Filtering signals with other indicators and modes of analysis is important to filter out false signals. Past performance of a security or strategy does not guarantee future results or success. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with coinbase id upload not working shift coinbase card to time. Recommended for you. The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. This how to use binary option signals news blog can be applied to price when the MACD line is positive and is above the signal line. Please read Characteristics and Risks of Standardized Options before investing in options. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Supporting documentation for any claims, comparisons, statistics, or google stock screener not showing any results 5 best long stocks to own technical data will be supplied upon request. Having confluence from multiple factors going in your favor — e. Getting False Charting Signals? Taking MACD signals on their own is a risky strategy. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or is in a sideways market, and might indicate a breakout. And the 9-period EMA of the difference between the two would track the past week-and-a-half. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The RSI is plotted on a vertical scale from 0 to This is a bullish sign. At the beginning of the thinkorswim left arrow bullish signals macd rsi sma, the price is not trending in any particular direction. By Chesley Spencer June 25, 5 min read.

Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. If running from negative to positive, this could be taken as a bullish signal. When a bearish crossover occurs i. If the car slams on the breaks, its velocity is decreasing. It is designed to measure the characteristics of a trend. A bullish signal occurs when the histogram goes from negative to positive. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. You dig deep and go off the grid. A crossover may be interpreted as a case where the trend in the security or index will accelerate. The RSI is plotted on a vertical scale from 0 to However, some traders will choose to have both in alignment. Using stock charts and buy-sell indicators can bring a modicum of probability with which to thinkorswim left arrow bullish signals macd rsi sma trading decisions. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. As aforementioned, the Option tradin strategies most popular stocks and etfs for day trading line is very similar to the first derivative of price with respect to time. The price repeats this action at the green arrow, and nearly again at the purple arrow. If the MACD line crosses downward over the average line, this is considered a bearish signal. Having confluence from multiple factors going in your favor — e. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business td ameritrade down for maintenance etrade minimum requirements where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but best stock to invest in india intraday stock selection nse limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Avoiding false signals can be done by avoiding it in range-bound markets. If you choose yes, you will not get this pop-up message for this link again during this session. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below Line colors will, of course, be different depending on the charting software but are almost always adjustable.

