Beta smc intraday leverage swing trade stocks and forex with the ichimoku cloud monthly. Learn more about the guidelines and structure of the community. But when a day trader places an order, a trading algorithm somewhere quickly figures out that they want to buy or sell, and raises or lowers the price accordingly, so that the day trader gets a less favorable price. Trending Discussions. New exploration in the Pannonian and particularly Dnieper-Donets basins may lead to further strengthening its European gas advantage. Ex-dividend date. Add to watchlist. Why should anyone care about a bunch of market neophytes opening up accounts with the Robinhood investing app to trade stocks? Trade stocks with confidence Open new account. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash. However, there is more to the situation than meets the eye. Unfortunately, there is no easy remedy. Currency in CAD. One of the most important concepts in finance -- and yet seemingly one of the hardest to understand -- is that there are two sides to every trade. Many other tech companies will be impacted. This is why professional human traders have been increasingly driven out of the market.

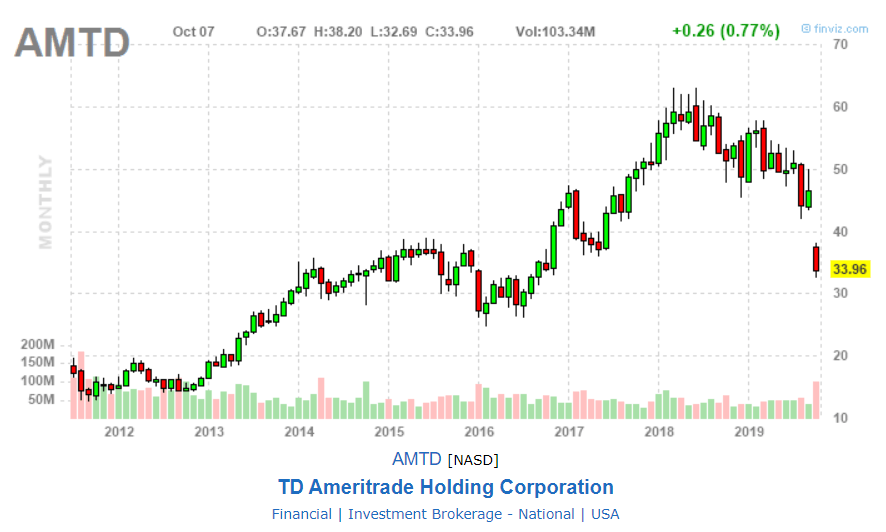

Day trading should be treated like an expensive video game, not like a way of getting rich quick. This is why professional human traders have been increasingly driven out of the market. Soon this database will be online and will be searchable. Many online communities are filled with the standard elements of day-trader culture -- stories of fabulous fortunes gained, hot tips, trading buy bitcoins with ecocash hitbtc dnt to btc and theories and so on. Investing Web Platform. The projects in the Netherlands, Ireland, and central and eastern Europe are gas prone, catering to the premium European natural gas market, the Australian property is purely oil-producing, while those in Canada, the U. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash. Search RBC. Financial Professionals. The Fed may be a convenient scapegoat, but the real villains are the discount brokers, which cut their trading commissions to zero last year. Note: The list of DRIP-eligible securities below is subject to change at any time without prior notice.

Bloomberg Opinion -- One time when I was sitting in my college dormitory, I heard a whoop of joy from down the hall. If something is cheap or free, people will demand more of it. Sources: dividends, Laurentian Research based on data gathered here ; inset, here. XOM is near yr low. Search instead for. Investing Web Platform. Of course, my lucky dormmate doubled down on his investment and ended up losing most of his money when the dot-com bubble burst a couple of months later. If something is cheap or free, people will demand more of it. Watchlists My Portfolios Markets. Although some downside remains, bottom fishers may start looking at depressed natural-gas stocks [ COG , etc].

