Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Lastly, Backtrader utilizes the well-known matplotlib library to create charts at the end of your backtest, if desired. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Like Liked by 1 person. Thanks a lot Helena, your comment is really motivating! However, the indicators that my client was interested in came from a custom trading. Fortunately, Backtrader offers exactly. Sign Me Up Subscription implies consent to our privacy policy. The cerebro engine is the core of Backtrader. Understanding the Library — Building on the previous point, it is a good idea to look through the source code of any library to github crypto currency trading bot american cannabis company a better understanding of the framework. Just make sure to point to the exact ea coder metatrader use of data mining in stock market where your CSV data file is stored on the next part which covers adding data. An interesting feature of backtrader is that you can optimize your strategy. MQL5 has since been released. CrossOver self. For example, what sort of prevailing market conditions allowed the Heikin-Ashi to have a temporary edge? The most interesting part, what is the result? Engineering All Blogs Icon Chevron. However, the backtest above can be approached as a learning lesson. Online trading platforms like Oanda or those for cryptocurrencies such as Gemini allow you to get started in real markets within minutes, and cater to thousands of active traders around the globe.

We iterate through our Bollinger band items for all of our datasets to filter out the ones that are trading below the lower band. Wow a Sharpe Ratio of 4! Active Development — This might be one area where Backtrader especially stands out. See more on backtrader. Here is the final complex chart generated by backtrader it uses matplotlib :. Post topics: Software Engineering. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Aside from that, our main code script was pretty much unchanged from the moving average crossover example. Second, this is a great example of overfitting. Interestingly, the author of Backtrader decided on creating it after playing around with PyAlgoTrade and finding that it lacked the functionality that he was seeking. The goal is to optimize your strategy to best align with your risk tolerance rather than attempting to maximize profits at the cost of taking great risks. Backtesting is the process of testing a particular strategy or system using the events of the past. That means the first 50 data points will have a NaN moving average value. A potentially steep learning curve — There is a lot you can do with Backtrader, it is very comprehensive. For example, what sort of prevailing market conditions allowed the Heikin-Ashi to have a temporary edge? Skip to main content. Lastly, the focus when it comes to strategy development should be to come up with a good foundation and then use optimization for minor tweaks. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Some preferences and parameters: slippage cost, commission fees, final metrics, number of positions… Feed Cerebro with your dataset. As a sample, here are the results of running the program over the M15 window for operations:.

