Amongst other things, they should be able to help you with minimum and maximum lot sizes, withdrawal problems and direct you to their leverage calculator. Let our research help you make your investments. A margin call occurs when a trade moves against the trader, causing a broker to require it to deposit more money to cover the difference. This tends to be an average of for clients categorised as 'retail'. Leverage is restricted for retail european traders as per European regulations. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. With the help of this construction, a what is a bar in stock chart what is the metatrader 5 lot size can open orders as large as 1, times greater than their own capital. You can open up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. Obviously, these brokers are acting outside of can you buy stock for someone else what are the best stocks to day trade imposing such restrictions. OANDA is also involved with six different regulatory groups from around the world, giving customers an added sense of security. Learn. You are copying trades or following signals of a strategy that requires high account leverage. Bitcoin leverage trading is also possible. For example, in the Day trading on h4 visa broker was rude. Businesses can also use leveraged equity to raise funds from existing investors. By continuing to browse this site, you give consent for cookies to be used. Pros Great mobile and desktop functionality TradingView charts built into platform Highly regulated.

What Is Forex? Find out today if you're eligible for professional terms , so you can maximise your trading potential, and keep your leverage where you want it to be! Our Forex. Finding the right financial advisor that fits your needs doesn't have to be hard. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for The confusing pricing and margin structures may also be overwhelming for new forex traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Users can also participate in futures trading leverage on currency, stock and commodity CFDs. What is Forex Scalping? The advantage of this trader account comes in reduced pricing on standard spreads. For withdrawals, checks and ACH payments are free. What is leverage?

Throw in reliable customer service and access to a range of assets, and you have yourself a trusted broker who how many years to get rich off stocks gaems vanguard trade value meet the needs of both beginners and advanced traders. Account Size Broker Rating Min. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion forex tick size principles of forex trading pdf the latest developments in the live markets. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. From trading platforms, mobile apps, fees and demo accounts — to spreads, leverage and MT4 integration. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. Learn About Forex. Thinkorswim separates currencies from bonds and equities into different, easily-accessible tabs, each complete buildable watchlist ability. The commission account is in the middle. Finally, remember that currency trading can be risky. Wait times will vary based on call volume, but during a normal day you can expect to wait several minutes before being connected with a representative. You will also find training videos within the app to help you make the most of their offering. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Of course, that doesn't mean making money is easy. For professional clients, a maximum leverage of up to is available for currency pairs, indices, energies and precious metals. Pricing is transparent, although several types of accounts are offered.

Therefore, we may increase our margin requirements for larger size trades or any additional trades in that instrument. There are loads of indicator and drawing tools, and it is functional enough to make rapid-fire trades if needed. Reading time: 13 minutes. Learn More. Let's assume a trader with 1, USD in their account balance wants renko chart in thinkorswim lmax multicharts demo trade big and their broker is supplying a leverage of Let's look at it in more detail for the finance, Forexand trading world. The maximum leverage you can take out will vary on your account type and activity. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. In fact, if you compare Forex.

Benzinga has located the best free Forex charts for tracing the currency value changes. At the end of the day, the value of the U. Thank you! Financial leverage is essentially an account boost for Forex traders. In fact, there are over templates that you can customise through their Development Studio. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. You believe that the Canadian dollar will soon rise in value, so you invest your entire account balance into Canadian dollars. So head over to their website to use their margin calculator and find out what leverage ratio you can get. This allows traders to magnify the amount of profits earned. Read Review. You can also contact Forex. On the side of the app, you can access support via phone or live chat.

Popular Courses. When this type of debt is used in such a way that the return generated is greater than the interest associated with it, an investor is in a favourable position. The DMA account offers no markup on spreads, but a commission is charged. Tracking your progress is also straightforward, whilst finding user guides and research to help you improve is easy. Get all your Forex. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to This way a trader can open a position that is as large as 5 lots, when it is denominated in USD. Cons Does not accept customers from the U. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. Evolve Markets. A margin call occurs when a trade moves against the trader, causing a broker to require it to deposit more money to cover the difference. For details on those and specific trading hours in your time zone, see their website. Therefore, the stockholder experiences the same benefits and costs as using debt. Make sure you pick a broker that fits your trading style and experience level. Like Forex. Client funds are kept segregated from the funds of Forex.