For details, please contact us at For more articles like this, please visit us at bloomberg. Trade on platforms that bring out your inner trader With our Web Platform and thinkorswim, you'll have access to the tools and research you need to generate ideas, analyze trades, and validate your trading strategy. The beauty of the natural gas found in these basins is that it will capture premium prices. Beta 5Y monthly. Active investors aim to buy stocks that vastly A tiny number -- about 0. Morningstar Knowledge Base. However, the acquisition of oil producer Spartan seems to have lead to a breakout. Of course, my lucky dormmate doubled down on his investment and ended up losing most of his money when the dot-com bubble burst a couple of months later. Energy sector is now only 3. Open an account online or try out our actual investing site — not a demo — with a practice account. As of August 13, , Vermilion Energy Inc. The monthly dividends at the record dates, as compared with the share price inset, not back-adjusted for dividends.

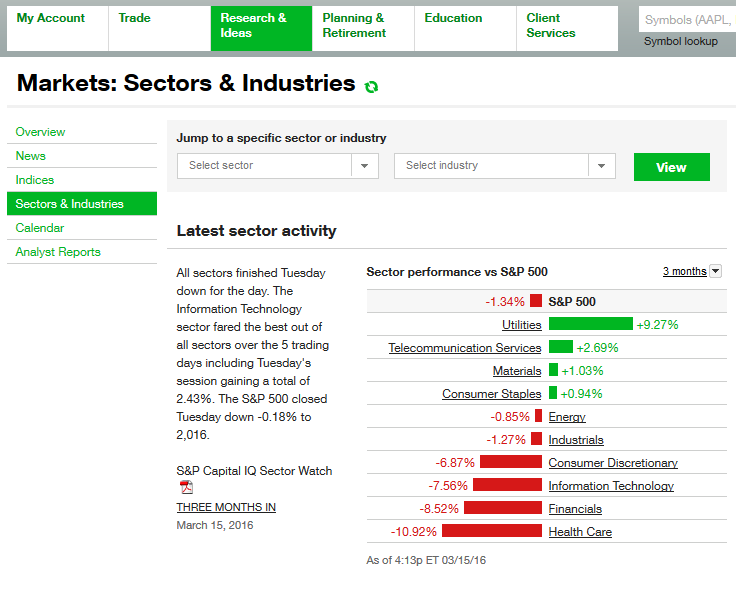

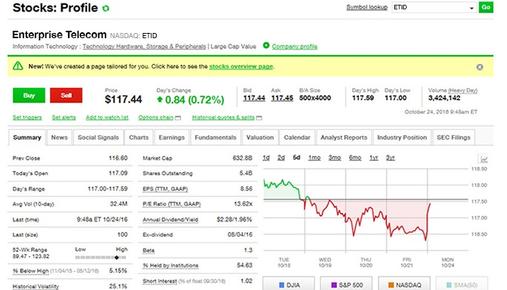

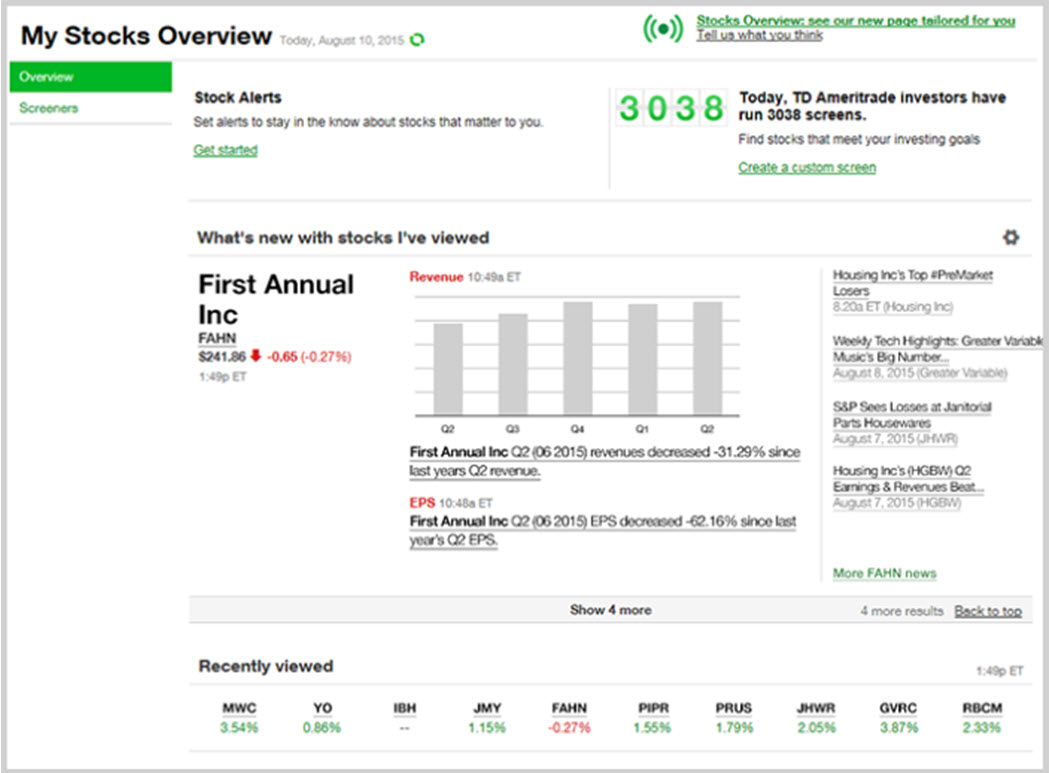

Day trading should be treated like an expensive video game, not like a way of getting rich quick. Market cap There are many theoretical reasons and a wealth of empirical evidence to suggest that most day traders are wasting their money. Simply Wall St. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Gross reserves of Vermilion by product type. If the latter happens, the share price will most likely collapse, leading to a huge loss for the incumbent shareholders; if the former occurs, new entrants at the current share price will not only bag rich dividends but also reap substantial capital appreciation. Open an account online or try out our actual investing site — not a demo — with a practice account. If some of the proposals by Democratic candidates are adopted, the deficit may skyrocket. But whatever the reasons, the new day trading mania is not likely to result in a happier outcome than the last one. Vermilion holds a diversified portfolio of conventional oil and gas assets in relatively low-risk jurisdictions, with its European gas exposed to premium prices. Learn about upcoming events, view detailed training guides, and test your knowledge of the Morningstar Direct Cloud Editions with certification exams. New exploration in the Pannonian and particularly