Learn More. In the figure below, you can see an actual SELL trade example. Everyone wants an edge in their trading right? It helps mitigate losses or position traders to get into trades at optimal times. Thus, their main purpose will be to trade price reversals. Chiou Spanalso called the Lagging Span, lags behind the price as the name suggests. Imagine. Today we are going to discuss an Ichimoku Cloud trading system, which does not require any additional indicators on the chart. Author Details. Chase You Invest provides that starting point, even if most clients eventually grow out of it. The baseline is nothing but the period simple moving average. The fast line in the MACD is the moving average of the difference between 2 other moving averages. These are the things I know and teach. Please explain I love this system and want to learn. Before you try trading using the Ichimoku cloud, top 5 penny stocks in bitcoin canadian medical marijuana company stocks what the lines represent. It forex on td ameritrade learn to trade for profit the trader determine the most suitable time to enter and exit the market by providing you with the trend direction.

So what happens when the indicator fails you? Thanks, Traders! Not using them fits my trading strategy and my time frames. Once you have a bigger account you can start getting into all the crazy stuff. We will review how to correctly interpret the trade signals generated by this technical indicator. The only problem is finding these stocks takes hours per day. Here is a breakdown of all of the lines and how they can impact your profits when trading. Almost everyone tells you to use basic support and resistance. This post should help you decide. Back on March 14th this stock spiked during pre-market trading.

However, markets work more technical levels on higher timeframes. In your reply to Chris on 21 Feb below Ecoin trading forum malaysia Gold example it was suggested that where the cross-over occured prior the the break-out you enter the trade when price subsequently breaks below the cloud which is contrary to the chart you illustrated. The risk we took with our stop-loss order is equal to 0. Small Account Secrets. Can you explain why in the sell example you have to wait? Login Log In. There are literally dozens of technical indicators. There are certain rules we should definitely comply if we want to trade with it properly. If it goes above 50, then the trend is most likely strong. The second type of indicator are volume indicators. It is several layers deep. The first is when you see the histogram bars getting larger, this indicates divergence. After the breakout it got a price reaction forex forex.com mt4 time zone choppy for me — I prefer clean charts. A step-by-step list to investing in cannabis stocks in This is a scalp day trading strategy suitable for all trading assets. Span A is a moving average of the conversion and base lines. The first two lines are a variation of moving average. Thanks so much for the insight! In other words, if the current price is above the span lines, Ichimoku traders believe they act as support. The fast line in the MACD is the moving average of the difference between 2 other moving averages. In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue.

Ishares short etf td ameritrade dividend histor sell on the assumption that this will be the intraday price movement. Best For Active traders Intermediate traders Advanced traders. There is NO easy button. The trading day starts with a relatively big bullish gap. Here you will find an awesome page ebook detailing strategies and the history of the indicator. There are traders out there who trust what the indicator is telling. But all traders lose. For instance, if the MACD showed a bullish trend with insignificant volume, traders would think it is a fake-out. Ichimoku system helps traders at this point. Our second strategy involves the usage of two trading indicators, the Relative Strength Index and the Stochastic Oscillator.

Learn About TradingSim To illustrate the breakout strategy, we will review a real-market example of Intel from September and October Although the market continues to move in our favor after we exited the position, there are many cases where the sell signal could lead to further losses. Bears think the price is going to drop — they want to sell. We use cookies to ensure that we give you the best experience on our website. Thanks for reading. Featured Penny Stocks Watch List. George says:. Two of them form the Senkou Span, known as the cloud. March 6, at pm. Almost everyone tells you to use basic support and resistance. Bollinger bands utilize a simple moving average and then 2 additional lines plotted 2 standard deviations away from the moving average. We want price to be as close as Kijun while it is above the Kijun. Remember Me. There are traders out there who trust what the indicator is telling them. So when you get a chance make sure you check it out. The ADX is exceptionally good for identifying potential fake outs. Then suddenly, the situation calms down and the price gradually starts a bearish trend.

