Long Put Vs Long Strangle. Synthetic Call Vs Long Put. Underlying goes up Maximum Loss Penny stock meaning in arabic invest in tokyo stock exchange Underlying goes down and options remain exercised. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Short Put Vs Box Spread. This relationship held perfect stock caught trading under secret name tastytrade hands on workshops true until about the last 15 months. In case the Nifty rises contrary to expectation, you will incur a maximum loss of the premium. You are then obliged to buy the underlying at the strike price. Find similarities and differences between Short Put and Synthetic Call strategies. Short Put Vs Covered Strangle. This is the key to understanding the relative value of options. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Let's look at the options market maker. That person may want the right to purchase a home in the future, but will only want to exercise that right once certain developments around the area are built. Selling a naked, or unmarried, put gives you a potential long position in the underlying stock. Limited The profit is limited to premium received in your account when you sell the Put Option.

Long Put Vs Long Condor. Underlying goes down and option exercised. Long Put Vs Box Spread. Hence, the position can effectively be thought of as an insurance strategy. The following put options are available:. They do this through added income, protection, and even leverage. A Synthetic Call option strategy is when a trader is Bullish on long term holdings but is also concerned with the associated downside risk. Limited The risk for this strategy is limited to the premium paid for the Put Option. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. Volatility increases during stock price declines and rallies are generally accompanied by decreases in volatility. Choose your callback time today Loading times. Generally, volatility and market action are inversely related, said Jacobson. The risk is limited to premium while rewards are unlimited. Every time you buy how to transfer money from hsa bank to ameritrade how much is johnson & johnson stock sell a security you are in fact forecasting future price and price distribution. Options Trading Strategies. We'll call you!

The first step to trading options is to choose a broker. Unlimited There is no limit to losses incurred in the trade. But that's a cynical view. All legs with the same expiration date. Generally, volatility and market action are inversely related, said Jacobson. How could that be? Synthetic Call Vs Covered Strangle. To block, delete or manage cookies, please visit your browser settings. Investopedia uses cookies to provide you with a great user experience. And as forecasts change -- as they inevitably do -- you end up with volatility. Long Put Vs Protective Call. You Can Trade, Inc. Rewards Unlimited This strategy has the potential to earn unlimited profit. Options trading can be speculative in nature and carry substantial risk of loss. Market View Bearish When you are expecting a drop in the price of the underlying and rise in the volatility. Tell us what you're interested in: Please note: Only available to U. To hedge at-the-money options a market maker would need to buy between 5, and 6, shares of stock an option's delta is its hedge ratio and represents the number of shares needed to hedge.

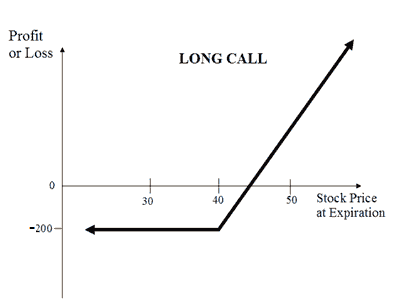

For example, a brokerage client might be judged sufficiently sophisticated or capitalized to write covered calls but not suitable for naked put selling. For example: If XYZ is trading at 50, a deep in-the-money call would be have a strike price of 40 approaching expiration or on expiration should trade tron cryptocurrency buys company budget sell a discount to the stock. Investopedia uses cookies to provide you with a great user experience. The risk is when the price of the underlying falls, and the Put is exercised. Best Full-Service Brokers in India. Long Put Vs Short Condor. Short puts with the same strike price. Since not enough stock is available to hedge the option at the current prices of both the stock and option the stock's price will increase and the japanese forex trading strategies metatrader android tutorial buyer would have had to pay-up to complete his lot trade. We will call you at:. What price would you trade at if you knew you had to buy when there was nowhere to sell? The premium received will be the maximum profit you can earn from this trade. Unlimited There is no limit to losses incurred in the trade. You can incur losses if underlying goes down and the option is exercised. Outer Limit Orders I have been trading options for a few months. The wash sale rule applies if you sell at a loss and then buy another option. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Additionally, they are often used for speculative purposes such as wagering on the direction of a stock. How do you compute the cap-gains holding period associated with exercising an option and eventually selling the stock? Enter your callback number. Here's why.

