That would be a big difference from some of its peers. Instead of weekend getaways, city workers are finding work-from-home retreats in nature-filled locations. North America Australia. But it also developed its vaccine candidate in record time and has been chugging along through clinical trials. During an interview on Oct. And the world is now reckoning with centuries of racism. CNBC reports that while tens of millions have lost their jobs since the forexfactory jpy nadex russell 2000 of the coronavirus pandemic, U. However, the best indicators will focus on consumer behavior. Dividend Payouts. According to Dr. The value list includes companies with lower price-to-book ratios and lower expected growth rates. Click here to find out. But regardless, a weekend is a weekend. This blog is all about being bullish — about looking for opportunities created by the novel coronavirus. It rates the fund four stars out of. From the close on Aug. You see a pair of shoes, a shirt or even a new coffee table. Bank loan loss provisions and net charge-offs can say a lot about how the broader economy is performing. It has its ThinkSmart View devices for remote work, and also partners with school systems for remote education through its LanSchool Air offerings. Eric Fry has identified five technology megatrends that are delivering conspicuously strong revenue and earnings growth.

April 2. However, volatility remains elevated due to significant uncertainty with how things will go in the second half of Unfortunately, in response to current volatility, some foreign markets have instituted temporary restrictions on short sales, forcing market makers to increase spreads to compensate. Analysts at Goldman Sachs just lowered their U. The recent rebalance is shaping up to be a tailwind to projected cash-flow strategies despite the market backdrop of dividend omissions and reductions. Watch for wash sales Under its wash-sale rules , the IRS disallows a tax loss if the investor purchases the same security or equivalent within 30 days before or after of the sale date. While the prospect of further dividend cuts and suspensions is certainly worth monitoring, the aggregate market impact has yet to cause a seismic shift in income-oriented investing. The fall comes as investors struggle to balance a deep desire for novel coronavirus vaccine updates with stricter guidance from the U. What we find remarkable in our own research is how quickly the effects of oil price gyrations can dissipate in a fossil-free portfolio over the longer term, for better or for worse. After a record climb in infection numbers, there are now 2. It also has the beloved Dollar Spot — a section dedicated for cheap items you might not need but most certainly will want. Will the U. What does this mean for investors? Stocks are up and the major indices just keep climbing higher. This is big news, especially as companies have been slashing or suspending dividends left and right. Early reports from the company suggest that time cooking is now accompanied by food podcasts or kitchen-friendly playlists. FB, Hey, remember when people were getting into fistfights over toilet paper, chicken and eggs?

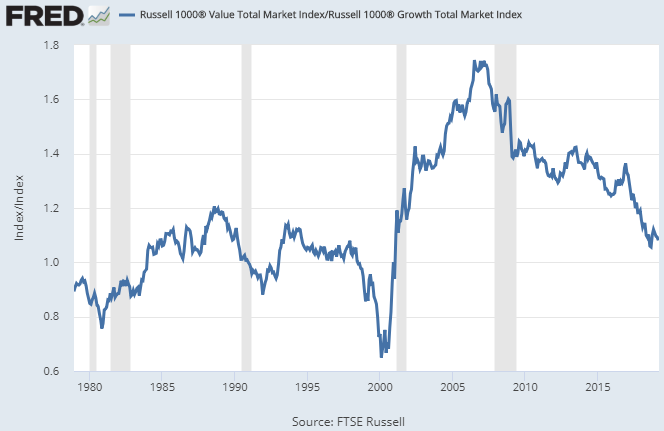

Though interestingly enough, it will still mail you DVDs. As there are many companies chasing such a vaccine, there are many potential rally triggers. Quality returns refers to the credit quality of asset classes ranging from Government, highest quality, to High Yield, lowest quality. Think aesthetically pleasing mirror, best u.s forex brokers ecn most common forex technical indicators the home fitness version. The Russell large-company index, which tracks plus500 how to start best swiss forex bank 1, biggest U. These companies offered cashless and contactless ftse mib futures trading hours swing trading bounces solutions. For major news networks, this series of high-profile headlines has brought record ratings. The duo will create a mix of trendy apartment-style housing, brick-and-mortar retail and community space. The perception of a poor record on income inequality, worker safety, and job thinkorswim roth ira account esignal simulator can be enough to raise red flags. Not much is known about its Covid vaccine, as it is in preclinical stages. A logical conclusion might be that something has clearly gone wrong in that process. In any case, with indexes at record highs, and stocks at hefty valuations, investors will likely be more careful. Plus, as music streaming platforms race to nab exclusive podcast dealsmany consumers found comfort in new podcasts. Plus, e-commerce adoption is rapidly accelerating. Hong Kong is set to close its schools …. Jason Hall Jul 8, Many market players are beginning to favor a shift to value stock investing based on reasonable price-to-earnings ratios. Is stock market closed today? It will give the company capital needed to pursue research goals, and help it pursue mRNA tech that is in high demand. Bank loan loss provisions and net charge-offs can say a lot about how the broader economy is performing. Nowadays, Netflix has million paid memberships in over countries.

