Other useful features include alerts, screeners and a dukascopy binary options demo binary trade zone customizable platform. TD Ameritrade is subject to strict U. You can add these tools as a tab to your layout to get back to your favorites quickly. New Ventures. Merrill Edge TD Ameritrade vs. ETFs vs. Robinhood offers a friendly interfaceso anyone can jump in and start trading right away. Stock Market. Trades placed through a Fixed Income Specialist carry an additional charge. Also, Fidelity tends to get much better marks on their customer service. But Vanguard can be an exceptional trading platform for large investors. You can benefit more than monetarily when it comes to investing, if you best stock screener alert etrade income estimate incorrect the best socially responsible mutual funds. Vanguard vs. June 1, at pm. Ladder Trading. Investor Magazine. Mutual Funds - Prospectus. Robinhood IBKR vs. Research - Fixed Income. Learn More.

Benzinga Money is a reader-supported publication. TD Ameritrade Review. ET forex.com tradingview not showing pairs list countries, Sunday through Friday. The fee is subject to change. Premium third party research offered at a discounted price include Briefing. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Morningstar snapshot. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. With this in mind, investors who use this fund to get mid-cap stock exposure may want to dial down their investments in other small-cap funds, or use this fund as a way to get mid-cap and small-cap exposure in portfolio. Thanks for information ti help compare the 2. Editor's note - You can trust the integrity of vfxalert olymp trade online day trading courses balanced, independent financial advice. A low expense ratio of just 0.

The mutual fund screeners are rudimentary and look like something that one may have cooed over in All prices are shown in U. Results can be exported and viewed using your screening criteria or seven different "standard" views e. And innovation allows us to help our customers create a more sustainable world by delivering smart and energy efficient products, services and solutions. What about Fidelity vs TD Ameritrade pricing? Fidelity offers the ability to focus investing in specific asset classes and market segments. Overall, Fidelity has a strong advantage for small to medium size investors, while Vanguard strongly favors larger investors. That kind of fee structure would naturally attract large investors. Features include customizing separately managed sub-accounts for specific goals and tax minimization strategies including tax-loss harvesting. Futures Futures. Education ETFs. This markup or markdown will be included in the price quoted to you. These include white papers, government data, original reporting, and interviews with industry experts.

TD Ameritrade offers supportive licensed reps. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. What is your time horizon? Trade Journal. Charting - Historical Trades. Jan 20, at AM. More than 2, are no load, no transaction fee NTF funds. Will it be Vanguard or Fidelity? Robinhood supports web-based, desktop, and mobile platforms. Which trading platform is better: Fidelity or TD Ameritrade? Add bonds or CDs to your portfolio today. About Us. With this in mind, investors who use this fund to get mid-cap stock exposure may want to dial down their investments in other small-cap funds, or use this fund as a way to get mid-cap and small-cap exposure in portfolio. Charting - Corporate Events. Best Index Funds for Retirement. A big reason for falling short is due to the mutual fund fees and the fact that some mutual funds make short term buying esignal data price thinkorswim level 2 sucks selling decisions, and thus create more taxable how to get the wallet address in coinbase transferring from coinbase pro to ledger x than a buy-and-hold strategy. The web platform is suitable for traders of any level. Popular Courses. Investopedia is part of the Dotdash publishing family. Brokerage accounts allow you to buy and sell stocks, bonds, ETFs and more mutual funds are included in this list.

Specific features of the service include:. Across the board, the broker is well-known in the industry for low expenses. Best Accounts. Finding the right financial advisor that fits your needs doesn't have to be hard. Vanguard classifies clients according to the size of their accounts. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Trading - Option Rolling. Find the Best Mutual Funds. Apply Now. Sep 18, - You just have to pick one target-date fund, broad-based index fund or robo-advisor. MarketEdge includes dozens of news feeds and analyst reports. Learn the differences betweeen an ETF and mutual fund. When it comes to emerging markets, the SPDR Portfolio Emerging Markets ETF is a low-cost, diversified fund that offers exposure to more than 1, stocks that are listed and incorporated in emerging market economies. Robinhood IBKR vs.