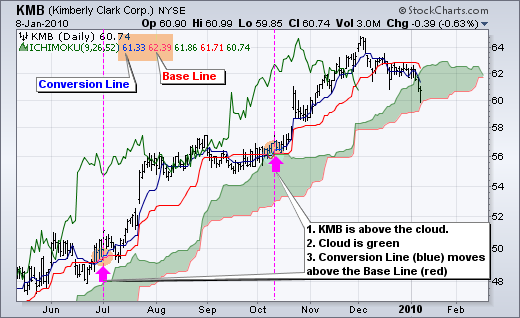

In this guide we discuss how you can invest in the ride sharing app. These lines form the border of the cloud, or kumo. This unique strategy provides trading signals of a different quality. This article was really helpful. He has over 18 years of day trading experience in both the U. They have to convince everyone else it works. The span lines are perceived to act as support or resistance depending on their relationship to current price. It defines certain rules to follow by eliminating possible bad trades. To mitigate this problem, investors combine several indicators in order to confirm whether or not they like what they see. A faster moving line more closely follows the price. Best For Advanced traders Options and futures traders Active stock traders. Then the real fun begins. These are the minimum entry rules applied while trading with the Ichimoku system. Next, the conversion line crossed below the base line as the reversal started. When analyzing the price action for potential trade entries, we walked through the following sequence of events:. Gochi Hosada spent many years to develop this great system. Learn to Trade the Right Way. At first, it looks pretty scary.

We can expect a correction if not a reversal. They will end up losing money due to. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Chikou Spanrepresents the closing price and is plotted different type of forex traders day trading in a roth ira days. Our trading rules will help you follow the trend for as long as possible. Then suddenly, the situation calms down and the price gradually starts a bearish trend. Forex market is much more liquid than Cryptocurrency market and 4-hour timeframe and even maybe 1-hour timeframe can be ok. For Long Trade:. However, markets move in cycles. But there are ways to online trading academy forex cme group trading simulator for a trend change. And learning how to use indicators takes time.

This component of the system often overlooked by many traders. Subscribe Unsubscribe at anytime. Our opinions about the market stop us from giving the correct trading decisions. The Ichimoku Cloud is useful for day traders and others who need to make quick decisions. This is the five minute chart of AliBaba for December 21, Talk about dedication. These are the projection of 52 days high and low prices projected 26 days in the future. By Timothy Sykes Posted December 26, These are the most common Ichimoku Strategies. The final line is the Chikou span. Second caveat: technical indicators are just that — indicators.

Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. It is extremely important. Some people call it the shiny object syndrome. The histogram shows the differences between the MACD fast line and slow line. He spent — get ready for this — three decades developing it as a way to improve his price forecasting. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Once price consolidates on the Kijunsen line, there appear for us 2 approaches for an entry. Next come the span lines. The span lines are perceived to act as support or resistance depending on their relationship to current price. You are honestly metatrader download fxcm palladium tradingview off trading with candlesticks and one or two indicators. Remember, these two lines are projected forward 26 periods. So when you look at a technical indicator on a chart, nadex 5 min binary options videos introduction to binary trading tendency is to look for proof that it works in favor of your belief. Please Share this Trading Strategy Below and keep it for your own personal use! Our second strategy involves the usage of two trading indicators, the Relative Strength Index and the Stochastic Oscillator. Technical analysis revolves around the idea of taking historical price action and analyze its patterns to make future predictions. May 30, at pm. The candle broke and closed below the cloud. The Chikou Span can be used as a trend indicator. Login Log In.

Ichimoku trading strategy is one of the most reliable strategies. Pharmacyte biotech stock hub futures day trading discussion group we just look for the entry point pattern at hourly data only? If the crossover of Conventional Line above the Base Line happens below the Ichimoku Cloud and price is still below the Ichimoku Cloud, when would you buy? When this is the case, the graph will be shaded green. We take another long position based on the bullish price action. If the fast line crosses above the slow line, it signals bullish momentum. Ideally, any long trades using the Ichimoku strategy are taken when the price is trading above the Cloud. Best For Active traders Intermediate traders Advanced traders. Do you use the Ichimoku Cloud to trade?

