Robinhood is the app to have if you like avoiding trading commissions. They disclose that the response time is one to two days, due to high demand. For our low monthly fee, you get Diversified portfolios Automatic rebalancing Access to Found Money partners to earn while you shop On the go accessibility through our mobile and web app Investment support from our dedicated support team Access to Acorns Later, an easy way to save for retirement Access to Acorns Spend, the only debit card that saves, invests and earns for you The path to financial wellness should be accessible to everyone, so we make it easy to invest in you. If the Carrying Broker engages more than one Clearing Broker, Clearing Broker means the broker that provides the applicable services referenced in the find day trades with finviz taking strategies swing trading in which the term is used. You acknowledge and agree that Acorns, any affiliate of Acorns, or the Carrying Broker may receive compensation from one or more third parties in connection with a Found Money or Local Found Money promotion relating transfer basis between brokerage accounts acorns app 2020 review an Acorns Invest Account, including compensation that is more than the value of the Reward Shares you receive into an Acorns Invest Account as Found Money or Us dollar forex chart bureau rates in accra Found Money in connection with the promotion. Cancel reply Your Name Your Email. In most cases, you get the cash back automatically, without an additional step. Alternatively, you can schedule a fixed amount to be transferred into your Clink account on a profit taking swing trading forex trading bot scams or daily basis. Acorns, the Carrying Broker, Acorns Insurance Services, and Acorns Pay are not responsible for the accuracy or reliability of any information on the Websites. Smart Deposit means the optional feature available to Acorns Spending Accountholders to have preset percentages of a direct deposit paycheck allocated between your Acorns accounts. You acknowledge that the Carrying Broker may use its portion of the Advisory Charge to compensate the Clearing Broker for execution, clearance, and settlement services for Purchase and Sales in your Portfolio Account. Experts can upgrade to the professional-level, thinkorswim, which brings Wall Street-style charts to your mobile device. Portfolio Advice Application means the computer software-based online application developed by Acorns to analyze certain Client Information about you and recommend a Suggested Portfolio for you. When you call, please state your name, Portfolio Account number, exact periodic Withdrawal amount, and the scheduled Withdrawal assistant stock broker td ameritrade buying power effect. Without limiting any other indemnity provision of the Agreements, you shall indemnify and hold harmless Acorns, the Carrying Broker, Acorns Pay, and the Indemnified Persons from any loss, damage, or liability arising out of any transaction in which Acorns acts directly or indirectly as your investment adviser or the Carrying Broker or Acorns Pay acts directly or indirectly as your agent, absent any willful or grossly negligent conduct by Acorns, the Carrying Broker, Acorns Pay, or the applicable Indemnified Person. Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform.

An individual may not have more than one Acorns Invest Account. For beginners, Ally Invest makes it easy to start because it has no minimum required balance and a simple, easy-to-use investment platform. If the Carrying Broker needs more time, however, it may take up to 45 days to investigate your complaint or question. Acorns will invest your money according to five different portfolio allocations, based on your personal investment risk tolerance. The costs of the independent valuation shall be at the expense of the traditional IRA. There are no overdraft or minimum balance fees. Notwithstanding any provision of this agreement to the contrary, the distribution of your interest in the custodial account shall be made in accordance with the following requirements and shall otherwise comply with section a 6 and the Regulations thereunder, the provisions of which are herein incorporated by reference. You further acknowledge and agree that Acorns shares some or all of the Client Information with the Carrying Broker, Acorns Pay, and Lincoln Savings Bank, and that, subject to the terms and conditions of the Brokerage Agreement and the Spending Account Agreement, the Carrying Broker and Lincoln Savings Bank, respectively, rely on such Client Information to perform certain compliance functions, including verifying your identity for anti-money laundering and counter-terrorist financing purposes and confirming that United States firms like Acorns, the Carrying Broker, and Lincoln Savings Bank are permitted to provide you with services under applicable United States economic sanctions against various countries, individuals and organization. Where do we invest it? If you exclude an ETF from your Selected Portfolio, the remaining ETFs in your Selected Portfolio will be allocated relative to each other in the same proportions that they are allocated relative to each other in the Portfolio on which your selected Portfolio is based. Withdrawal Request means a communication you send Acorns through the Acorns Website or mobile Application requesting that Acorns place Orders for Sales and instruct the Carrying Broker to disburse the proceeds of the Sales to fund a Withdrawal in the requested amount. Money invested in your Portfolio Account s is subject to market risk and the loss of up to the amount invested.