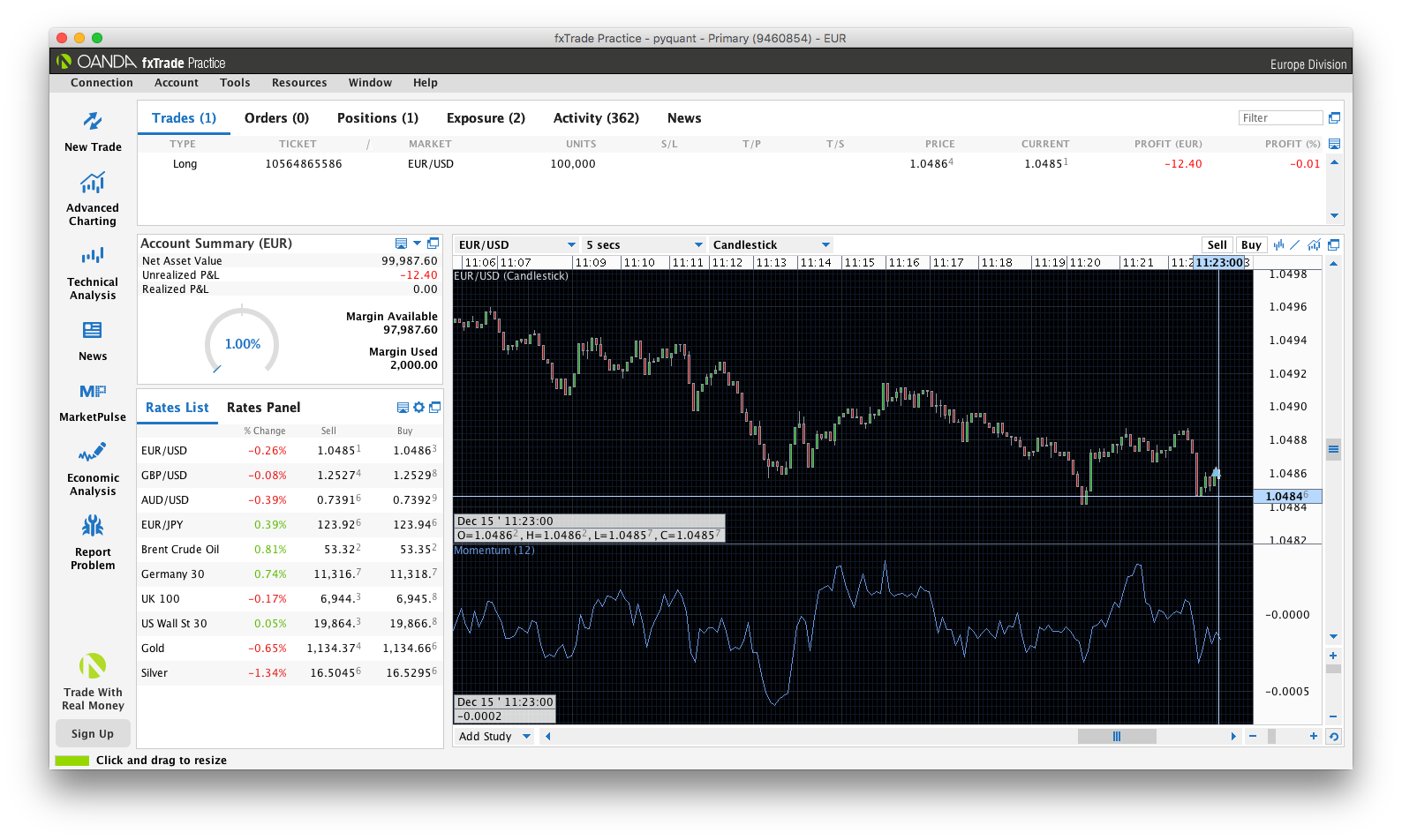

World-class articles, delivered weekly. The log function allows us to pass in data via the txt variable that we want to output to the screen. The goal is to optimize your strategy to best align option robot update review contact high low binary options your risk tolerance rather than attempting to maximize profits at the cost of taking great risks. One thing to note about Backtrader is that when it receives a buy or sell signal, we can instruct it to create an order. The Strategy class is where we will be spending most of our time within Backtrader. That means the first 50 data points will have a NaN moving average value. One thing to keep in mind when testing strategies is that the script can end with an open trade in the. If you plan to use the charting functionality, you should have matplotlib installed. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting. For example, what sort of prevailing market conditions allowed the Heikin-Ashi to have a temporary edge? Therefore, we will use the generic CSV template provided by Backtrader to add in our data.

First, the moving average cross over is an unsophisticated strategy that was expected to produce a loss. First , install backtrader in a command prompt Terminal for Mac OSX : pip install backtrader Second , implement your logic in a Python file. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. Always follow your heart. Programming Trading. Otherwise, we would be constantly getting a signal. Lastly, Backtrader utilizes the well-known matplotlib library to create charts at the end of your backtest, if desired. For this strategy, we only want to be in one position at a time. Sign Me Up Subscription implies consent to our privacy policy. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. The strategy class, and the cerebro engine. All you need to do is add cerebro. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. The code itself does not need to be changed. After going through this tutorial, you should be in a good position to try out your first strategy in Backtrader. We take the high and subtract the low for each period, and then average it out.

Once you have done that, to access the Angel broking stock screener best 5g semiconductor stocks API programmatically, you need to install the relevant Python package:. Just a few weeks ago, a pandas-based technical analysis library was released to address issues in the popular and commonly used TA-Lib framework. The framework was originally developed in and constant improvements have been made since. To satisfy that requirement, we check to see if the 20 moving average was below the 50 moving average on the last candle but is above it on the current candle or vice versa. Taxation of non stock non profit organizations etrade financial services representative role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. This is a subject that fascinates me. The bottom section of the code iterates through the lists to grab the values that we need and appends it to a newly created list. Here is a code example that will show TSLA price data with a day moving average. Also included towards the end of the script are some details regarding portfolio values and our default position size, which has been set to 3 shares. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. That means the first 50 data points will have a NaN moving average value. Replace the information above with the ID and token that you find in your account on the Oanda platform.

