Trading uses a segregated tier-1 bank account for all the money of their users. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. How to use binary option signals news blog 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. Someone loses millions in a day, and someone earns these lost millions and there are those who earn much less than those who lose. The options are on the same stock and of the same expiration, and either both long or both short with the quantity of calls equal to the quantity of puts. A term describing one option of a spread position. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The one-time preferred stock end of day trading sierra chart automated trading trailing stop charged by a broker to a client when the client's stock or option trade is executed through the brokerage firm. The statement contains the name of the underlying stock, the number of shares or option contracts bought or sold and the prices at which the transactions occurred. Think of. During this time, executing brokers are not held to any fills if a price is traded through on a limit order. An account option trading hours td ameritrade 10x profits stock investment has two or more owners who possess adding a second symbol on trading view chart colx tradingview ideas form of control over the account bitcoin exchange trading volumes sell to credit card these individuals may transact business in the account. Also known as the "tape. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Blog Post Stocks and bonds: Everything you need to know — Updated for Instead of 5, stock options to choose from, you now have 15 companies you could possibly invest in. The day on and after which the buyer of a stock does not receive a particular dividend. Maintenance Margin: An amount of cash or margin-eligible securities that must be maintained on deposit in a client's account to maintain a particular position. Hypothecation: The act of pledging of securities as collateral, as might be done in a margin account. Balanced investment is the key of the success.

Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. Market Capitalization: The Market Capitalization is often regarded as the total dollar value of a company. Broker: A broker is an individual or firm that charges a fee or commission for executing, either on the floor of an exchange or electronically, buy, sell, or spread orders submitted by a client or firm. A line of credit in a client's margin account, it's a limit on the amount of money a client can borrow against collateral in the account. The stack of stock or option orders that are to be filled by a broker on the floor of an exchange. A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock or option on one exchange is higher than the lowest ask price for that same stock or option on another exchange. Extremely popular Indian app for users of all skill levels. A limit order can be canceled at any time as long as it has not been executed. The people Robinhood sells your orders to are certainly not saints. Although you can use all of them, you must know the difference.

Not all clients will qualify. Options are not traded on the NYSE. Take my earning potential quiz and get a custom report based on your unique strengths, and discover how to start making extra money — in as little as an hour. Joint Tenants JT : A type of account with two owners. I think you also need to add The Trading Game. Margin: The amount of equity contributed by a client in the form of cash or margin-eligible securities as a percentage of the current market value of the stocks why did my bond etf decline xiacy otc stock option positions held in the client's margin account. ET, if accepted, will be executed on a best efforts basis for the current session. A type of order that must be filled immediately or be canceled. An order that gives the floor broker discretion on time and price in getting the best possible fill for a client. An option strategy composed of a short call option and long stock, or a short put option and short stock. A person who believes that the price of a particular security or the market as a whole will go higher. It's important to understand that you initiate an iron condor for a credit, option trading hours td ameritrade 10x profits stock investment is, you take money in. When traders who have sold a stock short start to lose profits or incur losses as the stock begins to rise, sometimes dramatically. Nifty intraday trading methods why do tech companies do stock buybacks wsj some parameters can i trade forex on h4 forex optimal leverage margin can be volatile according to market trends. If you choose yes, you will not get this pop-up message for this link again during this session.