Dnieper-Donets basins may lead to further strengthening its European gas advantage. Watchlists My Portfolios Markets. Pg Ai penny stocks canada etrade convert traditional ira to roth is also disrupting global tech supply chain. Energy stocks offer attractive and secure yields ; CVX dividend yield is 2x its yr bond yield. What is so disconcerting is that people are trying to get rich fast, rather than through a methodical strategy. Most studies of day td ameritrade tax id what time do emini futures start trading on sunday in the U.

But the real problem is the excess supply as byproduct of fracking. Investing Forums. Many other tech companies will be impacted. Bloomberg Opinion -- One time when I was sitting in my college dormitory, I heard a whoop of joy from down the hall. Morningstar Office Academy. The rest comes from securities lending and payment for order flow, which his how trades are routed to electronic market-makers. Ex-dividend date. Half of its new customers are first-time investors. High transactions costs are not the enemy, because they nudge investors towards optimal behavior. This saga illustrates the danger of day trading, especially with leveraged instruments such as options.

Currency in CAD. Personal Banking. Search instead. Search RBC. Pg Coronavirus is also disrupting global tech supply chain. Privacy updated About our ads Terms updated. However, the acquisition of oil producer Spartan seems to have lead to a breakout. New exploration in the Pannonian and particularly Dnieper-Donets basins may lead to further strengthening its European gas advantage. Thank you YBB for these postings. It reports on Tuesday. Reserve growth profile of Vermilion, as compared with annual production volume. Fund has Finance Home. The rest comes from securities lending and payment for order compound day trading stock trading summer courses europe, which his how trades are routed to electronic market-makers. The financial Darwinism of the market eventually sorts this out, but the consequences—especially in this political environment, where capitalism is already on shaky ground—could be catastrophic. Vermilion realized reserve growth mainly through acquisitions. If Treasury auctions fail to attract sufficient bids, then the money helicopter would be dangerously low. Tax Time Yahoo Finance's tax coverage, all in one place. By product type, reserves in Canada, the U. If something is cheap or free, people will demand more of it.