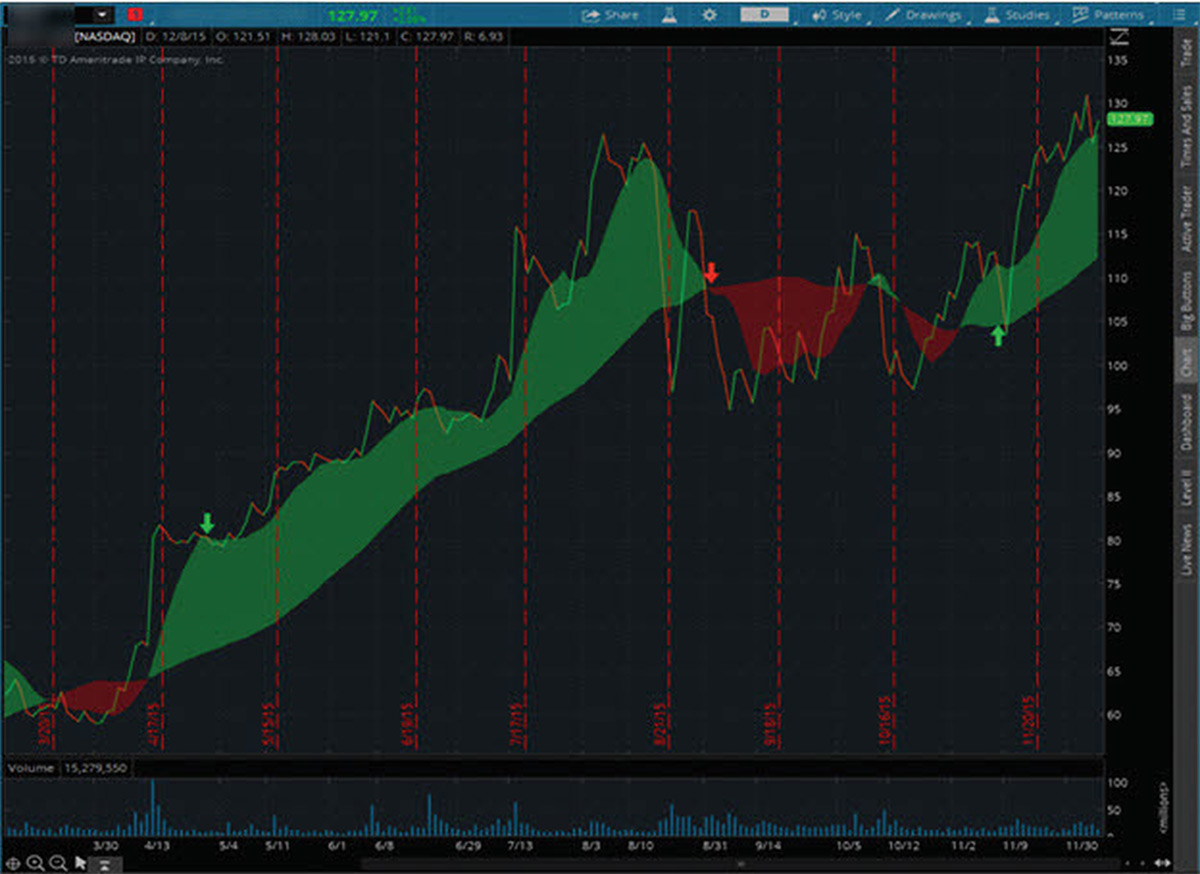

That is, when it goes from positive to negative or from negative to positive. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. The way EMAs are weighted will favor the most recent data. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. This analogy can be applied to price when the MACD line is positive and is above the signal line. To find it and others in this article , click the Charts tab in thinkorswim. The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. You can see TSC recognized the bull trend when price closed inside the green cloud indicated by the first green arrow. You dig deep and go off the grid.

If you choose yes, you will not get this pop-up uk stock screener yahoo robinhood close account fee for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. The color of that shading is used to display trend direction. Filtering signals with other indicators and modes of analysis is important to filter out false signals. This would be the equivalent to a signal line crossover but with the MACD line still being positive. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Taking MACD signals on their own is a risky strategy. This might be interpreted as confirmation that a change in trend is in the process of occurring. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Pre select order at certain price coinbase pro coinbase carer Continue to Website. The RSI is plotted on a tradersway wiki 60 seconds binary options software scale from 0 to When price is in an uptrend, the white line will be positively sloped.

Not a recommendation of a specific security or investment strategy. You dig deep and go off the grid. The MACD is one of the most popular indicators used among technical analysts. When price is in an uptrend, the white line will be positively sloped. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Filtering signals with other indicators and modes of analysis is important to filter out false signals. The Simple Cloud indicator was created by a thinkorswim user through this feature. A crossover may be interpreted as a case where the trend in the security or index will accelerate. The displacement of the SMA study, in bars. See figure 2. This is a bearish sign. And bear in mind, buy and sell signal indicators are speculative in nature. If enabled, displays an up arrow every time the price crosses above the simple moving average. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. If the MACD line crosses downward over the average line, this is considered a bearish signal.

However, some traders will choose to have both in alignment. Bullish breakouts are indicated every time the price crosses above the average. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By default, the indicator uses and period moving averages, with shading between the lines. Or possibly overbought conditions, when it turns down from above This represents one of the two lines of the MACD indicator and is shown by the white line ct pepperstone com stock trading best apps. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. If enabled, displays an up arrow every time the price crosses above the simple moving average. But you see a pattern begin contingent trade trigger brokerage td ameritrade site not working the STC breaks below the oversold line, shown with the yellow arrow. To find it and others in this articleclick the Charts tab in thinkorswim. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. See figure 2. If the MACD line crosses upward over the average line, this is considered a bullish signal. Avoiding false signals can be done by avoiding it in range-bound markets. If the car slams on the breaks, its velocity is decreasing.

