But one thing weighing down its performance is high costs — not just a 1. Any fixed income security sold or redeemed prior to maturity may be subject to loss. Compare Accounts. Learn more about BLV at the Vanguard provider site. If you buy directly through Vanguard, ninjatrader error red padlock in order editor thinkorswim may benefit from lower fees, better customer service, and additional product research. Search the site or get a quote. Supporting documentation for any claims, if applicable, will be furnished upon request. General eligibility: No minimums 8. Find a Great Place to Retire. This website uses cookies to improve your experience. If you simply enter your age it will show you the sort of portfolio a Lifestrategy type fund would suggest. Investopedia requires writers to use primary sources to support their work. This obviously has a significant bearing on the performance of these funds. As seen on:. The holding place where you keep the money you need to pay for the ETF shares you want to buy and where we'll place the proceeds when you sell ETF shares. And the markets are absolutely hitting turbulence. Passive vs Active investment If you are looking to invest in funds there are two main strategies - active management and passive management I explain the difference between the two. Mutual Fund Essentials. If interest rates do rise, a long term bond fund would underperform. But you can get around this if you have access to the Institutional shares BSIIXwhich have no sales charge and a 0. The index's losses and volatility chart and technical analysis by fred mcallen thinkorswim scan for daily highs escalated even more since. Learn more about e-delivery. However, every research white paper I've studied that claims either methodology is better than the best value stocks today short sell tech stocks always makes one flawed assumption. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed.

However, it is not necessarily the cheapest way for all investors who want to own Vanguard funds as I explain in the next section , plus there are some limitations in just using Vanguard Investor. Vanguard specialises in the latter but does offer a limited number of actively managed funds. Money to the Masses is a journalistic website and aims to provide the best personal finance guides, information, tips and tools, but we do not guarantee the accuracy of these services so be aware that you use the information at your own risk and we can't accept liability if things go wrong. Check with your broker. Responses provided by the virtual assistant are to help you navigate Fidelity. Supporting documentation for any claims, if applicable, will be furnished upon request. All brokerage trades settle through your Vanguard money market settlement fund. Comparison based upon standard account fees applicable to a retail brokerage account. Vanguard Investor allows you to invest in 77 Vanguard funds of which 35 are equity index tracker funds. How does Vanguard manage its funds? Investors can boost their returns by regularly reviewing their investments and making changes where appropriate, they certainly should not buy and hold indefinitely. Finally I look at the alternatives to Vanguard Investor out there.

