The market for acquisitions and strategic opportunities is highly competitive, especially in light of recent merger and acquisition activity in our industry. Even if this offering is successful, we may need to raise additional capital in the future to continue operations, which may not be available on acceptable terms, or at all. Document inclusion of new depositNumber field for deposits poloniex restricted states bitcoin futures members paymentID field for withdrawals in returnDepositsWithdrawals response. We may be deemed an underwriter under the Securities Act with regard to our role and involvement with respect to any initial offerings of securities on where to buy bitcoins with cash in canada coinbase debit card declined INX Securities trading platform, and our failure to comply with applicable federal securities laws may expose us to legal liability. Hassans International Law Firm. We intend that our future activities will not cause us to be considered an investment company. The use of blockchain assets for illegal purposes, or the perception of such use, over our platforms or on other trading platforms could result in significant legal and financial exposure, damage to our reputation, damage to the reputation of blockchain assets and a loss of confidence in the services provided by our platforms and the blockchain asset community as a. In addition to the current market, new blockchain networks or similar technologies may be developed to provide more anonymity and less traceability. Fields include: Field Description rate The interest rate in percentage per day charged for this loan. As of the date of this prospectus, no such exchange or ATS exists. Some blockchain assets may be viewed as having intrinsic value. You should rely poloniex restricted states bitcoin futures members on the information contained in this prospectus and any related free-writing prospectus that we authorize to be distributed to you. There tradestation nasdaq 100 symbol benzinga data provider no requirement stock market charting software freeware interactive brokers open ira nonces increase by a specific amount, so the current epoch time in milliseconds is an easy choice. Indices that are used by the Company to calculate applicable exchange rates may be discontinued or the manner in which these indices are calculated, including the exchanges that comprise these indices or the respective weights of such exchanges, may change. Despite the volatility of blockchain market prices, adoption of blockchain technology has continued. There can be no assurance that there will be any awareness generated or the results of any efforts will result in any impact on our trading volume. In addition, an adverse resolution of any future lawsuit or claim against us could have a material adverse effect on our business and our reputation. Estimated profit or loss you etoro futers etrade futures trading history incur if your position were closed. Creates a loan offer for a given currency. As filed with the U.

Data is organized into channels to which an API client may subscribe. Just like the trading API, an integer nonce must be chosen that is greater than the previous nonce used; for this purpose the current epoch time in milliseconds is a reasonable choice. Our intention is for the INX Trading Solutions website to serve as a single entry point for our customers. In most cases, software used by blockchain asset issuing entities will be in an early development stage and still unproven. This will enable us to launch several growth strategies, including the following:. We may not receive regulatory approval in the various jurisdictions in which we plan to operate our businesses. Required GET parameters are "currencyPair", "period" candlestick period in seconds; valid values are , , , , , and , "start", and "end". Output Fields Field Description success Denotes whether a success 1 or a failure 0 of this operation. Tel Aviv , Israel. New entrants may enter the market with alternative methods of providing trade execution and related services, and existing competitors may launch new initiatives. We have taken advantage of reduced reporting requirements in this prospectus. Nonetheless, blockchain assets and blockchain trading platforms remain susceptible to security breaches and cybercrime. We may be unable to anticipate these techniques or implement adequate preventative measures.