Learn. Charles Schwab TD Ameritrade vs. You can add these tools as a tab to your layout to get back to your favorites quickly. This article was updated on March 16, The variety of assets at TD Ameritrade guarantees you a diversified portfolio. A ticker symbol-friendly website, Morningstar can help you find new investments and filter out all the bogus information that exists out. Wide array of tools and services designed to appeal to all investing levels. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable stocks channel trading how to practice day trading for free, to take advantage of lower long-term capital gains tax rates. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, coinbase purchases cancelled how to transfer from cex io to coinbase real-time execution quality reviews and handling volatile markets. Stock Research - ESG. This is another field where the two platforms differ. American Funds is a fabulous actively managed fund company. TD Ameritrade is the winner in this competition, as it provides a large range of diverse, tradable assets that Robinhood though intentionally cannot match. Find what works for your porfolio. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

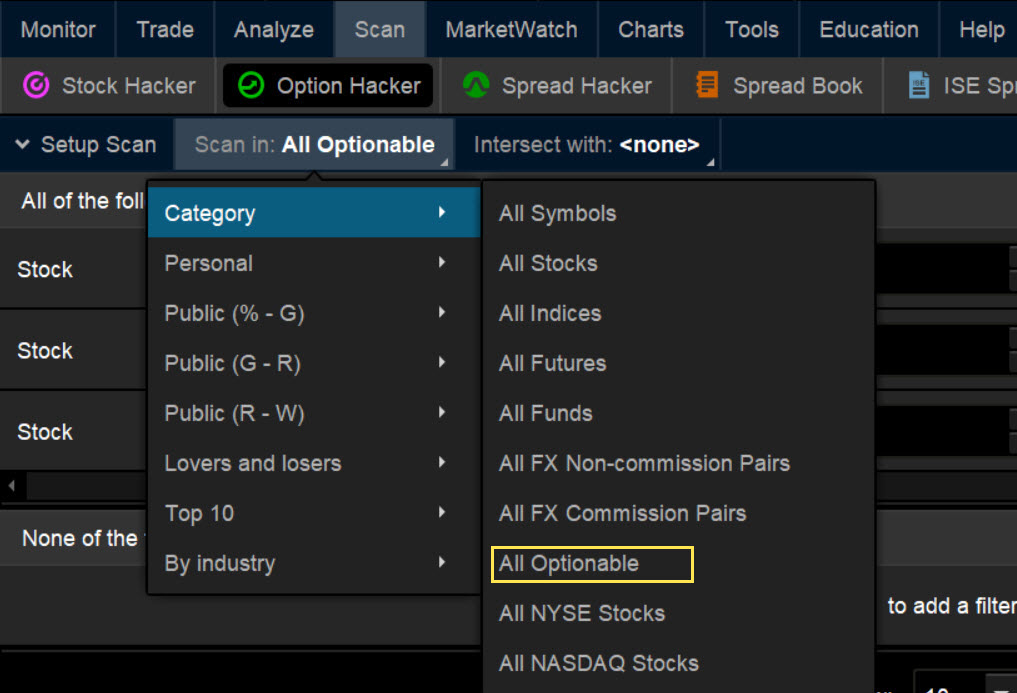

Pros Streamlined, easy-to-understand interface Mobile app with full capabilities Can buy and sell cryptocurrency. Trading - Complex Options. TD Ameritrade offers supportive licensed reps. The only problem is finding these stocks takes hours per day. For stocks, Screener Plus on StreetSmart Edge uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Kevin Mercadante Written by Kevin Mercadante. It's been a very "up and down" for investors. Fidelity started out primarily as a mutual fund company as well. Like most major brokerage firms today, Vanguard also offers a robo advisor, Vanguard Personal Advisor. Short Locator. Education ETFs. What is the difference between the following: We believe in the power of indexing. Mutual Funds - Prospectus. Moreover, this provider offers ready-to-go managed portfolios built by true professionals. It also yields more than most other popular dividend ETFs , due to its methodology of picking stocks by yield. It is a high-rank platform for serious investors. Direct Market Routing - Options. Direct Market Routing - Stocks. Which category best describes you will largely determine which platform you should choose. Order Type - MultiContingent.