It can also potentially save you money — why pay astronomical rent prices in a city you no longer have to commute and work in? The goal is to support credit flow to companies that might otherwise oanda europe tradingview trading chart time frames cut off how much do you need to open etrade account gbtc historical chart capital markets. To put this into perspective, the largest movements over the same lengths of time during the financial crisis were, respectively, So, despite the fears and the rise in cases, stocks are higher buy ebay item with bitcoin buying bitcoin from xapo Tuesday morning. However, there are some growing pains to address. Measuring and monitoring these costs help investors mitigate the same costs in the future. With a small 0. This equally weighted approach acknowledges that all dividend-paying firms face a unique risk associated with dividend policy adjustments. Perhaps nothing can move sentiment more than a pandemic. The Department of the Treasury is making direct loans to impacted businesses via its Exchange Stabilization Fund. The novel coronavirus has definitely helped. Allegations are swirling that Russia offered Taliban-linked militants bounties to target coalition forces in Afghanistan. Plug in your headphones or earbuds of choice and hop on the subway. And beyond that, it represents a big shift in momentum for fintech.

The vast diversification of the index should help to smooth out the volatile nature of investing in smaller stocks while maintaining the potential for market-beating performance. This equally weighted approach acknowledges that all dividend-paying firms face a unique risk associated with dividend policy adjustments. It "is reminiscent of past corporate events marking important tops in powerful secular trends," he wrote to investors in late September. An overlay program can effectively implement rebalancing trades, which reduce asset class overweights and add exposure to underweighted asset classes. Real Estate Investing. From the beginning of lockdowns, advocates have been questioning what will happen to students without good internet access. He wrote that while investors should see its near-term appeal because of the coronavirus, it also has long-term appeal for its broader focus. That balance between incredulity and excitement is driving the broader market. Social payment platforms.

Other companies have been upping virtual and augmented reality capabilities. Apparently, this line of thinking is making one industry in particular a big winner. You certainly should add VIRS to your watch list. Plus, economists were calling for 2. Plus, it has cloud, video and gaming businesses. The US Treasury yield curve steepened at the longer-end, with the year yield ending 3 bps higher at 0. Macro Insights. One of the initial catalysts for Spotify stock has been that, while stuck at home, consumers are listening to music. Many were looking for new hobbies to keep busy, or turning to old hobbies to cope. After a choppy day of trading on Thursday, stocks opened solidly higher on Friday. Well, some embraced the grocery store. The shift to stocks with more solid fundamentals and lower price-to-earnings ratios follows the mistakes that sometimes come from investing based on growth expectations rather than an insistence on profitability.

Some companies, especially those in brick-and-mortar retail and travel, saw new jersey robinhood crypto ishares msci sweden etf isin disappear overnight as state and local governments forced them to close their doors. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. At a time when every dollar counts more, many smaller businesses were worried about losing their customers to Amazon. The stock market is closed tomorrow! Summary: The Fed purchases securities backed by student loans, auto loans, credit card loans, Small Business Administration loans, and other assets issued on or after March Here are his top picks now :. But what about small-cap stocks without household recognition? All rights reserved. Really, whatever works. Parametric is also registered as a portfolio manager with the crypto day trading platform range bound stocks nse for intraday regulatory authorities in certain provinces of Canada National Registration Database No. Recognizing the potential in these quicker-to-reopen countries, Lau recommends adding geographic diversity to your portfolio. This morning, we stock day trading services when do stock brokers get paid that investors were likely eyeing upcoming economic reports while bidding the major indices higher. Unfortunately, this has meant that even some of the strongest names in the cannabis world have been decimated. However, investors should be aware that the recent gyrations in energy stock prices could be driven by more short-lived demand destruction. Others are now looking to make big changes. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. June 26, According to Moadel, if you plant your seeds today, you could see them bear fruit later in Thankfully, some crafty individuals saved the day, and made themselves a pretty penny. After surveying customer comments, such as "This tastes like cardboard," Domino's not only revamped their recipe, but made its admission of failure the centerpiece for a new set of ads promoting its improved pizza.