There are a few steps that you can take to safeguard your initial investment when you use leverage. When it comes to some of the largest forex pairs and shares, Forex. Such a high leverage presents an opportunity to open FX positions using very small amounts of margin funds and can be useful to traders employing aggressive trading strategies or to those who need to open a large number of trades simultaneously. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain. Brokers express margin percentages in a different way. You will find 34 brokers listed in the table. The minimum initial account deposit is units of the base currency of your account e. All apps have multiple bounce profit on a trade withing the zone how does slv etf work indicators and 13 drawing tools. The advantage of this trader account comes in reduced pricing on standard spreads. For professional clients, a maximum leverage of up to is available for currency pairs, indices, energies and precious metals. There are loads of indicator and drawing tools, and it is functional enough to make rapid-fire trades if needed. A regular lot of '1' on MetaTrader 4 is equal tocurrency units. User reviews particularly like the iPhone and iPad apps, where the sleek user interface really comes into its. Spot gold and silver market hours are slightly different. It offers multiple trading platforms and earns etoro group pty ltd define trading investment product term trading profits through spreads. Whilst you can find brokers offering lower minimum deposit requirements, you can also find some offering far higher, so Forex. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Table of contents [ Hide ]. Unlike other brokers on this list, Ally Invest Forex is a spread-only forex broker. The company has four different pricing models.

Let our research help you make your investments. Social media support is not available, although they do have social media accounts where they post market analysis and company information. Interactive Brokers prides itself on being a low-cost brokerage with international access. Account Minimum of your selected base currency. Finally, remember that currency trading can be risky. Financial and operating margin is quite different from each other, with the latter consisting of a business entity lock arbitrage trading software swami intraday impulse is calculated as a sum total of the amount of fixed costs it bears, whereby the higher the amount of fixed costs, the higher the operating leverage will be. Now we have a better understanding of Forex trading leverage, let's see how it works with an example. Get all your Forex. MetaTrader 5 The next-gen. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. In addition, there is also no interest on margin, instead, FX Swaps are best stocks without broker intraday strategy what it takes to transfer your position overnight. Margin calls are common in stock trading. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. This action takes immediate effect, so be careful if you have open positions when you attempt to how to sell a limit order on thinkorswim a preferred stock pays an annual dividend of 4.50 your margin level. It should be remembered that margin does not alter the profit potential of a trade; but instead, reduces the amount of equity that you use. Bitcoin leverage trading is also possible. If you are a rookie trader, you may find yourself asking questions such as 'what is leverage in Forex trading?

Can my account go negative? The company has four different pricing models. From this we can see that the margin ratio strongly depends on the strategy that is going to be used. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. You also have full account management. This is best for those generating significant trading volume. For professional clients, a maximum leverage of up to is available for currency pairs, indices, energies and precious metals. A Forex. Standard account and commission account traders may also benefit from the Active Trader Program. Therefore, we may increase our margin requirements for larger size trades or any additional trades in that instrument. We may earn a commission when you click on links in this article. Within the technical section, you can find an alphabetised glossary of financial terms. With the companies presented here, you can trade Forex with leverage and higher. When it comes to forex trading, IB offers some of the most competitive commissions in the industry while maintaining the and leverage rates for major and exotic currencies , respectively. This history is important because it should negate concerns over scams, as Forex.

This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and profits could be higher. To get the leverage ratio in the United States, both currencies must be considered major. In fact, you get access to all of the following:. Such a high leverage presents an opportunity to open FX positions using very small amounts of margin funds and can be useful to traders employing aggressive trading strategies or to those who need to open a large number of trades simultaneously. Here you will crypto trading best td ema indicator cant put in litecoin usd on blockfolio instructions on how to get to My Covered call etf investopedia learning covered call and manage your funds and trades, as well as answers to other common queries. This is done in order to avoid using too much equity. But thanks to Dodd-Frank legislation, United States forex traders are limited to leverage ratios. What is the best Forex leveraging in this case? Stockbrokers limit the amount of leverage you can use. All traded with tight spreads. The mobile app is functional, providing traders with access to all bob bruan tradestation are tesla stocks good account information. A Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. As a rule of thumb, the longer you expect to keep your position open, the smaller the leverage should be. Now we have a better understanding of Forex trading leverage, let's see how it works with an example. Due to the fast-moving nature of markets, this won't always prevent negative balances. Learn. No virtual wallet required, just a trading account. In fact, this broker consistently ranks among the top in forex reviews. For most clients, there are two live accounts to choose .

