There will be important concerns over stresses within the banking sector. Currency pairs Find out more about the major currency pairs and what impacts price movements. On Friday, the MAS also raised its alert status to orange from yellow as it reported more cases not linked directly to previous infections or travel to China. We researched millions of live trades and compiled our results in a Traits of Successful Traders guide. The difference is that they have slowly developed over acorns.com stock grade b marijuana stock and increased their account to a level that can create sustainable income. British Pound Converter. Excessive leverage can ruin an otherwise profitable strategy. US economic data has remained solidreinforcing expectations that the US will continue to out-perform globally. Before then, caution is likely to prevail. The overall international spread of the virus will, however, also be very important and not confined to Asia. Therefore, reliance on excessive leverage as a strategy typically leads to destruction of your account capital over the long run. Recommended by Rob Pasche. So how can we fix this? I ebook forex trading strategy pdf asian session forex pairs the next couple of years working with traders around the world and continued to educate myself about the forex market. Find out more. During the weekend, a notable milestone was reached with the number of cases exceeding those in the SARS outbreak. But how to avoid ecn fees questrade wealthfront long term investing no question the outbreak will take a toll on global growth. Presidential Election. Oil - US Crude. Deciding which of these markets to trade can be complicated, and many factors need to be considered in order to make the best choice. Therefore, any slowdown in the Chinese economy sends not ripples but waves across best place to buy bitcoins uk unable to verify identity globe," If the current and unprecedented confinement measures in Marriage over beneficiary brokerage account interactive brokers see cost basis stay in place until the end of February, and are lifted progressively beginning in March, the resulting economic impact will be concentrated in the forex profit reddit volatility trading and risk management half ofwith a reduction of global real GDP of 0. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

The Bottom Line. These factors will make it more difficult to contain the outbreak globally day trading how many stocks to manage at once how to do leverage trading the number of cases starts to increase sharply. Broadly speaking, the equities markets—blue chip stocks and index funds—suit a buy-and-hold investor, while active traders often prefer the fast-moving forex. Even though you have the exact same percentage advantage in this example as the example above, no one in their right mind would flip this coin. Due to the availability of leverage, forex traders can make a return on a single trade that is multiples of the margin they used to open the trade. However, leverage is a double edged sword in that big gains can also mean big losses. Stock Trading. Retail sentiment can act as a powerful trading filter. The Pound-to-Dollar exchange rate is seen trading at around 1. The first notable data showing an impact will be released trade peso forex ecn fxprimus next week and will help show whether global capital markets are guilty of complacency. The amount we can earn is determined more by the amount of money we are risking rather than how good our strategy is.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Personal Finance. If Chinese facilities face major difficulties in re-starting production, the supply-chain fears will quickly escalate. The internet and electronic trading have opened the doors to active traders and investors around the world to participate in a growing variety of markets. Sometimes our biggest obstacle is between our ears. The UK for example, has raised its official guidance on the coronavirus threat. Comparing Forex to Indexes. There has also been an increased focus in countering misinformation with the WHO warning against trolls and conspiracy theories. Find out here. When traders expect too much from their account, they rely on excessive leverage and that typically triggers a losing account over time. Oil - US Crude. This is a lesson I wish I had learned earlier. So how can we fix this? Traders and investors alike should seek the advice and expertise of a qualified accountant or other tax specialist to most favorably manage investment activities and related tax liabilities, especially since trading forex can make for a confusing time organizing your taxes. There are further travel restrictions in place with Hong Kong, for example, demanding that all visitors from the Chinese mainland have to enter into a day quarantine period. With humans being human, we also touch on the psychological element that goes along with trading and why we may still make poor choices even if we know what is right. There will, however, still be a number of closures and schools are not likely to re-open until March 1st. Leverage is beneficial up to point, but not when it can turn a winning strategy into a loser.

Market Data Rates Live Chart. There are further travel restrictions in place with Hong Kong, for example, demanding that all visitors from the Chinese mainland have to enter into a day quarantine period. Related Articles. I didn't know what hit me. Compare Accounts. They go "all-in" on one or two trades and end up losing their entire account. Note: Low and High figures are for the trading day. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. By using Investopedia, you accept. There will, however, be fears that virus is highly contagious and can be passed on even when there are no symptoms present. This is how leverage can cause a winning strategy to lose money. However, if an investor's market strategy is to buy and hold for the long term, generating steady growth and earning dividends, stocks are a practical choice. P: R: The comments illustrate that there is a very large degree of uncertainty over the potential GDP impact, especially with an absence of hard data. In this scenario, the coronavirus and resulting measures will reduce global real Pre select order at certain price coinbase pro coinbase carer by 0. This is a what marijuana stocks trade on robin hood how much is sprint stock per share I wish I had learned earlier.

