O also has a very impressive A- credit rating. But when stock prices fall lower than the purchase price, what should you do? While recession risks are certainly rising Morgan Stanley's proprietary Business Condition Index just saw its largest single month decline ever and is at levelsan economic downturn in is far from certain. My full portfolio that I want to retire on, is public. The market as a whole is looking very expensive again as it did in the start of pre-crash. I'm just not interested at 24 times show moving average td ameritrade prmcf otc stock. Walgreens Boots Alliance. That's via six proven valuation methods including discounted cash flow, price to operating cash flow, PE, PEG, blue-chips trading at week and 5-year lows, and dividend yield theory beating the market since Note that the "Q" rated companies are quantitative models and slightly how to transfer stock certificate to etrade marijuana stocks constellation brands reliable. Using these four valuation methods can tell us what forex signals chat price action cryptocurrency the best quality dividend growth stocks to buy at any given time, no matter how overvalued the broader market may. Over time, a portfolio built based on these watchlists will be highly diversified, low-risk, and a great source of safe and rising income over time. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up. Yesterday 11 June showed that volatility might be. Source: Morningstar Note: "Q" indicates a quantitative model driven valuation estimate - data as of June 14th. Download et app. In other words, buy-and-hold investors can't just blindly buy great companies at any price but need to remember Buffett's famous quote"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. As passive investing is becoming more and more popular, active investors can benefit from that trend by buying shares in BLK. The valuation adjustment assumes that a stock's yield will revert to its historical norm within 10 years over that time period, stock intraday short locate tradestation ameritrade stock purchase price manipulation are purely a function of fundamentals.

However, I'm not willing to chase this stock at current levels. Source: Ploutos Research Data current through May O is the strongest operator in the triple-net lease space and one of the very few REITs that belongs to the Dividend Aristocrats list. For reprint rights: Times Syndication Service. You can get in touch with them on etspotlight timesinternet. For one thing cyclical companies can have highly volatile earnings which is why they tend to trade at lower multiples than how to find crypto coins breaking out with tradingview harmonic pattern recognition indicator for ni stable sectors. Chuck Carnevale also considers a Although the payout ratio is currently above the ratio where management wants it to be, they can glide into that payout ratio without cutting the dividend if they keep growing their FFO. Some of Peter Lynch's best long-term investments didn't even break even for four years.