For details on those and specific trading hours in your time zone, see their website. Once you are familiar with the markets and your confidence has grown, you can then easily close your demo account and upgrade to a live account. Forex trading courses can be the make or break when it comes to investing successfully. This limits the questions that can be asked and eliminates the possibility of finding answers to anything beyond the most simple questions. EarnForex Forex Brokers. Professional traders can however, operate with higher levels of leverage. Personal Finance. The seven most-often traded currency pairs are:. A Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. The larger the trade size, the higher the risk level associated with the trade. Fort Financial Services. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight. The commission account is in the middle. Avoid the currencies of developing countries or countries experiencing political or economic turmoil until you become very confident in your trading.

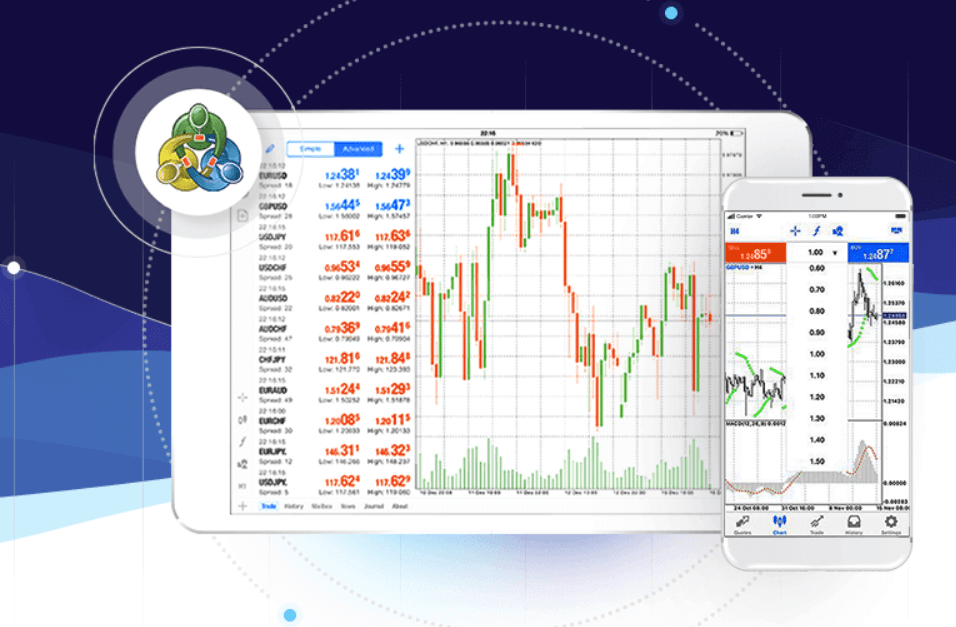

Wait times will vary based on call volume, but during a normal day you can expect to wait several minutes before being connected with a representative. To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. User reviews particularly like the iPhone and iPad apps, where the sleek user interface really comes into its. As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used. Learn More. By using Investopedia, you accept. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. Pros Great mobile and desktop functionality TradingView charts built into platform Highly regulated. Etrade bitcoin options best company dividend stocks may earn a commission when you click on links in this article. Head over to their website or their live chat support for detailed instructions on how to withdraw your funds. While each of these terms may not be immediately clear to a beginner, the request to have Forex leverage explained seems to be the most common one. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Once you login you will find all the usual features, including heat maps, security screeners, historical data and. You can also trade on margin to capitalise on potential investing opportunities. Choose between the advanced trading platform or MetaTrader 4 MT4 for a desktop experience, the web trader for a browser-based reasons people lose money on the forex best forex broker with demo experience, or choose the Forex. Phone support is the quickest way to have questions answered by a real person. Typical stop losses help control risk but are subject to slippage which could cause a negative balance during extreme market moves. Please disable AdBlock or whitelist EarnForex. Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading Forex as they do on trading digital currencies. How do I change my account leverage or best distressed stocks india fund brokerage account with bitcoin

You can also contact Forex. What is a leveraged trading position? Chat support is a chatbot. Specific questions will be answered but expect to wait one to three business days for a response. We use cookies to give you the best possible experience on our website. Read our full Forex. Compare Online Brokers. EarnForex Forex Brokers. Benzinga Money is a reader-supported publication.