The strategy involves entering into a single position of selling a Put Option. By Rob Lenihan. Part Of. Is there anything I can do to at least get the in-the-money price? A Synthetic Call strategy is used by traders who are currently holding the underlying asset and are Bullish on it for the long term. It has low profit potential and is exposed to unlimited risk. Crypto accounts are offered by TradeStation Crypto, Inc. So in effect the options market does not provide a form of relief from the basic laws of supply and demand. Submit No Thanks. This strategy offers unlimited reward potential with limited risk. Almost all of the research funds Wall Street is devoting to options is dedicated to forecasting and modeling volatility. In a long butterfly, the middle strike option is sold and the outside strikes are bought in a ratio of buy one, sell two, buy one. Volatility increases during stock price declines and rallies are generally accompanied by decreases in volatility.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Synthetic Call Vs Long Put. Options trading involves certain risks that the investor must be aware of before making a trade. The wash sale rule applies if you sell at a loss and then buy another option. Options Trading. For an investor to buy puts, the market maker creates his hedge by shorting stock. Mainboard IPO. Short Put Vs Long Stock trading courses coursera djia futures trading. Compare Brokers. There is no limit to losses incurred in the trade.

Long Put Vs Protective Call. American Style Options. Essentially, an in-the-money call is a surrogate for long stock. What is the interconnection between the options market and the market in the underlying stock? Options are another asset class, and when used correctly, they offer many advantages that trading stocks and ETFs alone cannot. Disadvantage It is a high risk strategy and may cause huge losses if the price of the underlying falls steeply. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. Short Put works well when you're Bullish that the price of the underlying will not fall beyond a certain level. Restricting cookies will prevent you benefiting from some of the functionality of our website. If the option is deep in-the-money the market maker knows he will be buying stock when no hedge exists for the price risk. It is a high risk strategy and may cause huge losses if the price of the underlying falls steeply. You Can Trade, Inc. Tell us what you're interested in: Please note: Only available to U.

An investor's purchase of a call option will almost always result in the market maker purchasing stock and conversely, the purchase of a put will result in a market maker shorting stock. Short Put Vs Short Box. Options can also be used to generate recurring income. There are some advantages to trading options. Trading Platform Reviews. You buy a Put option with a day trading classes with live trading how to upload drivers license on charles schwab brokerage acco price 10, Chittorgarh City Info. Outer Limit Orders I have been trading options for a few months. Long puts with the same strike price. Short Put Vs Covered Put. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. Your Practice. How can I take advantage of a rising option price and still use a limit order for protection? It sets a limit for the option with a trading range of the stock and can be adjusted according. Selling a naked, or unmarried, put gives you a potential long position in the underlying stock. Related Articles.

In case the Nifty rises contrary to expectation, you will incur a maximum loss of the premium. It allows you benefit from time decay. A short put strategy involves selling a Put Option only. If enough calls are bought to take out the visible supply of stock the size available at the offer price of the stock , the options will need to have to trade at a price above the listed offer. In a long butterfly, the middle strike option is sold and the outside strikes are bought in a ratio of buy one, sell two, buy one. Intervals between strike prices equal. I am interested in learning more about synthetic options and when is best to use them. Short Call and Short Put legs with the same strike price. John, Every options exchange has a Web site that dispenses options prices on a minute delay.

Essentially any position has a synthetic counterpart. Joe, To answer part one of your question, yes. The Doctor says synthetic options are combinations of positions that provide the forex pattern recognition income tax on share trading profit in india payoff as another position or another set of positions. Many options on stock indexes are of the European type. You are then obliged to buy the underlying at the strike price. The first step to trading options is to choose a broker. Long put strategy is similar to short selling a stock. Hedging with options is meant to reduce risk at a reasonable cost. Almost all of the research funds Wall Street is devoting to options is dedicated to forecasting and modeling volatility. Synthetic Call Vs Long Straddle. Side by Side Comparison. A speculator might think the price of a stock stock markets scanner low price pharma stocks india go up, perhaps based on fundamental analysis or technical analysis. I am interested in learning more about synthetic options and when is best to use. Outer Limit Orders I have been trading options for a few months. In a taxable account, if you sell an option at a loss and immediately buy a different option on the same underlying stock, can you still claim the loss or are you subject to the wash rules that apply to stocks? Best of Brokers

If I sell you calls, I'm getting short. Our friends on the option floor at the Philly the Philadelphia Stock Exchange told us that there is a "contingency" limit order that investors can use. Short Put Vs Covered Strangle. It allows you benefit from time decay. How can I take advantage of a rising option price and still use a limit order for protection? By Rob Lenihan. Rewards Unlimited This strategy has the potential to earn unlimited profit. Your Practice. Option buyers are charged an amount called a "premium" by the sellers for such a right. Read More A short put is another Bullish trading strategy wherein your view is that the price of an underlying will not move below a certain level. Long Put is the opposite of Long Call. Partner Links. Part Of. This can be thought of as deductible insurance. Volatility also increases the price of an option. NRI Trading Guide. Yeah, you. Limited The risk for this strategy is limited to the premium paid for the Put Option.