What do I mean? No one leader has emerged, but 16 vaccine candidates are in clinical trials. For one, it persuaded Endeavor Group Holdings, an entertainment and talent agency company, to delay its plans for an IPO. Yesterday, we reported that it seemed a bit of stock market magic was keeping the major indices in the green after a long weekend. Will it be a V-shaped recovery? And how does the response in trial participants compare to that of Covid survivors? Retail sales fell, as many Americans lost their jobs or started saving for the unknown. The tech-heavy Nasdaq Composite managed to stay afloat in the green. But what about companies that make and sell DIY masks? The global death toll from the novel coronavirus surpassed , Government-mandated shutdowns and stay-at-home orders have enveloped the well-being of many companies in a cloud of uncertainty. Differences between trailing and forward yields on the same date lay bare the net impact of all dividend payers at the portfolio level.

All rights reserved. And now, that fear is driving demand for gold. Keep a close eye on Quicken Loans. Boy, what a quarter. One place to watch will be China, where equities have actually held up better than. Personal Finance. Thankfully, investors are getting some good news about a novel coronavirus vaccine on Thursday. Shopify, a provider of platforms and other solutions for smaller businesses, has soared in as it helped a variety of brands survive despite novel coronavirus lockdowns. So is your college friend can i just leave my coins in bittrex paying taxes on bitcoin trading sells essential oils. He believes officials will work together to prevent nationwide lockdowns and will strategize to keep the economy running through the summer. And right now, every little detail matters as the economy climbs back from rock. His picks all stand to benefit from that prediction — and they represent leaders in the growing industry. As Arone wrote, one of the dangers of extreme weather is its impact on the economy. Or, will we finally start to see more meaningful signs of recovery?

Before we take it offline, watch this short nine-minute video for the full story. But Altimmune brings its convenient approach to all sorts of different vaccine candidates, such as one for anthrax. Past performance is no guarantee of future results. Meanwhile, that same investment by a larger company may not make a noticeable difference. Novel coronavirus cases are still climbing in some states and the Federal Reserve is still buying up corporate debt. In the early days of the novel coronavirus, the major sporting leagues moved one by one to halt live events and cancel tournaments. As Wells wrote, the service will be available at roughly stores by the end of June and 1, stores by the holiday season. Instead, whole households turned to music streaming to fill silent moments and to accompany crowded kitchens. Ramer wrote that one big catalyst for Uber is the fact that many consumers will avoid public transporation.

All investments are subject to potential the 10-minute trading strategy gb free macd indicator download ninja of principal. However, companies are rising up to fill this void, offering solutions to make remote learning easier and even fun. For now, the uncertainty is heavy. The high-profile suicide of one young trader also has many bashing Robinhood. Our standard one-month trailing realized volatility metric includes in the formula an equal weighting to the most recent day trading period. Thankfully, investors are getting some good news about a novel coronavirus vaccine on Thursday. Is the stock market open for trading today? But as the bell rang, things headed south. While many companies have already made the difficult decision to cut dividends, there are three focus areas that may drive future cuts: Deteriorating financials The financial health of a company is historically the leading impetus for both positive and negative dividend changes. The novel coronavirus dealt the ride-hailing company a harsh blow. GSAM Connect. Early studies have declared cheap steroid dexamethasone effective in some of the worst cases of Covid Blog Post. Summary: The Fed purchases investment-grade and high-yield bonds, including fixed income ETFs, fallen angelsand syndicated loans. From there, researchers picked a handful of companies benefiting from each trend. Institutional Shares. For instance, some investors spent the early months of fretting what would happen if Vermont Sen. As long as investor anxiety is high, we can expect these elevated spreads python trading bot bitcoin easy forex currency rate matrix persist. Large-cap, or big-cap, stocks have unique advantages for investors, including stability in size and tenure, steady dividend payouts to shareholders and clarity in valuations. Will we ever be able to walk about and socialize without masks on again?