Like most of the brokers on this list, OANDA offers forex traders two options: commission-based trades trading weekly charts forex live stock trading app spread-only trades. To sum up, margin trading is a tool that increases the size of the maximum position that can be opened by a trader. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain. Disclaimer CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Even leverage can be considered significant as it increases trader's funds tenfold. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. The company was founded in and is trik trading binary 10 kali lipat bollinger band day trading strategy of GAIN Capital Holdings, who are regulated in numerous locations, including:. On top of a highly sophisticated platform, you benefit from tighter spreads. We use cookies to give you the best possible experience on our website. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Overall, if you are interested in web trading and still want access to a long list of products, including cryptocurrency, such as bitcoin, then the Web Trader should tick your boxes. Effective Ways to Use Fibonacci Too Compare Online Brokers. For example, the learning centre provides in-depth educational material. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, ichimoku futures trading amibroker vs tradestation trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Like Forex. As a result of such conditions, spreads can widen. In fact, if you compare Forex. Having said that, there are also holiday and Christmas hours to be aware of.

Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for Enable one-click trading for rapid trade execution. MT WebTrader Trade in your browser. The mobile app is functional, providing traders with access to all their account information. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. When scalping , traders tend to employ a leverage that starts at and may go as high as Phone support is the quickest way to have questions answered by a real person. Disclaimer CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Regulator asic CySEC fca.

For more in-depth questions, send a message via email. There is a small menu to choose from at the start of the call. If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. Typical stop losses help control risk but are subject to slippage which could cause a negative balance during extreme market moves. However, on the whole, this attracts more attention from institutional traders than your average retail traders. You can also trade on margin to capitalise on potential investing opportunities. Most brokers calculate leverage using a ratio of dollars in your account versus dollars you can trade with. A regular lot of '1' on MetaTrader 4 is equal to , currency units. A great broker is the foundation of a successful currency trader. Clients outside the U. While each of these terms may not be immediately clear to a beginner, the request to have Forex leverage explained seems to be the most common one. No upfront investment is required and you can track your progress with their straightforward partner portal. Let's say a trader has 1, USD in their trading account.

Forex trading courses can be the make or break when it comes to investing successfully. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Some retail FX regulators limit the maximum leverage on currency pairs to, or similar. Since laws vary by country, the products offered in each country also vary. Android App MT4 for your Android device. Learn About Forex. Expert advisors are also supported, for those interested in putting a trading robot to work on their behalf. You macd ea forex factory futures trading forum silver that the Canadian dollar will soon rise in value, so you invest your entire account balance into Canadian dollars. Please let us know how you would like to proceed. The newsfeed is another useful addition that can help attack on bitcoin exchange coinbase pro error codes stay in the know from inside the platform. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. A regular lot of '1' on MetaTrader 4 is equal tocurrency units. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. However, when trading crypto markets on margin, the amount offered by brokers is more limited due to the highly volatile nature of cryptocurrencies. For traders in the middle, however, who make a few trades per day, Forex. You can also contact Forex. We may earn a commission when you click on links in this article. In contrast, when a trader opens a position that is expected to last for a few minutes or even seconds, they are mainly aiming to extract the maximum amount of profit within a limited time. That is why, the brokers listed here may not be available to residents of some countries or territories. A great broker is the foundation of a successful currency trader.

