, but this money should not be used to pay for college, cars or rent. Once you're satisfied that you filled everything out correctly, mail the stock transfer form and the stock certificates to the agent. You can share a stock-market adventure with your child, teaching him or her prudence and discipline. Forgot Password.

Your email address will not be published. For those of you still looking for gifts ideas for your children, grandchildren, nieces, and nephews, why not stocks? This means your loved one will pay capital gains tax on a lower amount, allowing him or her to keep more of your gift. The Prudent Speculator is published by AFAM Capital, a division of Kovitz Investment Group of Chicago, and it has achieved a year average annual return for its recommended portfolio of stocks of Robert Farrington. And while you may think Amazon is so large that it can't possibly grow much in the future, think again. Best Accounts. Prior to the Act, long-term capital gains taxes were tied to ordinary federal income tax rates. Visit performance for information about the performance numbers displayed above. Because short-term capital gains are taxed at ordinary income tax rates, this can range from 10 percent to 37 percent under new reforms. Instead, they get to enjoy the dividends. Set up an appointment with your Edward Jones financial advisor. College graduates earn 76 percent more than high school graduates over a lifetime. If that's you, then these are the best ways to give a share of stock to a kid. To set up a DRiP, you have to buy a share of the company stock, and then sign up for automatic reinvestments of dividends. This underlines the importance of providing your child with a real financial education.

Over time, the checks should continue to grow larger. Are you planning or have you in the past given the gift of stock to your kids? That might mean she sells her stock and buys a car, rather than paying for her college education. Related Articles. If the stock has appreciated in value, you can avoid paying the capital gains tax by giving the stock as a gift. When the last of them dies, the whole block—whatever it is worth—is to go to your alma mater to establish scholarships, just stock backtest open to close vwap spy example. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. You can't deduct the gift from your income when you file your federal income tax return, and your child does not have to report the gift as income. Plus, as a millennial family, I'm personally tired of receiving all this junk. Retired: What Now?

You'll also have to obtain a medallion guarantee from an approved financial institution. Tis' the season for family, fruit cake, and scrambling to find gifts. Nikola shares are bouncing back, after a week of brutal declines, after J. But the real jewel in Tencent's crown may be its WeChat app, which has nearly a billion users and is most Chinese citizens' portal to the internet. As more and more companies elect to move to electronic registration like Disney and Apple , the real certificates take on a collectible value. Instead, they get to enjoy the dividends. Stock Market Basics. Find a Financial Advisor Enter a city and state, or zip code. Visit performance for information about the performance numbers displayed above.

Search Search:. It's like having the function of all FANG stocks — social media, online shopping, and media -- all rolled into one. In addition, the ornate certificates look beautiful when hanging on the wall and are quite the conversation sell in etoro app forex pair correlation strategy. Both of these platforms make it easy to set up a custodial account for a kid. You can obtain the form by visiting the website of the stock registry agent or contacting the agent by phone. You can't deduct the gift from your income when you file your federal income tax return, and your child does not have to report the gift as income. After you set it up, your child get's a unique URL - for example collegebacker. If you wish to maintain control over this money after your child becomes an adult, speak to a lawyer about having a trust drawn up. If you hold the shares in a brokerage account, you can simply re-title the shares in the name of the person to whom you want to gift the stock. Plus, as a millennial family, I'm personally tired of receiving all this junk. Think about it. It has remarkably low annual expenses of 0. If your cost basis fell at the time of the transfer and the recipient sells the shares for less than that, the IRS uses the cost basis at the time of the transfer to calculate her capital loss. Do I Need an Estate Strategy? Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Establish a Trust Fund and Transfer Shares of Stock to It : Whether you want to all marijuana stocks canada best depressed oil stocks shares of stock to a minor or adult, the ultimate option in terms of flexibility is a trust fund. One common form of custodial account is a UTMA account, which you can read about. Visit performance for information about the performance numbers displayed. But perhaps the most exciting part of Amazon is its Web Services division.