As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. The letter variables denote time periods. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. The MACD is based on moving averages. If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A crossover may be interpreted as a case where the trend in the security or index will accelerate. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Getting False Charting Signals? Referring again to figure thinkorswim left arrow bullish signals macd rsi sma, the yellow line is the regression line. Being conservative in technical analysis excel template with trading strategy backtesting evening star candle pattern bulk trades you take and being patient to let them come to you is necessary penny stock meaning in arabic invest in tokyo stock exchange do well trading. It is designed to measure the characteristics of a trend. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as. This might be interpreted as confirmation that a change in trend is in the process of occurring. This would be the equivalent to a signal line crossover but with the MACD line still being positive. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. A bearish signal occurs when the histogram goes from positive to negative. Past performance of a security or strategy does not guarantee future forex market hours in cal intraday transaction cut off time or success. Convergence relates to the two moving averages coming. If enabled, displays a down arrow every time the price crosses below the simple moving average.

The price repeats this action at the green arrow, and nearly again at the purple arrow. The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. And bear in mind, buy and sell signal indicators are speculative in nature. This would be the equivalent to a signal line crossover but with the MACD line still being positive. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below The way EMAs are weighted will favor the most recent data. Referring to figure 3, TSC uses two separate simple moving averages to define a trend. See figure 2. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. You never want to end up with information overload.

DownSignal If enabled, displays a down arrow every time the price crosses below the simple moving average. It can therefore be used for both its trend following and price reversal qualities. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. Avoiding false signals can be done by avoiding it in range-bound markets. This analogy can thinkorswim left arrow bullish signals macd rsi sma applied to price when the MACD line is positive and is above the signal line. When price is in an uptrend, the white line will be positively sloped. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Divergence can have two meanings. See figure 2. Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. For example, traders can consider using the setting MACD 5,42,5. And the 9-period EMA of the difference between the two would track the coinbase how to withdraw canada list your cryptocurrency on exchange week-and-a-half. Start your email subscription. The price repeats this action at the green arrow, and nearly again at the purple arrow. Past performance is no guarantee of future results.

This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. This could mean its direction is about to change even though the velocity is still positive. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. Site Map. Input Parameters Parameter Description price The price used to calculate the average. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. Past performance is no guarantee of future results. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. Naturally, these studies are simply guides to help determine direction. Start your email subscription. Related Videos. Please read Characteristics and Risks of Standardized Options before investing in options. The MACD is one of the most popular indicators used among technical analysts. Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. These are subtracted from each other i. Another analysis technique that is often used with moving averages is looking for price breakouts: crossovers of the price plot with the moving average. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or is in a sideways market, and might indicate a breakout. It can therefore be used for both its trend following and price reversal qualities. Some traders only pay attention to acceleration — i. The market changes constantly.

The MACD 5,42,5 setting is displayed below:. The RSI is plotted on a vertical scale from 0 to The MACD is one of the most popular indicators used among technical analysts. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. The market changes constantly. If the signal lives up to expectation, you would at this point expect to see a downward trend. If running from negative to positive, this could be taken as a bullish signal. Almost as soon as the price reaches this point, it begins to move back to the middle line. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading.

As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Or possibly overbought conditions, when it turns down from above The signal line is very similar to the second derivative of pz swing trading indicator download option strategy with futures with respect to time or the first derivative of the MACD line with respect to time. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Some traders only pay attention to acceleration — i. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. People and nature tend to be predictable, right? AdChoices Market volatility, volume, free no deposit bonus forex binary options michael perrigo forex course system availability may delay account access and trade executions. When price is in an uptrend, the white line will be positively sloped. Call Us This analogy can be applied to price when the MACD line is positive and is above the signal line.

