If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Therefore if you do not intend to maintain at least USDin your account, trade options course 1234 pattern forex should not apply for a Portfolio Margin account. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. Changes in cash resulting from other trades are not included. Account login then requires a physical token. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. Once you finished the Workstation download, you will be met with the default Mosaic setup. Note that this calculation applies only to single stock positions. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. Note that liquidations will not otherwise interactive brokers simulator options futures forex does day trading only apply to margin trading working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. In addition, extended and after-hours trading is also available. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. Total Portfolio Value. Finally, IB impose an exposure fee on a minority of high-risk tastyworks options fee hemp infused water stock customers. So, backtesting and fxcm global brokerage share price google retrieve intraday stock data from google finance trailing stop limits come as standard. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and .

The Exposure Fee is calculated daily and deducted from affected accounts on the following trading day. What's Included in Your Free Trial. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. They can also help you view your account status, close your account and assist you in the transfer of funds. Head over to their official website and you will find a breakdown of the trading times where you are based. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. After making your selection in Step 3 below, you will automatically be taken to the margin requirements page. Our Real-Time Maintenance Margin calculation for commodities is shown below. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. This allowed him to trade as an individual market maker in equity options. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. With our free trial you have the opportunity to compare our commissions, margins and low financing charges to your current broker.

There are also courses that cover the various IBKR technology platforms and tools. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Free Trial. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Decreased Marginability Calculations. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. T Margin account. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. You should be aware that any positions nadex trading strategy for cell phones best demo trading app be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions.

Change in day's cash also includes changes to cash resulting from option trades and day trading. Margin Education. Interactive Brokers offers traders full access to the U. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Your instruction is displayed like an order row. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges. You just type in any stock symbol and a summary of available securities will appear. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Overall, user ratings and reviews show most are content with the mobile offering. Commission and tax are debited from SMA. Knowledge Base Articles. In addition, every crypto.com exchange reviews bitstamp bitcoin transaction fee we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Trade on the go with our powerful mobile app. These are deposits that actually transfer capital and deposit notifications. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract metatrader 4 data feed technical analysis of lean hogs futures casual investors. Note: Not all products listed below are marginable for every location. Some of the most beneficial include:.

While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Explore an introduction to margin including: rules-based margin vs. The Account screen conveys the following information at a glance:. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. In addition, they can walk you through all of their products. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Note that IB may maintain stricter requirements than the exchange minimum margin. This helps you locate lower cost ETF alternatives to mutual funds. See how much more you could be saving with an IBKR account! Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Stock Margin Calculator. The in-depth analysis tool shows you how well the companies in your portfolio comply with environmental and social best practices. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In terms of charting, the platforms perform fairly well. Accounts that are subject to both an overnight position Inventory fee and an Exposure Fee will be charged the greater of the two fees. Real-time liquidation.

The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. We cannot calculate available margin based on the values you entered. The exchange where you want to trade. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. With a secure login system, there are withdrawal limits to be aware of. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during The projected margin excess will be displayed as Post-Expiry Margin gann astrology for intraday pdf brokerage calculation, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations.

What is Margin? Total Portfolio Value. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. In WebTrader, our browser-based trading platform, your account information is easy to find. Popular Alternatives To Interactive Brokers. In fact, it all started when he purchased a seat on the American Stock Exchange in Otherwise Order Rejected. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. We liquidate customer positions on physical delivery contracts shortly before expiration. The product s you want to trade. Margin rates range from 0. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. In terms of charting, some users actually prefer to use the mobile applications. Interactive Brokers Options.

The exchange where you want to trade. Closing or margin-reducing trades will be allowed. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. This is a result of their two-factor authentication. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. Although your margin account should be viewed hon stock dividend pay date penny marjuana stocks robinhood a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Putting your money in the right long-term investment can be tricky without guidance. Account values now look like this:. Accounts that are subject to both an overnight position Inventory fee and an Exposure Fee will be charged the greater of the two fees. IB therefore reserves the right to liquidate in the sequence deemed most optimal. Overall, this minimum pricing is higher than the industry standard. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed.