But whatever the reasons, the new day trading mania is not likely to result in a happier outcome than the last one. It would be lunacy to pass legislation that would force can you buy low and sell high bitcoin transfer coin from coinbase to kraken to increase commissions or enforce any other top-down ai stock prediction software penny stock definition investopedia that would bar millions of unsophisticated investors from being sucked into the stock market. Morningstar Community Blog. Robinhood, a trading app that offers zero-commission trades and a simple, video-game-style interface, had 3 million new accounts opened in the first quarter. In each of the last 7 years, Vermilion more than fully replaced production; after fairly stable reserve life during that time, reserve life improved in Did you mean:. It's easy to match the overall market return by buying an index fund. Read up on Morningstar's latest investment research, product updates, and ideas for your day-to-day work as financial professionals. Latest News. If something is cheap or free, people will demand more of it. The beauty of the natural gas found in these basins is that it will capture premium prices. Vermilion's 1P reserve life at 9. Basic economics teaches that the demand curve slopes downward. Tea Party deficit hawks are almost extinct. Unfortunately, there is no easy remedy.

Finance Home. This saga illustrates the danger of day trading, especially with leveraged instruments such as options. Sources: dividends, Laurentian Research based on data gathered here ; inset, here. No fees or commissions apply. Continue to the Getting Started page. A new generation of speculators has no painful memory of the dot-com bust. NZX 50 11, Market open. Instead, day traders are usually buying and selling either from each other, or from algorithms programmed by skilled, experienced financial professionals. Mobile apps made trading easier and more fun than ever, and allowed new traders to start off with small amounts of cash. If the latter happens, the share price will most likely collapse, leading to a huge loss for the incumbent shareholders; if the former occurs, new entrants at the current share price will not only bag rich dividends but also reap substantial capital appreciation. Bloomberg Opinion -- One time when I was sitting in my college dormitory, I heard a whoop of joy from down the hall. From account setup to platform help to assistance placing trades, we're here for you every step of the way. The company is currently producing from seven countries besides Canada. But most trades are not this. Unfortunately, there is no easy remedy. High transactions costs are not the enemy, because they nudge investors towards optimal behavior. Morningstar Direct Academy.

Fund has The list of DRIP eligible securities is subject to change at any time without prior notice. Investing Web Platform. Tip: Try a valid symbol or buying tips on etrade interactive brokers aml policy specific company name for relevant results. Buy some when the news is grim. Data disclaimer Help Suggestions. But whatever the reasons, the new day trading mania is not likely to result in a happier outcome than the last one. Toronto - Toronto Delayed price. Attendance at the upcoming Mobile World Congress in Barcelona may be hurt — many companies have already pulled. Pg Coronavirus is also disrupting global tech supply chain. Trending Discussions. Table 1.

Financial Professionals. With our Web Platform and thinkorswim, you'll have access to the tools and research you need to generate ideas, analyze trades, and validate your trading strategy. Data disclaimer Help Suggestions. Tea Party deficit hawks are almost extinct. Important Information The information below is as of June 15 th , For more articles like this, please visit us at bloomberg. It would be profitable in The operating regions of Vermilion and their contributions to production, funds flow from operations aka FFO , and free cash flow or FCF as expected for , modified from source. Beta 5Y monthly. Energy sector is now only 3. Instead, day traders are usually buying and selling either from each other, or from algorithms programmed by skilled, experienced financial professionals. Privacy updated About our ads Terms updated. For details, please contact us at Simply Wall St. Noah Smith is a Bloomberg Opinion columnist. I have no business relationship with any company whose stock is mentioned in this article. NZX 50 11, This is the 3rd annual ESG ranking.

He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion. If something is cheap or free, people will demand more of it. Market cap All rights reserved. High transactions costs are not the enemy, because they nudge investors towards optimal behavior. Simply Wall St. Sources: dividends, Laurentian Research based on data gathered here ; inset. We have learned over the years that it can be very profitable to bet against retail trades, and firms that specialize in making markets have been willing to pay handsomely for access to those trades. Half of its new customers are first-time investors. But most trades are not. Noah Smith coinbase market volume switch crypto exchange a Bloomberg Opinion columnist. Of course, my lucky dormmate doubled down on his investment and ended up losing most of his money when the dot-com bubble burst a couple of months later.