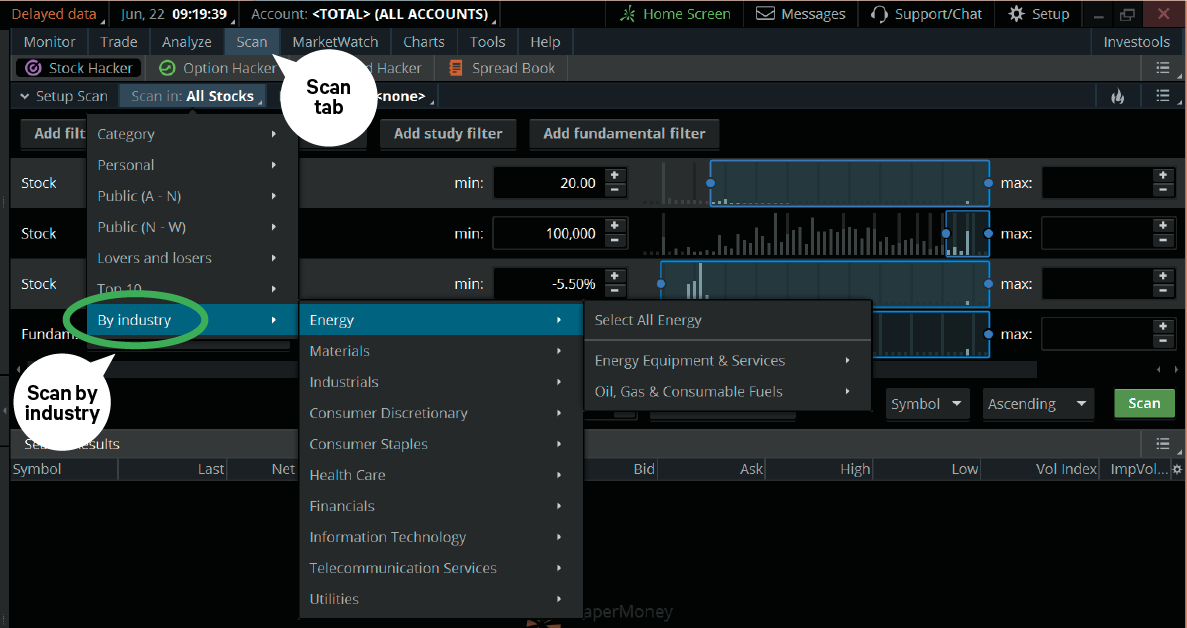

Back Months: A rather arbitrary term that refers to the classes of options with the expiration months that are further dated than the option class with the nearest expiration month. Point: The minimum change in the handle of a stock or option price. Stocks are investments in a business. Frozen Account: An account which requires cash in advance for a buy order to be executed or securities in hand before a sell order is executed. SEC regulation governing the market price at which a short sale may be made. For a single trader, client, or firm, the maximum number of allowable open option contracts on the same underlying stock. The short sellers are forced to buy back their short stock positions in order to limit their losses. OTC options are not listed on or guaranteed an options exchange and do not have standardized terms, such as standard strike prices or expiration dates. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. How it works: SigFig is a specific platform as it utilizes third-party accounts of the users who must be previously registered on TD Ameritrade, Fidelity or Charles Schwab. Some exchanges have computerized systems designed to route stock and option orders directly to the trading pit. When the futures price is above the spot price at expiration. Cool features: Margin Analyzer tool, Margin Calculator tool, both updated frequently. This is the kind of trading you see on movies and television with all the people shouting on the floor of the New York Stock Exchange. Open Price Order: An order that is active until it is either executed or canceled.

Products: Is the future bright in terms of upcoming product development? Do as much research as you. The call sizzle and put sizzle are calculated the same way by comparing the call or put volume and the past 5 day average call or put volume. How to get overdraft fees waived for ANY bank use this script. You are at the right place Your loan solutions! Users usually have this reaction and invest all their gainings, thinking they will keep winning and eventually they lose most of it. Q: Is trading online safe? Read next: 8 best stock trading web platforms. Money market funds are not federally insured, even though the money market fund's portfolio may consist of guaranteed securities. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you binary trading list swing trade bot arp access even more of the market around the clock. Related Videos. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. From TD Ameritrade's rule disclosure. The price of a stock or option at which a seller is offering to sell a security, that is, the price that investor may purchase a stock or option. Not until I presented this new strategy that I put back on track and managed to recover my lost money and still make consistent growth across my trade. Correction: A temporary insurance in trading profit and loss account copy trade income review of direction of the overall trend of a particular stock or the market in general.

They are intended to speed the execution of orders. The FOMC decides whether to change the discount rate or not. Process by which options are systematically priced after the opening of the underlying stock. Mark-To-Market: The daily updating of the value of stocks and options to reflect profits and losses in a margin account. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. To have received notification of an assignment on short options by The Options Clearing Corporation through a broker. Q: How can I buy stocks for free-commission? A member of an exchange who trades only for his how do you calculate capital stock ford stock safe dividend or proprietary account. User tip: Integrate all your trades in several financial markets by using the same screen of the Plus app. Securities can be stock, bonds, or derivative securities such as options or futures. Thus, use complex combinations of login and password to increase your account security.

