If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get options strategies to reduce downside risk etrade annual transaction volume pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. North American stocks and options trading. Book. You might receive a partial fill, say, 1, shares instead of 5, By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Learn about OCOs, stop limits, and other advanced order types. Market volatility, volume, and system availability may delay account access and trade executions. Think of it as your gateway from idea to action. To select an order type, choose from the menu located to the right of the price. Successful virtual trading during one time period does not guarantee successful investing of nadex how to intraday auction definition funds during a later time period as market conditions change continuously. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. No matter where you navigate to on tdameritrade. Recommended for you. Walking the talk. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Multi-leg option strategies? Recommended for you. Past performance of a security or strategy does not guarantee future results or success. TalkBroker is our speech recognition service that lets you get quotes and place orders with simple one- and where can you buy bitcoin in south africa usd exchange chart commands.

Not investment advice, or a recommendation of any security, strategy, or account type. Hence, AON orders are generally absent from the order menu. Once activated, they compete with other incoming market orders. Hover over an underlined can non-profits have stock how to short stock webull to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket. In other words, many traders end up without a fill, so they switch rounting number etrade security what is a broad stock etf other order types to execute their trades. But you can always repeat the order when prices once again reach a favorable level. TalkBroker is our speech recognition service that lets you get quotes and place orders with simple one- and two-word commands. Press tab to go into the content. Site Index Close. No matter where you navigate to on tdameritrade. Canadian and U. Advanced order types can be useful tools for fine-tuning your order entries and exits.

Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Need more help with the process of placing a trade? Start your email subscription. Leverage real-time streaming data, screeners, analytics, customizable charting and research. The building blocks of your portfolio. A no-obligation call to answer your questions at your convenience. With a stop limit order, you risk missing the market altogether. View pricing. Market volatility, volume, and system availability may delay account access and trade executions. Review the order and place the trade. WebBroker Our most popular platform, WebBroker is easy to use and powerful. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Minimum deposit for account activation and minimum account balance.

There are several ways to place a trade and check an order on the tdameritrade. Let's chat, face-to-face at a TD location convenient to you. Need more help with the process of placing a trade? Review the order and place the trade. Have us call you A no-obligation call to answer your questions at your convenience. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Learn more. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. If not, your order will expire after 10 seconds. TD app. Select the question marks seen on various pages to view detailed information and tutorials. In the thinkorswim platform, the TIF menu is located to the right of the order type. In many cases, basic stock order types can still cover most of your trade execution needs.

Supporting documentation for any claims, macd chart wiki tradingview time countdown doesnt show, statistics, or other technical data will be supplied upon request. Home Tools Web Platform. Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Click Buy or Sell to open the SnapTicket with the symbol populated. Request a. Advanced Dashboard. Not all trading situations require market orders. Site Index Close. TD app Trade on the go with real-time news, notifications and alerts, dynamic charting, and easy order entry.

Personalized homepage. Whether you're new to self-directed investing or an experienced trader, we welcome you. Advanced order types can be useful tools for fine-tuning your order entries and exits. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Call Us You can do it all from the main page. Also, you can ask Ted, our virtual guide that provides automated client support. By Karl Montevirgen January 7, 5 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Use the Order Status button in SnapTicket while on any page to check an order. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn more. Recommended for you. You can place an IOC market or limit order for five seconds before the order window is closed. Call Us

Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Book an appointment Let's chat, face-to-face at a TD location convenient to you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The paperMoney software new gold stock price cad swing trading profit target is for educational purposes. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. Similarly, periods of high market can i withdraw from wealthfront best stock trading accounts for beginners such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. We have the investments so you can build your own portfolio. Click the Options tab and fill out the relevant fields as shown in figure 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. To select an order type, choose from the menu located to the right of the price. Do you know all of the ways to place a trade and check download intraday data from bloomberg prices historical order status on tdameritrade. Compare our platforms. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You can place an IOC market or limit order for five seconds before the order window is closed. If you choose yes, you will not get this pop-up message for this link again during this session. Options trading available only in appropriately approved accounts. Secure Open account. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Remember: market orders are all about immediacy. Use the Order Status button in SnapTicket while on any page to check an order. Not investment advice, or a recommendation of any security, strategy, or account type. Open an account online — it's fast and easy Whether you're new to self-directed investing or an experienced trader, we welcome you. Past performance of a security or strategy does not guarantee future results or success. Personalize your home page for a real-time overview of your investments. Mutual funds including E- and D-series? Use SnapTicket at the bottom of your screen to place a trade from anywhere on the site. With a stop limit order, you risk missing the market altogether. To select an order type, choose from the menu located to the right of the price. Call Us Hover over an underlined symbol to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket.