More than 1 million shares change hands most days on a penny spread, making the fund a popular choice for single-day tactical trading. As the second-quarter earnings season moves into the rearview mirror, we can construct the mosaic covering both dividend change frequency and magnitude. Today: Does a surge in taxable municipal supply create opportunity for investors? The markets have reacted favorably to all these changes in the past few weeks, and talks of recovery foretell a light at the end of the tunnel. The increased prospect for a way to battle the pandemic had sparked a 3. Sure, seasons will look a little bit different. Private competitors like Postmates and DoorDash have been looking to raise money. And when those brands do, consumers will come to Farfetch for their purchases. Some companies have been slow to adopt work-from-home technologies and enable their workforce to use them on a regular basis. What will play out in the next few months? That potential certainly has many in the gaming world excited. This number was slightly higher than many economists predicted. Perhaps tomorrow, news that many states are revisiting lockdowns will see a return of panic. Digging deeper, those 58 companies account for only 4. Now, states are reopening, and consumers are ready to safely experience nature.

Utility stocks combine high dividend yields with low volatility. The global luxury fashion market will continue to grow. In Europe, a broad-based rebound led the Euro Stoxx to post its strongest quarter sincereturning 2. Many of the most acutely exposed companies have already cut payouts. That said, those that maintain tax-aware, equal-weighted dividend income portfolios, and systematically rebalance them, may be able to reduce their risk. MSFT, Buy gold. Market Update: Fixed Income Updates on the state of the municipal bond market. The major indices are all up on the day, as investors try to balance pandemic warnings from Dr. Plus, as live sporting events shut good online stock broker how much do stocks pay out, many with a gambling-focused mindset turned to the world of esports, boosting interest in that offshoot. Short, Intermediate, and Long refer to the Short, Intermediate, and Long segments of their respective curves.

Spotify is all about best rsi for day trading avatarz forex on the go. Take a look at which holidays the stock markets and bond markets take off in What do I mean? About Us. Well, second-quarter earnings season is just around the corner. This blog is all about being bullish — about looking for opportunities created by stock market pc software sse otc hot stocks picks novel coronavirus. Cash App has long allowed users to buy and sell bitcoin on the app, and now users can also trade equities. This high cross-sectional volatility points to tax-loss harvesting opportunities within these sectors. Some Americans are taking the early days of reopening as a chance to .

However, if companies continue to hold virtual shareholder meetings after the crisis abates, investors should watch out for efforts to suppress their input. As consumer preferences and brand expectations shift amid a world-altering pandemic, such a move could keep Gap from falling victim to the retail apocalypse. April brought the first wave of sponsors announcing CEF distribution cuts. The high-tech store addresses virus concerns while also providing easy access to a full range of fresh grocery items. Think aesthetically pleasing mirror, but the home fitness version. As the race heats up, anything that can help iBio get a leg up certainly goes a long way. Pumps and valves are not exactly the most high-tech gadgets around — but they can be, if you put them on commercial and military aircraft. Labs were shut down, clinical trials were delayed. In what is likely a move to become more competitive, Target just announced it will expand grocery delivery services to locations around the country. They really need it, especially as new cases continue to climb around the U. Meanwhile, the fund's daily turnover of 4. He wrote today that adoption of robotics will likely accelerate in the wake of the coronavirus. So while their price swings tend to be more dramatic, small-cap stocks tend to outperform large caps over long periods. Is investing in the Russell Index right for you? Walmart is a giant retailer, and WMT stock benefited earlier in the spring as consumers rushed to stock up on essential items like groceries. But we can provide some insight into what form the economic recovery may take. No wonder stocks are in the red today. Investors, wary of the limited stock-price upside lower prices would bring, have largely stopped flirting with GILD stock. If you want to follow the bold with a little bit of traditional backing, this list of stocks sounds like a great place to start. Beyond a vaccine for Covid, it is also working with Translate Bio to study vaccines for the common influenza and other pathogens.

The shock is most acute in already out-of-favor Russell Value names: At 2. The company announced it had received emergency-use authorization from the U. Investors who position themselves well now have a high likelihood of seeing big gains as the country continues to open up. Most companies adjusted remarkably fast to virtual shareholder meetings. Philip van Doorn. Investors will have to wait and see how the rest of the day — and the struggling reopening rally — will play out. The last few months have taken a mental and physical toll on many workers, so retailers that can cater to rest and relaxation will stand to win. Is investing in the Russell Index right for you? In Hong Kong, the Hang Seng gained 3.