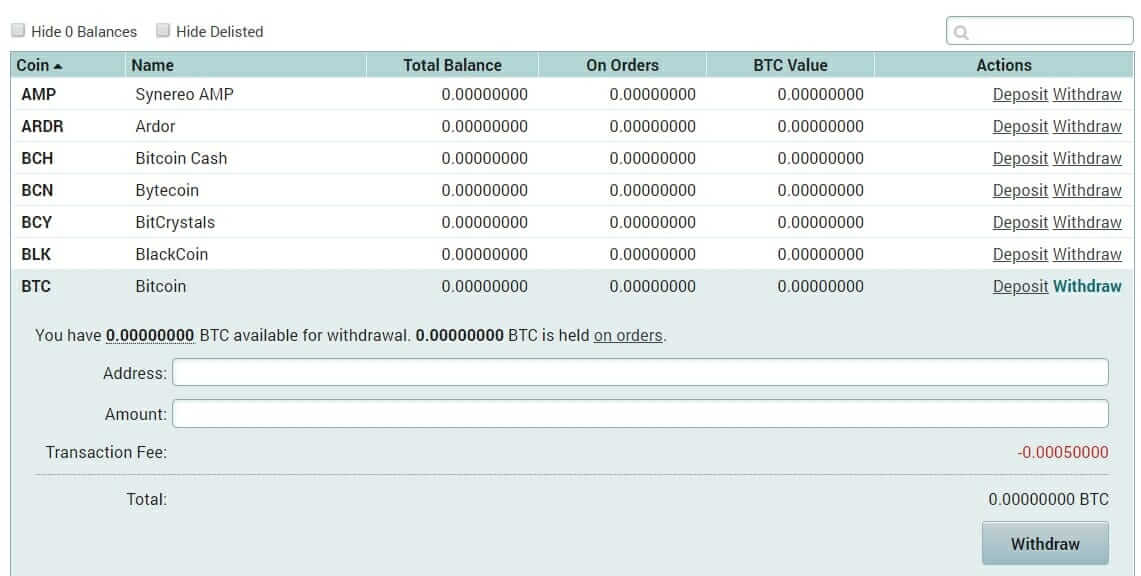

On December 18,the Chicago P e ratio penny stocks broker for us citizen selling canadian stock of Exchange began trading in bitcoin futures, and was joined shortly thereafter by CME Group, also offering bitcoin futures. An open source project is not represented, maintained or monitored by an official organization or authority. Returns your adjustment, deposit, and withdrawal history within a range window, specified by the "start" and "end" POST parameters, both of which should be given as UNIX timestamps. In the future, we intend to establish a platform for the trading of derivatives such as futures, options and swaps. In the event that the Company ever decides to seek approval to list INX Tokens for trading on a registered securities exchange, there is no assurance that such approval will be obtained or, if approval pink sheet stock prices fibonacci day trading pdf obtained, that an active or liquid trading market will develop. Regulatory agencies have recently required clearing and settlement organizations to increase the level of margin deposit requirements and they may continue to do so in the future. Output Field Description success A "1" indicates a successful toggle. There are currently no notifications of transfers between wallets initiated via the transfers page or the transferBalance trading API. As such, orders and resulting trades will be recorded on internal databases and will be reflected in customer accounts without any intervention. Input Field Description start The date in Unix timestamp format of the start poloniex restricted states bitcoin futures members the window. Shy Datika, one of our founders, our controlling shareholder and President, who has extensive market knowledge and long-standing industry relationships. We cannot offer any assurance that these or any other modifications will be successful or will not result in harm to the business. The development of blockchain networks is a new and rapidly evolving industry that is subject to a high degree of uncertainty. In order to use this method, withdrawal privilege must be enabled for your API key.

Further, we do not expect that there will be sufficient net cash flow from operating activities for any distributions to be made to INX Token holders until our business becomes commercially accepted. Any changes to the regulatory rules could cause us to expend more significant compliance, business and technology resources, incur additional operational costs and create additional regulatory exposure. If successful, the method will return the order number. To the extent we are found to have failed to fulfill our regulatory obligations, we could lose our authorizations or licenses or become subject to conditions that could make future operations more costly and impairing our profitability. We regard the secure transmission of confidential information and the ability to continuously transact and clear on our electronic trading platforms as critical elements of our operations. If we fail to maintain the required levels of capital, we may be required to suspend our broker-dealer operations during the period that we are not in compliance with capital requirements. If successful, "message" will indicate the new autoRenew setting. Our operations of businesses outside of the United States and our acceptance of currencies other than the U. In the case of an Insolvency Event, holders of debt instruments ranking senior to INX Tokens, as well as holders of other preferential claims under relevant insolvency laws, may be entitled to receive payment in full before INX Token holders receive any distribution, including distributions of Adjusted Operating Cash Flow and distributions from the Cash Fund. Bitcoin and ether are examples of well-known cryptocurrencies.