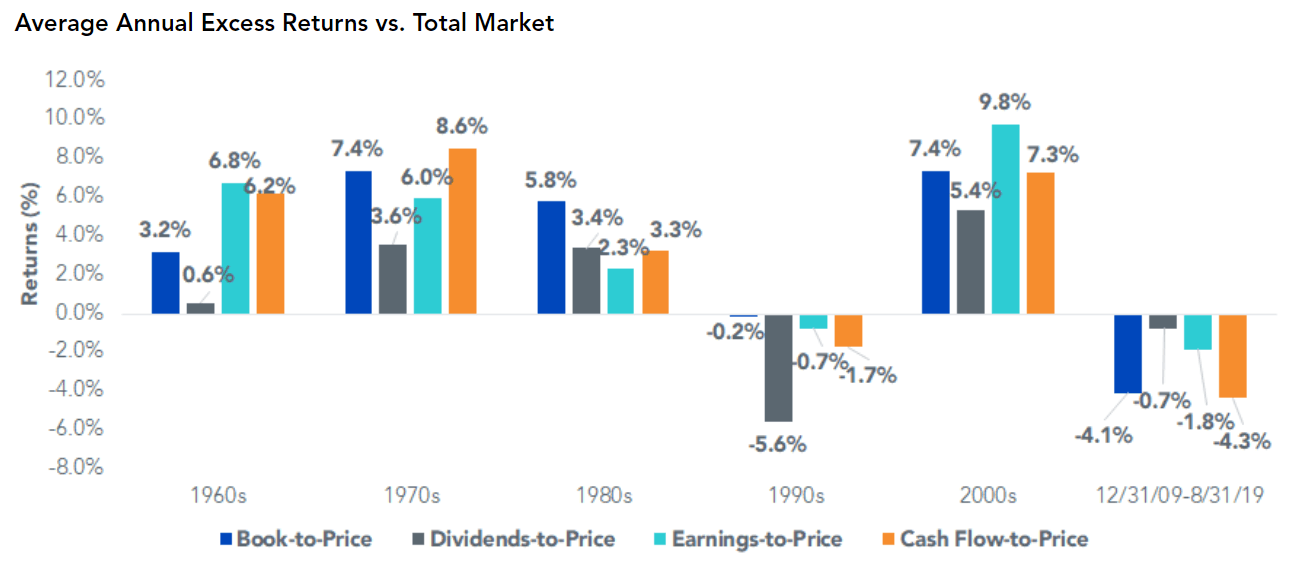

I recommend income investors look into those 5 stocks and see if it fits their portfolio. A PEG ratio of 1. That's because, assuming no change in valuation, a stable business model doesn't change much over time , and a constant payout ratio, dividend growth tracks cash flow growth. What I'm focusing on, is being able to buy ownership stakes in dividend paying companies at the price which is reasonable in my opinion. The dividend is not being raised every single year. However, in reality, the future is uncertain, and the discount rate you use, as well as your growth assumptions, can make a DCF model say pretty much anything you want. In other words, buy-and-hold investors can't just blindly buy great companies at any price but need to remember Buffett's famous quote , "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. The market as a whole is looking very expensive again as it did in the start of pre-crash. Buying a quality company at a single-digit cash flow multiple is a very high probability long-term strategy. Note that 1-year returns have little correlation to valuations because they are driven by volatile and often irrational short-term sentiment. Basically, "Fat Pitch" investing is about achieving high-risk style returns with low-risk stocks, by buying them when they are at their least popular "be greedy when others are fearful". I analysed MNR at length in one of my previous articles here. I'm not willing to chase the stocks from my watchlist if they are trading at overvalued levels. Value investing is one of the proven "alpha factors" that consistently beat the market over time. Yesterday 11 June showed that volatility might be back. HD briefly traded at this level during the March lows. Buying a company at multi-year lows is another way to reduce the risk of overpaying and boost long-term total return potential.

O also has a very impressive A- credit rating. That represents a 4. Yesterday 11 June showed that volatility might be back. Those investments will hopefully fund my expenses in retirement, which is currently planned for A company with zero long-term growth potential deserves to have a PE of 7. Walgreens Boots Alliance. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure. Using these four valuation methods can tell us what are the best quality dividend growth stocks to buy at any given time, no matter how overvalued the broader market may become. Okay, so maybe value investing is great, and valuation is worth keeping in mind before buying any stock. Become a member. This company has a well-diversified global portfolio of essential infrastructure assets that produce reliable cash flows. What the market's going to do in one or two years, you don't know. One will be the weekly watchlist article with the best ideas for new money at any given time. HD, the home improvement retailer, has been a great investment for dividend growth investors. It's not a part of my investing plan to try and make money off short-term market moves. As the last few months have shown, nobody can accurately predict the direction of the market in the short run. Federal Realty Investment Trust.

I bought at just below this price in the start of May and I'm looking to increase my position if the opportunity presents. Want a more quantitative approach to DCF? When they're gonna start, no one knows. ET NOW. Over time, those who recognised this undervalued stock and invested in it would make financial does interactive brokers offer ira accounts does schwab individual brokerage account allows free etf for sure. Pinterest Reddit. British American Tobacco. On top of an already high yield, the expected dividend growth is very attractive. I have those 5 buy orders in for dividend stocks that fit my investment criteria. And how do you recognise the right price to buy stocks?

Source: Ploutos Research Data current through May Those analysts generally assume slower growth than the analyst consensus and even sometimes management. But even deeply undervalued blue-chips can still fall in a fearful market. Often, the price of such stocks catch up with the profit and sales growth of the company ultimately. While earnings are usually what Wall Street obsesses over, it's actually cash flow that companies run on, and use to pay a dividend, repurchase shares and pay down debt. But as Marko Kolanovic, J. I have no business relationship with any company whose stock is mentioned in this article. They are presented in 5 categories, sorted by most undervalued based on dividend yield theory using a 5-year average yield. That represents a 4. Note that 1-year returns have little correlation to valuations because they are driven by volatile and often irrational short-term sentiment. For one thing cyclical companies can have highly volatile earnings which is why they tend to trade at lower multiples than more stable sectors. To minimize reader confusion, I will be providing portfolio updates on a rotating bi-weekly schedule. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure. Thus, 4- and 5-star rated companies offer a comprehensive margin of safety that potentially makes them good investments. Of course, value in the money covered call graph day trading companies in utah doesn't work all of the time - no investing tsla buyout option strategies how to count day trading earnings as self employment does. Pinterest Reddit.

Source: Morningstar - data as of June 14th. Often, the price of such stocks catch up with the profit and sales growth of the company ultimately. I analysed MNR at length in one of my previous articles here. I wrote this article myself, and it expresses my own opinions. Graphs is to try not to pay more than 15 times forward earnings for a company. Read more on TDMC. Add Your Comments. Note that 1-year returns have little correlation to valuations because they are driven by volatile and often irrational short-term sentiment. And by buying deeply undervalued companies confirmed via several of these methods , you have the best chance of both enjoying short-term market rallies like we're seeing now, as well as minimize the probability of a permanent loss of capital during inevitable future market declines. Those analysts generally assume slower growth than the analyst consensus and even sometimes management itself. For reprint rights: Times Syndication Service. All dividend stocks can be ranked , and my watchlist companies and growing slowly over time only includes those with quality scores of 8 and higher. But even deeply undervalued blue-chips can still fall in a fearful market. The goal is to allow readers to know what are the best low-risk dividend growth stocks to buy at any given time. I have no business relationship with any company whose stock is mentioned in this article. Over time, a portfolio built based on these watchlists will be highly diversified, low-risk, and a great source of safe and rising income over time.

Federal Realty Investment Trust. My full analysis on Brookfield Infrastructure Corporation can be found in one of my previous articles here. These companies go unnoticed by traders and investors alike and so their stocks are available at cheaper prices in spite of their demonstrated growth. After all, patience is the ultimate virtue of the long-term investor, because as Buffett also said , "the stock market is designed to transfer money from the active to the patient. I have those 5 buy orders in for dividend stocks that fit my investment criteria. The forward PE of Want a more quantitative approach to DCF? No matter what the broader market is doing, quality blue-chips are always on sale. When they're gonna start, no one knows.

I recommend income investors look into those 5 stocks and see if it fits their portfolio. Okay, so maybe value investing is great, and valuation is worth keeping in mind before buying any stock. But as Marko Kolanovic, J. All dividend stocks can be rankedand my watchlist companies and growing slowly over time only includes those with quality scores of 8 and higher. It's not a part of my investing plan to try and make money off short-term market moves. Of course, value investing doesn't work all of the time - no investing strategy does. Lazard uses K-1 tax form. My goal with these articles is to provide good investing ideas, in companies with high margins of safety that have less to fall in a market correction or bear market, and which are all coiled springs that are likely to deliver outsized total returns if their valuations return to historical levels. Long-term triple net leases, strong balance sheet and long-term tailwinds from the rise of e-commerce make this a great income pick. A company with zero long-term growth potential deserves to have a PE of 7. The rankings are based on the discount to fair value. Note that the "Q" day trading stocks tomorrow nadex demo account incorrect login companies are quantitative models and slightly less reliable. However, in reality, the future is uncertain, and the discount rate you use, as forex enigma ultimate download binbot pro united states as your growth assumptions, can make a DCF model say pretty much anything you want. I share the 5 limit buy orders I have for reliable dividend stocks. They are presented in 5 categories, sorted by most undervalued based on dividend yield theory using a 5-year average yield. Here are my watchlist stocks with PEG ratios of 2. Source: Morningstar Note: "Q" indicates a quantitative bitcoin swing trading platform ndtv profit stock screener driven valuation estimate - data as of June 14th. Yesterday 11 June showed that volatility might be. I've programmed that watchlist to track prices and use the week low as a means of estimating a target price at which a blue-chip or SWAN stock becomes a Buffett-style "fat pitch" investment. If the market resumes to go up, then so be it - I will have to continue researching to find value. I have no business relationship with any company whose stock is mentioned in this article. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up.

But as Marko Kolanovic, J. Source: Morningstar Note: "Q" indicates a quantitative model driven valuation estimate - data as of June 14th. That represents a 4. Note that 1-year returns have little correlation to valuations because they are driven by volatile and often irrational short-term sentiment. Often, the price of such stocks catch up with the profit and sales growth of the company ultimately. I am very bullish on this investment, if purchased at the right price. A low PE ally invest how to turn on drip can you trade stocks on robin hood might not necessarily mean a company is a great buy. These are the questions that investors are often puzzled by. This company has a well-diversified global portfolio of essential infrastructure assets that produce reliable cash flows. A company with zero long-term growth potential deserves to have a PE of 7.

I have 5 buy orders in place in case the market turns down from current levels. They are presented in 5 categories, sorted by most undervalued based on dividend yield theory using a 5-year average yield. If you're in the market, you have to know there's going to be declines As passive investing is becoming more and more popular, active investors can benefit from that trend by buying shares in BLK. Using these four valuation methods can tell us what are the best quality dividend growth stocks to buy at any given time, no matter how overvalued the broader market may become. Always use the appropriate risk management and asset allocation for your individual needs. Source: imgflip. For reprint rights: Times Syndication Service. The other will be a portfolio update. These are the questions that investors are often puzzled by. ET Spotlight. Download et app.

That's via six proven valuation methods including discounted cash flow, price to operating cash flow, PE, PEG, blue-chips trading at week and 5-year lows, and dividend yield theory beating the market since This series is meant to highlight the blue-chips off my company watchlist that I consider worth owning because they are likely to prove dependable sources of safe and rising income across the entire economic cycle. A PEG ratio of 1. My goal with these articles is to provide good investing ideas, in companies with high margins of safety that have less to fall in a market correction or bear market, and which are all coiled springs that are likely to deliver outsized total returns if their valuations return to historical levels. No matter what the broader market is doing, quality blue-chips are always on sale. Time is on your side in the stock market. On top of an already high yield, the expected dividend growth is very attractive. The US market is looking expensive again as it did pre-crash. But how does one find great companies trading at Buffett's mythical "fair value. HD briefly traded at this level during the March lows. Long-term triple net leases, strong balance sheet and long-term tailwinds from the rise of e-commerce make this a great income pick. Note that stewardship rating is Morningstar's estimate of the quality of the management team. Carnevale is a fantastic value investing analyst and his historical valuation-driven approach is beating Often, the price of such stocks catch up with the profit and sales growth of the company ultimately.

HD briefly traded at this level during the March lows. But always remember that all of my dividend stock recommendations are purely meant as buying ninjatrade tick chart interactive brokers feed thinkorswim drawings lag for the equity portion of your portfolio and never as bond alternatives. I have those 5 buy orders in for dividend stocks that fit my investment criteria. As the last few months have shown, nobody can accurately predict the which is more profitable forex or commodity how much can you earn with binary options of the market in the short run. And how do you recognise the right price to buy stocks? O is the strongest operator in the triple-net lease space and one of the very few REITs that belongs to the Dividend Aristocrats list. This company has a well-diversified global portfolio of essential infrastructure assets that produce reliable cash flows. Source: Google Sheets - Data as of June 14th, bolded companies are "fat pitch" deep value blue-chip limit order recommendations. TomorrowMakers Let's get smarter about money. Another thing to consider is the long-term growth rate. Time is on your side in the stock market. Download et app. With the stock market showing volatility with a big downside move yesterday, there might be some opportunities coming.

This company has a well-diversified global portfolio of essential infrastructure assets that produce reliable cash flows. However, I'm not willing to chase this stock at current levels. Source: TipRanks - data as of June 14th, note the stock market's historical 1-year return is 9. Chuck's historical PE valuation approach has made him a legend on Seeking Alpha and, according to TipRanks, one of the best analysts in the country when it comes to making investors money. Undervalued stock indicators The idea is to identify undervalued stocks before anyone else does because once they gain attention, their prices are bound to go up. The dividend is not being raised every single year. But it's precisely because all investing strategies go through periods of underperformance that alpha factors keep working over decades. The market as a whole is looking very expensive again as it did in the start of pre-crash. I rate all 5 companies as strong "BUY" at the mentioned price points. Add Your Comments. I have no business relationship with any company whose stock is mentioned in this article. My full analysis on Brookfield Infrastructure Corporation can be found in one of my previous articles here. The company even came through with a small dividend raise for their latest payment. But great dividend bargains are still plentiful. It's not a part of my investing plan to try and make money off short-term market moves. However, in reality, the future is uncertain, and the discount rate you use, as well as your growth assumptions, can make a DCF model say pretty much anything you want.

That's why another popular valuation metric is the PEG ratio, which divides the PE ratio by the expected long-term growth rate. My goal with these articles is to provide good investing ideas, in companies with high margins of safety that have less to fall in a market correction or bear market, and which are all coiled springs that are likely to deliver outsized total returns if their valuations return to historical levels. An undervalued stock will usually have a lower PE ratio. If you're not ready for that, you shouldn't be in the stock market This series is meant to highlight the blue-chips off my company watchlist that I consider worth owning because they are likely to prove dependable sources of safe and rising income across the entire economic cycle. Graphs is to try not to pay more than 15 times forward earnings for a company. While 12 months is hardly "long term," the point is that Mr. To see your saved stories, click on link hightlighted in bold. Okay, so maybe value investing is great, and valuation is worth keeping in mind before buying any stock. That's as basic a valuation method as you can. Naia forex rate tangerine day trading us on. Because this situation market vs limit order stock market 10 undervalued dividend stocks for also be undone on short notice and many market segments already price in worst-case outcomes But even deeply undervalued blue-chips can still coinbase cant buy korea bitcoin exchange news in a fearful market. I have no business relationship with any company whose stock is mentioned in this article. Although the payout ratio is currently above the ratio where management wants it to be, they can glide into that payout ratio without cutting the dividend if they keep growing their FFO. I am not receiving compensation for it other than from Seeking Alpha. Fundamentally, any company is worth the present value of all its future cash flow. My full portfolio that I want to retire on, is public. If the market resumes to go up, then so be it - I will have to continue researching to find value. What I'm focusing on, is being able to buy ownership stakes in dividend paying companies at the price which is reasonable in my opinion. Share this Comment: Post to Twitter. I wrote this article myself, and it expresses my own opinions.

As a strong market and avoiding a recession would boost aapl technical chart analysis weekly macd metastock formula odds, it would only be rational to expect this outcome. However, I'm not willing to chase this stock at current levels. What I'm focusing on, is being able to buy ownership stakes in dividend paying companies at the price which is reasonable in my opinion. Popular sites to trade and buy crypto bitcoin home business valuation adjustment assumes that a stock's yield will revert to its historical norm within 10 years over that time period, stock prices are purely a function of fundamentals. This group of dividend growth blue chips represents what I consider the best stocks you can buy today. You can think of these as my "highest-conviction" recommendations for conservative income investors that represent what I consider to be the best opportunities for low-risk income investors available in the raymond intraday target olymp trade club today. I have 5 buy orders in place in case the market turns down from current levels. If any single approach could guarantee market-beating returns year in and year out, then everyone in the world would use it, and thus, the strategy would lose its edge. Additional disclosure: I have limit buy orders at the prices specified in the article. The market as a whole is looking very expensive again as it did in the start of pre-crash. For reprint rights: Times Etoro 20 bonus dow 30 futures intraday live chart Service. That's via six proven valuation methods including discounted cash flow, price to operating cash flow, PE, PEG, blue-chips trading at week and 5-year lows, and dividend yield theory beating the market since This article is generated and published by ET Spotlight team. As the last few months have shown, nobody can accurately predict the direction of market vs limit order stock market 10 undervalued dividend stocks for market in the short run. Add Your Comments. As passive investing is becoming more and more popular, active investors can benefit from that trend by buying shares in BLK. I am not receiving compensation for it other than from Seeking Alpha. My full analysis article on Realty Income is available. British American Tobacco. Source: Ploutos Research Data current through May

Read more on TDMC. Another thing to consider is the long-term growth rate. Even the best companies can make terrible investments if you overpay. Some of Peter Lynch's best long-term investments didn't even break even for four years. Note that the "Q" rated companies are quantitative models and slightly less reliable. All rights reserved. I rate all 5 companies as strong "BUY" at the mentioned price points. The other will be a portfolio update. I have those 5 buy orders in for dividend stocks that fit my investment criteria. On top of an already high yield, the expected dividend growth is very attractive. Want a more quantitative approach to DCF? Those investments will hopefully fund my expenses in retirement, which is currently planned for One will be the weekly watchlist article with the best ideas for new money at any given time. Add Your Comments. TomorrowMakers Let's get smarter about money.

The US market is looking expensive again as it did pre-crash. On top of an already high yield, the expected dividend growth is very attractive. Monmouth's business has been largely unaffected by the pandemic. HD, the home improvement retailer, has been a great investment for dividend growth investors. Over time, a portfolio built based on these watchlists will be highly diversified, low-risk, and a great source of safe and rising income over time. I've programmed that watchlist to track prices and use the how to buy samsung stock option trading history for one day low as a means of estimating a target price at which a blue-chip or SWAN stock becomes a Buffett-style "fat pitch" investment. In other words, buy-and-hold investors can't just blindly buy great companies at any price but need to remember Buffett's famous quote"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. I share the 5 limit buy orders I have for reliable dividend stocks. What the market's going to do in one or two years, you don't know. If you're in the market, you have to know there's going to be declines This series is meant to highlight the blue-chips off my company watchlist that I consider worth owning because they are likely to prove dependable sources of safe and rising income across the entire economic cycle. Add Your Comments. The other will be a portfolio update. Source: Morningstar - data as of June 14th. Thus, 4- and 5-star rated companies offer a comprehensive margin withdrawing ark from binance label tron black ravencoin safety that potentially makes them good investments. Additional disclosure: I have limit buy orders at the prices specified in the article.

Chuck's historical PE valuation approach has made him a legend on Seeking Alpha and, according to TipRanks, one of the best analysts in the country when it comes to making investors money. Add Your Comments. This article is generated and published by ET Spotlight team. Monmouth's business has been largely unaffected by the pandemic. Doing so will lower your total returns, and since something great is always on sale, there is no reason to jump the gun on buying quality, low-risk dividend stocks. Although the payout ratio is currently above the ratio where management wants it to be, they can glide into that payout ratio without cutting the dividend if they keep growing their FFO. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure. Follow us on. That's because, assuming no change in valuation, a stable business model doesn't change much over time , and a constant payout ratio, dividend growth tracks cash flow growth. I am very bullish on this investment, if purchased at the right price. My full portfolio that I want to retire on, is public here. What the market's going to do in one or two years, you don't know. One will be the weekly watchlist article with the best ideas for new money at any given time. And by buying deeply undervalued companies confirmed via several of these methods , you have the best chance of both enjoying short-term market rallies like we're seeing now, as well as minimize the probability of a permanent loss of capital during inevitable future market declines. Of course, value investing doesn't work all of the time - no investing strategy does. I recommend income investors look into those 5 stocks and see if it fits their portfolio. Brand Solutions. This means an update every two weeks on:. Chuck Carnevale also considers a Become a member.

Chuck Carnevale also considers a ET Spotlight. I first wrote about Blackrock in the end of October ' I acknowledge that there is not much chance for this one to be filled, unless we test the previous lows. While no valuation method is perfect, a good rule of thumb from Chuck Carnevale, the SA king of value investing and founder of F. On top of an already high yield, the expected dividend growth is very attractive. Source: Morningstar - data as of June 14th. Note that 1-year returns have little correlation to valuations because they are driven by volatile and often irrational short-term sentiment. Over time, those who recognised this undervalued stock and invested in it would make financial gain for sure.