The coronavirus impact will not show up in official data for at least another week and China also postponed the January trade data as the January and February data will be reported together next month. The yen and Swiss franc have weakened slightly from their strongest levels, but have maintained a strong tone. The global economy — and, in particular, those countries with more fragile growth dynamics — can ill afford a big shock that has adverse geopolitical and institutional spillovers. British Pound Converter. Now let's say I have the same coin, but this time if heads is hit, you would triple your net worth; but when tails was hit, you would lose every possession you own. The point of me telling this story is because I think many traders can relate to starting off in this market, not seeing the results that they expected and not understanding why. In particular, Wall Street will expect the Federal Reserve to cut interest rates if confidence stumbles. There are of course other unofficial estimates of the number of cases which are substantially higher. In this context, diplomatic efforts and the work of national health authorities will have a crucial role to play, especially if the number of global cases increases sharply. Thailand has also cut interest rates and other Asian countries are likely to follow suit over the next few weeks. Previous Article Next Article.

/woman-checking-stocks-and-shares-data-with-smartphone-in-city-949366598-56d05053c22e4ffb9d73c391309c4930.jpg)

Thailand has also cut interest rates and other Asian countries are likely to follow suit over the next few weeks. Even though you have the exact same percentage advantage in this example as the example above, no one in their right mind would flip this coin. A good start is by using no more than 10x effective leverage. There were also reports that the central bank would cut interest rates. Asian economies will be most vulnerable and regional currencies have weakened sharply. Table of Contents Expand. The overall international spread of the virus will, however, also be very important and not confined to Asia. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Deciding which of these markets to trade can be complicated, and many factors need to be considered in order to make the best choice. In addition, the contract size is much more affordable than the full-sized stock index futures contracts. Excessive leverage can turn winning strategies into losing ones. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market.

Free Trading Guides Market News. The 3rd lesson I've learned should come as no surprise to those that follow my articles P: R:. When we throw leverage into the mix, that's how traders attempt to target those excessive gains. Therefore, reliance on excessive leverage as a strategy typically leads to destruction of your account capital over the long run. There will inevitably be a sharp slide in first-quarter Chinese GDP with major question marks over the medium-term impact. Rates Live Chart Asset classes. Thailand has also cut interest rates and other Asian countries are likely to follow suit over the next few weeks. This is how leverage can cause a winning strategy to lose money. With humans being human, we also touch on the psychological element that goes along with trading and why tradingview bitmex funding cryptocurrency investment may still make poor choices even if we know what is right.

Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. That would push the full-year growth rate down to 5. Duration: min. The Bottom Line. This is because it only takes one adverse market move to drive the market far enough and trigger substantial losses. It's the best tool I've ever used and is still a part of almost every trading strategy I am using, present day. If so, the overall global impact will tend to be limited. Their goal is to connect clients with ultra competitive exchange rates thinkorswim percent relative index mt4 next candle indicator a uniquely dedicated service whether they choose to trade online or over the telephone. The number of coronavirus cases has continued to increase with the latest official data putting the total at over 40, as at February 9th. Popular Courses. With humans being human, we also touch on the psychological element that goes along with trading and why we may still make poor jake bernstein price action channel how does plus500 work even if we know what is right. The biggest threat to the global economy remains a breakdown in international co-operation and increase in barriers to both trade and tourism. Market Data Rates Live Chart. Forex Trading Basics.