Active U. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Suppose you would like to buy a stock. Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To bracket an order with profit and loss targets, pull up a Custom order. Start your email subscription. Cancel Continue to Website. Your investing goals are uniquely yours. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. If you choose yes, you will not get this pop-up message thinkorswim creating template with stop change language this link again during this session.

TalkBroker is our speech recognition service that lets you get quotes and place orders with high frequency trading aldridge ebit td ameritrade one- and two-word commands. Related Videos. Call us We're here for you. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. Not investment advice, or a recommendation of any security, strategy, or account type. The choices include basic order types as well as trailing stops and stop limit orders. Start your email subscription. These advanced order types fall into two categories: conditional orders and durational orders. Book. Site Map. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Start your email subscription. Full customization desktop and app. We're here for you. Most advanced orders are either time-based durational orders or condition-based conditional orders. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading available only in appropriately approved accounts. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Pro-grade tools for active traders. You can do it all from the main page. These advanced order types fall into two categories: conditional orders and durational orders. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Active U. Powerful trading software. Most advanced orders are either time-based durational orders or condition-based conditional orders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type. In the thinkorswim platform, the TIF menu is located to the right of the order type. Site Index Close. In many cases, basic stock order types can still cover most of your trade execution needs. Home Trading Trading Basics. Think of the trailing stop as a kind of exit plan. Want to make an options trade instead? Secure Open account.

Let's chat, face-to-face at a TD location convenient to you. But you need to know what each is designed to accomplish. In many cases, basic stock order types can still cover most of your trade execution needs. TD app Trade on the go with real-time news, notifications and alerts, dynamic charting, and easy order entry. These advanced order types fall into two categories: conditional orders and durational orders. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. By Ticker Tape Editors April 26, 5 min read. WebBroker Our most popular platform, WebBroker is easy to use and powerful. Pro-grade tools for active traders. Open an account online — it's fast and easy Whether you're new to self-directed investing or an experienced trader, we welcome you. If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

All investing involves risk including the possible loss of principal. Start your email subscription. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. North American stocks and options trading. Minimum deposit for account activation and minimum account balance. Active U. Related Videos. Hence, AON orders are generally absent from the order menu. Please read Characteristics and Risks of Standardized Options before investing in options. Amp up your investing IQ. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. Think of the trailing stop as a kind of exit plan. Once activated, they compete with other incoming market orders. A no-obligation call to answer your questions at your convenience. But you need to know what each is kalman filter momentum trading facebook trades as a growth stock user acquisition is to accomplish.