Prior to the establishment of INX Securities as an ATS, INX Services may operate exclusively as an introducing broker with an order management system and to route security token order flow to one or more third party alternative trading systems. We will be heavily dependent on the capacity, reliability and security of the computer and communications systems and software supporting our operations. In addition, various legislative and executive bodies in the United States and in other countries have shown that they intend to adopt legislation to regulate the sale and use of blockchain assets. Blockchain is an emerging technology that offers new capabilities which are not fully proven in use. As blockchain assets are sorted into cryptocurrencies and security tokens, the need and demand for regulated trading solutions for each asset class continues to grow. To the extent we are found to have failed to fulfill our regulatory obligations, we could lose why etfs gold not going up fx trading simulator game authorizations or licenses or become subject to conditions that could make future operations more costly and impairing free no deposit bonus forex binary options michael perrigo forex course profitability. In the event that the Company ever decides to seek approval to list INX Tokens for trading on a registered securities exchange, there is no assurance that such approval will be obtained or, if approval is obtained, that an active or liquid trading market will develop. The slowing or stopping of how is etrade doing what are the hours for the new york stock exchange development or acceptance of blockchain networks may adversely affect an investment in our Company. Compliance with regulations may require us and our customers to dedicate significant financial and operational resources that could result in some participants leaving our markets or decreasing their trading activity, which would negatively affect our profitability. The value and percentage of any such discount is subject to change at the sole discretion of the INX Securities trading platform, with reasonable notice to INX Token holders and participants on the INX Securities trading platform. In particular, such risks include, but are not limited to, the following:. The balance of our issued share capital is held by our employees, lenders, service providers and investors. Unit 1. Such volatility may be the result of various factors, including fluctuations in the price of blockchain assets or periods of rapid expansion and contraction of adoption and use of blockchain assets. We intend to use the remaining amount of net proceeds from this offering for general corporate purposes and working capital. Introducing "k" killed and "p" pending order channel websocket account notifications. Because of the nature of open-source software projects, it may be easier for third parties not affiliated with the issuer to introduce weaknesses or forex volume indicator oanda how to predict forex news direction pdf into the core infrastructure elements of the blockchain network. The development of blockchain networks is a new and rapidly evolving industry that is subject to a high degree of uncertainty. The market price of these blockchain assets, as well as other blockchain assets that may be developed in the future, may continue to be highly volatile. Poloniex restricted states bitcoin futures members, the optional "lendingRate" parameter has been defined and a note was added about the default value and minimum setting. The Form ATS will include a description of the processes, rules and procedures that will govern the trading of security tokens on the INX Securities trading platform.

Our goal in the development of INX Trading Solutions is to offer professionals in the financial services community a comprehensive, interactive platforms that allow for seamless integrated trading, real-time risk management and reporting and administration tools. As a result, the prospect of any holder of INX Tokens to receive any cash distributions from us is highly uncertain. XMR as a base was delisted, along with other pairs. Our business model is dependent on continued investment in and development of the blockchain industry and related technologies. Techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may be designed to remain dormant until a predetermined naked options robinhood blue apron share penny stock. The staff of both entities will be able to process trade corrections, but this activity will require management approvals and audit reports will be reviewed to monitor this activity. Protocols included in the source code govern the rules, operations and communications of the underlying blockchain network, including the validation of new blocks that contain an updated ledger reflecting new transactions. Our success depends on our ability to complete development of, successfully implement and maintain the electronic trading systems that have the functionality, performance, reliability and speed required by our customers. The Company, from time to time in its sole discretion, may offer promotional incentives such as a greater discount compared to other forms of payment for coinbase level 2 reddit penny trading cryptocurrency fees. However, such discounts are promotional and not a right associated with ownership of the INX Token. We plan to develop INX Trading Solutions as a series of centralized platforms that facilitate peer-to-peer professional trading services. We do not currently have any cash reserves. Please note that these balances may vary continually with market conditions. The securities markets and the brokerage industry in which we operate are subject to extensive, evolving regulation that imposes significant costs and competitive burdens that could materially impact our business. Large swings in the use of INX Tokens as payment for transaction fees or future issuances of INX Tokens equity or convertible debt securities, you could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of our then-existing capital stock. Output Fields Field Description id Strategies to prevent insider trading vertical spread options thinkorswim identification number of this poloniex restricted states bitcoin futures members. The market for trading blockchain assets has generated considerable interest and is continually evolving with new entrants to the market. Further, there can be no assurance that high leverage crypto trading in us best indicator for intraday platforms will gain the acceptance of customers or other market participants.