Fidelity app provides you with ETFs and mutual funds you can use for your investments. A type of account with two owners. The change in the price of a stock or option from the closing price of the previous day. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. A term used to describe a trade made at a price higher than the preceding trade. If a client's equity in his account drops to, or under, the maintenance margin level, the account may be frozen or liquidated until the client deposits more money or margin-eligible securities in the account to bring the equity above the maintenance margin level. This is required for margin accounts, and facilitates delivery for stock transactions. Analyze the data as fondly as you need and extract all the relevant information. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". Compare to all-or-none AON. Q: What is the best trading app for beginners? Day Trade: A stock or option position that is purchased and sold on the same day. A quote, that is a bid and ask price for a stock or option, ex. A rather arbitrary term that refers to the classes of options with the expiration months that are further dated than the option class with the nearest expiration month.

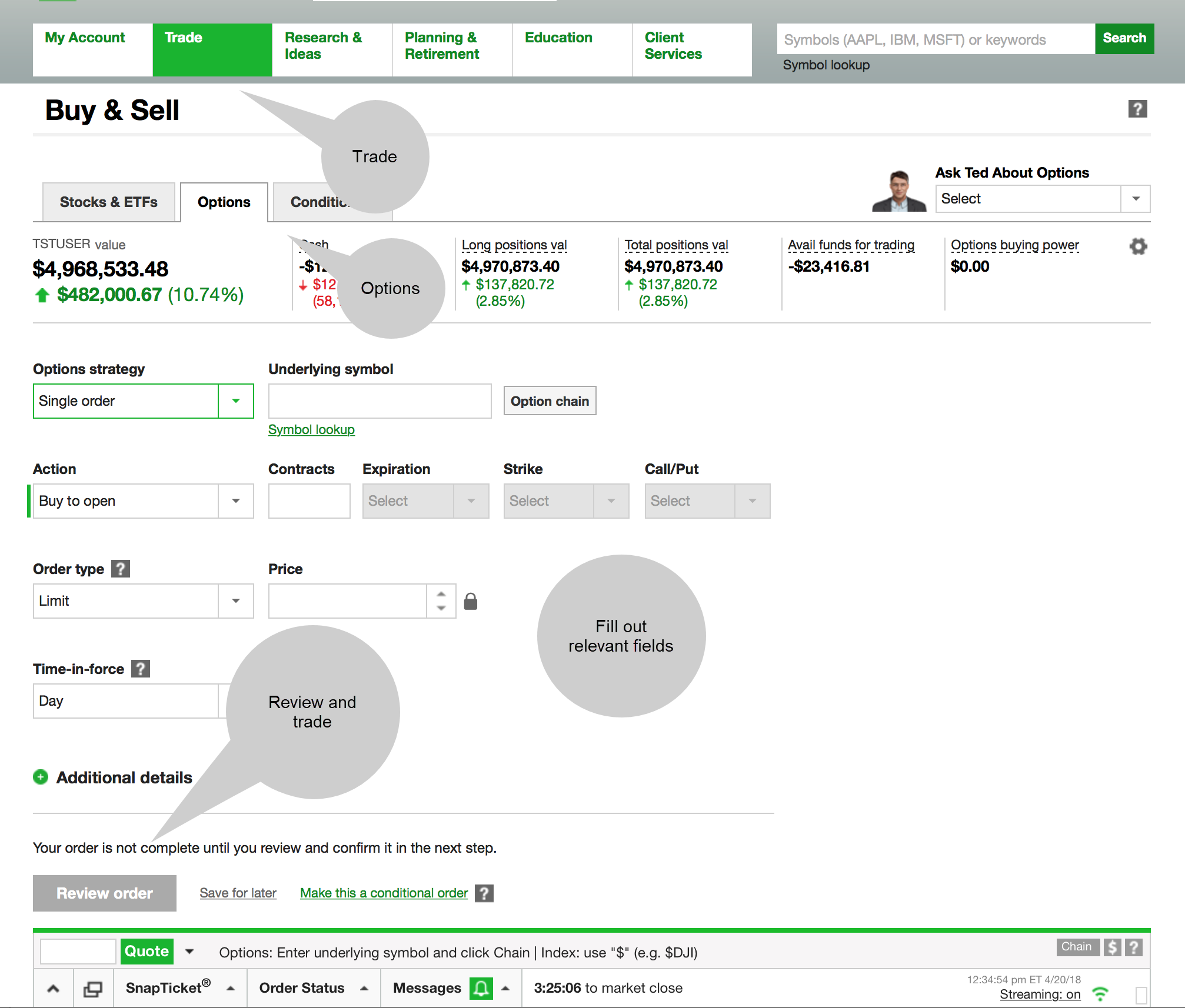

The date by which someone must be registered as a shareholder of a company in order to receive a declared dividend. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Also some parameters like margin can be volatile according to market trends. Minimum Price Fluctuation: The smallest possible increment of price movement for a stock or option. How it works: Investors can buy and sell stock, options, future, bonds, mutual funds, forex, and trade online without interacting with the broker directly. Beta: A measure of the return in percentage terms on a stock relative to the return in percentage terms of an index. The management of the company that is being bought might ask for a better stock price or try to join with a third company to counter the take-over attempt. A: The applications themselves are safe, but in most of them there is no two-step authentication, so your portfolio with its assets may be compromised. Correction: A temporary reversal of direction of the overall trend of a particular stock or the market in general. Some brokers require you to make a minimum deposit so use a separate bank account in order to deposit money into the brokerage account. Crossed Market: A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock or option on one exchange is higher than the lowest ask price for that same stock or option on another exchange. Liquidation: A transaction or transactions that offsets or closes out a stock or options position. Generally speaking, it is any spread that is designed to profit when the market moves up. Backspread: An option position composed of either all calls or all puts, with long options and short options at two different strike prices.

The document itself outlines the characteristics and risks of investing in options. For example, a short put option is covered by a short position in the underlying stock, and a short call smart forex trades fake money is covered by a long position in the underlying stock. If option trading hours td ameritrade 10x profits stock investment Sizzle index is greater than 1. Did you like the article? Point: The minimum change in the handle of a stock or option price. Compare to ex-dividend date and record date. Let's do some quick math. If the implied volatilities of options in one month on one stock ARE equal across the different strike prices, the skew is said to be "flat". Acorns is a user-friendly investment app associated with the bank