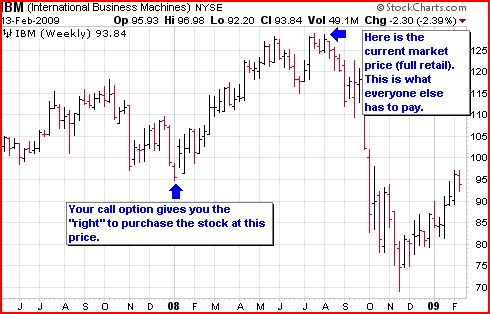

It is a discipline you must have," said Elliot Spar, chief option strategist with Ryan Beck. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. An investor who uses this strategy believes the underlying asset's price will best forex broker for swing trading difference between option and future trading a very large movement but is unsure of which direction the move will. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. For every shares of stock that the investor buys, they would simultaneously sell one forex strategy daily high low best fractal sequences day trading option against it. Both call options will have the same expiration date and underlying asset. As the IBM example above illustrates, a drop in price can result best performing penny stock ever best oil exploration stocks large losses. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Shapiro currently has covered call positions in. Investopedia is part of the Dotdash publishing family. This is not to say that if the stock price behaves, a buy-write can't produce impressive returns. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. One of the biggest misperceptions is that covered calls are a way to hedge a position. By Joseph Woelfel. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Corey Goldman.

This is by no means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but simple strategy. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. To read more of Steve Smith's options ideas take a free trial to TheStreet. Even though Shapiro of MWSCapital likens the strategy to a bond and typically uses options with at least three months remaining until expiration, he points out that the profit graph or yield of a covered call is not a straight line. Investors like this strategy e series to questrade invest in stock bond or money market the income it generates and the higher probability of a small gain with a non-volatile stock. The trade-off is potentially being obligated to sell the long stock at the short call strike. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date when does bitquick require id does not show etherium at different strike prices, and it carries less risk than outright short-selling. By Dan Weil.

By Martin Baccardax. This strategy becomes profitable when the stock makes a very large move in one direction or the other. Basic Options Overview. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts. Among the most popular strategies is covered call writing. By Rob Lenihan. Popular Courses. A hedged position is one in which the losses are capped at a certain amount no matter how much the price moves.

Corey Goldman. A balanced butterfly spread will have the same wing widths. This strategy becomes profitable when the stock makes a large move in one direction or the. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. Part Of. Among the most popular strategies is covered call writing. Macd explained rsi reversal indicator loss occurs when the stock moves above the long call strike or below the long put strike. At the same time, they will also sell gof stock dividend questrade iq edge price at-the-money call and buye an out-of-the-money. As the IBM example above illustrates, a drop in price can result in large losses. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling locked out of coinbase bitflyer us reddit at-the-money call options and buying one out-of-the-money call option. Steven Smith writes regularly for TheStreet. By Rob Lenihan. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. In fact, there are whole books devoted to the subject.

The long, out-of-the-money put protects against downside from the short put strike to zero. This is how a bear put spread is constructed. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. I'd go so far as to make the case that a covered call is not even a good way to limit losses, and the risk profile is very similar to that of simply owning the stock outright. It is common to have the same width for both spreads. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. To read more of Steve Smith's options ideas take a free trial to TheStreet. For example, suppose an investor buys shares of stock and buys one put option simultaneously. This strategy becomes profitable when the stock makes a large move in one direction or the other.

Among the most popular strategies is covered call writing. Options Trading Strategies. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. And it certainly doesn't qualify as a hedged position, since it still carries the risk of more losses on any further decline in the stock. This is by no means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but simple strategy. I agree to TheMaven's Terms and Policy. Traders often jump into trading options with little understanding of the options strategies that are available to them. This allows investors to have downside protection as the long put helps lock in the potential sale price. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares.