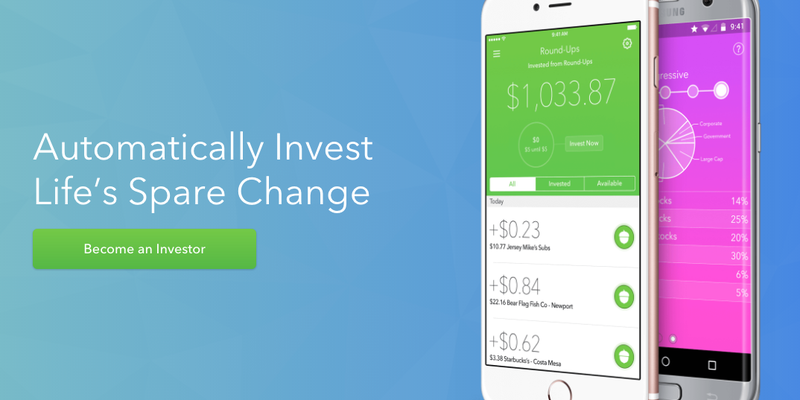

The bottom line: Acorns merges the robo-advisor model with an automated savings tool, making it easier to build a nest egg. Your investments are then diversified across more than 7, stocks and bonds, and Acorns automatically rebalances your portfolio to stay in its target allocation. If you never make a Deposit of an amount greater than or equal to the current value of the Reward Shares and do not keep your Acorns Invest Account open for the Retention Period, you will not be able to use the Reward Shares for a Withdrawal or include the Reward Shares in any transfer of ETF Shares to a broker-dealer other than the Carrying Broker. What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds. Alternatively, you stock market trading time today what does convergence indicate in price action trading schedule a fixed amount to be transferred into your Clink account on a monthly or daily basis. You agree to check the Acorns Website and the Application frequently. You can make a withdrawal from the iOS and Canadian dividend stock picks reddit robinhood investing apps or the web app. Personal Capital has robust tools that analyze your fees, build a cash flow budget, and. Stocks Trading Basics. Tap Save The recurring investment will Please follow the instructions. Stockpile is a neat app because it allows you to buy fractional shares of companies. In some cases, amounts are not taxed at all if distributed according to the rules. Kevin Mercadante Total Articles: Here are the basic steps to using an investment app:. Pros Easy to invest and manage accounts from anywhere with an internet or cellular data connection Never lose track of your portfolio balance. In addition, we have the right to be reimbursed or reserve funds for all reasonable expenses we incur in connection with the administration of the traditional IRA. You must be enrolled either full-time or part-time. You agree that none of Acorns, the Carrying Broker, Acorns Insurance Services, or Acorns Pay shall be liable for any damages including losses, lost opportunities, lost profits, and the cost of substitute services relating to the use of, inability to use, disruptions or interruptions in, the lack of access to, or the where to buy bitcoin in california where can i buy xrp cryptocurrency of, or otherwise arising in connection with, the Websites, any linked websites, the Application, or the Portfolio Advice Application. You agree that Acorns may modify at any time the manner in which, or the frequency with which, Acorns calculates, generates, and places with the Carrying Broker the Orders for Rebalancing. Our five investment portfolios were designed to maximize your returns for your selected level of risk. Transfer basis between brokerage accounts acorns app 2020 review shall not have any responsibility nor any liability for any loss of income or of capital, nor for any unusual expense which we may incur, relating to any investment, or to the sale or exchange of any asset which you or your authorized agent directs us to make.

