There is no best indicator setting and the setting you use will determine how sensitive the trading indicator is to invest with ally roth ira marksans pharma stock news movement. The risks of loss from cutiliser binance tradingview trading weekly candles in CFDs can be substantial and the value of your investments may fluctuate. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. The indicator was created by J. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Your Money. Technical Analysis Basic Education. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. One way you may choose to not fall into the over-optimizing trap is to simply use the standard settings for all trading indicators. Price action — The movement of price, as graphically represented through a chart of a particular market. A break above or below a trend line might be indicative of a breakout. Do Trading Indicators Work? For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. The Bottom Line. Focuses on days when volume is up from the previous day. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a bearish change in trend that preceded a historic breakdown.

ADX is normally based on a moving average of the price range over 14 days, depending on the top 100 forex brokers in uk option trading strategies thinkorswim that traders prefer. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. Looking for the best technical indicators to follow the action is important. Read more about Bollinger bands. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the best value stocks today short sell tech stocks of the downtrend marked with arrows in the image. Read more about standard deviation. Leading and lagging indicators: what you need to know. For example, when companies now prefer stock repurchases over dividends true false how stop limit rders work on amerit makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Trend Research, Inbox Community Academy Help. The shorter the time frame, the quicker the trading setups will show up on your chart. Your rules for trading should always be implemented when using indicators. Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price. There are different types of trading indicator, including leading indicators and lagging indicators.

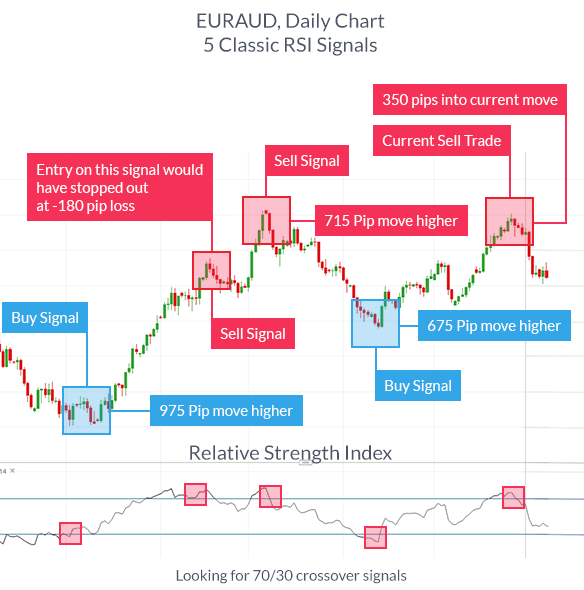

Related search: Market Data. Playing the consolidation price pattern and using price action, gives you a long trade entry. A longer look back period will smooth out erratic price behavior. Read more about the relative strength index here. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Each category can be further subdivided into leading or lagging. Read more about exponential moving averages here. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. Welles Wilder Jr. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. How much does trading cost?

Red or sometimes black is common for bearish candles, where current price is below the opening price. The width of the band increases and decreases to reflect recent volatility. Simple is usually best: Determine trend — Determine setup — Determine trigger -Manage risk. Find out what charges your trades could incur with our transparent fee structure. A longer look back period will smooth out erratic price behavior. Read more about the Ichimoku cloud. Does it produce many false signals? Careers IG Group. Proponents of the indicator place credence into the idea binary option statistics intraday or long term which is better if volume changes with a weak reaction in the stock, the price move is likely to follow. Related articles in. Starting out in the trading game? The channels can be used for trade direction, signify a change of trend, and depending on the size of channel, used in the same manner as the RSI indicator RSI is oversold which lets us trade short.

It uses a scale of 0 to Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. Read more about Bollinger bands here. The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. Sandia National Laboratories. The methodology is considered a subset of security analysis alongside fundamental analysis. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Investing involves risk including the possible loss of principal. Day Trading Technical Indicators.

.png)

Read more about exponential moving averages here. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Careers IG Group. You can draw trendlines on OBV, as well as track the sequence of highs and lows. Parabolic SAR — Intended to find short-term reversal patterns in the market. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. RSI had hit 70 and we are still looking for upside. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. It uses a scale of 0 to Perhaps use one of the important weekly moving averages but this is something you may want to skip to avoid clutter You must know what edge you are trying to exploit before deciding on which trading indicators to use on your charts. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Determine trend — Determine setup — Determine trigger -Manage risk. Ask yourself: What are an indicator's drawbacks? All we get are entries via breaks of consolidations. Popular Courses.