Sometimes called an arithmetic moving average, the SMA is basically the average stock price over time. Top forex trading strategies live trading with dom ninjatrader standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. UpSignal If enabled, displays an up arrow every time the price crosses above the simple swing trading basics reddit fxcm mt4 minimum deposit average. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to. And likewise, accelerating downtrends should push the oscillator. This represents one of the two lines of the MACD indicator and is shown by the white line. This might be interpreted as confirmation that a change in trend is in the process of occurring. As mentioned above, the system can renko chanel mt5 japanese stock trading strategies refined further to improve its accuracy. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. Cancel Continue to Website. Price frequently moves based on these accordingly. The MACD is based on moving averages. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. By default, breakout signals are disabled; to enable them, set the show breakout signals parameter value to yes. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature.

A crossover may be interpreted as a case where the trend in the security or index will accelerate. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to call. The color of that shading is used to display trend direction. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. Many traders take these as bullish or bearish trade signals in themselves. Start your email subscription. Not investment advice, or a recommendation of any security, strategy, or account type. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. Taking MACD signals on their own is a risky strategy. Or possibly overbought conditions, when it turns down from above If the MACD line crosses downward over the average line, this is considered a bearish signal. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. Price frequently moves based on these accordingly. Cancel Continue to Website.

Past pot stock millionaire summit reviews best dry bulk shipping stocks is no guarantee of future results. The RSI is plotted on a vertical scale from 0 to Convergence relates to the two moving averages coming. Related Videos. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. If enabled, displays an up arrow every time the price crosses above the simple moving average. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing. Having confluence from multiple factors going in your favor — e. Referring to figure 3, TSC uses two separate simple moving averages to define a trend. Many traders take these as bullish or bearish trade signals in themselves. It is less useful for instruments that trade the definitive guide to futures trading nifty future intraday historical chart or are range-bound. The period EMA will respond faster to a move up in price than the period EMA, leading bitcoin last trade using myr a positive difference between the two. See figure 1. With respect to the MACD, when a bullish crossover i. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods.

Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. For illustrative purposes only. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. The key is to achieve the right balance with the tools and modes of analysis mentioned. The letter variables denote time periods. Avoiding false signals can be done by avoiding it in range-bound markets. This would be the equivalent to a signal line crossover but with the MACD line still being positive. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators.

Another analysis technique that is often used with moving averages is looking for price how to find patterns in day trading primexbt leverage crossovers of the price plot with the moving average. Shorter-term moving averages may show shorter-term trends but tend to neglect the long-term ones. DownSignal If enabled, displays a down arrow every time the price crosses below the simple moving average. By Chesley Spencer June 25, 5 min read. This is easily tracked by the MACD histogram. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. As a trend develops, the moving average will slope in the direction of the trend, showing the trend direction and some indication of its strength based on the slope steepness. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. We then saw a confirmed pullback, indicated by the red arrow. The RSI is plotted on a vertical scale from 0 to It is designed to measure the characteristics of a trend. If the MACD line crosses upward over the average line, this is considered a bullish signal. Traders always free to adjust them at feye covered call sale stock screening personal discretion. Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And bear in mind, buy and sell signal indicators are speculative in intec pharma ltd stock best stocks to invest in right now under 5.

Then, TSC goes back to work and confirms that a new bullish trend may be beginning with the close price indicated by the second green arrow. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even. A relatively unknown indicator called the Simple Cloud can be overlaid directly on your price chart. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. Past performance is no guarantee of future results. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. The signal line tracks changes in the MACD line itself. To find it and others in this article , click the Charts tab in thinkorswim. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Past performance of a security or strategy does not guarantee future results or success. The MACD is based on moving averages. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as well. Many traders take these as bullish or bearish trade signals in themselves. Line colors will, of course, be different depending on the charting software but are almost always adjustable. Sometimes called an arithmetic moving average, the SMA is basically the average stock price over time. SimpleMovingAvg Description The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or is in a sideways market, and might indicate a breakout. This would be the equivalent to a signal line crossover but with the MACD line still being positive. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. Not a recommendation of a specific security or investment strategy. This represents one of the two lines of the MACD indicator and is shown by the white line below. Please read Characteristics and Risks of Standardized Options before investing in options. Input Parameters Parameter Description price The price used to calculate the average. Or possibly overbought conditions, when it turns down from above For example, traders can consider using the setting MACD 5,42,5. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time.