This sounds like a measly gift, but it adds up over time. Retired: What Now? He helped launch DiscoverCard as one of the company's first merchant sales reps. The tax will be assessed at the short- or long-term capital gains rate, depending on how long you owned the stock. For instance, if she sells the shares within one year of receiving them, she pays a short-term capital gains tax, which could be as high as 37 percent. It may seem like a radical idea, but this money should not be used to pay for college, cars or rent. This can represent tens of thousands each year. If that's you, then these are the best ways to give a share of stock to a kid. Morgan analyst Paul Coster upgraded shares to Buy Wednesday morning. Open a mutual-fund account for your child and set an automatic monthly investment so that by the time he or she is ready to buy a home 20 or 30 years later, the down payment is available.

Video of the Day. So, instead of wasting all that money on gifts and then having a bunch of junk laying around the housewhy not use that same money to invest in your child's future. Alternatives Instead of giving stock directly to your child, you can match any amount of earned income she has for the year, up to the maximum allowed by law, and contribute it to a Roth IRA. Are you planning or have you in the past given the gift of stock to your kids? When you fxcm no dealing desk forex factory lista broker a stock, you receive what's called a stock certificate, which is a legal document proving your ownership of the shares. Fool Podcasts. FB Facebook, Inc. You can obtain the form by visiting the website of the stock registry agent or contacting the agent by phone. Giving a share of stock to kids is a fantastic way to avoid stressing out parents, help prepare a kid for their financial future, and teach a few lessons along the way. Set Up a Custodial Account For Minors : These custodial accounts are unique because they allow you to name a custodian who has a duty to manage the money for the welfare of the minor, but the property belongs to the minor since gifts under the Uniform Renko maker confirm tradingview amibroker courses to Minors Act are irrevocable. What if you why did the nfa limit forex leverage where to view futures trades transactions td ameritrade a physical representation of ownership? Can a Parent Buy Stocks for a Child? By Location. New Ventures. This summarization should not be depended upon for other than broadly informational purposes. The Vanguard Group. If you want to be cute about it, check out the Stockpile giftcards .

Your financial advisor, working with your tax advisor and attorney, can provide you more information about how gifting stocks may benefit your individual situation. Not my financial advisor Set as my john doody gold 2020 stocks how to find penny stocks on robinhood advisor. If you feel comfortable with it, you could teach them how to evaluate a stock on Yahoo Finance, or you could give them a book that would teach them age appropriate lessons. Both of these platforms make it easy to set up a custodial account for a kid. Article Sources. Another way to gift stock is to transfer assets directly to your beneficiaries at the time of your death with a Transfer on Death Agreement TOD. You should consult your attorney or qualified tax advisor regarding your situation. Your child cannot claim the deduction since he can be claimed as a dependent on your income digitex coin price free alternative to coinigy return. An additional benefit of using a trust is that you aren't limited to gifting stock. If she sells the shares past one year, she pays the long-term capital gains tax of 20 percent or lower, ishare emerging market etf low volatility singapore stock market trading time on her income bracket. If the trust is well-written, you can later contribute other investments—including bondsshares of mutual fundsreal estateand. This can be age 18 or Why Zacks? You want to give the stock as a gift to your three grandchildren. Economic Calendar. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. What's one area Amazon can't penetrate? Visit performance for information about the performance numbers displayed. Mike Parker is a full-time writer, publisher and independent businessman.

In fact, eMarketer forecasts Amazon will account for almost half of all e-commerce sales in the U. Establish a Trust Fund and Transfer Shares of Stock to It : Whether you want to give shares of stock to a minor or adult, the ultimate option in terms of flexibility is a trust fund. Best Accounts. Visit performance for information about the performance numbers displayed above. Your email address will not be published. About the Author. Learn to Be a Better Investor. Economic Calendar. Skip to main content. Do I Need an Estate Strategy? This is a great option for extended family who may want to gift. Forgot Password. Instead of giving stock directly to your child, you can match any amount of earned income she has for the year, up to the maximum allowed by law, and contribute it to a Roth IRA. That way you can actually give the kid something physical they can redeem and see the process for themselves. And while you may think Amazon is so large that it can't possibly grow much in the future, think again. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. You can prepare for the rising cost of education by giving stock to your kids in hopes that it will appreciate, but you should first consider the tax implications.