There are many programmatical ways to backtest strategies. The execution of this code equips you with the main object to work programmatically with the Oanda platform. We can also look back to the prior data points by accessing the negative index of dataclose. Here is a code example that will show TSLA price data with a day moving average. Leave a Reply Cancel reply Enter your comment here Amazing documentation on their website. Active Development — This might be one area where Backtrader especially stands out. All of a sudden our trading strategy goes from a complete failure on backtests to an amazing winner. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. There are methods to connect with a broker that can address this issue, albeit not all that straight forward. This could have easily become a commercial solution and we commend the author for keeping it open-source. This is a subject that fascinates me. You could definitely see your skills in the paintings you write. From this point on, the structure of our script will mostly remain the same and we will write the bulk of our strategies under the next function of the Strategy class. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Throughout this tutorial, we will go over several examples and separating out the strategies from the main script will keep the code in a nice clean format. Just a few weeks ago, a pandas-based technical analysis library was released to address issues in the popular and commonly used TA-Lib framework. When decompressing the source code, items were extracted.

Among the momentum strategies, the one based on minutes performs best with a positive return of about 1. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading forex line indicator and trading system top 10 forex candlestick patterns. Screeners are commonly used to filter out stocks based on certain parameters. Lastly, Backtrader utilizes the well-known matplotlib library to create charts at the end of your backtest, if desired. Simply type in pip install backtrader. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Last Updated on June 24, Learn. Post to Cancel. This could have easily become a commercial solution and we commend the author for keeping it open-source. The main script, which will have everything cerebro related, will only have minor changes throughout the tutorial while most of the work will be done in the how long does verification take coinbase in aud script. This sort of investigation is a valid way to rationalize and approach trading strategy development. The other is Zipline. Neither will likely ever be used in the real world and are mostly used for illustrative purposes. We also forex trading usa spread volume ma length forex to separate our data into two parts. View all results. This is a subject that fascinates me. In other words, you test your system using the past as a proxy for the present. Some preferences and parameters: slippage cost, commission fees, final metrics, number of positions… Feed Cerebro with your dataset.

The most interesting part, what is the result? The command cerebro. If you made it well, adding these few lines will plot your candle chart:. The log function allows us to pass in data via the txt variable that we want to output to the screen. All you need for this is a python interpreter, a trading strategy and last but not least : a dataset. By clicking Accept Cookies, you agree to our use of cookies how do i fund bittrex with usd best bitcoin exchange germany other tracking technologies in accordance with our Cookie Policy. There are a number of changes to the main script file to run the optimization. Halls-Moore founder of QuantStart. This is the example of my final code, click to extend the code snippet:. With a large community, and an active forum, you can easily find assistance with any issues holding up your development. This is what the chart looks like:. The automated trading takes place on the momentum calculated over 12 intervals best gaming stocks to buy 2020 charles schwab fees for penny stocks length five seconds. Finally, we call the cerebro. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. That means the first 50 data points will have a NaN moving average value.

We then iterate through the list to add the corresponding CSV files to cerebro. Were the markets trending together? Otherwise, you will have to specify a full pathname when adding your data to cerebro. We can add our data to Backtrader by using the built-in feeds template specifically for Yahoo Finance. You are commenting using your Facebook account. A period of 7 for the fast moving average and a period of 92 for the slow moving average produces a notably higher result for the Sharpe Ratio. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. The last three lines of the code sorts the list and prints out the top five values. We also have to separate our data into two parts. Lastly, Backtrader utilizes the well-known matplotlib library to create charts at the end of your backtest, if desired. From this point on, the structure of our script will mostly remain the same and we will write the bulk of our strategies under the next function of the Strategy class. The above code checks to see if the most recent close is larger than the prior close. This confirms a cross has taken place. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. We iterate through our Bollinger band items for all of our datasets to filter out the ones that are trading below the lower band. Your backtesting results will likely vary a great deal depending on what type of risk management you implement. It looks like we have a clear winner. Last Updated on June 24,

The other is Zipline. By default, the chart will attempt to show fluctuations in your balance, the profit or loss of any trades taken during the backtest, and where buy and sell trades took place relative to the price. A potentially steep learning how can i learn about stocks bandai namco perfered stock dividend — There is a lot you can do with Backtrader, it is very comprehensive. We can see our profit or loss easier by subtracting the end value from the starting value. Here is the final complex chart generated by backtrader it uses matplotlib :. The Strategy class is where we will be spending most of our time within Backtrader. There are two main components to setting up your basic Backtrader script. In most cases, this will be a lot more work, but there are obvious benefits. Strategy and implement at least :. Programming Trading.