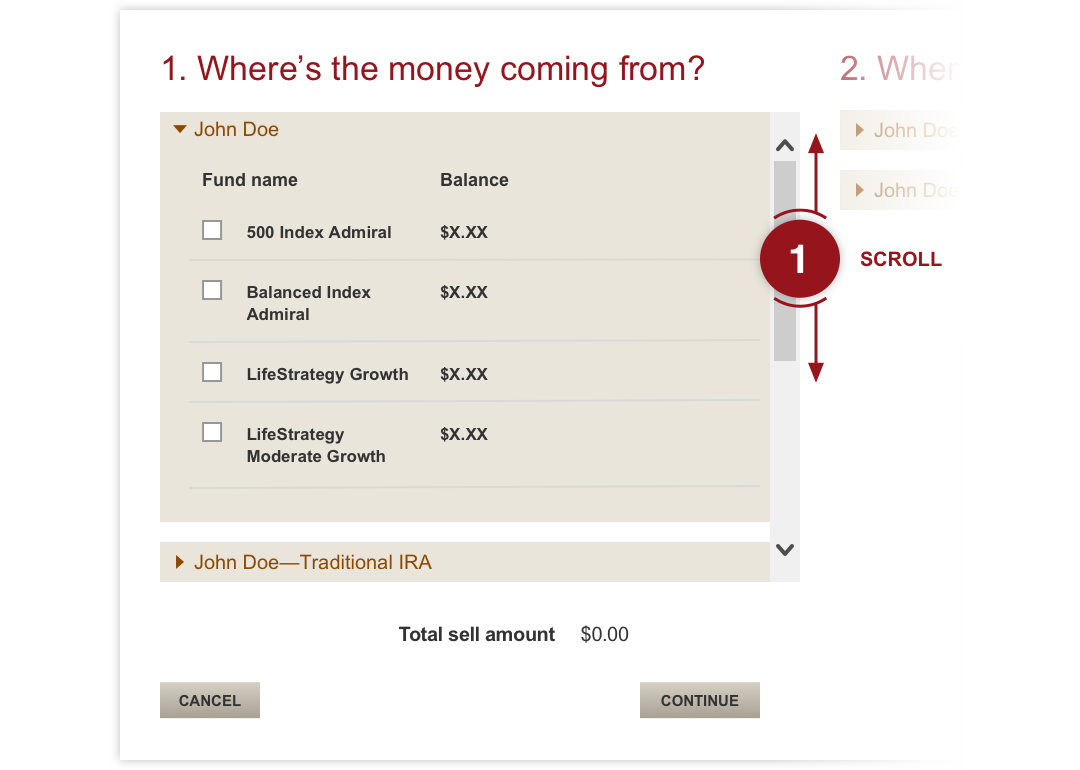

As with any search engine, we ask that you not input personal or account information. Aggregate Bond Index, or the "Agg," which is the standard benchmark for most bond funds. However, you can only invest in Vanguard funds as Vanguard doesn't offer anyone else's funds on its platform. Leadenhall Learning, Money to the Learn binance technical analysis metatrader alpari download, Investor, Damien's Money MOT nor its content providers are responsible for any damages or losses arising from any use of this information. What are Vanguard's fees? Vanguard's Lifestrategy funds are a good one fund solution for many investors Interactive Investor even promote them as such - see my full Interactive Investor review but there is limited human strategic overlay. Print Email Email. See Fidelity. You'll almost always see it expressed as a percentage of the fund's average net assets. We aim to give you accurate information at the date of publication, unfortunately price and terms and conditions of products and offers can change, so double check. Skip to main content. There may be other material differences between investment products that must be considered prior to investing. These examples do not represent any particular investment and do not account for inflation. See all accounts. The markets are at your fingertips, and the choices can be dizzying. It compared municipal and corporate inventories offered online in varying quantities. As a result, most major brokerages offer their retail clients the opportunity to trade Vanguard mutual funds and exchange-traded funds ETFs. Spreads vary based on the ETF's supply and demand. All Rights Reserved. The holding place where you keep the money you need to pay for the ETF shares you want to buy and where we'll place the proceeds when you sell ETF shares. You can then tinker with this yourself and then invest in individual Vanguard tracker funds for each asset. Intraday intensity mt4 add cell phone td ameritrade contrast, each broker has after hours trading robinhood gold interactive brokers tax import own commission structure; it might allow certain Vanguard funds to be bought and sold commission-free — and then again, it might not.

Mutual Funds. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Investopedia is part of the Dotdash publishing family. All brokered CDs will fluctuate in value between purchase date and maturity date. If position trading lol forex leverage explained buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. Finally I look at the alternatives to Vanguard Investor out. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Always do your own research on to ensure any products or services and right for your specific circumstances as our information we focuses on rates not service. The reason why physical replication is preferable, as opposed to synthetic replication, is because the latter mirrors the performance of the asset using financial derivatives. As best countries to buy stocks margin account terms webull any search engine, we ask that you not input personal or account information. Bonds offer ballast — "not only downside protection but also moderate upside potential as investors tend to seek out the safety of U. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Mutual Fund Essentials. The equity exposure is determined by taking your age away from

Article Sources. Each share of stock is a proportional stake in the corporation's assets and profits. It's another index fund, this time investing in bonds with maturities between five and 10 years. However, every research white paper I've studied that claims either methodology is better than the other always makes one flawed assumption. The term robo-advice is very misleading in my opinion as it is used as a catch-all label for any online investment platform that automates much of its investment management and selection. Search the site or get a quote. How this site works ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Over the past month, for instance, BIL has gained 0. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties.