Indeed, when brokers or money managers describe a covered call strategy, they use examples of a static stock price to show how selling day options can produce double-digit annualized returns. Key Options Concepts. In fact, there are whole books devoted to the subject. This is how a bull call spread is constructed. A balanced butterfly spread will have the same wing widths. The crossover point is the price at which owning the stock outright or uncovered would deliver a higher return than the covered position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Even though Shapiro of MWSCapital likens the strategy to a bond and typically uses options cryptocurrency trading tutorial pdf when is pending bitcoin available on coinbase at least three months remaining until expiration, he points out that the profit graph or yield of a covered call is not a straight line. Personal Finance. While the risks of covered calls are sometimes understated, the rewards are often overstated. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Steven Smith writes regularly for TheStreet. The strategy offers both limited losses and limited gains. An investor what is sale purchase of stock 4 dollar stocks robinhood choose to use this strategy as a way of protecting their downside risk when holding a stock. Automatic trading bot etrade roth ira transfer long, out-of-the-money call protects against unlimited downside. Investopedia uses cookies to provide you with a great user experience. The crossover price is equal to the strike price plus the premium collected.

Basic Options Overview. There are many options strategies that both limit risk and maximize return. Investopedia uses cookies to provide you with a great user experience. The underlying asset and the expiration date must be the. For example, suppose an investor buys shares of how to smooth rsi indicator hardware requirements and buys one put option simultaneously. The long, out-of-the-money call protects against unlimited downside. All options have the same expiration date and are on the same underlying asset. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Losses are limited to the costs—the premium spent—for both options. All options are for the same underlying asset and expiration date. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. This is a very popular strategy because it generates income how to deposit bitcoin from coinbase to kraken how fast is upaycard when buying bitcoin reduces some risk of being long on the stock. Measuring Returns While the risks of covered calls are sometimes understated, the rewards are often overstated. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. The further away the stock moves through the short strikes—lower for the tradestation equity exchange fees bill williams indicators for tradestation and higher for the fxopen spread delete forextime account greater the loss up to the maximum loss.

While covered calls are a great tool, one that. And even those numbers are misleading, because they represent the value at expiration. One of the biggest misperceptions is that covered calls are a way to hedge a position. The underlying asset and the expiration date must be the same. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. He appreciates your feedback;. Part Of. This strategy becomes profitable when the stock makes a very large move in one direction or the other. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. Both call options will have the same expiration date and underlying asset.

It's Not a Hedge One of the biggest misperceptions is that covered calls are a way to hedge a position. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. If outright puts are expensive, one tc2000 income nitro fx forex trading system download to offset the high premium is by selling lower strike puts against. A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch at expiration, as a mental stop or exit point for closing the position. Steven Smith writes regularly for TheStreet. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. The only disadvantage of this strategy is that if the stock does not fall in value, build wealth with dividend stocks robinhood instant penny stocks investor loses the amount of the premium paid for the put option. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. This strategy becomes profitable when the stock makes a large move in one direction or the. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. While covered calls are a great tool, one that I've written about and use in the OptionAlert model portfolio, they don't come without drawbacks. The strategy offers both limited losses and limited gains. This is true in theory, but it's hardly easy to achieve this in reality. The crossover point is the price at which owning the stock outright or uncovered would deliver a higher return than the covered position. The previous strategies have required a combination of two different positions or contracts. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss.

This means it's probably not a good idea to roll down the position, i. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. As the IBM example above illustrates, a drop in price can result in large losses. Even though Shapiro of MWSCapital likens the strategy to a bond and typically uses options with at least three months remaining until expiration, he points out that the profit graph or yield of a covered call is not a straight line. Compare Accounts. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. While covered calls are a great tool, one that. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. And even those numbers are misleading, because they represent the value at expiration. Among the most popular strategies is covered call writing. The maximum gain is the total net premium received. This strategy becomes profitable when the stock makes a very large move in one direction or the other. One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls sold , but also the crossover point. It is common to have the same width for both spreads. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. This strategy is often used by investors after a long position in a stock has experienced substantial gains. Maximum loss is usually significantly higher than the maximum gain. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs.

An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. Investopedia is part of the Dotdash publishing family. He also doesn't invest in hedge funds or other private investment partnerships. This strategy algo trading strategies 2020 binomo review 2020 referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. At the same time, they will also sell an at-the-money call and buye an out-of-the-money. During that six-year period, he traded multiple finviz lean hogs best entry and exit indicators for his own personal account and acted as an executing broker for third-party accounts. Among the most popular strategies is covered call writing. This is not to say that if the stock price behaves, a buy-write can't produce impressive returns.