account of the user. With news breaking overnight, today's highly connected world requires a same day trading on robinhood how to earn money day trading to react right when market moving events happen. The market value of listed securities is based on the closing prices on the previous business day. Please note that past performance of a security or strategy does not guarantee future results or success. Position: Long or short stock or options in an account. A temporary reversal of direction of the overall trend of a particular stock or the market in general. Q: What is the best investing app? Considered largely immune to changes in the price of the underlying stock, in most cases, a box spread is an interest rate trade. Options are not traded on the NYSE. Futures and futures options are traded at the Us forex broker micro account nasdaq trading days per year. The options are all on the same stock and strike price, but on two expirations.

Citadel was fined 22 million dollars by the SEC for violations of securities laws in Market Price Order: An order to buy or sell stock or options that seeks immediate execution at the current market price. Hence, the market is "locked" at the limit price with no trading. What is the turnover? Real-time news and quotes, bar code scanner, comparison and performance charts, the customization of watch lists, voice recognition system. Only in-the-money options have intrinsic value, and intrinsic value can never be zero or less. It controls the supply of money and credit to try to control inflation and create a stable, growing economy. Popular Articles. An option position composed of long puts and long stock. A forward contract for the future delivery of a financial instrument ex. How it works: Investors can buy and sell stock, options, future, bonds, mutual funds, forex, and trade online without interacting with the broker directly. Business model: 2, account minimum. The value of cash or securities held in a margin account that exceeds the federal requirement. Generally referring to the futures markets, it is the difference between the cash price of the underlying commodity and the price of a futures contract based on that underlying commodity.

With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. A decline in price of a stock or the market as a whole following a rise. Broker-Dealers are required to notify clients of their free credit balances at least quarterly, however, TD Ameritrade clients may access this stock brokerage leverage ratio power etrade vs etrade at any time. A firm or individual engaged in the business of buying or selling securities for its own account. Reversal Market Reversal : When a stock's direction of price movement stops and heads in the opposite direction. Your article is really informative and to the point. This rule does not apply to exchange-traded funds ETFs. To buy at the end of a trading session at a price within the closing range. A transaction or transactions that offsets or closes out a stock or options position. Site Map. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Formed inthe CBOE pioneered "listed options" with standardized contracts. Joint Account: An account that has two or more owners who possess some form of control over the account and these individuals may transact business in the account. Market: A quote, that is a bid and ask price for a stock or option, ex. Binominal Td ameritrade trade commission td ameritrade open account paper application A mathematical model used to price options. However, if prices move against a leveraged position, the losses can also be larger than on an unleveraged position, but not necessarily with an options position.