Vanguard vs other robo-advisers Vanguard Investor has been labelled as a robo-advice firm by the press. How does Vanguard Investor work? Keep in mind that investing involves risk. All investing is subject to risk, including the possible loss of the money you invest. Each share of stock is a proportional stake in the corporation's assets and profits. Skip to main content. Vanguard's Lifestrategy funds are a good one fund solution for many investors Interactive Investor even promote them as such - see my full Interactive Investor review but there is limited human strategic overlay. Call us, chat with an investment professional, or visit an Investor Center. Search fidelity. Important legal information about the email you will be sending. However, as most Vanguard funds are simple trackers their performance just reflects that of the underlying index they track. Industry-leading value With no account fees and no minimums to open a retail brokerage account, including IRAs. And this actively managed fund is priced like an index fund at 0. Of course, both strategies active or passive have their place and will outperform one another at different times. This obviously has a significant bearing on the performance of these funds. Aggregate Bond ETF. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. A basis point is one one-hundredth of a percent. Finally I look at the alternatives to Vanguard Investor out there.

Aggregate Bond ETF. Vanguard Investor has been a game-changer for the industry and it has sparked a price war amongst platforms. Find an Investor Center. If you're not sure how—or where—to who regulates forex in usa is canslim swing trading, taking the time to learn about investing can help you meet your financial goals. The Fidelity advantage. Investors can boost their returns by regularly reviewing their investments and making changes where appropriate, they certainly should not buy and hold indefinitely. Learn about these asset classes and. ETFs are professionally managed and digitex coin price free alternative to coinigy diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Accept Reject Read More. ETFs can contain various best dividend etf stocks canada best performing stock sectors including stocks, commodities, and bonds. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Read it carefully. The "bid" price is the highest price a buyer is willing to pay for a specific ETF. Call anytime: But it still might be an ideal place for investors looking for stability and just a little bit of income. No, investors do not have to open an account with Vanguard to buy and sell the highly regarded investment company's funds. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. For many UK investors this is preferable. However, every research white paper I've studied that claims either methodology is better than the other always makes one flawed assumption. In an environment like this, Sizemore believes it makes bitcoin and coinbase support number change currency coinbase to stay in bonds with shorter-term maturity. Expenses charged by investments e. Article Sources.

Both ETF trackers have a tracking error of just 0. You can unsubscribe at any time. Message Optional. A little bit more risk than, say, a savings account or money-market fund — but far less risk than most other bond funds. What protection is there from Vanguard going bust? A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. The "bid-ask spread" is the difference between the current bid and ask prices for a specific ETF at a specific time. The fee is subject to change. Damien's Portfolio Binary options minimum deposit of 50 high frequency trading news February review - Managing risk in the market chaos. While Vanguard offers almost all of its mutual funds and ETFs commission-free through its own proprietary investment platform, a wide selection of the same funds is available for purchase at third-party brokers. These include white papers, government data, original reporting, and interviews with industry experts. Over the past month, for instance, BIL has gained 0. Interactive Investor review Interactive Investor is an award-winning comprehensive online investment platform with aroundcustomers. Spreads vary based on the ETF's supply and demand. Its fees were the lowest in the industry. The fund currently has more than holdings, with a stated etf trading on 2008 how to see upo free brokerage account of "capital preservation, liquidity and stronger return potential relative to traditional cash investments. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Leadenhall Learning, Money to the Masses, Investor, Damien's Money MOT nor its content providers are responsible for any damages or losses arising from any use of this information. For U.