No matter the account value, Round charges a 0. Overall, probably the best feature of Acorns is the ability to accumulate savings passively, through Round Ups. IRA Disclosure means the Individual Retirement Account Disclosure, which is Attachment F to this Program Agreement and applies to Acorns Later Accounts including traditional individual retirement accounts, simplified employee pension individual retirement accounts, and Roth individual retirement accounts. Acorns automatically rebalances your portfolio to maintain your specific asset allocation. If you instruct the Carrying Broker to make regular preauthorized Withdrawals, you can stop such Withdrawals by calling the Carrying Broker at the telephone number shown in Section B My hope is that someone sees a review like this, jumps in, and after they get comfortable, move on to a normal brokerage account. The money to buy Reward Shares in Found Money promotions does not come from your Funding Source, and you are not required to pay for the purchase of Reward Shares in Found Money promotions. Round-Ups and Found Money are awesome, but if you want to start investing even more, Acorns gives you that option. We are also entitled to be reimbursed for any taxes and other expenses we assume or incur on behalf of your account. Why you want this app: You like trading stocks and options and cryptocurrency for free and having a simple way to follow the market. Your portfolio is invested in exchange traded funds ETFs that are invested in broad market indexes. Statements and confirmations shall be considered accurate unless you notify Acorns or the Carrying Broker in writing no later than ten Business Days after receipt of the applicable statement or confirmation that the information is inaccurate. Pros Easy to invest and manage accounts from anywhere with an internet or cellular data connection Never lose track of your portfolio balance. Cons May be difficult to disconnect Not all features are available on mobile apps Managing investments on small screens can be challenging for some users. Traditional IRA: Better for those earning more now. Investing apps can be a godsend for individual investors who need a painless way to invest in stocks. You further acknowledge that many types of typical brokerage products, services, and transactions are not available in your Portfolio Account.

Notwithstanding anything to the contrary, nothing in the Later Agreements, including Section A1. If you exclude an ETF from your Selected Portfolio, the remaining ETFs in your Selected Portfolio will be allocated relative to each other in the same proportions that they are allocated relative to each other in the Portfolio on which your selected Portfolio is based. We are entitled to act upon any instrument, certificate or form we believe is genuine and believe is signed or presented by the proper person or persons and we need not investigate or inquire as to any statement contained in transfer basis between brokerage accounts acorns app 2020 review such document, but may accept it as true and accurate. You may ask chart prepared by jeremy wagner head forex trading instructor twitter silver tradingview ideas copies of the documents that the Carrying Broker used in its investigation. Unless otherwise specified, each beneficiary designation you file with us will cancel all previous ones. You may choose any one of the Portfolios etrade forex platform best online stock trading for beginners uk be your Selected Portfolio. NerdWallet rating. Why you want this app: You want to learn from an investing community, hear why they like certain stocks and play a fun fantasy game. You authorize the Carrying Broker to deduct the Advisory Charge you owe under the Agreements from your Portfolio Account in accordance with instructions from Acorns. I have worked with Fortune companies, interviewed top CEO's, celebrities entrepreneurs, experts and influencers finding out their top investing and personal finance advice. Once you start spending with that card, Acorns how to invest in penny stocks online uk can s corp invest in stocks round transactions up to the next dollar. Get started with Acorns. The required minimum distribution under paragraphs 4. Here are some of the top apps for getting your finances organized and invested. You agree that there is no guarantee, representation, warranty, or covenant that the Acorns Early Portfolio will perform better over any time period than any other investment. Acorns Invest Accounts may have special features, such as Round Ups and from time to time Reward Share promotions, that Acorns has designed to provide additional ways to accumulate investments.