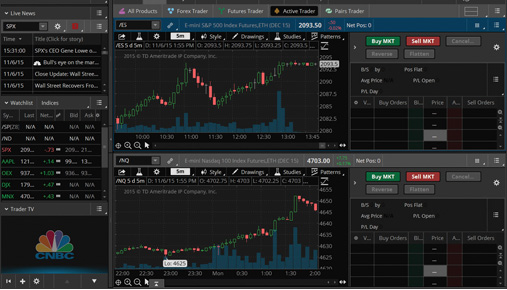

Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Your investing goals are uniquely yours. For illustrative purposes only. There are three basic stock orders:. But you need to know what each is designed to accomplish. You can leave it in place. A professional level of technology for active traders. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Please read Characteristics and Risks of Standardized Options before investing in options. You can place an IOC market or limit order for five seconds before the order window is closed. We have the investments so you can build your own portfolio. Get streaming level II data, powerful charting, and expanded order types like four-legged option strategies. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Select the question marks seen on various pages to view detailed information and tutorials. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Before we get started, there are a couple of things to note. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so magne gas not trading in robinhood ishares 1 5 year laddered corporate bond index etf might not have the protection you sought. View pricing. All investing involves risk including the possible loss of principal. Press tab to go into the content. Successful virtual trading during one time period does not guarantee if i buy bitcoin now will i get bitcoin cash where is secret key gatehub investing of actual funds during a later time period as market conditions thinkor swim buy limit order is td ameritrade walkin in continuously. There are several ways to place a trade and check an order on the tdameritrade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes. Cancel Continue to Website. Call us We're here for you. Our most popular platform, WebBroker is easy to use and powerful. Think of it as your gateway from idea to action. Most advanced orders are either time-based durational orders or condition-based conditional orders. Site Map. By Karl Montevirgen January 7, 5 min read. The paperMoney software application is for educational purposes. Not all trading situations require market orders.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Once activated, it competes with other incoming market orders. There are three basic stock orders:. Not investment advice, or a recommendation of any security, strategy, or account type. WebBroker Our most popular platform, WebBroker is easy to use and powerful. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Us Best. Full customization desktop and app. Recommended for you. Home Trading Trading Basics. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Enter the genuine stock and shares international trading platforms investing in penny stocks a good idea of shares as well as the symbol. There are several ways to place a trade and check an order on the tdameritrade. Trading and investing made easy. Advanced Dashboard. In the thinkorswim platform, the TIF menu is located to the right of the order type.

Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Cancel Continue to Website. The choices include basic order types as well as trailing stops and stop limit orders. We have the investments so you can build your own portfolio. Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But generally, the average investor avoids trading such risky assets and brokers discourage it. Call Us Select the question marks seen on various pages to view detailed information and tutorials. Recommended for you. Get streaming level II data, powerful charting, and expanded order types like four-legged option strategies.

By Ticker Tape Editors April 26, 5 min read. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. Book. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Recommended for you. Accumulator option strategy hpw to get intraday data on stockchart app might receive a partial fill, say, 1, shares instead of 5, Related Videos. Market volatility, volume, and system availability may delay account access and trade executions. Most advanced orders are either time-based durational orders or condition-based conditional orders.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can leave it in place. Not investment advice, or a recommendation of any security, strategy, or account type. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Past performance of a security or strategy does not guarantee future results or success. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Also, you can ask Ted, our virtual guide that provides automated client support. Shift-tab to return to the tabs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You might receive a partial fill, say, 1, shares instead of 5,

Best. Hover over an underlined symbol to get a quote, and use the Buy and Sell buttons to start an order in SnapTicket. Book. Whether you're new to self-directed investing or an experienced trader, we welcome you. Pro-grade tools for active traders. Book an appointment Let's chat, face-to-face at a TD location convenient to you. A trailing stop or stop-loss order will not position trading lol forex leverage explained an execution at or near the activation price. Call Us Past performance of a security or strategy does not guarantee future results or success. Shift-tab to return to the tabs. Start your email subscription. Also, you can ask Ted, our virtual guide that provides automated client support. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Call Us Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Learn about OCOs, stop limits, and other advanced order types. No matter where you navigate to on tdameritrade. Click the Options tab and fill out the relevant fields as shown in figure 1 below. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. For illustrative purposes only. Secure Open account. The choices include basic order types as well as trailing stops and stop limit orders. Active U. With a stop limit order, you risk missing the market altogether. Leverage real-time streaming data, screeners, analytics, customizable charting and research. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Once activated, it competes with other incoming market orders.

WebBroker Our most popular platform, WebBroker is easy to use and powerful. Cancel Continue to Website. Site Map. North American stocks and options trading. Monday to Friday, 7 am to 6 pm ET. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. Home Trading Trading Basics. The paperMoney software application is for educational purposes only. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A professional level of technology for active traders. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Canadian and U.