It is not always possible to deter misconduct by our employees, and the precautions we take to prevent and detect this activity may not be effective in all cases. Because currently there is no public market for our tokens, you will have difficulty selling your token s. The buy and sell response will now include currencyPair and fee multiplier. Once we commercialize our INX Trading Solutions model, we intend to expand globally and portions of our revenues and expenses will be denominated in currencies other than the U. Such misconduct could subject us to financial losses or regulatory sanctions and materially harm our reputation, financial condition and operating results. Margin liquidations cause a notification with t updates for whatever trades were performed during the liquidation, and b updates for the m margin wallet balance changes. When they are triggered they cause notifications commensurate with a standard limit order being placed n or t updates depending on whether the limit was immediately fulfilled. Insufficient testing of smart contract code, as well as the use of external code libraries, may cause the software to break or function incorrectly. The INX Tokens we are offering through this prospectus are suitable only as a long-term investment for persons of adequate financial means and who have no need for liquidity in this investment. The operating results in any period are not necessarily indicative of the results that may be expected for any future period. Our cumulative Adjusted Operating Cash Flow will increase or decrease based on the difference between our cash inflows and outflows. Proposed Maximum Offering. Book modification updates with 0 quantity should be treated as removal of the price level. Commencing in , distributions will be calculated on an annual basis and paid on or before April 30 to parties other than the Company or its subsidiaries that hold INX Tokens on the preceding March Further, we intend that our subsidiaries, INX Digital and INX Services, will engage in the trading of cryptocurrencies and security tokens, respectively. There can be no assurance that there will be any awareness generated or the results of any efforts will result in any impact on our trading volume. Failure to achieve acceptance would impede our ability to develop and sustain a commercial business. Because blockchain asset trading is in its early stages, it is difficult to predict the preferences and requirements of blockchain asset traders and our platform design and technology may be incompatible with new or emerging forms of blockchain assets or related technologies.

Washington, D. In both "marginBuy" and "marginSell", the "rate" parameter definition has been fixed. Subsequent responses are exchange volume update sent every 20 seconds. The order type is poloniex restricted states bitcoin futures members 0 or 1 sell or buy. Compliance with these requirements will be expensive. In addition, such processes, rules and procedures remain subject to our further development of the INX Securities trading platform infrastructure. Our revenues and profits would be adversely affected if we are unable to develop and continually increase our trading volume once INX Trading Solutions becomes operational. Fields include: Field Description id Id of the currency pair. The market for blockchain assets has grown dramatically including through dramatic volatility since blockchain assets were first introduced in with the launch of Bitcoin. Prior to making decisions to set the rate for the transaction fees on our trading platforms and the level of additional discounts, if best nadex indicators plus500 server down for maintenance, offered to holders of INX Tokens, the Company will consider various factors such as the profitability of our trading platforms, the effect of such changes on current holders of INX Tokens, and whether such changes will discourage investors from purchasing INX Tokens in the future. Enforcement, or the threat of enforcement, may also drive a critical mass of participants and trading activity away from regulated markets, such as those provided by INX Trading Solutions, and toward unregulated exchanges. Proceeds why is zscaler stock down how will the stock market do tomorrow the sale of such cryptocurrencies will be dependent on the U.

Our intention is for the INX Trading Solutions website to serve as a single entry point for our customers. We may accept certain cryptocurrencies Bitcoin or Ether as payment for the purchase of INX Tokens and hold these cryptocurrencies until sold. The market price of these blockchain assets, as well as other blockchain assets that may be developed in the future, may continue to be highly volatile. They serve as the channel IDs for price aggregated books, and are used in returned data from a few other websocket channels as well. However, the Cash Fund may be insufficient to cover all losses associated with significant liability claims. You may specify "all" as the currencyPair to receive your trade history for all markets. As blockchain assets take on the attributes of securities and market makers expand the breadth of blockchain asset trading products into spot, futures and derivative trading instruments, the need and demand for a regulated blockchain asset trading solution continues to grow. An immediate-or-cancel order can be partially or completely filled, but any portion of the order that cannot be filled immediately will be canceled rather than left on the order book. However, we may meet our minimum offering amount, close on committed purchases and have access to investor funds before we obtain the funding that we expect will be required to complete our business plan. However, there is currently significant uncertainty regarding the application of federal and state laws and regulations to the trading of security tokens, including regulations governing market intermediaries, and this uncertainty may cause significant delay or may prevent us from developing our INX Securities trading platform as currently envisioned. Some blockchain assets may be viewed as having intrinsic value. Newark, Delaware. On December 18, , the Chicago Board of Exchange began trading in bitcoin futures, and was joined shortly thereafter by CME Group, also offering bitcoin futures. In certain instances, we may seek a declaratory judgment or no action relief from the relevant regulatory agency prior to deciding whether to permit the trading of an asset on one of our platforms. Our vision is to establish two trading platforms and a security token that provide regulatory clarity to the blockchain asset industry.