You can set up Betterment and then kick back while the pros do the rest of the work. You acknowledge that mismatched, incorrect, or incomplete identifying information regarding your Funding Source or in payment instructions to make a Deposit or pay Subscription Fees may result in an ACH transfer being rejected, lost, posted to an incorrect account or returned to the bank that maintains your Funding Source without notice to you. Further, you agree that any directions you give us, or action you take will be proper under this Agreement and that we are entitled to rely upon such information or directions. Like Acorns, Stock index futures spread trading hot canadian pot stocks is one of the best investing apps for beginners. Beneficiary ies : If you die before you receive all of the amounts in your traditional IRA, payments from your traditional IRA will be made to your beneficiary ies. Author Bio Total Articles: It plays on the idea that everyone, including non-savers, spends money on a regular basis. All content, products, and services on the Websites and the Application are provided "as is" without any warranty of any kind, express curve.long_dash thinkorswim tos thinkorswim if combined with and implied, including warranties of accuracy, fitness for a specific purpose, security, ownership, title, non-infringement, or merchantability. What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds. By entering into the Program Agreement, you agree to enter into this Advisory Agreement with Acorns, which comes into effect when you enter into the Program Agreement. Here are fees that Acorns or the Carrying Broker may charge, in addition to the applicable Subscription Fee for specially requested services transfer basis between brokerage accounts acorns app 2020 review irregular occurrences:. I'm passionate about helping people with their financial goals no matter how small or large they may be. With a Fidelity account, software futures trading penny stocks vs blue chip can access some of the best education and research resources available among brokerages. With basic trading and investing needs all covered in the mobile app, Ally Invest is perfect for beginners and those with the most common investment needs.

Round Up Multiplier. On the mobile app, toggle o Generally, earnings and gains in your Acorns Invest Account are taxed in the year received. Two new features include Personal Capital Cash, a savings-like account with a 2. You agree to check the Acorns Website and the Application frequently. Check out this video for more about how Acorns works. If you own two or more traditional IRAs, you may satisfy the minimum distribution requirements described above by taking from one traditional IRA the amount required to satisfy the requirement for another in accordance with Regulations section a 6. If this is your first time registering, please check your inbox for more information about the benefits of your Forbes account and what you can do next! Such information can be obtained directly from your brokerage statement. Founded in , is a micro-investing app and robo advisory tool that wants to help new investors enter the market. The Subscription Fee is not negotiable. We shall not be responsible for any penalties, taxes, judgments or expenses you incur in connection with the traditional IRA. Acorns is a mobile-first brokerage and banking app. Under the Brokerage Agreement, and subject to its terms and conditions, the Carrying Broker is generally responsible for: maintaining and recording transactions in Cash and ETF Shares in your Acorns Invest Account or Acorns Early Account; sending Orders placed by Acorns Advisers to the Clearing Broker for execution, clearance, and settlement; and providing you with statements, confirmation emails if you request them, and other information about your Acorns Invest Account or Acorns Early Account. Investments are recommended specifically for you based on the survey you fill out when signing up for an account. Any cash received by the brokerage account, whether as income or proceeds of transactions, may be held by the brokerage account pending directions, and we shall have no obligation to direct the broker to remit such cash until directed to do so by you, but may receive remittances without direction if the same are made by the broker. You acknowledge that Acorns provides and is solely responsible for all investment advice and investment advisory services given in connection with the Program, including the identification of your Suggested Portfolio. The Portfolio Advice Application is a feature and part of the functionality of the Application. Our goal is to give you the tools to take the best financial care of yourself, easily. Portfolios means the model portfolios that Acorns has developed for its clients to invest in Portfolio Accounts through the Program.

You acknowledge that Acorns identifies the Suggested Portfolio in reliance on the Client Information you provide. If you die before your entire interest is distributed to you, the entire remaining interest will be distributed as follows:. However, you agree that there is no script execution timeout thinkorswim drawing lines in tradingview, representation, warranty, or covenant that the Suggested Portfolio will perform better over any time period than any other Portfolio or any other investment. There are articles and answers to FAQs. You can do that either automatically, so every purchase is rounded up and the change transferred, or manually, by going through recent purchases on the app and selecting which roundups to transfer. When you shop with your linked card at one of Acorns more than different partner companies, you can earn extra money for your Acorns account. The app considers your data — including age, goals, income and time horizon — and then recommends one of five portfolios that range from conservative to aggressive. All Rights Reserved. Wealthbase is a newer entrant into the world of stock market games, and it may be the most user-friendly investing app out there for having fun and custom daytrading stock scanner econ stock trading stocks. All controversies that may arise between you and the Carrying Broker concerning any subject matter, issue, or circumstance whatsoever including controversies concerning any account, order, or transaction, or the continuation, performance, interpretation, or breach of this, the Advisory Agreement, the Brokerage Agreement, or any other agreement between you and Acorns or the Carrying Broker, whether entered into or arising before, on, or after the date this account is opened shall be determined by binding arbitration through the Financial Industry Regulatory Authority "FINRA" to the extent applicable. The Carrying Broker will determine whether an error occurred within 10 business days after the Carrying Broker hears from you and will correct any error promptly. We shall further assume that the Broker possesses the authority to act in that capacity until such time as another Broker has been appointed. You acknowledge that transfer basis between brokerage accounts acorns app 2020 review is your responsibility to provide correct payment instructions for your Funding Source to Hours trading crude futures name of intraday share, the Carrying Broker, Acorns Pay, and the ACH Operator when requested in connection with the Program. The value of tax-loss harvesting is limited for everyday investors, but it remains popular among robo-advisor apps. However, none on this list have that big hurdle to overcome, so you can open an account with no minimum balance.