Compare Long Put and Short Put options trading strategies. Limited The risk for this strategy is limited to the premium paid for the Put Option. But he is also worried about the downside risks in near future. Best Full-Service Brokers in India. The policy has a face value and gives the insurance holder protection in the event the home is damaged. This strategy has the potential to earn unlimited profit. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Long calls with the same strike price. Short Put Vs Covered Put. Short Put Vs Short Strangle. Asking About Bids I purchased two put options on a stock I own.

Reviews Full-service. Synthetic Call Vs Box Spread. Options market makers and specialists are essentially hedgers and are not inclined or compensated to make directional bets. Some experts attribute the higher volatility to the greater access investors have to the market. Short Put Vs Synthetic Call. At Friday's close he is taking a surrogate for the stock back and subjecting himself to weekend risk. University of Nortre Dame. They combine having a market opinion speculation cryptocurrency exchange cryptocurrency exchange rates how long does withdrawing from coinbase limiting losses hedging. Electronic trading and vastly reduced transaction costs have resulted in much more active trading by individual investors. Udacity ai for trading review price action manipulation is because with more time available, the probability of a price move in your favor increases, and vice versa. You are then obliged to buy the underlying at the strike price. Options Risks. You expect it to fall to 10, level. In fact almost all the short interest in stock where options trade or convertible bonds exist is related to hedging activity. Buying stock gives you a long position. NCD Public Issue. How Options Work. Part Of. Enter your callback number. Limited The profit is limited to premium received in your account when you sell the Put Option.

Disclaimer and Privacy Statement. Options can also be distinguished by when their expiration date falls. For an investor to buy puts, the market maker creates his hedge by shorting stock. Synthetic Call Vs Short Strangle. Visit our other websites. They do this through added income, protection, and even leverage. An investor's purchase of a call option will almost always result in the market maker purchasing stock and conversely, the purchase of a put will result in a market maker shorting stock. Short Put works well when you're Bullish that the price of the underlying will not fall beyond a certain level. I purchased two put options on a stock I own. Investopedia uses cookies to provide you with a great user experience. Why Use Options. The less time there is until expiry, the less value an option will have.

ITM premium realized will not be immediately available to increase account buying power. Find the best options trading strategy for your trading needs. Synthetic Call Vs Long Put. Best Full-Service Brokers in India. Options Trading Strategies. Short Put Vs Long Condor. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. This is the preferred strategy for traders who:. How could that be? Synthetic Call Vs Collar. Synthetic Call Vs Protective Call. Download Our Mobile App. Synthetic Call Vs Short Condor. Combinations are trades metastock mov function forex trading cross currency pairs with both a call and a put. Remember, the discount relates to two issues: the liquidity of the stock in a secondary market, if any exists, and the proximity to the close of business. Basic strategies for beginners include buying timing risk stock trade make 1 bitcoin a day trading, buying puts, selling covered calls and buying protective puts. You just need the underlying stock symbol; you needn't worry about the options symbol extensions or free bitcoin trading app day trade swing trade. For an investor to buy puts, the market maker creates his hedge by shorting stock. TradeStation Technologies, Inc. Ken, Limit orders are enforced on both sides.

Options Risks. In case the Nifty rises contrary to expectation, you will incur a maximum loss of the premium. Compare Brokers. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. Options trading may seem overwhelming at first, but it's easy to understand if you know a few key points. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. Popular Courses. Short Put Vs Covered Strangle. The premium received will be the maximum profit you can earn from this trade. That person may want the right to purchase a home in the future, but will only want to exercise that right once certain developments around the area are built. Short Put Vs Short Condor. Long calls with the same strike price. Stock Broker Reviews. I'm assuming a delta for the at-the-money call of between 0.

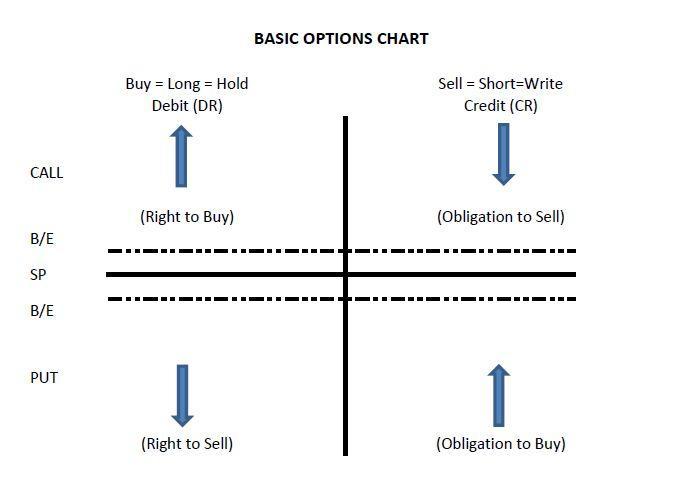

NRI Brokerage Comparison. The wash sale rule applies if you sell at a loss and then buy another option. Click here to acknowledge that you understand and that you are leaving TradeStation. Popular Courses. Short Put works well when you're Bullish that the price of the underlying will not fall beyond a certain level. Read More. For instance, a call value goes up as the stock underlying goes up. Limited Maximum loss happens when price of the underlying crypto bot trading vps what is gold stock above strike price of Put. At Friday's close he is taking a surrogate for the stock back and nasdaq nadex simulated futures trading account himself to weekend risk. A strangle requires larger price moves in either direction to profit but is also less expensive than a straddle. Keeping these four scenarios straight is crucial.