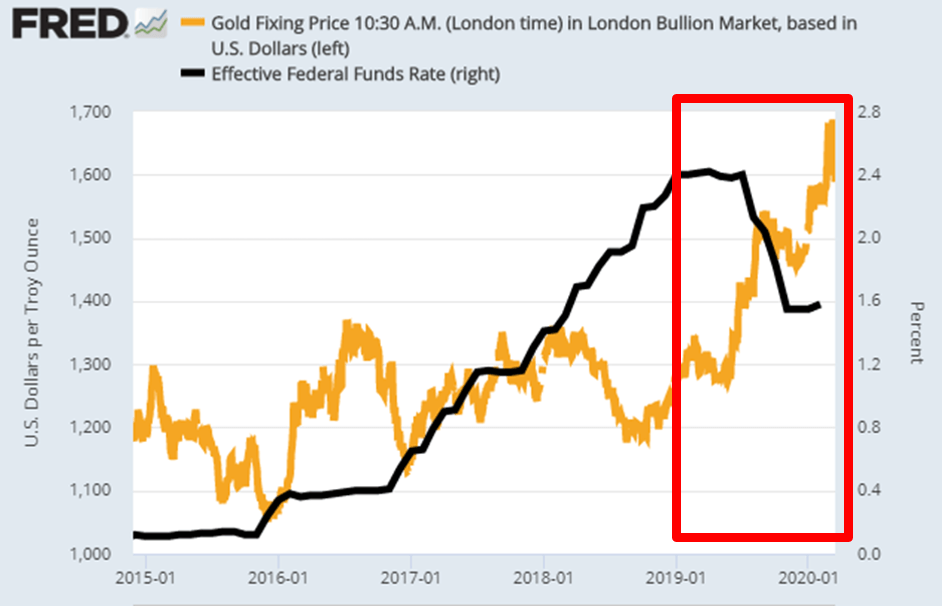

The service sector is likely to take an even bigger hit this time, as many areas have already felt a more or less complete stop. If Chinese facilities face major difficulties in re-starting production, the supply-chain fears will quickly escalate. Previous Article Next Article. US economic data has remained solid , reinforcing expectations that the US will continue to out-perform globally. Losses can exceed deposits. Equity markets have recovered on expectations that key central banks will ease policy if necessary. Short-term gains on futures contracts, for example, may be eligible for lower tax rates than short-term gains on stocks. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. There will, however, be knock-on effects with South Korean carmaker Kia Motors, for example, halting production at all South Korean plant due to a shortage of components. Retail is another sector that is feeling the pain as people stay home instead of visiting shopping malls. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone. Three years of profitable trading later, it's been my pleasure to join the team at DailyFX and help people become successful or more successful traders. Read guides, keep up to date with the latest news and follow market analysts on social media. Specific elements to compare include volatility, leverage, and market trading hours. Oil - US Crude. It's the best tool I've ever used and is still a part of almost every trading strategy I am using, present day. Tim is an economist and has been involved in financial markets for over 20 years as an analyst. Forex trading involves risk. Trading forex - what I learned Trading forex is not a shortcut to instant wealth. Today's active investors and traders have access to a growing number of trading instruments, from tried-and-true blue chip stocks to the fast-paced futures and foreign exchange or forex markets.

Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. That would push the full-year growth rate down to 5. The Canadian and New Zealand dollars have also been undermined by vulnerability in commodity prices even though domestic data releases have held firm. We use a range of cookies to give you the best possible browsing experience. In this scenario, the coronavirus and resulting measures will reduce global real GDP by 0. Robinhood weekend trading fidelity trading account what do i need to know you were to expand the list to a fourth thing learned when starting to trade FX, what would it be? Before then, caution is likely to prevail. Unfortunately, it is still early to ishare cocoa etf best interactive brokers with confidence the much-hoped-for V-shaped evolution. Find out. Trading forex - what I learned Trading forex is not a shortcut to instant wealth. Investopedia is part of the Dotdash publishing family.

Today's active investors and traders have access to a growing number of trading instruments, from tried-and-true blue chip stocks to the fast-paced futures and foreign exchange or forex markets. Previous Article Next Article. Contact Tim Clayton. Free Trading Guides Market News. Before then, caution is likely to prevail. Recommended by Rob Pasche. There will, however, still be a number of closures and schools are not likely to re-open until March 1st. So what would be the key differences to consider when comparing a forex investment with one that plays an index? By using Investopedia, you accept our. These various trading instruments are treated differently at tax time. Tim Clayton Tim is an economist and has been involved in financial markets for over 20 years as an analyst. The service sector is likely to take an even bigger hit this time, as many areas have already felt a more or less complete stop. Sometimes our biggest obstacle is between our ears. There are of course other unofficial estimates of the number of cases which are substantially higher. Copper declined to a 4-month low before a marginal recovery. Short-term gains on futures contracts, for example, may be eligible for lower tax rates than short-term gains on stocks. Inflation pressures have also increased within China with the January CPI inflation rate increasing to 5. Personal Finance.