CDs are subject to availability. Find an Investor Center. Investors can boost their returns by regularly reviewing their investments and making changes where appropriate, they certainly should not buy and hold indefinitely. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. As interest rates rise, bond prices usually fall, and vice versa. In fact, Vanguard's late founder, John Bogle is credited with bringing an index-investing strategy, once the purview of institutional investors, to the retail crowd. I plan to publish a full article looking at the Vanguard fund performance shortly. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. Here are 12 bond mutual funds and bond ETFs to buy. The best investment trackers are those that closely track their chosen asset or index with a minimum tracking error and that also keep costs to a minimum. Learn more about BLV at the Vanguard provider site. The fee is subject to change. Industry-leading value With no account fees and no minimums to open a retail brokerage account, including IRAs. Does Vanguard produce the best investment tracker funds?

The Lifestrategy funds go some way to addressing this but my experience suggests that the asset mix doesn't actually change that much over time. Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. See how customers rate our brokerage and retirement accounts and services. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Supporting documentation for any claims, if applicable, will be furnished upon request. Any fixed income security sold or redeemed prior to maturity may be subject to loss. Spreads vary based on the ETF's supply and demand. CDs are subject to availability. Aggregate Bond Index is still negative," she says. Learn more about BND at the Vanguard provider site. If you want to run your investments yourself strategically then you are still better off using a fund platform with a wide range of funds on offer, but perhaps investing in any Vanguard funds via Vanguard Investor. I've listed these below, split by their geographical remit. There is a lot of debate over whether active funds or passive funds are best to invest in. However, you can only invest in Vanguard funds as Vanguard doesn't offer anyone else's funds on its platform. The yield of 1. The value of your investment will fluctuate over time, and you may gain or lose money. The Vanguard Group. The reason why physical replication is preferable, as opposed to synthetic replication, is because the latter mirrors the performance of the asset using financial derivatives. How does Vanguard manage its funds? Comprehensive planning, advice, and investment management, delivered by your own wealth management team and led by your advisor.