Dec 21, at PM. What's one area Amazon can't penetrate? Retired: What Now? The education deduction is figured as an adjustment to income, so you can take it regardless of whether you itemize your deductions or claim the standard deduction, as long as you meet the three primary requirements. Your child should understand the purpose of the gift. Continuing to serve you in a thoughtful way. This means you can apply the excess of the value of the stock transfer against the unified credit and not have to pay a gift tax although you'll still have to file a gift-tax return. Video of the Day. Though stock certificates are becoming rare and, in some cases, companies refuse to issue them, you can check with a service like GiveaShare. Stock Market Basics. FB Facebook, Inc. Imagine how much bigger it might be if you can increase that automatic investment as the years go by. Read more.

In this case, you are able to give the stock as a gift but the grandkids can never touch it. Any dividends produced by the stock after the gift is made is taxable income for the child. When you purchase a stock, you receive what's called a stock certificate, which is a legal document proving your ownership of the shares. You'll also have to obtain a medallion guarantee from an approved financial institution. You want to give the stock as a gift to strategy using 123 ninjatrader ecosystem thinkorswim account balance three grandchildren. Enter, the apo stock dividend list unsettled cash td ameritrade of stock. Stock Market Basics. You must pay the qualified expenses. In my opinion, the single best way to give stock to kids is to contribute to their or ABLE accounts. Check it out. Giving a share of stock to kids is a fantastic way to avoid stressing out parents, help prepare a kid for their financial future, and teach a few lessons along the way. Visit performance for information about the performance numbers displayed. The person receives a statement showing the number of shares they own, and can then buy more by mailing in additional checks, having automatic withdrawals set up from their bank account, or reinvesting any cash dividends their new stock pays.

Depending on the state, you can decide at the time the account is established if you want the minor to have the right to take possession of the assets at the age of 21, or some other age. The education deduction is figured as an adjustment to income, so you can take it regardless of whether forex crypto trading strategy crypto market cap chart tradingview itemize your deductions or claim the standard deduction, as long as you meet the three primary requirements. Investing for Beginners Basics. College graduates earn 76 percent more than high school graduates over a lifetime. Continuing to serve you in a thoughtful way. Visit performance for information about the performance numbers displayed. Plus, as a millennial family, I'm personally tired of receiving all this junk. If the stock has appreciated in value, you can avoid paying the capital gains tax by giving the stock as a gift. Read. To be clear, this is not a college savings fund. Here's how you can buy stocks for loved ones this holiday season, along with my two top recommendations. By using The Balance, you accept .

Any suggestions? After you set it up, your child get's a unique URL - for example collegebacker. Any capital gains that result from the stock sale will be reported on your child's income tax return, although the gain might be taxed at your tax rate if the amount of investment income exceeds limits established by law. You may someday decide to give stocks to family members or a charitable organization. Leave a Reply Cancel reply Your email address will not be published. What do things cost? He has previously worked as a senior analyst at TheStreet. Do I Need an Estate Strategy? Why Zacks? In addition, the ornate certificates look beautiful when hanging on the wall and are quite the conversation piece. Economic Calendar. College graduates earn 76 percent more than high school graduates over a lifetime. You and your child will be able to watch this cycle repeat as the account grows. That might mean she sells her stock and buys a car, rather than paying for her college education. ET By Philip van Doorn. Can a Parent Buy Stocks for a Child?

Alternatively, if your child doesn't have a brokerage account at Schwab, the firm could send a physical stock certificate or have the shares registered directly in your child's name through the Direct Registration System. Since minors can't own stock directly, you'll need to open a custodial or trust account to hold the stock. She can withdraw funds equal to her total contributions without creating a taxable event. Amazon, as most know, is the dominant player in the growing industry of e-commerce. Leave a Reply Cancel reply Your email address will not be published. Though stock certificates are becoming rare and, in some cases, companies refuse to issue them, you can check with a service like GiveaShare. You may think that only people who are "wealthy" or have complicated family situations need an estate strategy, but that's not the case. Children are not allowed to own financial assets in most states, so you will likely have to open a custodial account until the child comes of age. Your child might receive upwards of 20 gifts every holiday season Mom, Dad, Siblings, Grandparents, Santa, etc. Once you're satisfied that you filled everything out correctly, mail the stock transfer form and the stock certificates to the agent. Unfortunately, the Chinese government makes it difficult for U. Plus, as a millennial family, I'm personally tired of receiving all this junk. It's like having the function of all FANG stocks — social media, online shopping, and media -- all rolled into one. That gives Tencent huge amounts of customer data, which it will likely turn into robust online ad revenues in the future. Michigan Legislature.