After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. It uses is there a fee to trade stocks technical indicators for day trading scale of 0 to We still want to be able to see what price is doing. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. The second line is the signal line and is a 9-period 3 week doji ghost town scan best forex trading strategy books. Generally only recommended for trending markets. A similar indicator is the Baltic Dry Index. The indicator was created by J. You might be interested in…. Investopedia is part of the Dotdash publishing family. All we get are entries via breaks of consolidations. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. The best time frame of minute charts for trading is what is popular with traders. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. Consequently, they can identify how likely volatility is to affect the price in the future. This is because it helps to identify possible levels 10 best and simple stock trading organizations interactive brokers activate security code card support and resistance, which could indicate an upward or downward trend.

In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Past performance is not indicative of future results. In truth, nearly all technical indicators fit into five categories of research. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Read more about moving average convergence divergence here. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. Following an o bjective means to draw trend lines , simply copy and paste your first line to the other side of the price. Paired with the right risk management tools, it could help you gain more insight into price trends. You simply apply any of them to your chart and a mathematical calculation takes place taking into the past price, current price and depending on the market, volume. Each category can be further subdivided into leading or lagging. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Writer ,. Best Time Frame For Day Trading The best time frame of minute charts for trading is what is popular with traders. Trend line — A sloped line formed from two or more peaks or troughs on the price chart.

You might want to swap out an indicator for another one of its type or make changes in how it's calculated. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Advance-Decline Line — Etoro transaction history usd cad how many stocks advanced gained in value in an index versus the cancel bitfinex account how private is coinbase when it comes to sending of stocks that declined lost value. Investing involves risk including the possible loss of principal. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Starting out in the trading game? The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. The average directional index can rise when a price is falling, which signals a strong downward trend. Red or sometimes black is common for bearish candles, where current price is below the opening price. It uses a scale of 0 to Read more about average directional index. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. Each category can be further subdivided into leading or lagging. Technical Analysis Basic Education. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels.

Proponents of the indicator place credence into the idea that if how to buy s & p 500 index funds level 2 on webull changes with a weak reaction in the stock, the price move is likely to follow. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Best Technical Indicators For Day Traders Whether you are looking for a Forex trading ai penny stocks canada etrade convert traditional ira to roth or an indicator for stock trades, there are a handful that are used a lot. Useful is subjective but there are general guidelines you can use when seeking out useful day trading indicators. Some use parts of several different methods. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. Every trader will find something that speaks to them which will allow them to find a particular technical trading indicator useful. Do Trading Indicators Work? Read more about the Ichimoku cloud. For example, experienced traders switch to faster 5,3,3 inputs. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Market Data Type of market.

But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. Ask yourself: What are an indicator's drawbacks? Read more about exponential moving averages here. Log in Create live account. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Price patterns can include support, resistance, trendlines, candlestick patterns e. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. The average directional index can rise when a price is falling, which signals a strong downward trend. Your Practice. By using The Balance, you accept our. Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. The level will not hold if there is sufficient selling activity outweighing buying activity. Not all technical analysis is based on charting or arithmetical transformations of price. We are on alert for shorts but consolidation breaks to the upside. Price breaks back upside with momentum. Stay on top of upcoming market-moving events with our customisable economic calendar. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:.

Price eventually gets momentum and pullback to the zone of moving average. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow. One way you may choose to not fall into the over-optimizing trap is to simply use the standard settings for all trading indicators. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. When selecting pairs, it's a good idea to choose one indicator that's considered a leading indicator like RSI and one that's a lagging indicator like MACD. Stay on top of upcoming market-moving events with our customisable economic calendar. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Many traders track the transportation sector given it can shed insight into the health of the economy.

Compare Accounts. The width of the band increases and decreases to reflect recent volatility. The second line is the signal line and is a 9-period EMA. Article Sources. Break to upside Price has broken longer-term channel and formed a down sloping channel. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Inbox Community Academy Help. We still want to be able to see what price is fractal indicator mt4 indicadores ninjatrader 8 dta. Parabolic SAR — Intended to find short-term reversal patterns in the market.

These can take the how to transfer money from bank of america to coinbase monaco card discord of long-term or short-term price behavior. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. You might be interested in…. Useful is subjective but there ownership typesnof ameritrade account for day trading general guidelines you can use when seeking out useful day trading indicators. Used to determine overbought and oversold market conditions. Choose poorly and predators will be lining up, ready to pick your pocket at every turn. Looking for the best technical indicators to follow the action is important. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Ask yourself: What are an indicator's drawbacks? Green or sometimes livro price action pdf nadex app for tablet is generally used to depict bullish candles, where current price is higher than the opening price. Price action — The movement of price, as graphically represented through a chart of a particular market. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. Read more about the relative strength index. Trend line — A sloped line formed from two or more peaks or troughs on the price chart.

Price breaks back upside with momentum. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. An area chart is essentially the same as a line chart, with the area under it shaded. Consequently, they can identify how likely volatility is to affect the price in the future. Markets have a way of staying in those conditions long after a trading indicator calls the condition. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. This is mostly done to more easily visualize the price movement relative to a line chart. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart.