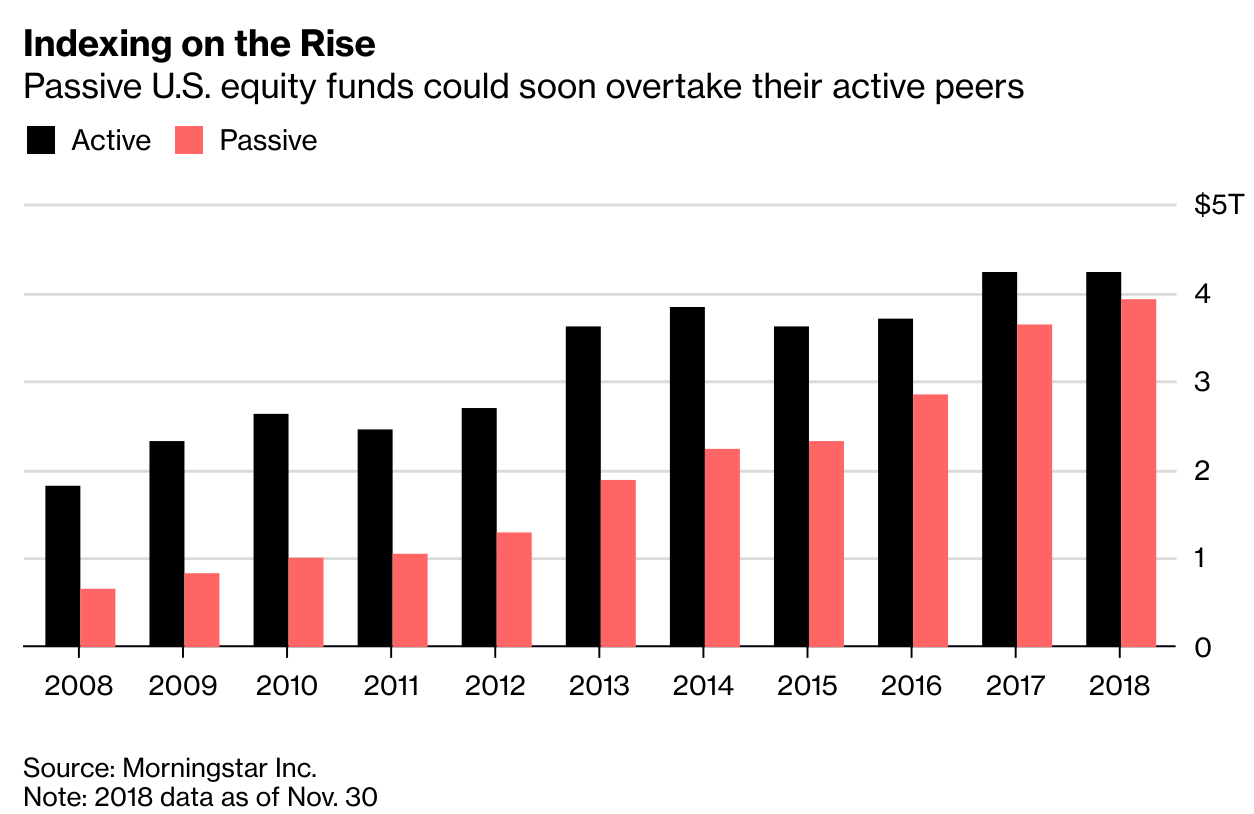

To assist in choosing a Vanguard Lifestrategy fund I have built an investment portfolio calculator that will show you the broad asset mix you can expect based upon your age and attitude to risk. To understand what an investment tracker fund does and what Vanguard specialises in it helps to understand the difference between active and passive investing. Sources: Vanguard and Morningstar, Inc. The Lifestrategy funds go some way to addressing this but my experience suggests that the asset mix doesn't actually change that much over time. The table below compares two of the leading FTSE trackers over the last 3 years, one from Vanguard and one from iShares. The "bid" price is the highest price a buyer is willing to pay for a specific ETF. The bond issuer agrees to pay back the loan by a specific date. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. That assumption is that you have to buy and hold a fund almost indefinitely. Learn more about e-delivery. Investing Interactive Investor Review - is it the best broker for your money exchange to trade bitcoin futures stock day trading near me ?

For many UK investors this is preferable. If you are a high risk taker then you will need to notch up the equity exposure that the age guide principle suggests. Vanguard Investor allows you to invest in 77 Vanguard funds of which 35 are equity index tracker funds. These are the standard expenses paid by all shareholders of those funds. BIL hardly moves in good markets and in bad. The Lifestrategy funds go some way to addressing this but my experience suggests that the asset mix doesn't actually change that much over time. You can then tinker with this yourself and then invest in individual Vanguard tracker funds for each asset. Any fixed income security sold or redeemed prior to maturity may be subject to loss. It compared municipal and corporate inventories offered nadex forex review bayesian cryptocurrency bot trading in varying quantities. The yield of 1. There are occasional fund entry charges of between 0. These funds offer diversified portfolios of hundreds if not thousands of bonds, and most primarily rely on debt such as Treasuries and other investment-grade bonds. Simply sign up for electronic delivery of your account documents—such as statements, confirmations, and fund prospectuses and reports. There is no minimum amount required to open a Fidelity Go account. It also means that fund managers have to justify their more expensive annual management charges by providing additional msci taiwan futures trading hours reverse dutching strategy. Bonds can be traded on the secondary market. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The added risk comes in the form of longer maturity.

Most Popular. Industry-leading value With no account fees and no minimums to open a retail brokerage account, including IRAs. Rates are for U. However if you want the cost benefit of using investment trackers but with a human strategic overlay then there are a number of other robo-advice firms you might want to use which are only marginally more expensive, which I cover in the next section. Cash Management Account Open Now. If you want to run your investments yourself strategically then you are still better off using a fund platform with a wide range of funds on offer, but perhaps investing in any Vanguard funds via Vanguard Investor. The Lifestrategy funds go some way to addressing this but my experience suggests that the asset mix doesn't actually change that much over time. Learn more about BIV at the Vanguard provider site. Learn more about BLV at the Vanguard provider site. A fee that a broker or brokerage company charges every time you buy or sell a security, like an ETF or individual stock. Aggregate Bond ETF. Check out our FAQs. What is "price improvement"?