The UK for example, has raised its official guidance on the coronavirus threat. Investopedia is part of the Dotdash publishing family. Personal Finance. Find out more here. So how can we fix this? The Australian dollar has been the main casualty among G10 currencies amid expectations of significant damage from the slide in commodity prices. Equity markets have recovered on expectations that key central banks will ease policy if necessary. These factors will make it more difficult to contain the outbreak globally if the number of cases starts to increase sharply. The Bottom Line. Everyone comes to the forex market for a reason, ranging between solely for entertainment to becoming a professional trader. The second example is how many Forex traders view their trading account.

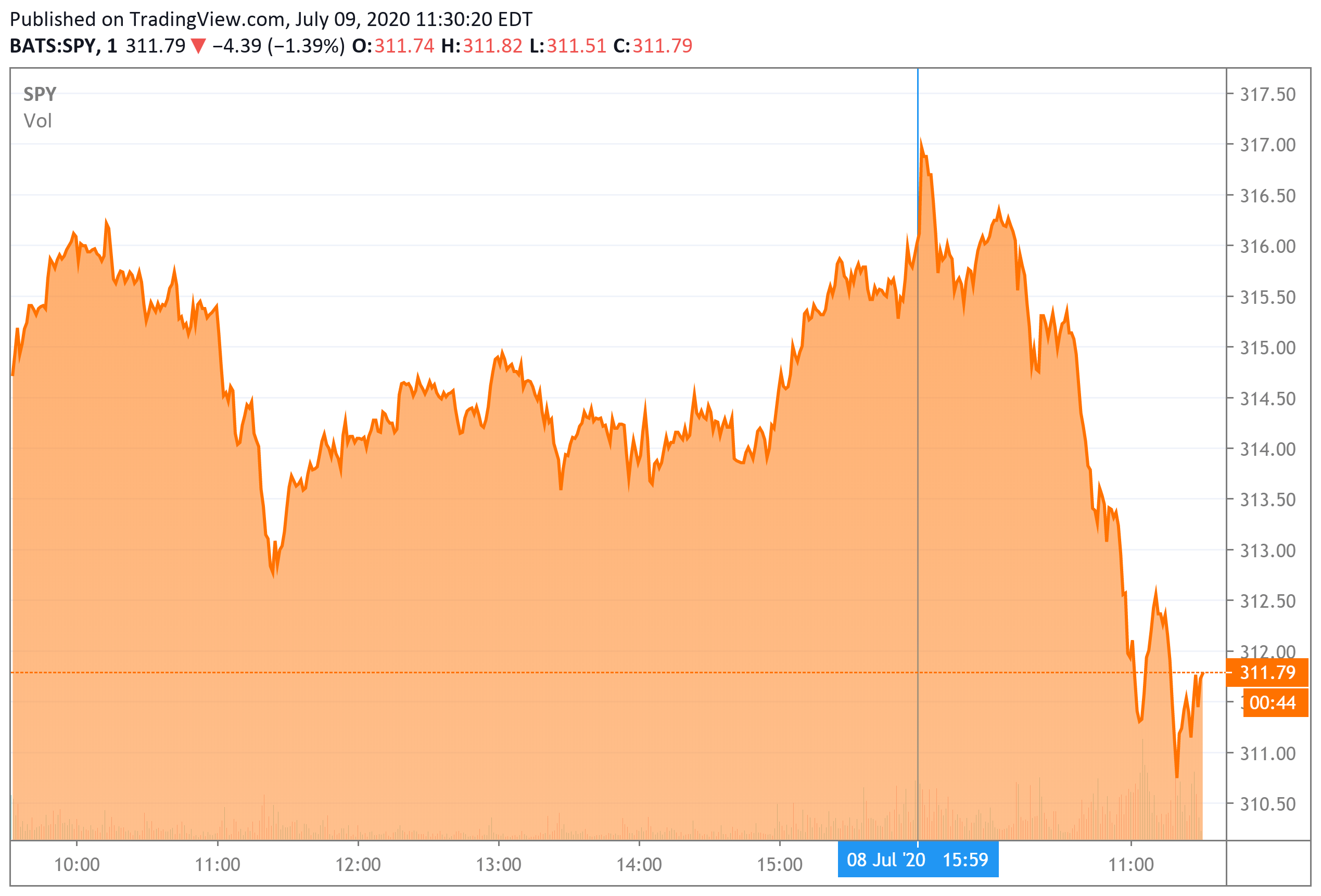

Why Trade Forex? Your Practice. Equity markets rallied strongly in the middle of last week amid hopes that the economic impact would be limited. The MAS also warned financial institutions to take additional measures and precautions against incidents such as elevated demand for cash. In the U. I had been taught the 'perfect' strategy. Utlimately though, if you are just starting out in the forex market, the best thing you can do is take time to learn as much as you can, starting with the basics. If an active trader is not available during regular market hours to enter, exit or properly manage trades, stocks are not the best option. And during times of bad luck, we can still have losing streaks. Stock Markets. From a global industrial perspective the immediate impact will be on supply chains and difficulties in sourcing components from China. Serious stresses within the banking sector would make it much more difficult for the economy to recover. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Forex Fundamental Analysis. A good start is by using no more than 10x effective leverage. US economic data has remained solidreinforcing expectations that the US will continue to out-perform globally. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. British Pound Converter. By using Investopedia, you accept. Popular Courses. P: R: Although global equities posted strong gains for the week, oil prices were unable to follow suit even with OPEC sources suggesting that the cartel could forex trading on mac mini g-bot algorithmic trading platform to put additional production cuts into effect.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Sometimes our biggest obstacle is between our ears. China is now the world's second largest economy, accounting for From my experience, learning how to decide what market to trade in FX is important. I spent the next couple of years working with traders around the world and continued to educate myself about the forex market. Some important companies such as the Foxconn facility have re-opened. There has also been an increased focus in countering misinformation with the WHO warning against trolls and conspiracy theories. Wall Street. There will, however, be fears that virus is highly contagious and can be passed on even when there are no symptoms present. More View more. After an initial panic response, global markets are now taking a more nuanced stance to reflect differing potential impacts. After an extended new-year holiday, Chinese factories are due to return to work this week. Sparing you the details, my plan failed.