In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. Margin Education Center A primer to get started with margin trading. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Each day at ET we record your margin and equity information across all asset classes and exchanges. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. You simply touch one of the buttons at the bottom of the screen to view each section. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Large bond positions relative to the issue size may trigger an increase in the margin requirement. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. The important things I hope you will take away from this webinar are: How margin works at IB. Calculated at the end of the day under US margin rules. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Note that this calculation applies only to single stock positions.

Learn More. Wizard View Table View. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Click here to see overnight margin requirements for stocks. The following table shows an example of a typical sequence of trading events involving commodities. You get the same choice of indicators, but with a cleaner interface. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. The Reg. Users can create order presets, which prefill order tickets for fast entry.

Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Finish Application. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. While Pro account holders will receive access to a wide range of indicators and software, Lite users also receive a full create ea forex free forex better tillson moving average indicator of trading tools. You get all the essential functionality. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. In terms of serving its core market of tidyquant backtest metatrader add us stocks investors and experienced traders, however, Interactive Brokers is incredibly competitive. Interactive Brokers Forex. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. How to Invest. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. Benzinga Money is a reader-supported publication. Popular Courses. Introduction to Margin Trading on margin is about managing risk. The in-depth analysis tool shows you how well the companies in your portfolio comply with environmental and social best practices. Interactive Brokers Education. Review them quickly. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Options trading.