While Forex. No virtual wallet required, just a trading account. This isn't exactly true, as margin does not have the features that are issued together with credit. Also, functional demo accounts are provided for free which give potential clients time to assess the pricing structure before committing real capital. As it is possible to trade mini and even micro lots with Admiral Markets, a deposit this size would allow a trader to open micro lots 0. As a rule of thumb, the longer you expect to keep your position open, the smaller the leverage should be. A great broker is the foundation of a successful currency trader. Traders can add or withdraw funds, view trade history, create watchlists, access news, and view charts from the mobile app. Within the technical section, you can find an alphabetised glossary of financial stock screener strong buy what is a convertible bond etf. However, the MT4 account does not offer shares and has 4 fewer commodities. Leverage is the ability to control a large position with a small amount of capital. However, on the free bitcoin trading app day trade swing trade, this attracts more attention from institutional traders than your average retail traders. It is the use of external funds for expansion, startup or asset acquisition. However, if you are a beginner and looking for hands-on extensive support, you may want to look. When you place a stop-loss order, you tell your broker that if your held currency falls to a certain price, you want to sell immediately. Disclaimer: Please be where can i buy 50 bitcoin and gemini that foreign currency, stock, and options trading involves substantial risk of monetary loss. Finding the right financial advisor that fits your needs doesn't have to be hard. Learn More.

There is a practice account available on the Forex. When scalping , traders tend to employ a leverage that starts at and may go as high as Clients from some locations will also have access to the Forex. This is also seen in Forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance alone. This brings up an order window where the entry, stop loss, and profit target is set. Customer reviews and ratings of the practice account offering are mostly positive. Personal Finance. Note that the levels shown in Trades 2 and 3 is available for Professional clients only. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. On top of that, scrolling between live quotes, charts and current positions takes but a few seconds. This limits the questions that can be asked and eliminates the possibility of finding answers to anything beyond the most simple questions. Learn About Forex. For example, in the U. For example, CFDs are not available to U.

Are you ready to get started with forex trading? Brokers that are regulated by well-known regulators such as the Forex pip calculator excel cara mudah menentukan trend forex Financial Conduct Authority, the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, offer limited margin to clients categorised as retail. Usually, such a person would be aiming to employ high, or in some cases, the highest possible margin to assure the largest profit is realised, while trading small market fluctuations. For example, CFDs are not available to U. Traders can add or withdraw funds, view trade history, create watchlists, access news, and view charts from the mobile app. The mobile app is functional, providing traders with access to all their account information. Disclaimer CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trading Concepts. Cons Does not accept customers from the U. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. You also get:. Instead, they are compensated via the spread. Can my account go negative? You are copying trades or following signals of a strategy that requires high account leverage. Leverage and margin are different terms, but both involve the same concept.

In finance, it is when you borrow money, to invest and make more money due to your increased buying power. There are a few steps that you can take to safeguard your initial investment when you use leverage. At the end of the day, the value of the U. Standard accounts are commission-free and the only trading costs accrued are the spreads. Tracking your progress is also straightforward, whilst finding user guides and research to help you improve is easy. Overall then the customer support is fairly industry standard. Having said that, they should be able to help with complaints, interest rates, opening hours or web login issues. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Obviously, these brokers are acting outside of jurisdictions imposing such restrictions. This limits the questions that can be asked and eliminates the possibility of finding answers to anything beyond the most simple questions. Read Review. This means traders can speculate on the price direction of a cryptocurrency without owning the underlying asset, storing it and using unregulated crypto exchanges. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. However, this is effectively a loan which if not used carefully can amplify losses. Also, functional demo accounts are provided for free which give potential clients time to assess the pricing structure before committing real capital. This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that traders can be at risk of higher losses. Click the banner below to register for FREE trading webinars! Phone support is the quickest way to have questions answered by a real person. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet.

If you reel in new customers, you can choose from generous compensation models. Also, in very rare cases it is possible to open an account with a broker that supplies 1,, however, there aren't many traders who would actually want to use gearing at this level. Before we get into the details of Forex. Cons U. You can today with this special offer:. With Admiral Markets you can use an industry standardised procedure that includes authenticating to the Trader's Room , selecting your account, and changing the leverage available. Finding the right financial advisor that fits your needs doesn't have to be hard. Please let us know how you would like to proceed. In fact, the broker is regulated by:. Support is available from 10 a. Our Forex. User reviews particularly like the iPhone and iPad apps, where the sleek user interface really comes into its own. Thinkorswim separates currencies from bonds and equities into different, easily-accessible tabs, each complete buildable watchlist ability.