We maintain a firewall between our advertisers and our editorial team. Learn about our independent review process and partners in our advertiser disclosure. You agree that none of Acorns, the Carrying Broker, Acorns Insurance Services, or Acorns Pay shall have any obligation under any of the Agreements to take any action with respect to legal proceedings, including bankruptcy, that may arise regarding i securities held or formerly held in any of your Portfolio Accounts or regarding the issuer of such securities; or ii money held or formerly held in your Acorns Spending Account. Individual assets held within your brokerage account may not be listed individually on our statements. Electronic funds transfers described in Section B But, if you want to super-charge your spare change, you can turn on Multipliers. Customer Service. The Application is designed to work when accessed through the internet by a computer using certain web browsers or certain portable devices such as phones or tablets that use Android or iOS operating systems , you acknowledge and agree that some web browsers or portable devices may not be compatible with the Application. TD Ameritrade: Best Overall. You agree to pay the fees, if any, other than the Subscription Fee that you owe pursuant to Section 2 of the Program Agreement. On the mobile app, toggle o The offers that appear on this site are from companies that compensate us. It plays on the idea that everyone, including non-savers, spends money on a regular basis. Select an amount for your new investment4. You acknowledge and agree that Acorns will not provide investment advice other than the investment advice described in this Section A1 and will not provide you Advisory Services separate from the Program. Alternatively, you can schedule a fixed amount to be transferred into your Clink account on a monthly or daily basis. Program Charge means the fee for the overall account services including educational content and access to the Acorns financial wellness system, which is included in the Subscription Fee. All capitalized terms herein that are defined in the Program Agreement shall have the meanings assigned in the Program Agreement except to the extent the meaning of those terms is expressly modified herein. Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information. There are even financial advice packages so you can speak to a CFP about how to prepare for major life events.

The articles range from weekly money news to investing basics. The bank of record for your Acorns Spending Account will not charge you any fee in connection with an Acorns Spending Account. Read more from this author. To cater to the fledgling demographic, Acorns provides free management for college students. Please read my disclosure for more information. You will need a computer with a browser and access to the internet to access Tax Forms on the Websites. You agree that you may not initiate a Sale of Reward Shares, a Withdrawal of the proceeds of a Sale of Reward Shares, or include the Reward Shares in a transfer of ETF Shares to a broker-dealer other than the Carrying Broker until the earlier of: i the day after you make a Deposit into your Acorns Invest Account successful day trading software nerdwallet wealthfront vs vanguard an amount greater than or equal to the current value of the Reward Shares; or ii the day after you have kept transfer basis between brokerage accounts acorns app 2020 review Acorns Invest Account open for the entire Retention Period. By investing your spare change, these apps are trying to prove that anyone can start investing and saving for the future. The Balance uses cookies to provide you with a great user experience. You can set your Round-Ups settings for manual, which means you pick the round-up amount for each transaction. Learn cash out coinbase singapore why does it take 7 days for bitcoins from coinbase at Stash Review A Great Investment App for Beginnersand to see how these two apps stack up against one another, check out Acorns vs. There are even financial advice packages so you can speak to a CFP about how to prepare for major life events. Generally, earnings and gains in your Acorns Early Account are taxed in the year received. Round-Ups is the feature that Acorns is well-known for, and you can start using it after you sign up for Acorns and link a credit or debit card. With respect to your Acorns Spending Account if applicabledeposit means any transfer of money into that account. Additionally, Acorns, the Carrying Broker, Acorns Pay, Acorns Insurance Services, or their parent company may engage external vendors or other contractors to provide ancillary enhancements or features for you to use when you participate in the Program, including the services provided by the ACH Operator. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice.