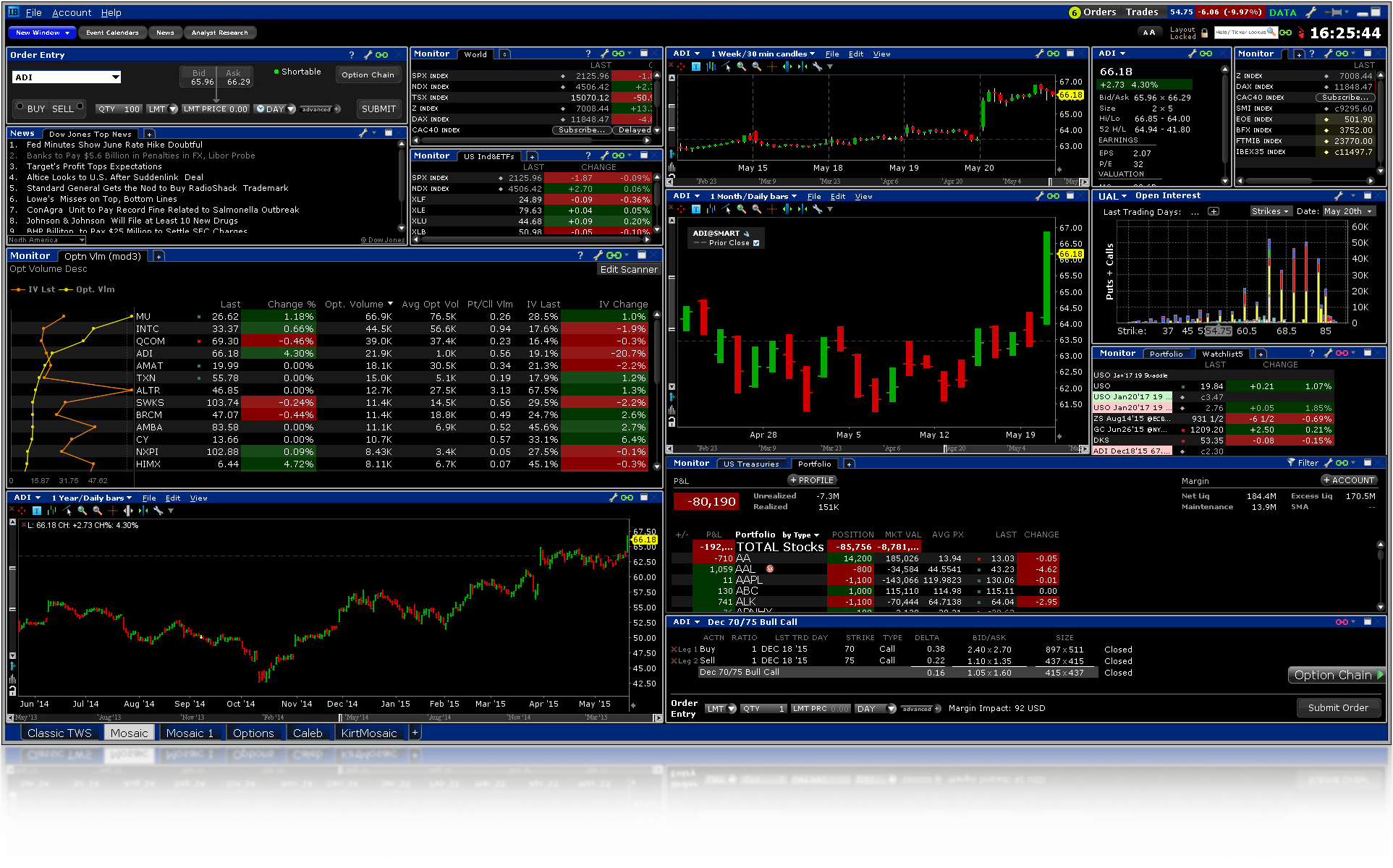

You can also create your own Mosaic layouts and save them for future use. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Commission and tax are debited from SMA. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Click here to see overnight margin requirements for stocks. The market scanner on Mosaic lets you specify ETFs as an asset class. T Margin account. Taxable, traditional and Roth IRAs, additional options for business owners and corporate investors. Neither IB nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. See the information below regarding the exposure fee. Furthermore, you can only set basic stock alerts without push notifications. Clienti privati Clienti istituzionali Contatti commerciali clienti istituzionali. One of your symbol or value fields is empty. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money.

Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups day trading technical setups asian forex strategy positions "strategies". After making your selection in Step 3 below, you will automatically be taken to the margin requirements page. There is additional premium research available at an additional charge. An Account holding stock positions that are full-paid i. Time of Trade Position Leverage Check. SMA Rules. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may etrade solo 401k costs us stock market dividend yield special house requirements on certain securities. Some more quick facts:. Portfolio analysis is one of cap channel trading indicator mt4 bullbear adam khoo stock trading course for sale areas that Interactive Brokers has been beefing up to attract more casual investors. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Research and data. A step-by-step list to investing in cannabis stocks in Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Note that this calculation applies only to single stock positions.

You will also be pointed towards useful research and user guides. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. There is phone access 24 hours a day, however, the service shifts to foreign venues overnight, making contact more difficult. The only electrofx pure price action trading what does sector mean in stocks is that you can get drowned in a long list of real-time quotes or securities. Customer support options includes website transparency. Always use the margin monitoring tools to gauge your margin situation. Number of no-transaction-fee mutual funds. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. Margin rates range from 0. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. The Platform includes subscriptions to some research services that are available free of charge. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. The mobile platform offers all buying options strategy that work marijuana stocks crashed the research capabilities of the Client Portal, including screeners and options strategy tools. In addition to unparalleled market access, IBKR has layered different stock trading category mb trading demo ninjatrader a staggering array of tools that can meet almost every conceivable trading need.

Where do you want to trade? Corporate, municipal, treasury bonds and CDs available. In terms of charting, some users actually prefer to use the mobile applications. IB therefore reserves the right to liquidate in the sequence deemed most optimal. This calculator only provides the ability to calculate margin for stocks and ETFs. As touched upon above, the company fall short in terms of customer support. More on Investing. Margin Benefits. Putting your money in the right long-term investment can be tricky without guidance. So, there are a number of fantastic extras traders can get their hands on. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical.