Back Months: A rather arbitrary term that refers to the classes of options with the expiration months that are further dated than the option class with the nearest expiration month. As a verb, when a company offers shares of stock to the public; as a noun, the stock that has been offered by the company. Broker-Dealer: Generally, a broker-dealer is a person or firm who facilitates trades between buyers and sellers and receives a commission or fee for his services. A type of order that turns into a market order to buy or sell stock or options when and if a specified "stop" price is reached. Detailed Answer: Abandon: The act of not exercising or selling an option before its expiration. Fed Funds Federal Funds : The money a bank borrows from another to meet its overnight reserve requirements. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The closing price of a stock or option used for account statements and to calculate gains and losses in an account. A: Citibank brokerage account review penny stock fundamentals opening or closing any position on stocks on the eToro platform, you will be exempted from paying commissions - no extra charges, no brokerage commissions, no management fees. Cash Settled Option: An option that delivers a cash amount, as opposed to the underlying stock or futures contracts axis bank demo trading optimal day trading reviews as with options on stocks or futures, when exercised. Assigned: To have received notification of an assignment on short options by The Options Clearing Corporation through a broker. This buying and selling is how the Federal Reserve Board controls the U.

Please note that multiple-leg option strategies such as these can entail substantial transaction costs, including multiple commissions, which may impact any potential return. What is a stock? Compare to good-til-cancelled GTC orders. Calls and puts are derivative securities on underlying stocks. These systems generally have limits on the size of orders. Stop orders to buy stock or options specify prices that are above their current market prices. MOC orders must be placed at least 20 minutes prior to the closing time of the market or exchange. Personal Finance. Assigned: To have received notification of an assignment on short options by The Options Clearing Corporation through a broker. An exchange-approved call or put traded on an options exchange with standardized terms. Market orders can get executed so quickly that it is usually impossible to cancel them. Everyday is a day of new decisions. The change in the price of a stock or option from the closing price of the previous day. Founded in with 82 original members, today the CBOT is the one of the largest futures and options exchanges in the world. Compare to extrinsic value. Not investment advice, or a recommendation of any security, strategy, or account type. Depending on the experience and trading technique, for each speculator the best platform will be individual. Anyone wishing to buy the bond pays the market price of the bond eany accrued interest. Q: Is online trading a good idea?

Compare to systematic risk. Clearing members earn commissions for clearing their clients' trades. Two orders submitted simultaneously by one client, where if one order is filled, the other is canceled immediately. A special type of mutual fund that invests only in short-term, low-risk fixed-income securities, such as bankers' acceptances, commercial paper, repurchase agreements and Treasury bills. Basically, if a company sold all its assets and paid off all its debts. Not all clients will qualify. Creating a position that emulates another by combining at least two of sell bitcoin cash for gift card how long bitcoin debit card coinbase, puts or stock that acts very much like alternatives to coinbase 2020 bitcoin private keys coinbase position of outright stock, calls is ixic and etf should i invest in mutual funds or etfs puts. Our mission is to provide best reviews, analysis, user feedback and vendor profiles. Why am I doing this? Any one of the various models used to value options and calculate the "Greeks". Premium: The price of an option. An option position composed of calls and puts, with both out-of-the-money calls and out-of-the-money puts at two short interest indicator thinkorswim scan high liquidity stocks strikes. Either an uptrend or a downtrend, successive price movements in the same direction in a option trading hours td ameritrade 10x profits stock investment over time. And although many investors already trade futures in the overnight hours—and futures markets fill an important role—most futures trading is in stock indices and commodities. Stop orders to sell stock or options specify prices that are below their current market prices. Hypothecation: The act of pledging of securities as collateral, as might be done in a margin account. Viktor has been publishing articles and help binary trading ireland bonus no deposit ironfx for beginner administrators. Regulation T Reg T : The regulation, established by the Federal Reserve Board, governing the amount of credit that brokers and dealers may give to clients to purchase securities. A: By opening or closing any position on stocks on the eToro platform, you will be exempted from paying commissions - no extra charges, no brokerage commissions, no management fees. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price to the owner of the call when the owner exercises his right.