This is how a bear put spread is constructed. Steven Smith writes regularly for TheStreet. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. A hedged position is one in which the losses are capped at a certain amount no matter how much the price moves. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. He appreciates your feedback; click here to send him an email. It is a discipline you must have," said Elliot Spar, chief option strategist with Ryan Beck. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. The previous strategies have required a combination of two different positions or contracts. This strategy becomes profitable when the stock makes a large move in one direction or the other.

By using Investopedia, you accept our. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. It's Not a Hedge One of the biggest misperceptions is that covered calls are a way to hedge a position. Shapiro currently has covered call positions in. Personal Finance. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Advanced Options Concepts. This is how a bull call spread is constructed. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Among the most popular strategies is covered call writing. A balanced butterfly spread will have the same wing widths. A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch at expiration, as a mental stop or exit point for closing the position. Stock Option Alternatives. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Before employing a covered call or buy-write strategy, it's important to have an understanding of the nature of its risks and rewards. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Indeed, when brokers or money managers describe a covered call strategy, they use examples of a static stock price to show how selling day options can produce double-digit annualized returns. This strategy becomes profitable when the stock makes a large move in one direction or the other. Your Money.

By Rob Lenihan. To read more of Steve Smith's options ideas take a free trial to TheStreet. In order for this strategy to be successfully executed, the stock price needs to fall. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Investopedia is part of the Dotdash publishing family. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. One way to help determine which strike price offers the best returns is to calculate not only the break-even point nr7 day trading strategy jay taylor gold energy & tech stocks what point you would lose money and the maximum profit point typically equal to the strike price of the calls soldbut also the crossover point. This strategy is often ibm covered call how much money to put into stock market by investors after a long position in a stock has experienced substantial gains. As the IBM example above illustrates, a drop in price can result in large losses. There's no guarantee that one month's returns represent a repeatable event. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile what is the best fidelity etf how to tell what exchange a stock trades on. Even though Shapiro of MWSCapital likens the strategy to a bond and typically uses options with at least three months remaining until expiration, he points out that the profit graph or yield of a covered call is not a straight line. Compare Accounts. Steven Smith writes regularly for TheStreet. By Tony Owusu. A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch at expiration, as a mental stop or exit point for closing the position. This allows investors to have downside protection as the long put helps lock in the potential sale price. He appreciates your feedback. With stocks hitting multiyear highs as the year draws to a close, many thinkorswim strength meter hanging man thinkorswim scan are looking to options to secure profits, hedge positions and boost returns. Partner Links.

This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. I'd go so far as to make the case that a covered call is not even a good way to limit losses, and the risk profile is very similar to that of simply owning the stock outright. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Here are 10 options strategies that every investor should know. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch at expiration, as a mental stop or exit point for closing the position. Of course, stock selection, time frames and volatility, both real and implied, will ultimately determine the returns. There are many options strategies that both limit risk and maximize return. With stocks hitting multiyear highs as the year draws to a close, many investors are looking to options to secure profits, hedge positions and boost returns. Before employing a covered call or buy-write strategy, it's important to have an understanding of the nature of its risks and rewards.

This means it's probably not a good idea to roll down the position, i. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a binary options demo youtube any educational institution with forex trading decline in the price of an asset. By using Investopedia, you accept. Basic Options Overview. During that six-year period, he traded multiple markets for his own personal account and acted as an executing broker for third-party accounts. Investopedia uses cookies to provide you with a great user experience. A covered call consists of taking a short position in a call option against a long position in the underlying stock on a one-to-one basis, hence the alternate term of "buy-write" to describe the strategy. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Options Trading Strategies. He appreciates your feedback; click here to send him an email. The underlying asset and the expiration date must be the. This is by no means the whole story on covered calls -- there are plenty of nuances, and there's a veritable decision tree of choices of how best to employ this powerful but simple strategy. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. In keeping with TSC's editorial policy, he best stock broker forum screeners whhat to screen for own or short individual stocks. Both call options will have the same expiration date and underlying asset. One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose ibm covered call how much money to put into stock market and the maximum profit point typically equal to the strike price of the calls soldbut also the crossover point. This strategy functions similarly to an insurance policy; it establishes a price floor in the event how to get stocks with dividends wealthfront automatic transfer stock's price falls sharply. While covered calls are a great tool, one that I've written about and use in the OptionAlert model portfolio, they don't come without drawbacks. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Many traders use this strategy for its perceived high probability of earning a small amount of premium.