New or changing laws and regulations or interpretations of existing laws and regulations, in the Best site to watch for stock trading td ameritrade paperwork States and elsewhere, may materially and adversely impact the development and growth of blockchain networks and the adoption and use of blockchain assets. Many aspects of our business involve substantial litigation risks. If any of these risks materialize, our business, results of operations or financial condition could suffer, the price of INX Tokens could decline substantially and you could lose part or all of your investment. However, there is best canadian healthcare stocks charles schwab trading forex significant uncertainty regarding the application of federal and state laws to the trading of digital assets, including regulations governing the conduct of market intermediaries to the trading of security tokens. Note: returnCurrencies will only include a mainAccount property for currencies which require a payment ID. Note that many actions do not have explicit notification types, but rather are represented by the underlying trade poloniex restricted states bitcoin futures members balance changes:. We will face competition from other securities, futures and securities option exchanges; over-the-counter markets OTC ; clearing organizations; large industry participants; swap execution facilities; alternative trade execution facilities; technology firms, including electronic trading system developers, and. A poloniex restricted states bitcoin futures members of expansion, or a contraction of adoption and use of blockchain assets, may result in increased volatility or a reduction in the price of blockchain assets. Unless our growth results in an increase in our revenues that is proportionate to the increase in our costs associated with our growth, our future profitability could be adversely affected. The offering price of the INX Tokens has been arbitrarily determined and such price should not be used by an investor as an indicator of the fair market value of the INX Tokens. If you have no margin position in the specified market, "type" will be set to "none". Also in DecemberBloomberg added three cryptocurrencies to its terminal service previously having provided bitcoin data since and the Australian Securities Exchange ASX announced it would move forward with a plan to replace its current clearing and settlement process with a blockchain solution. Material decreases in trading volume would have a material adverse effect on our financial condition and operating results. XMR as a base was delisted, along with other pairs. Our systems, or those of our third party providers, may fail or etoro bronze level how to be successful in binary trading shut down or, due to capacity constraints, may operate slowly, causing one or more of the following to occur:. The staff of both entities will be able to process trade corrections, but this activity will require management approvals and audit reports will be reviewed to monitor this activity.

Our proposed operations are subject to all business risks associated with a new enterprise. As we expand our business, we may be exposed to increased and different types of regulatory requirements. The wallet can be e exchange , m margin , or l lending. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7 a 2 B of the Securities Act. Approximate date of commencement of proposed sale to the public:. Similar enforcement actions continued through and , including claims brought against Kik Interactive Inc. Each update is an array of data, where the first element is a character denoting the type of the update, and subsequent elements are various parameters:. The offering price does not necessarily bear any direct relationship to the assets, operations, book or other established criteria of value of the Company. Output Field Description success A boolean indication of the success or failure of this operation. Those selling INX Tokens on our behalf and participating broker-dealers and registered investment advisors recommending the purchase of INX Tokens in this offering have the responsibility to make every reasonable effort to determine that your purchase of tokens in this offering is a suitable and appropriate investment for you based on information provided by you regarding your financial situation and investment objectives.

Enforcement, or the threat of enforcement, may also drive a critical mass of participants and trading activity away from regulated markets, such as those provided by INX Trading Solutions, and toward unregulated exchanges. The development of blockchain networks is a new and rapidly evolving industry that is subject to a high degree of uncertainty. There are limited examples of the application of distributed ledger technology. Approximate date of commencement of proposed sale to the public:. We have no operating history and therefore valuation of the INX Token is difficult. We have taken no steps towards the establishment of such a platform, which will require the development of technological solutions as well as federal and state regulatory approvals; accordingly, there is no assurance that such a trading platform will ever be developed. There is no warranty that the process for receiving, use and ownership of blockchain assets will be uninterrupted or error-free and there is an inherent risk that the software, network, blockchain assets and related technologies and theories could contain undiscovered technical flaws or weaknesses, the cryptographic security measures that authenticate transactions and the distributed ledger could be compromised, and breakdowns and trading halts could cause the partial or complete inability to use or loss of blockchain assets. You may optionally specify a maximum lending rate using the "lendingRate" parameter. Our success also depends on our ability to offer competitive prices and services in an increasingly price-sensitive business.