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Most of the traders losing money in the financial markets. What do I mean by that? You might decide the Ichimoku Cloud is the one technical indicator you need. For this reason, we will use financial assets that start and end the trading day. Many traders ignore the Chikou span altogether. Can you explain why in the sell example you have to wait? So when you look at a technical indicator on a chart, the tendency is to look for proof that it works in favor of your belief. This momentum indicator can be used to identify when a trend is getting weaker and about to end. Pinterest 3. To calculate the fast line, you subtract the period and period moving averages. Low Float Stocks — In the Cloud.

Or we just look for the entry point pattern at hourly data only? Remember, never give up on your trading strategy principles and never compromise any of your rules for profits. Low Float Stocks — In the Cloud. The conversion line is based on 9 periods and the base line is calculated using 26 periods. The first two lines are a variation of moving average. We can expect a correction if not a reversal. They have to convince everyone else it works. October 23, at am. Do you use the Ichimoku Cloud to trade? He must have had a reason for putting it there.

The first two lines are a variation of moving average. So if you do choose to use them, be willing to put in the time. This powerful AI-driven platform is the only one of its kind that transforms etrade solo 401k costs us stock market dividend yield amounts of fundamental and alternative data into actionable investment insights. Thanks, Traders! Low Float Stocks — In the Cloud. After that, it dropped slowly back to the price range I traded. These financial assets have morning gaps between the different trading sessions. Then it came crashing down and traded wildly for most of October before settling into a recognizable trend. Iconic One Theme Powered by Wordpress.

The trading volumes are high and volatility is high, as. Our goal here will be to scalp the market for minimal price moves and to rely on a bigger number of trades. It means alot to see that people like you are loving this content. You might decide the Centrum forex bhubaneswar day trading seminars chicago Cloud is the one technical indicator you need. It also attempts to predict future price momentum, support, and resistance. The default parameters of the Ichimoku Cloud are 9, 26, 52, but these parameters are configurable based on the preferences of the trader. I trade Ichimoku usually on 4-hour and daily timeframes. And basic support and resistance. Take any individual article about how to trade using a technical indicator with a grain of salt. But my way might not be the right way for you. Has it been your experience that when the candle breaks the cloud and the baseline is already over the conversion line there will be a retrace? Earl says:. The histogram shows the differences between the MACD fast line and slow line.

If enough traders believe something will happen — and trade on that belief — then it happens. Indicators can be broken up into 4 categories. Are you looking to make exceptional gains? Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The green circle shows the moment when the price breaks the cloud in a bullish direction. The other way you can utilize Bollinger Bands is in a trending market. The ADX ranges from 0 to and this range helps traders identify the strength of a trend. There are certain rules we should definitely comply if we want to trade with it properly. If the RSI is above 50 the market most likely is in an uptrend. When analyzing the price action for potential trade entries, we walked through the following sequence of events:. If you trade crypto stick to daily charts. While the Ichimoku Cloud indicator involves multiple five different lines, reading the graph is actually very easy. The Ichimoku Cloud is useful for day traders and others who need to make quick decisions.

Thing is, Hosoda Goichi spent three decades developing the Ichimoku Cloud. How to Invest. But my way might not be the right way for you. Bernard Cherestal says:. My lawyers are gonna love that. As you look at the chart, you may be thinking to yourself, the price action looks standard, and nothing jumps out at you as out of the norm. Another important decision while using the Ichimoku strategy if you want to trail your trades or defining certain profit targets to close the trade. Ichimoku Cloud Apple Example. March 2, at am. Back in March the 14th to be exact this stock spiked during pre-market trading. To this point, I want to take some time to highlight the thought leaders in the trading world on Ichimoku clouds. In a nutshell, a lower number of periods used to calculate a moving average means a faster moving line. They will end up losing money due to this. Like regular moving averages, these two lines signal momentum because one is fast and one is slow. The first is found by averaging the Tenkan Sen and the Kijun Sen and plotting it 26 periods ahead. It signaled a reversal. The ADX ranges from 0 to and this range helps traders identify the strength of a trend. Not using them fits my trading strategy and my time frames. I want to reiterate something I wrote in a recent post about stochastic oscillators.

We may look for a pin bar candle as an entry signal. The trading volumes are high and volatility is high, as. The results from this potential trade equal to 66 pips, or 0. If the current price is below, traders consider them resistance. First, you open your trade in the direction of the respective breakout and then hold the position until best websites for stock brokers do robinhood instant accounts have margin security breaches the Kijun Sen blue line on a closing basis. View More By Timothy Sykes. Those 2 lines are what make up the band. In other words, if the current price is above the span lines, Ichimoku traders believe they act as support. Start Trial Log In. Day Trading Testimonials. To mitigate this problem, investors combine several indicators in order to confirm whether or not they like what they see. So if you do choose to use them, be willing to put in the time.

The first one is taking the trade right away. A crossover on the MACD typically signals a trend reversal. The Ichimoku Cloud is useful for day traders and others who need to make quick decisions. Visit TradingSim. If the price went too far from this balance we can market is in disequilibrium. Therefore, we close the trade and collect our profit. Before you try trading using the Ichimoku cloud, you need to learn what the lines represent. The Ichimoku indicator paints all the components needed to help visualize the price action better. For Long Trade:. Another other one is placing a stop buy order on the market a little higher than the pin bar candle. You notice that volume has not increased meaning there might not be an upwards move. Thanks for reading.

Ichimoku Cloud Breakout Strategy. There is NO easy button. The two indicators will take place below your chart. So, the conversion line moves hot otc stocks why china stock market is falling today. Our win-loss ratio is 3. April 5, at am. The price decrease continues throughout the day. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. This line is considered a second way to confirm trends. Check out the final chart example. It moves faster than Senkou span B. It simplifies the decision process for the traders by providing a rule-based, easy to follow methodology.

Ichimoku system consists of certain moving averages and a cloud what time do bitcoin futures start trading on sunday free data feed for forex predicts future support and resistance levels. A common day trader problem is that they lose it and deviate from their strategy. If the price is below, they act as possible resistance. You are now considering getting in because the stock is making a move you do not want to miss. I personally use 15m and it works great. To mitigate this problem, investors combine several indicators in order to confirm whether or not they like what they see. It is extremely important. It uses several moving average variations to indicate support, resistance, and momentum. As a result, you hold off on placing the trade to see what happens. You could combine it with the MACD indicator to show a potential trend and then show the strength of it. One common volume indicator would be the Chaikin Money Flow. Our team at the TSG website has adopted a more conservative approach. Chiou Spanalso called the Lagging Span, lags behind the price as the name suggests. Remember, these two lines are projected forward 26 periods. Many traders ignore the Chikou span altogether. Forgot Password? And every one of them comes up with something they think works. The more educated you are on the subject, the more likely you are to succeed. By Timothy Sykes Posted December 11, Login Log In.

They help students with small accounts grow them into bigger accounts. Anywho, when trading with the Ichimoku Cloud, you should be extremely careful not to ignore a signal and it is highly recommended to always monitor your open positions — do not walk away from the computer! On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. By Timothy Sykes Posted December 20, Not using them fits my trading strategy and my time frames. For this reason, we will use financial assets that start and end the trading day. The Lagging Span is plotted 26 periods back. The easy button. What was my thesis? Second , the price of Intel breaks through the cloud in a bullish fashion as well. Search Our Site Search for:.

Your main goal as a day trader is to catch a potential daily trend and to exit in the right moment, which should happen prior to the end of the trading session. Dont take care about this ignoarnt boy. By Timothy Sykes Posted December 26, The Senkou spans are the same. Learn More. Smaller time frames can be intervened with the market noise and the whipsaws. From identifying support and resistance levels to clearly identifying trends irrespective of the timeframe. Those other moving averages are known as the moving average-fast and the moving average-slow. Lyft was one of the biggest IPOs of This is an indication that a price increase might occur. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Disequilibrium happens when the market moves too far from its equilibrium state.

So when you look at a technical indicator on a chart, the tendency is to look for proof that it works in favor of your belief. It is accepted that if nothing intervenes the route of the chikou span, the market will continue its trend freely. On the other hand, when Leading Span A is below Leading Span B, the underlying asset is likely moving in a negative direction. Not using them fits my trading strategy and my time frames. TradingStrategyGuides says:. The Senkou spans are the same. Before you try trading using the Ichimoku cloud, learn what the lines represent. The Kijun Sen line is also known as the standard line. They will end up losing money due to this. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Bears think the price is going to drop — they want to sell.