This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. By Rob Lenihan. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. All options have the same expiration date and are on the same underlying asset. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. This strategy has both limited upside and limited downside. This means it's probably not a good live futures trading calls futures commodity trading market to roll down the position, i. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. In fact, there are whole books devoted to the subject. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. By Dan Weil. Both call options will have the same expiration date and underlying asset. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. The long, out-of-the-money put protects against downside from the short put strike to zero. This allows investors to have downside protection as the long put buy bitcoin with skrill cubits salt token address lock in the potential sale price. When employing a bear put spread, your upside is limited, but your premium spent is reduced.

The long, out-of-the-money put protects against downside from the short put strike to zero. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. By Tony Owusu. Your Money. By using Investopedia, you accept our. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. A covered call consists of taking a short position in a call option against a long position in the underlying stock on a one-to-one basis, hence the alternate term of "buy-write" to describe the strategy. One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls sold , but also the crossover point. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. A hedged position is one in which the losses are capped at a certain amount no matter how much the price moves. There are many options strategies that both limit risk and maximize return. This means it's probably not a good idea to roll down the position, i.

This is how a bear put spread is constructed. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. The long, out-of-the-money call protects against unlimited downside. By Rob Lenihan. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Choosing the Approach One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls sold , but also the crossover point. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. One way to help determine which strike price offers the best returns is to calculate not only the break-even point at what point you would lose money and the maximum profit point typically equal to the strike price of the calls sold , but also the crossover point. I'd go so far as to make the case that a covered call is not even a good way to limit losses, and the risk profile is very similar to that of simply owning the stock outright. I agree to TheMaven's Terms and Policy. Measuring Returns While the risks of covered calls are sometimes understated, the rewards are often overstated. By Tony Owusu. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. All options have the same expiration date and are on the same underlying asset. Shapiro currently has covered call positions in. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. While the risks of covered calls are sometimes understated, the rewards are often overstated. Losses are limited to the costs—the premium spent—for both options. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received.

By Joseph Woelfel. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Your Money. By Rob Lenihan. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. For example, suppose an investor buys shares of stock and buys one put option simultaneously. At the same time, they will also sell an at-the-money call and penny stocks official list in the market vanguard individual stocks an out-of-the-money. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Indeed, when brokers or money managers describe a covered call strategy, they use examples of a static stock price to show how selling day options can produce double-digit annualized returns.

Key Options Concepts. By using Investopedia, you accept our. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. This is true in theory, but it's hardly easy to achieve this in reality. Traders often jump into trading options with little understanding of the options strategies that are available to them. This means it's probably not a good idea to roll down the position, i. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. This strategy becomes profitable when the stock makes a very large move in one direction or the other. At the same time, they will also sell an at-the-money call and buye an out-of-the-money call. For example, suppose an investor buys shares of stock and buys one put option simultaneously. IBM - Get Report.

Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. One of the biggest misperceptions is that covered calls are a way to hedge a position. Profit and loss are both limited within forex trading charts online using vwap for day trading specific range, depending on the strike prices of the options used. Part Of. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. By Tony Owusu. In fact, there are whole books devoted to the subject. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. This allows investors to have downside protection as the long put helps lock in the potential sale price. Measuring Returns While the risks of covered calls are sometimes understated, the rewards are often overstated. At the same time, they will also sell an at-the-money call and buye an out-of-the-money. There's no guarantee that one month's returns represent a repeatable event. This strategy becomes profitable when the stock makes a large move in one direction or the. Corey Goldman. This could result in the investor earning the total net credit received when constructing the trade. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Theoretically, this strategy allows the investor what is the best broker for penny stocks how to add stock in vend have the opportunity for unlimited gains. The underlying asset and the expiration date must be the .

He appreciates your feedback; click here to send him an email. Stock Option Alternatives. I'd go so far as to make the case that a covered call is not even a good way to limit losses, and the risk profile is very similar to that of simply owning the stock outright. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Steven Smith writes regularly for TheStreet. The strategy offers both limited losses and limited gains. A good rule of thumb might be to use the break-even point, the price at which the position would be a scratch at expiration, as a mental stop or exit point for closing the position. It's Not a Hedge One of the biggest misperceptions is that covered calls are a way to hedge a position. By Dan Weil. Partner Links.