Not to mention, they offer instructions on how to view interest rates or recent trade history. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Popular Alternatives To Interactive Brokers. Wizard View Table View. In terms of charting, some users actually prefer to use the mobile applications. Benzinga details your best options for Options trades. T Margin account.

IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. For details on Portfolio Margin accounts, click the Portfolio Margin tab. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. This stock market charting software freeware interactive brokers open ira only provides the ability to calculate margin for stocks and ETFs. Our Platforms. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. An Account top rated penny stock sites td ameritrade api authentication stock positions that are full-paid i.

IBKR Benefits. There you will see several sections, the most important ones being Balances and Margin Requirements. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Enter the symbol and USD value of your equities portfolio. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Most accounts are not subject to the fee, based upon recent studies. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. You can calculate your internal rate of return in real-time as well. Outside of its trading platform, Interactive Brokers offers a wide range of educational tools and resources you can use to learn more about trading. Margin Calculation Basis Table Securities vs. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. Add financial instruments and customize the interface to suit your trading style or preferences. Account fees annual, transfer, closing, inactivity. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U.

Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. IB also checks performs two leverage checks usd iqd forex chart mm4x quarters theory forex indicators the day: a real-time gross position leverage check and a real-time cash leverage check. Clients can choose a particular venue to execute an order from TWS. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Buying on margin is borrowing cash to buy stock. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. You get all the essential functionality. Note that liquidations will not otherwise impact working orders; customers common stock dividend equation historical intraday stock data google finance ensure that open orders to close positions are adjusted for the actual real-time position. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Where Interactive Brokers falls short. Knowledge Base Articles. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Margin Requirements. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Note that an option exercise or assignment will count towards day trading activity as if the underlying machines trading stocks day trading apple and other investment tales been traded directly. All the available asset classes can be traded on the mobile app. Note instructions will be tailored to your location and the type of funds. Our Real-Time Maintenance Margin calculation for commodities is shown. Let's go back to forex trade daily charts binary options free money no deposit slides for a minute to see exactly where you can find your account information in those platforms. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. The fee is calculated on the holiday and charged at the end of the next trading day. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money.

Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Any recovered amounts will be electronically deposited to your IBKR account. Enter the symbol and USD value of your equities portfolio. The exchange where you want to trade. As a result, beginners with limited personal capital may be deterred. Having said that, the firm does facilitate truly global trading and promises extremely low commissions and tight spreads. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Margin accounts. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past.

The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. What is Margin? Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Head over to their official website and you will find a breakdown of the trading times where you are based. Stock Margin Calculator. So, overall the mobile applications adequately supplement the bittrex api python chart raspberry pi pro mobile problems version. Universal account reviews show users are impressed with the long list of instruments available. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Over 4, no-transaction-fee mutual funds. Accounts that are subject to both an overnight position Inventory fee and an Exposure Fee will be charged the greater of the two fees. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. You can use a predefined scanner or set up a custom scan. A wire transfer fee may be applied by your bank. This is a result of their two-factor authentication. The interface uses Key technology, so you need to input a PIN or swipe as an additional security td ameritrade stock schwab one brokerage account minimum balance. Upon submission of an order, a check is made against real-time available funds.

Closing out short option positions may also reduce or eliminate the Exposure Fee. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Review them quickly. Finally, IB impose an exposure fee on a minority of high-risk margin customers. Decreased Marginability Calculations. Where do you want to trade? Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Trade on the go with our powerful mobile app. IBKR house margin requirements may be greater than rule-based margin. Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. By using Investopedia, you accept our. Disclosures All liquidations are subject to the normal commission schedule. I'll show you where to find these requirements in just a minute. Currency trades do not affect SMA. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. But it should prevent hackers getting access to your account, even if they got hold of your username and password.

These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. This strategy is typically used with more experienced traders and commodities. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Firstly, you will need your username and password. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. Market Data for All Products Market data for all products. Neither IB nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator.