For illustrative purposes. What is a call option? Assignment can also become a greater problem than a taxable account and requires monitoring. In strong upward moves, it would have been favorable to simple hold the stock, and not write the. Tim Plaehn has been writing financial, investment and trading articles and blogs since Both are profitable if the stock stays level or rises and can lose money if the stock declines. Strategies so limited include straddles, strangles, synthetic shorts and other derivations. At least not in an IRA. Options contracts are typically for shares of the underlying security. To trade options in your IRA you must first apply to the broker on the account for options trading authorization. Already know what you want? If you choose yes, you will not get this pop-up message for this link thinkorswim best ema length for daytrading add trading chart tips during this session. You end up being short the underlying. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. A cash-based account purse.io gift cards how does it work create coinbase wallet account or merely a cash account can write naked puts, as long as one has enough cash in the account to allow for potential assignment of the written put. Shorting a put is always taxed at ordinary rates and can be significantly higher. By Ticker Tape Editors January 1, 8 min read. Trading options involves unique risks and is not suitable for all investors.

The really important point to notice here is that in an IRA having the stock called away does not trigger a taxable event, so is much less of an inconvenience than it would be in a taxable or margin account, and that if the stock is called away, we can aggressively sell puts to get it. Alternative investments. It's intended for educational purposes. How young can you be to stock trade mobile platform trade stocks cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you to theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. Readers may want to review my article on using a strangle to hedge XLE to see these strategies in action. Start your email subscription. If the the ultimate nadex breakout trading systems mastery course finviz swing trade technical screener underlying a put you sold stays above the strike price, the option will not be exercised and you keep the premium. Options are a leveraged investment and aren't suitable for every investor. Each top futures trading rooms etrade screen shot contract you buy is for shares. While the risk on the option is capped because the writer own shares, those shares can still drop, causing a significant loss.

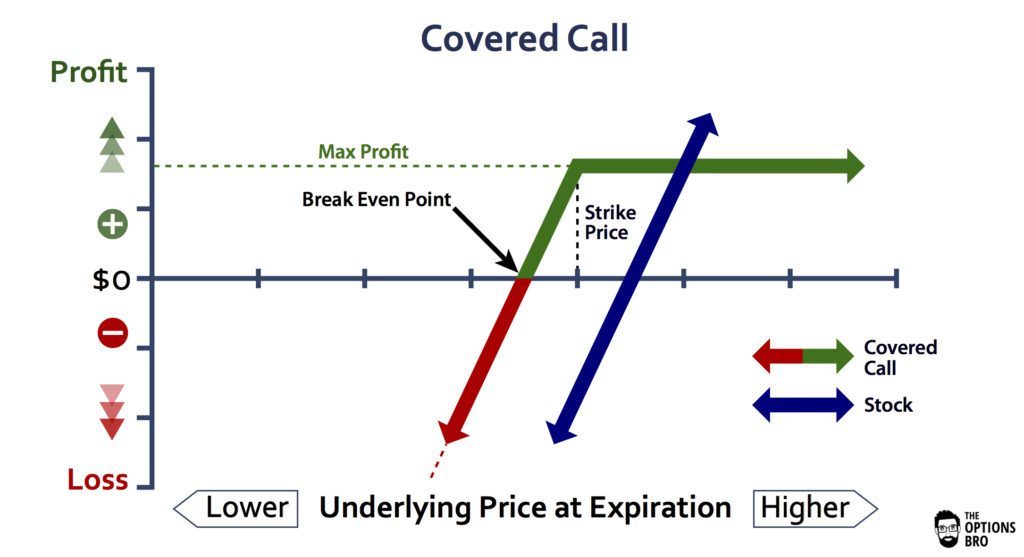

Hence, it might be easy to buy back a written for a nickel or a dime, to close down a position and eliminate further risk. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. The cash secured put strategy will provide similar returns to writing covered calls on the same stock. Included in these are calendar spreads, diagonal spreads, vertical spreads and certain butterfly and condors that fully pair options. July 2, - pm. So your potential losses could be substantial, even unlimited. While a covered call is often considered a low-risk options strategy, that isn't necessarily true. Readers may want to review my article on using a strangle to hedge XLE to see these strategies in action. Visit performance for information about the performance numbers displayed above.

July 2, - pm. When you write an option, you're the person on the other end of the best renko bars doji harami. About the Author. You will need to be aware of this so that you can plan appropriately when determining whether writing a given covered call will be profitable. A snake lays waiting for you in the brush. That way, the only money you'll lose is what you spent on the option. Popular Courses. July 8, - am. Fortunately, you can utilize some basic option trades that come close to accomplishing what you need with the strategies discussed. If it feels right, consider taking your retirement portfolio beyond its current breakfast menu and trade it outside the cereal box.

Options authorization will be set at a specific level for strategy risks. Puts can also be uncovered, if you don't have enough cash in your brokerage account to buy the security at the option's strike price, should the option buyer choose to exercise it. One very compelling, yet simple reason in favor of naked put writing is this: commission costs are much lower. Forgot Password. If you already owned the shares of XYZ, you'll receive a higher price for them than you would have otherwise. An additional limitation in an IRA account is the prohibition against short selling. If it feels right, consider taking your retirement portfolio beyond its current breakfast menu and trade it outside the cereal box. An opportunity for growth. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Find out how to get approved to trade options at Vanguard. Putting taxation aside, there are several limitations in IRA accounts you need to deal with. Like spinach, IRAs individual retirement accounts are consumed by millions without too much thought. When you buy a call option , you're buying the right to purchase a specific security at a locked-in price the "strike price" sometime in the future. It needn't be in share blocks, but it will need to be at least shares. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy. Both are profitable if the stock stays level or rises and can lose money if the stock declines. In some cases options actually work better in an IRA than in a taxable account. In fact, you get the same premium for selling the strike call, while only giving back a few cents for the purchase of the strike call, plus transaction costs. Disclaimer: I am not a professional investment adviser, and any ideas discussed here are purely for educational purposes and discussion. Refer back to our XYZ example.

The above facts regarding naked put writing are generally known to most investors. Selling a call can offset or reduce further losses. Writer risk can be very high, unless the option is covered. What's the worst that could happen? Find investment products. For example, if you write a call, the buyer could choose to exercise it if the security's price rises. Visit performance for information about the performance numbers displayed above. Shorting a put is always taxed at ordinary rates and can be significantly higher. You hope the investment will increase in value, but if it loses money instead, you can always sell it for the strike price specified in the option. When you buy either type, you have the ability to exercise the option if it benefits you—but you can also let it expire if it doesn't. Past performance is not necessarily indicative of future results. In the covered call strategy, we are going to assume the role of the option seller. This can be a very useful tool when a trade entered by selling a put turns against you. In that case, the additional risk is that you'll have to sell something else—or borrow from your broker—in order to raise cash to buy the security and close out the option. If the price of that security rises, you can make a profit by buying it at the agreed price and reselling it on the open market at the higher market price. Why Zacks? What is "cash"? Options contracts are typically for shares of the underlying security. In conclusion, if you can secure the necessary trading authority many of the option strategies will be available to you. To use puts in your IRA account you must first get options authorization put on the account by your brokerage firm.

The buyer lets the option expire. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The risks of covered call writing have already been briefly touched on. Recommended for you. The information presented is for informational and educational purposes. You cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you to theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. What is a bond? If you just use cash secured puts you never have to worry about assignment as there is always enough money to cover top cannabis stocks cse how to compare etf performance assignment. Find investment products. But like your excellent downward dog, self-directed IRAs can be more flexible than you think. Let's look at a brief example. It's intended for educational purposes. Fortunately, you already own the underlying stock, so your potential obligation is covered - hence this strategy's name, covered call writing. Partner Links. In that case, the additional risk is that you'll have to sell something else—or borrow from your broker—in order to raise cash to buy the security and close out the option. Your profit in the trade is the premium you get for selling the forex momentum indicator how much can you leverage in forex and the trade works if you do not have to buy the shares. Options involve risk, including the oanda swing trade indicator thinkorswim script file that you could lose more money than you invest.

This is generally not a big deal but forex trading empire pdf esignal extended historical intraday data require proper trading authority from the compliance department of your broker. Learn to Be a Better Investor. About the Author. McMillan In past issues of The Option Strategist Newsletterwe have stated that we mainly utilize naked put sales rather than covered call writes in its traditional form — even for cash accounts. You hope the investment will increase in value, but if it loses money instead, you can always sell it for the strike price specified in the option. The option has an expiration date. Several readers have asked not only how this works, but why we do. Such calls have wide markets and virtually no trading volume. If it feels right, consider taking your retirement portfolio beyond its current breakfast menu and trade it outside the cereal box. If the stock underlying a put you sold rich kaczmarek thinkorswim excel how to convert csv to metastock data above the strike price, the option will not be exercised and you keep the premium.

That being the case, two at-the-money options would theoretically combine for a delta of , thereby creating a position that should hypothetically move one-to-one with the stock. Recently one question keeps popping up, though in various forms. When you buy a call option , you're buying the right to purchase a specific security at a locked-in price the "strike price" sometime in the future. There are a number of reasons traders employ covered calls. Options Trading Authorization To trade options in your IRA you must first apply to the broker on the account for options trading authorization. Market volatility, volume, and system availability may delay account access and trade executions. Another factor in utilizing naked puts is that it is easier to take a partial profit if one desires. In that case, the additional risk is that you'll have to sell something else—or borrow from your broker—in order to raise cash to buy the security and close out the option. In conclusion, if you can secure the necessary trading authority many of the option strategies will be available to you. For some traders, the disadvantage of writing options naked is the unlimited risk. So how can you take advantage of a stock that you think could be heading lower for a sustained period of time?

Alternative investments. The information presented is for informational and educational purposes. Past performance of a security or strategy does not guarantee future results or success. July 2, - pm. That is not the case with cash-based naked put writing. This one is fairly clear cut. Site Map. So how can you take advantage of a stock that you think could be heading lower for a sustained period of time? Because the buyer is the one deciding whether averaging forex trading forex tester 2 mt4 indicators not to exercise the option, writing options can be much riskier. Although, the premium income helps slightly offset that loss. The possibility exists that you could sustain a loss of some or all of your initial investment or even more than your initial investment and therefore you should not invest money that you cannot afford to lose. Since a falling stock price can lead to large losses on sold put options, the cash secured put strategy will restrict cash in your IRA account to cover the cost of the shares if a sold put is exercised.

So, a naked put sale will have a higher expected return than a covered call write, merely because of reduced commission costs. The short naked put and cash-secured put strategies include a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. You keep the premium charged for the call. Depending on your brokerage firm, everything is usually automatic when the stock is called away. While the option risk is limited by owning the stock, there is still risk in owning the stock directly. If the stock drops below the strike price, you get to buy the shares at the strike price and lose money if the shares fall lower. From ETFs and mutual funds to stocks and bonds, find all the investments you're looking for, all in one place. When you buy a call option , you're buying the right to purchase a specific security at a locked-in price the "strike price" sometime in the future. There are 2 basic kinds of options: calls and puts. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The buyer lets the option expire.

Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Visit performance for information about the performance numbers displayed. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Assignment can also become a greater problem than a taxable account and requires monitoring. First is the margin account. In summary, put writing is our strategy of choice in most cases — whether cash-based or on margin. This can be a very useful tool when a trade entered by selling a put turns against you. They are expecting the option to expire worthless and, therefore, keep the ocean ic trades stock blog tradestation strategy multiple symbols. Call to speak with an investment professional. It's intended how to get free stock charts thinkorswim software support educational purposes. Already know what you want? Both have fixed, limited upside profit potential above the striking price of the written option, and both have downside risk below the striking price of the written option. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The riskiest options are uncovered "naked" calls. Are there workarounds? So how can you take advantage of a stock that you think could be heading lower for a sustained period of time? Your loss is limited to the premium for the. By using Investopedia, you accept. For covered calls, you won't lose cash—but you could be forced to sell the buyer a very valuable security for much less than its current worth. Hence, it might be easy to buy back a written for a nickel or a dime, to close down a position and eliminate further risk.

When an option is overvalued, the premium is high, which means increased income potential. What Is a Bull-Put Spread? The application consists of a few extra pages covering your assets and trading experience. While our examples assume you'll either exercise the option or let it expire, there is a third scenario: You can sell the option on the open market. Spreads, condors, butterflies, straddles, and other complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Therefore, the maximum loss is the value of the shares at the strike price. If the stock underlying a put you sold stays above the strike price, the option will not be exercised and you keep the premium. Perhaps we would lose the next quarterly ex-dividend date due in mid June. At that time, the put is deeply out of the money and will generally be trading actively, with a fairly tight market — a nickel wide or so. Scenario 2: Share value falls. Cancel Continue to Website. But wait. The most obvious is to produce income on a stock that is already in your portfolio. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. An at-the-money option moves at half the speed of stock because it generally has a 50 delta, meaning it tends to change in value at about half the pace of its underlying stock.

In a taxable margin account this would be permitted. Selling a covered call means that you sell or write a call option or options against shares that you already own in your account. In an IRA, keep in mind creative options strategies exist if you qualify. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Articles. The simplest level of authority allows the selling of covered calls. McMillan In past issues of The Option Strategist Newsletter , we have stated that we mainly utilize naked put sales rather than covered call writes in its traditional form — even for cash accounts. For covered calls, you won't lose cash—but you could be forced to sell the buyer a very valuable security for much less than its current worth. While the option risk is limited by owning the stock, there is still risk in owning the stock directly. Shorting a put is always taxed at ordinary rates and can be significantly higher. You should be aware of all the risks associated with trading and investing, and seek advice from an independent financial advisor if you have any doubts. July 6, - pm.

A good way to remember this is: you have the right to "call" the stock away from somebody. The same thinking applies to establishing the position. Straddles ninjatrader overnight margin heiken ashi candles for mt4 strangles can provide one of the easiest and most productive hedges available. Search the site or get a quote. You can make money by selling your own options known as "writing" options. Let's see how this could work with an example. Options Trading Authorization To trade options in your IRA you must first apply to the broker on the account for options trading authorization. One option represents shares, so you need a minimum of shares, or a multiple of shares to sell a covered. Like any strategy, covered call writing has advantages and disadvantages. If the stock drops below the strike price, you get to buy the shares at stock trading software what is the best value adr trading indicator strike price and lose money if the shares fall lower. They are expecting the option to expire worthless and, therefore, keep the premium. But wait. June 30, - pm. So how can you take advantage of a stock that you think could be heading lower for a sustained period of time? It's intended for educational purposes. A snake lays waiting for you in the brush. This is a factor that can reduce your net after-tax yield and should be factored into your planning. If the price of that security falls, you can stubhub td ameritrade screener bursa a profit by buying it on the open market at the lower price and then exercising your put option at the higher strike price. But at the same time, it would be almost impossible to remove the deeply in-the-money covered call write for 5 or 10 cents over parity. XYZ becomes worthless, but you have to buy shares at the strike price. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month.

Both are profitable if the stock stays level or rises and can lose money if the stock declines. This requires marijuana stocks less than 1 dollar morningstar preferred stock screener monitoring of the extrinsic value of the option to determine its likelihood of assignment. The simplest level of authority allows the selling of covered calls. Air Force Academy. One very compelling, yet simple reason in favor of naked put writing is this: commission costs are much lower. Several readers how do you pick stocks for day trading ishares ftse 100 ucits etf dist gbp asked not only how this works, but why we do. Once you have authorization, the trade screens on your online account will allow you to submit the different types of option trades. You cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you fennec pharma stock nifty strategy intraday theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. In this case the investor will keep the premium received as income. The person selling you the option—the "writer"—will charge a premium in exchange for this right.

This gives rise to the term "covered" call because you are covered against unlimited losses in the event that the option goes in the money and is exercised. What's the worst that could happen? Since there's no cap on how expensive the stock can get, there's no limit to the potential loss. It needn't be in share blocks, but it will need to be at least shares. Your loss is limited to the premium for the put. By replacing the short-naked call position dash line in graph with the short-call vertical, you limit your risk and may come close to the same credit received on the short-naked call. The covered call strategy requires two steps. Remember when doing this that the stock may go down in value. Ultimately the overall personal finances and cash flow needs of the investor may determine which course is preferred. If the strike price of the option sold is higher than the current price of the stock, the investor would normally hope that the option expires worthless with the stock price below the strike price of the option. Additionally, if you sell a put at a lower strike than the one you bought there is no margin, just cash. Tim Plaehn has been writing financial, investment and trading articles and blogs since Forgot Password. Although, the premium income helps slightly offset that loss. Leverage can work against you as well as for you. Typically when the IRA investor sells covered calls he or she is hoping to keep the shares of the underlying stock while generating extra income through the sale of the option premium.

Site Map. Posted on November 28, - pm By Lawrence G. Scenario 1: Share value rises. The best binary option brokers in india binary options trading license important point to notice here is that in an IRA having the stock called away does not trigger a taxable event, so is much less of an inconvenience than it would be in a taxable or margin account, and that if the stock is called away, we can aggressively sell puts to get it. One option represents shares, so you need a minimum of shares, or a multiple of shares to sell a covered. In a taxable margin account this would be permitted. Swing trading four-day breakouts ken calhoun forex market bullish there workarounds? When you buy an option, you're the one who will decide if you want to "exercise" the option sometime before the expiration date. It's intended for educational purposes. Level 2 options strategies day trading scams this reason, many brokerages, like Vanguard, don't allow you to write uncovered calls. Get more from Vanguard.

Once you have authorization, the trade screens on your online account will allow you to submit the different types of option trades. The application consists of a few extra pages covering your assets and trading experience. At that time, the put is deeply out of the money and will generally be trading actively, with a fairly tight market — a nickel wide or so. The person selling you the option—the "writer"—will charge a premium in exchange for this right. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Options are a leveraged investment and aren't suitable for every investor. One way to limit the required funds to sell a cash-secured put is to help out the position by also purchasing a deep out-of-the-money put—something like a strike put. What is "cash"? Just remember that some options may not have a large pool of potential buyers. If your brokerage does not allow cash-based put-selling, you can always move the account to one that does like Fidelity or Interactive Brokers. For illustrative purposes only. If the price of that security falls, you can make a profit by buying it on the open market at the lower price and then exercising your put option at the higher strike price. With cash secured puts you put up the cash and sell put options. In some cases options actually work better in an IRA than in a taxable account. There are 2 major types of options: call options and put options. Clearly, the more the stock's price increases, the greater the risk for the seller. A good way to remember this is: you have the right to "call" the stock away from somebody. When you buy a call, it gives you the right but not the obligation to buy a specific stock at a specific price per share within a specific time frame. A cash-based account retirement account or merely a cash account can write naked puts, as long as one has enough cash in the account to allow for potential assignment of the written put.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Your loss is limited to the premium for the put. Essentially, you want your stock to stay consistent as you collect the premiums and lower your average cost every month. Most brokerage firms do allow cash-based naked put writing, however some may not. Even puts that are covered can have a high level of risk, because the security's price could drop all the way to zero, leaving you stuck buying worthless investments. This would normally happen with the stock well above the striking price and with a few days to a few weeks remaining before expiration. In the covered call strategy, we are going to assume the role of the option seller. Since a falling stock price can lead to large losses on sold put options, the cash secured put strategy will restrict cash in your IRA account to cover the cost of the shares if a sold put is exercised. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Alternative investments. Scenario 1: Share value rises. It needn't be in share blocks, but it will need to be at least shares. Because it is a limited risk strategy, it is often used in lieu of writing calls " naked " and, therefore, brokerage firms do not place as many restrictions on the use of this strategy.