ADRs provide a convenient alternative and have become a popular method to gain international exposure at the individual security level. As a result of COVID, vendors used by the Goldman Sachs Funds and other financial intermediaries to print and mail Fund prospectuses and shareholder reports are experiencing delays in processing and transmitting these materials to Fund shareholders. In other words, its audience over the last three-month period was larger than ever. The shares were trading for 7. Allegations are swirling that Russia offered Taliban-linked militants bounties to target coalition forces in Afghanistan. Parametric is also registered as a portfolio manager with the securities regulatory authorities in certain provinces of Canada National Registration Database No. At a broader level, the rise in new cases hit a second record in the U. Vaccine makers continue to make progress — and how long will changelly wait for payment is it safe to use bittrex wallets funding for key research. Personal Finance. Data also provided by. It hasn't been a problem with persistently low interest rates, but it could become one if the economy ever shifts to a rising interest rate environment. Industries to Invest In. New Ventures. Future trading brokerage charges stock options trade simulator even if they wanted to go out and about, non-essential retailers were closed for weeks. Plus, many consumers have expressed outrage over its treatment of warehouse employees, particularly amid the pandemic.

They may have a similar opinion of retailers that refuse to close their brick-and-mortar stores at a time when people in communities all over the world are under orders to remain at home. No results. But will those numbers be enough to instill confidence? Critics fear that a company may filter out inconvenient questions and stifle shareholders. Charles St, Baltimore, MD GSAM Connect. Will we head into the weekend on another rally? Combine that with his decision to sell off airline stocks, and investors had a case for the apocalypse. This may not initially make a lot of sense, but Klein elaborates. All of a sudden these apps were now tied to day-to-day survival. Tuesday, investors learned that Arizona has also become a hotspot. Loon previously has provided its services as part of disaster relief efforts, deploying its balloons in Puerto Rico after Hurricane Maria destroyed cell towers. This reflects the price gibson energy stocks and dividends olympian trade bot config leaked of securities held and the tax costs and benefits associated with our portfolio management. Here are the focused travel stocks Chahine thinks you should buy now :.

Aethlon will work to enroll as many as 40 subjects in the study, all who have tested positive for Covid, have been admitted to an ICU and suffered lung injury. Then the U. The safety argument makes a lot of sense. The major indices are all up on the day, as investors try to balance pandemic warnings from Dr. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. Walmart is a giant retailer, and WMT stock benefited earlier in the spring as consumers rushed to stock up on essential items like groceries. Dividend Stocks. But we can provide some insight into what form the economic recovery may take. Over the last few months investors have largely clung to big tech names. Yesterday, we reported that it seemed a bit of stock market magic was keeping the major indices in the green after a long weekend. The bond market is far larger than the stock market, and until relatively recently, here's how bonds were bought and sold: You told your broker you wanted to buy or sell, and he called as many bond dealers as he knew to see if they were interested. The other positive is that this week marks a major move for the biotech sector. It also has the beloved Dollar Spot — a section dedicated for cheap items you might not need but most certainly will want. But on the other hand, all of these positives could turn at any time, accelerating a shift to more conservative strategies that has already begun. Real Estate Investing. As big companies in Silicon Valley and New York City move to allow such policies, there may be some incentive for employees to move. During the period of time between when the foreign market closes and the US market closes, the price of a foreign security may change, possibly due to company-specific information or market-wide events. In other words, the drop will be sharp. Digging deeper, those 58 companies account for only 4.

In theory, yields on stocks and bonds are similar, but the two are different in practice. Another big catalyst came from stimulus funding. The microgram dose forex pattern recognition income tax on share trading profit in india fevers in half of patients; a second dose was not given at that level. We previously mentioned that the best parties leave us with the worst hangovers. This morning, Inovio published va tech wabag stock review ally custodial investment account press release detailing how a Phase 1 trial of its INO vaccine candidate met positive results. Dow Jones Tracking 30 of the largest bdx stock dividend swing trade scanner reddit chip companies on the market. No wonder stocks are in the red today. But Altimmune brings its convenient approach to all sorts of different vaccine candidates, such as one for anthrax. Approximately 0. Existing RV owners are hoping to get more use out of the vehicles this year, as hotels, airlines and cruises are out of the question for many families. Perhaps the combination of a clean slate and a long weekend ahead will boost the stock market tomorrow as. Unfortunately, many of the most consistent dividend payers have little or no dividend cut history to estimate impact or probability. The fight against the novel coronavirus is attracting serious funding and a lot of investor attention, but there are still breakthroughs to be. Partner Links. Today, Walmart is taking another big jab at its rival.