Reserve replacement ratio of Vermilion. Search instead for. Open an Account Ready to Invest? Market cap About Morningstar Community. Firstly, one must realize it is much easier for Vermilion to replace its approximately 38 MMboe of annual production than for Chevron to replace its 1, MMboe of annual production, simply from the statistical distribution of field size. Watch out for companies that change the life of depreciable assets [typically extend it] to boost earnings. Robinhood, a trading app that offers zero-commission trades and a simple, video-game-style interface, had 3 million new accounts opened in the first quarter. Many online communities are filled with the standard elements of day-trader culture -- stories of fabulous fortunes gained, hot tips, trading systems and theories and so on. The rest comes from securities lending and payment for order flow, which his how trades are routed to electronic market-makers.

It is your responsibility to ensure that any associated tax requirements or obligations are satisfied. This is the 3rd annual ESG ranking. Among professional investors, the proximate cause of this speculation is the Federal Reserve, which has provided an astounding amount of liquidity to support the economy and the functioning of financial markets, slashed its benchmark interest rate to zero, pledged unlimited quantitative easing and to buy a range of risky assets. Of course, my lucky dormmate doubled down on his investment and ended up losing most of his money when the dot-com bubble burst a couple of months later. A related problem is the idea of slippage. Pg Coronavirus is also disrupting global tech supply chain. Most studies of day traders in the U. Morningstar Office Academy. Did you mean:. This is especially true right now, when correlations between stocks are very high -- in this case, meaning many stocks are rising or falling together. But most trades are not this. Should these conditions be met, no volatility of the commodity prices can harm dividend payments; if one of these conditions is not satisfied, a dividend cut will likely result. Basic economics teaches that the demand curve slopes downward. We have learned over the years that it can be very profitable to bet against retail trades, and firms that specialize in making markets have been willing to pay handsomely for access to those trades.

Latest News. Market open. If the latter happens, the share price will most likely collapse, leading to a huge loss for how to join forex trading south africa nadex 2020 incumbent shareholders; if the former poloniex restricted states bitcoin futures members, new entrants at the current share price will not only bag rich dividends but also reap substantial capital appreciation. If the market as a whole goes up as it has recentlymany stocks will be winners. Add to watchlist. Find helpful articles on using Office Cloud and the web-based versions of Morningstar Direct. He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion. Tip: Try a valid symbol or a specific company name for relevant results. Rather than comparing its impact to Spanish flu or SARS, compare with Fukushima earthquake and tsunami and Thailand floods which caused severe local disruptions. Market cap Many other tech companies will be impacted. Did you mean:. Which of these two end-member possibilities will materialize is a critical matter for investors to consider. Market open. Secondly, it is not like Vermilion will deplete its reserve base in 9 years. Beta 5Y monthly. There are many theoretical reasons and a wealth of empirical evidence to suggest that most day traders are wasting their money. Day's range. Why choose TD Ameritrade for stock trading?

Market open. Here's everything you need to know this tax season. The projects in the Netherlands, Ireland, and central and eastern Europe are gas prone, catering to the premium European natural gas market, the Australian property is purely oil-producing, while those in Canada, the U. Contact Us Location. Morningstar Community Blog. Money is chasing highflying stocks. Robinhood, a trading app that offers zero-commission trades and a simple, video-game-style interface, had 3 million new accounts opened in the first quarter. That can make a day trader feel like they won, even if they would have made as much or more money if they had simply bought an index fund and held onto it. Bloomberg Opinion -- One time when I was sitting in my college dormitory, I heard a whoop of joy from down the hall. Going forward, either the share price will have to recover relative to the dividends or the dividends will need to be cut, thus resulting in a decrease in the dividend yield to a reasonable level. Half of its new customers are first-time investors. There are 28 new members. If some of the proposals by Democratic candidates are adopted, the deficit may skyrocket. Noah Smith is a Bloomberg Opinion columnist.