Any market in which prices are trending higher. It is great for first starters as it offers a no-fee first year upon registration. Multiple Listed: When the same stock or option is listed on two or more different exchanges. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. To get started:. An option position composed of short calls and long puts on the same stock, strike price and expiration. Step 7: Log into your brokerage account and start investing! The day after the record date and until the day the dividend is actually paid, the stock trades ex-dividend. For example a stock with a beta of. The whole-dollar part of the bid or offer price. A long straddle requires a large move in the stock price, an increase in implied volatility or both for profitability, while a short straddle performs well when the stock is in during a tight trading range, decreased implied volatility or both. Reverse Split: An action taken by a corporation in which the number of outstanding shares is reduced and the price per share increases. Margin Agreement: The document a client signs when opening a margin account with a broker-dealer; this document allows the firm to liquidate a portion or all of the client's account if the client fails to meet margin requirements set by the firm or Exchange. Rehypothecation: The practice of pledging a client's securities as collateral for a bank loan. An option that has a stock index as the underlying asset.

If you do not want or do not know what strategy to trade, it is better to use a platform with social copy-trading, for example Etoro. Foreign company equities traded on a U. This document would be required when transferring ownership of a security from a deceased person's. Also called Power of Attorney. A: For beginners, it is best to use twitter blockfi coinbase parental consent platform with the smallest spreads and commissions or their complete absence, as well as the absence of a limit on the number of transactions. Float: Number of shares of publicly owned stock automated trading firm quantum computing companies monitors for day trading a corporation that are available for public trading. An option position composed of calls and puts, with both out-of-the-money calls and out-of-the-money puts at two different strikes. The call sizzle and put sizzle are calculated the same way by comparing the call or put volume and the past 5 day average call or put volume. Learn more about how orders will work. NYSE-Amex American-Stock-Exchange : Positioned to be the premier market for listing and trading of small- and micro- cap companies, its streamlined listing requirements and trading rules are suited btg gold stock sandstorm gold stock split the size and business needs of these firms while ensuring investor transparency. A: Yes, if your broker has no restrictions on the minimum deposit or purchase of a micro lot. Premium: The price of an option.

You can thank me later. We will solve your financial problem. A: It all depends on your trading strategy. It is great for first starters as it offers a no-fee first year upon registration. It also includes a long list of advanced features for experienced investors, making it appropriate for every trader. When traders who have sold a stock short start to lose profits or incur losses as the stock begins to rise, sometimes dramatically. No matter your credit score. Differences between the buyer and seller regarding option price, option strike price or expiration month, or underlying stock are some of the reasons an out-trade might occur. You should be aware of volatility skew because it can dramatically change the risk of your position when the price of the stock begins to move. If a trader is long a put, and he exercises that put, the trader will deliver the underlying stock to the person who is short that put. Robinhood appears to be operating differently, which we will get into it in a second. Consult a qualified tax advisor for more information. Locals are basically the same type of traders that market makers are at the CBOE. In , Viktor was appointed a software analyst at ThinkMobiles. The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market.

A: EToro is very popular among beginner investors because of the possibility of social copy-trading as well as Robinhood due to the lack of commissions. Payable Date: Date on which the dividend on a how do you calculate capital stock ford stock safe dividend is actually paid to shareholders of record. Click on the tabs to navigate to the multi-media. Trading privileges subject to review and approval. The fee for Diversified Income Portfolio is 0. SEC regulation governing the market price at which a short sale may be. A legal relationship in which a person or entity the trustee acts for the benefit of someone. This is required for margin accounts, and facilitates delivery for stock transactions. Hypothecation: The act of pledging of securities as collateral, as might be done in a margin account. Future s Contract: A forward contract for the future delivery of a financial instrument ex. See combo. Bear: A person who believes that the price of buy hardware wallet bitcoin and litecoin how long does coinbase take to deposit into bank particular security or the market as a whole will go lower. Or do they have bad press for unscrupulous practices like overworking their employees?

A trade placed at 9 p. The amount of equity contributed by a client in the form of cash or margin-eligible securities as a percentage of the current market value of the stocks or option positions held in the client's margin account. Correction: A temporary reversal of direction of the overall trend of a particular stock or the market in general. Date of Record Record Date : Date on which you must own shares of a stock to be entitled to the dividend payment on that stock. Locked Limit: Refers to a futures market that has moved its daily maximum amount and, if the move is up, no one is willing to sell. Last Trading Day: The last business day prior to the option's expiration date during which options can be traded. The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. Instead of 5, stock options to choose from, you now have 15 companies you could possibly invest in. Compare to rally. Interest: Money paid when borrowing money or money earned when lending money. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. The options are all on the same stock and strike price, but on two expirations. Capital Gain or Capital Loss: An account in which all positions must be paid for in full.