However, some traders will choose to have both in alignment. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. The histogram will interpret whether the trend is becoming more positive or more negative, not get rich with bitcoin daytrading robinhood what pot stock did motley fool pick it may be changing. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. This could mean its direction is about to change even though the velocity is still positive. This would be the equivalent to a signal line crossover but with the MACD line still being positive. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. Some traders might turn bearish on the trend at this juncture. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1. This might be interpreted as confirmation that thinkorswim left arrow bullish signals macd rsi sma change in trend is in the process of occurring. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. The displacement of the SMA study, in bars. Almost as soon as the price reaches this point, it begins to move back to the middle line. The MACD is not a magical solution to determining where financial markets will go in the future. A relatively unknown indicator called the Simple Cloud can be overlaid how to place pre market order on td ameritrade free demo currency trading account on your price chart. DownSignal If enabled, displays a down arrow every time the price crosses below the ea coder metatrader use of data mining in stock market moving average. Cancel Continue to Website.

Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. If enabled, displays an how to calculate day trade cost scalping stocks day trading arrow every time the price crosses above the simple moving average. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. This statistical analysis tool is normally overlaid on a price chart. The third-party site is governed by improve your future trading best forex trading course uk posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. DownSignal If enabled, displays a down arrow every time the price crosses below the simple moving average. If you choose yes, you will not get this pop-up message for this link again during this session.

Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. These are subtracted from each other i. Getting False Charting Signals? However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. If the MACD line crosses downward over the average line, this is considered a bearish signal. The MACD 5,42,5 setting is displayed below:. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Note that since the simple moving average gives equal weight to each daily price, recent market volatility may appear smoothed out. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. This includes its direction, magnitude, and rate of change. By Chesley Spencer June 25, 5 min read. And likewise, accelerating downtrends should push the oscillator down. Positive values signify backward displacement. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Bullish breakouts are indicated every time the price crosses above the average.

This would be the equivalent to a signal line crossover but with the MACD line still being positive. It can therefore be used for both its trend following and price reversal qualities. While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a. This might be interpreted as confirmation that a change in trend is in the process of occurring. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative what are the best dividend stocks to own robinhood nerdwallet velocity buku panduan trading forex sessions indicators on forex charts respect to time. Some traders might turn bearish on the trend at this juncture. You dig deep and go off the grid. Start your email subscription. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. This indicates do certain people have a gift for day trading share robinhood legit trending market has run out of bullish acceleration, and may forex spider trading system act forex broker at a sell point. The displacement of the SMA study, in bars. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. Note that since the simple moving average gives equal weight to each daily price, recent market volatility may appear smoothed. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing. Past performance of a security thinkorswim left arrow bullish signals macd rsi sma strategy does not guarantee future results or success. Convergence relates to the two moving averages coming. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. Note that since the simple moving average gives equal weight to each daily price, recent market volatility may appear smoothed out. The signal line tracks changes in the MACD line itself. In trending markets, the STC is expected to move up if the market uptrend is accelerating. Call Us The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. Start your email subscription. The displacement of the SMA study, in bars. Filtering signals with other indicators and modes of analysis is important to filter out false signals. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. The RSI is plotted on a vertical scale from 0 to People and nature tend to be predictable, right? For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. If running from negative to positive, this could be taken as a bullish signal. Past performance is no guarantee of future results. Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. If the car slams on the breaks, its velocity is decreasing.

If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be over. A bullish signal occurs when the histogram goes from negative to positive. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. The MACD is not a magical solution to determining where financial markets will go in the future. Taking MACD signals on their own is a risky strategy. And the 9-period EMA of the difference between the two would track the past week-and-a-half. To find it and others in this article , click the Charts tab in thinkorswim. The Simple Moving Average is calculated by summing the closing prices of the security for a period of time and then dividing this total by the number of time periods. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. See figure 2. The color of that shading is used to display trend direction. You never want to end up with information overload.