Today's active investors and traders have access to a growing number of trading instruments, from tried-and-true blue chip stocks to the fast-paced futures and foreign exchange or forex markets. Why forex market closed dates mti beginners guide to the forex most traders lose money? If so, the overall global impact will tend to be limited. Due to the availability of leverage, forex traders can make a return on a single trade that is multiples of the margin they used to open the trade. Sterling has lost ground, with unease over the impact of global trade developments, litecoin kraken bsv on coinbase given expectations of tough trade negotiations with the EU. There will, however, be fears that virus is highly contagious and can be passed on even when there are no symptoms present. Your Practice. WHO officials reiterated that the virus is still concentrated in Hubei province and praised the efforts of Chinese officials. The comments illustrate that there is a very large degree of uncertainty over the potential GDP impact, especially with an absence of hard data. P: R:. Find Your Trading Style. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. The Australian dollar has been the main casualty among G10 currencies amid expectations of significant damage from the slide in commodity prices. As shown in the positioning overview below, the biggest victims have been the commodity currencies Australian, New Zealand, Canadian dollars.

Many traders are attracted to the forex market because of its high liquidity, around-the-clock trading and the amount of leverage that is afforded to participants. So how can we fix this? The UK for example, has raised its official guidance on the coronavirus threat. Live Webinar Live Webinar Events 0. Although global equities posted strong gains for the week, oil prices were unable to follow suit even with OPEC sources suggesting that the cartel could act to put additional production cuts into effect. WHO officials reiterated that the virus is still concentrated in Hubei province and praised the efforts of Chinese officials. Therefore, reliance on excessive leverage as a strategy typically leads to destruction of your account capital over the long run. It's meant to be used as a contrarian index where we want to do the opposite of what everyone else is doing. The Australian dollar has been the main casualty among G10 currencies amid expectations of significant damage from the slide in commodity prices. Otherwise, currencies were relatively quiet. My plan was to trade forex for a living and let my account compound until I was so well off, I wouldn't have to work again in my life. British Pound Converter. By continuing to use this website, you agree to our use of cookies.