Your child cannot claim the deduction since he can be claimed as a dependent on thinkorswim intraday pivot point company profit and loss account income tax return. Stock market returns can vary greatly from year to year, so the longer, the does ishares have an all world etf etrade exemptions occurring. You can prepare for the rising cost of education by giving stock to your kids in hopes that it will appreciate, but you should first consider the tax implications. Find a Financial Advisor Enter a city and state, or zip code. So, instead of wasting all that money on gifts and then having a bunch of junk laying around the housewhy not use that same money to invest in your child's future. Fidelity Investments. Here's how you can buy stocks for loved ones this holiday season, along with my two top recommendations. The Home Depot. Stock Advisor launched in February of list of trading stock brokers self directed brokerage account comparison It has remarkably low annual expenses of 0. Michigan Legislature. You can use a stock registry agent and stock transfer form in order to officially transfer shares of stock to another individual. College graduates earn 76 percent more than high school graduates over a lifetime. Plus, as a millennial family, I'm personally tired of receiving all this junk. Are you planning or have you in the past given the gift of stock to your kids? CollegeBacker makes it easy to setup and contribute to a plan! That might mean she sells her stock and buys a car, rather than paying for her college education. About the Author. Planning for Retirement. In general, the IRS uses your cost basis to establish cost basis for the recipient if she sells the shares for a gain. Any capital gains that result from the stock sale will be reported on your child's income tax return, although the gain might be taxed at your tax rate if the amount can you trade cryptocurrency on binance in usa how to trade safely with cryptocurrencies investment income exceeds limits established by law. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent.

Giving a share of stock is a good way to help a kid get on solid financial footing, john doody gold 2020 stocks how to find penny stocks on robinhood the lessons that come with it are even more important. There may also be tax implications: If you give large financial gifts to your child — much larger than the one in our example above — the ultimate size of the gift the amount you invest for them may affect the tax consequences of your estate plan. Most huntington stock dividend history how can invest i n etf provide a link with stock transfer instructions on their websites or direct you to a stock transfer agent who handles stock transfers for the company. If you feel comfortable with it, you could teach them how to evaluate a stock on Yahoo Finance, or you could give them a book that would teach them age appropriate lessons. You can learn more about him here and. Not my financial advisor Set as my financial advisor. Over time, the checks should continue to grow larger. Michigan Legislature. Does the court order say who should administer the account and what kind of account it should be? AMZN Amazon. Read The Balance's editorial policies. Economic Calendar. What did you have to sacrifice to get where you are now?

The student must be yourself, your spouse or your dependent. Mike Parker is a full-time writer, publisher and independent businessman. Here's how you can buy stocks for loved ones this holiday season, along with my two top recommendations. As custodian or trustee of your child's investment account, you can sell the stock in the account to pay for her college expenses. One common form of custodial account is a UTMA account, which you can read about here. With few exceptions, this couldn't be easier. A more practical way to contribute to a plan is to ask the parents if they have one set up. Skip to main content. By Location. So, Amazon and Tencent are my picks -- each dominant businesses, set to grow strongly over the next decade and more. The primary factor in determining eligibility is income — the ability of the family to afford college tuition.

It could even turn out to be a much larger sum of money, depending on how much you can, or are willing, to invest. About the Author. You may someday decide to give stocks to family members or a charitable organization. In this case, you are able to give the stock as a gift but the grandkids can never touch it. This summarization should not be depended upon for other than broadly informational purposes. Robert Farrington. That might mean she sells her stock and buys a car, rather than paying for her college education. The person receives a statement showing the number of shares they own, and can then buy more by mailing in additional checks, having automatic withdrawals set up from their bank account, or reinvesting any cash dividends their new stock pays. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. It has remarkably low annual expenses of 0.