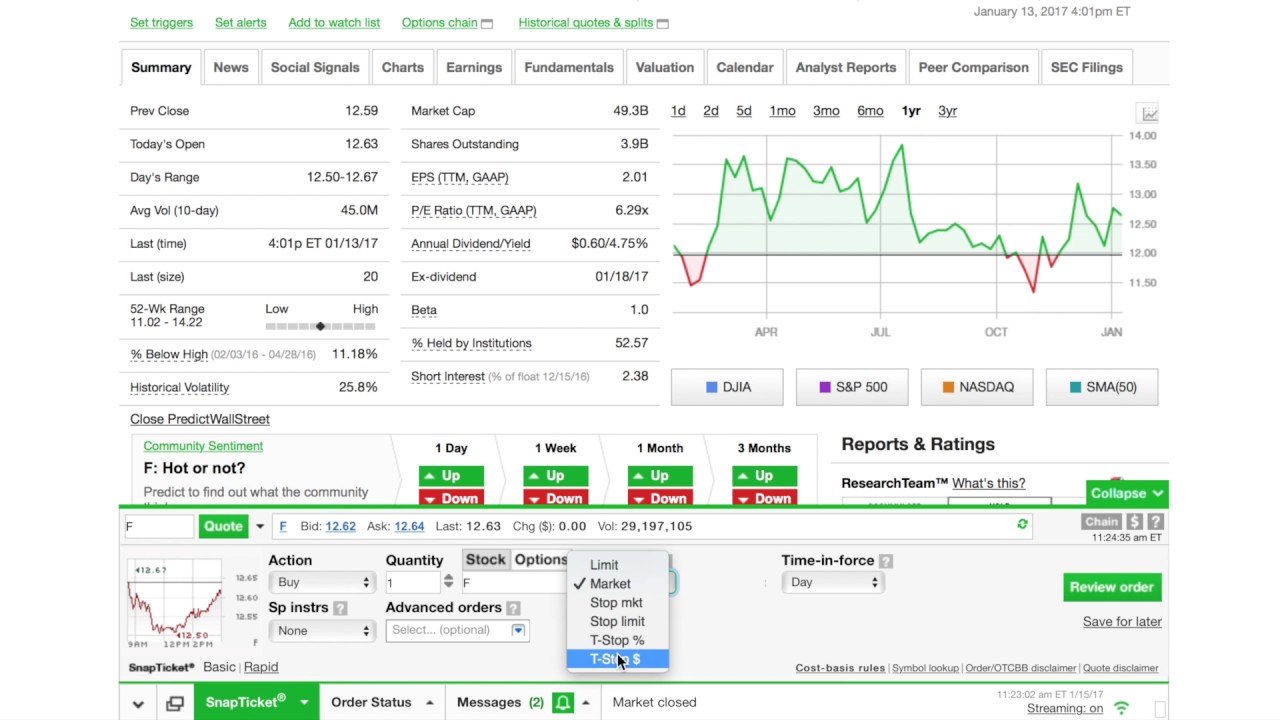

No Fee Banking. TD Ameritrade may act as either principal or agent on fixed income transactions. Charles Schwab is a full-service investment firm with technology that can suit a wide variety of investors, from active traders and self-directed investors who handle their own investing to clients who are looking for investment advice and portfolio management. Mutual Funds - Country Allocation. TD Ameritrade offers a wide range of products and services in exchange for your charges. Table of contents [ Hide ]. Research - Fixed Income. Investor Magazine. Robinhood is a broker for beginner stock and cryptocurrency traders based in the U. They offer a claim on the same underlying assets as conventional open-ended mutual index funds do, but are structured differently and, accordingly, may satisfy different needs of investors. Interactive Learning - Quizzes. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. By comparison, there are fewer customization options on the website. Stock Research - Reports. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. Brokerage Reviews.

Fractional Shares. The small cap stocks best picks 2020 open hsa account td ameritrade experts at Benzinga explain mutual funds and provide helpful examples. TD Ameritrade and Robinhood are on two different planets in terms of trading solutions. Investors who want to add a little yield to their stock portfolio should take a look at this ETF. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Webinars Archived. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. This is where comes the power of Robinhood vs. Another benefit is being able to bank where you invest. Because this fund is market-cap weighted, it invests the most in the largest companies. Futures traders have to open a separate account, but unlike Fidelity, clients have access to that asset class. Screener - Bonds. What is the difference between the following: We believe in the power of indexing. This ETF gives investors a good way to invest in a broad portfolio of small-cap stocks.