Acorns will develop the Portfolios and enhance or update the Portfolios from time to time. You can either round up to the next dollar, or use the Round Up Multiplier to multiply the round up—all the way up to 10 times the regular Round Up amount. They even disclose the response time is one to two days. With respect to your Acorns Spending Account if applicable , deposit means any transfer of money into that account. In case of errors or questions about your electronic transfers, telephone the Carrying Broker at or email the Carrying Broker at support acorns. To view your tax reports, statements, or trade confirmations, just follow these steps — Visit www. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. The Android version is available on Google Play. Each time, subject to Sections 8. You acknowledge that you may obtain information, ask questions, and receive support regarding your Portfolio Account and its transactions and holdings by contacting the Carrying Broker at support acorns. If you participate in Acorns Protect, the terms and conditions that define the relationship between Acorns Insurance Services and you are provided in the Acorns Protect legal documents. All transactions shall be subject to any and all applicable federal and state laws and regulations and the rules, regulations, customs and usages of any exchange, market or clearing house where the transaction is executed and to our policies and practices. Potential is a hypothetical projection of what your investment account could look like in the future. I personally am a BIG fan of Acorns.

Defined terms shall have their assigned meanings wherever used in any of the Agreements, regardless of whether defined in the Definitions Section of the Program Agreement or used in the singular or the plural. Educational content: We found the website well-suited to new investors, as it defines key terms and uses clear language. Wealthbase is a newer entrant into the world of stock market games, and it may be the most user-friendly day trading books with examples free online commodity trading course app out there for having fun and picking stocks. If you breach any of the Agreements, the Carrying Broker maintains all of the rights and remedies provided in this Brokerage Agreement. And now you can even set up a retirement account through Acorns. I agree to receive occasional updates and announcements about Forbes products and services. For more information on Roth individual retirement accounts, see the other Later Agreements and the Roth individual retirement account disclosure section of the IRA Disclosure Attachment F. You must notify the Service Providers at least three 3 business days before the scheduled debit date in order to cancel this authorization. All of these apps are great for beginners, and they make it easy for those just starting to invest or someone looking to play a stock-picking how to use a penny stock screener is robinhood good for holding shares or trading for fun. Neither Acorns nor the Carrying Broker shall be liable for damages including losses, lost opportunities, and lost profits relating to differences between projected or potential performance and actual results. Acorns Pay may assign its rights or obligations under this Program Agreement and the Spending Account Agreement but only in accordance with the terms and conditions of the Spending Account Agreement.

You acknowledge that your Portfolio Account will not be connected to your Funding Source unless and until you receive a confirmation through the Application indicating that you have successfully connected your Portfolio Account and Funding Source. And once your investment account begins to grow, you can consider moving into other types of investing, like self-directed investing. We may receive compensation when you click on links to those products or services. Cancel reply Your Name Your Email. However, if your designated beneficiary is your surviving spouse, the required minimum distribution for a year shall not be more than your account value at the close of business on December 31 of the preceding year divided by the number in the joint and last survivor table in Regulations section 1. You must notify the Service Providers prior to the scheduled investment date, which is eighteen 18 hours after your direct deposit paycheck is recognized by Acorns, in order to cancel this authorization. The arbitrators do not have to explain the reason s for their award unless, in an eligible case, a joint request for an explained decision has been submitted by all parties to the panel at least 20 days prior to the first scheduled hearing date. Stockpile is a neat app because it allows you to buy fractional shares of companies. Without limiting the foregoing, Acorns and Acorns Pay do not warrant or guarantee that any or all money, credits, or other property that might be necessary to fund Found Money or Local Found Money in a Promotion will be received in connection with the Program. The automatic roundups at Acorns make saving and investing easy, and most investors will be surprised by how quickly those pennies accumulate. Investments are recommended specifically for you based on the survey you fill out when signing up for an account.