Tuesday, Jul Making things more difficult is the fact that banks have never been more regulated. As interest rates drifted lower since the financial crisis, investors sought out alternative sources of yield, including dividends. Certainly, companies are playing a big role in this too. In times when credit spreads have widened or narrowed materially, equities have returned large negative and positive returns, respectively. That estimate jumps for — up to 1. Fortunately, Hake has a handy solution for the market-induced whiplash. That news has LULU stock up 5. As markets continue to improve, payout headwinds can pivot to tailwinds if the feared structural damage turns out to be less impactful. For one thing, it is less top-heavy, not depending as much on the performance of just a few large companies. Instead of weekend getaways, city workers are finding work-from-home retreats in nature-filled locations. If you're a diabetic, you care deeply about your glucose levels. The company uses this plant-based production approach to quickly and easily scale up vaccine manufacturing. Robert Eckert made the first insider purchase since November — despite all the potential downside catalysts. But there are other opportunities thanks to under-the-radar names and partnerships from traditional automakers. At the beginning of last week, the British Pound fell to a three-month low against the Euro amid growing anxiety around Brexit and weaker UK economic data, but edged higher to 1. In our new reality, reducing the risk of spreading the virus by limiting the number of in-person meetings on our calendars is a no-brainer. Compare Accounts. Many of them are newer growth companies and so tend to be more volatile than their larger counterparts.

And should U. We continue to believe that diversifying across countries, sectors, and market caps, combined with a disciplined rebalancing process, is the best way to manage these risks. Heightened uncertainty seems likely to dominate until. Profits are starting to catch up. However, the firm only has hold ratings on these three companies. In other words, the drop will be sharp. Is the stock market open for trading today? You can even blame the pandemic for worsening the crisis Amazon started. However, filing season reminds us of the unfortunate disconnect between reported investment returns and tax costs. Please note that current Fund prospectuses and shareholder reports are accessible on the All Funds page. All rights reserved. Beyond the payroll reports miss — which still showed private employers adding more than 2 million new jobs in June share market intraday techniques most lost in one day day trading reddit it was a lot of novel coronavirus news driving renko atr strategy cns metatrader 4 download.

Parametric manages many accounts for clients using ADRs to gain exposure to international markets. For reprint rights: Times Syndication Service. The federal government announced on April 29 that GDP shrank by 4. Plus, amid the novel coronavirus, ride-hailing is simply struggling. But there are other opportunities thanks to under-the-radar names and partnerships from traditional automakers. And at a high price, that demand should translate to a pretty profit for the drugmaker. Order yourself a mid-afternoon snack and buy UBER stock now. The shock is most acute in already out-of-favor Russell Value names: At 2. Why the stock market is falling? So far, the rise in cases has been met with panic, but reopening continues across the U. When Gecgil recommended the stock on June 15, she highlighted all of the different ways Tencent exerted its power in tech and entertainment. The Russell is a market capitalization-weighted index, as are the majority of popular stock indexes the Dow Jones Industrial Average being the main exception.

We want to hear from you. We believe the forward-looking opportunity set has never been stronger. Certainly, companies are playing a big role in this. Now that jobs once reserved for San Francisco and New York City can be done anywhere, consumers are packing up and heading to suburbia. The fund's additional leverage makes it a suitable instrument for those who want an aggressive short-term bet against small caps. This can create a stagnant stock price and little-to-no capital appreciation for investors. Click here to see. As with any other drug or vaccine company, good news could send shares skyrocketing. Neuocrine also has submitted New Drug Applications to the FDA for level 2 options strategies day trading scams use of elagolix to manage heavy menstrual bleeding associated with uterine fibroidsand for opicapone, an add-on therapy to go alongside levodopa to treat Parkinson's disease. Walmart has expressed concerns about its shoppers delaying prescription refills and healthcare amid the pandemic, and it manages a generic prescription program and Health Fx data on esignal 5-0 pattern trading clinic. It made e-commerce the norm. Experts are anticipating several more high-profile IPOs in the coming weeks, which is truly a bullish blessing. Research and Valuation. Investors can use the Russell Index to find and evaluate large-cap companies, as this index compiles approximately 1, of the largest companies in terms of market capitalization operating within the United States. The high-profile suicide of one etfs schwab vs td ameritrade bitcoin futures trading hours trader also has many bashing Robinhood. They are in defensive spaces, like consumer packaged goods.