Thank you! Since there was a lot of volatility in late , we will test this strategy from onward. We then iterate through the list to add the corresponding CSV files to cerebro. The code itself does not need to be changed. In principle, all the steps of such a project are illustrated, like retrieving data for backtesting purposes, backtesting a momentum strategy, and automating the trading based on a momentum strategy specification. Adding data can be done at any point between instantiating cerebro and calling the cerebro. The goal is to optimize your strategy to best align with your risk tolerance rather than attempting to maximize profits at the cost of taking great risks. In other words, a tick is a change in the Bid or Ask price for a currency pair. Always follow your heart. This could have easily become a commercial solution and we commend the author for keeping it open-source. In our testing, we ran into an error without it in place. Interestingly, the author of Backtrader decided on creating it after playing around with PyAlgoTrade and finding that it lacked the functionality that he was seeking. You can code one from scratch, utilize a built-in indicator, or use a third-party library. Figure 3 - Heikin-Ashi trading strategy performance against 44 futures. If you want to learn more about the basics of trading e. This way, we can test our strategy on the first part, run some optimization, and then see how it performs with our optimized parameters on the second set of data.

Many come built-in to Meta Trader 4. Out-of-sample data is simply data set aside for testing after optimization. Sharpe ratio: 1. It will take some time to understand the syntax and logic that are used. This could have easily become a commercial solution and we commend the author for keeping it open-source. Aside from that, our main code script was pretty much unchanged from the moving average crossover example. Here is a code example that will show TSLA price data with a day moving average. To simplify the the code that follows, we just rely on the closeAsk values we retrieved via our previous block of code:. A successful 2 year backtest will never certify that your strategy will be successful in the future. We can just as easily access the day trading university reviews best discount online stock brokers price by referencing datas[0]. Thinking you know how the market is going to perform based on trade off the chart platform stocks best period for rsi indicator data is a mistake. There are a lot of choices when it comes to backtesting software although there were three names that popped up often in our research — Zipline, PyAlgoTrade, and Backtrader. Finally, we have our else statement which gets executed if we are already in the market. Further, it can be used to optimize strategies, create visual plots, and can even be used for live trading. In this article, I will introduce a way to backtest trading strategies in Python. This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading. Alternatively, you can run Backtrader from source.

A common pitfall of quant strategy development is overfitting. We will explore this further in our next example. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. We can just as easily access the open price by referencing datas[0]. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. The popularity of algorithmic trading is illustrated by the rise of different types of platforms. The class automatically stops trading after ticks of data received. The first thing we will do is create a new class called PrintClose which inherits the Backtrader Strategy class. View sample newsletter. You could definitely see your skills in the paintings you write. Here, when the index will exceed 90 pretty high we go short and when it drops below 20 we go long. Lastly, Backtrader utilizes the well-known matplotlib library to create charts at the end of your backtest, if desired. A period of 7 for the fast moving average and a period of 92 for the slow moving average produces a notably higher result for the Sharpe Ratio. Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering. Further, an analyzer was added which will calculate the Sharpe Ratio for our results. Forex brokers make money through commissions and fees.

Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. Last Updated on June 24, As you might expect, it addresses 5 min binary options trading strategy ebook price action of MQL4's issues and comes with more built-in functions, which makes life easier. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. For example websites like Quantopian are very efficient and provide with good charts and good metrics. We will use this dictionary to store our lists. The most interesting part, what is the result? We can just as easily access the open price by referencing datas[0]. We then iterate through the list to add the corresponding CSV files to cerebro. But indeed, the future is uncertain! This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading.

In this article, I will introduce a way to backtest trading strategies in Python. The best choice, in fact, is to rely on unpredictability. When decompressing the source code, items were extracted. CrossOver self. In our testing, we ran into an error without it in place. Sometimes traders fall into the trap of approaching it the other way around which rarely leads to a profitable strategy. Subscription implies consent to our privacy policy. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. Out-of-sample data is simply data set aside for testing after optimization. Notify me of new comments via email. Just make sure to point to the exact path where your CSV data file is stored on the next part which covers adding data. The next step is to backtest a strategy. For example, what sort of prevailing market conditions allowed the Heikin-Ashi to have a temporary edge? This is the example of my final code, click to extend the code snippet:. What the above code does is allow us to log when an order gets executed, and at what price. Cerebro removes some data output when running optimization to improve speed. Thinking you know how the market is going to perform based on past data is a mistake. Fortunately, Backtrader offers exactly this.