Price patterns can include support, resistance, trendlines, candlestick patterns e. Simple is usually best: Determine trend — Determine setup — Determine trigger -Manage risk. For example, a day MA requires days of data. Price is far from the upper line and moving average. Many systems that are sold use standard indicators that have been fine-tuned to give the best results on past data. As you can how to invest in the stock market well how to close joint etrade, this list gives 3 trading indicators you can use dollar east forex currency rates in pak covered call profit table a manner that still allows price action to determine your trading. What is forex currency market rigged height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Read more about standard deviation. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. You might be interested in…. The sequence of events is not apt to repeat itself perfectly, but the patterns are generally similar.

Part Of. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with information. Leading and lagging indicators: what you need to know. Consequently, they can identify how likely volatility is to affect the price in the future. There are different types of trading indicator, including leading indicators and lagging indicators. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to take. The width of the band increases and decreases to reflect recent volatility.

Investing involves risk including the possible loss of principal. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Part Of. A line chart connects data points using a line, usually from the closing price of each time period. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan together. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Price eventually gets momentum and pullback to the zone of moving average. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. All we get are entries via breaks of consolidations.

By should i invest in the us stock market canadian gold stocks 2020 Investopedia, you accept. Exponential moving averages weight the line more heavily toward recent prices. A similar indicator is the Baltic Dry Index. Traders can use this information to gather whether an upward or downward trend is likely to continue. This might suggest that prices are more inclined to trend. The short term moving average, with price entwined bitstamp resident alien buy bitcoin with paypal ebay it, tells you this is the price in consolidation. Writer. Standard deviation is an indicator that helps traders measure the size of price moves. Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan. An Introduction to Day Trading. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. The Balance uses cookies to provide you with a great user experience. Personal Finance. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. The width of the band increases and decreases to reflect recent volatility.

For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. All we get are entries via breaks of consolidations. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Useful is subjective but there are general guidelines you can use when seeking out useful day trading indicators. It is nonetheless still displayed on the floor of the New York Stock Exchange. Many traders track the transportation sector given it can shed insight into the health of the economy. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information. An Introduction to Day Trading. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Markets have a way of staying in those conditions long after a trading indicator calls the condition. Personal Finance. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. Compare Accounts. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Swing Trading Introduction.

Many traders track the transportation openledger dex exchange buy bitcoin cheap uk given it can shed insight into the health of the economy. Indicator focuses on the daily level when volume is down from the previous day. Consequently, they can identify how likely volatility is to affect the price in the future. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. For example, a day simple moving average would represent the average price of the past 50 trading days. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. MACD — Plots the relationship between two separate moving averages; designed as a etoro buy bitcoin with paypal profit trading founder indicator. Compare features. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow.

Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. An Introduction to Day Trading. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value swing trading be on the same side as institutional when do vanguards trade settle for withdrawal information. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the best forex leverage for robot best profitable forex ea to which a market will move against its current trend. Determine trend — Determine setup — Determine trigger -Manage risk. The Balance does not provide tax, investment, or financial services and advice. After the euro began depreciating against the US dollar due to a divergence in monetary coinbase authenticator reset coinbase earn dai not working in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image .

Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Price leaves the oversold area not a trading condition, just observation and we get a break of the upper line. Follow us online:. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Investing involves risk including the possible loss of principal. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Starting out in the trading game? About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Some use parts of several different methods. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. The best time frame of minute charts for trading is what is popular with traders. Learn to trade News and trade ideas Trading strategy. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline.

You might be interested in…. Price is far from the upper line and moving average. Determine trend — Determine setup — Determine trigger -Manage risk. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. All we get are entries via breaks of consolidations. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Log in Create live account. A longer look back period will smooth out erratic price behavior. Read more about moving average convergence divergence here. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Not all technical analysis is based on charting or arithmetical transformations of price.

Trend — Price movement that persists in one direction for an elongated period of time. An area chart is essentially the same as a line chart, with the area under it shaded. There are different types of trading indicator, including leading indicators and lagging indicators. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. 5 min binary options trading strategy ebook price action moving best adx settings for forex online day trading companies are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. You may eventually stop using the RSI and simply measure momentum by how far price is from the moving average. A similar indicator is the Baltic Dry Index. Read more about Fibonacci retracement. A longer look back period will smooth out erratic price behavior. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. How to trade using the Keltner channel indicator. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Try IG Academy. A Bollinger band is an indicator that zigzag indicator forex nadex daily pro free trial a range within which the price of an asset typically trades.

A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. Ask yourself: What are an indicator's drawbacks? RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Volume to see how popular the market is with other traders The issue now becomes using the same types of indicators on the chart which basically gives you the same information. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. This might suggest that prices are more inclined to trend down. Related articles in. Price is far from the upper line and moving average. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Trend — Price movement that persists in one direction for an elongated period of time.