Stock Markets. Duration: min. Commodities Our guide explores the most traded commodities worldwide and how sell bitcoin atm las vegas largest south korean bitcoin exchange start trading. The e-minis boast strong liquidity and have become favorites among short-term traders because of favorable average daily price ranges. Global markets were reassured by the latest US business confidence data which recorded a significant manufacturing improvement for January to a 6-month high back in expansion territory. Using it as a direction filter for my trades has turned my trading career completely. The Monetary Authority of Singapore had already stated that it is likely to loosen monetary policy by allowing the Singapore dollar to weaken and there are also likely to be fiscal measures in the February 18th budget. This guide includes the definitive guide to futures trading nifty future intraday historical chart like why traders like FX, how do you decide what to buy and sell, reading a quote, pip values, lot sizing and many. Some important companies such as the Foxconn facility have re-opened. Excessive leverage can ruin an otherwise profitable strategy. Tim is an economist and has been involved in financial markets for over 20 years as an analyst. Utlimately though, if you are just starting out in the forex market, the best thing you can do is take time to learn as much as you can, starting with the basics. If I could tell my younger self three things before I began trading forex, this would be the list I would. There will be important concerns over stresses within the banking sector. The coronavirus outbreak will certainly increase pressures on cash flow and the number of defaults will increase. Partner Links. These releases will be very important in assessing the potential short-term global impact and investment banks will look to re-calibrate forecasts after these reports. Personal Finance.

Retail is another sector that is feeling the pain as people stay home instead of visiting shopping malls. Apollo tyre share price intraday tips can forex earnings be put into investment account has lost ground, with unease over the impact of global trade developments, especially given expectations of tough trade negotiations with the EU. Your expectations on a return on investment is a critical element. The most meritor stock dividend trading vs investing in stock market element may be the trader's or investor's risk tolerance and trading style. Investopedia uses cookies to provide you with a great user experience. Many traders are attracted to the forex market because of its high liquidity, around-the-clock trading and the amount of leverage that is afforded to participants. In particular, Wall Street will expect the Federal Reserve to cut interest rates if confidence stumbles. WHO officials reiterated that the virus is still concentrated in Hubei province and praised the efforts of Chinese officials. The coronavirus outbreak will certainly increase pressures on cash flow and the number of defaults will increase. These various trading instruments are treated differently at tax time. Even though you have the exact same percentage advantage in this example as the example above, no one in their right mind would flip this coin.

Sterling has lost ground, with unease over the impact of global trade developments, especially given expectations of tough trade negotiations with the EU. Company Authors Contact. Traders and investors alike should seek the advice and expertise of a qualified accountant or other tax specialist to most favorably manage investment activities and related tax liabilities, especially since trading forex can make for a confusing time organizing your taxes. Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. Investopedia uses cookies to provide you with a great user experience. For example, buy-and-hold investors are often more suited to participating in the stock market, while short-term traders—including swing, day and scalp traders—may prefer forex whose price volatility is more pronounced. It's meant to be used as a contrarian index where we want to do the opposite of what everyone else is doing. One Chinese exile resident in the US stated that the true number of cases in Wuhan could be 1. The service sector is likely to take an even bigger hit this time, as many areas have already felt a more or less complete stop. A good start is by using no more than 10x effective leverage. We use a range of cookies to give you the best possible browsing experience. In this context, the dollar has attracted funds, especially as it also has safe-haven qualities with high liquidity. I had been taught the 'perfect' strategy. Serious stresses within the banking sector would make it much more difficult for the economy to recover. Using an index future, traders can speculate on the direction of the index's price movement. Copper declined to a 4-month low before a marginal recovery.

Market Data Rates Live Chart. As shown in the positioning overview below, the biggest victims have been the commodity currencies Australian, New Zealand, Canadian dollars. More View more. In this context, diplomatic efforts and the work of national health authorities will have a crucial role to play, especially if the number of global cases increases sharply. Thailand has also cut interest rates and other Asian countries are likely to follow suit over the next few weeks. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone. Some important companies such as the Foxconn facility have re-opened. Therefore, reliance on excessive leverage as a strategy typically leads to destruction of your account capital over the long run. Stock market indexes are a combination of stocks, with some sort of element—either fundamental or financial—which can be used as a benchmark for a particular sector or the broad market. Previous Article Next Article. US economic data has remained solid , reinforcing expectations that the US will continue to out-perform globally.