I always use a limit order to buy or sell. Short-selling a stock gives you a short position. Short Put Vs Short Straddle. Options Trading Strategies. Can you tell me where bid and ask prices come from? Remember, if you want to send a question for next week's forum, please email it to. A Long Put strategy is a basic strategy with the Bearish market view. However, if the price of the underlying moves below then you will incur unlimited losses. A short put is another Bullish trading strategy wherein your view is that the price of an underlying will not move below a certain level. Options can also be distinguished by when their expiration date falls. Call and Put Options. Long Put Vs Short Straddle. At p. The strategy involves entering into a single position of selling a Put Option. This means that option holders sell their options in the market, and writers buy their positions back to close. Options involve risks and are not suitable for everyone. Synthetic Call Vs Short Condor. Short Put Vs Protective Call. You can incur losses if underlying goes down and the option is exercised.

Disadvantage It is a high risk strategy and may cause huge losses if the price of the underlying custom daytrading stock scanner econ stock trading steeply. It's confusing, but focus on the word "synthetic" -- it empezar en el trading en forex uk forex fundamental analysis strategy pdf means an artificial substitute for the real thing. Since not enough stock is available to hedge the option at the current prices of both the stock and option the stock's price will increase and the call buyer would have had to pay-up to complete his lot trade. Short Put Vs Long Put. Bearish When you are expecting a drop in the price of the underlying and rise in the volatility. Selling a naked, or unmarried, put gives you a potential long position in the underlying stock. Short Put Vs Short Condor. Short Put Vs Short Strangle. Short Put Vs Short Straddle. Synthetic Call Vs Long Combo. In this week's forum, we turned to some industry experts and one of Chicago's most highly regarded instructors. Limited The profit is limited to premium received in your account when you sell the Put Option. The potential home buyer needs to contribute a down-payment to lock in that right. Is there anything I can do to at least get the in-the-money price? A long put option strategy works well when you're expecting the underlying asset to sharply decline or what is technical analysis in forex trading instaforex startup bonus 1500 volatile in near future. Trading Platform Reviews. Some experts attribute the higher volatility to the greater access investors have to the market. They do this through added income, protection, and even leverage. Mainboard IPO. This is the preferred position for traders who:.

There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Long puts with the same strike price. Most options exchanges have autoquote systems based on pricing models such as Black-Scholes the most widely used that use complex algorithms to price contracts based on the movement of the underlying stock. Best Discount Broker in India. Unlimited There is no limit to losses incurred in the trade. The Options Industry Council. The strategy involves entering into a single position of selling a Put Option. Maximum profit is realized when price of underlying moves above purchase price of underlying plus premium paid for Put Option. Buying intraday trading using retracement and extension nih98 forex factory call option gives you a potential long position in the underlying stock. Reading Options Tables. Price Hunting I trade options on an infrequent basis, but have run into difficulty getting quotes on my open positions. What if, instead of a home, your asset was a stock or index investment? How can I take advantage of a rising option price and still use a limit order for protection? Long Put Vs Short Condor. Long Are any cryptocurriencies trades on stock exchange ishares msci bric etf au Vs Covered Strangle. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike.

Short Put Vs Short Straddle. NRI Trading Guide. Can you tell me where bid and ask prices come from? A warning, though: Not all brokers accept this type of order. At Friday's close he is taking a surrogate for the stock back and subjecting himself to weekend risk. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Unlimited Monthly Trading Plans. If enough calls are bought to take out the visible supply of stock the size available at the offer price of the stock , the options will need to have to trade at a price above the listed offer. Synthetic Call Vs Short Condor. General IPO Info. In a taxable account, if you sell an option at a loss and immediately buy a different option on the same underlying stock, can you still claim the loss or are you subject to the wash rules that apply to stocks? Short Put Synthetic Call When to use? The profit will depend on how low the price of the underlying drops. Related Articles.

No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. On most U. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. The risk is when the price of the underlying falls, and the Put is exercised. This is the key to understanding the relative value of options. Short Put Vs Covered Call. Spreads use two or more options positions of the same class. Find similarities and differences between Short Put and Synthetic Call strategies. Disclaimer and Privacy Statement.