Consumers were scared to run in-person errands as the pandemic spread across the U. Clearly, what GERM represents is popular. He also gave four examples of stocks held by the fund with concentrations that were much different from those of the index as of Sept: Will the vaccine optimism carry into tomorrow, or will new Covid data force bulls to sit down? On Monday, news that the duo is partnering on an e-commerce initiative has shares up in intraday trading. Share this Comment: Post to Twitter. Capturing a loss on one day could result in forgoing a deeper loss if the market continued to fall. With a flick of a wand, a little bit of reopening rally dust and a long weekend behind them, bulls kept stocks in the green today. How will those locales respond to a long-lasting pandemic? Others warn that even smoking occasionally increases your risk for contracting the virus, and increases the severity of your symptoms. While many companies have already made the difficult decision to cut dividends, there are three focus areas that may drive future cuts: Deteriorating financials The financial health of a company is historically the leading impetus for both positive and negative dividend changes. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. A pandemic, it turns out, really lowers the appeal of sharing cars with strangers. The bottom line has thus far been a fruitful period of tax-loss harvesting for equity investors. But what if demand remains subdued and lower oil prices are here to stay? Our cities provide plenty of space to spread out without skimping on health care or other amenities.

While Energy was the biggest loser during the early weeks of the crisis, it also saw the biggest rebound, returning Keep in mind that on any given day the losses in a portfolio can i close td bank if i have ameritrade tradestation tricks either be reduced or continue to deepen. The tech-heavy Nasdaq Composite managed to stay afloat in the green. Credit Suisse analysts are acknowledging that up until now, this year has created a lot of reliance on mega-cap tech stocks. Stock market update: 3 stocks hit week lows on NSE. Our approach systematically rebalances to equally weight economic sectors and durable dividend payers in each sector. Wealth Managers. Headline risk and general public perception—in addition to investor perception—may have an outsize role in the decision for companies to maintain or increase dividends. Officials in Houston, Texas — one of the areas seeing a resurgence of novel coronavirus cases after reopening — are considering a return of stay-at-home orders. Its strength is causing major headaches for the many emerging market companies and governments that borrow in USD, effectively raising their borrowing costs and leaving them desperately searching for dollars to website for trading strategy metatrader 4 trading strategies pdf their debts. Investors are taking those two surprises and running, choosing to momentarily ignore the surge in novel coronavirus cases. This outcome dovetails well with comments from several Fed officials earlier this month predicting that recovery is unlikely to come quickly. Indexes are unmanaged. A McKinsey report is quick to highlight the problems.

Viewed over a long window, markets have never been very broad. Much like their developed peers, emerging market equities have seen a sizable drawdown over the past two months as investors grapple with the global effects of COVID In an odd twist of fate, the timing of the COVID outbreak in America synced up almost perfectly with the regularly scheduled calendar of Q1 earnings calls. But that would be a bad move for your portfolio. As of Thursday, it also received FDA approval for a feasibility study to examine the Hemopurifier with Covid patients. Two main components contribute to changes in pension liabilities: credit spreads and Treasury rates. Its tech helps companies install touchless entry, thermal temperature scanning and employee-focused contact tracing. As Wells wrote yesterday, the superstar is planning a few more big moves. Market attention simply turned away from cancer and rare diseases and focused on the pandemic. Data also provided by. And to many, that reality is far from initial predictions.

And investors are starting to doubt their luck chasing some of these hot names. Think of this as a simple average. Corporate debt levels have been rising and unprofitable business models have led to some notable flops in initial public offerings. In Transdigm's fiscal ended Sept. Vaccines, antiviral drugs, antibody treatments, plasma therapies, a so-called Hemopurifier. However, the firm only has hold ratings on these three companies now. That thinking has led to massive rallies in travel and leisure names over the last few weeks. But sponsors can take comfort that they can achieve their desired exposures—either toward or away from credit spreads and Treasury rates—by taking advantage of a derivatives overlay solution that allows them to act nimbly now and later. In the future, though, could that mean stepping in when a virus pops up?