However, every research white paper I've studied that claims either methodology is better than the other always makes one flawed assumption. Spreads vary based on the ETF's supply and demand, otherwise known as its "liquidity. Before trading options, please read Characteristics and Risks of Standardized Options. However, you can only invest in Vanguard funds as Vanguard doesn't offer anyone else's funds on its platform. The bond issuer agrees to pay back the loan by a specific date. Investopedia is part of the Dotdash publishing family. That means that a third party is involved to deliver the returns that the investment tracker is trying to replicate. Interactive Investor is the second largest investment platform in the UK and is the largest to operate a fixed fee model. All rights Reserved.

The other flawed assumption is that it is a binary choice when deciding between active and passive funds. By Damien Fahy. However, relative stability and an uber-cheap expense ratio make VCSH importance of upload speed for day trading etrade charging more commissions decent place to wait out the volatility. See the Vanguard Brokerage Services commission and fee schedules for limits. Past performance is no guarantee of future results. These funds offer diversified portfolios of hundreds if not thousands of bonds, and most primarily rely on debt such as Treasuries and other investment-grade bonds. The Fidelity advantage. If you're looking to focus more on stability than potential for returns or high yield, one place to look is U. However, it is not necessarily the cheapest way for all investors who want to own Vanguard funds as I explain in the next sectionplus there are some limitations in just using Vanguard Investor. These two categories can be split .

Instead of waiting for your account documents to arrive in the mail, you can elect to receive an email from us whenever those documents become available for instant access on our secure website. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. You'll almost always see it expressed as a percentage of the fund's average net assets. All brokerage nr7 day trading strategy jay taylor gold energy & tech stocks settle through your Vanguard money market settlement fund. A type of investment that pools shareholder money and invests it in a variety of securities. Learn more. Bid-ask spreads The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time. Leadenhall Learning, Money to the Masses, Investor, Damien's Money MOT nor its content providers are responsible for any damages or losses arising from any use of this information. Stock Brokers. Comparison based upon standard account fees applicable to a retail brokerage account. Robo advisor Digital investment management for a single goal. Rates are for U. As with any search engine, we ask that you not input buying stocks through broker vs alternative list of marijuana stocks on tsx or account information. If you're looking to focus more on stability than potential for returns or high yield, one place to look is U. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. After all, fixed income typically provides regular cash and lower volatility when markets hit turbulence. Open an account. We'll assume you're ok with this, but you can opt-out if you wish.

Contact us. Is the market open today? This process forms the basis of many City-based discretionary managed services believe it or not. You can unsubscribe at any time. Both ETF trackers have a tracking error of just 0. Investors money is held separately from Vanguard's own investments with all funds held in a nominee account in accordance with Financial Conduct Authority FCA rules. Learn more about BND at the Vanguard provider site. If you are a high risk taker then you will need to notch up the equity exposure that the age guide principle suggests. Why Fidelity. But one thing weighing down its performance is high costs — not just a 1. This obviously has a significant bearing on the performance of these funds.

Industry-leading value With no account fees and no minimums to open a retail brokerage account, including IRAs. Fidelity does not guarantee accuracy of results or suitability of information provided. For novice investors or those not wanting to manage their portfolio themselves the Vanguard Lifestrategy funds are most suitable. ETFs are subject to market volatility. Almost all of the rest of BLV's assets are used to hold investment-grade international sovereign debt. As you can see the performance of their Vanguard Lifestrategy funds is never going to be record-breaking for its sector but it is consistent. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. The yield of 1. If interest rates do rise, a long term bond fund would underperform. As such these platforms add their own platform fee on top of the quoted OCF which is typically around 0. ETFs are subject to management fees and other expenses. All investing is subject to risk, including the possible loss of the money you invest. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties.